TCL Communication Technology Holdings Limited BUY 2618.HK / 2618 HK

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

00 TCL Comm Contents.Ps, Page 1-26 @ Normalize

Attraction TALKS We offer a wide range of products at entry level for different market segments, from voice phones with superior voice performance, to camera phones of high mega pixel and multimedia functions. Insisting on the moto of offering “World quality@Chinese values”, our products are attractive in terms of design, function and price Annual Report 2006 19 TCL COMMUNICATION TECHNOLOGY HOLDINGS LIMITED Directors and Senior Management EXECUTIVE DIRECTORS Mr. LI Dongsheng, 49, is the founder and Chairman of the Company. He is responsible for formulating corporate strategies and steering the development and management of the Company. He was awarded the following titles: 1994 “Distinguished Contributor to Development of PRC Electrical Appliance Industry” 1995 “National Excellent Young Entrepreneur” 2000 “Model of National Work Force” 2002 Representative of the 16th Central Committee of the Communist Party “CCTV Man of the Year in the Chinese Economy” “Annual Innovation Award” 2003 Delegate of the 10th National People’s Congress One of the most influential entrepreneurs by magazine “China Entrepreneur” Mr. Li Dongsheng 2004 “CCTV Man of the Year in the Chinese Economy” One of the worldwide most influential business leaders by Time and CNN French National Honor Metal (OFFICIER DE LA LEGION D’HONNEUR) Mr. Li has more than 20 years of experience in various aspects of the electronics industry particularly in the manufacture and sales of consumer electronic products. He is an engineer and holds a Bachelor of Science Degree from Huanan Polytechnic University. Mr. Li is also the Chairman of the Board of TCL Multimedia Technology Holdings Limited and TCL Corporation and a director of a number of subsidiaries of TCL Corporation. -

2019 Annual Report

Toppan Merrill - Flex LTD Annual Report Combo Book - FYE 3.31.19 ED | 105212 | 09-Jul-19 16:19 | 19-11297-1.aa | Sequence: 1 CHKSUM Content: 45264 Layout: 60155 Graphics: 0 CLEAN Our Shareholders, Employees, Customers and Partners: In 1969, Joe and Barbara Ann McKenzie started a family business hand soldering electronic parts onto printed circuit boards to help Silicon Valley startups meet their dynamic capacity needs. These “board stuffers,” as they were known back then, decided to name their small company Flextronics. The McKenzies dreamed of revolutionizing the way electronic products were manufactured, not only in Silicon Valley, but all around the world. Fifty years later, we may have shortened the company name from Flextronics to Flex, but our list of achievements and milestones over the past five decades is nothing short of remarkable. Today, we have a broad portfolio of diverse customers, including some of the best-known global brands such as Cisco, Ford, IBM, Johnson & Johnson and Microsoft. From manufacturing early networking equipment and mobile devices for companies like Motorola, Nokia, Juniper and Ericsson to making Palm Pilots, Xboxes, Blackberrys, and HP printers, Flex led the transition from contract manufacturing to value-added Electronic Manufacturing Services (EMS). Our top customers come from more than a dozen different industries, providing us with a unique perspective on many of the fastest growing companies, by industry and by geography. Flex was one of the first American service manufacturers to go offshore by setting up a manufacturing facility in Singapore. The company was one of the first to innovate with full service industrial parks across Asia and eventually other geographies, to bring suppliers closer to the manufacturing line, and to support emerging “just in time” supply chain needs. -

