___15.963 Management Accounting and Control

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

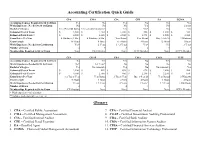

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

Historical Evolution of Management Accounting

1990's: Value Based Management Focus shifted to include the creation of customer value, strategy, balanced scorecards, EVA, and other related concepts. 1980's: Lcan Enterprise CA M-I Cost Management Focus shifted to the reduction of waste, JTT, teamwork, ABC, target costing, quality, investment & product life cycle management. 1951 - 1980's: Managerial Accounting Focus shifted to providinginformation for management planning & control. 1920 - 1950: Cost Accounting Matching concept developed. Focus on cost determination and financial control. 1812 - 1920: Accountingfor Processes Prior to the matching concept. Focus on operating cost and efficiency of processes. Shah Kamal Historical Evolution of Assistant Relationship Manager Management Accounting Bank Alfalah [email protected] Abstract The obsolescence of most companies' cost accounting and management control systems is particularly unfortunate for the global competition of the 1980s (Johnson & Kaplan, 1987). During the past two decades, conventional cost and management accounting practices have been under extensive criticism for their malfunction to instigate change and their inability to support management accounting innovations in coping with the requirements of a changing environment. The academic literature has been crucial of conventional management accounting systems particularly for their lack of efficiency and capability to present comprehensive and the latest information and to assure decision makers and potential users of such information. Focusing on this debate, current study reviews the evolution of cost and management accounting innovations over the past century around the world and to examine whether there has been a significant impact of management accounting in the organization. The analyses suggest that management accounting is changing. However, these changes do not have much bearing upon the type of management accounting techniques. -

Government Audit Committees – Part 1 – Charter, Roles and Responsibilities

Management Accounting & Finance Sponsored by the AICPA’s Government Performance & Accountability Committee (GPAC) Government Audit Committees – Part 1 – Charter, Roles and Responsibilities Lori A. Sexton, CPA, CGMA A government’s audit committee provides governance and accountability but must address the enhanced transparency expectations of the public which it serves. Developing an entity specific charter as well as creating roles and responsibilities of the audit committee which may include unique requirements is the first step in achieving a successful audit committee. Before we dig into best practices of a government audit committee, there are certain limitations placed on the audit committee and therefore will not be addressed. The audit committee is not responsible for planning or conducting audits; this is the independent auditor’s responsibility. Neither is the audit committee responsible for (1) preparing and fairly presenting the government entity’s financial statements in accordance with generally accepted accounting principles, (2) maintaining effective internal control over financial reporting, and (3) ensuring the government entity’s compliance with applicable laws, regulations, and other requirements. These responsibilities are management’s, and the independent auditor and the audit committee have independent and complementary oversight responsibilities for determining that the related objectives of management’s responsibilities are achieved. The audit committee begins it’s responsibilities by creating a charter that lays out it’s specific governance responsibilities, expectations and measures as applicable. This includes the committee’s purpose, reporting hierarchy, committee membership, authority and responsibilities. This article links to the full report https:// www.cgma.org/content/dam/cgma/resources/reports/downloadabledocuments/cgma-govt-audit- committee-part-1.pdf which includes a tool of 20 best practices for developing a government audit committee charter. -

Introduction to Management Accounting and Control

⬛⬛ CHAPTER 1 Introduction to Management Accounting and Control FEATURE STORY It’s Monday morning, 9 o’clock. Pekka Virtanen, Pekka: Restructuring means laying-off a larger general manager at FinnXL, one of the larg- percentage of the employees. Let me have est furniture companies in the world, calls a closer look at your scenarios, please. I’m for a meeting with his chief controller, Linn sure you’ll have included all the financials Petersson. in your model, but have you considered One of FinnXL’s production facilities in Estonia potential employee reaction to the restruc- is under discussion for a major restructur- turing plans? I remember some five years ing. The profitability of the production site ago, when I was the plant manager at our has dropped severely in the last six months. production site in Poland, that the financial Pekka is responsible for the Eastern European forecasts, which had been prepared by the operations, and FinnXL’s top management has central accounting department, were too instructed him to solve the problem. optimistic. They underestimated the nega- tive effects on employee motivation. Pekka: Good morning Linn. Great that you Linn: I have to admit, employee reaction is not could make it at such short notice. As I told explicitly considered in my model, as this is you last week, we need to find a solution for really difficult to quantify. But I have looked our Estonian production facility. up FinnXL’s experience with restructurings Linn: Absolutely. I’ve collected all the numbers in the Baltic states. In recent years, the actual from the last six months. -

