Captures Asean

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nqmobile Response Presentation IR V Dist

Oct 26, 2013 This report and all of the information contained herein specifically address the allegations from the Muddy Water’s report as released on Oct 24, 2013 and is being provided as an addendum to an investor call held on Oct 25 th , 2013. © 2013 NQ Mobile Inc. Proprietary and Confidential 2 Allegation: NQ China Revenue is Fraudulent Claim: NQ CASH holdings are fabricated and falsified. • NQ CASH HOLDINGS ARE REAL. CASH is the ultimate determinate of the health of a business and is the yardstick by which any business can be measured. • NQ has made public all of its bank account holdings, bank names, account numbers, and balances. • NQ will immediately take steps to obtain an independent validation of NQ CASH holdings. • NQ has a very strong balance sheet and will show details of its cash position to anyone wishing to do additional diligence. © 2013 NQ Mobile Inc. Proprietary and Confidential 3 Allegation: NQ China Revenue is Fraudulent • NQ holds approximately US$280M in term deposits including ~US166M from the recent CB offering proceeds. Other cash accounts exist at various operating entities. © 2013 NQ Mobile Inc. Proprietary and Confidential 4 Allegation: NQ China Revenue is Fraudulent • The following are actual scanned copies of NQ’s actual bank deposit receipts and bank statement from the recent convertible bond offering proceeds. © 2013 NQ Mobile Inc. Proprietary and Confidential 5 Allegation: NQ China Revenue is Fraudulent Claim: Level 2 classification of NQ cash holdings is suspicious. • Classification of cash and term deposits as Level 2 assets is consistent with US GAAP guidance of fair value measurement. -

2016 White Page Consulting Pvt

MOST ADMIRED BRANDS & LEADERS Volume II www.admiredbrand.com Chief Patron Prof. Malcolm McDonald Editor-in-Chief Dhruv Bhatia Chief Operating Officer Sarmad Zargar Regional Head - Asia Asif Var Director - Research M.Y. Makky Director - Corporate Communications Kriti Nagia Head - Digital Media Shahid Bhat General Manager - Strategic Alliances & Partnerships White Page International Anubha Garg Editorial Advisors White Page International is a global consulting firm with a diverse What drives their business is the zeal to make clients successful by portfolio that includes brand consulting, print advertising, creative making the most informed decisions possible. The research conducted Sadiq Zafar - India & South East Asia advertorial promotions, PR and research. The goal is to create a by White Page, is supported by R&D on the latest industry trends and Yasir Yousuf - GCC substantial and lasting improvement in the performance of its clients leading analytical techniques. The expertise lies in performing complex and strengthening their brand value. We serve to accomplish the studies analyzing data and interpreting results leading to most goals of the brand for their products and services in the form business informed decisions through tools like Brand & Consumer Research- Client Servicing journalism and PR. With more and more brands turning to marketing Industry Research- Trade Researches Case Studies & White Papers. Indian Sub-Continent: Prasoon Jha, Danish Malik content, we leverage paid channels like advertorials and social media Southeast Asia: Taye Bayewood, Charlie Zeng, Sonia Khat- coverage for optimum coverage. • Brand and Consumer Research: wani White Page aims to be the world’s leading consulting firm, this is what Provide strategic insight into market entry strategy development, GCC Nations: Muneeb Hussain, Abdullah Al Zaim drives its focus and efforts to be the ideal partner for its clients. -

Sunzen Biotech AR2014

Sunzen Biotech Berhad (680889-W) | Annual Repor Sunzen Biotech Berhad (680889-W) t 2014 ANNUAL REPORT 2 0 1 4 Sunzen Biotech Berhad (680889-W) No 11, Jalan Anggerik Mokara 31/47 Kota Kemuning 40460 Shah Alam, Selangor Darul Ehsan MALAYSIA TEL: +6.03.5121.8998 FAX: +6.03.5121.9922 WEBSITE: www.sunzen.com.my EMAIL: [email protected] Contents Corporate Information 02 Corporate Structure 03 Directors’ Profile 04 5-Year Financial Highlights 07 Chairman’s Statement 08 Audit Committee Report 09 Statement on Corporate Governance 12 Directors Responsibility Statement 22 Additional Compliance Information 23 Statement On Risk Management 25 And Internal Control Financial Statements 26 Supplementary Information 79 List of Properties 80 Analysis of Shareholdings 81 Analysis of Warrant Holdings 83 Notice of Annual General Meeting 85 Statement Accompanying Notice of 88 Annual General Meeting Proxy Form 2014 SUNZEN BIOTECH ANNUAL REPORT 2 BERHAD (680889-W) CORPORATE INFORMATION BOARD OF DIRECTORS Tan Sri Haji Musa Bin Tan Sri Haji Hassan Senior Independent Non-Executive PRINCIPAL BANKER Chairman Malayan Banking Berhad Hong Choon Hau Executive Director Chief Executive Officer COMPANY SECRETARIES Lim Lee Kuan (MAICSA 7017753) Lim Eng Chai Teo Mee Hui (MAICSA 7050642) Executive Director Chief Operating Officer REGISTERED OFFICE Dr. Kok Poe Chu 10th Floor, Menara Hap Seng Executive Director No. 1 & 3, Jalan P. Ramlee Chief R&D Officer 50250 Kuala Lumpur Tel : 03-2382 4288 Dato’ Dr. Mhd Nordin Bin Mohd Nor Fax : 03-2382 4170 Independent Non-Executive Director Khoo Kien Hoe Independent Non-Executive Director SHARE REGISTRAR Symphony Share Registrars Sdn. Bhd. -

