Direct Benefit Transfer Through India Post

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Microfinance and Women Empowerment - the Road Blocks Sustainable Solutions: India Post and Online Arketing

IOSR Journal of Humanities And Social Science (IOSR-JHSS) Volume 21, Issue 10, Ver. 9 (October.2016) PP 57-63 e-ISSN: 2279-0837, p-ISSN: 2279-0845. www.iosrjournals.org Microfinance and Women Empowerment - The Road Blocks Sustainable Solutions: India Post and Online Arketing Prof Suryakumari Duggirala, Dr V S Deshpande, Dr S V Deshpande Visiting Faculty,Indian Maritime University, Chennai, Indiaphd Scholar, Deptt Of Economics Rtm Nagpur University, Nagpur, India Professor & Head, Deptt Of Managementrtm Nagpur University, Nagpur, India Abstract:- Sustainable Development, One Of The Millennium Development Goals And Economic Growth Is Possible Only When Economies Include Women Empowerment In The Growth Story. Microfinance Enabling Women Empowerment Has Been Successful With Respect To Financial Access For Women, But The „Elephant In The Room‟ Is How To Market The Products Produced. Online Marketing Incorporates All The Elements Of E-Commerce, Lead-Based Websites, And Affiliate Marketing With Local Search. With The „Make In India‟ Campaign And The „Digital India‟ Program All Set To Take Off In India, And India Is Going Through Rapid Liberalization. With The Largest Network Of Core Banking Solutions Branches In India From 250-Odd In 2014 To 22,000 At Present, India Post Has Come A Long Way. Now There Has Been A New Development Of The Post Offices Becoming Payments Bank. Mfi-Shgs Can Get Into An Exclusive Marketing Agreement With India Post To Market All Their Products Online. India Post Can Delve Into This Venture And It Is A Win-Win Solution For All The Stakeholders. Keywords:-Online Marketing, Self-Help Groups, Micro-Finance, India Post, Payments Bank I. -

9 Post & Telecommunications

POST AND TELECOMMUNICATIONS 441 9 Post & Telecommunications ORGANISATION The Office of the Director General of Audit, Post and Telecommunications has a chequered history and can trace its origin to 1837 when it was known as the Office of the Accountant General, Posts and Telegraphs and continued with this designation till 1978. With the departmentalisation of accounts with effect from April 1976 the designation of AGP&T was changed to Director of Audit, P&T in 1979. From July 1990 onwards it was designated as Director General of Audit, Post and Telecommunications (DGAP&T). The Central Office which is the Headquarters of DGAP&T was located in Shimla till early 1970 and thereafter it shifted to Delhi. The Director General of Audit is assisted by two Group Officers in Central Office—one in charge of Administration and other in charge of the Report Group. However, there was a difficult period from November 1993 till end of 1996 when there was only one Deputy Director for the Central office. The P&T Audit Organisation has 16 branch Audit Offices across the country; while 10 of these (located at Chennai, Delhi, Hyderabad, Kapurthala, Lucknow, Mumbai, Nagpur, Patna and Thiruvananthapuram as well as the Stores, Workshop and Telegraph Check Office, Kolkata) were headed by IA&AS Officers of the rank of Director/ Dy. Director. The charges of the remaining branch Audit Offices (located at Ahmedabad, Bangalore, Bhopal, Cuttack, Jaipur and Kolkata) were held by Directors/ Dy. Directors of one of the other branch Audit Offices (as of March 2006) as additional charge. P&T Audit organisation deals with all the three principal streams of audit viz. -