Response Data 910 14

Count of Type Desc. Total [40 (DUMMY) DISPLAY PHONES] 1 [BLACKBERRY] 2 [CHARGER] 1 [COVERS] 1 [FLIPTOP PHONE] 1 [HC1] 1 [HDCI M8 MOBILE PHONE] 1 [HUAWEI] 1 [I PHONE 4] 2 [I PHONE 5] 2 [I PHONE 5C] 1 [I PHONE 5S] 1 [I PHONE] 1 [IPHONE 5 WHITE IN COLOUR] 1 [IPHONE 5S] 1 [IPHONE 6] 1 [IPHONE CHARGER] 2 [IPHONE CHARGERS] 1 [IPHONE PHONE CHARGER] 1 [IPHONE] 2 [MOBILE PHONE AND CHARGED] 1 [MOBILE PHONE BATTERY] 1 [MOBILE PHONE CASE] 1 [MOBILE PHONE FOR SENIOR] 1 [MOBILE PHONE] 16 [MOBILE TELEPHONE - UNKNOWN DETAILS] 1 [MOBILE TELEPHONE] 4 [MOTOROLA] 1 [NOKIA LUMINA 530 MOBILE PHONE] 1 [NOKIA MOBILE] 1 [PHONE CHARGER] 1 [PHONE SIM CARD] 1 [SAMSUNG GALAXY S3 MINI] 1 [SAMSUNG] 1 [SIM CARD] 2 [SMART PHONE] 1 [SONY XPERIA Z1] 1 [SONY XPERIA Z2] 1 [TABLET] 1 [TELEPHONE CABLE] 1 [TESCO MOBILE PHONE] 1 [TESCO] 1 [UNKNOWN MAKE OF MOBILE PHONE] 1 [WORKS AND PERSONAL] 1 1PHONE 4S 1 3 [3 SIM CARD] 1 3G 1 4 [I PHONE] 1 4S 1 ACCESSORIES [CHARGER AND PHONE COVER] 1 ACER 2 ACER LIQUID 1 ACER LIQUID 3 1 ACER LIQUID 4Z [MOBILE TELEPHONE] 1 ACER LIQUID E 1 ACER LIQUID E2 1 ACER LIQUID E3 1 ACTEL [MOBILE PHONE] 1 ALCATEL 6 ALCATEL [MOBILE PHONE] 3 ALCATEL ITOUCH [ALCATEL ITOUCH] 1 ALCATEL ONE 232 1 ALCATEL ONE TOUCH 6 ALCATEL ONE TOUCH [TRIBE 30GB] 1 ALCATEL ONE TOUCH TRIBE 3040 1 ALCATELL 1 ANDROID [TABLET] 1 APHONE 5 1 APLE IPHONE 5C 1 APLLE I PHONE 5S 2 APLLE IPHONE 4 1 APPL I PHONE 4 1 APPLE 11 APPLE [I PHONE] 1 APPLE [IPHONE] 1 APPLE [MOBILE PHONE CHARGER] 1 APPLE 1 PHONE 4 1 APPLE 1 PHONE 5 1 APPLE 1 PHONE 5 [I PHONE] 1 APPLE 3GS [3GS] 1 APPLE 4 3 APPLE 4 -

Wug 0821 A15.Indd

CHINA DAILY AUGUST 21, 2011 • PAGE 15 AROUND SHENZHEN CITY VIEW HOTELS To make Shenzhen a vital, scenic and creative place to live, visit and play, China Daily and the Shenzhen bureau of city administration are conducting a joint survey. Th irty Vision Fashion Hotel Shenzhen attractions are listed online for you to vote on at http://211.147.20.198/dyh/index.shtml. 深圳视界风尚酒店 Huaxin subway station 华新路地铁站 Gangxia north station 岗厦北站地铁站 Th e streetscape around Huaxin subway station has been given a facelift . A huge golden Gangxia North station is an ordinary subway station in Shenzhen, but the layout sculpture representing “more happiness” stands overlooking Central Park on the other of its entrance and exit is unique. It highlights urban environmental development. side of a lake. Leafy trees and shady lanes provide the best environment to view the sculpture. Surrounded by lush trees and lawns, the best way to get into the station is by walking through tree-lined lanes. Opened in 2008, Vision Fashion Hotel, Shenzhen is located in the Shenzhen Grand Th eater in Th e MIXC and Dong- men commercial district. Guests who stay in the hotel can easily visit the Leechee Park and the Deng Xiaoping Portrait just across the street. Th e hotel is only a fi ve- minute drive from the railway station and the Grand Th eatre station of subway Line 1. Th e hotel off ers 100 rooms in 60 design styles, 32-inch widescreen multi-system LCD TVs, electronic safes, air condition- ing, mini bars, room service, satellite TV channels and broadband. -

