Brooklyn New Development

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sunset Park South Historic District

DESIGNATION REPORT Sunset Park South Historic District Landmarks Preservation Designation Report Designation List 513 Commission Sunset Park South LP-2622 Historic District June 18, 2019 ESSAY RESEARCHED AND WRITTEN BY Michael Caratzas and Jessica Baldwin BUILDING PROFILES MaryNell Nolan-Wheatley, Margaret Herman, Theresa Noonan, and Michael Caratzas ARCHITECTS’ APPENDIX COMPLIED BY Marianne S. Percival EDITED BY Kate Lemos McHale PHOTOGRAPHS BY Sarah Moses and Jessica Baldwin COMMISSIONERS Sarah Carroll, Chair Frederick Bland, Vice Chair Diana Chapin Wellington Chen Michael Devonshire Michael Goldblum John Gustafsson Anne Holford-Smith Jeanne Lutfy Adi Shamir-Baron LANDMARKS PRESERVATION COMMISSION Lisa Kersavage, Executive Director Mark Silberman, General Counsel Kate Lemos McHale, Director of Research Cory Herrala, Director of Preservation Landmarks Preservation Designation Report Designation List 513 Commission Sunset Park South LP-2622 Historic District June 18, 2019 DESIGNATION REPORT Sunset Park South Historic District LOCATION Borough of Brooklyn LANDMARK TYPE Historic District SIGNIFICANCE Consisting almost entirely of two-story row houses built between 1892 and 1906, Sunset Park South is a remarkably cohesive historic district representing the largest collection of well-preserved row houses in Sunset Park, containing several of the neighborhood’s most distinctive streetscapes, and recalling Sunset Park’s origins and history as a middle-class community. Landmarks Preservation Designation Report Designation List 513 Commission -

3550 North Lakeline Blvd, Leander, Texas

Brooklyn’s Pizza Sauces Famous tomato sauce Fresh basil pesto sauce White pizza (olive oil and garlic) Giant Pizza by the Slice - 4.50 cheese - .75 each additional topping (excluding specialty toppings) Traditional Cheese Pizza - Our tomato sauce and whole milk mozzarella cheese Medium (12”) - 9.99 - Large (16”) - 12.99 White Pizza - Extra virgin olive oil, fresh minced garlic and mozzarella cheese; no tomato sauce Medium (12”) - 9.99 - Large (16”) - 12.99 Basil Pesto Pizza - Fresh basil pesto and mozzarella cheese Medium (12”) - 10.99 Large (16”) - 13.99 28” Party Pizza with Cheese 35.00 (5.00 each additional topping) 14” Gluten Free Pizza Dough - 12.99 Choice Toppings: Medium* 1.50 / Large 2.00 Pepperoni • Italian Sausage • Smoked Ham • Hamburger • Black Olive • Green Olive • Pineapple • Marinated Tomato • Extra Mozzarella White Onions • Bell Peppers • Fresh Garlic • Mushrooms • Banana Pepper • Jalapeños • Red Onions • Extra Sauce RISTORANTE Gourmet Toppings: Medium 2.00 / Large 2.50 Chicago Italian Meatballs • Genoa Salami • Chicken • Lamb/Beef Gyro • Spicy Sicilian Sausage • Portobello Mushrooms • Roasted Red Peppers Artichoke Heart • Cilantro • Kalamata Olives • Real Bacon • Sun-Dried Tomato • Roma Tomato • Spinach PIZZERIA Specialty Toppings Medium 2.25 / Large 3.25 Anchovies • Feta Cheese • Gorgonzola • Fresh Mozzarella Specialty Pizzas MauiWowee - Smoked ham & pineapple 13.99 - 17.99 Let us cater your next event or party Margaritaville - Roma tomatoes, fresh mozzarella, parmesan-reggiano, fresh basil & herbs 15.99 - 20.99 call: -

