Brooklyn 1Q2019 | Brooklyn | 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gowanus Gentrified?

Gowanus Gentrified? Community Responses to Gentrification and Economic Development in the Shadow of the Superfund Michael Spitzer-Rubenstein Senior Thesis for the Urban Studies Program Barnard College, Columbia University Submitted April 18, 2012 Thesis Advisor: Meredith Linn Abstract Gowanus is an industrial neighborhood changing into a gentrified area, but it faces such severe pollution that the EPA designated the Gowanus Canal, which bisects the area, a Superfund site in 2010. The industry still in Gowanus includes a mix of traditional industrial businesses, craft industries, and artists, but they might disappear if developers build luxury condos in the neighborhood. This study looks at the clash between activists over how the community has and will change, focusing on the pro-development Gowanus Canal Community Development Corporation and the preservationist and pro-Superfund Friends and Residents of Greater Gowanus. Many local activists embrace the vision of Gowanus as a place for making things and hope to maintain industry. Even though industry left the neighborhood polluted, most do not connect the two. The Superfund seeks to clean up the neighborhood but it may pave the way for environmental gentrification, which is the pollution cleanup causing gentrification. However, fears of the Superfund harming home prices do not appear to be true; GIS analysis shows that land closest to environmental hazards increased the most in value. Residents also hope to avoid the experiences of other New York neighborhoods, which saw gentrification cause displacement. More than residential displacement, though, activists worry about the culture of Gowanus disappearing and hope to save it. Their remedies such as historic preservation and zoning Gowanus for mixed use may not be effective or viable, though. -

Sunset Park South Historic District

DESIGNATION REPORT Sunset Park South Historic District Landmarks Preservation Designation Report Designation List 513 Commission Sunset Park South LP-2622 Historic District June 18, 2019 ESSAY RESEARCHED AND WRITTEN BY Michael Caratzas and Jessica Baldwin BUILDING PROFILES MaryNell Nolan-Wheatley, Margaret Herman, Theresa Noonan, and Michael Caratzas ARCHITECTS’ APPENDIX COMPLIED BY Marianne S. Percival EDITED BY Kate Lemos McHale PHOTOGRAPHS BY Sarah Moses and Jessica Baldwin COMMISSIONERS Sarah Carroll, Chair Frederick Bland, Vice Chair Diana Chapin Wellington Chen Michael Devonshire Michael Goldblum John Gustafsson Anne Holford-Smith Jeanne Lutfy Adi Shamir-Baron LANDMARKS PRESERVATION COMMISSION Lisa Kersavage, Executive Director Mark Silberman, General Counsel Kate Lemos McHale, Director of Research Cory Herrala, Director of Preservation Landmarks Preservation Designation Report Designation List 513 Commission Sunset Park South LP-2622 Historic District June 18, 2019 DESIGNATION REPORT Sunset Park South Historic District LOCATION Borough of Brooklyn LANDMARK TYPE Historic District SIGNIFICANCE Consisting almost entirely of two-story row houses built between 1892 and 1906, Sunset Park South is a remarkably cohesive historic district representing the largest collection of well-preserved row houses in Sunset Park, containing several of the neighborhood’s most distinctive streetscapes, and recalling Sunset Park’s origins and history as a middle-class community. Landmarks Preservation Designation Report Designation List 513 Commission -

