Case M.8861 - COMCAST / SKY

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Must See Movies Sponsorship

Must See Movies Sponsorship . skymedia.co.uk @skymediaupdates skymedia Must See Movies The Latest Movies. The Greatest Movies. The Ultimate Cinematic Experience The Lion King Channel Investment Start Platforms Available on Available Now Linear broadcast Clickable VoD request Big Screen VoD Off-air Activation Reach A Hugely Engaged On Quality. Media Value Activate Around 8.8m Individuals Brand New Demand Environment. Sophistication. Premiere Every THE 3.9m Abc1 Ads 53.9m Accessible. Single Day Biggest Movies £2.3m 14% Abc1 Ads impressions World Class. The Opportunity Only the best up coming movies… Partner with this year’s biggest and best blockbusters *This illustrates some of the titles available across 2020 before any other film subscription service - Must See Movies across Sky Cinema Premiere. Spread your brand across multiple platformsincludingBroadcast, On Demand & Sky Go. The home of blockbuster movies, scheduling the biggest Box Office titles before any other movie subscriptionservice. Watch Sky Cinema whenever with whoever and wherever! Making this a truly ‘always on’ opportunity. A Brand New Premiere Everyday: A Brand new premiere every single day! Some blockbuster titles coming to the service only 3 monthsafter cinemarelease. Quality Films With A List Talent The talent list on Sky's portfolio gets bigger and better every year! Brands can become synonymouswith A list and much loved talent: The Ultimate Movies Experience • The latest blockbuster hits closest to cinemarelease! • Brand new premiere each day of the week • Over 1000 of the biggest ever films availableon demand • Premium Environment • Quality and award winning environment The Best Viewer Experience With our innovation in technology, our exclusive relationships with world-class studios and our undeniable passion for movies , We bring the big screen cinematic experience straight into peoples home! Bringing you movies just as the director intended! Opportunity to Activate: A range of activation opportunities can be designed to help a brand TV UHD drive fame and engage with key audiences. -

Broadcast Bulletin Issue Number 285 17/08/15

Ofcom Broadcast Bulletin Issue number 285 17 August 2015 1 Ofcom Broadcast Bulletin, Issue 285 17 August 2015 Contents Introduction 5 Notice of Sanction Yoga for You Lamhe TV, 17 June 2014, 09:30 7 Note to Broadcasters 9 Code on the Scheduling of Television Advertising Standards cases In Breach Britain’s Got Talent ITV, 31 May 2015, 19:30 10 News Geo News, 7 May 2015, 08:00 and 14:00 17 Different Anglez New Style Radio 98.7 FM, 7 May 2015, 10:00 19 News ARY News, 7 May 2015, 11:10 and 14:05 21 News Samaa, 7 May 2015, 14:30 23 News Dunya News, 7 May 2015, 17:30 25 Resolved Off Their Rockers: Blue Badge Special (trailer) ITV, 30 May to 1 June 2015, various times pre-watershed. 27 Funded Factual Programmes cases Funded Factual Programmes: managing risks to editorial independence and ensuring viewer confidence 30 Assessment of programmes produced by FactBased Communications and other funded content BBC World News, CNBC and CNN International 33 FBC-produced programming BBC World News, various dates between 14 February 2009 and 2 July 2011 34 2 Ofcom Broadcast Bulletin, Issue 285 17 August 2015 Sponsored programmes BBC World News, various dates between 23 October 2009 and 4 June 2011 49 World Business CNBC, various dates between 17 December 2010 and 22 July 2011. 77 Marketplace Middle East and Quest Means Business CNN International, various dates between 6 March 2009 and 13 July 2011 95 Sponsored programmes CNN International, various dates between 14 August 2009 and 4 August 2012 115 Advertising Scheduling cases In Breach Advertising minutage -