Roles and Practices In

Cost Management Roles and Practices in Management Accounting Today RESULTS FROM THE 2003 IMA-E&Y SURVEY B Y A SHISH G ARG,DEBASHIS G HOSH,JAMES H UDICK, AND C HUEN N OWACKI anagement accounting is at a critical juncture. themselves against their peers. What’s more, more than Increased competition and uncertain business 200 members indicated that they would like to participate Mconditions have put significant pressure on in detailed interviews about industry-wide best practices corporate management to make informed business deci- in management accounting. sions and maximize their company’s financial perfor- mance. In response, a range of management accounting KEY FINDINGS tools and techniques has emerged. The survey revealed six major findings: Given this abundance of solutions, what decision- 1. Cost management is a key input to strategic decision support tools and cost analytics methodologies are makers. finance professionals employing? And what are the fron- 2. Decision makers and decision enablers alike identify tier issues in cost management? Surprisingly, there have “actionable” cost information as their topmost priori- been few contemporary broad-based surveys that illumi- ty.(For purposes of this analysis, we presumed that nate and identify cutting-edge issues in cost management decision makers run the finance or accounting depart- today. That’s why the Institute of Management Accoun- ment and decision enablers include all other manage- tants (IMA) and Ernst & Young (E&Y) undertook a sur- ment accountants.) vey to understand the evolving role of management 3. Several factors impair cost visibility. accountants, the goals of the organizations they serve, 4. Adopting new cost management tools isn’t a priority and the tools they use to meet those goals. -

The Roles and Domain of the Professional Accountant in Business

Information Paper The Roles and Domain of the Professional Accountant in Business Published by the Professional Accountants in Business Committee Professional Accountants in Business Committee International Federation of Accountants 545 Fifth Avenue, 14th Floor New York, New York 10017 USA The mission of the International Federation of Accountants (IFAC) is to serve the public interest, strengthen the worldwide accountancy profession and contribute to the development of strong international economies by establishing and promoting adherence to high-quality professional standards, furthering the international convergence of such standards and speaking out on public interest issues where the profession’s expertise is most relevant. This publication was prepared by IFAC’s Professional Accountants in Business (PAIB) Committee. The PAIB Committee serves IFAC member bodies and the more than one million professional accountants worldwide who work in commerce, industry, the public sector, education, and the not-for-profit sector. Its aim is to enhance the role of professional accountants in business by encouraging and facilitating the global development and exchange of knowledge and best practices. This publication may be downloaded free-of-charge from the IFAC website http://www.ifac.org. The approved text is published in the English language. Copyright © November 2005 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided further that each copy bears the following credit line: “Copyright © by the International Federation of Accountants. All rights reserved. Used by permission.” Otherwise, written permission from IFAC is required to reproduce, store or transmit this document, except as permitted by law. -

Cost Transformation and Management

CGMA® COST TRANSFORMATION AND MANAGEMENT Create a business that is not just leaner, it’s more competitive too. Two of the world’s most prestigious accounting bodies, AICPA and CIMA, have formed a joint venture to establish the Chartered Global Management Accountant (CGMA®) designation to elevate and build recognition of the profession of management accounting. This international designation recognises the most talented and committed management accountants with the discipline and skill to drive strong business performance. CGMA® designation holders are either CPAs with qualifying management accounting experience or associate or fellow members of the Chartered Institute of Management Accountants. Engendering a Managing the risks cost-conscious inherent in driving culture cost-competitiveness Understanding CGMA COST cost drivers: Cost Connecting products accounting systems TRANSFORMATION with profi tability and processes MODEL Incorporating Generating maximum sustainability to value through new optimise profi ts products The CGMA Cost Transformation Model is designed to help businesses to achieve and maintain cost-competitiveness. It serves as a practical and logical planning and control framework for transforming and continuously managing a business’ cost competitiveness. The model transcends the finance function, requiring the full participation of and buy-in by all functions and processes. www.cgma.org/cost COST TRANSFORMATION AND MANAGEMENT A new industrial revolution is challenging traditional businesses models. The combined effects of rapid changes in technology, communications and information are the key forces that threaten to disrupt the ways in which businesses have traditionally operated. The competitive advantage Technology eliminating cost To survive, businesses must become globally cost Technology is eliminating cost as a barrier to entry. -

