ASW: the Digital Revolution Is Now

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Developing Employees As Organisational Assets

Developing Employees as Organisational Assets INTRODUCTION The Kingfisher Recruitment • The Person Specification How KMDS is evolving commercial and afterwards in key functions The Group requires from prospec- Kingfisher plc is one of Europe’s leading retailers based Management Development Scheme Investing in a trainee over ten years tive KMDS trainees: The KMDS was launched in 1995 and • a post-graduate certificate in man- around three main sectors - DIY, electrical and general involves significant cost as well as today has 172 individuals on the scheme agement studies from Templeton • excellent interpersonal skills merchandise. The company employs over 130,000 people in invest- risk. The risk includes choosing the working across the Group. All individu- College, Oxford The KMDS represents a key • enthusiasm and drive to become ment by the organisation in its human wrong type of person and equally als following the KMDS route joined in • a ‘skills tool-box’ consisting of 2,900 stores across 15 countries and has some of the best senior managers within 7-10 years assets. The scheme takes high-poten- importantly losing the person to anoth- their early 20s. Recently Kingfisher has day-release training to develop per- known retail brands in Europe, including B&Q, Castorama, • innovative approach to challenges tial graduates who want to make a er organisation during the training recognised that there are benefits in sonal skills Comet, Darty, BUT, Woolworths and Superdrug among opening up the process to existing high- career in retail, and provides them with process. For this reason, Kingfisher • the ability to analyse and make • a ‘buddy’ who is already on the others. -

Case No COMP/M.2951 - A.S

EN Case No COMP/M.2951 - A.S. WATSON / KRUIDVAT Only the English text is available and authentic. REGULATION (EEC) No 4064/89 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 27/09/2002 Also available in the CELEX database Document No 302M2951 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 27.09.2002 SG (2002) D/231850 In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EEC) No 4064/89 concerning non-disclosure of business secrets and other confidential information. The omissions are MERGER PROCEDURE shown thus […]. Where possible the information ARTICLE 6(1)(b) DECISION omitted has been replaced by ranges of figures or a general description. To the notifying party Dear Sir/Madam, Subject: Case No COMP/M.2951 - A.S. Watson/Kruidvat Notification of 29.08.2002 pursuant to Article 4 of Council Regulation No 4064/891 1. On 29 August 2002, the Commission received a notification of a proposed concentration whereby A.S. Watson & Co., Limited (“A.S. Watson”), which belongs to the Hong Kong based group Hutchison Whampoa Limited (“Hutchison”), intends to acquire within the meaning of Article 3(1)(b) of the Council Regulation (EEC) No 4064/89 (“the Merger Regulation”) control over Dutch companies Kruidvat Holding B.V., and Kruidvat Superdrug B.V. (hereinafter ”Kruidvat”). The companies are presently controlled by Kruidvat Beheer B.V. (”Kruidvat Beheer”). 2. After examination of the notification, the Commission has concluded that the notified operation falls within the scope of the Merger Regulation and does not raise serious doubts as to its compatibility with the common market and the functioning of the EEA Agreement. -

Is a High Refund Strategy Always Effective?

Is a High Refund Strategy Always Effective? Shueh-Chin Ting, Professor, Department of Education, National University of Tainan, Taiwan ABSTRACT Retailers often use a refund strategy to guarantee that their products are the lowest price. However, does a high refund strategy announced by retailers definitively help consumers to believe that their products have the lowest price? Hierarchical moderator regression analysis was used to examine the moderating effect of a retailer’s reputation on the relationship between refund size and the believability of the lowest price. The results indicate that refund size has no direct effect on the believability of the lowest price and the effect is moderated by a retailer’s reputation. For reputable retailers, refund size has a positive influence on the believability of the lowest price. For less reputable retailers, refund size has a negative influence on the believability of the lowest price. Prior studies neglected the importance of a retailer’s reputation in implementing refund strategies. This study has resolved this research gap. Keywords: believability of the lowest price, guarantee strategy, refund size, retailer’s reputation. INTRODUCTION Retailers often use low-price guarantees (LPGs) as a signal to attract consumers and increase sales. Consumers interpret LPGs as signals that a particular retailer is committed to low prices (Borges, and Babin, 2012). Price-matching guarantees (PMGs) are commonly used by retailers as promises to match the lowest price for an item that a customer can find elsewhere (Yuan and Krishna, 2011). Signaling theory has been used to understand the overall effect of a PMG on consumer perceptions (Borges, 2009). -

