Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jeenay Ke Rang

Jeenay ke rang Annual Report 2015 CONTENTS Company Information 03 Company Profile 05 The Mission 07 A Commitment to Excellence 09 Customer Service 09 People 10 Health, Safety & Environment 11 Berger Business Lines 13 Quality in Diversity 14 Decorative Paints 15 Automotive Paints 17 Powder Coatings 19 General Industrial Finishes 21 Protective Coatings 23 Vehicle Refinishes 23 Road Safety 24 Govt. & Marine 27 Construction Chemicals 27 Adhesives 28 Printing Inks 29 Marketing Activities 30 Corporate Activities 36 Financial Highlights 40 Directors’ Report 41 Pattern of Shareholding 45 Statement of Compliance 47 Review Report to the Members 49 Financial Statements Auditors’ Report to the Members 50 Balance Sheet 51 Profit and Loss Account 52 Statement of Comprehensive Income 53 Cash Flow Statement 54 Statement of Changes in Equity 55 Notes to the Financial Statement 56 Notice of Annual General Meeting 106 Consolidated Financial Statements Directors’ Report 110 Auditors’ Report to the Members 111 Consolidated Balance Sheet 112 Consolidated Profit and Loss Account 113 Consolidated Statement of Comprehensive Income 114 Consolidated Cash Flow Statement 115 Consolidated Statement of Changes in Equity 116 Notes to the Consolidated Financial Statement 117 Form of Proxy 01 02 Company Information Board of Directors Bankers Mr. Maqbool H. H. Rahimtoola - Chairman Al-Barka Bank Limited Dr. Mahmood Ahmad - Chief Executive Bank Al-Habib Limited Mr. Hamid Masood Sohail Faysal Bank Limited Mr. Muhammad Naseem Habib Bank Limited Mr. Ilyas Sharif Habib Metropolitan Bank Limited Mr. Shahzad M. Husain JS Bank Limited Mr. Zafar A. Osmani MCB Bank Limited Summit Bank Limited Audit Committee United Bank Limited Mr. -

PACRA Assigns Initial Ratings to Ghandhara Nissan Limited

T P C R A L NL FY - 2020 - 332 Mr. Ahmed Kuli Khan Khattak Confidential CEO Dec 13, 2019 Ghandhara Nissan Limited Karachi G N L R | U Dear Sir This is with reference to Ratings of Ghandhara Nissan Limited . PACRA has updated its opinions, following are the respective details. Opinion Action Rating Outlook Opinion Type Long Term Short Term Current Previous Current Previous Ghandhara Nissan Limited Maintain A A A1 A1 Stable Entity Yours truly (Muhammad Jhangeer Hanif) Unit Head | Ratings The Pakistan Credit Rating Agency Limited [PACRA] TEL: 92(42)3586 9504 Awami Complex FB-1, Usman Block, New Garden Town Fax: 92(42)3583 0425 Lahore - 54600, Pakistan www.pacra.com The Pakistan Credit Rating Agency Limited Rating Report Report Contents 1. Rating Analysis Ghandhara Nissan Limited 2. Financial Information 3. Rating Scale 4. Regulatory and Supplementary Disclosure Rating History Dissemination Date Long Term Rating Short Term Rating Outlook Action Rating Watch 13-Dec-2019 A A1 Stable Maintain - 13-Jun-2019 A A1 Stable Maintain - 12-Dec-2018 A A1 Stable Maintain - 30-Jun-2018 A A1 Stable Maintain - 29-Dec-2017 A A1 Stable Initial - Rating Rationale and Key Rating Drivers Ghandhara Nissan Limited (GNL) operates in the truck segment of the automobile sector. Presently, the company deals in Chinese and European brands. Company's performance was diluted owing to discontinuation of UD Trucks, which they managed to beef up with other alternative products. Ghandhara Nissan has solidified its position in the market through the launch of JAC X-200 and Renault Trucks, recently. -