Introduction to Cost and Management Accounting

CHAPTER 1 INTRODUCTION TO COST AND MANAGEMENT ACCOUNTING LEARNING OUTCOMES State the meaning, objective and importance of cost and management accounting. Discuss the functions and role of cost accounting department in an organization. Discuss the essentials of cost and management accounting and to know how a system of cost accounting is installed. Differentiate between cost accounting with financial accounting and management accounting. List the various elements of cost and the way these are classified. Explain the methods of segregating semi-variable costs into fixed and variable cost. Discuss the concept of cost reduction and cost control. Discuss the methods and techniques of costing. Discuss cost accounting with the use of information technology. © The Institute of Chartered Accountants of India 1.2 COST AND MANAGEMENT ACCOUNTING Objectives of Cost and Management Cost Accounting Accounting Cost Objects using IT Scope of Cost Users of Cost and Accounting Responsibility Management Centres Accounting Relationship of Cost and Role & Functions Management of Cost and Accounting with Cost Classification Management other related Accounting desciplines 1.1 INTRODUCTION Michael E. Porter in his theory of Generic Competitive Strategies has described ‘Cost Leadership’ as one of the three strategic dimensions (others are ‘Product differentiation’ and ‘Focus or Niche’) to achieve competitive advantage in industry. Cost Leadership implies producing goods or provision of services at lowest cost while maintaining quality to have better competitive price. In a business environment where each entity is thriving to achieve apex position not only in domestic but global competitive market, it is essential for the entity to fit into any of the three competitive strategic dimensions. -

Management Vs. Cost Accounting

MMAANNAAGGEEMMEENNTT VVSS.. CCOOSSTT AACCCCOOUUNNTTIINNGG http://www.tutorialspoint.com/accounting_basics/management_versus_cost_accounting.htm Copyright © tutorialspoint.com Management accounting collects data from cost accounting and financial accounting. Thereafter, it analyzes and interprets the data to prepare reports and provide necessary information to the management. On the other hand, cost books are prepared in cost accounting system from data as received from financial accounting at the end of each accounting period. The difference between management and cost accounting are as follows: S.No. Cost Accounting Management Accounting 1 The main objective of cost accounting is The primary objective of management to assist the management in cost control accounting is to provide necessary and decision-making. information to the management in the process of its planning, controlling, and performance evaluation, and decision- making. 2 Cost accounting system uses quantitative Management accounting uses both cost data that can be measured in quantitative and qualitative data. It also monitory terms. uses those data that cannot be measured in terms of money. 3 Determination of cost and cost control Efficient and effective performance of a are the primary roles of cost accounting. concern is the primary role of management accounting. 4 Success of cost accounting does not Success of management accounting depend upon management accounting depends on sound financial accounting system. system and cost accounting systems of a concern. 5 Cost-related data as obtained from Management accounting is based on the financial accounting is the base of cost data as received from financial accounting. accounting and cost accounting. 6 Provides future cost-related decisions Provides historical and predictive based on the historical cost information. -

