Telephone Users Tax Statement Instructions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The History of the Telephone

STUDENT VERSION THE HISTORY OF THE TELEPHONE Activity Items There are no separate items for this activity. Student Learning Objectives • I will be able to name who invented the telephone and say why that invention is important. • I will be able to explain how phones have changed over time. THE HISTORY OF THE TELEPHONE STUDENT VERSION NAME: DATE: The telephone is one of the most important inventions. It lets people talk to each other at the same time across long distances, changing the way we communicate today. Alexander Graham Bell, the inventor of the telephone CENSUS.GOV/SCHOOLS HISTORY | PAGE 1 THE HISTORY OF THE TELEPHONE STUDENT VERSION 1. Like many inventions, the telephone was likely thought of many years before it was invented, and by many people. But it wasn’t until 1876 when a man named Alexander Graham Bell, pictured on the previous page, patented the telephone and was allowed to start selling it. Can you guess what “patented” means? CENSUS.GOV/SCHOOLS HISTORY | PAGE 2 THE HISTORY OF THE TELEPHONE STUDENT VERSION 2. The picture below, from over 100 years ago, shows Alexander Graham Bell using one of his first telephones to make a call from New York to Chicago. Alexander Graham Bell making a telephone call from New York to Chicago in 1892 Why do you think it was important that someone in New York could use the telephone to talk to someone in Chicago? CENSUS.GOV/SCHOOLS HISTORY | PAGE 3 THE HISTORY OF THE TELEPHONE STUDENT VERSION 3. Today, millions of people make phone calls each day, and many people have a cellphone. -

![TELEPHONE TRAINING GUIDE] Fall 2010](https://docslib.b-cdn.net/cover/8505/telephone-training-guide-fall-2010-238505.webp)

TELEPHONE TRAINING GUIDE] Fall 2010

[TELEPHONE TRAINING GUIDE] Fall 2010 Telephone Training Guide Multi Button and Single Line Telephones Office of Information Technology, - UC Irvine 1 | Page [TELEPHONE TRAINING GUIDE] Fall 2010 Personal Profile (optional) ........................................... 10 Group Pickup (optional) ............................................... 10 Table of Contents Abbreviated Dialing (optional) ..................................... 10 Multi-Button Telephone General Description Automatic Call-Back ..................................................... 10 ....................................................................................... 3 Call Waiting .................................................................. 10 Keys and Buttons ............................................................ 3 Campus Dialing Instructions ............................ 11 Standard Preset Function Buttons .................................. 3 Emergency 911 ............................................................. 11 Sending Tones (TONE) .................................................... 4 Multi-Button Telephone Operations ................ 4 Answering Calls ............................................................... 4 Placing Calls .................................................................... 4 Transferring Calls ............................................................ 4 Inquiry Calls .................................................................... 4 Exclusive Hold ................................................................. 4 -

Osprey Nest Queen Size Page 2 LC Cutting Correction

Template Layout Sheets Organizing, Bags, Foundation Papers, and Template Layout Sheets Sort the Template Layout Sheets as shown in the graphics below. Unit A, Temp 1 Unit A, Temp 1 Layout UNIT A TEMPLATE LAYOUT SHEET CUT 3" STRIP BACKGROUND FABRIC E E E ID ID ID S S S Please read through your original instructions before beginning W W W E E E Sheet. Place (2) each in Bag S S S TEMP TEMP TEMP S S S E E A-1 A-1 A-1 E W W W S S S I I I D D D E E E C TEMP C TEMP TEMP U U T T A-1 A-1 T A-1 #6, #7, #8, and #9 L L I the queen expansion set. The instructions included herein only I C C C N N U U U T T T T E E L L L I I I N N N E E replace applicable information in the pattern. E Unit A, Temp 2, UNIT A TEMPLATE LAYOUT SHEET Unit A, Temp 2 Layout CUT 3" STRIP BACKGROUND FABRIC S S S E E E The Queen Foundation Set includes the following Foundation Papers: W W W S S S ID ID ID E TEMP E TEMP E TEMP Sheet. Place (2) each in Bag A-2 A-2 A-2 E E E D D D I I TEMP I TEMP TEMP S S S A-2 A-2 A-2 W W W C E C E E S S S U C C U C U U U T T T T T T L L L L IN IN L IN I I N #6, #7, #8, and #9 E E N E E NP 202 (Log Cabin Full Blocks) ~ 10 Pages E NP 220 (Log Cabin Half Block with Unit A Geese) ~ 2 Pages NP 203 (Log Cabin Half Block with Unit B Geese) ~ 1 Page Unit B, Temp 1, ABRIC F BACKGROUND Unit B, Temp 1 Layout E E T SHEE YOUT LA TE TEMPLA A T UNI E D I D I D I S S STRIP 3" T CU S W W E W TP 101 (Template Layout Sheets for Log Cabins and Geese) ~ 2 Pages E S S E S TEMP TEMP TEMP S S S E E E 1 A- 1 A- 1 A- W W W S S S I I I D D D E E E C C Sheet. -

