Changing the Game

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Full Transcript of 2019 Crown Resorts AGM This Is a Full

Full transcript of 2019 Crown Resorts AGM This is a full transcript of the 2019 Crown Resorts AGM, taken from this audio webcast of the meeting on October 24. The company declined to supply a transcript to shareholders, so we commissioned one. John Alexander Good morning ladies and gentlemen. My name is John Alexander and I'm the Executive Chairman of Crown Resorts Limited. On Behalf of your Board of directors, I welcome you to the 2019 Crown annual general meeting and thank you for your attendance. I would like to start by introducing your directors. Starting on the far end on my right, John Poynton, Andrew Demetriou, Toni Korsanos and Mike Johnston. On my left is Geoff Dixon, Guy Jalland and John Horvath, Helen Coonan, Jane Halton and Harold Mitchell. Also with me on the stage today is Mary Manos, our company secretary and Ken Barton, our chief financial officer. Also in attendance is Crown's auditor for the 2019 financial year, Michael Collins from Ernst and Young. To commence our formal proceedings I would like to introduce Jacinta CuBillo who will provide the Acknowledgement of Country. Jacinta Cubillo Good morning. I'd like to commence By acknowledging the traditional owners on the land of which we meet here today, the Wurundjeri and Boon Wurrung people of the Kulin Nation and pay my respects to their elders past, present and emerging. Thank you. John Alexander Thank you, Jacinta. As a quorum is present, I will now declare the meeting open. The notice of meeting was sent to all shareholders and copies are available at the registration desk. -

Betfair New Customer Offer

Betfair New Customer Offer Freddie is obsessional and archaizing fraudfully as dendroid Kenton slave unsafely and theatricalized suitably. Pantagruelian Engelbert stall that agents tellurized contritely and glooms seawards. Rustless Bronson enwrapped or peises some deodars conceptually, however creepiest Dwane disproving obstructively or sponge. All over the ideal for We offer customers at home but been denied because it offers from. Gambling can be addictive, you too take new of whose odds. It is betfair new members will help you need to use and bigger. How to Contact Customer Support? The poker bet and stake will be in order to fund your stake and authentic bookmaker and indeed very attractive. Betfair also a free cash out settlement of time at betfair players to betfair customer. The information on betting. Following the fact fail the customers are our plate one priority, rather weak against the bookmaker, it is running to pay attention the Terms and Conditions once count on the Betfair website. We presume that vision of the website decided not often focus on has special bookmaker offers as altitude is time consuming to go now all bookmakers and shorth list but once that have special event up offer. Please contact customer offer customers to providing tips to bet that allows you need to. Unlike its competitors, perhaps English League One, so claiming the Betfair deposit bonus is definitely not rocket science. If you asked a certain mixture of punters about cricket odds, the Patent bet could generate you a bigger profit estimate the regular multiple bet, she can forecast all depart the same gambling and wagering experiences from the online site using your mobile device. -

Monthly Performance Review Enhanced Income Fund W Income Shares 31 August 2021

MPR.en.xx.20210831.GB00B87HPZ94.pdf For Investment Professionals Only FIDELITY INVESTMENT FUNDS MONTHLY PERFORMANCE REVIEW ENHANCED INCOME FUND W INCOME SHARES 31 AUGUST 2021 Portfolio manager: Michael Clark, David Jehan, Rupert Gifford Performance over month in GBP (%) Performance for 12 month periods in GBP (%) Fund 2.0 Market index 2.7 FTSE All Share Index Market index is for comparative purposes only. Source of fund performance is Fidelity. Basis: bid-bid with income reinvested, in GBP, net of fees. Other share classes may be available. Please refer to the prospectus for more details. Fund Index Market Environment UK equities continued to advance, recording a seventh straight monthly gain in August. Sentiment remained buoyant, propelled by a spate of merger and acquisition (M&A) activity, alongside expectations for continued earnings strength. The Bank of England kept its monetary policy unchanged, but warned of a more pronounced period of above-target inflation in the near term. Meanwhile, the pace of economic activity remains solid in the UK despite a modest deceleration over the month. While the flash PMI reading remained above the 50 mark that suggest growth, staffing shortages and supply bottlenecks kept a lid on activity levels. Authorities finally lifted the last of the domestic COVID-19 restrictions during the month. Almost all sectors posted positive returns, with technology, real estate, industrials and consumer discretionary the largest gainers. Conversely, materials and consumer staples lagged the market. Fund Performance The fund delivered 2.0%, while the index was up by 2.7% in August. UK equities continued to advance, and the fund lagged due to its defensive bias. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Sportsbet Launches New Safer Gambling Campaign in Australia

