NFI GROUP INC. Annual Information Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation

Investor Presentation NOVEMBER 2019 WHO IS NFI? Bus Design and Manufacture Part Fabrication Aftermarket and Service Carfair Composites is a leader in North America’s most The North American Leader in fiber-reinforced plastic (FRP) comprehensive parts Heavy-Duty Transit buses design and composites organization, providing technology parts, technical publications, training, and support for its OEM Started in 1941 in Winnipeg, NFI’s dedicated internal parts- product lines North America’s largest fabrication facility launched in manufacturer of Motor Coaches 2017 in Shepherdsville, KY UK’s leading bus parts distributor and aftermarket service Tracing its roots to 1892 with the support network Dennis, Alexander and Plaxton companies, ADL is a global manufacturer of double deck Supports eMobility and single deck buses and projects from start to motor coaches headquartered in finish Larbert, Scotland Founded in 2008 in Middlebury, Indiana ARBOC is a leader in low- floor cutaway and medium-duty shuttles 2 OUR MISSION OUR VISION To design and deliver To enable the future of exceptional transportation mobility with innovative solutions that are safe, and sustainable solutions accessible, efficient and reliable WHY INVEST IN NFI Track Record Our Differentiators • Trusted business partner with nearly 400 years of combined • Exclusively focused on bus & coach with market leading bus and motor coach design and manufacturing experience positions in multiple jurisdictions • 5 year Q3 2019 LTM Revenue CAGR of 13.3% and Adj. • ~75% of revenue driven by public customers EBITDA CAGR of 22.3% • A market technology leader with a track record of • 11.3% Q3 2019 LTM Adj. EBITDA margin innovation offering all types of propulsion options • History of sustainable dividends: 13.3% annual growth in • Vertically integrated North American part fabrication to annual dividend in 2019 with 49.6% Q3 2019 LTM payout ratio control cost, time and quality. -

March 2020 After 28 Years of Service with the Company, Fifteen of Which As CFO

NFI GROUP INC. Annual Information Form March 16, 2020 TABLE OF CONTENTS BUSINESS OF THE COMPANY ............................................................................................................................... 2 CORPORATE STRUCTURE ..................................................................................................................................... 3 GENERAL DEVELOPMENT OF THE BUSINESS .................................................................................................. 4 Recent Developments ........................................................................................................................................... 4 DESCRIPTION OF THE BUSINESS ......................................................................................................................... 7 Industry Overview ................................................................................................................................................ 7 Company History ............................................................................................................................................... 10 Business Strengths .............................................................................................................................................. 10 Corporate Mission, Vision and Strategy ............................................................................................................. 13 Environmental, Social and Governance Focus .................................................................................................. -

Multiple Year Bus Procurement Program

Customer Services, Operations, and Safety Committee Board Action/Action Item III-A September 13, 2007 Multiple Year Bus Procurement Program Washington Metropolitan Area Transportation Authority Board Action/Information Summary Action MEAD Number: Resolution: Information 99828 Yes No PURPOSE Obtain Board approval to award a one-year base with four one-year options competitive procurement of hybrid electric buses and a procurement of 22 articulated Compressed Natural Gas (CNG) buses utilizing piggy-back options available from Los Angeles County Metropolitan Transportation Authority. DESCRIPTION On May 4, 2006, staff presented to the Planning and Development Committee the Bus Technology selection for FY08-12 and requested approval to initiate and award a one-year base with four one-year options competitive procurement of hybrid electric buses. This contract includes 100 buses a year for five years with options for an additional 100 buses each year assignable to other agencies. The Committee requested staff return to the Committee for final approval of the selected vendor. On June 19, 2006, the Board approved funding and authority to initiate the contracting action. Additionally, staff is requesting Board approval to purchase 22 articulated CNG buses as replacement buses. These 22 articulated CNG buses will be procured in accordance with Federal Transit Administration (FTA) Circular 4220 1.E “Assignabilty” options available from Los Angeles County Metropolitan Transportation Authority for CNG Bus Rapid Transit (BRT) style buses. FUNDING IMPACT There is no further impact on funding. Funding approved June 2006. RECOMMENDATION Board approval to award a one-year base with four one-year options competitive procurement of hybrid electric buses and procure 22 articulated CNG buses utilizing piggy-back options available from Los Angeles County Metropolitan Transportation Authority for CNG Bus Rapid Transit (BRT) style buses. -