CHAPTER 1: RESEARCH OVERVIEW 1.0 Introduction

Purchasing Behavior on Smartphone CHAPTER 1: RESEARCH OVERVIEW 1.0 Introduction The following chapter provides the background of the research, the statement of the problem, research objectives, research questions, and significance of the study. This will provide a better understanding on smartphone in general view, local view and globally. It will also provide how competitive this industry is, and how it influence people‟s daily lives, especially towards undergraduates which is our target for this research. In the research background, we did our research on the invention of smartphone in general and how it has impacted the society at large. We also did research on purchasing behavior in general. Statement of the problem is related to the research objectives and research questions. This study can be used as reference to smartphone developers as we targeting the undergraduates as our respondents and they are the future main users of smartphone. 1.1 Research Background Smartphone started in year 1992, invented by IBM, which was nicknamed as “Simon”. The features it had was calendar, address book, calculator, email service, and a touch screen. It was very expensive at that time, USD$899, not many can manage to afford it. At the year 1996, Nokia launched a series of smartphone that merged between a cell phone and a PDA. The real actual smartphone that first have all-in-one device is Ericsson, R380. As picture show, the phone is able to be flip open and close, inside is a touch screen, using Symbian operating system. Nokia also started with the first camera phone and Wi-Fi phone, which is called the 9500. -

List of Mobile Phone Makers by Country

List of mobile phone makers by country This is a list of mobile phone makers sorted by country. • TCL Corporation (Alcatel-Lucent later sold its shares in TCL and is no longer related to the Alcatel Mobile Phones brand) 1 Australia • Technology Happy Life • Kogan • Vivo Electronics • Xiaomi Tech 2 Bangladesh • Zopo Mobile • Walton • ZTE 3 Brazil 6 Czech Republic • Gradiente • Jablotron • Positivo • Verzo 4 Canada 7 Denmark • BlackBerry • Lumigon (made by BYD Electronic, a China Com- pany) 5 China 8 Finland See also: Mobile phone industry in China • Jolla (manufactured in China) • Huawei • Microsoft Mobile (formerly Nokia) • BBK • Coolpad 9 France • Gfive • Alcatel (Joint venture between Alcatel-Lucent and • Gionee TCL Corporation ) • Haier • Archos • Hisense • Bull • Meizu • MobiWire (formerly Sagem Wireless) • OnePlus • Thomson • Oppo • Wiko (A subsidiary of Tinno, a Chinese company • Sagetel formerly Ningbo Bird that makes Wiko mobile phones) 1 2 18 MEXICO 10 Germany 14 Italy • AEG • Brondi • Grundig Mobile • NGM • Medion (Lenovo) • Olivetti • Siemens (discontinued) • Onda Mobile Communication • Telefunken • Telit (discontinued) • Tiptel 15 Japan 11 Hong Kong • Fujitsu • NUU mobile - manufactured in ShenZhen, China • Kyocera Communications 12 India • Mitsubishi Electric (discontinued) • NEC • Arise India • NEC Casio Mobile Communications • Celkon • Panasonic • HCL Technologies • Sanyo • iball • • Intex Technologies Sansui • Karbonn Mobiles • Sharp Corporation • Lava International • Sony Mobile Communications • Micromax Informatics • -

