Management Information Circular

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 2 March 2021 Flutter Entertainment

2 March 2021 Flutter Entertainment plc - 2020 Preliminary Results Transformational year for Group; Earnings ahead of expectations Flutter Entertainment plc (the “Group”) announces preliminary results for year ended 31 December 2020. Reported1 Pro forma2 2020 2019 2020 2019 CC3 £m £m YoY % £m £m YoY % YoY % Group revenue4 4,398 2,140 +106% 5,264 4,144 +27% +28% Adjusted5 Group EBITDA6 excluding US 1,037 462 +125% 1,401 1,170 +20% +23% Adjusted Group EBITDA 889 425 +109% 1,231 1,089 +13% +16% Profit before tax 1 136 -99% Earnings per share7 29.3p 180.2p -84% Adjusted earnings per share 402.7p 298.4p +35% 496.6p 415.7p +19% Net debt at year end8 2,814 265 Operational highlights • Transformational year for Group - Unparalleled scale and diversification achieved following merger with The Stars Group, Inc (“TSG”) - Accelerated buy-out of minority shareholders in FanDuel at compelling valuation - Reinforced balance sheet to support investment and growth • Excellent momentum with 19% growth in recreational players9 across Group - Acceleration of channel shift from retail to online and increased share of entertainment spend • Further investment in safer gambling initiatives to ensure sustainable growth - Enhanced predictive technology; increase in safer gambling tool usage by customers - Advocating a customer driven approach to affordability • Merger integration progressing well - Australian integration complete, PokerStars strategy in place and core momentum maintained - Annualised cost synergies now expected to be £170m, up from £140m previously -

The Stars Group and FOX Sports Announce Historic U.S. Media and Sports Wagering Partnership

The Stars Group and FOX Sports Announce Historic U.S. Media and Sports Wagering Partnership May 8, 2019 Toronto and Los Angeles, May 8, 2019 – The Stars Group Inc. (Nasdaq: TSG)(TSX: TSGI) and FOX Sports, a unit of Fox Corporation (Nasdaq: FOXA, FOX), today announced plans to launch FOX Bet, the first-of-its kind national media and sports wagering partnership in the United States. The Stars Group and FOX Sports have entered a long-term commercial agreement through which FOX Sports will provide The Stars Group with an exclusive license to use certain FOX Sports trademarks. The Stars Group and FOX Sports expect to launch two products in the Fall of 2019 under the FOX Bet umbrella. One will be a nationwide free-to-play game, awarding cash prizes to players who correctly predict the outcome of sports games. The second product, which will be named FOX Bet, will give customers in states with regulated betting the opportunity to place real money wagers on the outcome of a wide range of sporting events in accordance with the applicable laws and regulations. In addition to the commercial agreement of up to 25 years and associated product launches, Fox Corporation will acquire 14,352,331 newly issued common shares in The Stars Group, representing 4.99% of The Stars Group’s issued and outstanding common shares, at a price of $16.4408 per share, the prevailing market price leading up to the commencement of exclusive negotiations. The Stars Group currently intends to use the aggregate net proceeds of approximately $236 million for general corporate purposes and to prepay outstanding indebtedness on its first lien term loans. -

