Pipeline Bubble 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Annual Report Are Commission-Free

Table of Contents 1 Letter to Our Shareholders 4 Financial Highlights 6 Our Businesses Midstream Chemicals Refining Marketing and Specialties 7 Our Value Chain 8 Our Strategy Operating Excellence Growth Returns Distributions High-Performing Organization 28 Board of Directors 30 Executive Leadership Team 31 Non-GAAP Reconciliations 32 Form 10-K | ON THE COVER AND TABLE OF CONTENTS Lake Charles Refinery WESTLAKE, LA In 2019, Lake Charles Manufacturing Complex achieved a sustained safety record of more than 55 months, equivalent to 7.5 million safe work hours. 2019 PHILLIPS 66 ANNUAL REPORT 1 To Our Shareholders We have the right strategy in place to create shareholder value, and our employees are executing it well. Phillips 66 achieved 34% total shareholder return during 2019, which exceeded our peer group average and the S&P 100. In 2019, we delivered earnings of $3.1 billion and earnings per share of $6.77. Adjusted earnings were $3.7 billion or $8.05 per share. During the year, we generated $4.8 billion of operating cash flow. We reinvested $3.9 billionback into the business and returned $3.2 billion of capital to shareholders through dividends and share repurchases. We increased our quarterly dividend 12.5% and announced a $3 billion increase to our share repurchase program. Since our formation, we have returned $26 billion to shareholders through dividends, share repurchases and exchanges, reducing our initial shares outstanding by 33%. Operating excellence is our No. 1 priority and core to everything we do. Our goal is zero incidents, zero accidents and zero injuries. We believe this is attainable, and we strive for it daily. -

Report Document

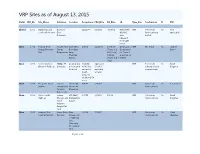

VRP Sites as of August 13, 2015 Status VRP_No. Site_Name Volunteer Location Acceptance DatePRA_Date RA_Date LA Type_Site Contaminant IC PM Closed 1001 Rail siding and Big Horn 12/11/00 3/26/02 3/26/02 NFA Letter VRP Petroleum No Not coal load out area Coal 4/26/02; hydrocarbons, applicable Company area metals released from LQD bond Open 1002 Powder River Powder River 1095 West 1/8/01 10/17/01 10/01/07 Certificate of VRP Oil, diesel No Jaymee Energy Sheridan Energy Brundage (Tracts 8, 9, Completion Binion Site Corporation Lane, & 10 only), for Tracts 8, Sheridan, 5/18/09 9, and 10 on 82801 (Tracts 6 & 7 5/8/09 only) Open 1003 Former Conoco Phillips 66 Located 1/2 3/19/01; Approved VRP Petroleum No Sarah Glenrock Refinery Company mile west of 6/28/2011 5/13/02; refinery related Bargsten Glenrock amended amended contaminants South 9/19/02 property additional 54 acres Open 1004 Cheyenne Crude Suncor 199 South 4/4/01 5/30/06 VRP Petroleum No Ben Luckey Station Energy USA, Morrie Av, hydrocarbons formerly Cheyenne Conoco Inc. Open 1005 Union Pacific Former 543 West 4/4/01 7/31/03 1/3/05 VRP Petroleum No Sarah Railroad Chicago and Midwest Av, Hydrocarbons Bargsten North Casper Western Casper Rail Yard Open 1006 Laramie Yard Union Pacific Near 4/4/01 7/09/04 VRP Petroleum No Cindi Fueling Platform Railroad intersection Hydrocarbons Martinez of Railroad and University St., Laramie Yard Page 1 of 29 Status VRP_No. Site_Name Volunteer Location Acceptance DatePRA_Date RA_Date LA Type_Site Contaminant IC PM Closed 1007 Gulley Enterprises Cheyenne 411 E. -

2020 Fact Book 2 Our Businesses Our Strategy Midstream Chemicals Refining Marketing and Specialties Energy Research & Innovation Global Asset Map General Information