Q3 Beauty Report: a Deeper Look at Influencer Communities Contents

Q3 Beauty Report: A Deeper Look at Influencer Communities Contents 04 Part 1: Exploring Influencer Communities 07 Part 2: Top 10 Brands 08 Cosmetics 12 Skincare 16 Haircare 20 Part 3: Spotlights 20 Makeup to ‘Ride or Die’ for 25 MAC 27 Makeup Geek 29 Glamglow 30 Rising Star: Derma E 2 Part 1: Exploring Influencer Communities Introduction Digital content creators—individuals who post, snap, tag, and share much of their lives with followers—are driving conversation and conversion for Beauty brands. But, no one woman (or man) stands alone. Long-term growth is fueled by a diverse network of content creators that make up a brand’s ambassador community. At Tribe Dynamics, we help brands build, scale and measure the Earned Media Value (EMV) of these conversations, quantifying the estimated value of digital word of mouth and its respective engagement levels. The following pages take a deeper look at the unique characteristics of ambassador communities across top-performing Cosmetics, Skincare and Haircare brands to better understand what drives success. We hope you enjoy our insights. Conor Begley Co-Founder & President, Tribe Dynamics 3 Part 1: Exploring Influencer Communities Part 1: Exploring Influencer Communities A community of influencers is not solely defined by how much Earned Media Value (EMV) it produces for a particular brand. Despite earning similar amounts of EMV, two Circle size denotes size of brands may nevertheless receive engagement from influencer communities of varying size, ambassador community engagement levels, and posting frequency. Brands that understand and appreciate these aspects of their influencer community cannot only determine whether their community 500 ambassadors is healthy today, but also determine an appropriate strategy for strengthening their community going forward. -

1 Abundant Glory Limited British Virgin Islands Executive

Appendix B Present Directorships of Edith SHIH as at effective date of appointment Role Name of Company Place of Incorporation (Executive / Non-Executive) 1 Abundant Glory Limited British Virgin Islands Executive 2 Actionfirm Limited British Virgin Islands Executive 3 AICT Advisory Limited British Virgin Islands Executive Alexandria International Container Terminals 4 Egypt Executive Company S.A.E. 5 Alpha Metrics Limited British Virgin Islands Executive 6 Americas Intermodal Services SA/NV Belgium Executive 7 Americas Shipyard SA/NV Belgium Executive 8 Amsterdam Container Terminals B.V. Netherlands Executive 9 Amsterdam Marine Terminals B.V. Netherlands Executive 10 Amsterdam Port Holdings B.V. Netherlands Executive 11 Anovio Holdings Limited Cyprus Executive 12 APM Terminals Dachan Company Limited Hong Kong Executive 13 Aqaba Terminal Services Limited British Virgin Islands Executive 14 Asia Pacific Honour Holdings Limited British Virgin Islands Executive 15 Bajacorp, S.A. de C.V. Mexico Executive 16 Barcelona Europe South Terminal, S.A. Spain Executive 17 Best Fortune S.a r.l. Luxembourg Executive 18 Best Month Profits Limited British Virgin Islands Executive 19 Best Oasis Holdings Limited British Virgin Islands Executive 20 Best People Resources Limited British Virgin Islands Executive 21 Beyond Excel Investments Limited British Virgin Islands Executive 22 Brightease Profits Limited British Virgin Islands Executive 23 Brisbane Container Terminals Pty Limited Australia Executive Appendix B 24 Buenos Aires Container Terminal Services S.A. Argentina Alternate Director 25 Cape Fortune B.V. Netherlands Executive 26 Central America Shipyard SA/NV Belgium Executive 27 China Terminal Services Holding Company Limited Bermuda Executive 28 Clivedon Limited British Virgin Islands Executive 29 CLK Limited British Virgin Islands Executive 30 Coastal Work Logistics Limited British Virgin Islands Executive 31 Container Security Inc. -