Assembly Panel REJECTS CAP on Expat RESIDENCE

SUBSCRIPTION MONDAY, MAY 12, 2014 RAJAB 13, 1435 AH www.kuwaittimes.net Assembly panel rejects Max 42º Min 28º cap on expat residence High Tide 10:07 & 22:44 Low Tide Court frees tweeter, tries former lawmakers 03:50 & 16:42 40 PAGES NO: 16163 150 FILS By B Izzak Sulaibiya killings’ mastermind captured KUWAIT: The National Assembly’s legal and legislative committee yesterday rejected a proposal to impose a By Hanan Al-Saadoun five-year residence cap on expatriates in Kuwait, saying the suggestion is unconstitutional and contains several KUWAIT: Jahra detectives yesterday arrested the suspected illegal points. The legal committee scruti- alleged main suspect in an armed robbery in which nizes all draft laws and key proposals to make sure they two Indian guards were killed at the vegetable mar- are in line with the country’s constitution before for- ket in Sulaibiya last month. With the arrest of Yousuf warding them to the concerned panels for further stud- Suleiman Obaid Ali, a 21-year-old bedoon, all three ies. suspects are now in custody, as police arrested The proposal was submitted in January by inde- Abdullah Saad Al-Enezi, 18, a Syrian, and Meshari pendent Shiite MP Abdullah Al-Tameemi, who has Falah Al-Hajiri, 20, a bedoon, a day earlier. been targeting the 2.8-million strong foreign commu- Obaid told police where the AK-47 used in the nity in Kuwait with strange proposals under the pretext crime and his share of the stolen cash were hidden, of serving the interests of citizens. The bill’s acceptance while Hajiri disclosed the whereabouts of the rest of would have forced hundreds of thousands of expatri- the money that Enezi left with him. -

TCL Communication Technology Holdings Limited BUY 2618.HK / 2618 HK

Initiation 10 Feb 2015 TCL Communication Technology Holdings Limited BUY 2618.HK / 2618 HK China Mobile technology – Mobile devices HK$7.20* Smartphones blasting out of China Target price: HK$10.30 Upside: 43% We initiate coverage on TCL Comm with a BUY rating and a target price of HK$10.30. The company HSI: 24,521.00 primarily manufactures and sells feature phones, smartphones and tablets in emerging regions such *Closing price as at 9 Feb 2015 as Latin America (LATAM) and Europe, Middle East and Africa (EMEA). We believe TCL Comm will experience strong and sustainable growth due to the following reasons: Share Data 52week Hi/Lo (HK$) 10.96/6.60 ► Strong shipment growth driven by LATAM and EMEA markets – Overseas shipment in Avg. daily t/o (US$m) 3.582 2014 reached 65.9m units, up 30.8% from 2013. Given low penetration rates of mobile devices Market Cap. (US$m) 1,137 in LATAM and EMEA, we believe shipments in the aforesaid regions are expected to attain over Total issued shares (m) 1,224 20% CAGR for the next 3 years. Auditor E&Y Public float (%) 33.95% ► Migration to smartphones in key markets boost ASP – Currently, around 65% of shipments Major shareholder: are smartphone shipments. ASP of smartphones can reach US$80 compared to ~US$15 for TCL Corporation 60.07% feature phones. We expect migration to smartphones will be the key growth driver in the next 2 Value Partners 5.98% years and up-trading will fuel subsequent growth. Source: HKEx & Bloomberg ► Superior margins compared to Chinese peers – TCL Comm consistently achieves a GPM of ~19% for the past 7 quarters. -

Examining Product and External Factors Affecting

EXAMINING PRODUCT AND EXTERNAL FACTORS AFFECTING THE SATISFACTION OF SMARTPHONE CONSUMERS FAIZ BIN MASNAN MASTER OF SCIENCE (INTERNATIONAL BUSINESS) UNIVERSITI UTARA MALAYSIA JUNE 2015 EXAMINING PRODUCT AND EXTERNAL FACTORS AFFECTING THE SATISFACTION OF SMARTPHONE CONSUMERS FAIZ BIN MASNAN A thesis submitted to the Faculty of International Studies in partial fulfillment of requirement for the degree Master of Science (International Business) University Utara Malaysia I PERMISSION TO USE In presenting this partial fulfillment of the requirements for a postgraduate degree from University Utara Malaysia, I agree that the University Library make it freely available for inspection. I further agree that permission for copying of this thesis in any manner in whole or in part for scholarly purpose may be granted by my supervisor of in their absence by the Dean of College of Law, Government, and International Studies. It is understood that any copying or publication of the thesis or part for financial gain shall not be allowed without my written permission. It is also understood that due to recognition shall be given to me and University Utara Malaysia for any scholarly use that may be made of any material from my request for permission to copy or make use of material in this thesis, in whole or part should be addressed to: Dean of Center for Graduate Studies, College of Law, Government, and International Studies, Universiti Utara Malaysia, 06010 Sintok, Kedah Darul Aman. II ABSTRACT Smartphone is a fast growing product in electronic industry and it has been considered important for most of the people following its diversity of its use. -