Pr-Dvd-Holdings-As-Of-September-18

CALL # LOCATION TITLE AUTHOR BINGE BOX COMEDIES prmnd Comedies binge box (includes Airplane! --Ferris Bueller's Day Off --The First Wives Club --Happy Gilmore)[videorecording] / Princeton Public Library. BINGE BOX CONCERTS AND MUSICIANSprmnd Concerts and musicians binge box (Includes Brad Paisley: Life Amplified Live Tour, Live from WV --Close to You: Remembering the Carpenters --John Sebastian Presents Folk Rewind: My Music --Roy Orbison and Friends: Black and White Night)[videorecording] / Princeton Public Library. BINGE BOX MUSICALS prmnd Musicals binge box (includes Mamma Mia! --Moulin Rouge --Rodgers and Hammerstein's Cinderella [DVD] --West Side Story) [videorecording] / Princeton Public Library. BINGE BOX ROMANTIC COMEDIESprmnd Romantic comedies binge box (includes Hitch --P.S. I Love You --The Wedding Date --While You Were Sleeping)[videorecording] / Princeton Public Library. DVD 001.942 ALI DISC 1-3 prmdv Aliens, abductions & extraordinary sightings [videorecording]. DVD 001.942 BES prmdv Best of ancient aliens [videorecording] / A&E Television Networks History executive producer, Kevin Burns. DVD 004.09 CRE prmdv The creation of the computer [videorecording] / executive producer, Bob Jaffe written and produced by Donald Sellers created by Bruce Nash History channel executive producers, Charlie Maday, Gerald W. Abrams Jaffe Productions Hearst Entertainment Television in association with the History Channel. DVD 133.3 UNE DISC 1-2 prmdv The unexplained [videorecording] / produced by Towers Productions, Inc. for A&E Network executive producer, Michael Cascio. DVD 158.2 WEL prmdv We'll meet again [videorecording] / producers, Simon Harries [and three others] director, Ashok Prasad [and five others]. DVD 158.2 WEL prmdv We'll meet again. Season 2 [videorecording] / director, Luc Tremoulet producer, Page Shepherd. -

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

Service Makes the Difference

SERVICE MAKES THE DIFFERENCE Sky creates a unique customer experience by listening to feedback CASE STUDY SKY DEUTSCHLAND www.questback.com People matter. Get their insight. CASE STUDY Sky Deutschland OUTSTANDING CUSTOMER SERVICE Sky provides customers with a unique service experience – thanks to Questback Pay-TV provider Sky Deutschland’s high quality customer service is well-known, and was recognized most recently when the company won its category in the prestigious Handelsblatt “TOP SERVICE Germany 2015” awards. The secret behind this success is Sky’s belief that customer satisfaction is not enough on its own – at the same time it is critical to efficiently solve customer problems. Sky measures and optimizes both of these metrics using Questback’s Enterprise Feedback Suite (EFS). SITUATION Premium Service Experiences Objectives: With about 4.3 million customers, Sky is the pay-TV market leader in Germany and Austria. Exclusive content, innovative products for anywhere, anytime › Measure customer service as viewing, and outstanding customer service – these are the key ingredients in part of the overall customer the media company’s formula for success. The figures speak for themselves: experience customer growth is 61 % higher than the previous year. › Optimize service quality from a customer perspective Sky’s brand promise is to always offer the best entertainment experience – › Improve customer service and not just in terms of programs and products. It also applies to customer performance › Increase customer loyalty and willing- service, which is a key strategic priority for the company: “We don’t just offer ness to recommend our customers first-class entertainment, we also give them a unique customer experience,” says Robert Wiedemer, Head of Quality & Feedback Management at Sky. -

DISCOVER NEW WORLDS with SUNRISE TV TV Channel List for Printing

DISCOVER NEW WORLDS WITH SUNRISE TV TV channel list for printing Need assistance? Hotline Mon.- Fri., 10:00 a.m.–10:00 p.m. Sat. - Sun. 10:00 a.m.–10:00 p.m. 0800 707 707 Hotline from abroad (free with Sunrise Mobile) +41 58 777 01 01 Sunrise Shops Sunrise Shops Sunrise Communications AG Thurgauerstrasse 101B / PO box 8050 Zürich 03 | 2021 Last updated English Welcome to Sunrise TV This overview will help you find your favourite channels quickly and easily. The table of contents on page 4 of this PDF document shows you which pages of the document are relevant to you – depending on which of the Sunrise TV packages (TV start, TV comfort, and TV neo) and which additional premium packages you have subscribed to. You can click in the table of contents to go to the pages with the desired station lists – sorted by station name or alphabetically – or you can print off the pages that are relevant to you. 2 How to print off these instructions Key If you have opened this PDF document with Adobe Acrobat: Comeback TV lets you watch TV shows up to seven days after they were broadcast (30 hours with TV start). ComeBack TV also enables Go to Acrobat Reader’s symbol list and click on the menu you to restart, pause, fast forward, and rewind programmes. commands “File > Print”. If you have opened the PDF document through your HD is short for High Definition and denotes high-resolution TV and Internet browser (Chrome, Firefox, Edge, Safari...): video. Go to the symbol list or to the top of the window (varies by browser) and click on the print icon or the menu commands Get the new Sunrise TV app and have Sunrise TV by your side at all “File > Print” respectively. -