Analyzing Physics Students' Ethical Reasoning During a Unit On

ANALYZING PHYSICS STUDENTS’ ETHICAL REASONING DURING A UNIT ON THE DEVELOPMENT OF THE ATOMIC BOMB: A CALL FOR MACRO-ETHICAL DISCUSSIONS IN THE PHYSICS CLASSROOM by Egla K. Ochoa-Madrid, B.S A thesis submitted to the Graduate Council of Texas State University in partial fulfillment of the requirements for the degree of Master of Science with a Major in Physics August 2020 Committee Members: Alice Olmstead, Chair Eleanor Close Hunter Close Ayush Gupta COPYRIGHT by Egla K. Ochoa-Madrid 2020 FAIR USE AND AUTHOR’S PERMISSION STATEMENT Fair Use This work is protected by the Copyright Laws of the United States (Public Law 94-553, section 107). Consistent with fair use as defined in the Copyright Laws, brief quotations from this material are allowed with proper acknowledgement. Use of this material for financial gain without the author’s express written permission is not allowed. Duplication Permission As the copyright holder of this work I, Egla K. Ochoa-Madrid, authorize duplication of this work, in whole or in part, for educational or scholarly purposes only. DEDICATION I dedicate this page to my beautiful mother. Todo lo que hago, lo hago en su honor. ACKNOWLEDGEMENTS I’d like to acknowledge my advisor Dr. Alice Olmstead and my research partner Dr. Brianne Gutmann. I’d like to acknowledge the rest of my committee Dr. Ayush Gupta, Dr. Eleanor Close, & Dr. Hunter Close for offering their expertise and guidance v TABLE OF CONTENTS Page ACKNOWLEDGEMENT .............................................................................................. -

Telecommunications Provider Locator

Telecommunications Provider Locator Industry Analysis & Technology Division Wireline Competition Bureau February 2003 This report is available for reference in the FCC’s Information Center at 445 12th Street, S.W., Courtyard Level. Copies may be purchased by calling Qualex International, Portals II, 445 12th Street SW, Room CY- B402, Washington, D.C. 20554, telephone 202-863-2893, facsimile 202-863-2898, or via e-mail [email protected]. This report can be downloaded and interactively searched on the FCC-State Link Internet site at www.fcc.gov/wcb/iatd/locator.html. Telecommunications Provider Locator This report lists the contact information and the types of services sold by 5,364 telecommunications providers. The last report was released November 27, 2001.1 All information in this report is drawn from providers’ April 1, 2002, filing of the Telecommunications Reporting Worksheet (FCC Form 499-A).2 This report can be used by customers to identify and locate telecommunications providers, by telecommunications providers to identify and locate others in the industry, and by equipment vendors to identify potential customers. Virtually all providers of telecommunications must file FCC Form 499-A each year.3 These forms are not filed with the FCC but rather with the Universal Service Administrative Company (USAC), which serves as the data collection agent. Information from filings received after November 22, 2002, and from filings that were incomplete has been excluded from the tables. Although many telecommunications providers offer an extensive menu of services, each filer is asked on Line 105 of FCC Form 499-A to select the single category that best describes its telecommunications business. -

Dual Tone Multi Frequency (DTMF) Signal Generation and Detection Using MATLAB Software Nihat Pamuk Turkish Electricity Transmission Company, [email protected]

University of Business and Technology in Kosovo UBT Knowledge Center UBT International Conference 2015 UBT International Conference Nov 7th, 9:00 AM - 5:00 PM Dual Tone Multi Frequency (DTMF) signal generation and detection using MATLAB software Nihat Pamuk Turkish Electricity Transmission Company, [email protected] Ziynet Pamuk Sakarya University, [email protected] Follow this and additional works at: https://knowledgecenter.ubt-uni.net/conference Part of the Computer Sciences Commons, and the Digital Communications and Networking Commons Recommended Citation Pamuk, Nihat and Pamuk, Ziynet, "Dual Tone Multi Frequency (DTMF) signal generation and detection using MATLAB software" (2015). UBT International Conference. 97. https://knowledgecenter.ubt-uni.net/conference/2015/all-events/97 This Event is brought to you for free and open access by the Publication and Journals at UBT Knowledge Center. It has been accepted for inclusion in UBT International Conference by an authorized administrator of UBT Knowledge Center. For more information, please contact [email protected]. International Conference on Computer Science and Communication Engineering, Nov 2015 Dual Tone Multi Frequency (DTMF) signal generation and detection using MATLAB software Nihat Pamuk1, Ziynet Pamuk2 1Turkish Electricity Transmission Company 2Sakarya University, Electric - Electronic Engineering Department [email protected], [email protected] Abstract. In this study, Dual Tone Multi Frequency (DTMF) signal generation and detection is implemented by using Goertzel Algorithm in MATLAB software. The DTMF signals are generated by using Cool Edit Pro Version 2.0 program for DTMF tone detection. The DTMF signal generation and detection algorithm are based on International Telecommunication Union (ITU) recommendations. Frequency deviation, twist, energy and time duration tests are performed on the DTMF signals. -

