Satnav News, Fall 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

Sustainable Aviation Fuel Leadership

FACT SHEET #7 / AUGUST 2020 SUSTAINABLE AVIATION FUEL LEADERSHIP As the aviation sector moves towards an energy transition towards sustainable aviation fuel, some airlines are showing particular leadership in the move. Leading edge Recognising leadership in the promotion of sustainable aviation fuel through significant, multi-million dollar forward-purchase agreements with suppliers and/or investments in SAF supply. Pioneers Investment and significant start-up support for sustainable aviation fuel deployment projects with long-term benefits for the industry, these airlines are providing important first steps for more ambitious action. Current airports with regular sustainable aviation fuel supply Airlines purchasing SAF which is distributed through the regular airport hydrant system. Bergen San Francisco Oslo Los Angeles Stockholm enviro.aero FACT SHEET #7 / PAGE 2 Explorers Have helped with the promotion of SAF through test flights and initial involvement with SAF trials, research and investigation of local opportunities. The full list of flights can be found onwww.enviro.aero/SAF Carrier Date of first SAF flight Details Air New Zealand December 2008 Technical test flight on a Boeing 747 Interjet July 2011 Commercial flight on an Airbus A320 between Mexico City and Tuxtla Gutierrez AeroMexico August 2011 Commercial flight on a Boeing 777 between Mexico City and Madrid Iberia October 2011 Commercial flight on an Airbus A320 between Madrid and Barcelona Thomson Airways October 2011 Commercial flight between Birmingham and Arrecife on a -

AIRLINES Monthly

AIRLINES monthly OTP APRIL 2018 Contents GLOBAL AIRLINES GLOBAL RANKING Top and bottom Regional airlines Latin American EMEA ASPAC North America and Caribbean Notes: % On-Time is percentage of flights that depart or Update: Status coverage as of April 2018 will only be based arrive within 15 minutes of schedule. on actual gate times rather than estimated times. This may Source: OAG flightview. Any reuse, publication or distribution of result in some airlines/airports being excluded from this report data must be attributed to OAG flightview. report. Global OTP rankings are assigned to all airlines/ Global OTP rankings are assigned to all Airports airports where OAG has status coverage for at least 80% where OAG has status coverage for at least 80% of the of scheduled flights. If you would like to review your flight scheduled flights. status feed with OAG please [email protected] AIRLINE MONTHLY OTP – APRIL 2018 Global airlines – top and bottom BOTTOM AIRLINE ON-TIME TOP AIRLINE ON-TIME FLIGHTS On-time performance On-time performance FLIGHTS Airline Arrivals Rank Flights Rank Airline Arrivals Rank Flights Rank TW T'way Air 99.5% 1 3,419 138 3H Air Inuit 39.2% 153 1,460 212 HX Hong Kong Airlines 95.8% 2 3,144 141 SF Tassili Airlines 41.9% 152 424 291 SATA International-Azores JH Fuji Dream Airlines 95.1% 3 2,122 173 S4 47.0% 151 625 268 Airlines S.A. PM Canaryfly 94.0% 4 1,072 232 EE Regional Jet 52.2% 150 70 367 BT Air Baltic Corporation 92.9% 5 4,624 117 VC ViaAir 53.4% 149 297 319 RC Atlantic Airways Faroe Islands 92.1% 6 221 333 TP TAP Air Portugal 53.8% 148 11,263 59 HR Hahn Air 91.7% 7 14 377 Z2 Philippines AirAsia Inc. -