Award Bid/OEM Auto Parts, Multi-Department

MEMORANDUM COUNTY OF PLACER DEPARTMENT OF ADMINISTRATIVE SERVICES PROCUREMENT SERVICES DIVISION TO: Honorable Board of Supervisors FROM: Brett Wood, Purchasing Manager DATE: June 18, 2013 SUBJECT: Bid No. 10242 for OEM Auto Parts- Multiple Vendors ACTION REQUESTED 1. Approve the award of competitive Bid No. 10242 to Cummins West Inc. of San Leandro (CA), Riverview International Trucks of West Sacramento (CA), Magnussen's Auburn Dodge of Auburn (CA), and Gold Rush Chevrolet of Auburn (CA) for Original Equipment Manufacturer (OEM) auto parts and service in the total aggregate amount of $174,500, funded by revenue collected from Fleet rate customers and Fleet direct charge customers as well as Fire revenues with no net County cost however the Sheriff has budgeted these expenses resulting in a net County cost of $22,500, for the period of July 1, 2013 through March 31, 2014; and 2. Approve the renewal of negotiated blanket purchase orders (BPOs) with Auburn Ford of Auburn (CA), Future Ford of Roseville (CA), Elk Grove Dodge of Elk Grove (CA), Performance Chevrolet of Sacramento (CA), Auburn Honda of Auburn (CA), Auburn Toyota of Auburn (CA), Nixon-Egli Equipment of Tracy (CA), Holt of California of Sacramento (CA), Cashman Equipment Company of Sparks (NV), A-Z Bus Sales of Sacramento (CA), CASE Power & Equipment of Sacramento (CA), Sacramento Truck Center of Sacramento (CA), Smith Power Products of Sparks (NV), Valley Power Systems Inc. of West Sacramento (CA), Owen Equipment Sales of Portland (OR), Gillig LLC of Hayward (CA), Snoquip Inc. of West Sacramento (CA), Pape Machinery of Sacramento (CA), Motor Coach Industries of Schaumburg (IL), and Edward R. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Surplus Property Inventory

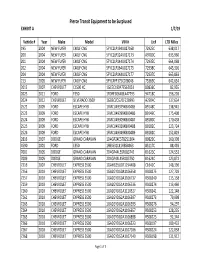

Pierce Transit Equipment to be Surplused EXHIBIT A 1/7/19 Vehicle # Year Make Model VIN # Lic# LTD Miles 195 2004 NEW FLYER C40LF CNG 5FYC2LP194U027168 72925C 638,017 200 2004 NEW FLYER C40LF CNG 5FYC2LP124U027173 A9780C 633,960 201 2004 NEW FLYER C40LF CNG 5FYC2LP144U027174 72935C 664,068 202 2004 NEW FLYER C40LF CNG 5FYC2LP164U027175 72938C 645,301 204 2004 NEW FLYER C40LF CNG 5FYC2LP1X4U027177 72937C 665,863 213 2005 NEW FLYER C40LF CNG 5FYC4FP175C028046 75369C 642,634 2012 2007 CHEVROLET C1500 XC 1GCEC19047E562051 80836C 82,955 2023 2011 FORD F350 1FDRF3G64BEA47793 94718C 156,201 2024 2012 CHEVROLET SILVERADO 3500 1GB3CZCG2CF228993 A2904C 137,634 2522 2009 FORD ESCAPE HYB 1FMCU49379KB00485 89148C 138,941 2523 2009 FORD ESCAPE HYB 1FMCU49399KB00486 89149C 175,408 2524 2009 FORD ESCAPE HYB 1FMCU49309KB00487 89180C 170,458 2525 2009 FORD ESCAPE HYB 1FMCU49329KB00488 89182C 123,724 2526 2009 FORD ESCAPE HYB 1FMCU49349KB00489 89181C 152,819 2816 2007 DODGE GRAND CARAVAN 1D4GP24E57B251304 80829C 160,398 4590 2001 FORD E350 1FBSS31L81HB58963 85117C 88,493 7001 2005 DODGE GRAND CARAVAN 2D4GP44L55R183742 B1623C 124,553 7009 2005 DODGE GRAND CARAVAN 2D4GP44L45R183750 B1624C 123,872 7216 2007 CHEVROLET EXPRESS 3500 1GAHG35U071194408 C1642C 148,396 7256 2010 CHEVROLET EXPRESS 3500 1GA2GYDG0A1106558 RS08275 127,703 7257 2010 CHEVROLET EXPRESS 3500 1GA2GYDG0A1106737 RS08240 115,158 7259 2010 CHEVROLET EXPRESS 3500 1GA2GYDG1A1106536 RS08274 113,460 7260 2010 CHEVROLET EXPRESS 3500 1GA2GYDG1A1110327 RS08241 122,148 7261 2010 CHEVROLET EXPRESS 3500 -

