Scheme Booklet Registered with Asic

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Presentation to Macquarie Conference

4 May 2021 ASX Markets Announcements Office ASX Limited 20 Bridge Street Sydney NSW 2000 PRESENTATION TO MACQUARIE CONFERENCE 4 May 2021: Attached is a copy of Nine’s presentation to the Macquarie Australia Conference 2021. Authorised for lodgment by Mike Sneesby, Chief Executive Officer. Further information: Nola Hodgson Victoria Buchan Head of Investor Relations Director of Communications +61 2 9965 2306 +61 2 9965 2296 [email protected] [email protected] nineforbrands.com.au Nine Sydney - 1 Denison Street, North Sydney, NSW, 2060 ABN 60 122 203 892 MIKE SNEESBY | CHIEF EXECUTIVE OFFICER Important Notice and Disclaimer as a result of reliance on this document. as a general guide only, and should not be relied on This document is a presentation of general as an indication or guarantee of future performance. background information about the activities of Nine Forward Looking Statements Forward looking statements involve known and unknown risks, uncertainty and other factors which Entertainment Co. Holdings Limited (“NEC”) current This document contains certain forward looking can cause NEC’s actual results to differ materially at the date of the presentation, (4 May 2021). The statements and comments about future events, from the plans, objectives, expectations, estimates information contained in this presentation is of including NEC’s expectations about the performance and intentions expressed in such forward looking general background and does not purport to be of its businesses. Forward looking statements can statements and many of these factors are outside complete. It is not intended to be relied upon as generally be identified by the use of forward looking the control of NEC. -

DISCOVER NEW WORLDS with SUNRISE TV TV Channel List for Printing

DISCOVER NEW WORLDS WITH SUNRISE TV TV channel list for printing Need assistance? Hotline Mon.- Fri., 10:00 a.m.–10:00 p.m. Sat. - Sun. 10:00 a.m.–10:00 p.m. 0800 707 707 Hotline from abroad (free with Sunrise Mobile) +41 58 777 01 01 Sunrise Shops Sunrise Shops Sunrise Communications AG Thurgauerstrasse 101B / PO box 8050 Zürich 03 | 2021 Last updated English Welcome to Sunrise TV This overview will help you find your favourite channels quickly and easily. The table of contents on page 4 of this PDF document shows you which pages of the document are relevant to you – depending on which of the Sunrise TV packages (TV start, TV comfort, and TV neo) and which additional premium packages you have subscribed to. You can click in the table of contents to go to the pages with the desired station lists – sorted by station name or alphabetically – or you can print off the pages that are relevant to you. 2 How to print off these instructions Key If you have opened this PDF document with Adobe Acrobat: Comeback TV lets you watch TV shows up to seven days after they were broadcast (30 hours with TV start). ComeBack TV also enables Go to Acrobat Reader’s symbol list and click on the menu you to restart, pause, fast forward, and rewind programmes. commands “File > Print”. If you have opened the PDF document through your HD is short for High Definition and denotes high-resolution TV and Internet browser (Chrome, Firefox, Edge, Safari...): video. Go to the symbol list or to the top of the window (varies by browser) and click on the print icon or the menu commands Get the new Sunrise TV app and have Sunrise TV by your side at all “File > Print” respectively. -

Timber Lines

TIMBER LINES S VOL. VIII JUNE 19 THIRTY-YEAR CLUB R-6 FOREST SERVICE V TIMBER LINES NO. VIII - PUBLISHED NOW MD THEN 13Y R-6 THIRTY-YEAR CLUB - JUNEl9SL When things go wrong, as they sometimes will, When the road you're trudging seenis all up hill, Whe funds are low and the debts are high And you want to smile, but you have to sigh When care is pressing you doun a bit, Rest, if you must - but don't you quit. Success Is failure turned inside out, The silver tint on the clouds of doubt, And you never can tell how cl6se you are, It may be near when it seems afar; 'So stick to the fight when you're hardest hit - It'swhenthings seem worst that you niust'nt. quit.. Anonymous S .. :.:THE PURPOSE OF TIER LINES To provide a means of keeping the clib informed on matters of common interest, to provide a nidiuzn of communication between members, to assist in making real the objectives of our constitution arid to' provide a bridge to span the gap between membersinretirement arid those stillin active service. To these things we dedicate Timber Lines. Editor Ny greetings to the 30-Year Club with some notes of major happenings in F.Y. 1951i. The past year has been a busy one for Region Six. That's not new. There has never been a year since the Region was formed that has not been a busy one..This year our timber cut is up slightly. It is close to 2billionfeet, although prices are down and our receipts will be less than last year. -

