Presentation to Macquarie Conference

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fremantle Press News

FREMANTLE PRESS NEWS Welcome to the Fremantle Press newsletter for retailers. Can we help? Contact us for merchandise, event bookings, co-promotion opportunities, reading copies and more. WHAT’S NEW: JUNE 2015 Overview Detective Daniel Clement is back in Broome, licking his wounds from a busted marriage and struggling to be impressed by his new team of small-town inexperienced cops. But stagnation and lethargy soon evaporate when a man is found dead in a crocodile-infested watering hole. As a monster cyclone brews on the horizon, Clement finds himself following the murky trail of a decades old mystery. Crime fiction * 9781925161175 (PB) What’s planned Media: Interviews in Good Reading Magazine, Scoop Magazine, The West Australian and local newspapers in Sydney and Perth. Reviews in Herald Sun, Sydney Morning Herald, The Australian, The Advertiser, Austra and The Examiner. Radio interviews on ABC Perth and Sydney, 6PR, RTR FM, 2SER and more. Advertising: Good Reading Magazine, Australian Book Review, plus book trade advertising in Sydney and Melbourne and online advertising on Google, Facebook and the Australian Crime Writers Association website. 9781925 161175 About the author Dave Warner is the author of nine novels and six non-fiction titles, and has written for feature film, stage, television, radio and newspapers. His first book, City of Light, won the Western Australian Premier’s Book Award for Fiction. Dave Warner originally gained national recognition as a musician-songwriter. His nine albums include the gold album Mug’s Game. In 1992 he was the inaugural inductee into the West Australian Rock’n’Roll of Renown. -

Timber Lines

TIMBER LINES S VOL. VIII JUNE 19 THIRTY-YEAR CLUB R-6 FOREST SERVICE V TIMBER LINES NO. VIII - PUBLISHED NOW MD THEN 13Y R-6 THIRTY-YEAR CLUB - JUNEl9SL When things go wrong, as they sometimes will, When the road you're trudging seenis all up hill, Whe funds are low and the debts are high And you want to smile, but you have to sigh When care is pressing you doun a bit, Rest, if you must - but don't you quit. Success Is failure turned inside out, The silver tint on the clouds of doubt, And you never can tell how cl6se you are, It may be near when it seems afar; 'So stick to the fight when you're hardest hit - It'swhenthings seem worst that you niust'nt. quit.. Anonymous S .. :.:THE PURPOSE OF TIER LINES To provide a means of keeping the clib informed on matters of common interest, to provide a nidiuzn of communication between members, to assist in making real the objectives of our constitution arid to' provide a bridge to span the gap between membersinretirement arid those stillin active service. To these things we dedicate Timber Lines. Editor Ny greetings to the 30-Year Club with some notes of major happenings in F.Y. 1951i. The past year has been a busy one for Region Six. That's not new. There has never been a year since the Region was formed that has not been a busy one..This year our timber cut is up slightly. It is close to 2billionfeet, although prices are down and our receipts will be less than last year. -

Campaign Monitoring Process 1. Dispatch Creative Audio to Networks

Campaign Monitoring Process 1. Dispatch Creative Audio to Networks: All material for monitoring must be dispatched to networks via AudioNET for Key Number identification in the AirCheck system. Dispatch can be processed by the creative agency, media agency or the client themselves. (Charges apply) 2. Export Campaign from SMD. AudioNET currently relies on a .csv file from SMD to match campaign bookings with airplay. 3. Email the SMD export, Material Instructions and the Media Plan to [email protected]. • Keep AudioNET updated with all changes to campaign bookings, including Upweight campaigns, dropped spots, key number changes, spot volume changes as they occur to avoid delays in receiving your reports. 4. Subscribe to reports: From the list of Reporting Options below, nominate reports required, weekly, monthly or at the end of campaign. Report packages can be decided on a client-by-client basis and altered at any time. All reports are available in PDF and/or excel format. 5. Auditing Process: Your designated account manager will audit your client’s activity weekly, a week in arrears. Standard weekly reports are emailed through on any day between Tuesday to Thursday as the auditors work through each of their client’s radio campaign activities. The time to complete an audit and provide files is variant, dependent on the size and complexity of the campaign. A prompt delivery of weekly reports is also dependent on the accuracy of the campaign booking information provided to us (SMD & Material Instructions), whilst we compare these with how each station has aired your booked campaign. When booking discrepancies do arise, our auditors then start the manual process of reconciling ‘where has the error occurred’. -