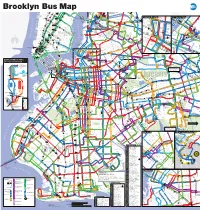

Brooklyn Bus Map

Brooklyn Bus Map 7 7 Queensboro Q M R Northern Blvd 23 St C E BM Plaza 0 N W R W 5 Q Court Sq Q 1 0 5 AV 6 1 2 New 3 23 St 1 28 St 4 5 103 69 Q 6 7 8 9 10 33 St 7 7 E 34 ST Q 66 37 AV 23 St F M Q18 to HIGH LINE Chelsea 44 DR 39 E M Astoria E M R Queens Plaza to BROADWAY Jersey W 14 ST QUEENS MIDTOWN Court Sq- Q104 ELEVATED 23 ST 7 23 St 39 AV Astoria Q 7 M R 65 St Q PARK 18 St 1 X 6 Q 18 FEDERAL 32 Q Jackson Hts Downtown Brooklyn LIC / Queens Plaza 102 Long 28 St Q Downtown Brooklyn LIC / Queens Plaza 27 MADISON AV E 28 ST Roosevelt Av BUILDING 67 14 St A C E TUNNEL 32 44 ST 58 ST L 8 Av Hunters 62 70 Q R R W 67 G 21 ST Q70 SBS 14 St X Q SKILLMAN AV E F 23 St E 34 St / VERNON BLVD 21 St G Court Sq to LaGuardia SBS F Island 66 THOMSO 48 ST F 28 Point 60 M R ED KOCH Woodside Q Q CADMAN PLAZA WEST Meatpacking District Midtown Vernon Blvd 35 ST Q LIRR TILLARY ST 14 St 40 ST E 1 2 3 M Jackson Av 7 JACKSONAV SUNNYSIDE ROTUNDA East River Ferry N AV 104 WOODSIDE 53 70 Q 40 AV HENRY ST N City 6 23 St YARD 43 AV Q 6 Av Hunters Point South / 7 46 St SBS SBS 3 GALLERY R L UNION 7 LT AV 2 QUEENSBORO BROADWAY LIRR Bliss St E BRIDGE W 69 Long Island City 69 St Q32 to PIERREPONT ST 21 ST V E 7 33 St 7 7 7 7 52 41 26 SQUARE HUNTERSPOINT AV WOOD 69 ST Q E 23 ST WATERSIDE East River Ferry Rawson St ROOSEV 61 St Jackson 74 St LIRR Q 49 AV Woodside 100 PARK PARK AV S 40 St 7 52 St Heights Bway Q I PLAZA LONG 7 7 SIDE 38 26 41 AV A 2 ST Hunters 67 Lowery St AV 54 57 WEST ST IRVING PL ISLAND CITY VAN DAM ST Sunnyside 103 Point Av 58 ST Q SOUTH 11 ST 6 3 AV 7 SEVENTH AV Q BROOKLYN 103 BORDEN AV BM 30 ST Q Q 25 L N Q R 27 ST Q 32 Q W 31 ST R 5 Peter QUEENS BLVD A Christopher St-Sheridan Sq 1 14 St S NEWTOWN CREEK 39 47 AV HISTORICAL ADAMS ST 14 St-Union Sq 5 40 ST 18 47 JAY ST 102 Roosevelt Union Sq 2 AV MONTAGUE ST 60 Q F 21 St-Queensbridge 4 Cooper McGUINNESS BLVD 48 AV SOCIETY JOHNSON ST THE AMERICAS 32 QUEENS PLAZA S. -

Gentrifying Crown Heights by Marlon Peterson (2011)

Crown Heights 1 Marlon Peterson [email protected] [email protected] Crown Heights: The Question of Gentrification, Violence, Social Disorganization, and Social Preservation. More questions than answers and the inevitability of neighborhood harms cased by gentrification. How does a community minimize the problems of in-migration? Crown Heights 2 “In [the] beginning God created the heavens and the earth. –Genesis 1:1 (New World Translation) “Crown Heights Brooklyn is my home. From the hallways of P.S. 138 on Prospect Place and Nostrand Avenue to Brower Park to Sonatas Steel Orchestra on Sterling and Troy to the West Indian Day Parade on Eastern Parkway, Crown Heights is my home. I am a true product of this neighborhood. I have received academic accolades in one vein and handcuffs in the other. I have seen Crown Heights grow from the crack-filled, crime- riddled days of the 1980’s to the gentrifying neighborhood it is becoming. Throughout it all, however, there has remained one constant; crime” (Peterson, yosos.org). When I grew up in Crown Heights during the 1980’s and 1990’s Prospect Heights was only the name of a notoriously low performing school with an even more infamous nickname for the way young girls from that school were viewed—Prostitute’ Heights.’ Now this name, Prospect Heights—still with the dubious nickname for the high school according to neighborhood teens—is the chic new name of an expanding co-opted section of Crown Heights. Real estate companies in an effort to sell homes at higher rates constantly increase the boundaries of Prospect Heights into the neighborhood formerly known as Crown Heights. -

Narrative Summary of Constraints and Opportunities Provided to the Panel by NYC DOT