Cover Photo: Taft Storage Facility at Gray Oak Pipeline TAFT, TX Contents 3 4 5 OUR BUSINESSES OUR STRATEGY MIDSTREAM Ferndale Ferndale Rail Terminal* Renton North Spokane Tacoma (MT) Yellowstone Cut Bank Moses Lake Thompson 17Falls Rail 24 14 Spokane Terminal Palermo* UROPE DLE EA Portland D Great Falls E I ST Portland (MT) Missoula Rail Terminal M Yello Glacier Sacagawea* Missoula wsto Helena Roundup Keene CDP* ne Billings Crude* Bozeman Billings Billings Humber SPCo & S-Chem ooth Sheridan* Semino Bakk Beart en Bayway MiRO CHEMICALS REFINING * MARKETING AND SPECIALTIES Bighorn e* Linden* Q-Chem I & II Casper* Tremley Pt. (MT)* * Po Rock Springs wd Bayway Rail eminoe er Ri Terminal* S Harbor Red Line Oil North Salt Lake Pioneer ve Des Moines s r Sacramento Rockies Expr Hartford Lincoln ess Line 20 ess Richmond (MT) Rockies Expr San Francisco Denver Borg Conway Kansas City* Po 0 Rockies Expres to Wichita wd Paola er-Den Gold Line* Wood River er Riv Wichita N.* Products* HeartlandPaola* Blue Line 0 Wichita S.* E. St. ver Jeerson City* Junction er Louis* Southern Hills* m Cherokee North* r*Hartford* Line 30 re Line 40 ol Standish* La Junta * h Ponca City* Explo his Ponca City ld Line C Crude* Go 0 Los Angeles Medford* eeMount Vernon* ok t Los Angeles Borger CherEas Torrance Cherokee Colton Borger to Amarillo* Blue LineSouth* Glenpool* Ponca Selmer Line O* * CushPo* Albuquerque* K PL Sk AC ATA Line* elly ST Cushing City SA Oklahoma City* Amarillo* -Belvieu Los Angeles AL Borger Oklahoma Crude* * Explor Wichita Falls* Lubbock* Savannah North -

Transportation and Storage

TRANSPORTATION AND STORAGE Baker & O'Brien consultants have considerable experience in the transportation, storage, and distribution of energy raw materials and finished products. We are RELATED SERVICES frequently called upon to analyze the costs associated with truck, rail, pipeline, and/or marine transportation of crude oil, petroleum products, and chemical feedstocks. We Accident/Incident Investigation undertake feasibility studies associated with pipelines and petroleum storage facilities. Asset Valuations We investigate the source and implications of leaks, fires, explosions, and other Due Diligence and Advisor to operating incidents that periodically occur during the operation of such facilities. Our Lenders and Investors consultants have provided evidence and expert testimony regarding proper Engineering, Procurement, and maintenance and safe operating practices for all types of transportation systems. Construction (EPC) Markets and Strategy Merger and Acquisition Support PRIMARY CONTACTS Property Damage and Business Interruption Insurance Claims Technology Assessment Robert L. Beck Consultant Houston William D. Jackson, Ph.D. Consultant Dallas Amy L. Kalt Consultant, Manager of Analytical Services Houston © 2021 Baker & O'Brien, Inc. All rights reserved. 1 of 22 TRANSPORTATION AND STORAGE Charles G. Kemp Vice President, Business Development Manager Dallas RELATED EXPERIENCE Bankruptcy Reorganization Developed, in conjunction with senior management, reorganization plans for various operating segments of a major trading and transport company. The resulting business plan formed the foundation of the company's successful reorganization and emergence from bankruptcy. Bitumen Valuation Study Developed a methodology using a marker crude oil to value bitumen at the production site. Methodology addressed differences in qualities (sulfur, acid number) and refining yields. Transportation costs from the valuation hub to the production site were developed. -

America's Energy Corridor Year Event 1868 Louisiana's First Well, an Exploratory Well Near Bayou Choupique, Hackberry, LA Was a Dry Hole