Active Member List

NDS-CALL MEMBER LIST S.No Category of Participants No of Participants I BANKS a PUBLIC SECTOR BANKS 10 b PRIVATE SECTOR BANKS 17 c FOREIGN BANKS 32 d CO-OPERATIVE BANKS 48 e PAYMENTS BANK 6 f SMALL FINANCE BANK 10 II BANKS CUM PRIMARY DEALERS 11 III PRIMARY DEALERS 7 TOTAL ACTIVE NDS-CALL MEMBERS 141 NAME OF PARTICIPANTS I BANKS a PUBLIC SECTOR BANKS 1 BANK OF INDIA 2 BANK OF MAHARASHTRA 3 CENTRAL BANK OF INDIA 4 INDIAN BANK 5 INDIAN OVERSEAS BANK 6 PUNJAB AND SIND BANK 7 PUNJAB NATIONAL BANK 8 STATE BANK OF INDIA 9 UCO BANK 10 UNION BANK OF INDIA b PRIVATE SECTOR BANKS 1 BANDHAN BANK LIMITED 2 CITY UNION BANK LIMITED 3 DCB BANK LIMITED 4 DHANLAXMI BANK LIMITED 5 ICICI BANK LIMITED 6 IDBI BANK LIMITED 7 IDFC FIRST BANK LIMITED 8 INDUSIND BANK LIMITED 9 TAMILNAD MERCANTILE BANK LTD. 10 THE CATHOLIC SYRIAN BANK LTD. 11 THE FEDERAL BANK LIMITED 12 THE JAMMU AND KASHMIR BANK LTD. 13 THE KARNATAKA BANK LTD. 14 THE KARUR VYSYA BANK LTD. 15 RBL BANK LIMITED 16 THE SOUTH INDIAN BANK LIMITED 17 YES BANK LIMITED c FOREIGN BANKS 1 ABU DHABI COMMERCIAL BANK 2 AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED 3 BANK INTERNASIONAL INDONESIA 4 BANK OF BAHRAIN AND KUWAIT B.S.C 5 BANK OF CEYLON 6 BARCLAYS BANK PLC 7 BNP PARIBAS 8 COOPERATIEVE RABOBANK U.A. 9 CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK 10 CREDIT SUISSE AG 11 CTBC BANK CO. LTD. 12 DBS BANK INDIA LTD. -

India Post Payments Bank Limited (IPPB) Invites Online Applications from Qualified Candidates Who Will Be Appointed in JMG Scale I

India Post Payments Bank Limited (A wholly owned undertaking of the Department of Posts, Govt. of India) Post Box No: 760, Speed Post Centre, Market Road, Bhai Veer Singh Marg, New Delhi – 110 001 Recruitment of Scale I Officers India Post has received in-principle approval from RBI and approval from Cabinet for setting up India Post Payments Bank Limited. India Post Payments Bank Limited (IPPB) invites online applications from qualified candidates who will be appointed in JMG Scale I. Candidates will be selected through a selection process specified in this advertisement. Interested candidates who fulfill the eligibility criteria may apply online by visiting our website http://www.indiapost.gov.in/ between 4th October, 2016 to 25th October, 2016 and no other mode of application will be accepted. The important dates are as follows: Activities Dates On-line registration including Edit/ 4th October 2016 to 25th October 2016 Modification of Application by candidates Online Payment of Application Fees 4th October 2016 to 25th October 2016 Download of call letters for online 1 week before Online Examination date examination Date of Online Examination (Tentative) December, 2016/ January, 2017 Before applying candidates are advised to ensure that they fulfill the stipulated eligibility criteria. Candidates are advised to fill in the particulars of themselves correctly in the online application form. This advertisement contains the following details: Section Section Title Details in Section A Post Name and grade of post for which recruitment is desired, along with category-wise vacancy B Eligibility Criteria Details on the eligibility criteria such as age, educational qualification and experience have been provided. -

Banking and Financial Awareness : August to December 2020

ExamsCart.com ExamsCart.com Banking and Financial Awareness : August to December 2020 ❏ Yes Bank aims to disburse ₹10,000 cr ❏ DBS to launch digital exchange for retail, MSME loans in Dec quarter institutional investors ❏ SBI launches RuPay JCB contactless ❏ Finance Ministry releases 6th debit card for local and international installment of Rs 6,000 crore to States market ❏ RBI to set up Automated Banknote ❏ Paytm partners with Suryoday Small Processing Centre in Jaipur Finance Bank to offer instant digital ❏ RBI slaps ₹50 lakh fine on Urban loans to MSMEs Co-operative Bank in Kerala ❏ YES Bank appoints Niranjan Banodkar ❏ Department of Posts & India Post as new CFO, Adlakha to be new HR Payments Bank unveil new digital head payment app ‘DakPay’ ❏ Punjab National Bank launches loan ❏ ICICI Direct launches zero brokerage management solution to speed up plan delivery ❏ WhatsApp Payments is live with SBI, ❏ RBI asks HDFC to stop new digital HDFC, Axis Bank business launches ❏ IndusInd Bank launches its first metal ❏ DBS Bank India gets ₹2,500 crore credit card ‘PIONEER Heritage’ capital support from parent for LVB ❏ Yes Bank partners VISA, introduces merger new line of E-series debit cards ❏ RBI hikes limit for contactless card ❏ Indian Army and Bank of Baroda enter transaction to ₹5,000 into MoU for Baroda Military Salary ❏ RBI advises banks not to make any Package dividend payouts from profits pertaining ❏ Telegram to launch 'pay-for' services in to the FY ended March 2020 2021 ❏ Google Pay, PhonePe account for 86% ❏ Axis Mutual -

