Surmounting the Challenges of Transacting OTC Crypto-Derivatives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Bitcoin Trading Ecosystem

ArcaneReport(PrintReady).qxp 21/07/2021 14:43 Page 1 THE INSTITUTIONAL CRYPTO CURRENCY EXCHANGE INSIDE FRONT COVER: BLANK ArcaneReport(PrintReady).qxp 21/07/2021 14:43 Page 3 The Bitcoin Trading Ecosystem Arcane Research LMAX Digital Arcane Research is a part of Arcane Crypto, bringing LMAX Digital is the leading institutional spot data-driven analysis and research to the cryptocurrency exchange, run by the LMAX Group, cryptocurrency space. After launch in August 2019, which also operates several leading FCA regulated Arcane Research has become a trusted brand, trading venues for FX, metals and indices. Based on helping clients strengthen their credibility and proven, proprietary technology from LMAX Group, visibility through research reports and analysis. In LMAX Digital allows global institutions to acquire, addition, we regularly publish reports, weekly market trade and hold the most liquid digital assets, Bitcoin, updates and articles to educate and share insights. Ethereum, Litecoin, Bitcoin Cash and XRP, safely and securely. Arcane Crypto develops and invests in projects, focusing on bitcoin and digital assets. Arcane Trading with all the largest institutions globally, operates a portfolio of businesses, spanning the LMAX Digital is a primary price discovery venue, value chain for digital nance. As a group, Arcane streaming real-time market data to the industry’s deliver services targeting payments, investment, and leading indices and analytics platforms, enhancing trading, in addition to a media and research leg. the quality of market information available to investors and enabling a credible overview of the Arcane has the ambition to become a leading player spot crypto currency market. in the digital assets space by growing the existing businesses, invest in cutting edge projects, and LMAX Digital is regulated by the Gibraltar Financial through acquisitions and consolidation. -

Balancing Privacy and Accountability in Digital Payment Methods Using Zk-Snarks

1 Faculty of Electrical Engineering, Mathematics & Computer Science Balancing privacy and accountability in digital payment methods using zk-SNARKs Tariq Bontekoe M.Sc. Thesis October 2020 Supervisors: prof. dr. M. J. Uetz (UT) dr. M. H. Everts (TNO/UT) dr. B. Manthey (UT) dr. A. Peter (UT) Department Applied Mathematics Discrete Mathematics & Mathematical Programming Department Computer Science 4TU Cyber Security Faculty of Electrical Engineering, Mathematics and Computer Science University of Twente Preface This thesis concludes my seven years (and a month) as a student. During all these years I have certainly enjoyed myself and feel proud of everything I have done and achieved. Not only have I completed a bachelor’s in Applied Mathematics, I have also spent a year as a board member of my study association W.S.G. Abacus, spent a lot of time as a student assistant, and have made friends for life. I have really enjoyed creating this final project, in all its ups and downs, that concludes not only my master’s in Applied Mathematics but also that in Computer Science. This work was carried out at TNO in Groningen in the department Cyber Security & Ro- bustness. My time there has been amazing and the colleagues in the department have made that time even better. I am also happy to say that I will continue my time there soon. There are quite some people I should thank for helping my realise this thesis. First of all, my main supervisor Maarten who helped me with his constructive feedback, knowledge of blockchains and presence at both TNO and my university. -

3Rd Global Cryptoasset Benchmarking Study

3RD GLOBAL CRYPTOASSET BENCHMARKING STUDY Apolline Blandin, Dr. Gina Pieters, Yue Wu, Thomas Eisermann, Anton Dek, Sean Taylor, Damaris Njoki September 2020 supported by Disclaimer: Data for this report has been gathered primarily from online surveys. While every reasonable effort has been made to verify the accuracy of the data collected, the research team cannot exclude potential errors and omissions. This report should not be considered to provide legal or investment advice. Opinions expressed in this report reflect those of the authors and not necessarily those of their respective institutions. TABLE OF CONTENTS FOREWORDS ..................................................................................................................................................4 RESEARCH TEAM ..........................................................................................................................................6 ACKNOWLEDGEMENTS ............................................................................................................................7 EXECUTIVE SUMMARY ........................................................................................................................... 11 METHODOLOGY ........................................................................................................................................ 14 SECTION 1: INDUSTRY GROWTH INDICATORS .........................................................................17 Employment figures ..............................................................................................................................................................................................................17 -