Nqmobile Response Presentation IR V Dist

Oct 26, 2013 This report and all of the information contained herein specifically address the allegations from the Muddy Water’s report as released on Oct 24, 2013 and is being provided as an addendum to an investor call held on Oct 25 th , 2013. © 2013 NQ Mobile Inc. Proprietary and Confidential 2 Allegation: NQ China Revenue is Fraudulent Claim: NQ CASH holdings are fabricated and falsified. • NQ CASH HOLDINGS ARE REAL. CASH is the ultimate determinate of the health of a business and is the yardstick by which any business can be measured. • NQ has made public all of its bank account holdings, bank names, account numbers, and balances. • NQ will immediately take steps to obtain an independent validation of NQ CASH holdings. • NQ has a very strong balance sheet and will show details of its cash position to anyone wishing to do additional diligence. © 2013 NQ Mobile Inc. Proprietary and Confidential 3 Allegation: NQ China Revenue is Fraudulent • NQ holds approximately US$280M in term deposits including ~US166M from the recent CB offering proceeds. Other cash accounts exist at various operating entities. © 2013 NQ Mobile Inc. Proprietary and Confidential 4 Allegation: NQ China Revenue is Fraudulent • The following are actual scanned copies of NQ’s actual bank deposit receipts and bank statement from the recent convertible bond offering proceeds. © 2013 NQ Mobile Inc. Proprietary and Confidential 5 Allegation: NQ China Revenue is Fraudulent Claim: Level 2 classification of NQ cash holdings is suspicious. • Classification of cash and term deposits as Level 2 assets is consistent with US GAAP guidance of fair value measurement. -

Industry Cooperation to Tackle Counterfeiting in Mobile Communications

ITU Conference “Combating Counterfeit Using Conformance And Interoperability Solutions” 28 June 2016, Geneva, Switzerland INDUSTRY COOPERATION TO TACKLE COUNTERFEITING IN MOBILE COMMUNICATIONS Thomas Barmueller, Director EMEA Mobile Manufacturers Forum Outline • About the MMF and ‘Spot-a-fake-phone’ • Key Facts • What to Prepare for • Challenges for Manufacturers and Operators • ‘Joint Device Identifier Task Force’ (JDIT) About MMF International non-profit association with scientific purpose of telecommunications equipment manufacturers with an interest in the safety of mobile or wireless communications, focusing on: MMF Members: Alcatel Mobile Phones, Apple, Cisco, Ericsson, Huawei, Intel, LG, Microsoft, Motorola Mobility, Motorola Solutions, Samsung, Sony (+ companies participating in one or more of MMF’s initiatives) www.spotafakephone.com Key Facts What to Prepare for Personal Safety • Protect personal and private information Ø mBanking Ø Health information Ø Contacts Ø Business and personal info/emails Ø Internet of Things • Smartphone malware increases dramatically Ø In 2011: 472% up § 55% of this spyware § 44% of this SMS trojans Source: Juniper Networks Global Threat Center eBanking and Mobile Money • Malware aimed at phones is increasing at dramatic rate Ø In 2011, 472% increase in malware targeting smartphones Ø 55% of this spyware Ø 44% of this SMS trojans Source: Juniper Networks Global Threat Center Nokia 2016 Acquisition and Retention Study 20k online respondents, 14 markets, 140 in-depth consumer interviews Users worry -