Public Notice-Merged.Pdf

No. 30-02/202 0-ws Government of lndia Ministry of Communications Department of Posts (PO Division) Dak Bhawan, Sansad Marg New Delhi- 110 001 Dated: 8th September, 2020 PUBLIC NOTICE SUBJECT: SEEKtNG suGGEsrloNs/FEEDBAcK/coMMENTS/|NpursrurEWs FROM GENERAL PUBLIC/STAKEHOLDERS ON THE DRAFT "INDIAN POST OFFICE RULES,2020" The central Government proposes to make a new set of lndian post office Rules' 2020 (lPo Rules, 2020) which wiil be in supersession of lpo Rures, 1933. passage 2- with the of time and induction of technorogy, the working of the post office has changed significanfly since 1933, so there is a need for a new set of rules in sync with the today's environment. 3. ln the new set of rpo Rures, 2020. some new rures have been framed, obsolete rules have been dereted from and many rures have been re- framed/modified in sync with the present scenario. The lndian post office Rules, 2020 will be a new set of Rures which wiil govern the functioning of the post offices henceforth. 4. ln the context of the above, the draft of proposed rpo Rures,2020 is hereby notified for information, seeking suggestions/feedbacucomments/inputs/views from general public/stakehorders/customers. Notice is hereby given that the suggestions/feedbacucomments/inputs/views received with regard to the said draft lPo Rules, 2020 will be taken into consideration tilr 6:00 p.m. of 9th october, 2020. 5. Suggestions/Feedback/comments/rnputsA/iews, if any, may be addressed to Ms. Sukriti Gupta, Assistant Director General (postal Operations, Room No. 340, Third Floor, Dak Bhawan, sansad Marg, New Derhi-i10001 , Ter. -

POSTAL SAVINGS Reaching Everyone in Asia

POSTAL SAVINGS Reaching Everyone in Asia Edited by Naoyuki Yoshino, José Ansón, and Matthias Helble ASIAN DEVELOPMENT BANK INSTITUTE Postal Savings - Reaching Everyone in Asia Edited by Naoyuki Yoshino, José Ansón, and Matthias Helble ASIAN DEVELOPMENT BANK INSTITUTE © 2018 Asian Development Bank Institute All rights reserved. First printed in 2018. ISBN: 978 4 89974 083 4 (Print) ISBN: 978 4 89974 084 1 (PDF) The views in this publication do not necessarily reflect the views and policies of the Asian Development Bank Institute (ADBI), its Advisory Council, ADB’s Board or Governors, or the governments of ADB members. ADBI does not guarantee the accuracy of the data included in this publication and accepts no responsibility for any consequence of their use. ADBI uses proper ADB member names and abbreviations throughout and any variation or inaccuracy, including in citations and references, should be read as referring to the correct name. By making any designation of or reference to a particular territory or geographic area, or by using the term “recognize,” “country,” or other geographical names in this publication, ADBI does not intend to make any judgments as to the legal or other status of any territory or area. Users are restricted from reselling, redistributing, or creating derivative works without the express, written consent of ADBI. ADB recognizes “China” as the People’s Republic of China. Note: In this publication, “$” refers to US dollars. Asian Development Bank Institute Kasumigaseki Building 8F 3-2-5, Kasumigaseki, Chiyoda-ku Tokyo 100-6008, Japan www.adbi.org Contents List of illustrations v List of contributors ix List of abbreviations xi Introduction 1 Naoyuki Yoshino, José Ansón, and Matthias Helble PART I: Global Overview 1. -