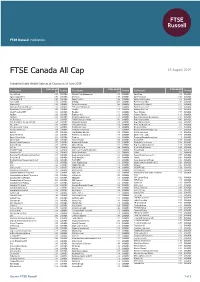

FTSE Publications

2 FTSE Russell Publications 19 August 2019 FTSE Canada All Cap Indicative Index Weight Data as at Closing on 28 June 2019 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Aecon Group 0.05 CANADA Element Fleet Management 0.19 CANADA Onex Corp 0.3 CANADA Agnico Eagle Mines 0.73 CANADA Emera Inc 0.58 CANADA Open Text Corp 0.65 CANADA Air Canada Cl B 0.25 CANADA Empire Co Cl A 0.26 CANADA Osisko Gold Royalties 0.1 CANADA Alacer Gold 0.06 CANADA Enbridge 4.35 CANADA Pan American Silver 0.16 CANADA Alamos Gold 0.14 CANADA Encana Corporation 0.46 CANADA Paramount Res Class A 0.02 CANADA Algonquin Power & Utilities Co 0.36 CANADA Endeavour Mining Corp. 0.07 CANADA Parex Resources Inc 0.14 CANADA Alimentation Couche-Tard B 1.63 CANADA Enerflex 0.07 CANADA Parkland Fuel Corp. 0.28 CANADA Allied Properties REIT 0.24 CANADA Enerplus 0.11 CANADA Pason Systems 0.07 CANADA AltaGas. 0.25 CANADA Enghouse Sys 0.06 CANADA Pembina Pipeline 1.14 CANADA Aphria Inc 0.09 CANADA Ensign Energy Services 0.03 CANADA Peyto Exploration & Development 0.03 CANADA Arc Resources 0.1 CANADA Fairfax Financial Holdings 0.81 CANADA Power Corp Canada 0.46 CANADA Artis Real Estate Investment Trust 0.07 CANADA Finning International 0.18 CANADA Power Financial Corp 0.32 CANADA Atco Class I 0.15 CANADA First Capital Realty 0.16 CANADA PrairieSky Royalty Ltd 0.2 CANADA ATS Automation Tooling 0.07 CANADA First Majestic Silver 0.08 CANADA Precision Drilling 0.03 CANADA Aurora Cannabis Inc 0.38 CANADA First National Financial 0.02 CANADA Premium Brands Holdings Corp 0.12 CANADA B2Gold 0.18 CANADA First Quantum Minerals 0.39 CANADA Pretium Resources 0.1 CANADA Bank of Montreal 2.93 CANADA FirstService Corporation 0.18 CANADA Quebecor Inc. -

Quarterly Commentary 18 AM Canadian Equity Portfolio March 31, 2020

Quarterly Commentary 18 AM Canadian Equity Portfolio March 31, 2020 18 AM Canadian Equity Highlights The 18 AM Canadian Equity portfolio is uniquely positioned, with 50/50 exposure to two focused style portfolios, Offence (growth and momentum) and Defence (income, quality and low risk). We manage the Offence and Defence styles independently, using 15-stock portfolios of companies that exhibit attractive balance sheet and income statement fundamentals (factors) of the respective style. As of the close of 2019, the 18 AM Canadian Equity portfolio reached a 6-year track record. Over that period, the portfolio realized objectives by: ✓ Outperforming the benchmark S&P/TSX Composite (TSX) in 5 of 6 calendar years, and overall since inception before fees. ✓ Experiencing a lower risk profile versus the TSX, evidenced by having both a lower volatility, and by losing less during calendar years when the index declined. ✓ Maintaining a fundamental profile that is superior to the benchmark across a variety of impactful factors as intended within each style, such as: i) a lower Price/Earnings ratio, ii) higher Return on Equity, iii) better Earnings Growth and iv) enhanced Yield. Details of the portfolio and style performance are shown in the following table. Since Inception Performance Q1 2020 1 Year 3 Year 5 Year Return Volatility Offence* -25.6% -20.0% -3.6% -2.1% 0.2% 14.1% Defence* -15.9% -7.7% 0.9% 4.1% 6.3% 10.0% Portfolio** -20.8% -13.9% -1.1% 1.1% 3.3% 11.1% Benchmark -20.9% -14.2% -1.9% 0.9% 2.8% 11.4% *The chart depicts performance data for the style portfolios managed by 18 AM and is for information purposes only. -