3550 North Lakeline Blvd, Leander, Texas

Brooklyn’s Pizza Sauces Famous tomato sauce Fresh basil pesto sauce White pizza (olive oil and garlic) Giant Pizza by the Slice - 4.50 cheese - .75 each additional topping (excluding specialty toppings) Traditional Cheese Pizza - Our tomato sauce and whole milk mozzarella cheese Medium (12”) - 9.99 - Large (16”) - 12.99 White Pizza - Extra virgin olive oil, fresh minced garlic and mozzarella cheese; no tomato sauce Medium (12”) - 9.99 - Large (16”) - 12.99 Basil Pesto Pizza - Fresh basil pesto and mozzarella cheese Medium (12”) - 10.99 Large (16”) - 13.99 28” Party Pizza with Cheese 35.00 (5.00 each additional topping) 14” Gluten Free Pizza Dough - 12.99 Choice Toppings: Medium* 1.50 / Large 2.00 Pepperoni • Italian Sausage • Smoked Ham • Hamburger • Black Olive • Green Olive • Pineapple • Marinated Tomato • Extra Mozzarella White Onions • Bell Peppers • Fresh Garlic • Mushrooms • Banana Pepper • Jalapeños • Red Onions • Extra Sauce RISTORANTE Gourmet Toppings: Medium 2.00 / Large 2.50 Chicago Italian Meatballs • Genoa Salami • Chicken • Lamb/Beef Gyro • Spicy Sicilian Sausage • Portobello Mushrooms • Roasted Red Peppers Artichoke Heart • Cilantro • Kalamata Olives • Real Bacon • Sun-Dried Tomato • Roma Tomato • Spinach PIZZERIA Specialty Toppings Medium 2.25 / Large 3.25 Anchovies • Feta Cheese • Gorgonzola • Fresh Mozzarella Specialty Pizzas MauiWowee - Smoked ham & pineapple 13.99 - 17.99 Let us cater your next event or party Margaritaville - Roma tomatoes, fresh mozzarella, parmesan-reggiano, fresh basil & herbs 15.99 - 20.99 call: -

2Q17 BROOKLYN Contentssecond Quarter 2017 3 Overview 3/7 Market Wide 4 Sales 5 Inventory 6 Prices 7 Market Share

The Corcoran Report 2Q17 BROOKLYN ContentsSecond Quarter 2017 3 Overview 3/7 Market Wide 4 Sales 5 Inventory 6 Prices 7 Market Share 8 Resale Co-ops 9 Resale Condos 10 New Developments 11 Luxury 12/27 Neighborhoods 12/13 Williamsburg & Greenpoint 14/15 Brooklyn Heights, Cobble Hill, Dumbo & Downtown 16/17 Park Slope & Gowanus 18/19 Fort Greene, Clinton Hill & Prospect Heights 20/21 Carroll Gardens, Boerum Hill & Red Hook 22/23 Bedford-Stuyvesant, Crown Heights, Lefferts Gardens & Bushwick 24/25 Kensington, Windsor Terrace, Ditmas Park, Flatbush & Prospect Park South 26/27 South Brooklyn 28 Methodology The following members of the The Corcoran Group made significant contributions to this report: Kristy Hoffman I Steve Pak I Madison Rosenwald I Ryan Schleis I Brie Train 2Q Corcoran2017 Report Overview Brooklyn 2Q17 2Q16 % Chg (yr) 1Q17 % Chg (qtr) Brooklyn’s second quarter maintained Overview the pace set at the start of 2017 Closed Sales 1,459 1,248 17% 1,456 0% and improved on the sales activity Contracts Signed 1,186 1,036 14% 1,016 17% recorded in Second Quarter 2016. Inventory 1,723 2,234 -23% 2,063 -16% Challenged by limited resale Months of Supply 3.8 5.1 -25% 4.7 -20% inventory, buyers turned to new Average Days on Market 79 65 22% 89 -11% development properties in numbers Prices significant enough to boost market- Median Price $760K $599K 27% $700K 9% wide sales and prices overall. But Average Price $937K $756K 24% $951K -1% more aggressive pricing and the lack of low-priced inventory also Median PPSF $913 $904 1% $1,011 -10% generated some buyer resistance; the Average PPSF $954 $887 8% $1,028 -7% average days on market increased by Median Price by Bedroom two weeks compared to a year ago. -