What to Do If You Hear Radio Communications on Your Telephone

What to do if you hear radio communications on your telephone Interference occurs when your telephone instrument fails to "block out" a nearby radio communication. Potential interference problems begin when the telephone is built at the factory. All telephones contain electronic components that are sensitive to radio frequencies, but cordless telephones are particularly susceptible because they use radio transmitters/receivers. Cordless telephones are also highly sensitive to electrical noise, (electric fences) radio interference, and the communications of other nearby cordless phones. Cordless phones with more features like messaging, redial and intercom, contain more electronic components; this creates a greater potential for outside interference. If the manufacturer does not build in interference protection, these components may react to nearby radio communications. For example, you could hear the transmission of a local radio station through your telephone’s handset. This is not necessarily a sign that the interference is intentional or that the interfering radio transmitter is illegal but that your equipment has no, or inadequate, protection. If you own an unprotected telephone, as the radio environment around you changes, you may sometimes hear unwanted radio communications. This is a technical problem, not a law enforcement problem Because interference problems begin at the factory, you should send your complaint to the manufacturer who built your telephone. It is important that you follow through and contact the manufacturer of your phone if you are having an interference problem. The company needs to know if you are unhappy about your phone’s failure to block out radio communications. Also, the manufacturer knows the designs of its telephones and may be able to suggest a solution for your specific phone. -

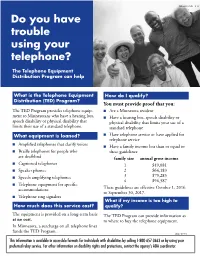

Telephone Equipment Distribution Program Can Help

DHS-4005-ENG 8-16 Do you have trouble using your telephone? The Telephone Equipment Distribution Program can help What is the Telephone Equipment How do I qualify? Distribution (TED) Program? You must provide proof that you: The TED Program provides telephone equip- Are a Minnesota resident ment to Minnesotans who have a hearing loss, Have a hearing loss, speech disability or speech disability or physical disability that physical disability that limits your use of a limits their use of a standard telephone. standard telephone What equipment is loaned? Have telephone service or have applied for telephone service Amplified telephones that clarify voices Have a family income less than or equal to Braille telephones for people who these guidelines: are deafblind family size annual gross income Captioned telephones 1 $49,081 Speaker phones 2 $64,183 Speech amplifying telephones 3 $79,285 4 $94,387 Telephone equipment for specific accommodations These guidelines are effective October 1, 2016 to September 30, 2017. Telephone ring signalers What if my income is too high to How much does this service cost? qualify? The equipment is provided on a long-term basis The TED Program can provide information as at no cost. to where to buy the telephone equipment. In Minnesota, a surcharge on all telephone lines funds the TED Program. ADA2 (12-12) This information is available in accessible formats for individuals with disabilities by calling 1-800-657-3663 or by using your preferred relay service. For other information on disability rights and protections, contact the agency’s ADA coordinator. How do I apply? Where are the regional offices? New applicants – Fill out and sign the application. -

POTS Modems Vs IP Telephony

Modems Vs IP Telephony Our Hotline, Vector, Matrix and BlueBox products all use V.34 modems designed for operation on conventional phone lines. Best modem performance occurs in the “classic” telephone setup of an analog line to the phone company, a digital conversion to a 64 kb/s path all the way to the other phone office, where the call goes back to analog for delivery to the other codec. The weak links have always been the analog loops at both ends, and any constriction in the digital path that results in a lower data rate. All of these things raise the noise seen by the modems, and may result in low connect speeds or intermittent behavior. There’s a new issue, however. If the network between the analog ends is done on IP circuits, the data throughput may drop, and will certainly be variable. IP traffic is sent with data packets that may be routed over widely different paths, or perhaps dropped altogether. The resulting delays, out-of-sequence data, and dead spots on Voice Over IP (VOIP) networks may be perfectly fine for voice calls, but are downright nasty for modem use. Even worse, data compression schemes such as V.729 that are used to shrink IP telephone channels down to 8 kb/s or less will absolutely keep a modem from operating. You’ll probably never even get a connection. Note that the IP conversion may be happening locally, or over the long-distance network. You are probably familiar with VOIP services offered by telephone and cable companies, as well as independent companies such as Vonage. -

