BELGIUM Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download (490Kb)

i -------- ----------------------- --------- COMMISSION OF THE EUROPEAN COMMUNITIES * * * Directorate-General Information, Commun1cat1on, Culture * * * * a newssheet for journalists Weekly nu 31/90 8 - 15 October 1990 SUMMARY P. 2 CONSUMERS: Eurocheques in the dock The European Commission feels users have had a raw deal, especially in France. P. 3 TOURISM: Italy proposes it be included in the Treaty of Rome But the procedure is long and complex, even though it has majority support in the Council of Ministers. P. 5 IMMIGRATION: Integrating 8 million immigrants An experts• report suggests how it could be done. P. 7 ENERGY: Substantial savings durinq the 1980s ... but oil imports still accounted for 36% of consumption. P. 8 ENERGY: Revolutionary nuclear power stations for the year 2040 The European Commission proposes a new fusion programme. P. 9 TQ~RISM~_The charms of the cqgDsrysid~ Community action plan in favour of rural tourism. Mailed from: Brussels X The contents of th1s publ1cdt1on do not necessanly reflect tt>e off1c1al v1ews of the lllStltutlons of the Commun1ty Reprodurt1on authonzed 200 rucc de ICJl_ul • 1049 Brussels • Beig1um • Tel 235 11 11 • Te!ex 21877 COMEU B Eurofocus 31/90 2. CONSUMERS: Eurocheques in the dock The European Commission feels users have had a raw deal, especially in France. In 1989 some 42mn. Eurocheques were issued abroad, including 27mn. within the European Community, for a total value of ECU 5,000mn.*. Practical, guaranteed, accepted virtually everywhere, Eurocheques have been used in increasingly large numbers since the last 15 years. In 1984 the European Commission even granted Eurocheque International, which had launched the scheme, an exemption from the EC's very strict competition rules. -

January / February 1995

The Ecologist Vol 25 Nol January/February 1995 ^ J £3.50 (US $7) New- Diseases - Old Plagues Who's Behind the Ecolabel? Mexico - Wall Street on the Warpath Oestrogen Overdose Ozone Backlash ISSN DEbl-3131 0 1 > The Unsettling of Tibet 770261"313010 Housing Plans and Policies ONA ODERN ANET RICHARD D NORTH 'Richard D North has long been one of the best informed and most thought provoking writers on the whole nexus of environmental and develop ment issues. This sharp and intelligent book shows North at the top of his form, arguing convincingly that concern about the future of our globe does not require you to be a modish ecopessimist. It comes like a sunburst of rational optimism and commonsense.' CHRISTOPHER PATTEN Governor of Hong Kong and former Secretary of State for the Environment (1989-1990) The Ecologist is published by Ecosystems Ltd. Editorial Office and Back Issues: Agriculture House, Bath Road, Sturminster Newton, Dorset, DT10 1DU, UK. Tel: (01258) 473476 Fax: (01258) 473748 E-Mail [email protected] Subscriptions: RED Computing, The Outback, 58-60 Kingston Road, New Maiden, Surrey, KT3 3LZ, United Kingdom Tel: (01403) 782644 Fax: (0181) 942 9385 Books: WEC Books, Worthyvale Manor, Camelford, Cornwall, PL32 9TT, United Kingdom Tel: (01840) 212711 Fax: (01840) 212808 Annual Subscription Rates Advertising Contributions £21 (US$34) for individuals and schools; For information, rates and booking, contact: The editors welcome contributions, which Wallace Kingston, Jake Sales (Ecologist agent), should be typed, double-spaced, on one £45 (US$85) for institutions; 6 Cynthia Street, London, N1 9JF, UK side of the paper only. -