AUSTRALIAN PODCAST RANKER TOP 100 PODCASTS Reporting Period: 25 November - 22 December

AUSTRALIAN PODCAST RANKER TOP 100 PODCASTS Reporting Period: 25 November - 22 December RANK PODCAST PUBLISHER SALES REPRESENTATION RANK CHANGE 1 Hamish & Andy SCA-PodcastOne Australia PodcastOne Australia 0 2 The Lighthouse News Corp Australia News Corp / Nova Ent h5 3 Kate, Tim & Marty Nova Nova Entertainment 0 4 7am Schwartz Media Schwartz Media New 5 The Kyle & Jackie O Show Australian Radio Network Australian Radio Network i3 6 Life and Crimes with Andrew Rule News Corp Australia News Corp / Nova Ent h2 7 SEN Breakfast SEN / Crocmedia SEN / Crocmedia i2 8 Whateley SEN / Crocmedia SEN / Crocmedia i4 9 Sky News - News Bulletin News Corp Australia News Corp / Nova Ent h5 10 WILOSOPHY with Wil Anderson TOFOP Productions Whooshkaa New 11 Money News with Ross Greenwood Nine Radio1 Nine Radio i5 12 The Alan Jones Breakfast Show Nine Radio Nine Radio i2 13 Bedtime Explorers The Parent Brand The Parent Brand New 14 Kennedy Molloy SCA-Triple M SCA i5 15 The Howie Games SCA-PodcastOne Australia PodcastOne Australia i4 16 Hughesy and Kate SCA-Hit SCA i1 17 Moonman In The Morning - 104.9 SCA-Triple M SCA i5 Triple M Sydney 18 The Hot Breakfast SCA-Triple M SCA h1 19 Who the Hell is Hamish? News Corp Australia News Corp / Nova Ent i6 20 Chrissie, Sam & Browny Nova Nova Entertainment i4 21 Jase & PJ Australian Radio Network Australian Radio Network i1 22 Tech News News Corp Australia News Corp / Nova Ent h3 23 Police Tape News Corp Australia News Corp / Nova Ent h24 24 The Ray Hadley Morning Show Nine Radio Nine Radio i3 25 Motley Fool Money Australia -

A Bloomin' Good Idea!

Uniview Vol. 35 No. 2, Spring 2015 A bloomin’ good idea! “ The Delano Scholarship has helped me flourish in my music studies.” JULIA NICHOLLS Be part of our future For generations, UWA’s musical stars have created magical moments here on campus and across the globe. Bequests from people like the late Vic Delano, a professional musician, have provided young musicians like Julia, Christopher and William with the mentorship of some of the world’s finest performers and relieved the financial burden associated with studying music at university. Through Vic’s generosity, we can share special times with rising stars like Julia and her fellow musicians for many years to come. If you would like to help our talented musicians create magical moments for future generations, consider a gift in your will today. To find out more, contact: Liz Terracini, Development Manager, Bequests on +61 8 6488 8537 or [email protected] CRICOS Provider Code 00126G UNIPRINT 127326 CRICOS Provider VOL.35 NO. 2, SPRING 2015 ALUMNI MAGAZINE FOR THE UNIVERSITY OF WESTERN AUSTRALIA CONTENTS In Focus: campus news and views 2 From the Vice-Chancellery 8 Vocal studies hit the high notes 9 The Forrest Scholars – unlocking the doors of knowledge 12 Graduate profile: AMA WA President Dr Michael Gannon 14 Launching UWA IQ 17 What makes a good idea grow? 18 Searching for the ‘gold standard’ of healing 22 From idea to “serious innovation” 24 The CEED career launch pad 26 Rammed Earth 28 “Making things happen” for PIAF 30 Archaeology in a war zone 32 “ The Delano Scholarship Foreign Minister Julie Bishop hopes New Colombo Volunteers central to UWA’s success 34 Plan students gain insights and understanding of has helped me flourish Grad News 36 the region during study and internships. -