Bus & Motorcoach News

BUS & MOTORCOACH NEWS —JuneApril 1, 1, 2005 2005 — 1 INDUSTRY NEWS WHAT’S GOING ON IN THE BUS INDUSTRY Medical examiner list is teed up by FMCSA; group plans to certify WASHINGTON — The thorny MONTGOMERY, Texas —Three issue of whether the federal govern- long-time truck and bus safety pro- ment should establish a national fessionals have created a not-for- registry of individuals certified to profit organization that will certify perform medical examinations for the proficiency of individuals who commercial vehicle drivers is being conduct U.S. Department of Trans- teed up again by the Federal Motor portation medical examinations. Carrier Safety Administration. The formation of the National The FMCSA has scheduled a Academy of DOT Medical Examin- high-profile public meeting June 22 ers, or NADME, was announced in to explore the controversial concept Washington, D.C., last month by its and to hear from experts of every organizers. stripe. The meeting is likely to be The purpose of NADME “is to contentious. promote and enhance the quality Upscale cutaway coaches like this ABC M1000, photographed at Shattuck-St. Mary’s School in Fairbault, Minn., are gaining in popularity. In announcing the public ses- and level of professional knowledge sion, the FMCSA also made clear and skills of medical practitioners it’s interested in developing infor- and other individuals who perform 35-foot Redux mation that could lead to making or assist in the performance of med- improvements to the system for ical examinations to determine the assuring the physical qualifications physical qualification of drivers of Operators bite bullet, buy cutaways of commercial drivers — under its commercial motor vehicles,” said current legal authority. -

Financial Analysis of Battery Electric Transit Buses (PDF)

Financial Analysis of Battery Electric Transit Buses Caley Johnson, Erin Nobler, Leslie Eudy, and Matthew Jeffers National Renewable Energy Laboratory NREL is a national laboratory of the U.S. Department of Energy Technical Report Office of Energy Efficiency & Renewable Energy NREL/TP-5400-74832 Operated by the Alliance for Sustainable Energy, LLC June 2020 This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications. Contract No. DE-AC36-08GO28308 Financial Analysis of Battery Electric Transit Buses Caley Johnson, Erin Nobler, Leslie Eudy, and Matthew Jeffers National Renewable Energy Laboratory Suggested Citation Johnson, Caley, Erin Nobler, Leslie Eudy, and Matthew Jeffers. 2020. Financial Analysis of Battery Electric Transit Buses. Golden, CO: National Renewable Energy Laboratory. NREL/TP-5400-74832. https://www.nrel.gov/docs/fy20osti/74832.pdf NREL is a national laboratory of the U.S. Department of Energy Technical Report Office of Energy Efficiency & Renewable Energy NREL/TP-5400-74832 Operated by the Alliance for Sustainable Energy, LLC June 2020 This report is available at no cost from the National Renewable Energy National Renewable Energy Laboratory Laboratory (NREL) at www.nrel.gov/publications. 15013 Denver West Parkway Golden, CO 80401 Contract No. DE-AC36-08GO28308 303-275-3000 • www.nrel.gov NOTICE This work was authored by the National Renewable Energy Laboratory, operated by Alliance for Sustainable Energy, LLC, for the U.S. Department of Energy (DOE) under Contract No. DE-AC36-08GO28308. Funding provided by the U.S. Department of Energy Office of Energy Efficiency and Renewable Energy Vehicle Technologies Office. -