Market Report Brooklyn

First Quarter 2021 Residential Market Report Brooklyn BHSID 19098184 We’re growing! Halstead has joined Brown Harris Stevens - which means BHS now has 2,500 agents and 55 offices in luxury markets across NYC, the Tristate area, the Hamptons, Palm Beach, and Miami. Historically ranked among the nation’s top residential firms, in 2019 both firms combined closed 6,000 transactions totaling more than $9 billion. Simply put, we have more resources than ever to support our trusted clients. We are here to serve you, and Brown Harris Stevens has never been stronger. We look forward to working together. BHSID 20650302 BHS 1 Message from Bess Freedman CEO of Brown Harris Stevens The Brooklyn residential market remained hot in the first quarter of 2021, with prices for both apartments and townhouses higher than a year ago. Apartment prices averaged $939,368, which was 13% more than 2020’s first quarter. The average 1-3 family house price of $1,289,768 represented a 7% improvement over the past year. Apartment sales continued to surge in 2021’s first quarter, with the number of closings up 20% from a year ago. That’s impressive considering COVID-19 had very little impact on closings in the first quarter of 2020, while it is still impacting our economy today. Contracts signed in the first quarter to buy a Brooklyn apartment hit their highest level in almost four years, a sign that this momentum is only getting stronger. BHSID 20625191 BHS 2 Q1 2021 Cooperatives & Condominiums Both the average and median prices posted strong gains compared to 2020’s first quarter. -

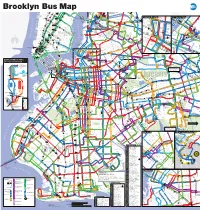

Brooklyn Bus Map

Brooklyn Bus Map 7 7 Queensboro Q M R Northern Blvd 23 St C E BM Plaza 0 N W R W 5 Q Court Sq Q 1 0 5 AV 6 1 2 New 3 23 St 1 28 St 4 5 103 69 Q 6 7 8 9 10 33 St 7 7 E 34 ST Q 66 37 AV 23 St F M Q18 to HIGH LINE Chelsea 44 DR 39 E M Astoria E M R Queens Plaza to BROADWAY Jersey W 14 ST QUEENS MIDTOWN Court Sq- Q104 ELEVATED 23 ST 7 23 St 39 AV Astoria Q 7 M R 65 St Q PARK 18 St 1 X 6 Q 18 FEDERAL 32 Q Jackson Hts Downtown Brooklyn LIC / Queens Plaza 102 Long 28 St Q Downtown Brooklyn LIC / Queens Plaza 27 MADISON AV E 28 ST Roosevelt Av BUILDING 67 14 St A C E TUNNEL 32 44 ST 58 ST L 8 Av Hunters 62 70 Q R R W 67 G 21 ST Q70 SBS 14 St X Q SKILLMAN AV E F 23 St E 34 St / VERNON BLVD 21 St G Court Sq to LaGuardia SBS F Island 66 THOMSO 48 ST F 28 Point 60 M R ED KOCH Woodside Q Q CADMAN PLAZA WEST Meatpacking District Midtown Vernon Blvd 35 ST Q LIRR TILLARY ST 14 St 40 ST E 1 2 3 M Jackson Av 7 JACKSONAV SUNNYSIDE ROTUNDA East River Ferry N AV 104 WOODSIDE 53 70 Q 40 AV HENRY ST N City 6 23 St YARD 43 AV Q 6 Av Hunters Point South / 7 46 St SBS SBS 3 GALLERY R L UNION 7 LT AV 2 QUEENSBORO BROADWAY LIRR Bliss St E BRIDGE W 69 Long Island City 69 St Q32 to PIERREPONT ST 21 ST V E 7 33 St 7 7 7 7 52 41 26 SQUARE HUNTERSPOINT AV WOOD 69 ST Q E 23 ST WATERSIDE East River Ferry Rawson St ROOSEV 61 St Jackson 74 St LIRR Q 49 AV Woodside 100 PARK PARK AV S 40 St 7 52 St Heights Bway Q I PLAZA LONG 7 7 SIDE 38 26 41 AV A 2 ST Hunters 67 Lowery St AV 54 57 WEST ST IRVING PL ISLAND CITY VAN DAM ST Sunnyside 103 Point Av 58 ST Q SOUTH 11 ST 6 3 AV 7 SEVENTH AV Q BROOKLYN 103 BORDEN AV BM 30 ST Q Q 25 L N Q R 27 ST Q 32 Q W 31 ST R 5 Peter QUEENS BLVD A Christopher St-Sheridan Sq 1 14 St S NEWTOWN CREEK 39 47 AV HISTORICAL ADAMS ST 14 St-Union Sq 5 40 ST 18 47 JAY ST 102 Roosevelt Union Sq 2 AV MONTAGUE ST 60 Q F 21 St-Queensbridge 4 Cooper McGUINNESS BLVD 48 AV SOCIETY JOHNSON ST THE AMERICAS 32 QUEENS PLAZA S. -