AAmmeerriiccaa’’ss EEnneerrggyy CCoorrrriiddoorr LOUISIANA Serving the Nation’s Energy Needs LOUISIANA DEPARTMENT OF NATURAL RESOURCES SECRETARY SCOTT A. ANGELLE A state agency report on the economic impacts of the network of energy facilities and energy supply of America’s Wetland. www.dnr.state.la.us America’s Energy Corridor LOUISIANA Serving the Nation’s Energy Needs Prepared by: Louisiana Department of Natural Resources (DNR) Office of the Secretary, Scott A. Angelle Technology Assessment Division T. Michael French, P.E., Director William J. Delmar, Jr., P.E., Assistant Director Paul R. Sprehe, Energy Economist (Primary Author) Acknowledgements: The following individuals and groups have contributed to the research and compilation of this report. Collaborators in this project are experts in their field of work and are greatly appreciated for their time and assistance. State Library of Louisiana, Research Librarians U.S. Department of Energy (DOE) Richard Furiga (Ret.) Dave Johnson Ann Rochon Nabil Shourbaji Robert Meyers New Orleans Region Office Louisiana Offshore Oil Port (LOOP) Louisiana Offshore Terminal Authority (LOTA) La. Department of Transportation and Development (DOTD) Louisiana Oil Spill Coordinator’s Office, Dr. Karolien Debusschere ChevronTexaco and Sabine Pipeline, LLC Port Fourchon Executive Director Ted Falgout Louisiana I Coalition Executive Director Roy Martin Booklet preparation: DNR Public Information Director Phyllis F. Darensbourg Public Information Assistant Charity Glaser For copies of this report, contact the DNR Public Information Office at 225-342-0556 or email request to [email protected]. -i- CONTENTS America’s Energy Corridor LOUISIANA Serving the Nation’s Energy Needs……………………………………………... i Contents…………………………………………………………………………………………………………………………………………….. ii Introduction………………………………………………………………………………………………………………………………………… iii Fact Sheet…………………………………………………………………………………………………………………………………………. -

Large Floating Structure with Free-Floating, Self-Stabilizing Tanks for Hydrocarbon Storage

energies Article Large Floating Structure with Free-Floating, Self-Stabilizing Tanks for Hydrocarbon Storage Jian Dai 1,* , Kok Keng Ang 2,*, Jingzhe Jin 3, Chien Ming Wang 4 , Øyvind Hellan 3 and Arnstein Watn 5 1 Department of Marine Technology, Norwegian University of Science and Technology, 7491 Trondheim, Norway 2 Department of Civil and Environmental Engineering, National University of Singapore, Singapore 117576, Singapore 3 SINTEF Ocean, 7052 Trondheim, Norway 4 School of Civil Engineering, University of Queensland, St Lucia, QLD 4072, Australia 5 SINTEF, 7465 Trondheim, Norway * Correspondence: [email protected] (J.D.); [email protected] (K.K.A.) Received: 30 July 2019; Accepted: 6 September 2019; Published: 10 September 2019 Abstract: Hydrocarbon is a major source of energy for sustainable development. Storage of hydrocarbon products, however, requires a significant amount of land space to land-scarce countries like Singapore. This paper presents an alternative way of storing hydrocarbon in Singapore coastal waters through the innovative design of a floating hydrocarbon storage facility. The design comprises free-floating and self-stabilizing tanks enclosed by barges that form a floating hydrocarbon storage facility. The tanks are made of prestressed concrete and they are designed to be self-stabilized when floating in the sea water. Owing to the lack of available design guidelines, design requirements on the stability and motion criteria for floating storage tanks are developed based on a review of existing codes of practice and design specifications for both onshore tanks and offshore vessels. A comprehensive study on the hydrostatic performance of various proposed floating tank design concepts with different storage capacities is carried out. -

Nord Stream 2

Updated August 24, 2021 Russia’s Nord Stream 2 Natural Gas Pipeline to Germany Nord Stream 2, a natural gas pipeline nearing completion, is which accounted for about 48% of EU natural gas imports expected to increase the volume of Russia’s natural gas in 2020. Russian gas exports to the EU were up 18% year- export capacity directly to Germany, bypassing Ukraine, on-year in the first quarter of 2021. Factors behind reliance Poland, and other transit states (Figure 1). Successive U.S. on Russian supply include diminishing European gas Administrations and Congresses have opposed Nord Stream supplies, commitments to reduce coal use, Russian 2, reflecting concerns about European dependence on investments in European infrastructure, Russian export Russian energy and the threat of increased Russian prices, and the perception of many Europeans that Russia aggression in Ukraine. The German government is a key remains a reliable supplier. proponent of the pipeline, which it says will be a reliable Figure 1. Nord Stream Gas Pipeline System source of natural gas as Germany is ending nuclear energy production and reducing coal use. Despite the Biden Administration’s stated opposition to Nord Stream 2, the Administration appears to have shifted its focus away from working to prevent the pipeline’s completion to mitigating the potential negative impacts of an operational pipeline. Some critics of this approach, including some Members of Congress and the Ukrainian and Polish governments, sharply criticized a U.S.-German joint statement on energy security, issued on July 21, 2021, which they perceived as indirectly affirming the pipeline’s completion. -