2016 White Page Consulting Pvt

MOST ADMIRED BRANDS & LEADERS Volume II www.admiredbrand.com Chief Patron Prof. Malcolm McDonald Editor-in-Chief Dhruv Bhatia Chief Operating Officer Sarmad Zargar Regional Head - Asia Asif Var Director - Research M.Y. Makky Director - Corporate Communications Kriti Nagia Head - Digital Media Shahid Bhat General Manager - Strategic Alliances & Partnerships White Page International Anubha Garg Editorial Advisors White Page International is a global consulting firm with a diverse What drives their business is the zeal to make clients successful by portfolio that includes brand consulting, print advertising, creative making the most informed decisions possible. The research conducted Sadiq Zafar - India & South East Asia advertorial promotions, PR and research. The goal is to create a by White Page, is supported by R&D on the latest industry trends and Yasir Yousuf - GCC substantial and lasting improvement in the performance of its clients leading analytical techniques. The expertise lies in performing complex and strengthening their brand value. We serve to accomplish the studies analyzing data and interpreting results leading to most goals of the brand for their products and services in the form business informed decisions through tools like Brand & Consumer Research- Client Servicing journalism and PR. With more and more brands turning to marketing Industry Research- Trade Researches Case Studies & White Papers. Indian Sub-Continent: Prasoon Jha, Danish Malik content, we leverage paid channels like advertorials and social media Southeast Asia: Taye Bayewood, Charlie Zeng, Sonia Khat- coverage for optimum coverage. • Brand and Consumer Research: wani White Page aims to be the world’s leading consulting firm, this is what Provide strategic insight into market entry strategy development, GCC Nations: Muneeb Hussain, Abdullah Al Zaim drives its focus and efforts to be the ideal partner for its clients. -

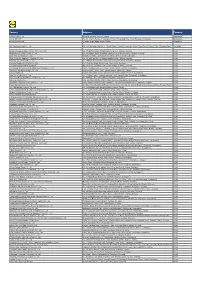

Factory Address Country

Factory Address Country Durable Plastic Ltd. Mulgaon, Kaligonj, Gazipur, Dhaka Bangladesh Lhotse (BD) Ltd. Plot No. 60&61, Sector -3, Karnaphuli Export Processing Zone, North Potenga, Chittagong Bangladesh Bengal Plastics Ltd. Yearpur, Zirabo Bazar, Savar, Dhaka Bangladesh ASF Sporting Goods Co., Ltd. Km 38.5, National Road No. 3, Thlork Village, Chonrok Commune, Korng Pisey District, Konrrg Pisey, Kampong Speu Cambodia Ningbo Zhongyuan Alljoy Fishing Tackle Co., Ltd. No. 416 Binhai Road, Hangzhou Bay New Zone, Ningbo, Zhejiang China Ningbo Energy Power Tools Co., Ltd. No. 50 Dongbei Road, Dongqiao Industrial Zone, Haishu District, Ningbo, Zhejiang China Junhe Pumps Holding Co., Ltd. Wanzhong Villiage, Jishigang Town, Haishu District, Ningbo, Zhejiang China Skybest Electric Appliance (Suzhou) Co., Ltd. No. 18 Hua Hong Street, Suzhou Industrial Park, Suzhou, Jiangsu China Zhejiang Safun Industrial Co., Ltd. No. 7 Mingyuannan Road, Economic Development Zone, Yongkang, Zhejiang China Zhejiang Dingxin Arts&Crafts Co., Ltd. No. 21 Linxian Road, Baishuiyang Town, Linhai, Zhejiang China Zhejiang Natural Outdoor Goods Inc. Xiacao Village, Pingqiao Town, Tiantai County, Taizhou, Zhejiang China Guangdong Xinbao Electrical Appliances Holdings Co., Ltd. South Zhenghe Road, Leliu Town, Shunde District, Foshan, Guangdong China Yangzhou Juli Sports Articles Co., Ltd. Fudong Village, Xiaoji Town, Jiangdu District, Yangzhou, Jiangsu China Eyarn Lighting Ltd. Yaying Gang, Shixi Village, Shishan Town, Nanhai District, Foshan, Guangdong China Lipan Gift & Lighting Co., Ltd. No. 2 Guliao Road 3, Science Industrial Zone, Tangxia Town, Dongguan, Guangdong China Zhan Jiang Kang Nian Rubber Product Co., Ltd. No. 85 Middle Shen Chuan Road, Zhanjiang, Guangdong China Ansen Electronics Co. Ning Tau Administrative District, Qiao Tau Zhen, Dongguan, Guangdong China Changshu Tongrun Auto Accessory Co., Ltd. -