As presented to the BQE Expert Panel for informational/background purposes only https://bqe-i278.com/en/expert-panel/documents Narrative Summary of Constraints and Opportunities Provided to the panel by NYC DOT What Makes the Project So Complicated? Fixing the BQE is exceptionally complicated due to its unusual design and the constrained site in which it operates. This corridor is sandwiched between Brooklyn Bridge Park, the Promenade and Brooklyn Heights, the Manhattan and Brooklyn Bridges, bustling DUMBO and Vinegar Hill, and an extraordinary volume of infrastructure below – four subway lines, an eight-foot DEP interceptor sewer, and many other utility lines. Creating sufficient space to stage the construction (e.g. to fit equipment like cranes and store materials) is a key challenge that any concept must address. Specifically, any construction concept needs to account for the complexities of working with a cantilever structure, building on or around Furman Street, the surrounding open spaces, and other infrastructure running above and below the BQE. This part of the BQE corridor is also comprised of multiple structures that require different methods of rehabilitation or replacement. Although the triple cantilever is the most well-known portion of this project, the double cantilever and the bridges at Joralemon, Old Fulton, and Columbia Heights all require repair. Cantilever Considerations A traditional bridge structure is usually rehabilitated lane-by-lane. Construction crews shut down a portion of the bridge, repair those areas, and then shift traffic to the rehabilitated section. This type of construction staging is not possible on the triple cantilever due to the unique nature of the BQE. -

Cop Saves Woman from Slope Rapist

GARCIA MAKES METS AS CLONES CLINCH BACK PAGE INSIDE BROOKLYN’S WEEKLY NEWSPAPER Including The Downtown News, Carroll Gardens-Cobble Hill Paper and Fort Greene-Clinton Hill Paper Painters take on avant-garde Published weekly by Brooklyn Paper Publications at 26 Court St., Brooklyn, NY 11242 Phone 718-834-9350 © Brooklyn Paper Publications • 16 pages including GO BROOKLYN • Vol.26, No. 36 BWN • September 8, 2003 • FREE Cop saves woman from Slope rapist By Patrick Gallahue thug took off and Ward chased him and tack- instinct was to go over and chase the perp Bridge. A suspect was arrested in the incident. The Brooklyn Papers led him near Prospect Park West. down,” said Deputy Inspector Edward On July 10, a 45-year-old woman was at- The suspect, Bennie Hogan, 39, of Browns- Mullen, commanding officer of the 78th tacked at Lookout Hill, inside the park off A quick-thinking police officer chased ville, has been charged with attempted rape, as- Precinct. Prospect Park South and Terrace Place, at down a career criminal and convicted sex sault and resisting arrest. The scooter was purchased for the precinct around 10:45 am. offender on the Park Slope side of The beaten and bloodied victim was taken last Christmas by Park Slope Councilman Bill The assailant was scared off by another Prospect Park on Tuesday after the sus- to Kings County Medical Center where she DeBlasio using discretionary funds allocated jogger as the victim tried to fight off her at- pect allegedly attempted to rape a 33-year- was treated for severe cuts and bruises. -

Summer Camp Guide 2018 Summer Camps Easily Accessible from Brooklyn Heights, DUMBO, Downtown Brooklyn, Bococa and Beyond

Summer Camp Guide 2018 Summer camps easily accessible from Brooklyn Heights, DUMBO, Downtown Brooklyn, BoCoCa and beyond This comprehensive summer camp guide profiles 50 local summer camps in Brooklyn Heights, DUMBO, Downtown Brooklyn, Gowanus, BoCoCa and beyond! We have listed program details, age groups, dates, hours, costs and contact information for each camp for children 18 months to 18 years old. The guide includes arts, animation, circus, cooking, engineering, fashion design, movie making, swimming, skateboarding, tennis, theater, STEM, and textile camps. It also features French, Spanish, Hebrew, Italian and Mandarin immersion summer programs in our neighborhood and much more! Animation & Music Camp Program: In our Stop Motion Animation camp young creators ages 5-9 will learn and create original animation movies and engage in activities designed to cultivate curiosity, creativity, self- expression and friendship. They are guided through the steps of producing movies with cool themes, titles, sound effects and a whole host of unique features and work with variety of materials to create their stop-motion’s objects, sets, figures, props, sequential drawing or animate toys. Our enriching summer experience is designed so that children additionally to movie making explore sound, music, drumming, martial arts and other activities indoor and outdoor including a daily recess at the John Street lawn in Brooklyn Bridge Park. Small group limited to 6 campers a day. Students are required to bring their own iPad or iPhone to camp with the appropriate -

