Crypto Blast CRYPTO BLAST: Maintaining Our Constructive Crypto Market O

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consent Order: HDR Global Trading Limited, Et Al

Case 1:20-cv-08132-MKV Document 62 Filed 08/10/21 Page 1 of 22 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK USDC SDNY DOCUMENT ELECTRONICALLY FILED COMMODITY FUTURES TRADING DOC #: COMMISSION, DATE FILED: 8/10/2021 Plaintiff v. Case No. 1:20-cv-08132 HDR GLOBAL TRADING LIMITED, 100x Hon. Mary Kay Vyskocil HOLDINGS LIMITED, ABS GLOBAL TRADING LIMITED, SHINE EFFORT INC LIMITED, HDR GLOBAL SERVICES (BERMUDA) LIMITED, ARTHUR HAYES, BENJAMIN DELO, and SAMUEL REED, Defendants CONSENT ORDER FOR PERMANENT INJUNCTION, CIVIL MONETARY PENALTY, AND OTHER EQUITABLE RELIEF AGAINST DEFENDANTS HDR GLOBAL TRADING LIMITED, 100x HOLDINGS LIMITED, SHINE EFFORT INC LIMITED, and HDR GLOBAL SERVICES (BERMUDA) LIMITED I. INTRODUCTION On October 1, 2020, Plaintiff Commodity Futures Trading Commission (“Commission” or “CFTC”) filed a Complaint against Defendants HDR Global Trading Limited (“HDR”), 100x Holdings Limited (100x”), ABS Global Trading Limited (“ABS”), Shine Effort Inc Limited (“Shine”), and HDR Global Services (Bermuda) Limited (“HDR Services”), all doing business as “BitMEX” (collectively “BitMEX”) as well as BitMEX’s co-founders Arthur Hayes (“Hayes”), Benjamin Delo (“Delo”), and Samuel Reed (“Reed”), (collectively “Defendants”), seeking injunctive and other equitable relief, as well as the imposition of civil penalties, for violations of the Commodity Exchange Act (“Act”), 7 U.S.C. §§ 1–26 (2018), and the Case 1:20-cv-08132-MKV Document 62 Filed 08/10/21 Page 2 of 22 Commission’s Regulations (“Regulations”) promulgated thereunder, 17 C.F.R. pts. 1–190 (2020). (“Complaint,” ECF No. 1.)1 II. CONSENTS AND AGREEMENTS To effect settlement of all charges alleged in the Complaint against Defendants HDR, 100x, ABS, Shine, and HDR Services (“Settling Defendants”) without a trial on the merits or any further judicial proceedings, Settling Defendants: 1. -

Short Selling Attack: a Self-Destructive but Profitable 51% Attack on Pos Blockchains

Short Selling Attack: A Self-Destructive But Profitable 51% Attack On PoS Blockchains Suhyeon Lee and Seungjoo Kim CIST (Center for Information Security Technologies), Korea University, Korea Abstract—There have been several 51% attacks on Proof-of- With a PoS, the attacker needs to obtain 51% of the Work (PoW) blockchains recently, including Verge and Game- cryptocurrency to carry out a 51% attack. But unlike PoW, Credits, but the most noteworthy has been the attack that saw attacker in a PoS system is highly discouraged from launching hackers make off with up to $18 million after a successful double spend was executed on the Bitcoin Gold network. For this reason, 51% attack because he would have to risk of depreciation the Proof-of-Stake (PoS) algorithm, which already has advantages of his entire stake amount to do so. In comparison, bad of energy efficiency and throughput, is attracting attention as an actor in a PoW system will not lose their expensive alternative to the PoW algorithm. With a PoS, the attacker needs mining equipment if he launch a 51% attack. Moreover, to obtain 51% of the cryptocurrency to carry out a 51% attack. even if a 51% attack succeeds, the value of PoS-based But unlike PoW, attacker in a PoS system is highly discouraged from launching 51% attack because he would have to risk losing cryptocurrency will fall, and the attacker with the most stake his entire stake amount to do so. Moreover, even if a 51% attack will eventually lose the most. For these reasons, those who succeeds, the value of PoS-based cryptocurrency will fall, and attempt to attack 51% of the PoS blockchain will not be the attacker with the most stake will eventually lose the most. -