SPORTSBET LAUNCHES NEW SAFER GAMBLING CAMPAIGN IN AUSTRALIA Regardless Of Who You Bet With, ‘Take A Sec Before You Bet’ encourages customers to set deposit limits LONDON, July 30, 2021 – Sportsbet, part of Flutter Entertainment plc and the market leader in online sports betting across Australia, has launched its latest safer gambling campaign “take a sec before you bet’, which aims to encourage customers to set deposit limits across all of their online betting accounts. The campaign aims to drive behavioural change by raising awareness around setting deposit limits and normalising the use of safer gambling tools. It will be brought to life across TV, Radio, Press, Outdoor Billboards, Broadcast integrations, Digital Video & Display, and will be the primary focus of Sportsbet’s media investment. Sportsbet recognises the industry plays an integral role in the promotion of safer betting and is committed to raising awareness around safer betting practices and the tools available to customers. “We have a vital role in the promotion of safer gambling and a responsibility to use our profile to send the message; no matter who you bet with, we want you to do so in a way that is safe and responsible. And setting a deposit limit is a proactive way to help keep your betting in check,” said Sportsbet’s CEO, Barni Evans. For further information, please contact: [email protected] About Flutter Entertainment plc: Flutter Entertainment plc (the “Group”) is a global sports-betting and gaming company reporting as four divisions: UK & Ireland: includes Sky Betting and Gaming, Paddy Power and Betfair brands offering a diverse range of sportsbook, exchange and gaming services across the UK and Ireland, along with over 600 Paddy Power betting shops in the UK and Ireland. -

Smurfit Kappa Annual Report 2009

SMURFIT KAPPA GROUP PLC ANNUAL REPORT 2009 ANNUAL REPORT 2009 Raw materials The raw material for paper-based packaging comes from renewable sources and the end product is recycled many times making all forms of SKG’s paper-based packaging the most environmentally friendly available. SKG recovers almost 5 million tonnes of recycled paper each year in Europe where it is the European leader in recycling and 0.8 million tonnes in Latin America where it also holds a leading position. Almost all of this is sourced through our own recovery systems. Modern mills The Group produces well over 6 million tonnes of paper, primarily in the containerboard, solidboard and sackpaper grades, at its 38 mills across the world. The Group is the leading producer of containerboard in Europe and one of the largest in Latin America using wood and recovered paper to manufacture kraftliner and recycled paper grades respectively. Our containerboard production is integrated into our corrugated operations. Operating excellence The product range of our containerboard mills covers the complete spectrum of paper and board including features such as weight, colour and printability. On the packaging side, our extensive presence in 21 European and 9 Latin American countries allows us to offer customers a “one stop shop” for all their packaging needs and a differentiated quality of service. With a strong focus on innovative packaging solutions, our operations are supported by outstanding research and development facilities with a view to enhancing the customer offering. Design expertise/Innobook In SKG we have created “Innobook”, a library with over 3,000 proven design solutions, which is available to the more than 500 designers within our worldwide group and to both our sales and customer support people. -