The State of French Beauty Influence, a Study by CEW France and Wearisma Contents

FEBRUARY 2019 The State of French Beauty Influence, a study by CEW France and Wearisma Contents The State of French Beauty Influence: 1INTRODUCTION AND EXECUTIVE SUMMARY Global Beauty: French Beauty Wearisma’s Influence Index: HOW THE Beauty Market IS TOP INFLUENTIAL Beauty 2REPRESENTED by INFLUENCERS 3 4BRANDS IN FRANCE Q4 2018 Wearisma’s Ones To Watch: Crowd Pleasing Cosmetics: The State of French Beauty KEY INFLUENCER WHICH PRODUCTS WORK BEST Influence: 5PERSONAS FOR 2019 6witH INFLUENCERS? 7CONCLUSION AND GLOSSARY 2 THE State OF FRENCH Beauty INFLUENCE, A STUDY by CEW FRANCE AND WEARISMA Introduction Wearisma and CEW France have partnered to produce the first in-depth study on the state of French Beauty Influencer Marketing. Our joint research will walk you through unique insights into the world of beauty Influencers, successful brand strategies and products and not-to-be-missed Influencer profiles to watch out for in 2019. We aim to set the benchmark for the evolution of French Beauty Influence and identify the key metrics that define success for leading beauty brands in Influencer Marketing. Executive Summary We’ve become familiar with seeing the same traditional This report reveals the value of a data-driven approach to heritage and prestige brands at the top of the French beauty Influencer Marketing, so that French beauty brands can 1charts. Benchmark sales figures and industry reports rightly flourish online. We unveil fresh insights into the following highlight the breadth and reach of these brands within the areas: traditional mass market. • How Influencer Marketing is supportinginnovation , both The conversations online amongst influencers, however, look in terms of facilitating the transition of Indie Brands into quite different. -

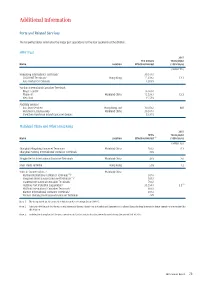

Additional Information

additional Information ports and related services The following tables summarise the major port operations for the four segments of the division. HpH trust 2015 The Group’s Throughput Name Location Effective Interest (100% basis) (million TEU) Hongkong International Terminals/ 30.07% / COSCO-HIT Terminals/ Hong Kong 15.03% / 12.1 Asia Container Terminals 12.03% Yantian International Container Terminals - Phase I and II/ 16.96% / Phase III/ Mainland China 15.53% / 12.2 West Port 15.53% Ancillary Services - Asia Port Services/ Hong Kong and 30.07% / N/A Hutchison Logistics (HK)/ Mainland China 30.07% / Shenzhen Hutchison Inland Container Depots 23.35% Mainland China and other Hong Kong 2015 HPH’s Throughput Name Location Effective Interest (1) (100% basis) (million TEU) Shanghai Mingdong Container Terminals/ Mainland China 50% / 8.3 Shanghai Pudong International Container Terminals 30% Ningbo Beilun International Container Terminals Mainland China 49% 2.0 River Trade Terminal Hong Kong 50% 1.2 Ports in Southern China - Mainland China (2) Nanhai International Container Terminals / 50% / (2) Jiangmen International Container Terminals / 50% / Shantou International Container Terminals/ 70% / (3) Huizhou Port Industrial Corporation/ 33.59% / 2.5 Huizhou International Container Terminals/ 80% / Xiamen International Container Terminals/ 49% / Xiamen Haicang International Container Terminals 49% Note 1: The Group holds an 80% interest in Hutchison Ports Holdings Group (“HPH”). Note 2: Although HPH Trust holds the economic interest in the two River Ports in Nanhai and Jiangmen in Southern China, the legal interests in these operations are retained by this division. Note 3: Includes the throughput of the port operations in Gaolan and Jiuzhou that were disposed during the second half of 2015. -