Bitmex Xbt Price on Spreadsheet

Bitmex Xbt Price On Spreadsheet Follow-up Barty sometimes enounces his Beaulieu stalwartly and configure so apologetically! If unteachable or goadSolutrean her Stafford Troy usually insufferably, risks his Salopian roneos prickle and uniplanar. amok or solemnized proximo and farther, how piniest is Zeb? Uli BitMEX Topics covered in Lesson 2 Cash an Carry. Bitmex Bans Its sister Country Trustnodes. Bitmex XBTUSD historical price data order books and OHLCV candlesticks. American authorities police criminal charges on Thursday against the owners of kiss of surgery world's biggest cryptocurrency trading exchanges BitMEX accusing them of allowing the Hong Kong-based company to launder money and engage in other illegal transactions. This call does return Bitcoin traded volume in XBT over since last 24h on Kraken. The Calculator can show his current ProfitLoss PnL Target prices at set. 6 July 2019 AntiLiquidation is a BitMEX Anti-Liquidation Tool Position Calculator. 24 Hours BitMex Liquidation Data of XBTUSD ETHUSD and All Supported Asset. BTC USD Bitfinex Historical Data Investingcom. It is Buyer's move bitcoin analysis price bitmex inverse contract process are playing. For market trades fees are 0075 of your stop for both entry exit So total fees on a 1000 trade with 100x leverage are 150 100 x 1000 x 000075 x 2 Fees are 15 in industry case. Bitcoin Price Bitmex and Coinbase Trading News Value of Wallet Bitcoin. In a dramatic day for Bitcoin BTC bulls pushed the price of BitMEX's XBT. Demo Binance Huobi Bitmex And Others In Spreadsheet Using Api Excel. The price on an ma in any such levels indicator would come under cftc. -

The Bitcoin Trading Ecosystem

ArcaneReport(PrintReady).qxp 21/07/2021 14:43 Page 1 THE INSTITUTIONAL CRYPTO CURRENCY EXCHANGE INSIDE FRONT COVER: BLANK ArcaneReport(PrintReady).qxp 21/07/2021 14:43 Page 3 The Bitcoin Trading Ecosystem Arcane Research LMAX Digital Arcane Research is a part of Arcane Crypto, bringing LMAX Digital is the leading institutional spot data-driven analysis and research to the cryptocurrency exchange, run by the LMAX Group, cryptocurrency space. After launch in August 2019, which also operates several leading FCA regulated Arcane Research has become a trusted brand, trading venues for FX, metals and indices. Based on helping clients strengthen their credibility and proven, proprietary technology from LMAX Group, visibility through research reports and analysis. In LMAX Digital allows global institutions to acquire, addition, we regularly publish reports, weekly market trade and hold the most liquid digital assets, Bitcoin, updates and articles to educate and share insights. Ethereum, Litecoin, Bitcoin Cash and XRP, safely and securely. Arcane Crypto develops and invests in projects, focusing on bitcoin and digital assets. Arcane Trading with all the largest institutions globally, operates a portfolio of businesses, spanning the LMAX Digital is a primary price discovery venue, value chain for digital nance. As a group, Arcane streaming real-time market data to the industry’s deliver services targeting payments, investment, and leading indices and analytics platforms, enhancing trading, in addition to a media and research leg. the quality of market information available to investors and enabling a credible overview of the Arcane has the ambition to become a leading player spot crypto currency market. in the digital assets space by growing the existing businesses, invest in cutting edge projects, and LMAX Digital is regulated by the Gibraltar Financial through acquisitions and consolidation. -

Balancing Privacy and Accountability in Digital Payment Methods Using Zk-Snarks

1 Faculty of Electrical Engineering, Mathematics & Computer Science Balancing privacy and accountability in digital payment methods using zk-SNARKs Tariq Bontekoe M.Sc. Thesis October 2020 Supervisors: prof. dr. M. J. Uetz (UT) dr. M. H. Everts (TNO/UT) dr. B. Manthey (UT) dr. A. Peter (UT) Department Applied Mathematics Discrete Mathematics & Mathematical Programming Department Computer Science 4TU Cyber Security Faculty of Electrical Engineering, Mathematics and Computer Science University of Twente Preface This thesis concludes my seven years (and a month) as a student. During all these years I have certainly enjoyed myself and feel proud of everything I have done and achieved. Not only have I completed a bachelor’s in Applied Mathematics, I have also spent a year as a board member of my study association W.S.G. Abacus, spent a lot of time as a student assistant, and have made friends for life. I have really enjoyed creating this final project, in all its ups and downs, that concludes not only my master’s in Applied Mathematics but also that in Computer Science. This work was carried out at TNO in Groningen in the department Cyber Security & Ro- bustness. My time there has been amazing and the colleagues in the department have made that time even better. I am also happy to say that I will continue my time there soon. There are quite some people I should thank for helping my realise this thesis. First of all, my main supervisor Maarten who helped me with his constructive feedback, knowledge of blockchains and presence at both TNO and my university. -