Gentrifying a Superfund Site: Why Gowanus, Brooklyn Is Becoming a Real Estate Hot Spot

Consilience: The Journal of Sustainable Development Vol. 14, Iss. 2 (2015), Pp. 214–224 Gentrifying a Superfund Site: Why Gowanus, Brooklyn is Becoming a Real Estate Hot Spot Rebecca Salima Krisel School of International and Public Affairs Columbia University, New York [email protected] Abstract This feature length article tells the story of Gowanus, a Brooklyn neighborhood on the Gowanus Canal, haunted by the pollutants of its industrial past.. The Environmental Protection Agency recognized the Gowanus Canal as a Superfund cleanup site in March 2010. Yet Gowanus is experiencing an economic and cultural revival. What was historically a booming manufacturing area with active warehouses spilling their waste into the Gowanus Canal is now an industrial site where middle to upper class families, seeking to purchase organic foods, are willing to relocate and settle down. As of December 2014, a two-bedroom condo boasting waterfront views and located just one block away from the Gowanus Canal on Carroll Street was priced at $1,549,000. The average price per square foot for homes in Gowanus is 50 percent higher than the rest of Brooklyn. This story links issues of sustainable development and current urban housing needs in New York City. My research rested primarily on interviews with subjects who have expertise in the changes of the neighborhood. I was fortunate to speak with a real estate agent who specializes in Gowanus, a representative at an affordable housing advocacy group working on development in Gowanus, two separate families who moved to the area when they started began having children, and a life-long resident of 27 years. -

Gentrifying Crown Heights by Marlon Peterson (2011)

Crown Heights 1 Marlon Peterson [email protected] [email protected] Crown Heights: The Question of Gentrification, Violence, Social Disorganization, and Social Preservation. More questions than answers and the inevitability of neighborhood harms cased by gentrification. How does a community minimize the problems of in-migration? Crown Heights 2 “In [the] beginning God created the heavens and the earth. –Genesis 1:1 (New World Translation) “Crown Heights Brooklyn is my home. From the hallways of P.S. 138 on Prospect Place and Nostrand Avenue to Brower Park to Sonatas Steel Orchestra on Sterling and Troy to the West Indian Day Parade on Eastern Parkway, Crown Heights is my home. I am a true product of this neighborhood. I have received academic accolades in one vein and handcuffs in the other. I have seen Crown Heights grow from the crack-filled, crime- riddled days of the 1980’s to the gentrifying neighborhood it is becoming. Throughout it all, however, there has remained one constant; crime” (Peterson, yosos.org). When I grew up in Crown Heights during the 1980’s and 1990’s Prospect Heights was only the name of a notoriously low performing school with an even more infamous nickname for the way young girls from that school were viewed—Prostitute’ Heights.’ Now this name, Prospect Heights—still with the dubious nickname for the high school according to neighborhood teens—is the chic new name of an expanding co-opted section of Crown Heights. Real estate companies in an effort to sell homes at higher rates constantly increase the boundaries of Prospect Heights into the neighborhood formerly known as Crown Heights. -

Park Slope/Prospect Park PROSPECT HEIGHTS • CROWN HEIGHTS • WINDSOR TERRACE • PROSPECT LEFFERTS GARDENS