The Shadow Economy in Norway: Demand for Currency Approach

MEMORANDUM No 10/2004 The shadow economy in Norway: Demand for currency approach Isilda Shima ISSN: 0801-1117 Department of Economics University of Oslo This series is published by the In co-operation with University of Oslo The Frisch Centre for Economic Department of Economics Research P. O.Box 1095 Blindern Gaustadalleén 21 N-0317 OSLO Norway N-0371 OSLO Norway Telephone: + 47 22855127 Telephone: +47 22 95 88 20 Fax: + 47 22855035 Fax: +47 22 95 88 25 Internet: http://www.oekonomi.uio.no/ Internet: http://www.frisch.uio.no/ e-mail: [email protected] e-mail: [email protected] List of the last 10 Memoranda: No 09 Steinar Holden. Wage formation under low inflation. 22 pp. No 08 Steinar Holden and Fredrik Wulfsberg Downward Nominal Wage Rigidity in Europe. 33 pp. No 07 Finn R. Førsund and Michael Hoel Properties of a non-competitive electricity market dominated by hydroelectric power. 24 pp. No 06 Svenn-Erik Mamelund An egalitarian disease? Socioeconomic status and individual survival of the Spanish Influenza pandemic of 1918-19 in the Norwegian capital of Kristiania. 24 pp. No 05 Snorre Kverndokk, Knut Einar Rosendahl and Thomas F. Rutherford Climate policies and induced technological change: Impacts and timing of technology subsidies. 34 pp. No 04 Halvor Mehlum, Edward Miguel and Ragnar Torvik Rainfall, Poverty and Crime in 19th Century Germany. 25 pp. No 03 Halvor Mehlum Exact Small Sample Properties of the Instrumental Variable Estimator. A View From a Different Angle. 14 pp. No 02 Karine Nyborg and Kjetil Telle A dissolving paradox: Firms’ compliance to environmental regulation. -

Growth of Central Banking: the Societe Generale Des Pays-Bas And

Growth of Central Banking: The Soci•t• Ge•e•rale des Pays-Bas and the Impact of the Function of General State Cashier on Belgium's Monetary System (1822-1830) Julienne M. Laureyssens University of Manitoba I intend to reexamine in this paper the creation and the first ten odd years of operation of Belgium's first corporate bank, the SocaeteG(n•rale des Pays-Bas,with special regard to its function as General State Cashier. The bank was founded in 1822 by King William I of the United Kingdom of the Netherlands. It was the only corporate bank in the southern part of the Netherlands until 1835. During the Dutch period, which lasted until September 1830 and up to the creation of the National Bank of Belgium in 1850, it carried out some of the functions of a central bank. King William I had an extensive knowledge of financial affairs, in fact, they were his private passion. According to Demoulin, he consideredbanks to be "des creatmns para-•'ta- tiques," institutions that are the state's "helpmates" whether they are owned and managed privately or not. The bank's particular function within the spectrum of the state's tasks were to mobilize BUSINESS AND ECONOMIC HISTORY., Second Series, Volume Fourteen, 1985. Copyright (c) 1985 by the Board of Trustees of the University of Illinois. Library of Congress Catalog No. 85-072859. 125 126 capital and to extend the benefits of credit. William I was a firm believer in paper money, in the beneficial use of a wide variety of paper debt instruments, and in low interest rates. -

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution. -

Financial Stability Report 2019

2019 Report Financial Stability National Bank of Belgium FINANCIAL STABILITY REPORT 2019 Financial Stability Report 2019 © National Bank of Belgium All rights reserved. Reproduction of all or part of this publication for educational and non‑commercial purposes is permitted provided that the source is acknowledged. Contents Executive summary 7 Macroprudential Report 9 A. Introduction 9 B. Main risks and points for attention and prudential measures adopted 10 Financial Stability Overview 43 Banking sector 43 Insurance sector 68 Additional charts and tables for the banking and insurance sector 80 Thematic articles 89 Transaction-level data sets and monitoring of systemic risk : an illustration with Securities Holding Statistics 91 Climate-related risks and sustainable finance. Results and conclusions from a sector survey 107 A risk dashboard for detecting and monitoring systemic risk in Belgium 129 Statistical Annex 149 5 Executive summary 1. In the current macro-financial context, monitoring financial stability risks continues to be of great importance. In addition to the growing relevance for financial stability of a range of structural trends and risks – such as the intensive digitisation of the financial sector or risks related to climate change – the macro-financial impact of a persistent low interest rate environment is becoming increasingly apparent. Although a highly accommodative monetary policy on the part of the ECB is justified, given the current macroeconomic situation, the acceleration of the credit cycle in many EU countries, including Belgium, is an important warning that such a policy can also have adverse spillover effects and present potential risks to financial stability. The build‑up of vulnerabilities in Belgium in the form of an increasing debt ratio of households and companies or rising exposure of the financial sector to undervalued or under-priced financial risks may, in the long term, affect the resilience and absorption capacity of the Belgian economy in the event of major shocks. -