Mount Allison University Endowment Fund Holdings As of December 31, 2017

Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) EQUITY HOLDINGS Canadian Holdings 5N PLUS INC $ 155 ABSOLUTE SOFTWARE CORP $ 851 ACADIAN TIMBER CORP $ 302 ADVANTAGE OIL & GAS LTD $ 283,788 AECON GROUP INC $ 1,728 AFRICA OIL CORP $ 684 AG GROWTH INTERNATIONAL INC $ 1,163 AGELLAN COMMERCIAL REAL ESTATE $ 349 AGF MANAGEMENT LTD $ 990 AGNICO-EAGLE MINES LTD $ 427,207 AGT FOOD AND INGREDIENTS INC $ 653 AIMIA INC $ 832 AIR CANADA INC $ 325,411 AIRBOSS OF AMERICA CORP $ 315 ALACER GOLD CORP $ 1,289 ALAMOS GOLD INC $ 2,216 ALAMOS GOLD INC NEW COM CLASS A $ 4,877 ALARIS ROYALTY CORP $ 1,107 ALGOMA CENTRAL CORP $ 330 ALIMENTATION COUCHE-TARD INC $ 98,854 ALIO GOLD INC $ 472 ALLIED PROPERTIES REAL ESTATE INVESTMENT TRUST $ 2,575 ALTIUS MINERALS CORP $ 1,233 ALTUS GROUP LTD/CANADA $ 1,916 ANDREW PELLER LTD $ 1,448 ARGONAUT GOLD INC $ 656 ARTIS REAL ESTATE INVESTMENT TRUST $ 1,539 ASANKO GOLD INC $ 209 ATCO LTD $ 119,947 ATHABASCA OIL COP $ 703 ATS AUTOMATION TOOLING SYSTEMS INC $ 1,769 AURICO METALS INC $ 311 AUTOCANADA INC $ 1,128 AVIGILON CORP $ 1,258 B2GOLD CORP $ 29,898 BADGER DAYLIGHTING LTD $ 1,525 BANK OF MONTREAL $ 725,449 BANK OF NOVA SCOTIA $ 2,019,757 BARRICK GOLD CORP $ 459,749 BAYTEX ENERGY CORP $ 1,213 BCE INC $ 791,441 BELLATRIX EXPLORATION LTD $ 94 BIRCHCLIFF ENERGY LTD $ 1,479 BIRD CONSTRUCTION INC $ 731 1 Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) BLACK DIAMOND GROUP LTD $ 95 BLACKBERRY LIMITED $ 151,777 BLACKPEARL RESOURCES INC $ 672 BOARDWALK REAL ESTATE INVESTMENT TRUST $ 1,610 BONAVISTA ENERGY CORP $ 686 BONTERRA ENERGY CORP $ 806 BORALEX INC $ 2,276 BROOKFIELD ASSET MANAGEMENT INCORPORATED $ 672,870 BROOKFIELD INFRASTRUCTURE PARTNERS L.P. -

BCI's 2018 Responsible Investing Annual Report

Responsible Investing Annual Report 2018 British Columbia Investment Management Corporation Table of Contents 2018 Highlights ...............................................................1 Private Markets .............................................................22 To Our Clients ..................................................................2 Mortgage ..................................................................23 BCI and Responsible Investing ......................................3 Real Estate ................................................................24 BCI's Responsible Investing Principles .........................4 Infrastructure & Renewable Resource ..................26 Climate Action .................................................................5 Private Equity ...........................................................27 Climate Action Plan ...................................................6 Corporate Updates & Collaboration ...........................28 Public Markets .................................................................8 Corporate Reporting & Disclosure ........................29 Public Equities ............................................................9 BCI's PRI Involvement .............................................30 Fixed Income ............................................................20 Collaboration ...........................................................32 Appendices ...................................................................34 1 — BCI's Policy Submissions .................................35 -

Week 16 Newsletter

The Sunday Investor Week 16: Ending April 17, 2020 An Introduction For subscribers, new and old. First of all, thank you to all my subscribers, including brand new ones and for those Basic fundamental metrics such as return on equity, price-earnings ratios, free cash who signed up to receive this newsletter almost a year ago when I first started The flow per share, earnings per share, and interest coverage ratios – they’re all freely Sunday Investor. Administering this website has brought out the true passion I available on many websites in the form of stock screeners, but even some of the have for the investing industry and each time I get a new subscriber, it motivates best stock screeners don’t allow you to filter for exactly what you need. me to keep going. I hope you find The Sunday Investor to be a reliable and useful source as you seek to achieve your investment goals. Here you will find the tools you need to keep track of your Canadian and U.S. equity holdings. I maintain a weekly total return tracker for all S&P/TSX Composite Prior to starting my website, I had been noticing a gap in the information the and S&P 500 issuers, and provide several fundamental monthly reports depending average investor has access to on popular investment and financial planning on your investment strategy. I routinely write about the importance of developing websites. While a lot of data is publicly available, many websites do a poor job of a low-volatile portfolio aimed at maximizing the Sharpe Ratio, behavioural finance compiling this information into a format that is easily digestible. -