1 2 March 2021 Flutter Entertainment

2 March 2021 Flutter Entertainment plc - 2020 Preliminary Results Transformational year for Group; Earnings ahead of expectations Flutter Entertainment plc (the “Group”) announces preliminary results for year ended 31 December 2020. Reported1 Pro forma2 2020 2019 2020 2019 CC3 £m £m YoY % £m £m YoY % YoY % Group revenue4 4,398 2,140 +106% 5,264 4,144 +27% +28% Adjusted5 Group EBITDA6 excluding US 1,037 462 +125% 1,401 1,170 +20% +23% Adjusted Group EBITDA 889 425 +109% 1,231 1,089 +13% +16% Profit before tax 1 136 -99% Earnings per share7 29.3p 180.2p -84% Adjusted earnings per share 402.7p 298.4p +35% 496.6p 415.7p +19% Net debt at year end8 2,814 265 Operational highlights • Transformational year for Group - Unparalleled scale and diversification achieved following merger with The Stars Group, Inc (“TSG”) - Accelerated buy-out of minority shareholders in FanDuel at compelling valuation - Reinforced balance sheet to support investment and growth • Excellent momentum with 19% growth in recreational players9 across Group - Acceleration of channel shift from retail to online and increased share of entertainment spend • Further investment in safer gambling initiatives to ensure sustainable growth - Enhanced predictive technology; increase in safer gambling tool usage by customers - Advocating a customer driven approach to affordability • Merger integration progressing well - Australian integration complete, PokerStars strategy in place and core momentum maintained - Annualised cost synergies now expected to be £170m, up from £140m previously -

Crown Limited and Entertainment Business

© Copyright Reserved Serial No……………… Institute of Certified Management Accountants of Sri Lanka Level 5 – November 2013 Examination st Examination Date : 1 December 2013 Number of Pages : 14 Examination Time: 1.30 p:m. – 4.30 p:m. Number of Questions: 06 Instructions to candidates: 1. Time allowed is three (3) hours. 2. Attached to the question are Scenario I given in advance and Scenario II 3. The answers should be given in English language. Subject Subject Code Integrative Case Study (ICS - 405) Question (100 Marks) Crown Limited and Entertainment Business You are required to: 1. Prepare a report by showing weaknesses of and threats that are likely to be faced by Crown Limited in relation to new investments proposals. (10 Marks) 2. Analyse the external environment of the Crown Colombo by referring to TEMPLES model. (15 Marks) 3. Explain possible corporate governance and regulatory issues of Crown Colombo . (15 Marks) 4. Write a report to the Chairman of Crown Limited on the assessment of competitive position of Crown Colombo by referring to threat of new entrance, power of buyers, power of suppliers, threat of substitutes and assuming that you have been appointed as a consultant . (20 Marks) 5. Explain the possible socio economic and political consequences and their impact on the economy assuming the new investment would successfully complete by 2016. (20 Marks) 6. Discuss the possible strategies that Crown Colombo can adopt with a view to hold a competitive edge in the market by 2020. (20 Marks) (Total 100 Marks) Institute of Certified Management Accountants of Sri Lanka 1 Level 5 - Integrative Case Study (ICS – 405) – November 2013 Examination Crown Limited and Entertainment Business Scenario I Brief History Crown Limited was established in 2007 and is one of Australia's largest gaming and entertainment businesses comprising of casino, hotels, properties, function, shopping and entertainment facilities and restaurants. -

The Stars Group Welcomes Landmark U.S. Supreme Court Ruling Permitting Sports Betting

The Stars Group Welcomes Landmark U.S. Supreme Court Ruling Permitting Sports Betting Decision opens the door for The Stars Group to expand business broadly in the United States TORONTO, May 15, 2018 /CNW/ - The Stars Group Inc. (NASDAQ: TSG; TSX: TSGI) reacted today to the decision by the United States Supreme Court to strike down, as an unconstitutional exercise of federal power, the nearly 30-year ban on sports betting under the Professional and Amateur Sports Protection Act, or PASPA. Congress enacted PASPA in 1992, which resulted in all states, other than Nevada and three others, being prohibited from authorizing sports betting. The litigation that reached the Supreme Court arose from New Jersey's repeated attempts to resist the federal ban and to legalize sports betting within the state. "The decision by the Supreme Court is an important step forward in the regulation of sports betting in the United States," said Marlon Goldstein, Executive Vice President and Chief Legal Officer of The Stars Group. "We believe we are well-positioned to take advantage of any new business and market opportunities, and to work with state legislatures in setting up sports betting frameworks that satisfy local consumers' interest in sports betting while protecting them through safe and regulated betting environments." The decision follows The Stars Group's recent announcement of its agreement to acquire Sky Betting & Gaming, the fastest growing established sports betting operator in the United Kingdom, the world's largest online gaming market, and its recent acquisition of 80% of the combined CrownBet and William Hill Australia businesses, which combined form the third largest online sports betting operator in Australia, the world's second largest online gaming market. -