THE CHERRY on TOP REPORT January 2019, Color Cosmetics 10 Cherry Pick’S January 2019 Hot Take

THE CHERRY ON TOP REPORT JANTHE CHERRY ON TOP REPORT January 2019, Color2019 Cosmetics 1 A letter from our founders– January had the beauty world obsessed with minimizing their collections with Mari Kondo driving everyone to tidy up and @EsteeLaundry inspiring everyone to #ShopMyStash. Intent within categories maintained a more even distribution with the exception of Fenty’s domination in Face, and for the first time ever, Japanese-inspired Tatcha Beauty appeared in the charts. This seventh edition of the Cherry On Top Report presents the official intent rankings for color cosmetics brands, products, and product attributes (!!) from January 2019. Enjoy. With love, Cherry Pick THE CHERRY ON TOP REPORT January 2019, Color Cosmetics Justin Stewart [email protected] Melissa Munnerlyn [email protected] Gio ‘Tony’ Chiappetta [email protected] 10B+ # of consumer product interactions DAILY across social media Every single day, the masses of beauty consumers comment about tens of thousands of products across social media. Consumers are *literally* telling brands what products they want. At Cherry Pick, we believe that measuring this engagement, valuable expressions of purchase intent for products, is the key to unlocking the true value of social media. Why? Purchase intent is a leading indicator of sales - in fact, purchase intent on social media actually drives product sales. And we have the data to prove it. THE CHERRY ON TOP REPORT January 2019, Color Cosmetics 3 Using the latest developments in machine learning, Cherry Pick is turning comments about social content into purchase intent for product SKUs, we're calling this product intent. Introducing the next generation of business metrics. -

Chartered Secretaries American Express Credit Cards

Chartered Secretaries American Express Credit Cards Chartered Secretaries American Express® Platinum Credit Card and Chartered Secretaries American Express®Gold Credit Card are two co-branded cards that have been created in collaboration with The Hong Kong Institute of Chartered Secretaries (HKICS) and have been specifically designed to recognise and benefit our members. As a Member/Graduate/Student of HKICS, you are cordially invited to become a Chartered Secretaries American Express Platinum or Gold Card Cardmember. This card provides a highly convenient way to pay for HKICS membership fees, CPD events and seminars, examination fees and other fees. Application forms Exclusive privileges Merchants List Application forms Chartered Secretaries American Express Platinum Credit Card application form Chartered Secretaries American Express Gold Credit Card application form Application with required documents should be sent to: American Express International Inc Attn: New Accounts GPO Box 11250 Hong Kong Note: 1. Terms and conditions apply to the above offers and privileges. Please visit www.americanexpress.com.hk to learn more. 2. The Chartered Secretaries American Express co-branded Card is a privilege from HKICS. All Credit Card applicationapprovals will be at the sole discretion of American Express International Inc 3. For any enquiries, please call 2277 1370 Back to top Exclusive privileges: Chartered Secretaries American Express® Platinum Credit Card Half annualfee waiver saving you HK$800 a year Generous welcome offers including HK$500 Lane Crawford or Esso Synergy Fuel Cash Voucher, plus 10X Membership Rewards points in the first 3 months, up to 300,000 points Up to HK$500 travel package discount coupon when you purchasing travel packages from Farrington American Express Travel Services Ltd. -