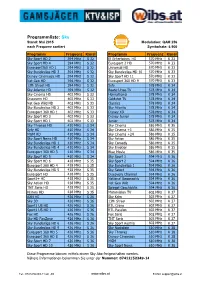

Programmliste: Sky Stand: Mai 2015 Modulation: QAM 256 Nach Frequenz Sortiert Symbolrate: 6.900

Programmliste: Sky Stand: Mai 2015 Modulation: QAM 256 nach Frequenz sortiert Symbolrate: 6.900 Programm Frequenz Kanal Programm Frequenz Kanal Sky Sport HD 2 394 MHz S 32 E! Entertainm. HD 570 MHz K 33 Sky Sport HD 4 394 MHz S 32 Eurosport 2 HD 570 MHz K 33 Eurosport360 HD 2 394 MHz S 32 Universal HD 570 MHz K 33 Sky Bundesliga HD 3 394 MHz S 32 Sky Bundesliga HD 10 570 MHz K 33 Disney Cinemagic HD 394 MHz S 32 Sky Sport HD 11 570 MHz K 33 Nat Geo HD 394 MHz S 32 Eurosport 360 HD 9 570 MHz K 33 13th Street HD 394 MHz S 32 Syfy 578 MHz K 34 Sky Atlantic HD 394 MHz S 32 Beate-Uhse.TV 578 MHz K 34 Sky Cinema HD 402 MHz S 33 Heimatkanal 578 MHz K 34 Discovery HD 402 MHz S 33 Goldstar TV 578 MHz K 34 Nat Geo Wild HD 402 MHz S 33 Classica 578 MHz K 34 Sky Bundesliga HD 2 402 MHz S 33 Sky Atlantic 578 MHz K 34 Eurosport 360 HD 1 402 MHz S 33 Disney XD 578 MHz K 34 Sky Sport HD 3 402 MHz S 33 Disney Junior 578 MHz K 34 Sky Sport HD 1 402 MHz S 33 Junior 578 MHz K 34 Sky Thrones HD 410 MHz S 34 Sky Cinema 586 MHz K 35 Syfy HD 410 MHz S 34 Sky Cinema +1 586 MHz K 35 MGM HD 410 MHz S 34 Sky Cinema +24 586 MHz K 35 Sky Sport News HD 410 MHz S 34 Sky Action 586 MHz K 35 Sky Bundesliga HD 1 410 MHz S 34 Sky Comedy 586 MHz K 35 Sky Bundesliga HD 4 410 MHz S 34 Sky Emotion 586 MHz K 35 Eurosport 360 HD 3 410 MHz S 34 Blue Movie 586 MHz K 35 Sky Sport HD 5 410 MHz S 34 Sky Sport 1 594 MHz K 36 Sky Sport HD 6 418 MHz S 35 Sky Sport 2 594 MHz K 36 Eurosport 360 HD 4 418 MHz S 35 Sky Bundesliga 1 594 MHz K 36 Sky Bundesliga HD 5 418 MHz S 35 Sky Select -

Nbcuniversal International Television Production, Mediengruppe RTL Deutschland and TF1 Enter Ground- Breaking Partnership to Produce US Procedural Dramas