Park Slope/Prospect Park PROSPECT HEIGHTS • CROWN HEIGHTS • WINDSOR TERRACE • PROSPECT LEFFERTS GARDENS Streets 24th Street, M1 East 18th St, L12 New York Av, A12 St. Marks Av, A10, B8, C4 Brooklyn Conservatory of Music, D4 Duryea Presbyterian Church, C7 Greenmarkets, E6, K6 Memorial Presbyterian Church, D5 Park Slope Senior Citizens Center, H4 Prospect Park Residence, E6 St. Joseph’s Svcs for Children & Families, B1 Whole Foods, F1 Academy Park Pl, A3 East 19th St, L12 Nostrand Av, A11 St. Marks Pl, C1, C3 Points of Interest Brooklyn Flea, A2 Ebbets Field Apartments, E11 Greenwood Baptist Church, G4 Montessori School, E5 Park Slope Post Office, F4 Prospect Park West P.O., K6 St. Saviour Roman Catholic Church, G5 Windsor Terrace, L5 1st Street, F1, F4 Adelphi St, A4 East Dr, E7, G9 Ocean Av, H11 St. Pauls Pl, K12 1st Christian Science Church, D5 Brooklyn Free Space, F3 Ebbets Field Cong. of Jehovah’s Witnesses, D11 Greenwood Cemetery, M5 Montauk Club, D5 Park Slope Public Library, H3 Prospect Park YMCA, H3 St. Saviour High School, G5 Wyckoff Gardens Houses, C1 Key accessible Transit Police 2nd Street, F1, F4 78th Police Precinct, B3 YWCA, B1 entrance & exit District Office Argyle Rd, M12 East Lake Dr, G10, H10 Pacific St, A7, B1, B4 State St, A1 Brooklyn Lyceum, E2 Ebbets Field Golden Age Group, E11 Haitian American Day Care Center, B10 MS 51 William Alexander School, G2 Park Slope United Methodist Church, H3 PS 9, B6 St. Saviour Elementary School, H5 Y PW District 1 TPD 3rd Avenue, B1, C1, F1, J1 210 EX 440 Gallery, K3 S Ashland Pl, A1 Eastern Pkwy, D9 Parade Pl, L11 Sterling Pl, B11, C6, D3 Brooklyn Miracle Temple, E12 Ebbets Field MS, F11 Hellenic Classical Charter School, L2 MS 88, L4 Pavilion Theatre, K6 PS 10, L4 97 368 St. -

Narrative Summary of Constraints and Opportunities Provided to the Panel by NYC DOT

As presented to the BQE Expert Panel for informational/background purposes only https://bqe-i278.com/en/expert-panel/documents Narrative Summary of Constraints and Opportunities Provided to the panel by NYC DOT What Makes the Project So Complicated? Fixing the BQE is exceptionally complicated due to its unusual design and the constrained site in which it operates. This corridor is sandwiched between Brooklyn Bridge Park, the Promenade and Brooklyn Heights, the Manhattan and Brooklyn Bridges, bustling DUMBO and Vinegar Hill, and an extraordinary volume of infrastructure below – four subway lines, an eight-foot DEP interceptor sewer, and many other utility lines. Creating sufficient space to stage the construction (e.g. to fit equipment like cranes and store materials) is a key challenge that any concept must address. Specifically, any construction concept needs to account for the complexities of working with a cantilever structure, building on or around Furman Street, the surrounding open spaces, and other infrastructure running above and below the BQE. This part of the BQE corridor is also comprised of multiple structures that require different methods of rehabilitation or replacement. Although the triple cantilever is the most well-known portion of this project, the double cantilever and the bridges at Joralemon, Old Fulton, and Columbia Heights all require repair. Cantilever Considerations A traditional bridge structure is usually rehabilitated lane-by-lane. Construction crews shut down a portion of the bridge, repair those areas, and then shift traffic to the rehabilitated section. This type of construction staging is not possible on the triple cantilever due to the unique nature of the BQE. -