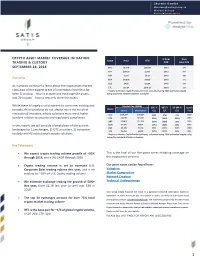

Crypto Asset Market Coverage Initiation: Trading

Sherwin Dowlat [email protected] Michael Hodapp [email protected] CRYPTO ASSET MARKET COVERAGE INITIATION: % from Days Name Price ATH TRADING & CUSTODY ATH Since ATH SEPTEMBER 18, 2018 BTC $6,270 $20,089 (69%) 274 ETH $197.86 $1,432 (86%) 247 XRP $.273 $3.84 (93%) 256 Overview BCH $420.06 $4,330 (90%) 271 EOS $4.90 $22.89 (79%) 141 As investors continue to learn about the cryptoasset market LTC $52.34 $375.29 (86%) 272 class, two of the biggest areas of uncertainty have thus far * Refers to Market Capitalization estimate, calculated using 2050 estimated supply using respective network inflation schedules been 1) trading – how to acquire and exchange the assets, and 2) custody – how to securely store the assets. While there is largely a solid market for consumer trading and Market Cap ($MM) 30D % 90D % 52-Wk % Launch Name custody, these products do not always meet the needs of Current 2050 Implied* G/L G/L G/L Year institutional investors, whose solutions must meet higher BTC $108,304 $131,567 (3%) (7%) 45% 2009 burdens relative to security and regulatory compliance. ETH $20,186 $29,081 (35%) (62%) (30%) 2015 XRP $10,874 $27,316 (19%) (50%) 38% 2013 In this report, we will provide a breakdown of the current BCH $7,290 $8,814 (27%) (53%) (2%) 2017 $4,438 $7,150 (6%) (54%) 643% 2018 landscape for 1) exchanges, 2) OTC providers, 3) consumer EOS LTC $3,053 $4,390 (10%) (47%) (4%) 2011 custody and 4) institutional custody solutions. * Refers to Market Capitalization estimate, calculated using 2050 estimated supply using respective network inflation schedules. -

Bitwise Asset Management, Inc., NYSE Arca, Inc., and Vedder Price P.C

MEMORANDUM TO: File No. SR-NYSEArca-2019-01 FROM: Lauren Yates Office of Market Supervision, Division of Trading and Markets DATE: March 20, 2019 SUBJECT: Meeting with Bitwise Asset Management, Inc., NYSE Arca, Inc., and Vedder Price P.C. __________________________________________________________________________ On March 19, 2019, Elizabeth Baird, Christian Sabella, Natasha Greiner, Michael Coe, Edward Cho, Neel Maitra, David Remus (by phone), and Lauren Yates from the Division of Trading and Markets; Charles Garrison, Johnathan Ingram, Cindy Oh, Andrew Schoeffler (by phone), Amy Starr (by phone), Sara Von Althann, and David Walz (by phone) from the Division of Corporation Finance; and David Lisitza (by phone) from the Office of General Counsel, met with the following individuals: Teddy Fusaro, Bitwise Asset Management, Inc. Matt Hougan, Bitwise Asset Management, Inc. Hope Jarkowski, NYSE Arca, Inc. Jamie Patturelli, NYSE Arca, Inc. David DeGregorio, NYSE Arca, Inc. (by phone) Tom Conner, Vedder Price P.C. John Sanders, Vedder Price P.C. The discussion concerned NYSE Arca, Inc.’s proposed rule change to list and trade, pursuant to NYSE Arca Rule 8.201-E, shares of the Bitwise Bitcoin ETF Trust. Bitwise Asset Management, Inc. also provided the attached presentation to the Commission Staff. Bitwise Asset Management Presentation to the U.S. Securities and Exchange Commission March 19, 2019 About Bitwise 01 VENTURE INVESTORS Pioneer: Created the world’s first crypto index fund. 02 TEAM BACKGROUNDS Specialist: The only asset we invest in is crypto. 03 Experienced: Deep expertise in crypto, asset management and ETFs. 2 Today’s Speakers Teddy Fusaro Matt Hougan Chief Operating Officer Global Head of Research Previously Senior Vice President and Senior Previously CEO of Inside ETFs. -