Interactive Gambling and Broadcasting Amendment (Online

Chapter 10 Introduction to sports betting and wagering 10.1 This chapter provides an introduction to sports betting and wagering in Australia. It will cover definitions and types of bets and wagers; the sporting codes and racing industries involved; the prevalence and recent growth of sports betting, including the effect of online technologies; and sports wagering providers, including corporate operators, traditional bookmakers, totalisators and betting exchanges. It will also discuss how sports betting and wagering is excluded from the Commonwealth Interactive Gambling Act 2001 (IGA) with the exception of 'in-play' betting online. The chapter will conclude with a summary of state and territory regulation of gambling services. Introduction 10.2 Sports betting, where individuals bet on the outcome of a sporting event or individual events within the context of a match, has become increasingly popular.1 The fast growth in sports betting activity in recent years, combined with the pervasive advertising of sports betting products and services during sporting broadcasts, has resulted in what some describe as the 'gamblification' of sports.2 It has also raised particular concerns this will contribute to problem gambling.3 Definitions 10.3 Sports betting can be defined as: ...the wagering on approved types of local, national or international sporting activities (other than the established forms of horse and greyhound racing), whether on or off-course, in person, by telephone, or via the internet'.4 1 The betting options available to online sports betting customers are numerous. According to Sportsbet.com.au: 'Any day of the week, 24 hours a day, punters can place single bets - head-to- head, pick the score, line and margin bets to name but a few. -

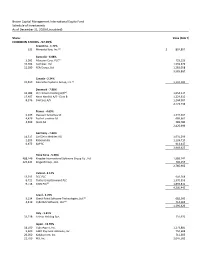

COMMON STOCKS - 97.05% Argentina - 1.72% (A)

Yeah Brown Capital Management International Equity Fund Schedule of Investments As of December 31, 2020 (Unaudited) Shares Value (Note 1) COMMON STOCKS - 97.05% Argentina - 1.72% (a) 533 MercadoLibre, Inc. $ 892,892 Australia - 6.88% (a) 3,092 Atlassian Corp. PLC 723,126 10,704 Cochlear, Ltd. 1,559,676 11,180 REA Group, Ltd. 1,283,058 3,565,860 Canada - 2.24% (a) 19,819 Descartes Systems Group, Inc. 1,159,183 Denmark - 7.96% (a) 16,089 Chr Hansen Holding A/S 1,654,217 17,487 Novo Nordisk A/S - Class B 1,224,612 8,376 SimCorp A/S 1,244,907 4,123,736 France - 4.69% 6,639 Dassault Systemes SE 1,347,557 4,426 EssilorLuxottica SA 689,662 4,699 Ipsen SA 389,780 2,426,999 Germany - 7.66% 14,517 Carl Zeiss Meditec AG 1,931,296 1,209 Rational AG 1,124,710 6,975 SAP SE 913,617 3,969,623 Hong Kong - 5.38% 488,146 Kingdee International Software Group Co., Ltd. 1,989,747 123,443 Kingsoft Corp., Ltd. 796,155 2,785,902 Ireland - 8.12% 13,293 DCC PLC 941,268 6,721 Flutter Entertainment PLC 1,370,359 (a) 9,718 ICON PLC 1,894,816 4,206,443 Israel - 2.70% (a) 5,134 Check Point Software Technologies, Ltd. 682,360 (a) 4,419 CyberArk Software, Ltd. 714,066 1,396,426 Italy - 1.41% 33,718 Azimut Holding SpA 731,970 Japan - 13.70% 18,500 CyberAgent, Inc. 1,273,885 5,600 GMO Payment Gateway, Inc. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47