Page 1 of 32 VEHICLE RECALLS by MANUFACTURER, 2000 Report Prepared 1/16/2008

Page 1 of 32 VEHICLE RECALLS BY MANUFACTURER, 2000 Report Prepared 1/16/2008 MANUFACTURER RECALLS VEHICLES ACCUBUIL T, INC 1 8 AM GENERAL CORPORATION 1 980 AMERICAN EAGLE MOTORCYCLE CO 1 14 AMERICAN HONDA MOTOR CO 8 212,212 AMERICAN SUNDIRO MOTORCYCLE 1 2,183 AMERICAN SUZUKI MOTOR CORP. 4 25,023 AMERICAN TRANSPORTATION CORP. 5 1,441 APRILIA USA INC. 2 409 ASTON MARTIN 2 666 ATHEY PRODUCTS CORP. 3 304 B. FOSTER & COMPANY, INC. 1 422 BAYERISCHE MOTOREN WERKE 11 28,738 BLUE BIRD BODY COMPANY 12 62,692 BUELL MOTORCYCLE CO 4 12,230 CABOT COACH BUILDERS, INC. 1 818 CARPENTER INDUSTRIES, INC. 2 6,838 CLASSIC LIMOUSINE 1 492 CLASSIC MANUFACTURING, INC. 1 8 COACHMEN INDUSTRIES, INC. 8 5,271 COACHMEN RV COMPANY 1 576 COLLINS BUS CORPORATION 1 286 COUNTRY COACH INC 6 519 CRANE CARRIER COMPANY 1 138 DABRYAN COACH BUILDERS 1 723 DAIMLERCHRYSLER CORPORATION 30 6,700,752 DAMON CORPORATION 3 824 DAVINCI COACHWORKS, INC 1 144 D'ELEGANT CONVERSIONS, INC. 1 34 DORSEY TRAILERS, INC. 1 210 DUTCHMEN MANUFACTURING, INC 1 105 ELDORADO NATIONAL 1 173 ELECTRIC TRANSIT, INC. 1 54 ELGIN SWEEPER COMPANY 1 40 E-ONE, INC. 1 3 EUROPA INTERNATIONAL, INC. 2 242 EXECUTIVE COACH BUILDERS 1 702 FEATHERLITE LUXURY COACHES 1 83 FEATHERLITE, INC. 2 3,235 FEDERAL COACH, LLC 1 230 FERRARI NORTH AMERICA 8 1,601 FLEETWOOD ENT., INC. 5 12, 119 FORD MOTOR COMPANY 60 7,485,466 FOREST RIVER, INC. 1 115 FORETRAVEL, INC. 3 478 FOURWINNS 2 2,276 FREIGHTLINER CORPORATION 27 233,032 FREIGHTLINER LLC 1 803 GENERAL MOTORS CORP. -

Advanced Technology Equipment Manufacturers*

Advanced Technology Equipment Manufacturers* Revised 04/21/2020 On-Road (Medium/Heavy Duty, Terminal Tractors) OEM Model Technology Vocations GVWR Type Altec Industries, Inc Altec 12E8 JEMS ePTO ePTO ePTO, Utility > 33,000, 26,001 - 33,000 New Altec Industries, Inc Altec JEMS 1820 and 18E20 ePTO ePTO ePTO, Utility > 33,000, 26,001 - 33,000 New Altec Industries, Inc Altec JEMS 4E4 with 3.6 kWh Battery ePTO ePTO, Utility 16,001-19,500, 19,501-26,000 New Altec Industries, Inc Altec JEMS 6E6 with 3.6 kWh Battery ePTO ePTO, Utility 16,001-19,500, 19,501-26,000 New Autocar Autocar 4x2 and 6x4 Xpeditor with Cummins-Westport ISX12N Engine Near-Zero Engine Truck > 33,001 New Autocar Autocar 4x2 and 6x4 Xpeditor with Cummins-Westport L9N Engine Near-Zero Engine Refuse > 33,001 New Blue Bird Blue Bird Electric Powered All American School Bus Zero Emission Bus, School Bus > 30,000 New Blue Bird Blue Bird Electric Powered Vision School Bus 4x2 Configuration Zero Emission Bus, School Bus > 30,000 New BYD Motors BYD 8Y Electric Yard Tractor Zero Emission Terminal Truck 81,000 New BYD Motors BYD C10 45' All-Electric Coach Bus Zero Emission Bus 49,604 New BYD Motors BYD C10MS 45' All-Electric Double-Decker Coach Bus Zero Emission Transit Bus 45' New BYD Motors BYD C6 23' All-Electric Coach Bus Zero Emission Bus 18,331 New BYD Motors BYD K11 60' Articulated All-Electric Transit Bus Zero Emission Bus 65,036 New BYD Motors BYD K7M 30' All-Electric Transit Bus Zero Emission Bus, Transit Bus 30' New BYD Motors BYD K9 40' All-Electric Transit Bus Zero Emission -