Multi-Dimensional Approaches Towards New Technology

Ashish Bharadwaj · Vishwas H. Devaiah Indranath Gupta Editors Multi-dimensional Approaches Towards New Technology Insights on Innovation, Patents and Competition Multi-dimensional Approaches Towards New Technology Ashish Bharadwaj • Vishwas H. Devaiah Indranath Gupta Editors Multi-dimensional Approaches Towards New Technology Insights on Innovation, Patents and Competition Editors Ashish Bharadwaj Indranath Gupta Jindal Global Law School Jindal Global Law School O.P. Jindal Global University O.P. Jindal Global University Sonipat, Haryana, India Sonipat, Haryana, India Vishwas H. Devaiah Jindal Global Law School O.P. Jindal Global University Sonipat, Haryana, India Disclosure: Opinions expressed in the chapters are independent of any research grants received from governmental, intergovernmental and private organizations. The authors’ opinions are personal and are based upon their research findings and do not reflect the opinions of their institutional affiliations. ISBN 978-981-13-1231-1 ISBN 978-981-13-1232-8 (eBook) https://doi.org/10.1007/978-981-13-1232-8 Library of Congress Control Number: 2018945460 © The Editor(s) (if applicable) and The Author(s) 2018. This book is an open access publication. Open Access This book is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adap- tation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made. The images or other third party material in this book are included in the book’s Creative Commons license, unless indicated otherwise in a credit line to the material. -

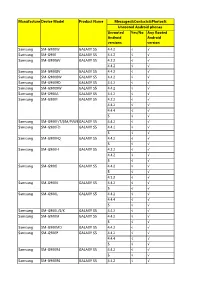

Android Data Recovery Tech Spec

ManufacturerDevice Model Product Name Messages&Contacts&Photos& Videos&Audio&DocumentUnrooted Android phones Unrooted Yes/No Any Rooted Android Android versions version Samsung SM-G900W GALAXY S5 4.4.2 √ √ Samsung SM-G900 GALAXY S5 4.4.2 √ √ Samsung SM-G9006V GALAXY S5 4.2.2 √ √ 4.4.2 √ √ Samsung SM-G9008V GALAXY S5 4.4.2 √ √ Samsung SM-G9008W GALAXY S5 4.4.2 √ √ Samsung SM-G9009D GALAXY S5 4.4.2 √ √ Samsung SM-G9009W GALAXY S5 4.4.2 √ √ Samsung SM-G900A GALAXY S5 4.4.2 √ √ Samsung SM-G900F GALAXY S5 4.2.2 √ √ 4.4.2 √ √ 4.4.4 √ √ 5 √ √ Samsung SM-G900F/T/I/M/P/W8GALAXY S5 4.4.2 √ √ Samsung SM-G900FD GALAXY S5 4.4.2 √ √ 5 √ √ Samsung SM-G900FQ GALAXY S5 4.4.2 √ √ 5 √ √ Samsung SM-G900H GALAXY S5 4.2.2 √ √ 4.4.2 √ √ 5 √ √ Samsung SM-G900I GALAXY S5 4.4.2 √ √ 5 √ √ 4.1.2 √ √ Samsung SM-G900K GALAXY S5 4.4.2 √ √ 5 √ √ Samsung SM-G900L GALAXY S5 4.4.2 √ √ 4.4.4 √ √ 5 √ √ Samsung SM-G900L/S/K GALAXY S5 4.4.2 √ √ Samsung SM-G900M GALAXY S5 4.4.2 √ √ 5 √ √ Samsung SM-G900MD GALAXY S5 4.4.2 √ √ Samsung SM-G900P GALAXY S5 4.4.2 √ √ 4.4.4 √ √ 5 √ √ Samsung SM-G900R4 GALAXY S5 4.4.2 √ √ 5 √ √ Samsung SM-G900R6 GALAXY S5 4.4.2 √ √ Samsung SM-G900R7 GALAXY S5 4.4.2 √ √ Samsung SM-G900S GALAXY S5 4.3 √ √ 4.4.2 √ √ 5 √ √ Samsung SM-G900T GALAXY S5 4.4 √ √ 4.4.2 √ √ 4.4.4 √ √ 5 √ √ Samsung SM-G900T1 GALAXY S5 4.4.2 √ √ Samsung SM-G900V GALAXY S5 4.4.2 √ √ 4.4.4 √ √ Samsung SM-G900W8 GALAXY S5 4.4.2 √ √ 4.4.2_EYAL_MOBILE√ √ 5 √ √ Samsung SM-G900X GALAXY S5 4.4.2 √ √ 4.4.4 √ √ Samsung SM-G901F GALAXY S5 4.4.4 √ √ 5.0.2 √ √ Samsung SM-G906 GALAXY S5 4.4.2