Winning the Oil Endgame: Innovation for Profits, Jobs, and Security Oil Dependence

“We’ve embarked on the beginning of the Last Days of the Age of Oil. Nations of the world that are striving to modernize will make choices different from the ones we have made. They will have to. And even today’s industrial powers will shift energy use patterns....[T]he market share for carbon-rich fuels will diminish, as the demand for other forms of energy grows. And energy companies have a choice: to embrace the future and recognize the growing demand for a wide array of fuels; or ignore reality, and slowly—but surely—be left behind.” —Mike Bowlin, Chairman and CEO, ARCO, and Chairman, American Petroleum Institute, 9 Feb. 1999 1 “My personal opinion is that we are at the peak of the oil age and at the same time the begin- ning of the hydrogen age. Anything else is an interim solution in my view. The transition will be very messy, and will take many and diverse competing technological paths, but the long- term future will be in hydrogen and fuel cells.” —Herman Kuipers, Business Team Manager, Innovation & Research, Shell Global Solutions, 1. Bowlin 1999. 21 Nov. 2000 2 2. Kuipers 2000. “The days of the traditional oil company are numbered, in part because of emerging technolo- gies such as fuel cells....” 3. Bijur, undated. — Peter I. Bijur, Chairman and CEO, Texaco, Inc., late 1990s 3 4. Ingriselli 2001. “Market forces, greenery, and innovation are shaping the future of our industry and propelling 5. Gibson-Smith 1998. us inexorably towards hydrogen energy. Those who don’t pursue it…will rue it.” — Frank Ingriselli, President, Texaco Technology 6. -

GECF Annual Statistical Bulletin 2019 3Rd Edition

1 2 GECF Annual Statistical Bulletin 2019 3rd edition Authors and Contributors Namely in Alphabetical Order Amira Remadna Data Analysis and Research Diana Cueto ICT and Software Support Katrien Hermans Public Relations and Marketing Maria Arteaga Graphic Design & Administrative Support Mohamed Arafat Data Engineering and Curation Mona Shokripour, PhD Data Modelling and Integration Rixio Morales, PhD ICT Solutions Architect and Maintenance Roberto Arenas Lara, PhD Team Leader 3 Disclaimer The GECF Annual Statistical Bulletin (ASB) 2019 is the result of the data gathering collection and processing obtained directly from GECF Member and Observer Countries through the GECF Data Exchange Mechanism and in part using processed data from secondary sources examined and analysed by GECF Secretariat. The data contained in the GECF ASB 2019 are for information purposes only and do not necessary reflect the views of GECF Member and Observer Countries. Neither GECF Secretariat nor any of GECF Member and Observer Countries nor any of their agents or their employees are liable for any errors in or omissions from such information and materials and does not assume any liability or responsibility for the accuracy completeness or reasonableness of data. Unless copyrighted by a third party, the information presented in the GECF ASB 2019 may be used and/or reproduced for research educational and other non-commercial purposes without GECF Secretariat’s prior written permission provided, fully acknowledging GECF as the copyright holder. Written permission from GECF Secretariat is required for any commercial use. The GECF ASB 2019 contains references to materials from third parties. GECF Secretariat will not be responsible for any unauthorized use of third party materials. -

For Health and Climate: Retiring Coal-Fired Electricity and Promoting Sustainable Energy Transition in Developing Countries Author: by Donald P