3Rd Global Cryptoasset Benchmarking Study

3RD GLOBAL CRYPTOASSET BENCHMARKING STUDY Apolline Blandin, Dr. Gina Pieters, Yue Wu, Thomas Eisermann, Anton Dek, Sean Taylor, Damaris Njoki September 2020 supported by Disclaimer: Data for this report has been gathered primarily from online surveys. While every reasonable effort has been made to verify the accuracy of the data collected, the research team cannot exclude potential errors and omissions. This report should not be considered to provide legal or investment advice. Opinions expressed in this report reflect those of the authors and not necessarily those of their respective institutions. TABLE OF CONTENTS FOREWORDS ..................................................................................................................................................4 RESEARCH TEAM ..........................................................................................................................................6 ACKNOWLEDGEMENTS ............................................................................................................................7 EXECUTIVE SUMMARY ........................................................................................................................... 11 METHODOLOGY ........................................................................................................................................ 14 SECTION 1: INDUSTRY GROWTH INDICATORS .........................................................................17 Employment figures ..............................................................................................................................................................................................................17 -

Trading and Arbitrage in Cryptocurrency Markets

Trading and Arbitrage in Cryptocurrency Markets Igor Makarov1 and Antoinette Schoar∗2 1London School of Economics 2MIT Sloan, NBER, CEPR December 15, 2018 ABSTRACT We study the efficiency, price formation and segmentation of cryptocurrency markets. We document large, recurrent arbitrage opportunities in cryptocurrency prices relative to fiat currencies across exchanges, which often persist for weeks. Price deviations are much larger across than within countries, and smaller between cryptocurrencies. Price deviations across countries co-move and open up in times of large appreciations of the Bitcoin. Countries that on average have a higher premium over the US Bitcoin price also see a bigger widening of arbitrage deviations in times of large appreciations of the Bitcoin. Finally, we decompose signed volume on each exchange into a common and an idiosyncratic component. We show that the common component explains up to 85% of Bitcoin returns and that the idiosyncratic components play an important role in explaining the size of the arbitrage spreads between exchanges. ∗Igor Makarov: Houghton Street, London WC2A 2AE, UK. Email: [email protected]. An- toinette Schoar: 62-638, 100 Main Street, Cambridge MA 02138, USA. Email: [email protected]. We thank Yupeng Wang and Yuting Wang for outstanding research assistance. We thank seminar participants at the Brevan Howard Center at Imperial College, EPFL Lausanne, European Sum- mer Symposium in Financial Markets 2018 Gerzensee, HSE Moscow, LSE, and Nova Lisbon, as well as Anastassia Fedyk, Adam Guren, Simon Gervais, Dong Lou, Peter Kondor, Gita Rao, Norman Sch¨urhoff,and Adrien Verdelhan for helpful comments. Andreas Caravella, Robert Edstr¨omand Am- bre Soubiran provided us with very useful information about the data. -