MBA Accounting for Managers 1St Year

MBA - I Semester Paper Code: MBAC 1003 Accounting For Managers Objectives Ֆ To acquaint the students with the fundamentals principles of financial, cost and management accounting Ֆ To enable the students to prepare, analyse and interpret financial statements and Ֆ To enable the students to take decisions using management accounting tools. Unit-I Book-Keeping and Accounting – Financial Accounting – Concepts and Conventions – Double Entry System – Preparation of Journal, Ledger and Trial Balance – Preparation of Final Accounts –Trading, Profit and Loss Account and Balance Sheet With Adjustment Entries, Simple Problems Only - Capital and Revenue Expenditure and Receipts. Unit-II Depreciation – Causes – Methods of Calculating Depreciation – Straight Line Method, Diminishing Balance Method and Annuity Method - Ratio Analysis – Uses and Limitations – Classification of Ratios – Liquidity, Profitability, Financial and Turnover Ratios – Simple Problems Only. Unit-III Funds Flow Analysis – Funds From Operation, Sources and Uses of Funds, Preparation of Schedule of Changes In Working Capital and Funds Flow Statements – Uses And Limitations - Cash Flow Analysis – Cash From Operation – Preparation of Cash Flow Statement – Uses and Limitations – Distinction Between Funds Flow and Cash Flow – Only Simple Problems 1 Unit-IV Marginal Costing - Marginal Cost and Marginal Costing - Importance - Break-Even Analysis - Cost Volume Profit Relationship – Application of Marginal Costing Techniques, Fixing Selling Price, Make or Buy, Accepting a Foreign Order, Deciding Sales Mix. Unit-V Cost Accounting - Elements of Cost - Types of Costs - Preparation of Cost Sheet – Standard Costing – Variance Analysis – Material Variances – Labour Variances – Simple Problems Related to Material And Labour Variances Only. [note: distribution of questions between problems and theory of this paper must be 60:40 i.e., problem questions: 60 % & theory questions: 40 %] REFERENCES Jelsy Josheph Kuppapally, ACCOUNTING FOR MANAGERS, PHI, delhi, 2010. -

The Relationship Between Managerial and Financial Accounting Ileana

Bulletin UASVM Horticulture, 69(2)/2012 Print ISSN 1843-5254; Electronic ISSN 1843-5394 The Relationship between Managerial and Financial Accounting Ileana ANDREICA1), Marioara ILEA1) 1) University of Agricultural Sciences and Veterinary Medicine, Faculty of Horticulture, Manastur Street, no 3-5, 400372, Cluj-Napoca, Romania; [email protected] Abstract. Managerial accounting is a very useful tool in decision making given that managers need various information about the evolution of the economic within organizations they lead, from detailed knowledge of costs and to modeling the behavior of decision makers. The paper aims to identify the linkage between managerial accounting and financial accounting knowing that the managerial accounting has therefore become an integral part of the management process by providing critical information for managers who must plan, supervise and decide in a changing business environment, highly competitive, characterized by imperfect information, disparate objectives and control problems within the organization. Keywords: managerial accounting, financial accounting, decisions Introduction. Accounting information is a connection factor between the economic, legal, financial and fiscal systems. (Bobocea, 2008). If financial accounting informs us about the past and what happened, the managerial accounting is concerned with the future and what will happen (Diaconu, 2006). Financial accounting, known as general, ensures information on asset management, necessary for internal decision-makers, and information -

Management - Accounting

UNIVERSITY OF PITTSBURGH AT GREENSBURG Management - Accounting undergraduate program Management - Accounting 54 credits Bachelor of Science Core Management Courses 4 courses - 12 credits The Management - Accounting major provides a firm MGMT 0022 Financial Accounting foundation in Management as MGMT 0023 Managerial Accounting well as extensive training in MGMT 1818 Management Science INFSCI 0010 Introduction to Information Systems and Society Accounting. Accounting students are well-prepared Area Courses 2 courses - 6 credits and eligible to sit for the MGMT 1821 Introduction to Finance (required) Certified Public Accounting Choose one additional area course from the following list: exam immediately following graduation. Students are MGMT 1819 Introduction to Marketing encouraged to schedule full MGMT 1820 Operations Management MGMT 1832 Human Resources Management terms throughout their college career enabling them to Advanced Accounting Courses 6 courses - 18 credits graduate with 130-144 credit MGMT 1138 Corporate Financial Accounting hours, graduating in a position MGMT 1140 Accounting Information Systems and Financial Statement Analysis to easily obtain the 150 credit MGMT 1835 Intermediate Accounting 1 hours required for certification MGMT 1836 Intermediate Accounting 2 after passing the CPA exam. MGMT 1837 Advanced Accounting MGMT 1838 Standard Costs, Budgets, and Profit Planning Accounting Electives 2 courses - 6 credits Employment: Select two from the following list of Accounting and Management courses: MGMT 1839 Federal Income Tax Accounting 1 * Auditing/assurance MGMT 1840 Federal Income Tax Accounting 2 services MGMT 1841 Auditing * Tax services MGMT 1898 Accounting Internship * Environmental accounting Electives 3 courses - 9 credits * Forensic accounting * International accounting Take an additional three courses in Management, Accounting, Healthcare Management, or another course from the approved elective list.