Sunset Park Library

Sunset Park Library Brooklyn Public Library (BPL) and the Fifth Avenue Committee (FAC), a nonprofit with extensive affordable housing and community development experience, are partnering to redevelop Sunset Park Library. They are proposing to build a new 21,000-square-foot branch topped by 49 units of affordable housing—including 9 units reserved for victims of domestic violence. WHY A NEW LIBRARY? Sunset Park has outgrown its library. The neighborhood needs and deserves a larger, better branch. Sunset Park is home to one of Brooklyn’s busiest libraries, with attendance and circulation that rank in the top 10 of Brooklyn Public Library’s 60 branches. At 12,200 square feet, the current branch is too small, and too badly outdated, to meet the needs of the patrons who depend on its collections and services. Sunset Park Library requires more than $6 million in repairs. Its air conditioner is broken and has been replaced by loud porta- ble chillers that do a poor job cooling the branch on hot days. There are only 12 electrical outlets available to patrons, and too much of the library’s space is inaccessible to the public. WHAT WILL THE NEW BRANCH LOOK LIKE? The new Sunset Park Library will be an inviting, inspiring space that is worthy of the great neighborhood it serves. The new Sunset Park Library will meet the needs of today’s library patrons, with modern technology and flexible workspaces. Public feedback will inform the planning and design of the new, larger Sunset Park branch. There will be several community and stakeholder planning sessions to shape the library before it is designed. -

S.O.S. Bed-Stuy Guide to Community Resources, Services and Organizations

S.O.S. Bed-Stuy Guide to Community Resources, Services and Organizations BED-STUY CONTENTS S.O.S. BED-STUY — 3 CROWN HEIGHTS COMMUNITY MEDIATION CENTER — 4 HISTORY OF BED-STUY — 5 ADULT EDUCATION — 6 BUSINESS AND ENTREPRENEUR RESOURCES — 7 CAREER COUNSELING AND TRAINING PROGRAMS — 8 COMMUNITY CENTERS — 11 CULTURAL INSTITUTIONS — 12 DOMESTIC VIOLENCE RESOURCES — 15 FINANCIAL ADVICE — 19 LGBTQ RESOURCES — 21 DAYCARE CENTERS AND HEAD START — 23 HEALTH — 24 HIV/AIDS SERVICES — 27 HOMELESSNESS — 29 HOUSING — 31 HUNGER — 33 LEGAL SERVICES — 35 MEDIATION AND DISPUTE RESOLUTION — 38 MENTAL HEALTH RESOURCES — 39 RE-ENTRY SERVICES AND RESOURCES — 41 SENIOR, VETERAN, AND DISABLED SERVICES — 42 SUBSTANCE ABUSE — 45 YOUTH PROGRAMS AND FAMILY RESOURCES — 48 AFTER SCHOOL PROGRAMS — 49 AND ACTIVITIES — 49 FATHERHOOD PROGRAMS — 52 FAMILY RESOURCES — 53 USEFUL GOVERNMENT NUMBERS — 55 ELECTED OFFICIALS AND GOVERNMENT REPRESENTATIVES — 57 2 S.O.S. Bed-Stuy Guide to Community Resources, Services and Organizations S.O.S. BED-STUY Save Our Streets (S.O.S.) is a community-based effort to end gun violence. S.O.S. staff prevent gun violence from occurring in the program target areas by mediating conflicts that may end in gun violence and acting as peer counselors to men and women who are at risk of perpetrating or being victimized by violence. S.O.S. works closely with neighborhood leaders and businesses to promote a visible and public message against gun violence, encouraging local voices to articulate that shooting is an unacceptable behavior. The Save Our Streets staff is comprised of Outreach Workers and Violence Interrupters. The outreach staff all have first-hand knowledge of street life and gang life and live in or near the program target area. -

Brooklyn School of Languages

BROOKLYN THE NEIGHBORHOODS Brooklyn has more diversity in its neighborhoods than any other borough in New York City. And those neighborhoods define it: from the new and lively Dumbo just below the Brooklyn Bridge, to vibrant and artsy Fort Greene. The cool bars and restaurants of Park Slope and the antique stores of Atlantic Avenue. The famous brownstones of Brooklyn Heights and it’s promenade with the views of Manhattan just over the water to up and coming Prospect Heights and Vanderbilt Avenue. The supremely hip Williamsburg and Greenpoint, the next big thing… And in the middle of it all, sits beautiful emergence as the hip place to be. The recently Prospect Park which has the unique feel of an opened Barclays Center, which sits between English Common at times: ar away from the Park Slope, Prospect Heights and Fort Greene, crowds; the perfect place to spend a lazy has also given the borough a world class music afternoon in the sun. and sports venue, which can definitely rival Like the other boroughs of the city, Brooklyn is iconic Madison Square Garden in Manhattan. also ethnically diverse. This diversity, which Looking beyond this tag though, Brooklyn is has been carefully maintained and protected also a very sophisticated district that contains throughout the years, typifies many of the experimental and innovative galleries as well neighborhoods. as rare and valuable collections in famous Brooklyn has a rich history as a center for the museums. arts, most notably the famous BAM, Brooklyn The only way to really experience and get the Academy of Music, which is located in Fort best from Brooklyn is to walk or cycle its Greene. -