2015 SWM Annual Report

ABN 91 053 480 845 Delivering the future of content. Anywhere. Any screen. Anytime. Annual Report 2015 Seven West Media cares about the environment. By printing 2000 copies of this Annual Report on ecoStar Silk and ecoStar Offset the environmental impact was reduced by*: 1,185kg 171kg 1,707km of landfill of CO2 and travel in the average greenhouse gases European car 26,982 2,486kWh 1,926kg litres of water of energy of wood Source: European BREF data (virgin fibre paper). Carbon footprint data evaluated by Labelia Conseil in accordance with the Bilan Carbone® methodology. Results are obtained according to technical information and are subject to modification. *compared to a non-recycled paper. Delivering the future of content. Anywhere. Any screen. Anytime. Annual Report 2015 Contents What We Do 4 The Future of Us 44 Our Brands 6 Board of Directors 46 Our Strategy 8 Corporate Governance Statement 49 Our Strategic Framework 10 Directors’ Report 60 Letter from the Chairman 12 Remuneration Report 64 Letter from the Managing Director & CEO 14 Auditor’s Independence Declaration 83 Performance Dashboard 16 Financial Statements 84 Performance of the Business 18 Directors’ Declaration 134 Group Performance 20 Independent Auditor’s Report 135 Television 26 Company Information 137 Newspapers 32 Investor Information 138 Magazines 36 Shareholder Information 139 Other Business and New Ventures 40 Risk, Environment and Social Responsibility 42 2 Seven West Media Annual Report 2015 ABN 91 053 480 845 Contents The right people creating great content across television, digital, mobile and newspaper and magazine publishing. Delivering the future of content 3 What We Do We are achieving growth in the delivery of our content across our portfolio of integrated media platforms. -

Appendix 4E (Rule 4.3A) for the Year Ended 30 June 2020

FINANCIAL REPORT– 30 JUNE 2020 Appendix 4E (Rule 4.3A) for the year ended 30 June 2020 Results for Announcement to the Market 2020 2019 Key Financial Information $’000 $’000 Continuing operations Revenue from ordinary activities, excluding specific items Up by 17% 2,172,021 1,854,676 (Loss)/Profit from ordinary activities after tax n/m (508,778) 216,566 Net profit after tax, excluding specific items Down by 17% 155,937 187,064 Discontinued operations (Loss)/Profit from ordinary activities after tax n/m (66,189) 17,314 Total income attributable to: Net (loss)/profit from ordinary activities after tax — owners of the parent n/m (590,033) 221,229 Net profit from ordinary activities after tax — non-controlling interest Up by 19% 15,066 12,651 n/m: not meaningful. Refer to the attached Financial Report, Results Announcement and Investor Presentation for management commentary on the results. Dividends An interim fully franked dividend of 5 cents per share was paid on 20 April 2020. Since the end of the financial year, the directors have determined that a fully franked dividend of 2 cents per share will be payable in October 2020 in respect of the year ended 30 June 2020. Dividend and AGM Dates Ex-dividend date: 9 September 2020 Record date: 10 September 2020 Payment date: 20 October 2020 Annual General Meeting date: 12 November 2020 Net Tangible Assets per Share 2020 2019 Reported cents cents Net tangible asset (deficit)/backing per ordinary share1 (39.0) (10.9) Net asset backing per ordinary share 110.6 162.6 1 If right-of-use assets are included then the net tangible assets backing per share is (25.8) cents (2019: N/A). -