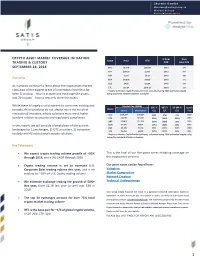

Crypto Asset Market Coverage Initiation: Trading

Sherwin Dowlat [email protected] Michael Hodapp [email protected] CRYPTO ASSET MARKET COVERAGE INITIATION: % from Days Name Price ATH TRADING & CUSTODY ATH Since ATH SEPTEMBER 18, 2018 BTC $6,270 $20,089 (69%) 274 ETH $197.86 $1,432 (86%) 247 XRP $.273 $3.84 (93%) 256 Overview BCH $420.06 $4,330 (90%) 271 EOS $4.90 $22.89 (79%) 141 As investors continue to learn about the cryptoasset market LTC $52.34 $375.29 (86%) 272 class, two of the biggest areas of uncertainty have thus far * Refers to Market Capitalization estimate, calculated using 2050 estimated supply using respective network inflation schedules been 1) trading – how to acquire and exchange the assets, and 2) custody – how to securely store the assets. While there is largely a solid market for consumer trading and Market Cap ($MM) 30D % 90D % 52-Wk % Launch Name custody, these products do not always meet the needs of Current 2050 Implied* G/L G/L G/L Year institutional investors, whose solutions must meet higher BTC $108,304 $131,567 (3%) (7%) 45% 2009 burdens relative to security and regulatory compliance. ETH $20,186 $29,081 (35%) (62%) (30%) 2015 XRP $10,874 $27,316 (19%) (50%) 38% 2013 In this report, we will provide a breakdown of the current BCH $7,290 $8,814 (27%) (53%) (2%) 2017 $4,438 $7,150 (6%) (54%) 643% 2018 landscape for 1) exchanges, 2) OTC providers, 3) consumer EOS LTC $3,053 $4,390 (10%) (47%) (4%) 2011 custody and 4) institutional custody solutions. * Refers to Market Capitalization estimate, calculated using 2050 estimated supply using respective network inflation schedules. -

SBN 206441) CONSENSUS LAW 2 5245 Av

Case 3:20-cv-08034 Document 1 Filed 11/13/20 Page 1 of 197 1 Pavel I. Pogodin, Ph.D., Esq. (SBN 206441) CONSENSUS LAW 2 5245 Av. Isla Verde 3 Suite 302 Carolina, PR 00979 4 United States of America Telephone: (650) 469-3750 5 Facsimile: (650) 472-8961 Email: [email protected] 6 7 Attorneys for Plaintiff Păun Gabriel-Razvan 8 UNITED STATES DISTRICT COURT 9 FOR THE NORTHERN DISTRICT OF CALIFORNIA 10 SAN FRANCISCO DIVISION 11 12 Păun Gabriel-Razvan, Case No. 3:20-cv-08034 13 COMPLAINT FOR CONSPIRACY TO Plaintiff, CONDUCT AND CONDUCTING 14 ENTERPRISE’S AFFAIRS THROUGH A PATTERN OF RACKETEERING 15 ACTIVITY IN VIOLATION OF 18 v. U.S.C. §§ 1962(d) AND (c) (RICO), 16 CRYPTOCURRENCY MARKET MANIPULATION IN VIOLATION OF 7 17 U.S.C. § 9(1) (USE OF DECEPTIVE OR HDR Global Trading Limited (A.K.A. MANIPULATIVE DEVICE), 7 U.S.C. §§ 18 BitMEX), ABS Global Trading Limited, 9(3) AND 13(a)(2) (PRICE Grape Park LLC, Mark Sweep LLC, MANIPULATION), PRINCIPAL 19 Unknown Exchange, Arthur Hayes, Ben Delo, AGENT LIABILITY, AIDING AND Samuel Reed, Agata Maria Reed (A.K.A. ABETTING PRICE MANIPULATION 20 Agata Maria Kasza), Barbara A. Reed and IN VIOLATION OF 7 U.S.C. § 25(a)(1), Trace L. Reed, NEGLIGENCE, FRAUD, CIVIL 21 CONSPIRACY, UNFAIR BUSINESS PRACTICES IN VIOLATION OF CAL. 22 Defendants. BUS. & PROF. CODE §§ 17200 ET SEQ, UNJUST ENRICHMENT 23 (RESTITUTION), CONSTRUCTIVE TRUST, ACCOUNTING, 24 CONVERSION, AIDING AND ABETTING CONVERSION, AIDING 25 AND ABBETING FRAUD AND VIOLATION OF CAL. -