Dewan Farooque (DFML) Sept-2016.FH10

Contents Company Information -----------------------------------------------------------------------------01 Directors Report -----------------------------------------------------------------------------------02 Condensed Interim Balance Sheet ----------------------------------------------------------------03 Condensed Interim Profit and Loss Account------------------------------------------------------04 Condensed Interim Statement of Comprehensive Income --------------------------------------05 Condensed Interim Cash Flow Statement --------------------------------------------------------06 Condensed Interim Statement of Changes in Equity --------------------------------------------07 Notes to the Condensed Interim Financial Statements ------------------------------------------08 DEWAN FAROOQUE MOTORS LIMITED Company Information Executive Directors Dewan Muhammad Yousuf Farooqui Chairman Board of Directors Mr. Waseem-ul- Haque Ansari Mr. Muhammad Naeem Uddin Malik Mr. Mohammad Saleem Baig Non-Executive Directors Mr. Haroon Iqbal Syed Muhammad Anwar Independent Director Mr. Aziz-ul-Haque CHIEF EXECUTIVE OFFICER Dewan Muhammad Yousuf Farooqui CFO & COMPANY SECRETARY Mr. Muhammad Naeem Uddin Malik AUDIT COMMITTEE MEMBERS Mr. Aziz-ul-Haque Chairman Syed Muhammad Anwar Member Mr. Haroon Iqbal Member HUMAN RESOURCE & REMUNERATION COMMITTEE MEMBERS Mr. Haroon Iqbal Chairman Dewan Mohammad Yousuf Farooqui Member Mr. Aziz-ul-Haque Member BANKERS AUDITORS REGISTERED OFFICE Feroze Sharif Tariq & Co. 7th Floor, Block 'A', Allied Bank of Pakistan -

Hyundai Motor Company Annual Report 2006

Hyundai Motor Company Annual Report 2006 Table of Contents 02 Financial Highlights 04 Letter from the Chairman 06 Letter from the Vice Chairman 10 Customer-First Management 32 Sustaining Global Management 44 Global Marketing 46 Sports Marketing 48 Sustainable Management 52 Environmental Advancements 54 Social Initiatives 56 Financial Statements 126 Hyundai Motor Company Worldwide 128 Domestic & Overseas Facilities 130 Full Line-Up Open Road Breathe in the big sky of the open road. This is a limitless horizon and an expansive vision. Through the blue you can reflect on your achievements and you can see yourself in the future and a realization of all your present dreams. This is the life journey. Where you began, where you are and where you are going to. With the clear view of the open road you can see clearly the road ahead and all the perils of the future become triumphs as you move forever forward. Financial Highlights For the years ended December 31, 2006, 2005, and 2004 Korean won US dollars in billions in millions 2006 2005 2004 2006 Sales ₩63,648 ₩58,831 ₩53,101 $68,468 Net Income 1,259 2,445 1,642 1,355 Total Assets 70,709 66,079 58,023 76,064 Shareholder's Equity 20,966 19,828 16,756 22,554 Earnings Per Share (Korean won, US dollars) 5,737 11,275 7,193 6.17 Dividends Per Share (Korean won, US dollars) 1,000 1,250 1,150 1.076 ₩70,709 ₩63,648 $76,064 $68,468 2,445 66,079 1,642 ₩1,259 58,831 58,023 53,101 $1,355 ‘04 ‘05 ‘06 ‘04 ‘05 ‘06 ‘04 ‘05 ‘06 Sales Net Income Total Assets • Korean won in billion, US dollars in million • Korean won in billion, US dollars in million • Korean won in billion, US dollars in million 20,966 1,250 ₩ 11,275 $22,554 ₩1,000 19,828 7,193 ₩5,737 1,150 $1.076 16,756 $6.17 ‘04 ‘05 ‘06 ‘04 ‘05 ‘06 ‘04 ‘05 ‘06 Shareholder’s Equity Earnings Per Share Dividends Per Share • Korean won in billion, US dollars in million • Korean won, US dollars • Korean won, US dollars 02 We’re so glad you joined us. -