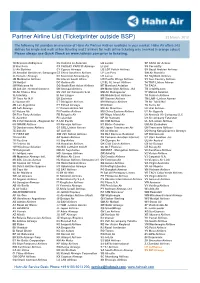

Airlines List in Outside

Partner Airline List (Ticketprinter outside BSP) 23 March, 2012 The following list provides an overview of Hahn Air Partner Airlines available in your market. Hahn Air offers 243 airlines for single and multi airline ticketing and 2 airlines for multi airline ticketing only (marked in orange colour). Please always use Quick Check on www.hahnair.com prior to ticketing. 1X Branson AirExpress CU Cubana de Aviacion LG Luxair SP SATA Air Acores 2I Star Perú CX CATHAY PACIFIC Airways LI Liat SS Corsairfly 2J Air Burkina CY Cyprus Airways LO LOT Polish Airlines SV Saudi Arabian Airlines 2K AeroGal Aerolineas Galapagos CZ China Southern Airlines LP Lan Peru SW Air Namibia 2L Helvetic Airways D2 Severstal Aircompany LR Lacsa SX SkyWork Airlines 2M Moldavian Airlines D6 Interair South Africa LW Pacific Wings Airlines SY Sun Country Airlines 2N Nextjet DC Golden Air LY EL AL Israel Airlines T4 TRIP Linhas Aéreas 2W Welcome Air DG South East Asian Airlines M7 Marsland Aviation TA TACA 3B Job Air - Central Connect DN Senegal Airlines M9 Motor Sich Airlines JSC TB Jetairfly.com 3E Air Choice One DV JSC Air Company Scat MD Air Madagascar TF Malmö Aviation 3L InterSky EI Aer Lingus ME Middle East Airlines TK Turkish Airlines 3P Tiara Air N.V. EK Emirates MF Xiamen Airlines TM LAM - Linhas Aereas 4J Somon Air ET Ethiopian Airlines MH Malaysia Airlines TN Air Tahiti Nui 4M Lan Argentina EY Etihad Airways MI SilkAir TU Tunis Air 4Q Safi Airways F7 Darwin Airline SA MK Air Mauritius U6 Ural Airlines 5C Nature Air F9 Frontier Airlines MU China Eastern Airlines -

Nextjet Flyger Vidare Från Arvidsjaur Och Gällivare. Redan Idag Startar Trafik Med Jetflyg!

Nextjet flyger vidare från Arvidsjaur och Gällivare. Redan idag startar trafik med jetflyg! Nextjet och Fly Lapland startar idag trafik till och från Arvidsjaur och Gällivare från Arlanda med jetflygplan. Trafiken består av två dagliga avgångar måndag till fredag och en avgång på söndagar. De senaste åtta åren har Nextjet trafikerat de bägge destinationerna och skulle igår ha upphört med trafiken sedan en annan aktör valt att gå in på linjerna. Sent innevarande vecka valde den andra aktören att avbryta sin satsning. På kort varsel går nu Nextjet, tillsammans med det lokala initiativet Fly Lapland, in och tar ansvar för regionens infrastruktur med start redan i eftermiddag. Trafiken kommer att bestå i två dagliga avgångar måndag-fredag och en avgång på söndagar. Den stora nyheten är att det från och med idag blir jettrafik och att restiden kortas till två timmar för Gällivare - Arlanda och till en timma och tio minuter för Arvidsjaur - Arlanda. - Jag är både stolt och glad över att vi med väldigt kort varsel kan gå in och säkra den, för regionerna, så viktiga infrastrukturen. Vi har en lång historia på linjerna och de är och förblir en viktig del av vårt linjenät. Att vi dessutom kan erbjuda en jet-produkt med kortade restider känns riktigt roligt säger Magnus Ivarsson, VD Nextjet. Nextjet har en lång erfarenhet av att flyga linjerna och sedan tidigare ett väl fungerande koncept på plats innefattande såväl kundtjänst, företagsbokning och moderna bokningssystem som en marknads och försäljningsorganisation. Tillsammans med Fly Laplands lokala förankring och kunskap utgör det nya samarbetet parterna emellan en garant för en långsiktigt och stabil flygtrafik för de bägge regionerna. -