NBCUniversal International Television Production, Mediengruppe RTL Deutschland and TF1 enter ground- breaking partnership to produce US procedural dramas LONDON – 13 April 2015: NBCUniversal International Television Production (NBCU-ITVP), Mediengruppe RTL Deutschland and TF1 today announce that they have entered into an international co-production partnership to produce original US-style TV procedural dramas, allowing these leading international broadcasters to secure a pipeline of high quality, US-style procedural content from NBCUniversal. It is the first time that European broadcasters have partnered with a major US media company for a deal of this nature. This unique tripartite collaboration, conceived by Michael Edelstein, President of NBCU-ITVP, brings together leading international broadcasters – Mediengruppe RTL Deutschland and TF1 – with a major US media company that produces world class content across multiple genres. The partnership is designed to produce up to three new dramas over two years and will benefit from NBCUniversal’s wealth of expertise in producing high-quality, long-running procedural dramas such as Law & Order and House. Commenting on the partnership, Michael Edelstein said: “Procedural drama is a highly popular TV format in the global marketplace due to its episodic, rather than serialized, format. This pioneering venture with RTL and TF1 has the ability to create a number of exciting new series and represents the bold approach of these forward thinking broadcasters. For the first time, our partners will have the opportunity to commission US procedural drama directly from a company with a proven track record of success in the genre.” Procedural drama is particularly valuable to European broadcasters who are able to schedule programs with far greater freedom – episodes can be stacked and aired out of sequence. -

EDITED TRANSCRIPT CMCSA.OQ - Q3 2020 Comcast Corp Earnings Call

REFINITIV STREETEVENTS EDITED TRANSCRIPT CMCSA.OQ - Q3 2020 Comcast Corp Earnings Call EVENT DATE/TIME: OCTOBER 29, 2020 / 12:30PM GMT OVERVIEW: Co. reported 3Q20 consolidated revenue of $25.5b. REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2020 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. OCTOBER 29, 2020 / 12:30PM, CMCSA.OQ - Q3 2020 Comcast Corp Earnings Call CORPORATE PARTICIPANTS Brian L. Roberts Comcast Corporation - Chairman & CEO David N. Watson Comcast Corporation - President & CEO, Comcast Cable Jeff Shell Comcast Corporation - CEO, NBCUniversal Jeremy Darroch Comcast Corporation - Group Chief Executive, Sky Marci Ryvicker Comcast Corporation - SVP of IR Michael J. Cavanagh Comcast Corporation - CFO CONFERENCE CALL PARTICIPANTS Benjamin Daniel Swinburne Morgan Stanley, Research Division - MD Craig Eder Moffett MoffettNathanson LLC - Founding Partner Douglas David Mitchelson Crédit Suisse AG, Research Division - MD Jessica Jean Reif Ehrlich BofA Merrill Lynch, Research Division - MD in Equity Research John Christopher Hodulik UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group and Telco & Pay TV Analyst Philip A. Cusick JPMorgan Chase & Co, Research Division - MD and Senior Analyst PRESENTATION Operator Good morning, ladies and gentlemen, and welcome to Comcast's Third Quarter 2020 Earnings Conference Call. (Operator Instructions) Please note that this conference call is being recorded. I will now turn the call over to Senior Vice President, Investor Relations, Ms. Marci Ryvicker. Please go ahead, Ms. Ryvicker. Marci Ryvicker - Comcast Corporation - SVP of IR Thank you, operator, and welcome, everyone. -

Q4 2020 Comcast Corp Earnings Call on January 28, 2021 / 1:30PM

REFINITIV STREETEVENTS EDITED TRANSCRIPT CMCSA.OQ - Q4 2020 Comcast Corp Earnings Call EVENT DATE/TIME: JANUARY 28, 2021 / 1:30PM GMT OVERVIEW: Co. reported 4Q20 reported revenue of $27.7b and adjusted EPS of $0.56. REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2021 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JANUARY 28, 2021 / 1:30PM, CMCSA.OQ - Q4 2020 Comcast Corp Earnings Call CORPORATE PARTICIPANTS Brian L. Roberts Comcast Corporation - Chairman & CEO Dana Strong Comcast Corporation - Group Chief Executive Officer, Sky David N. Watson Comcast Corporation - President & CEO, Comcast Cable Jeff Shell Comcast Corporation - CEO, NBCUniversal Marci Ryvicker Comcast Corporation - SVP of IR Michael J. Cavanagh Comcast Corporation - CFO CONFERENCE CALL PARTICIPANTS Benjamin Daniel Swinburne Morgan Stanley, Research Division - MD Brett Joseph Feldman Goldman Sachs Group, Inc., Research Division - Equity Analyst Craig Eder Moffett MoffettNathanson LLC - Founding Partner Douglas David Mitchelson Crédit Suisse AG, Research Division - MD Jessica Jean Reif Ehrlich BofA Merrill Lynch, Research Division - MD in Equity Research John Christopher Hodulik UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group and Telco & Pay TV Analyst Philip A. Cusick JPMorgan Chase & Co, Research Division - MD and Senior Analyst PRESENTATION Operator Good morning, ladies and gentlemen, and welcome to Comcast's Fourth Quarter and Full Year 2020 Earnings Conference Call. (Operator Instructions) Please note that this conference call is being recorded. I will now turn the call over to Senior Vice President, Investor Relations, Ms. -