Creating a Global Leader in Sports Betting and Gaming

Creating a global leader in sports betting and gaming Combination of Flutter Entertainment plc and The Stars Group Inc. Disclaimer NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN OR INTO ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION Cautionary Note Regarding Forward Looking Statements This presentation contains forward-looking statements and information within the meaning of applicable securities laws, including the US Private Securities Litigation Reform Act of 1995, including, without limitation, as it relates to the possible combination of Flutter and The Stars Group (“Possible Combination”) as referenced herein, as well as certain expectations with respect to the same and certain future operational and growth plans and strategies. Forward-looking statements and information can, but may not always, be identified by the use of words such as “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might“, "would”, “should”, “believe”, “objective”, “ongoing”, “imply”, “assumes”, “goal”, “likely” and similar references to future periods or the negatives of these words and expressions. These statements and information, other than statements of historical fact, are based on current expectations of management and are subject to a number of risks, uncertainties, and assumptions, including market and economic conditions, business prospects or opportunities, future plans and strategies, -

STOXX Canada 50 Last Updated: 03.12.2018

STOXX Canada 50 Last Updated: 03.12.2018 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) CA7800871021 2754383 RY.TO RY Royal Bank of Canada CA CAD Y 93.5 1 1 CA8911605092 2897222 TD.TO TDpD Toronto-Dominion Bank CA CAD Y 90.2 2 2 CA0641491075 2076281 BNS.TO BNS Bank of Nova Scotia CA CAD Y 59.2 3 3 CA29250N1050 2466149 ENB.TO IPL Enbridge Inc. CA CAD Y 49.5 4 6 CA1363751027 2180632 CNR.TO TCNR Canadian National Railway Co. CA CAD Y 48.5 5 5 CA8672241079 B3NB1P2 SU.TO T.SU Suncor Energy Inc. CA CAD Y 46.7 6 4 CA0636711016 2076009 BMO.TO BMO Bank of Montreal CA CAD Y 42.2 7 7 CA1125851040 2092599 BAMa.TO TEBC.A BROOKFIELD ASSET MANAGEMENT CA CAD Y 35.2 8 9 CA05534B7604 B188TH2 BCE.TO B BCE Inc. CA CAD Y 34.0 9 10 CA1360691010 2170525 CM.TO 217052 Canadian Imperial Bank of Comm CA CAD Y 32.8 10 8 CA89353D1078 2665184 TRP.TO TRP TransCanada Corp. CA CAD Y 32.1 11 12 CA56501R1064 2492519 MFC.TO 274642 Manulife Financial Corp. CA CAD Y 29.0 12 14 CA67077M1086 BDRJLN0 NTR.TO POT NUTRIEN CA CAD Y 28.6 13 13 CA1363851017 2171573 CNQ.TO TCNQ Canadian Natural Resources Ltd CA CAD Y 27.2 14 11 CA13645T1003 2793115 CP.TO 279311 Canadian Pacific Railway Ltd. CA CAD Y 26.9 15 15 CA01626P4033 2011646 ATDb.TO 201164 ALIMENTATION CCH.TARD CA CAD Y 20.0 16 17 CA8667961053 2566124 SLF.TO 256612 Sun Life Financial Inc. -