AUSTRALIAN PODCAST RANKER TOP 100 PODCASTS Reporting Period: 25 November - 22 December

AUSTRALIAN PODCAST RANKER TOP 100 PODCASTS Reporting Period: 25 November - 22 December RANK PODCAST PUBLISHER SALES REPRESENTATION RANK CHANGE 1 Hamish & Andy SCA-PodcastOne Australia PodcastOne Australia 0 2 The Lighthouse News Corp Australia News Corp / Nova Ent h5 3 Kate, Tim & Marty Nova Nova Entertainment 0 4 7am Schwartz Media Schwartz Media New 5 The Kyle & Jackie O Show Australian Radio Network Australian Radio Network i3 6 Life and Crimes with Andrew Rule News Corp Australia News Corp / Nova Ent h2 7 SEN Breakfast SEN / Crocmedia SEN / Crocmedia i2 8 Whateley SEN / Crocmedia SEN / Crocmedia i4 9 Sky News - News Bulletin News Corp Australia News Corp / Nova Ent h5 10 WILOSOPHY with Wil Anderson TOFOP Productions Whooshkaa New 11 Money News with Ross Greenwood Nine Radio1 Nine Radio i5 12 The Alan Jones Breakfast Show Nine Radio Nine Radio i2 13 Bedtime Explorers The Parent Brand The Parent Brand New 14 Kennedy Molloy SCA-Triple M SCA i5 15 The Howie Games SCA-PodcastOne Australia PodcastOne Australia i4 16 Hughesy and Kate SCA-Hit SCA i1 17 Moonman In The Morning - 104.9 SCA-Triple M SCA i5 Triple M Sydney 18 The Hot Breakfast SCA-Triple M SCA h1 19 Who the Hell is Hamish? News Corp Australia News Corp / Nova Ent i6 20 Chrissie, Sam & Browny Nova Nova Entertainment i4 21 Jase & PJ Australian Radio Network Australian Radio Network i1 22 Tech News News Corp Australia News Corp / Nova Ent h3 23 Police Tape News Corp Australia News Corp / Nova Ent h24 24 The Ray Hadley Morning Show Nine Radio Nine Radio i3 25 Motley Fool Money Australia -

Case M.8861 - COMCAST / SKY

EUROPEAN COMMISSION DG Competition Case M.8861 - COMCAST / SKY Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 15/06/2018 In electronic form on the EUR-Lex website under document number 32018M8861 EUROPEAN COMMISSION Brussels, 15.6.2018 C(2018) 3923 final In the published version of this decision, some information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and PUBLIC VERSION other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying party Subject: Case M.8861 - Comcast/Sky Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 7 May 2018, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Comcast Corporation ("Comcast" or the "Notifying Party", United States) proposes to acquire within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of Sky plc ("Sky", United Kingdom and the "Proposed Transaction"). Comcast and Sky are collectively referred to as the "Parties".3 1. THE OPERATION (2) Comcast is a US listed global media, technology and entertainment company, with two primary businesses: Comcast Cable and NBCUniversal ("NBCU"). Comcast is present in Europe almost entirely through NBCU, which is active in Europe in: (i) production, sales and distribution of film and television content; (ii) wholesale supply of TV channels and on-demand services; (iii) CNBC, a business news service, as well as NBC News; (iv) the provision of television content to end users through NBCU’s video on demand service; (v) the licensing of its 1 OJ L 24, 29.1.2004, p. -

Annex 4: Report from the States of the European Free Trade Association Participating in the European Economic Area