National Fuel Cell Bus Program: Accelerated Testing Evaluation

Form Approved REPORT DOCUMENTATION PAGE OMB No. 0704-0188 Public reporting burden for this collection of information is estimated to average one hour per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, to Washington Headquarters Services, Directorate for Information Operations and Reports, 1215 Jefferson Davis Highway, Suite 1204, Arlington, VA 22202-4302, and to the Office of Management and Budget, Paperwork Reduction Project (0704-0188), Washington, DC 20503. 1. AGENCY USE ONLY (Leave 2. REPORT DATE 3. REPORT TYPE AND DATES blank) January 2009 COVERED Appendices, January 2009 4. TITLE AND SUBTITLE 5. FUNDING NUMBERS National Fuel Cell Bus Program: Accelerated Testing Report, AC Transit Appendices 6. AUTHOR(S) Kevin Chandler*, Leslie Eudy,** 7. PERFORMING ORGANIZATION NAME(S) AND ADDRESS(ES) 8. PERFORMING ORGANIZATION REPORT National Renewable Energy Laboratory, 1617 Cole Blvd., Golden, CO 80401 NUMBER Battelle, 505 King Ave. Columbus, OH 43201 9. SPONSORING/MONITORING AGENCY NAME(S) AND ADDRESS(ES) 10. SPONSORING/ Office of Research, Demonstration, and Innovation MONITORING Federal Transit Administration, 1200 New Jersey Ave, S.E., Washington, D.C. 20590 AGENCY REPORT NUMBER FTA-CO-26-7004-2009.1A 11. SUPPLEMENTARY NOTES *Battelle Memorial Institute **National Renewable Energy Laboratory 12a. DISTRIBUTION/AVAILABILITY STATEMENT 12b. DISTRIBUTION CODE No Restrictions. Available From: National Technical Information Service/NTIS, Springfield, Virginia, 22161. Phone 703.605.6000, Fax 703.605.6900, Email [[email protected]] 13. -

Fuel Cell Electric Buses Are in Operation Between Versailles and Jouy-En-Josas

INFORMATIONAL April 2020 Fuel Cell Electric Buses An attractive value proposition for zero emission buses in France Zero–Emission Fuel Cell Buses for France Van Hool fuel cell electric buses are in operation between Versailles and Jouy-en-Josas 2 Executive Summary France has recognized the importance of sustainable transportation. With the knowledge that mobility is a key contributor to air pollution, there is immense pressure to reduce CO2 emis- sions. Evidence of this is the ban on diesel and petrol car sales from 2040 and the strategy for clean mobility put forward in the “Loi de Transition Energétique pour la Croissance Verte.” French cities are also leading initiatives to reduce local emissions, such as Paris’ ambition to ban diesel cars as early as 2023. There is no doubt that the future of public transportation is going to be zero emission. Transit agencies and operators in France are being called to find ways to improve air quality in their communities while maintaining quality of service. The choice that faces cities and transit au- thorities is what technology to deploy. Transit operators can consider two zero emission elec- tric bus solutions: fuel cell electric buses (FCEBs) or battery electric buses (BEBs). FCEBs are electric buses which offer all the benefits of BEBs while facilitating large scale de- ployments. FCEBs fueled with hydrogen are the only zero-emission technology to match diesel fleets with complete route flexibility, short refueling time and similar depot space utilization. With more than 15 years on the road and millions of kilometers in passenger service, FCEBs have proven their performance.