Annex 4: Report from the States of the European Free Trade Association Participating in the European Economic Area

ANNEX 4: REPORT FROM THE STATES OF THE EUROPEAN FREE TRADE ASSOCIATION PARTICIPATING IN THE EUROPEAN ECONOMIC AREA 1. Application by the EFTA States participating in the EEA 1.1 Iceland European works The seven covered channels broadcast an average of 39.6% European works in 2007 and 42.2% in 2008. This represents a 2.6 percentage point increase over the reference period. For 2007 and 2008, of the total of seven covered channels, three channels achieved the majority proportion specified in Article 4 of the Directive (Omega Television, RUV and Syn - Vision TV), while four channels didn't meet this target (Sirkus, Skjár 1, Stöð 2 and Stöð 2 Bio). The compliance rate, in terms of numbers of channels, was 42.9%. European works made by independent producers The average proportion of European works by independent producers on all reported channels was 10.7% in 2007 and 12.6% in 2008, representing a 1.9 percentage points increase over the reference period. In 2007, of the total of seven identified channels, two channels exceeded the minimum proportion under Article 5 of the Directive, while three channels remained below the target. One channel was exempted (Syn - Vision TV) and no data was communicated for another one (Omega Television). The compliance rate, in terms of number of channels, was 33.3%. For 2008, of the total of seven covered channels, three exceeded the minimum proportion specified in Article 5 of the Directive, while two channels were below the target (Skjár 1 and Stöð 2 Bio). No data were communicated for two channels. -

Justin Pollard Film & TV Historian / Writer

Justin Pollard Film & TV Historian / Writer Agents Thea Martin [email protected] Credits In Development Production Company Notes OPIUM Tiger Aspect Exec Producer and Historical Consultant UNTITLED PROJECT Mandabach TV Historical Advisor UNTITLED PROJECT STX Historical Advisor 12 CAESARS Green Pavilion Co-Writer Television Production Company Notes VALHALLA MGM Associate Producer and Historical Consultant BROOKLYN HBO Historical Advisor 2018 BORGIA Company of Wolves Research Consultant. BRITANNIA Vertigo Films Historical Consultant United Agents | 12-26 Lexington Street London W1F OLE | T +44 (0) 20 3214 0800 | F +44 (0) 20 3214 0801 | E [email protected] Production Company Notes WILL Monumental / TNT Historical Consultant THE VIKINGS, Series MGM/ History Channel Associate Producer & Historical 1, 2, 3, 4 and 5 Consultant. 10 part drama series based on Viking Europe in the 9th century. PAGE EIGHT Carnival Films/ BBC Research Consultant. Film noir thriller starring Ralph Fiennes and Rachel Weisz. Directed by David Hare. QI Quite Interesting Ltd/ Talkback Writer/ Associate Producer. (Series 2 Thames/ BBC1 onward). PEAKY BLINDERS Tiger Aspect/ BBC Research Consultant. Drama series set amongst Birmingham gangs in the early 1920s. THE DRAGONS OF National Geographic Television Writer. MIDDLE EARTH Animated special on the symbolism of the dragon in the medieval Christian world. CAMELOT Starz/ GK-TV Script Consultant. 10 part drama series based on the Morte D’Arthur, starring Joseph Fiennes and Eva Green. THE TUDORS: SERIES Reveille/ Working Title/ TM Research Consultant. I-IV Productions/ Peace Arch Drama series starring Jonathan Rhys Entertainment Group, Inc. for Meyers as Henry VIII. Showtime ALEXANDRIA, Lion Television/ Channel 4 Writer/ Producer.