ANNEX 4: REPORT FROM THE STATES OF THE EUROPEAN FREE TRADE ASSOCIATION PARTICIPATING IN THE EUROPEAN ECONOMIC AREA 1. Application by the EFTA States participating in the EEA 1.1 Iceland European works The seven covered channels broadcast an average of 39.6% European works in 2007 and 42.2% in 2008. This represents a 2.6 percentage point increase over the reference period. For 2007 and 2008, of the total of seven covered channels, three channels achieved the majority proportion specified in Article 4 of the Directive (Omega Television, RUV and Syn - Vision TV), while four channels didn't meet this target (Sirkus, Skjár 1, Stöð 2 and Stöð 2 Bio). The compliance rate, in terms of numbers of channels, was 42.9%. European works made by independent producers The average proportion of European works by independent producers on all reported channels was 10.7% in 2007 and 12.6% in 2008, representing a 1.9 percentage points increase over the reference period. In 2007, of the total of seven identified channels, two channels exceeded the minimum proportion under Article 5 of the Directive, while three channels remained below the target. One channel was exempted (Syn - Vision TV) and no data was communicated for another one (Omega Television). The compliance rate, in terms of number of channels, was 33.3%. For 2008, of the total of seven covered channels, three exceeded the minimum proportion specified in Article 5 of the Directive, while two channels were below the target (Skjár 1 and Stöð 2 Bio). No data were communicated for two channels. -

View Annual Report

ANNUSKY NETWORKA TLELEVI REPOSION LIMITEDRT JUNE 2013 EVEry Day we’RE ON AN ADVENTURE LESLEY BANKIER FanaticalAS THE about RECEPTIONI Food TV ST I love sweet endings. Whether I’m behind the front desk or attempting recipes from Food TV, I’ll do my best to whip it all into shape and serve it with a smile. COME WITH US EVEry Day we’RE ON AN ADVENTURE FORGING NEW GROUND AND BRINGING CUSTOMERS EXPERIENCES THEY NEVER KNEW EXISTED NADINE WEARING FanaticalAS THE about SENIO SKYR Sport MARKETING EXECUTIVE I’m passionate about getting the right message, to the right person, at the right time. Especially on a Saturday night when the rugby is on SKY Sport. Run it Messam! Straight up the middle! COME WITH US FORGING NEW GROUND AND BRINGING CUSTOMERS EXPERIENCES THEY NEVER KNEW EXISTED TOGETHER WE CAN GO ANYWHERE 7 HIGHLIGHTS 8 CHAIRMAn’S LETTER 10 CHIEF Executive’S REVIEW 14 EXECUTIVE COMMITTEE 16 BUSINESS OVERVIEW 22 COMMUNITY AND SPONSORSHIP 24 FINANCIAL OVERVIEW 30 BOARD OF DIRECTORS 33 2013 FINANCIALS 34 Financial Trends Statement 37 Directors’ Responsibility Statement 38 Income Statement 39 Statement of Comprehensive Income 40 Balance Sheet 41 Statement of Changes in Equity 42 Statement of Cash Flows 43 Notes to the Financial Statements 83 Independent Auditors’ Report 84 OTHER INFORMATION OPENING 86 Corporate Governance Statements 89 Interests Register CREDITS 91 Company and Bondholder Information 95 Waivers and Information 96 Share Market and Other Information 97 Directory 98 SKY Channels SKY Annual Report 2013 6 | HIGHLIGHTS TOTAL REVENUE TOTAL SUBSCRIBERS $885m 855,898 EBITDA ARPU $353m $75.83 CAPITAL EXPENDITURE NET PROFIT $82m $137.2m EMPLOYEES FTEs MY SKY SUBSCRIBERS 1,118 456,419 SKY Annual Report 2013 | 7 “ THE 17-DAY COVERAGE OF THE LONDON OLYMPICS WAS UNPRECEDENTED IN NEW ZEALAND .. -

2015 SWM Annual Report

ABN 91 053 480 845 Delivering the future of content. Anywhere. Any screen. Anytime. Annual Report 2015 Seven West Media cares about the environment. By printing 2000 copies of this Annual Report on ecoStar Silk and ecoStar Offset the environmental impact was reduced by*: 1,185kg 171kg 1,707km of landfill of CO2 and travel in the average greenhouse gases European car 26,982 2,486kWh 1,926kg litres of water of energy of wood Source: European BREF data (virgin fibre paper). Carbon footprint data evaluated by Labelia Conseil in accordance with the Bilan Carbone® methodology. Results are obtained according to technical information and are subject to modification. *compared to a non-recycled paper. Delivering the future of content. Anywhere. Any screen. Anytime. Annual Report 2015 Contents What We Do 4 The Future of Us 44 Our Brands 6 Board of Directors 46 Our Strategy 8 Corporate Governance Statement 49 Our Strategic Framework 10 Directors’ Report 60 Letter from the Chairman 12 Remuneration Report 64 Letter from the Managing Director & CEO 14 Auditor’s Independence Declaration 83 Performance Dashboard 16 Financial Statements 84 Performance of the Business 18 Directors’ Declaration 134 Group Performance 20 Independent Auditor’s Report 135 Television 26 Company Information 137 Newspapers 32 Investor Information 138 Magazines 36 Shareholder Information 139 Other Business and New Ventures 40 Risk, Environment and Social Responsibility 42 2 Seven West Media Annual Report 2015 ABN 91 053 480 845 Contents The right people creating great content across television, digital, mobile and newspaper and magazine publishing. Delivering the future of content 3 What We Do We are achieving growth in the delivery of our content across our portfolio of integrated media platforms. -