Bitcoin's Investment Thesis

Edison Explains Bitcoin’s investment thesis Part three: Durability and transferability Negative Positive X Cryptocurrencies – irrational recourse. The story of a German programmer who forgot hype or financial revolution? the password to his hard drive containing more than US$200m worth of BTC made the headlines earlier this Bitcoin (BTC) and other digital year. assets have been making the headlines in recent months, Multiple solutions to protect private keys are polarising the investment community with an equal number available of strong advocates and fierce critics (even within the same However, we note that the storage solutions currently financial institution or research house). Moreover, valid available for digital assets eliminate this risk (the analysis, backed by in-depth research, is mixed up with programmer received his BTC back in 2011, according to ideological, poorly researched conclusions both for and The New York Times, when these solutions were not widely against the theme. We have decided to look at both sides available). Retail investors who decide to use self-custody of the same (Bit)coin to extract the investment thesis for their digital assets can choose from a range of dedicated behind this new asset class. Each part of this Edison online and software wallets which, on set-up, ask the user Explains series looks at one feature of BTC and the to create a so-called 'recovery seed' or 'recovery phrase'. broader cryptocurrency landscape (broadly referred to as This is basically a list of 12, 18 or 24 words (preferably kept ‘altcoins’). We conclude by summarising our subjective offline, eg written down and stored in multiple physical view on how positive or negative we believe the feature is locations) that contain all the information required to for BTC’s investment thesis. -

List of Bitcoin Companies

List of bitcoin companies This is a list of Wikipedia articles about for-profit companies with notable commercial activities related to bitcoin. Common services are cryptocurrency wallet providers, bitcoin exchanges, payment service providers[a] and venture capital. Other services include mining pools, cloud mining, peer-to-peer lending, exchange-traded funds, over-the-counter trading, gambling, micropayments, affiliates and prediction markets. Headquarters Company Founded Service Notes Refs Country City bitcoin exchange, wallet Binance 2017 Japan Tokyo [1] provider bitcoin exchange, wallet Bitcoin.com [data unknown/missing] Japan Tokyo provider bitcoin exchange, digital Hong currency exchange, Bitfinex 2012 Kong electronic trading platform United San multisignature security BitGo 2013 States Francisco platform for bitcoin ASIC-based bitcoin BitMain 2013 China Beijing miners cryptocurrency BitMEX 2014 derivatives trading Seychelles platform United payment service BitPay 2011 Atlanta States provider Bitstamp 2011 bitcoin exchange Luxembourg bitcoin debit card, Bitwala 2015 Berlin international transfers, [2] Germany bitcoin wallet Blockchain.com 2011 wallet provider Luxembourg United San Blockstream 2014 software States Francisco shut down by the United BTC-e 2011 Russia bitcoin exchange States government in July 2017 Canaan ASIC-based bitcoin 2013 China Beijing Creative miners United Circle 2013 Boston wallet provider States United San wallet provider, bitcoin Coinbase 2012 States Francisco exchange bitcoin/ether exchange, wallet provider, -

Asia's Crypto Landscape

A MESSARI REPORT Asia’s Crypto Landscape The key exchanges, funds, and market makers that define crypto in China, Japan, Korea, Hong Kong, Singapore, and Southeast Asia, with commentary on regulatory and investment trends. SPONSORED BY Author Mira Christanto RESEARCH ANALYST AT MESSARI Mira is a Research Analyst at Messari. Previously, she was a Senior Portfolio Manager at APG Asset Management, managing a US $7 billion fund focused on Real Estate equity investments across Asia Pacific. Prior to APG, Mira worked at $15 billion hedge fund TPG-Axon Capital Management, an affiliate of Texas Pacific Group, where she was a private and public market investor across multiple sectors and geographies. Before that, Mira was in Credit Suisse’s Investment Banking Division in the Leveraged Finance and Restructuring group in New York and worked on a variety of mergers & acquisitions, leveraged buyouts and restructuring deals. She received a BA in Economics and Mathematical Methods in the Social Sciences from Northwestern University. Never miss an update Real-time monitoring and alerts for all the assets you support Built for: • Funds • Exchanges • Custodians • Infrastructure Providers Learn More Asia’s Crypto Landscape 2 © 2021 Messari Table of Contents Introduction 5 SBI Group 67 SBI Virtual Currencies Trade 68 1.0 The Countries 8 TaoTao 69 GMO Coin 69 China 8 Bitpoint 69 Hong Kong 13 DMM Bitcoin 69 Japan 15 Rakuten Wallet 70 LVC (BITMAX) 70 South Korea 20 B Dash Ventures & B Cryptos 71 Singapore 23 Rest of Southeast Asia 25 South Korea 72 Philippines -