Oil Rises As US Imposes New Sanctions on Iran

NISHAT JV | Page 4 STAKE SALE | Page 10 Hyundai set to MUFG Q3 net assemble cars profi t rises 17% To advertise here in Pakistan to $2.62bn Call: Saturday, February 4, 2017 Jumada I 7, 1438 AH NONFARM PAYROLLS UP : Page 12 US job growth GULF TIMES accelerates in January, BUSINESS but wages lag A M Best affirms Oil rises as US imposes QIIC rating with ‘stable’ outlook By Santhosh V Perumal agency said while the com- Business Reporter pany benefits from moderate new sanctions on Iran underwriting leverage, capital requirements are largely Reuters A M Best, an international insur- driven by asset risk relating to New York/London ance rating agency, has aff irmed the company’s concentrated Qatar Islamic Insurance Com- portfolio, which is weighted pany’s financial strength rating towards domestic equities and il prices jumped yesterday after at ‘B++ (Good)’ and long-term real estate assets. the United States imposed sanc- issuer credit rating at “bbb+” The policyholders’ fund is Otions on some Iranian individuals with “stable” outlook. “suff iciently” capitalised on a and entities, days after the White House The ratings reflect the insurer’s standalone basis, supported by put Tehran “on notice” over a ballistic track record of excellent operat- QR110mn of retained surplus as missile test. ing performance, adequate com- on September 30, 2016. Front month US West Texas Intermedi- bined risk-adjusted capitalisation QIIC has a track record of strong ate crude futures climbed 24¢ to $53.78, (considering both shareholders’ operating and technical profit- after closing 34¢ down on Thursday, as of and policyholders’ funds), and ability, highlighted by a five-year 12:22pm ET (1722 GMT). -

(Car) Industry of Pakistan?

E3S Web of Conferences 217, 11014 (2020) https://doi.org/10.1051/e3sconf/202021711014 ERSME-2020 Who has the largest share in automotive (car) industry of Pakistan? Aí Huu Tran1, Muhammad Imtiaz Subhani2, and Denis Ushakov3,* 1Van Hien University, Dien Bien Phurong 1, Quan 3, Hồ Chí Minh 700000, Vietnam 2ILMA University, Main Ibrahim Hyderi Road, Korangi Creek, Karachi, Pakistan 3Suan Sunandha Rajabhat University, 1 U-Thong Nok rd., Dusit, Bangkok, 10300, Thailand Abstract. This research aims to better comprehend & dissect the supply & demand in automotive industry of Pakistan. The primary objective of this study is to delve into casing-works which empowers us to better understand the biggest piece of the overall automotive (car) industry of Pakistan by utilizing interest & expense parameters of automotive items in business sector. The research aims to determine market shares of automotive (car) brands in Pakistani automotive industry. Finding confirms that in Pakistan in automotive or automobile (cars) industry, the Suzuki brand is enjoying the highest market share among the selected/ outlined brands and leading the industry with 29% of market shares. Toyota is enjoying 26% market shares while Honda brand is the third most winning brands in automotive industry in Pakistan with 25% market shares. Further, Nissan, Kia and Daihatsu have 10%, 6% and 4% market shares respectively for the years 2000 to 2019. In developing countries like Pakistan individuals have relatively lower wages, thus a vehicle-purchase decision requires more due-diligence, whereby the accessibility of car-parts in neighborhood markets, how pricy the car parts are, & the resale estimation of brand, are the primary decision-marking factors. -

India-Pakistan Trade: Perspectives from the Automobile Sector in Pakistan

Working Paper 293 India-Pakistan Trade: Perspectives from the Automobile Sector in Pakistan Vaqar Ahmed Samavia Batool January 2015 1 INDIAN COUNCIL FOR RESEARCH ON INTERNATIONAL ECONOMIC RELATIONS Table of Contents List of Abbreviations ................................................................................................................... iii Abstract ......................................................................................................................................... iv 1. Introduction ........................................................................................................................... 1 2. Methodology and Data .......................................................................................................... 2 3. Automobile Industry in Pakistan ......................................................................................... 3 3.1 Evolution and Key Players............................................................................................ 4 3.2 Structure of the Industry ............................................................................................... 6 3.3 Production structure ..................................................................................................... 7 3.4 Market Structure ........................................................................................................... 8 4. Automobile Trade of Pakistan............................................................................................ 10 4.1 Import -