Appendix 4E (Rule 4.3A) for the Year Ended 30 June 2020

FINANCIAL REPORT– 30 JUNE 2020 Appendix 4E (Rule 4.3A) for the year ended 30 June 2020 Results for Announcement to the Market 2020 2019 Key Financial Information $’000 $’000 Continuing operations Revenue from ordinary activities, excluding specific items Up by 17% 2,172,021 1,854,676 (Loss)/Profit from ordinary activities after tax n/m (508,778) 216,566 Net profit after tax, excluding specific items Down by 17% 155,937 187,064 Discontinued operations (Loss)/Profit from ordinary activities after tax n/m (66,189) 17,314 Total income attributable to: Net (loss)/profit from ordinary activities after tax — owners of the parent n/m (590,033) 221,229 Net profit from ordinary activities after tax — non-controlling interest Up by 19% 15,066 12,651 n/m: not meaningful. Refer to the attached Financial Report, Results Announcement and Investor Presentation for management commentary on the results. Dividends An interim fully franked dividend of 5 cents per share was paid on 20 April 2020. Since the end of the financial year, the directors have determined that a fully franked dividend of 2 cents per share will be payable in October 2020 in respect of the year ended 30 June 2020. Dividend and AGM Dates Ex-dividend date: 9 September 2020 Record date: 10 September 2020 Payment date: 20 October 2020 Annual General Meeting date: 12 November 2020 Net Tangible Assets per Share 2020 2019 Reported cents cents Net tangible asset (deficit)/backing per ordinary share1 (39.0) (10.9) Net asset backing per ordinary share 110.6 162.6 1 If right-of-use assets are included then the net tangible assets backing per share is (25.8) cents (2019: N/A). -

SFR Transition to 3Rd Wave

Future of Video Videoscape Architecture Overview Admir Hadzimahovic Systems Engineering Manager – EME VTG May 2011 © 2010 Cisco and/or its affiliates. All rights reserved. Cisco Public 1 Videoscape Architecture Overview Agenda: 1. Key IPTV video drivers 2. Claud – Mediasuit Platform 3. Network and ABR 4. Client – Home Gateway 5. Conductor 6. Demo © 2010 Cisco and/or its affiliates. All rights reserved. Cisco Public 2 CES Las Vegas Videoscape © 2010 Cisco and/or its affiliates. All rights reserved. Cisco Public 3 Consumer Broadcasters CE/Over The Top Service Provider Behavior and Media Video = 91% of consumer New distribution platform & Brand power Multi-screen offering IP traffic by 2014 interactive content – becoming table stakes Sky Sport TV on iPad / RTL on iPhone & iPad 20% New business models – Rising churn and Netflix = 20% of US Hulu 2009 revenue: $100M Building application & Subscriber acquisition cost st downstream internet 1 half 2010 revenue: $100M content eco-systems traffic in peak times Partnerships & Online Video Snacking Hybrid Broadcast Broadband TV: New Streaming Vertical Integration 11.4 Hour /month HbbTV subscription services Experience Diminishing SP Evolving Legacy Fragmentation Network Relevance Infrastructure Consumer Experience Business Models Content Fragmentation Subscription Fragmentation Broadcast, Premium, UGC Broadband, TV, Mobile, Movie rentals, OTT Device & Screen Fragmentation Free vs. Paid TV, PC, Mobile, Gaming, PDA Interactivity Fragmentation Ad Dollars Fragmentation Lean back, Lean forward, Social Transition from linear TV to online © 2010 Cisco and/or its affiliates. All rights reserved. Cisco Public 8 Presentation_ID © 2010 Cisco Systems, Inc. All rights reserved. Cisco Public 21 But SP’s Struggle to Deliver Online Content Intuitive Unified Navigation on TV /STB for All Content Multi-screen Web 2.0 Experiences on TV experience TV/STB © 2010 Cisco and/or its affiliates. -