Cryptocurrency Exchange Option Is Among One of the Most Promising Areas (Figure 1)

BDCENTER.DIGITAL CONTENTS Introduction 3 1. Jurisdictions 6 2. Exchanges possessing their own tokens 11 3. Profitability 17 4. Website versions (language and additional versions, landings) 23 5. Analysis of Fiat Gateways Capabilities 27 6. PR 34 7. Analysis of traffic sources 37 8. Social Networks 48 9. Social network activity shown by managers of the Exchanges 54 10. Forums activity 59 11. SEO, link mass, mentioning 60 12. Email marketing 73 13. Referral and affiliate programs 75 14. Visual style 79 15. Target Audiences 83 16. Opinion leaders 88 17. Brokers at Forex who work with cryptocurrency 90 Conclusion 99 2 BDCENTER.DIGITAL INTRODUCTION Nowadays, the Initial Coin Offering (ICO market) is experiencing a fundraising decline, that’s why many key market players have started to look for other high-yield cryptocurrency projects. Cryptocurrency exchange option is among one of the most promising areas (figure 1). Raised funds & Number of ICOs Check the amount of funds raised and number of ICOs finished by month for the past 12 months. Source: websites icobench.com/stats 3 BDCENTER.DIGITAL Figure 1. ICO funding has been declining from a record of 1.7 billion dollars in March to under 0.2 billion in October 2018. Binance Exchange turned out to be a huge success. Experts note that this exchange is the most successful unicorn startup in the history of cryptoprojects. In the last six months, Binance estimation of the market size was close to $ 2 billion. Moreover, the project is profitable. In a short period of time, the income of all cryptocurrency exchanges has grown rapidly. -

Liquidation, Leverage and Optimal Margin in Bitcoin Futures Markets

Liquidation, Leverage and Optimal Margin in Bitcoin Futures Markets Zhiyong Chenga, Jun Denga ,∗ Tianyi Wanga, Mei Yua Abstract Using the generalized extreme value theory to characterize tail distributions, we address liqui- dation, leverage, and optimal margins for bitcoin long and short futures positions. The empirical analysis of perpetual bitcoin futures on BitMEX shows that (1) daily forced liquidations to out- standing futures are substantial at 3.51%, and 1.89% for long and short; (2) investors got forced liquidation do trade aggressively with average leverage of 60X; and (3) exchanges should elevate current 1% margin requirement to 33% (3X leverage) for long and 20% (5X leverage) for short to reduce the daily margin call probability to 1%. Our results further suggest normality assumption on return significantly underestimates optimal margins. Policy implications are also discussed. Key words: Bitcoin futures; Liquidation; Margin; Leverage; Generalized extreme value theory JEL Classification: G11, G13, G32 arXiv:2102.04591v1 [q-fin.TR] 9 Feb 2021 ∗Corresponding Author. School of Banking and Finance, University of International Business and Economics, Beijing, China, 100029. Email: [email protected] 1 1 Introduction The largest cryptocurrency, bitcoin, accounts for more than 70% of the total market capitalization reported by CoinMarketCap on 14 December 2020. Compared with other traditional assets, bitcoin price is more volatile: 30-day volatility reaches to 167.24% on 31 March, 20201. This extraordinarily high price volatility imposes a tremendous risk to various market participants, see Chaim and Laurini (2018), Alexander et al. (2020b), Deng et al. (2020) and Scaillet et al. (2020). Futures contracts are commonly used to hedge spot price risk. -