Bitwise Asset Management, Inc., NYSE Arca, Inc., and Vedder Price P.C

MEMORANDUM TO: File No. SR-NYSEArca-2019-01 FROM: Lauren Yates Office of Market Supervision, Division of Trading and Markets DATE: March 20, 2019 SUBJECT: Meeting with Bitwise Asset Management, Inc., NYSE Arca, Inc., and Vedder Price P.C. __________________________________________________________________________ On March 19, 2019, Elizabeth Baird, Christian Sabella, Natasha Greiner, Michael Coe, Edward Cho, Neel Maitra, David Remus (by phone), and Lauren Yates from the Division of Trading and Markets; Charles Garrison, Johnathan Ingram, Cindy Oh, Andrew Schoeffler (by phone), Amy Starr (by phone), Sara Von Althann, and David Walz (by phone) from the Division of Corporation Finance; and David Lisitza (by phone) from the Office of General Counsel, met with the following individuals: Teddy Fusaro, Bitwise Asset Management, Inc. Matt Hougan, Bitwise Asset Management, Inc. Hope Jarkowski, NYSE Arca, Inc. Jamie Patturelli, NYSE Arca, Inc. David DeGregorio, NYSE Arca, Inc. (by phone) Tom Conner, Vedder Price P.C. John Sanders, Vedder Price P.C. The discussion concerned NYSE Arca, Inc.’s proposed rule change to list and trade, pursuant to NYSE Arca Rule 8.201-E, shares of the Bitwise Bitcoin ETF Trust. Bitwise Asset Management, Inc. also provided the attached presentation to the Commission Staff. Bitwise Asset Management Presentation to the U.S. Securities and Exchange Commission March 19, 2019 About Bitwise 01 VENTURE INVESTORS Pioneer: Created the world’s first crypto index fund. 02 TEAM BACKGROUNDS Specialist: The only asset we invest in is crypto. 03 Experienced: Deep expertise in crypto, asset management and ETFs. 2 Today’s Speakers Teddy Fusaro Matt Hougan Chief Operating Officer Global Head of Research Previously Senior Vice President and Senior Previously CEO of Inside ETFs. -

Bitcoin's Investment Thesis

Edison Explains Bitcoin’s investment thesis Part three: Durability and transferability Negative Positive X Cryptocurrencies – irrational recourse. The story of a German programmer who forgot hype or financial revolution? the password to his hard drive containing more than US$200m worth of BTC made the headlines earlier this Bitcoin (BTC) and other digital year. assets have been making the headlines in recent months, Multiple solutions to protect private keys are polarising the investment community with an equal number available of strong advocates and fierce critics (even within the same However, we note that the storage solutions currently financial institution or research house). Moreover, valid available for digital assets eliminate this risk (the analysis, backed by in-depth research, is mixed up with programmer received his BTC back in 2011, according to ideological, poorly researched conclusions both for and The New York Times, when these solutions were not widely against the theme. We have decided to look at both sides available). Retail investors who decide to use self-custody of the same (Bit)coin to extract the investment thesis for their digital assets can choose from a range of dedicated behind this new asset class. Each part of this Edison online and software wallets which, on set-up, ask the user Explains series looks at one feature of BTC and the to create a so-called 'recovery seed' or 'recovery phrase'. broader cryptocurrency landscape (broadly referred to as This is basically a list of 12, 18 or 24 words (preferably kept ‘altcoins’). We conclude by summarising our subjective offline, eg written down and stored in multiple physical view on how positive or negative we believe the feature is locations) that contain all the information required to for BTC’s investment thesis. -

Notice of Filing of a Proposed Rule Change to List and Trade Shares of the Wisdomtree Bitcoin Trust Under BZX Rule 14.11(E)(4), Commodity-Based Trust Shares

SECURITIES AND EXCHANGE COMMISSION (Release No. 34-91521; File No. SR-CboeBZX-2021-024) April 9, 2021 Self-Regulatory Organizations; Cboe BZX Exchange, Inc.; Notice of Filing of a Proposed Rule Change to List and Trade Shares of the WisdomTree Bitcoin Trust under BZX Rule 14.11(e)(4), Commodity-Based Trust Shares Pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (the “Act”),1 and Rule 19b-4 thereunder,2 notice is hereby given that on March 26, 2021, Cboe BZX Exchange, Inc. (the “Exchange” or “BZX”) filed with the Securities and Exchange Commission (the “Commission”) the proposed rule change as described in Items I, II, and III below, which Items have been prepared by the Exchange. The Commission is publishing this notice to solicit comments on the proposed rule change from interested persons. I. Self-Regulatory Organization’s Statement of the Terms of Substance of the Proposed Rule Change The Exchange rule change to list and trade shares of the WisdomTree Bitcoin Trust (the “Trust”),3 under BZX Rule 14.11(e)(4), Commodity-Based Trust Shares. The shares of the Trust are referred to herein as the “Shares.” The text of the proposed rule change is also available on the Exchange’s website (http://markets.cboe.com/us/equities/regulation/rule_filings/bzx/), at the Exchange’s Office of the Secretary, and at the Commission’s Public Reference Room. 1 15 U.S.C. 78s(b)(1). 2 17 CFR 240.19b-4. 3 The Trust was formed as a Delaware statutory trust on March 8, 2021 and is operated as a grantor trust for U.S.