SAS Annual Report 2012 English

SAS Group Annual Report with sustainability overview January–October 2012 Contents Events during the year 2012 in brief Outcome January−March: The shortened fiscal year January−October: The year in figures 1 Strengthened cash flow but negative Positive income before tax and nonrecur- President’s comments 2 income in line with expectations – 4Excel- ring items. The measures launched at the Goals and outcomes in 2012 4 lence measures corresponding to SEK 5 beginning of the year are now making an billion initiated to meet continued chal- impact: MSEK 23 in income before tax and lenges in 2012. nonrecurring items for January−October Strategy 4Excellence − The Board of Directors of Spanair filed for 2012. Passenger revenue up 5.6% (currency- Next Generation (4XNG) 6 bankruptcy and SAS made a provision of adjusted). Unit cost decreased by 4% (exclud- SEK 1.7 billion for outstanding receivables ing jet-fuel and currency adjustments). in the year-end report for 2011. Income before tax during the period, January− SAS customer offering 12 − SAS named Europe’s most punctual major October 2012, was MSEK −1,245. Previously airline for the third year in succession announced restructuring costs and other non- according to the independent source Flight- recurring items impacted income by MSEK Airline industry 16 Stats. 1,421, of which about SEK 1 billion pertained Policy framework for civil aviation 18 − Blue1started a statutory conciliation pro- to the upcoming restructuring program 4XNG. Quality and safety 19 cess to reorganize its operations as part of The airlines’ operations 20 the transition to a production company After the end of the fiscal year Risks and risk management 23 under the Scandinavian Airlines umbrella. -

Market Report a Publication of Saab Aircraft Leasing

Issue 22 APRIL/MAY 2009 MARKET REPORT A PUBLICATION OF SAAB AIRCRAFT LEASING DELTA LIVERY REPLACES NORTHWEST COLORS ON SAAB 340Bplus FLEET CArpAtAIR MARKS 10 YEARS OF SAAB SERVICE MURRAY AIR EXPANDS SAAB 340 SERVICE UNDER NATIONAL AIRLINES SAAB 2000S FLY JOE GIBBS’ RACE TEAMS IN CORPORATE SHUTTLE STYLE MESSAGE FROM CONTENTS Michael Magnusson SAL posts successful 2008 with entire portfolio allocated ............ 3 I often get asked these days how the Delta livery replaces Northwest colors recession is affecting us, and so far, I on Saab 340Bplus fleet ............................................................................ 4 am happy to respond “not that much”. Saab 340s, Saab 2000s and Saab Carpatair marks 10-year anniversary ................................................... 6 Aircraft Leasing’s services are still in strong demand. Activity associated with the small percentage of Saab Saab 340 operates in National Airlines Air Cargo 340s and Saab 2000s available is in- forwarding business ................................................................................... 9 credible! We have at least three to four prospects with our available portfolio aircraft and of the eight Saab 340s Saab 2000s fly Joe Gibbs’ Race teams in returned to headlessors over the past corporate shuttle style ............................................................................. 10 year, all have been placed within 30-60 days. One customer that recently had Argentine Air Force to accept two more to park a few aircraft is now putting them back into service to cover routes Saab 340Bs this summer ........................................................12 once flown by a major airline. Western Air grows Saab 340 fleet for Bahamian services ........... 13 Now that we are well into the year 2009, it is apparent that the effects of the economic down-turn is wreaking havoc on our industry. -

Hahn Air (HR) ~ Participating Carriers (GDS FARE +50)

Hahn Air (HR) ~ Participating Carriers (GDS FARE +50) 12APR2021 Airline Code Airline Country Airline Code Airline Country 1X Branson AirExpress United States LG Luxair Luxembourg Airlines Luxemburg 2I Star Perú Peru LI Liat Antigua and Barbuda 2J Air Burkina Burkina Faso LO LOT Poland 2K AeroGal Aerolineas Galapagos Ecuador LP Lan Peru Peru 2L Helvetic Airways Switzerland LR Lacsa Costa Rica 2N Nextjet Sweden LX Swiss International Airlines Switzerland 3E Air Choice One United States LY EL AL Israel Airlines Israel 3S Air Antilles Guadeloupe M9 Motor Sich Airlines Ukraine 3M Silver Airways United States ME Middle East Airlines Lebanon 3P Tiara Air Dutch-Caribbean MF Xiamen Airlines China 3U Sichuan Airlines China MH Malaysia Airlines Malaysia 4M Lan Argentina Argentina ML Air Mediterranee France 4Q Safi Airway United Arab Emirates MN kulula South Africa 5H Five Forty Aviation Kenya MR Hunnu Air Mongolia 5N Nordavia - Regional Airlines Russia MS EgyptAir Egypt 5Z CemAir South Africa MT Thomas Cook Airlines Germany 5W speed-alliance Germany MW Mokulele Airlines United States 6H Israir Airlines Israel MY Maya Island Air Belize 7F FIRST AIR Canada NF Air Vanuatu Vanuatu 7I Insel Air NL Antilles NN VIM Airlines Russia 7R RusLine Russia NT Binter Canarias Spain 7V Federal Airlines South Africa NU Japan Transocean Air Japan 7W Windrose Aviation Ukraine NX Air Macau Macau 8I Insel Air Aruba Aruba O6 Avianca Brasil Brazil 8M Myanmar Airways Intl. Myanmar OA Olympic Air Greece 8Q Onur Air Turkey OB Boliviana de Aviación Bolivia 8U Afriqiyah Airways -