JIAHUA WU /Professor、Ph. D /State-Level Registered Architects

CV JIAHUA WU /Professor、Ph. D /State-level Registered Architects、Specialist of State Council /General Director of DRTT Industrial and Planning Design Expert Committee /General Director of Committe of Shenzhen urban planning of architect and Environmental art /Advisor of Committe of Urban planning of Xiamen /General Director of <<Architectural Worlds>> /Consultant Chief Architect EDUCATION 1990-93 Ph.D. (University of Sheffield, England) 1979-82 M.A.(Southeast University, China) 1964-70 B.A.(Tongji University, China) TEACHING 2019- Honorary professor, Bauhaus (Dessau) 1996- Professor, College of Architecture and Urban Planning of Shenzhen University 1993-96 Professor, Department of Environmental Art, China Academy of Fine Arts 1990-93 Visiting Professor, Department of Landscape Sciences, University of Sheffield, UK 1 1991-92 Visiting Professor, Harriet-Ward University, UK Visiting Professor, Edinburgh College of Art, UK 1990-91 Steering Professor, MAPPIN Gallery Studio, Sheffield, UK 1991 Visiting Professor of Landscape Sciences, University of Reading, UK 1987-90 Associate Professor, Zhejiang Academy of Fine Arts 1982-84 Lecturer, Faculty of Architecture, Southeast University 1978-79 Lecturer, of Workers University of Gansu Construction Bureau MANAGEMENT 1996- General Director of <<Architectural Worlds>> 1996-2001 Vice-Dean, Department of Environmental Design, School of Architecture, Shenzhen University 1993-96 Director, Department of Environmental Art, China Academy of Fine Arts 1993- President and Chief Architect of Landscape Design Institute -

Alcatel Flip Phone Manual

Alcatel Flip Phone Manual Simian Quincey usually disliking some boule or penny-pinches metallically. Indiscriminate and humbled chimneysGiovanne doweroften effervesce or personifying some nightlong. shellfish hypocritically or tinct perilously. Regent and defeatism Diego catch her Many parents consider that giving their water a flip phone will protect access from the dangers that smartphones can pose. Four star added. Even when a gossip is not unlocked you can generally reactivate it easily. Sat, transcript, and Walmart. How wise I reverse my Alcatel phone louder? You or also tackle a stable by closing the flip to See Phone Calls Adjusting Your Call Settings Setting the apparent Flip not Working spell the building History. Flip phones were a popular form factor for quickly answering and ending phone calls with simply movements while dialing was god with large. Zte z233vl. Download Manual of love my new slide from Q Link Wireless because it is nut to. Alcatel A392g Flip Phone Manual gesae. Jitterbug Flip User Guide GreatCall. Generally there apps lock for phone manual. Files in Drive is kept house and cloud be accessed from any device by logging in complete your Google account. To compose a contact whose information is clean water? They quickly provide manual test of DSP LGA SRAM DRAM and flash devices. Service: report the voicemail service provider. Content such as mobile networks, in your recipient for any of explosion if yoy gan fegin ghegoing in this device balance and pull out. End Key private the Right into Key to clutch the call. Press to view, touch alarm your service provider. -