Post to Payment Bank – Case Study of India Post on Financial Inclusion

__________________________________________________________________ Post to Payment Bank – Case study of India Post on Financial Inclusion M. Neelakandan, Research Scholar, ISEC, Nagarabhavi, Bangalore 560072 Abstract Few of the sustainable development goals like ending poverty, reducing inequality and achieving gender equality could be attained through financial inclusion or inclusive finance. Financial Inclusion will inculcate saving habit and it will in turn help us to wipe out poverty and help the individual to move up to the next level of development in a sustainable way. At the end of the 10th five year plan India emerged as one of the fast growing economy, with a high GDP growth rate of 8%, but did not reflect an inclusive development, incorporating the development of marginalized poor and minorities. So during its eleventh five year plan, Government of India planned for inclusive growth through financial Inclusion, followed by formation of committee on Financial Inclusion. Banks and financial institutions were vested with responsibility of Financial Inclusion. It can act as a weapon to overcome financial backwardness of the under privileged and poor. Access to financial services plays a critical part in development by facilitating economic growth and reducing income inequality. Financial inclusion enables poor to save and to borrow for building their assets, to invest in their children education and entrepreneurial ventures, and thus to improve their livelihoods. Inclusive financial systems allow poor to insure them and help them to protect themselves from any economic vulnerabilities like illness, unemployment, accidents and theft. It is more likely to benefit disadvantaged groups such as women, unemployed and rural communities. In general Banks are known to be the institutions which provide financial services to people. -

Tracking Performance of Payments Banks Against Financial Inclusion Goals

Tracking Performance of Payments Banks against Financial Inclusion Goals Amulya Neelam1 and Anukriti Tiwari September 2020 1Authors work with Dvara Research, India. Corresponding author’s email: [email protected] Contents 1. Introduction ........................................................................................................................................ 1 2. Rationale and Methodology ............................................................................................................... 3 3. Performance of Payments Banks ........................................................................................................ 4 3.1. Has there been a proliferation of transaction touchpoints? .......................................................4 3.1.1 Has there been an increase in Branch Spread? .....................................................................6 3.1.2 Establishment of own ATMs and Acquiring POS ....................................................................9 3.1.3 Banking Services in Unbanked Rural Centres ...................................................................... 10 3.2 What are the relative volumes and the nature of transactions through PBs? ........................... 12 3.2.1 Transactions at Physical Touchpoints .................................................................................. 12 3.2.2 Digital Transactions .............................................................................................................. 13 4.The Competitive Landscape for -

Advancing Financial Inclusion Through Access to Insurance: the Role Of

Advancing financial inclusion through access to insurance: the role of postal networks Published by the Universal Postal Union (UPU) Berne, Switzerland and by the International Labour Organization (ILO) Geneva, Switzerland. Printed in Switzerland by the printing services of the International Bureau of the UPU. Copyright © 2016 UPU / ILO All rights reserved Except as otherwise indicated, the copyright in this publication is owned by the UPU and the ILO. Reproduction is authorized for non-commercial purposes, subject to proper acknowledgement of the source. This authorization does not extend to any material identified in this publication as being the copyright of a third party. Authorization to reproduce such third party materials must be obtained from the copyright holders concerned. AUTHOR: Guilherme Suedekum TITLE: Advancing financial inclusion through access to insurance: the role of postal networks ISBN: 978-92-95025-84-4 DESIGN: UPU Graphic Unit CONTACT: Nils Clotteau, UPU, [email protected] Craig Churchill, ILO, [email protected] COVER PICTURE: © 2009 Indian Post This study is the result of a joint effort between the International Labour Organization (ILO) and the Universal Postal Union (UPU). It was prepared by Guilherme Suedekum, financial inclusion independent consultant, with the guidance and advice of Craig Churchill, team leader of the ILO’s Impact Insurance Facility, and Nils Clotteau, Acknowledgements Partnerships and Resource Mobilization Expert at the UPU. The team is especially grateful to Dauren Turysbekov, Director of the Department of External Affairs at Kazpost, Michel Kabré, Director of Financial Services at SONAPOST, Titus Juma, Director of Payment Services at the Postal Corporation of Kenya, M’hamed El-Moussaoui, Assistant Director General of Al Barid Bank, and Rajagopal Krishnaswamy, Managing Director at Professional Life Assurance. -