Tax Relief Country: Italy Security: Intesa Sanpaolo S.P.A

Important Notice The Depository Trust Company B #: 15497-21 Date: August 24, 2021 To: All Participants Category: Tax Relief, Distributions From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers Tax Relief Country: Italy Security: Intesa Sanpaolo S.p.A. CUSIPs: 46115HAU1 Subject: Record Date: 9/2/2021 Payable Date: 9/17/2021 CA Web Instruction Deadline: 9/16/2021 8:00 PM (E.T.) Participants can use DTC’s Corporate Actions Web (CA Web) service to certify all or a portion of their position entitled to the applicable withholding tax rate. Participants are urged to consult TaxInfo before certifying their instructions over CA Web. Important: Prior to certifying tax withholding instructions, participants are urged to read, understand and comply with the information in the Legal Conditions category found on TaxInfo over the CA Web. ***Please read this Important Notice fully to ensure that the self-certification document is sent to the agent by the indicated deadline*** Questions regarding this Important Notice may be directed to Acupay at +1 212-422-1222. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages. -

Submission to the Reserve Bank of Australia Response to EFTPOS

Submission to the Reserve Bank of Australia Response To EFTPOS Industry Working Group By The Australian Retailers Association 13 September 2002 Response To EFTPOS Industry Working Group Prepared with the assistance of TransAction Resources Pty Ltd Australian Retailers Association 2 Response To EFTPOS Industry Working Group Contents 1. Executive Summary.........................................................................................................4 2. Introduction......................................................................................................................5 2.1 The Australian Retailers Association ......................................................................5 3. Objectives .......................................................................................................................5 4. Process & Scope.............................................................................................................6 4.1 EFTPOS Industry Working Group – Composition ...................................................6 4.2 Scope Of Discussion & Analysis.............................................................................8 4.3 Methodology & Review Timeframe.........................................................................9 5. The Differences Between Debit & Credit .......................................................................10 5.1 PIN Based Transactions.......................................................................................12 5.2 Cash Back............................................................................................................12 -

Download (PDF)

Review essay : Central banking through the centuries Working Paper Research by Ivo Maes October 2018 No 345 Editor Jan Smets, Governor of the National Bank of Belgium Statement of purpose: The purpose of these working papers is to promote the circulation of research results (Research Series) and analytical studies (Documents Series) made within the National Bank of Belgium or presented by external economists in seminars, conferences and conventions organised by the Bank. The aim is therefore to provide a platform for discussion. The opinions expressed are strictly those of the authors and do not necessarily reflect the views of the National Bank of Belgium. Orders For orders and information on subscriptions and reductions: National Bank of Belgium, Documentation - Publications service, boulevard de Berlaimont 14, 1000 Brussels Tel +32 2 221 20 33 - Fax +32 2 21 30 42 The Working Papers are available on the website of the Bank: http://www.nbb.be © National Bank of Belgium, Brussels All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. ISSN: 1375-680X (print) ISSN: 1784-2476 (online) NBB WORKING PAPER No. 345 – OCTOBER 2018 Abstract Anniversaries are occasions for remembrance and reflections on one’s history. Many central banks take the occasion of an anniversary to publish books on their history. In this essay we discuss five recent books on the history of central banking and monetary policy. In these volumes, the Great Financial Crisis and the way which it obliged central banks to reinvent themselves occupies an important place. Although this was certainly not the first time in the history of central banking, the magnitude of the modern episode is remarkable. -

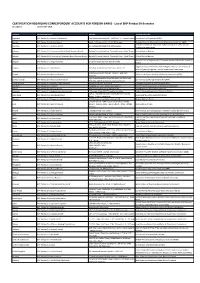

CERTIFICATION REGARDING CORRESPONDENT ACCOUNTS for FOREIGN BANKS - List of BNP Paribas SA Branches Last Update: 11 December 2018