Park Slope Historic District Extension II Designation Report April 12, 2016

Park Slope Historic District Extension II Designation Report April 12, 2016 Cover Photograph: 60 Prospect Place, built 1887, C.P.H. Gilbert architect, Queen Anne style. Photo: Jessica Baldwin, 2016 Park Slope Historic District Extension II Designation Report Essay Written by Donald G. Presa Building Profiles Prepared by Donald G. Presa, Theresa Noonan, and Jessica Baldwin Architects’ Appendix Researched and Written by Donald G. Presa Edited by Mary Beth Betts, Director of Research Photographs by Donald G. Presa, Theresa Noonan, and Jessica Baldwin Map by Daniel Heinz Watts Commissioners Meenakshi Srinivasan, Chair Frederick Bland Michael Goldblum Diana Chapin John Gustafsson Wellington Chen Adi Shamir-Baron Michael Devonshire Kim Vauss Sarah Carroll, Executive Director Mark Silberman, Counsel Lisa Kersavage, Director of Special Projects and Strategic Planning Jared Knowles, Director of Preservation PARK SLOPE HISTORIC DISTRICT EXTENSION II MAP ................................. after Contents TESTIMONY AT THE PUBLIC HEARING ................................................................................. 1 PARK SLOPE HISTORIC DISTRICT EXTENSION II BOUNDARIES ...................................... 1 SUMMARY ..................................................................................................................................... 5 THE HISTORICAL AND ARCHITECTURAL DEVELOPMENT OF THE PARK SLOPE HISTORIC DISTRICT EXTENSION II Introduction ................................................................................................................... -

FOR SALE RETAIL | Medical | OFFICE | HOTEL | STORAGE | COMMUNITY FACILITY

FOR SALE RETAIL | MEDICAl | OFFICE | HOTEL | STORAGE | COMMUNITY FACILITY SITE Available RENDERING Nestled Amongst The Largest Redevelopment In South Brooklyn - Coney Island 608 Sheepshead bay RD 22,800 SF EXISTING RETAIL BUILDING 130,000 SF AS-OF-RIGHT MIXED-USE DEVELOPMENT SITE Jason Gerbsman | [email protected] 25 E 21 ST, 9 FL | NY, NY 10010 | 212.579.7000 | www.hudsonre.com coney island style satellite map HEALTHCARE - 2022/2023 CONEY ISLAND HOSPITAL $920M Renovation TRANSIT - 2021 FERRY SERVICE PIER 11 / WALL STREET (37 Minutes) RESIDENTIAL - APPROVED NEPTUNE/SIXTH 250K +/- SF Mixed-Use + 575 Market Rate/Luxury Residential Units & Parking ocean dreams brooklyn SITE FOR SALE 608 SHEEPSHEAD BAY RD B68 B74 RESIDENTIAL - 2021 271 SEABREEZE AVENUE HOTEL - 2021 114 Residential Units RESIDENTIAL - 2021 1301 SURF AVENUE (Market Rate/Luxury) 1709 SURF AVENUE 50 Rooms - Spa 27K SF Commercial 1K Residential Units Rooftop Restaurant Phase 1/2 (Affordable) 150K SF - Retail ENTERTAINMENT - 2019 80K SF - Office DEG Presents ‘AMUSE’ Venue 4,000 capacity RESIDENTIAL - 2019 3514 SURF AVENUE THE FORD AMPHITHEATER 1902 W 19TH ST 311 Residential Units (Market Rate/Luxury) SEASIDE PARK/COMMUNITY Ice Rink ARTS CENTER LUNA PARK (2016) ENTERTAINMENT - PLANNING (EXPANSION - 2019/2020) Map data ©2019 Google 500 ft New Style Men's Salon 4.1 (10) Barber shop · 1736 Coney Island Ave Open until 7:00 PM Wood Style Flooring 5.0 (2) Flooring contractor · 3030 Coney Island Ave Open until 6:00 PM coney island classics 3.0 (1) Auto broker · 65 Roosevelt Ave CONEY ISLAND