Radiotelephone Transmitter. Tion of H3E and J3E Emissions on the (A) the Transmitter Must Be Capable Radiotelephone Distress Frequency

Federal Communications Commission § 80.859 § 80.855 Radiotelephone transmitter. tion of H3E and J3E emissions on the (a) The transmitter must be capable radiotelephone distress frequency. The of transmission of H3E and J3E emis- receiver must be capable of reception sion on 2182 kHz, and J3E emission on of J3E emissions on 2638 kHz and the 2638 kHz and at least two other fre- receiving frequencies associated with quencies within the band 1605 to 3500 the transmitting frequencies author- kHz available for ship-to-shore or ship- ized pursuant to § 80.855(a). to-ship communication. (b) One or more loudspeakers capable (b) The duty cycle of the transmitter of being used to maintain the distress must permit transmission of the inter- frequency (2182 kHz) watch at the prin- national radiotelephone alarm signal. cipal operating position and at any (c) The transmitter must be capable other place where the listening watch of transmitting clearly perceptible sig- is performed must be provided. nals from ship to ship during daytime (c) The receiver required by para- under normal conditions over a range graph (a) of the section must: of 150 nautical miles. (1) Have a sensitivity of 50 (d) The transmitter complies with microvolts; the range requirement specified in (2) Be capable of operation when en- paragraph (c) of this section if: ergized by the main source of energy, (1) The transmitter is capable of and by the reserve source of energy if a being matched to actual ship station reserve source is required by § 80.860(a); transmitting antenna meeting the re- (3) Be protected from excessive cur- quirements of § 80.863; and rents and voltages; (2) The output power is not less than (4) Be provided with a nameplate 60 watts peak envelope power for H3E showing the name of the receiver man- and J3E emission on the frequency 2182 ufacturer and the type or model. -

Bibliography on Videotelephony and Disability 1993-2002

Stockholm Institute of Education The Disability and Handicap Research Group Bibliography on Videotelephony and Disability 1993-2002 Magnus Magnusson & Jane Brodin Research Report 36 ISSN 1102-7967 Technology, Communication, Handicap ISRN 1102-HLS-SPEC-H-36-SE FOREWORD This report is part of the work at the FUNKHA-group at Stockholm Institute of Education, The Disability and Handicap Research Group It is also a complement to an earlier report published in 1993 within the European project RACE 2033 (Research in Advanced Communications Technologies in Europe), TeleCommunity. The earlier report was a compilation of references collected from nine databases on the subject of videotelephony. That report presented comments on 190 references from 20 years of publication, most of them related to disability. It is still available and the information is still valid. The present report wishes to follow up on that earlier study, almost exactly a decade later. We have made similar literature searches in similar databases. The main difference between the present and the earlier report is the fact that the field is more difficult to grasp today because there are more information sources, expecially the Internet itself which did not exist in any extensive form at that time. This means that the present report is more focussed on projects and activities and less on formal research reports and papers. The final result in numbers, however, was almost the same as in the first study in 1993, a total number of 188 formal references. We have tried to give a short and condensed picture of the situation as we see it in the world today in this very special, promising and dynamic field. -

“Picturephone”

An article on “Picturephone” Museum of Electrical Engineering Gathered by: Amir Fotovvat A brief history As far back as the 1930s, researchers at AT&T’s Bell Labs built a device that sent a television signal over standard phone lines. However, it had a problem; it was not efficient and practical enough to be used by people around the world. 34 years later AT&T’s Picturephone, introduced as a futuristic demonstration at the New York World’s Fair. There were eight Picturephone booths at the fair and visitors could use them for making video telephone calls. It seemed to many at Bell Labs and at AT&T that universal video telephony was a worthwhile new mission. Thus in 1969 Annual Report, AT&T confidently predicted with perhaps one million sets in use, Picturephone service might be a billion dollar business by 1980. They were thinking that it can largely utilized by businesses-particularly by large corporations then it would spread gradually into the residential market. On June 30, 1970, AT&T finally uncloaked a commercial Picturephone service in the city of Pittsburgh, Pennsylvania. Then after a couple of months they made three more available — one in New York, one in DC, and one in Chicago. The three machines could only communicate with one another and were extremely expensive, costing between $16 and $27 (that is $118 to $200 when adjusted for inflation) for just three minutes. The interesting statistics is that in the next 6 months Just 71 calls were made. Despite these setbacks over the next few years, Bell Labs designed an improved Picturephone set.