CERTIFICATION REGARDING CORRESPONDENT ACCOUNTS FOR FOREIGN BANKS - List of BNP Paribas SA Branches Last update: 11 December 2018 Country Name of the entity Address Banking authority Argentina BNP Paribas S.A. Buenos Aires Branch Casa Central Bouchard 547, PISOS 26 Y 27 - Capital Federal Central Bank of Argentina (BCRA) Austria BNP Paribas S.A. Austria Branch Vordere Zollamtsstraße 13, A-1030 Vienna Austrian Financial Market Authority (Finanzmarktaufsicht - FMA) Australian Prudential Regulation Authority/Australian Securites and Australia BNP Paribas S.A. Australia Branch 60 Castlereagh Street NSW 2000 Sydney Investments commission Bahrain BNP Paribas S.A. Conventional Retail Bank Manama Branch Barhain Financial Harbour, Financial Center - West Tower Central Bank of Bahrain Bahrain BNP Paribas S.A. Conventional Wholesale Bank Manama Branch Barhain Financial Harbour, Financial Center - West Tower Central Bank of Bahrain National Bank of Belgium (NBB)/Financial Services and Market Authority Belgium BNP Paribas S.A. Belgium Branch 3 rue Montagne du Parc, 1000 Bruxelles (FSMA) Bulgarian National Bank/Financial Intelligence Directorate of National Bulgaria BNP Paribas S.A. Sofia Branch 2 Blv Tzar Osvoboditel, 1000 Sofia - PO Box 11 Security Agency/Bulgarian Financial Supervision Commission 1981 Avenue McGill College - Quebec - H3A 2W8 Canada BNP Paribas S.A. Montreal Branch Office of the Superintendent of Financial Institutions (OFSI) Montréal Elgin Avenue Picadilly Centre 4th floor, PO BOX 10632 Cayman Islands BNP Paribas S.A. Grand Cayman Branch Cayman Islands Monetary Authority (CIMA) APO, KY1-1006 Gran Cayman, Cayman Islands Czech Republic BNP Paribas S.A. pobočka Česká Republika Ovocný trh 8 - 117 19 Praha 1 Czech National Bank (Česká národní banka) Denmark BNP Paribas S.A. -

A Study on Debit Cards

Dr. Yellaswamy Ambati, International Journal of Research in Management, Economics and Commerce, ISSN 2250-057X, Impact Factor: 6.384, Volume 08 Issue 02, February 2018, Page 248-253 A Study on Debit Cards Dr. Yellaswamy Ambati (Lecturer in Commerce, TS Model Junior College, Jangaon, Warangal, Telangana State, India) Abstract: A Debit Card is a plastic payment card that can be used instead of cash when making purchases. It is also known as a bank card or check card. It is similar to a credit card, but unlike a credit card, the money comes directly from the user's bank account when performing a transaction. Some cards may carry a stored value with which a payment is made, while most relay a message to the cardholder's bank to withdraw funds from a payer's designated bank account. In some cases, the primary account number is assigned exclusively for use on the Internet and there is no physical card. In many countries, the use of debit cards has become so widespread that their volume has overtaken or entirely replaced cheques and, in some instances, cash transactions. The development of debit cards, unlike credit cards and charge cards, has generally been country specific resulting in a number of different systems around the world, which were often incompatible. Since the mid-2000s, a number of initiatives have allowed debit cards issued in one country to be used in other countries and allowed their use for internet and phone purchases. Keywords: Debit Card, Credit Card, ATM, Bank, Master Card I. INTRODUCTION Debit cards are a great way to get more financial freedom without the risk of falling into debt. -

The Regulation and Supervision of the Belgian Financial System (1830 - 2005)

BANK OF GREECE EUROSYSTEM Working Paper The regulation and supervision of the Belgian financial system (1830 - 2005) Erik Buyst Ivo Maes SEEMHN 77 JUNE 2008WORKINKPAPERWORKINKPAPERWORKINKPAPERWORKINKPAPERWORKINKPAPER BANK OF GREECE Economic Research Department – Special Studies Division 21, Ε. Venizelos Avenue GR-102 50 Αthens Τel: +30210-320 3610 Fax: +30210-320 2432 www.bankofgreece.gr Printed in Athens, Greece at the Bank of Greece Printing Works. All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. ISSN 1109-6691 Editorial The South-Eastern European Monetary History Network (SEEMHN) is a community of financial historians, economists and statisticians, established in April 2006 at the initiation of the Bulgarian National Bank and the Bank of Greece. Its objective is to spread knowledge on the economic history of the region in the context of European experience with a specific focus on financial, monetary and banking history. The First and the Second Annual Conferences were held in Sofia (BNB) in 2006 and in Vienna (OeNB) in 2007. Additionally, the SEEMHN Data Collection Task Force aims at establishing a historical data base with 19th and 20th century financial and monetary data for countries in the region. A set of data has already been published as an annex to the 2007 conference proceedings, released by the OeNB (2008, Workshops, no 13). On 13-14 March 2008, the Third Annual Conference was held in Athens, hosted by the Bank of Greece. The conference was dedicated to Banking and Finance in South-Eastern Europe: Lessons of Historical Experience. It was attended by representatives of the Albanian, Austrian, Belgian, Bulgarian, German, Greek, Romanian, Russian, Serbian and Turkish central banks, as well as participants from a number of universities and research institutions.