For Health and Climate: Retiring Coal-Fired Electricity and Promoting Sustainable Energy Transition in Developing Countries Author: By Donald P. Kanak1 Abstract • Coal fuels 38% of global electricity and there are plans to build over 1,000 new coal-fired power plants, mostly in the developing countries with growing energy needs. • Carbon emissions from those current and planned power plants will prevent the world from achieving the 1.5⁰C climate scenarios that call for a reduction of coal-fired electricity from 38% to 9% of total generation by 2030 and to 0.6% by 2050. • ESG initiatives are resulting in leading global financial institutions exiting and/or avoiding new investments in coal, but other buyers are stepping in; thus, many existing and planned coal assets are likely, without intervention, to continue to operate well beyond 2030-2050. • Proposed solution: Coal Retirement Mechanisms (CRMs) financial facilities that purchase coal-fired power plants in developing countries from existing owners and retire the plants in 10-15 years vs. typical 30-40 years of operation. Funds paid to current owners of coal-fired power plants to be recycled into new greenfield sustainable power. • The CRM’s capital would come from developed countries, multilateral development banks, climate funds and/or blended finance. Those investors would be paid back from the power plants’ operating revenues, but at a lower rate of return reflecting today’s low costs of funds. Supplementary revenue from carbon credits, transfer of fossil fuel subsidies, or energy surcharges might be used to meet or accelerate the retirement date. • Parallel to the CRM, a Sustainable Energy Transition Mechanism (SETM) will provide host countries with both financial and technical assistance to accelerate transition towards renewables (including storage, transmission, and distribution infrastructure). -

Europe Gas Tracker Report 2021

Europe Gas Tracker Report 2021Mason Inman, Greig Aitken, Scott Zimmerman EUROPE GAS TRACKER REPORT 2021 Global ABOUT GLOBAL PERMISSION FOR NONCOMMERCIAL USE Energy ENERGY MONITOR This publication may be reproduced in whole or in part and Monitor Global Energy Monitor (GEM) is a in any form for educational or nonprofit purposes without network of researchers developing collaborative informa- special permission from the copyright holders, provided tional resources on fossil fuels and alternatives. Current that acknowledgement of the source is made. No use of this projects include: publication may be made for resale or other commercial ■ Global Coal Plant Tracker purpose without the written permission of the copyright holders. Copyright © April 2021 by Global Energy Monitor. ■ Global Fossil Infrastructure Tracker ■ Europe Gas Tracker FURTHER RESOURCES ■ Global Gas Plant Tracker The Europe Gas Tracker includes project-level data in ■ Global Coal Mine Tracker spreadsheets, methodology notes, and an interactive global ■ Global Steel Plant Tracker map. To obtain primary data from the Europe Gas Tracker, ■ The Gas Index please use our request form. ■ CoalWire newsletter ■ GEM.wiki energy wiki ABOUT THE COVER Cover photo: Construction of the Krk LNG Terminal in ABOUT THE EUROPE GAS TRACKER Croatia. Courtesy of Balkan Investigative Reporting Network. The Europe Gas Tracker is an online database that identifies, maps, describes, and categorizes gas infrastructure in the European Union and surrounding nations, including gas pipelines, liquified natural gas (LNG) terminals, gas-fired power plants, and gas fields. Developed by Global Energy Monitor, the tracker uses footnoted wiki pages to document each project. AUTHORS Mason Inman is Oil and Gas Program Director, Greig Aitken is Research Analyst, Scott Zimmerman is Researcher at Global Energy Monitor. -

Reply Comments of America’S Power Regarding the Commission’S Proposed Policy Statement

UNITED STATES OF AMERICA BEFORE THE FEDERAL ENERGY REGULATORY COMMISSION Carbon Pricing in FERC-Jurisdictional ) Organized Regional Wholesale Electric ) Docket No. AD20-14-000 Energy Markets ) REPLY COMMENTS OF AMERICA’S POWER REGARDING THE COMMISSION’S PROPOSED POLICY STATEMENT SUMMARY OF REPLY COMMENTS America’s Power submits these Reply Comments following the Initial Comments that were filed by at least 70 parties, including America’s Power, in response to the Commission’s Proposed Policy Statement on Carbon Pricing in Organized Wholesale Electricity Markets (“Policy Proposal”). i Our Initial Comments urged the Commission to withdraw its Policy Proposal and terminate Docket No. AD20-14-000. One of our major concerns is that the Commission’s statement of “encouragement” to consider carbon pricing could be misconstrued as a signal that states should adopt carbon prices and enable grid operators to submit new market rules for FERC approval. Such a signal would exceed FERC’s authority. On the other hand, if the Commission finalizes its Policy Statement, our Initial Comments urged the Commission to clarify its intent ii and to take into account certain considerations when reviewing carbon pricing proposals from ISOs/RTOs. iii After reviewing the Initial Comments of other parties, we continue to urge the Commission to withdraw its Policy Proposal and terminate the docket. However, we have modified our recommendation. Our recommendation now is that the Commission — • Withdraw the Policy Proposal and terminate the docket, as we urged the Commission