12 September 2019

Official Visit to Switzerland 7 – 12 September 2019 The Honourable Annastacia Palaszczuk MP Premier of Queensland and Minister for Trade Page 1 TABLE OF CONTENTS PROGRAM.............................................................................................................................................. 3 SATURDAY 7 SEPTEMBER 2019 ................................................................................................................................. 3 SUNDAY 8 SEPTEMBER 2019 .................................................................................................................................... 3 MONDAY 9 SEPTEMBER 2019 ................................................................................................................................... 4 TUESDAY 10 SEPTEMBER 2019 ................................................................................................................................. 5 WEDNESDAY 11 SEPTEMBER 2019 ............................................................................................................................ 6 THURSDAY 12 SEPTEMBER 2019 ............................................................................................................................... 6 DELEGATES AND MEMBERS .............................................................................................................. 7 OFFICIAL PARTY MEMBERS ....................................................................................................................................... 7 AUSTRALIAN -

SUBMISSION by COMMERCIAL RADIO AUSTRALIA Capacity Of

SUBMISSION BY COMMERCIAL RADIO AUSTRALIA Capacity of Communication Networks and Emergency Warning Systems to Deal with Emergencies and Natural Disasters Inquiry by the Senate Environment and Communications References Committee 21 April 2011 SUBMISSION BY COMMERCIAL RADIO AUSTRALIA 1. Introduction Commercial Radio Australia (CRA) welcomes the opportunity to participate in the Senate Inquiry relating to the capacity of communication networks and emergency warning systems to deal with emergencies and natural disasters. CRA is the peak national industry body for Australian commercial radio stations. CRA has 260 members and represents approximately 99% of the commercial radio broadcasting industry in Australia. The commercial radio industry is keen to offer as much assistance as possible in times of emergency and recognizes its responsibilities as one of the nation‟s major information sources during crises. Broadcast media is the most effective means by which emergency service organisations communicate with the public when critical events occur. Commercial radio plays a particularly important role, as 80% of Australians listen to commercial radio. The local commercial radio stations therefore play a critical role in the dissemination of information to the local community in times of emergency. We set out below a brief outline of the regulation and agreements which detail the way in which commercial radio assists in emergencies, together with examples from recent emergencies of the way in which this operates in practice. We also outline the challenges that stations have faced in dealing with the recent emergencies. 2. Regulatory framework Commercial Radio Codes of Practice The commercial radio industry is heavily regulated by the Federal Government. -

THE PACIFIC-ASIAN LOG January 2019 Introduction Copyright Notice Copyright 2001-2019 by Bruce Portzer

THE PACIFIC-ASIAN LOG January 2019 Introduction Copyright Notice Copyright 2001-2019 by Bruce Portzer. All rights reserved. This log may First issued in August 2001, The PAL lists all known medium wave not reproduced or redistributed in whole or in part in any form, except with broadcasting stations in southern and eastern Asia and the Pacific. It the expressed permission of the author. Contents may be used freely in covers an area extending as far west as Afghanistan and as far east as non-commercial publications and for personal use. Some of the material in Alaska, or roughly one half of the earth's surface! It now lists over 4000 this log was obtained from copyrighted sources and may require special stations in 60 countries, with frequencies, call signs, locations, power, clearance for anything other than personal use. networks, schedules, languages, formats, networks and other information. The log also includes longwave broadcasters, as well as medium wave beacons and weather stations in the region. Acknowledgements Since early 2005, there have been two versions of the Log: a downloadable pdf version and an interactive on-line version. My sources of information include DX publications, DX Clubs, E-bulletins, e- mail groups, web sites, and reports from individuals. Major online sources The pdf version is updated a few a year and is available at no cost. There include Arctic Radio Club, Australian Radio DX Club (ARDXC), British DX are two listings in the log, one sorted by frequency and the other by country. Club (BDXC), various Facebook pages, Global Tuners and KiwiSDR receivers, Hard Core DXing (HCDX), International Radio Club of America The on-line version is updated more often and allows the user to search by (IRCA), Medium Wave Circle (MWC), mediumwave.info (Ydun Ritz), New frequency, country, location, or station. -