FINNAIR Transportation/Finland, February 27, 2019 Company Update

FINNAIR Transportation/Finland, February 27, 2019 Company update Delivering on Asian strategy Rating HOLD Finnair’s Asian strategy has proven successful and the 14 remaining seven A350s deliveries in 2019-2022E support 12 strategy execution and growth further. Evolution of competition in short-to-mid-term remains a key risk, in our 10 view. We expect earnings to weaken slightly in 2019E and 8 consider valuation as largely fair. We retain “Hold” rating. 6 Price/EUR A350 fleet carries from Asia to Europe via shortest route 4 Finnair’s strategy is based on the geographic location of Helsinki 2 hub, as the shortest route from (North-East) Asia to Europe goes 0 over Helsinki. Finnair is able to serve most Asian routes in 24h 02/14 02/15 02/16 02/17 02/18 02/19 rotations, which enables high utilization rate of planes and Finnair DJ STOXX 600 reduces the need for additional crew. New A350s, 12/19 of which were delivered by the end of 2018, are an essential part of the Share price, EUR (Last trading day’s 8.33 Asian strategy and form the cornerstone of cost management as closing price) they have higher seat capacity, lower maintenance cost and Target price, EUR 8.0 better fuel efficiency vs. the replaced A340s. The remaining seven A350s will be delivered in 2019-2022E, enabling further growth. Latest change in recommendation 13-Nov-17 Latest report on company 18-Feb-18 New A350s enable growth and balance capacity in 2019E Research paid by issuer: Yes For 2019E Finnair guides 10% capacity growth (largely based on No. -

Government Support Measures for Domestic Air Connectivity Case-Specific Policy Analysis

CPB Corporate Partnership Board Government Support Measures for Domestic Air Connectivity Case-Specific Policy Analysis Government Support Measures for Domestic Air Connectivity Case-Specific Policy Analysis The International Transport Forum The International Transport Forum is an intergovernmental organisation with 59 member countries. It acts as a think tank for transport policy and organises the Annual Summit of transport ministers. ITF is the only global body that covers all transport modes. The ITF is politically autonomous and administratively integrated with the OECD. The ITF works for transport policies that improve peoples’ lives. Our mission is to foster a deeper understanding of the role of transport in economic growth, environmental sustainability and social inclusion and to raise the public profile of transport policy. The ITF organises global dialogue for better transport. We act as a platform for discussion and pre- negotiation of policy issues across all transport modes. We analyse trends, share knowledge and promote exchange among transport decision-makers and civil society. The ITF’s Annual Summit is the world’s largest gathering of transport ministers and the leading global platform for dialogue on transport policy. The Members of the Forum are: Albania, Armenia, Argentina, Australia, Austria, Azerbaijan, Belarus, Belgium, Bosnia and Herzegovina, Bulgaria, Canada, Chile, China (People’s Republic of), Croatia, Czech Republic, Denmark, Estonia, Finland, France, Former Yugoslav Republic of Macedonia, Georgia, Germany, Greece, Hungary, Iceland, India, Ireland, Israel, Italy, Japan, Kazakhstan, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Mexico, Republic of Moldova, Montenegro, Morocco, the Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Russian Federation, Serbia, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine, the United Arab Emirates, the United Kingdom and the United States. -