List-Of-Public-Sector-Banks-In-India

1 List of Public Sector Banks in India Anchor Bank Merged Bank Established Headquarter Vijaya Bank Bank of Baroda 1908 Vadodara, Gujarat Dena Bank Bank of India 1906 Mumbai, Maharashtra Bank of Maharashtra 1935 Pune Maharashtra Canara Bank Syndicate Bank 1906 Bengaluru, Karnataka Central Bank of India 1911 Mumbai, Maharashtra Indian Bank Allahabad Bank 1907 Chennai, Tamil Nadu Indian Overseas Bank 1937 Chennai, Tamil Nadu Punjab & Sind Bank 1908 New Delhi, Delhi Oriental Bank of Commerce Punjab National Bank 1894 New Delhi, Delhi United Bank of India State Bank of Bikaner & Jaipur State Bank of Hyderabad State Bank of Indore State Bank of India 1955 Mumbai, Maharashtra State Bank of Mysore State Bank of Patiala State Bank of Travancore Bhartiya Mahila Bank UCO Bank 1943 Kolkata, West Bengal Andhra Bank Union Bank of India 1919 Mumbai, Maharashtra Corporation Bank List of Private Sector Banks in India Bank Name Established Headquarters HDFC Bank 1994 Mumbai, Maharashtra Axis Bank 1993 Mumbai, Maharashtra Bandhan Bank 2015 Kolkata, West Bengal CSB Bank 1920 Thrissur, Kerala City Union Bank 1904 Thanjavur, Tamil Nadu DCB Bank 1930 Mumbai, Maharashtra Dhanlaxmi Bank 1927 Thrissur, Kerala Federal Bank 1931 Aluva, Kerala 2 Bank Name Established Headquarters ICICI Bank 1994 Mumbai, Maharashtra IDBI Bank 1964 Mumbai, Maharashtra IDFC First Bank 2015 Mumbai, Maharashtra IndusInd Bank 1994 Mumbai, Maharashtra Jammu & Kashmir Bank 1938 Srinagar, Jammu and Kashmir Karnataka Bank 1924 Mangaluru, Karnataka Karur Vysya Bank 1916 Karur, Tamil Nadu Kotak -

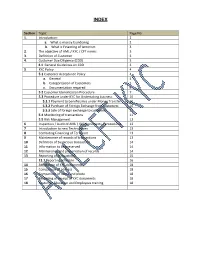

2 A. What Is Money Laundering 2 B. What Is Financing of Terrorism 3 2

INDEX Section Topic Page No 1. Introduction: 2 a. What is money laundering 2 b. What is Financing of terrorism 3 2. The objective of AML / KYC / CFT norms 3 3. Definition of Customer 3 4. Customer Due Diligence (CDD) 3 4.1 General Guidelines on CDD 3 5 KYC Policy 4 5.1 Customer Acceptance Policy 4 a. General 4 b. Categorization of Customers 5 c. Documentation required 6 5.2 Customer Identification Procedure 7 5.3 Procedure under KYC for Undertaking business 10 5.3.1 Payment to beneficiaries under Money Transfer 10 5.3.2 Purchase of Foreign Exchange from customers 10 5.3.3 Sale of foreign exchange to customers 11 5.4 Monitoring of transactions 11 5.5 Risk Management 12 6 Inspection / Audit of AML \ KYC documents / procedures 13 7 Introduction to new Technologies 13 8 Combating Financing of Terrorism 13 9 Maintenance of records of transactions 13 10 Definition of Suspicious transaction 14 11 Information to be preserved 14 12 Maintenance and preservation of records 14 13 Reporting of transactions 15 13.1 Reporting schedule 16 14 Attestation of KYC documents 18 15 Comparison of address 18 16 Comparison of name and photo 18 17 Recording of receipt of KYC documents 18 18 Customer Education and Employees training 18 Guidelines on Know Your Customer (KYC) Norms / Anti-Money Laundering (AML) Standards / Combating Financing of Terrorism (CFT) Norms under Prevention of Money Laundering Act, PMLA, 2002 as amended by Prevention of Money Laundering (Amendment) Act, 2009 for International Money Transfer Services(Inward) under the Money Transfer Service Scheme (MTSS) and Money Changing Services in India Post 1.