Financial Analysis of Toyota Indus Motor Company

Financial Analysis of Toyota Indus Motor Company 2017 Financial Analysis of Toyota Indus Motor Company Financial Year 2011-2016 Ayesha Majid Lahore School of economics 5/1/2017 Financial Analysis of Toyota Indus Motor Company i Table of Contents Preamble .................................................................................................................... 1 Categories of Financial Ratios Analysed ................................................................ 1 Limitations .............................................................................................................. 2 Toyota Indus Motors................................................................................................... 3 Company Profile ..................................................................................................... 3 Financial Profile ...................................................................................................... 3 Introduction ............................................................................................................. 4 Mission Statement ............................................................................................... 5 Vision Statement ................................................................................................. 5 Slogan ................................................................................................................. 5 Quote Summary as on 1st May 2017 .......................................................................... 6 -

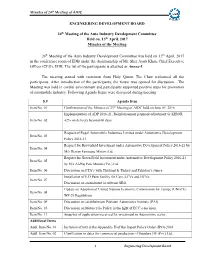

ENGINEERING DEVELOPMENT BOARD 24Th Meeting of the Auto

th Minutes of 24 Meeting of AIDC ENGINEERING DEVELOPMENT BOARD 24th Meeting of the Auto Industry Development Committee Held on, 13th April, 2017 Minutes of the Meeting 24th Meeting of the Auto Industry Development Committee was held on 13th April, 2017 in the conference room of EDB under the chairmanship of Mr. Sher Ayub Khan, Chief Executive Officer (CEO), EDB. The list of the participants is attached as Annex-I. The meeting started with recitation from Holy Quran. The Chair welcomed all the participants. After introduction of the participants, the forum was opened for discussion. The Meeting was held in cordial environment and participants supported positive steps for promotion of automobile industry. Following Agenda Items were discussed during meeting. S.# Agenda Item Item No. 01 Confirmation of the Minutes of 23rd Meeting of AIDC held on June 09, 2016 Implementation of ADP 2016-21, Reimbursement payment adjustment @ KIBOR Item No. 02 +2% on delivery beyond 60 days Request of Regal Automobile Industries Limited under Automotive Development Item No. 03 Policy 2016-21 Request for Brownfield Investment under Automotive Development Policy 2016-21 by Item No. 04 M/s Dewan Farooque Motors Ltd. Request for Green Field Investment under Automotive Development Policy 2016-21 Item No. 05 by M/s Al-Haj Faw Motors (Pvt.) Ltd Item No. 06 Discussion on FTA’s with Thailand & Turkey and Pakistan’s stance. Installation of E.D Paint facility for Cars, LCVs and HCVs: Item No. 07 Discussion on amendment in relevant SRO. Update on Adoption of United Nations Economic Commission for Europe (UNECE) Item No. -

UNITED NATIONS SYSTEM Annual Statistical Report 2005

Annual Statistical Report 2005 • Procurement of Goods & Services • All Sources of Funding • UNDP Funding • Procurement from DAC Member Countries • International & National Project Personnel • United Nations Volunteers • Fellowships Published: July 2006 by UNITED NATIONS SYSTEM Annual Statistical Report 2005 Procurement of Goods and Services • All Sources of Funding • UNDP Funding Procurement from DAC Member Countries International & National Project Personnel United Nations Volunteers Fellowships July 2006 Copyright © 2006 by the United Nations Development Programme 1 UN Plaza, New York, NY 10017, USA All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, photocopying, recording or otherwise, without prior permission of UNDP/IAPSO. TABLE OF CONTENTS INTRODUCTION...................................................................................................................... 1 GLOASSARY OF TERMS ...................................................................................................... 3 EXECUTIVE SUMMARY: ALL SOURCES OF FUNDING (UN SYSTEM)............................ 4 PROCUREMENT OF GOODS AND SERVICES - ALL SOURCES OF FUNDING Procurement of goods by country of procurement and services by country of head office ................................................................................................... 9 Procurement by UN agency ...................................................................................... -