Suomen Lentohintaindeksi™

Suomen lentohintaindeksi™ - julkaisija matkahakukone travelmarket.fi Nro 54 | 04.02.2016 Lähtöviikko: EUROOPPA 9/2016 KOHDE LENTOYHTIÖ VÄLILASKUJA LÄHTÖKENTTÄ HINTA INDEKSI TENDENSSI AMSTERDAM Ukraine Int. Airlines 1 Helsinki 138,- 83 Finnair 1 Tampere 249,- 115 Finnair 1 Oulu 307,- 126 AirBaltic 1 Turku 173,- 80 SAS 2 Vaasa 289,- 133 BARCELONA Turkish Airlines 1 Helsinki 142,- 86 Finnair / Air Berlin 1/2 Tampere 260,- 90 Finnair / Air Berlin 1/2 Oulu 318,- 127 AirBaltic 1 Turku 198,- 102 SAS / Swiss 2 Vaasa 290,- 136 BERLIINI KLM 1 Helsinki 116,- 85 Finnair 1 Tampere 216,- 134 Finnair 1 Oulu 256,- 140 AirBaltic 1 Turku 175,- 117 Finnair 1 Vaasa 246,- 149 KÖÖPENHAMINA Finnair 0 Helsinki 84,- 117 Finnair 1 Tampere 168,- 113 Norwegian Air 1 Oulu 202,- 145 AirBaltic 1 Turku 149,- 119 Finnair 1 Vaasa 218,- 157 LONTOO AirBaltic / Norwegian 1/0 Helsinki 128,- 117 Finnair 1 Tampere 221,- 433 Norwegian 1 Oulu 210,- 113 Wizz Air / Ryanair 1 Turku 136,- 76 Finnair 1 Vaasa 271,- 123 Finnair / Air Berlin / NIKI 1 Helsinki 253,- 127 MALAGA Luftfahrt Gmbh Finnair / Air Berlin / NIKI 2 Tampere 430,- 95 Luftfahrt Gmbh Norwegian 1/2 Oulu 399,- 57 Finnair / Air Berlin / NIKI 2 Turku 360,- 70 Luftfahrt Gmbh Finnair / Air Berlin / NIKI 2 Vaasa 440,- 98 Luftfahrt Gmbh Czech Airlines / 0 Helsinki 94,- 59 PARIISI Norwegian SAS / Lufthansa 2 Tampere 259,- 119 Norwegian Air 1 Oulu 215,- 93 AirBaltic 1 Turku 197,- 83 SAS / Lufthansa 2 Vaasa 260,- 118 Norwegian Air / Czech 0 Helsinki 122,- 79 PRAHA Airlines SAS / Lufthansa 2 Tampere 276,- 103 Norwegian 1 Oulu 211,- -

Qatar Airways Increases Seats in Winter Versus Summer

Issue 27 Monday 5th November 2018 www.anker-report.com Contents Vueling is most seasonal major LCC in 1 Vueling is most seasonal major LCC in Europe; Qatar Airways increases seats in winter versus summer. Europe; Qatar Airways increases seats 2 Austrian Airlines still dominates in With the winter season now under way, airlines face the six of the seven (U)LCCs are more seasonal than all eight of the Vienna despite advancing LCCs. perennial problem of seasonality. Nearly all airlines operating in flag-carriers, reflecting their business model focus on leisure 3 Focus on: Italy and the UK. Europe generate more demand in summer than they do in traffic. The one exception is Norwegian, which is arguably the winter, driven by the strong European leisure market which LCC that is most like a flag-carrier with its growing portfolio of 4 Latest European route launches and peaks around July and August when schools (and some long-haul routes and also having several bases in the analysis covering 39 airlines and businesses) take their annual summer break. A handful of traditionally less seasonal Nordic markets. almost 300 routes. airports, mostly serving ski resorts in and around the Alps Across all airlines the average reduction in seat capacity for 9 LEVEL is newest airline to connect actually see demand peak in the winter, but they are the winter versus summer is 25%. Europe’s two biggest airlines France and the Caribbean. exception rather than the rule. have similar reductions with Ryanair (down 23.3%) being 10 Valencia welcomes four new airlines The summer months are typically when airlines in Europe make marginally less seasonal than easyJet (down 25.9%).