FORT GREENE and BROOKLYN HEIGHTS (Including Boerum Hill, Brooklyn Heights, Clinton Hill, Downtown Brooklyn, DUMBO, Fort Greene and Vinegar Hill)

COMMUNITY HEALTH PROFILES 2015 Brooklyn Community District 2: FORT GREENE AND BROOKLYN HEIGHTS (Including Boerum Hill, Brooklyn Heights, Clinton Hill, Downtown Brooklyn, DUMBO, Fort Greene and Vinegar Hill) Health is rooted in the circumstances of our daily lives and the environments in which we are born, grow, play, work, love and age. Understanding how community conditions affect our physical and mental health is the first step toward building a healthier New York City. FORT GREENE AND BROOKLYN HEIGHTS TOTAL POPULATION WHO WE ARE 102,814 1 2 3 4 5 6 7 8 9 10 POPULATION BY RACE AND ETHNICITY 46%e Whit * 27% Black* 14% Hispanic 8% Asian* 4% Other* Population BY AGE HAVE LIMITED 44% ENGLISH NYC 20% PROFICIENCY 20% 15% NYC 10% 10% 11% ARE 0–17 18–24 25–44 45–64 65+ FOREIGN 0 - 17 18-24 25-44 45-64 65+ BORN Percent WHO REPORTED THEIR OWN health AS “EXCELLENT,” LIFE EXPECTANCY ”VERY GOOD” OR “GOOD” 79.4 84% YEARS * Non-Hispanic Note: Percentages may not sum to 100% due to rounding Sources: Overall population, race and age: U.S. Census Bureau Population Estimates, 2013; Foreign born and English proficiency: U.S. Census Bureau, American Community Survey, 2011-2013; Self-reported health: NYC DOHMH Community Health Survey, COMMUNITY2011-2013; Life Expectancy: HEALTH NYC DOHMH PROFILESBureau of Vital Statistics, 2015: 2003-2012 FORT GREENE AND BROOKLYN HEIGHTS 2 Note from Dr. Mary Bassett, Commissioner, New York City Department of Health and Mental Hygiene New York City is a city of neighborhoods. Their diversity, rich history and people are what make this city so special. -

Brooklyn 1Q2019 | Brooklyn | 2

The Corcoran Report 1Q | 2019 | BROOKLYN 1Q2019 | BROOKLYN | 2 Overview Closed Sales Contracts Signed At the start of 2019, Brooklyn buyers faced still-lingering uncertainty in the market surrounding the effects of tax reform while sellers grappled with downward pressure on prices. As a result, the for-sale market registered 9% fewer 1,279 821 transactions versus a year ago. However, worth noting is -9% YEAR OVER YEAR -4% YEAR OVER YEAR that 2018 had the second highest number of transactions -9% QUARTER OVER QUARTER -14% QUARTER OVER QUARTER of any first quarter in the last ten years. The pace of sales The annual decline was exaggerated relative to Signed contract activity fell but at a slower rate during First Quarter 2019 was still higher than the starting a very strong First Quarter 2018. than closings. quarters of both 2015 and 2016, yet prices were far lower during those years. Days on Market Inventory Overall sales dipped to 1,279 closings due to a six-year low figure in the resale condo market and 19% fewer closings of new development closings. Resale co-ops remained relatively stable, with sales actually improving 2% annually. 80 2,104 Activity waned inconsistently across price points, though in general share of sales over $750,000 fell 6%. This quarter, -15% YEAR OVER YEAR +18% YEAR OVER YEAR -12% QUARTER OVER QUARTER +8% QUARTER OVER QUARTER sales continued to contract in Williamsburg / Greenpoint Marketing time shrank versus last year as Inventory improved by double-digits compared while Bedford-Stuyvesant, Crown Heights, Lefferts Gardens much-needed inventory growth renewed to the constrained supply figure last year.