2019 Diversity Disclosure Practices: Women in Leadership Roles at TSX

2019 Diversity Disclosure Practices Women in leadership roles at TSX-listed companies By Andrew MacDougall and John Valley, co-authors and project leaders. And by Jennifer Jeffrey, co-author, and Ramz Aziz, Madison Black, Jennifer Cao, Marleigh Dick, Dhananjay Ghildyal, Sunia Hassan, Aly Kim, Bradley Lastman, Reba Nauth, Janice To and Tiye Traore. DIVERSITY DISCLOSURE PRACTICES Osler, Hoskin & Harcourt llp Table of contents INTRODUCTION 3 1. Developments in diversity: Diversity and disclosure beyond gender 6 2. Our methodology 13 3. 2018 full-year results 15 4. Mid-year results for 2019: Women on boards 20 5. Mid-year results for 2019: Women in executive officer positions 30 6. The road to gender parity – Who has achieved it and practices disclosed by companies for increasing female representation 39 7. Going above and beyond – Best company disclosure 47 The 2019 Diversity Disclosure Practices report provides general information only and does not constitute legal or other professional advice. Specific advice should be sought in connection with your circumstances. For more information, please contact Osler’s Corporate Governance group. 2 DIVERSITY DISCLOSURE PRACTICES Osler, Hoskin & Harcourt llp Introduction In this, our fifth annual comprehensive report examples of excellence in disclosure and we report on diversity disclosure practices relating on the number of board committees that are to women in leadership roles by TSX-listed chaired by women. However, we continue to see companies, we highlight the achievement almost no increase in the proportion of female of some key benchmarks that reflect a collective executive officers. In addition, we note a gradual commitment to increasing board diversity. -

Q1 2018 – TSX Quarterly Review

Linde Equity Research TSX Performance Review 2018 Q1: TSX delivers weakest quarter since 2015-Q3 Ten of eleven sectors down in Q1 with only Information Technology bucking the trend 2018 Q1 Capped Sector Performance Information Technology 9.58% -0.67% Real Estate -1.90% Industrials -3.40% Consumer Discretionary -4.22% Financials -4.57% Materials -5.19% S&P/TSX Composite -5.38% Consumer Staples -6.95% Utilities -7.76% Telecommunications Services -8.09% Energy -11.78% Health Care -15% -10% -5% 0% 5% 10% 15% • The S&P/TSX Composite returned -5.2% in Q1. 2018 Index Returns Q1 YTD • Of the 252 stocks that were in the TSX S&P/TSX Composite -5.19% -5.19% Composite at some point during Q1, 78 (31%) recorded a gain. S&P/TSX 60 (Large Cap) -5.28% -5.28% • In Q1, the Composite, Large Cap (TSX 60) and S&P/TSX Completion (Mid) -4.92% -4.92% Mid Cap (Completion Index) performed broadly S&P/TSX Small Cap -8.22% -8.22% similarly, while Small Cap lagged. • In Q1, the Canadian market underperformed the Q1 Biggest Contributors Q1 Biggest Detractors US market in home currency terms (US returned -1.2%) and in Canadian dollar terms (US market Shopify Enbridge returned +1.5% in C$ terms). Constellation Software Canadian National Railway • Ten of eleven market sectors posted losses. The Bombardier TransCanada Corporation worst performing sectors were Health Care and Energy. Rising interest rates caused higher CGI Group Canadian Natural Resources dividend yielding sectors to underperform, Goldcorp Royal Bank of Canada causing Telecommunications Services and Utilities to also appear on the list of worst CCL Industries Manulife Financial performing sectors. -

Board Shareholder Confidence Index 2018

Clarkson Centre for Board Effectiveness Board Shareholder Confidence Index 2018 Developed in spring 2003, the Board Shareholder Confidence Index comprises factors often used by active shareholders to assess Boards of Directors.* While there are other variables not in our model that contribute to the effectiveness of Boards -- including elements that can only be observed from inside the boardroom -- we capture factors affecting shareholders’ confidence in the Boards’ abilities to fulfill their duties. These factors are different from the TSX Guidelines for effective corporate governance in that they take into account the shareholders’ perception of risk. Based on factors available to those outside the walls of the boardroom, we evaluate and rank Boards of Directors by their potential to act in an effective way and by their performance, as indicated by past practices. The score is developed using four linked steps. The result is a transparent, objective, and adaptable rating system that assigns companies listed on the S&P/TSX Composite Index a score out of 150. *Please see the BSCI 2018 Methodology for further details. Sections in Report: 1 - Totals (11 pages) 2 - Individual Potential (11 pages) 3 - Group Potential (7 pages) 4 - Board DecisionBOARD Output DECISION (7 pages) OUTPUT Information on scoring can be found on our website at http://uoft.me/3Nx Joseph L. Rotman School of Management Tel: (416) 978-8998 105 St. George Street, Toronto, Ontario M5S 3E6 1/34 Email: [email protected] Clarkson Centre for Board Effectiveness