Blockchain Democracy William Magnuson Index More Information

Cambridge University Press 978-1-108-48236-3 — Blockchain Democracy William Magnuson Index More Information Index ABN Amro, 29 AXA, French insurer, 83 abortion, 11 Axelrod, David, 111 ACLU. See American Civil Liberties Union Aztecs, 27 Advanced Voting Solutions, 87 Adventures of Tron, 10 Baldet, Amber, 203 Agora, 88 Bancor, 99 AlphaBay, 119 Bangladesh, 186 altcoins, 77–78 bank bailout of 2008, See Troubled Asset Relief Dash, 77 Program Dogecoin, 77 Bank for International Settlements, 132 Litecoin, 77 Bank Secrecy Act, 160 Tether, 77 banks, 9, 73, 83, 99, 164, 227, 242 Amazon, 76 Barclays, 83 America Online, 16 Barlow, John Perry, 17 American Civil Liberties Union, 110 Becker, Gary, 102 American Express, 27 Bell, Jim, 23–25 Andreesen, Marc, 73, 208 Benichou, Laurent, 83 Andresen, Gavin, 42, 43, 115 Bickel, Alexander, 142 anonymity, 26 Bill of Rights, 16 Anti-Drug Abuse Act, 109 Binance, 175 anti-money-laundering rules, 73 binge drinking, 108 Antminer, 130, 131 BIS. See Bank for International Settlements AOL. See America Online Bit Gold, 29, 207 application-specific integrated circuits, 56, 76, BitBay, 175 123, 134 Bitcoiin cryptocurrency, 78 Arctic Circle, 122, 123, 124 bitcoin Aristotle, 35, 196 ”1 RETURN” bug, 115 Arizona, 183 0.8 fork, 41 ASICs. See application-specific integrated addresses, 44, 47 circuits anonymity of, 104–6 Assange, Julian, 23 arms race in mining, 10, 74, 75, 76, 129, 132, Cypherpunks: Freedom and the Future of the 139, 205, 206 Internet, 23 Bitcoin Core, 45 assassination markets, 23–25, 209 bitcoin forum, 69, 70 Astroblast, 10 bitcoin pizza, 69, 74, 205, 208 Atlas Shrugged, 18 bitcointalk.org, 68 252 © in this web service Cambridge University Press www.cambridge.org Cambridge University Press 978-1-108-48236-3 — Blockchain Democracy William Magnuson Index More Information Index 253 block rewards, 128 Block.one, 79 block size, 58 blockchain boom in, 208 block size, 58 carbon footprint, 127 contents of blocks, 54 coinbase transaction, 57 elections, 85–90 collapse of Mt. -

Crypto and Blockchain Fundamentals

Arkansas Law Review Volume 73 Number 2 Article 4 August 2020 Crypto and Blockchain Fundamentals Mary C. Lacity University of Arkansas, Fayetteville Follow this and additional works at: https://scholarworks.uark.edu/alr Part of the Business Law, Public Responsibility, and Ethics Commons, E-Commerce Commons, and the Technology and Innovation Commons Recommended Citation Mary C. Lacity, Crypto and Blockchain Fundamentals, 73 Ark. L. Rev. 363 (2020). Available at: https://scholarworks.uark.edu/alr/vol73/iss2/4 This Article is brought to you for free and open access by ScholarWorks@UARK. It has been accepted for inclusion in Arkansas Law Review by an authorized editor of ScholarWorks@UARK. For more information, please contact [email protected]. CRYPTO AND BLOCKCHAIN FUNDAMENTALS Mary Lacity* I. FROM THE “INTERNET OF INFORMATION” TO THE “INTERNET OF VALUE” “I believe blockchain will do for trusted transactions what the Internet has done for information.” — Ginni Rometty, CEO of IBM1 Since the 1990s, we have had an “Internet of Information” that allows us to seamlessly share information such as documents, images, emails, and videos over the Internet. While most Internet users do not need to understand the details of the technical protocols2 operating underneath user-friendly software interfaces, it is helpful to understand how they work at a high-level. With the “Internet of Information,” copies of information are routed * Dr. Mary C. Lacity is a Walton Professor of Information Systems and Director of the Blockchain Center of Excellence in the Sam M. Walton College of Business at the University of Arkansas. She was previously the Curators’ Distinguished Professor at the University of Missouri-St.