June 30, 2016 (Annual)

Contents 02 Vision & Mission 03 Company Information 04 Company Review 09 Board of Directors 10 Our Products 20 Notice of Meeting 22 Directors’ Report 31 Key Operating & Financial Data 36 Pattern of Shareholding 38 Statement of Compliance with the Code of Corporate Governance 40 Review Report to the Members 41 Auditors’ Report to the Members 42 Balance Sheet 43 Profit & Loss Account 44 Cash Flow Statement 45 Statement of Changes in Equity 46 Notes to the Financial Statements Dividend Mandate Form Proxy Form Facilitating Future Growth Vision “To acquire market Mission leadership and contribute to the society by providing high quality and environment friendly ISUZU Vehicles in Pakistan’s Market”. To assist the society in To enhance performance hazards ensuring growth by introducing of the Company and environment friendly vehicles. stakeholders. To maximize share of To create conducive ISUZU in Pakistan. environments for To be a market & customer oriented development and well being of Employees. services to the customers. 02 Annual Report 2016 Facilitating Future Growth Board of Directors Mr. Raza Kuli Khan Khattak Chairman Company Mr. Ahmad Kuli Khan Khattak Chief Executive Lt. Gen. (R) Ali Kuli Khan Khattak Director Information Dr. Parvez Hassan Director Maj. (R) Muhammad Zia Director Mr. Shahid Kamal Khan Ind. Director Legal Advisors Audit Committee S. Abid Sherazi & Co. Lt. Gen. (R) Ali Kuli Khan Khattak Chairman Hassan & Hassan (Advocates) Mr. Jamil Ahmed Shah Member Maj. (R) Muhammad Zia Member Bankers Mr. Shahid Kamal Khan Member National Bank of Pakistan Mr. Shahnawaz Damji Secretary Al-Baraka Bank (Pakistan) Ltd. JS Bank Ltd. Human Resource & Remuneration Faysal Bank Ltd. -

Annual 2012.Pdf

A View of Baluchistan Wheels Limited Vision Mission To Produce Automotive Wheels and Allied Products of International Quality Standard of ISO 9002 and contribute towards national economy by import substitution, exports, taxation, employment and consistently compensate the stake holders through stable returns. BALUCHISTAN WHEELS LIMITED Table of Contents Corporate Information 04 Notice of the Meeting 06 Our Leadership Team 08 Directors Report to the Shareholders 10 Pattern of Shareholding 16 Breakup of Shareholding 17 Statement of Compliance with the Code of 19 Corporate Governance Statement of Compliance with the 21 Best Practices on Transfer Pricing Review Report to the Members on Statement 22 of Compliance with the Best Practices of the Code of Corporate Governance Auditors Report 23 Balance Sheet 24 Profit and Loss Account 25 Statement of Comprehensive Income 26 Cash Flow Statement 27 Statement of Changes in Equity 28 Notes to the Financial Statements 29 Six years at a Glance 53 Form of Proxy New Induction of CO2 Welding New Induction of Automobile Disc profile Forming Machine by Spinning Process BALUCHISTAN WHEELS LIMITED Corporate Information Mr. Muhammad Siddique Misri Mr. Razak H. M. Bengali Mr. Muhammad Irfan Ghani Chairman Chief Executive Chief Operating Officer BOARD OF DIRECTORS Mr.Muhammad Siddique Misri Chairman(Executive Director) Mr.Razak H.M.Bengali Chief Executive(Executive Director) Mr. Muhammad Irfan Ghani Chief Operating Officer(Executive Director) Syed Haroon Rashid Director (Nominee - NIT)(Non Executive Director) Syed Zubair Ahmed Shah Director (Nominee - NIT)(Non Executive Director) Mr.Muhammad Javed Director(Executive Director) Mr.Irfan Ahmed Qureshi Director(Executive Director) COMPANY SECRETARY Mr.Irfan Ahmed Qureshi BOARD AUDIT COMMITTEE Syed Haroon Rashid - Chairman Director Syed Zubair Ahmed Shah- Member Director Mr.