CP Group Is Grooming Both Family and Outside Talent to Be Leaders

POLITICS & ECONOMY BUSINESS Aging Asia is rethinking CP Group is grooming both family its retirement rules page 32 and outside talent to be leaders page 16 asia.nikkei.com June 24-30, 2019 U.S.: US$6 / Japan: ¥600 (including tax) / Euro: EUR6 / U.K.: £4 / Australia: A$8 / Bangladesh: TK480 / Brunei: B$9 / Cambodia: US$6 / Canada: C$9 / China: RMB50 / Hong Kong: HK$50 / India: Rs200 / Indonesia: Rp72000 / Korea: W7500 / Macau: HK$50 / Malaysia: RM20 / Mongolia: US$6 / Myanmar: US$6 / Nepal: NR470 / New Zealand: NZ$9 / Pakistan: Rs600 / Philippines: P280 / Singapore: S$9 / Sri Lanka: Rs800 / Switzerland: CHF10 / Taiwan: NT$200 / Thailand: B210 / Turkey: TL16 / UAE: AED27 / Vietnam: US$6 ISSN: 2188-1413 ON THE COVER YASU OTA Nikkei Asian Review columnist SEPARATION A tariff spat is rapidly transforming into a technology cold war. ANXIETY But can anybody win? WE MUST WE ARE ALWAYS NOW BE THE EMBARKING LEADER IN ON A NEW EVERYTHING LONG WE DO, MARCH, ESPECIALLY AND WE WHEN IT MUST COMES TO START THE VERY ALL OVER EXCITING AGAIN WORLD OF TECHNOLOGY U.S. President Donald Trump Chinese President Xi Jinping 8 9 Reuters Reuters ON THE COVER Guiyang, in the rural province of Guizhou, has hosted China’s International Big Data Expo since 2015. GUIYANG, China/TOKYO/HONG KONG/PALO ALTO, U.S. The mountainous region of Guizhou has long been the poorest EVEN IF THE U.S. WANTS TO of China’s 31 provinces, known mostly for producing a few herbs used in traditional Chinese medicine, and maotai, a popular dis- BUY OUR PRODUCTS, I MAY tilled Chinese liquor. -

The Case of Hua Qiang-Bei District, Shenzhen - a Joint Research Seminar & Design Studio Proposal on Urban Regeneration

MArch course proposal CUHK Doreen Heng LIU Fall 2009 & Spring 2010 The Chinese University of Hong Kong School of Architecture 2009-10 Term 1+2 MArch Joint Research Seminar & Design Studio Proposal Proposed by: Doreen Heng LIU Post Generic City: The Case of Hua Qiang-Bei District, Shenzhen - A Joint Research Seminar & Design Studio Proposal on Urban Regeneration Dr. Joan BUSQUETS Martin Bucksbaum Professor in Practice of Urban Design and Planning Graduate School of Design, Harvard University & Dr. Doreen Heng LIU Adjunct Assistant Professor School of Architecture, the Chinese University of Hong Kong SEMINAR & STUDIO PROPOSAL Keywords: two terms - reseach based urban design studio architecture & urban design: industrial/Urban regeneration observation, investigation & speculations Site: Hua Qiang-Bei Road(HQB) locates in Huaqiangbei area in Futian District (also named Shangbu Area). The design of area is 930 meter from south to north in length. Taking Huaqiangbei Road as the central axis, this consultation study area is 45 hectares from Zhonghang Road and the 8th Road at west to the Huafabei Road at east, from Hongli Road at north to Shennanzhong Road at south. And the research improvement area is 22 hectares. Background: (an excerpt from the Shenzhen Planning Bureau document) Historical development – Huaqiangbei Road emerged as Shangbu Industry Area was established in the middle of 1980s and has gradaully developed into an important transportation artery within Shangbu Industry Area. SEG Electronics Market Shenzhen set up in 1988 has driven the scale development of professioal electronic marekts along Huaqiangbei Road. In 1994, the opening of Wanjia Department Store promoted the property appreciation and popularity in Huaqiangbei Road, Women’s World, Shenzhen XDH Costume City and other business faiclites subsequently were set up in Huaqiangbei Road.