'Content' Brochure

CONTENT SOLUTIONS ‘VBH is specialized in integrating luxury technology on board superyachts’ We believe the ultimate luxury is custom innovation, turning your dreams into reality. By developing user-friendly innovations for all on board, we create new experiences for the yachting lifestyle. SKY UK YACHT ULTIMATE PACKAGE ENTERTAINMENT & SPORTS ADD-ON PACKAGES (5+ cards) PACKAGE (1-4 cards) Kids Kids Racing UK Sports Sports At the races Cinema Cinema Box Nations HD Channels HD Channels Sky Cinema Music Music SKY ITALY SKY ITALY SILVER SKY ITALY GOLD SKY ITALY PLATINUM SKY TV BASE SKY TV BASE SKY TV BASE + + + SKY CINEMA A choice from 1 out of 3: A choice from 2 out of 3: + SKY SPORT SKY CINEMA SKY CINEMA + SKY CALCIO SKY SPORT SKY SPORT + FAMILY CHANNEL PACKAGE SKY CALCIO SKY CALCIO + PREMIERE LEAGUE UEFA CHAMPIONSHIP Satelite footprint DimensionsSatellite and footprint positions are approximate and for illustrative purposes only. Dimensions and positions are approximate and for illustrative purposes only. BEIN SPORTS GOLD PACKAGE PLATINUM PACKAGE ACCESS ACCESS + + TOPSPORTS TOPSPORTS + ENTERTAINMENT Satellite footprint DimensionsSatelite and footprint positions are approximate and for illustrative purposes only. Dimensions and positions are approximate and for illustrative purposes only. CANAL+ FRANCE L’INTEGRALE Canal + Chaînes Sports Jeunesse Diverstissement Découverte Musique TV Ciné & Séries Satellite footprint Dimensions and positions are approximate and for illustrative purposes only. DIRECTV USA PLATINUM PACKAGE ADD-ON PACKAGES ADD-ON PACKAGES + More than 150 TV Channels Sports Choice NFL Sunday Ticket FOX Soccer Plus ESPN College Extra Longhorn Network MBL Extra Innings SEC Network NBA League Pass NHL Center Ice Satellite footprint Dimensions and positions are approximate and for illustrative purposes only. -

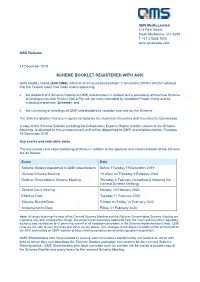

Scheme Booklet Registered with Asic

QMS Media Limited 214 Park Street South Melbourne, VIC 3205 T +61 3 9268 7000 www.qmsmedia.com ASX Release 13 December 2019 SCHEME BOOKLET REGISTERED WITH ASIC QMS Media Limited (ASX:QMS) refers to its announcement dated 12 December 2019 in which it advised that the Federal Court had made orders approving: • the dispatch of a Scheme Booklet to QMS shareholders in relation to the previously announced Scheme of Arrangement with Shelley BidCo Pty Ltd, an entity controlled by Quadrant Private Entity and its institutional partners (Scheme); and • the convening of meetings of QMS shareholders to consider and vote on the Scheme. The Scheme Booklet has been registered today by the Australian Securities and Investments Commission. A copy of the Scheme Booklet, including the Independent Expert's Report and the notices of the Scheme Meetings, is attached to this announcement and will be dispatched to QMS' shareholders before Thursday 19 December 2019. Key events and indicative dates The key events (and expected timing of these) in relation to the approval and implementation of the Scheme are as follows: Event Date Scheme Booklet dispatched to QMS shareholders Before Thursday 19 December 2019 General Scheme Meeting 10.00am on Thursday 6 February 2020 Rollover Shareholders Scheme Meeting Thursday 6 February (immediately following the General Scheme Meeting) Second Court Hearing Monday 10 February 2020 Effective Date Tuesday 11 February 2020 Scheme Record Date 5.00pm on Friday 14 February 2020 Implementation Date Friday 21 February 2020 Note: All dates following the date of the General Scheme Meeting and the Rollover Shareholders Scheme Meeting are indicative only and, among other things, are subject to all necessary approvals from the Court and any other regulatory authority and satisfaction or (if permitted) waiver of all conditions precedent in the Scheme Implementation Deed.