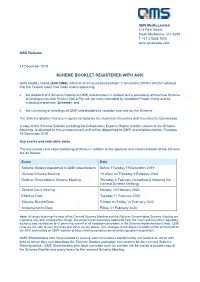

Scheme Booklet Registered with Asic

QMS Media Limited 214 Park Street South Melbourne, VIC 3205 T +61 3 9268 7000 www.qmsmedia.com ASX Release 13 December 2019 SCHEME BOOKLET REGISTERED WITH ASIC QMS Media Limited (ASX:QMS) refers to its announcement dated 12 December 2019 in which it advised that the Federal Court had made orders approving: • the dispatch of a Scheme Booklet to QMS shareholders in relation to the previously announced Scheme of Arrangement with Shelley BidCo Pty Ltd, an entity controlled by Quadrant Private Entity and its institutional partners (Scheme); and • the convening of meetings of QMS shareholders to consider and vote on the Scheme. The Scheme Booklet has been registered today by the Australian Securities and Investments Commission. A copy of the Scheme Booklet, including the Independent Expert's Report and the notices of the Scheme Meetings, is attached to this announcement and will be dispatched to QMS' shareholders before Thursday 19 December 2019. Key events and indicative dates The key events (and expected timing of these) in relation to the approval and implementation of the Scheme are as follows: Event Date Scheme Booklet dispatched to QMS shareholders Before Thursday 19 December 2019 General Scheme Meeting 10.00am on Thursday 6 February 2020 Rollover Shareholders Scheme Meeting Thursday 6 February (immediately following the General Scheme Meeting) Second Court Hearing Monday 10 February 2020 Effective Date Tuesday 11 February 2020 Scheme Record Date 5.00pm on Friday 14 February 2020 Implementation Date Friday 21 February 2020 Note: All dates following the date of the General Scheme Meeting and the Rollover Shareholders Scheme Meeting are indicative only and, among other things, are subject to all necessary approvals from the Court and any other regulatory authority and satisfaction or (if permitted) waiver of all conditions precedent in the Scheme Implementation Deed. -

Weekly Audience Pack As at 19 May, 2020 Summary

Weekly Audience Pack As at 19 May, 2020 Summary Linear TV BVOD Digital & Publishing Radio The Nine Network continues to be the 9Now continues to be the leading This week the focus is on lifestyle Audiences continue to turn to Nine preferred primetime network for all key CFTA BVOD platform with a year-to- content with social restrictions being Radio for trusted voices and platforms demographics for the calendar year-to- date share of 48% in total minutes. lifted Australians are reconnecting with where they can share their date, with a 39.7% commercial share their love of travel content. opinions. The second GfK Radio Survey among P25-54. 9Now has experienced year-on- of 2020 has seen 2GB, 3AW, 4BC and year minutes growth for key Nine’s Traveller had double-digit week- 6PR post significant audience growth Engagement for the Nine Network is demographics include P25-54 (+33%) on-week growth in users (+44%), during the COVID-19 crisis. increasing year-on-year across all key and P18-39 (+34%). sessions (+46%) and page views (+43%). demographics. P25-54 are spending an Readers are also in travel planning Nine digital radio continues to see year- additional +2.78 minutes per day viewing As viewers continue to turn to mode, with week-on-week growth in on-year growth, with 4BC in Brisbane primetime content. entertainment for an escape during Traveller’s planning section across users delivering +17% in live streaming week- the current global pandemic, (+80%), sessions (+92%) and page views on-week. More listeners are tuning in The LEGO Masters season final viewers are choosing family favourite (+79%).