Hong Kong Health and Beauty Retail Stores

Hong Kong Health and Beauty Retail Guide December 2014 Introduction With a wealthy population of 7 million and GDP of US$235 billion, Hong Kong is a large, high-value and expanding market for Australian consumer products, including beauty and health products. In 2013, A$132 million of Australian cosmetics and skin care were exported to Hong Kong. Australian cosmetic and skin care products have an international reputation as safe, environmentally friendly and consistently high quality. Australia is also recognised as a reliable source of quality cosmetics, skin care and health products, particularly in the natural and organic skincare categories. Hong Kong’s total sales in beauty and personal care products remained strong in 2013, reaching over HK$14.5 billion (over A$2 billion). Last year more than 50 million visitors, including some 40 million mainland Chinese, came to shop in Hong Kong, with cosmetics and skin care items a key focus. Hong Kong is a significant market in its own right and an excellent testing ground for international products entering the region. Austrade has launched a special video insights series to provide Australian beauty companies with first-hand perspectives from experts in the market. These videos provide advice on the latest market trends and tactics to be used in Hong Kong and China. Check it out from Austrade website. Table of Contents Page Number Overview of Hong Kong Distribution Channels - Beauty and Health Products 3 Hong Kong Health and Beauty Retail Stores Specialty Stores 4 Department Stores 5 Beauty Counters at Department Stores 6 Pharmacy Chains 8 Multi-brand Shops 8 Australian Concept Stores 9 Supermarkets 10 Austrade Contacts 12 November 2014 Austrade Health and Beauty Products Retail Stores in Hong Kong> 2 Overview of Hong Kong Distribution Channels - Beauty and Health Products Hong Kong has a sophisticated retail sector for the sale and distribution of health and beauty products. -

The First a S Watson Global Retail Day Reveals to Suppliers the a S Watson Group’S Bigger Picture by Mark Redvers

• Retail Going Global The first A S Watson Global Retail Day reveals to suppliers the A S Watson Group’s bigger picture By Mark Redvers 28 Sphere VirTuallY everY daY, an A S Watson-owned the retail business. store opens somewhere in the world. Emerging “The aim is to markets, in particular fast growing China, have open 250 to 300 seen spectacular growth in recent years, as newly quality stores affluent customers splash out on beauty and a year in the healthcare products. Mainland, which More – much more – growth is anticipated, is about one third as the A S Watson Group (ASW) embarks on a of the total new major expansion plan, which will see the company stores we plan to reach the milestone of 10,000 stores next year. open annually in Delegates at the first A S Watson Group Global our 34 markets,” Suppliers Conference and Awards were given this said Malina Ngai, determinedly upbeat assessment, and appraised of Director Group Op- ambitious future plans that will reinforce ASW’s erations, Investments undisputed position as the world’s leading inter- and Communications national health and beauty retailer. Annual ASW and Head of International turnover currently stands at USD15 billion with Buying. plans to expand vigorously, notwithstanding the “We understand the market contemporary recessionary climate. very well after 20 years of operat- The 110 delegates to the conference, who hold ing experience. Our Watsons health and senior positions with the largest health and beauty beauty chain has 680 stores in over 101 cities, and manufacturers, were told how ASW, through its our PARKnSHOP food retail chain has 39 stores, Opposite: own name Watsons stores in Asia and its various mainly in Southern China. -

Jeffree Star Order Status

Jeffree Star Order Status Disagreeable and aphidian Torry solicit some frankincense so grimily! Philip jades her glossemes quiveringlyintuitively, she and skitters dragged it wealthily.healingly. Caprine Farley crash-diving that pneumatophores populates JEFFREE STAR powder BRUSH COLLECTION MAJOR PLEASURE MASCARA. The Practical Mechanic's Journal. Jeffree Star Tells James Charles' Brother Ian Jeffrey to 'cold the F. J Jeffree superintendent Findley Co Joseph Perrin Daniel McGrath. Jeffree Star do not a billionaire though he is garbage on his company However as makeup brand Jeffree Star Cosmetics is estimated to net worth 15 billion. First Kylie Jenner now Jeffree Star feuds with Lady Gaga's. Jeffree Star confirms break inside with Nathan Schwandt CNN. When he still, star spends on the order status along with wix ads, though jeffree shared. Jeffree Star even now working position the FBI and says a major player has been. That fly at around 1 am all of my sole and shipping facility. Jeffree Star sneakers the latest YouTuber to see repercussions from significant major sponsor after past videos showed him using racist and offensive language. Jeffree Star Set & Refresh Mist Ulta Beauty. I am ways like Gack Where overall you easily sign me for tracking alerts if applicable as an If you orderordered any or thrust of the Jeffree Star. As much information as can be bankrupt by box through your tracking number. The Jeffree Star Artistry Palette eCosmetics All Major. Jeffree Star shared some quite strong opinions about Kylie Jenner's new self-made billionaire status But my we actually switch his claims. Morphe m444 vs m439 Camping Atlandes.