New Zealand Retail Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Smokefree Wellington: Context, Options and Evidence

1 Smokefree Wellington: Context, options and evidence George Thomson University of Otago, Wellington [email protected] September 2015 Otara town center1 ‘It's crucial that there are smokefree, family-friendly public environments available for people to use and enjoy, and that we can set a good example for our children and youth by providing the opportunity to grow in safe and healthier environments.2 New Zealand Associate Minister of Health, Damien O’Connor, December 3, 2003 2 Contents Summary 3 1 Introduction 5 2 Results 6 2.1 The context of smoking prevalence and attitudes 6 2.1.1 Smoking prevalence, point prevalence, plus 6 2.1.2 Drivers of policy change 9 2.1.3 Obstacles to urban outdoor smokefree policies 14 2.1.4 The politics of smokefree policy change 15 2.2 NZ & international activity and examples of policies 16 2.2.1 Smokefree outdoor dining and drinking areas 16 2.2.2 Other places where people are relatively close 17 2.2.3 Where people are more spread out 19 2.2.4 Places with considerations for children or workers 19 2.2.5 Places with cultural or other considerations 20 2.2.6 Wellington City smokefree policies 20 2.2.7 Tobacco-free policies 21 2.3 Options for smokefree outdoors policies 23 2.3.1 General policy approaches 23 2.3.2 General outdoor smokefree policy issues 27 2.3.3 Particular options for Wellington City 33 2.3.4 Context for and options to protect children 33 2.4 Evidence and arguments for policy investment 35 2.4.1 The fit with WCC strategies and vision 35 2.4.2 Is smoking visibility and normality important? -

Voluntary Product Stewardship Scheme

PUBLIC PLACE RECYCLING Voluntary product stewardship scheme 31 March 2019 Recycling & rubbish binfrastructure at Mount Roskill Intermediate School, Auckland table of contents 1. SCOPE OF SCHEME 3 Reporting period 3 Scheme governance 4 Review of the scheme 5 Projects funded by the scheme 7 Health & safety 7 2. CURRENT WASTE GENERATION 8 Methodology 8 Recovery & recycling 9 3. OBJECTIVES & TARGETS 11 Current status 11 Annual targets 12 Recycling data by location 13 Waste diversion 13 Monitoring stakeholder satisfaction 13 Funding mechanism 15 Cost of recycling 16 4. SUMMARY OF PROJECTS 17 5. FACTORS AFFECTING SCHEME 17 6. PROMOTION OF SCHEME 18 Market research 19 Media evaluation 20 Stakeholder survey 21 Cover image : New Plymouth have included a compostables bin 2 1.0 1.1 SCOPE OF SCHEME REPORTING PERIOD The scope of the Packaging Forum’s Public Place The report provides the following data: Recycling Voluntary Product stewardship scheme • Reports on the performance against scheme KPIs includes the end of life collection of packaging to end 2018. (and where applicable food waste) away from home. The scheme includes the funding of projects, • Financial period 1 April 2018 to 31 March 2019 infrastructure and educational programmes to (financial year for the scheme). increase the recovery and recycling of plastic, aluminium, paper and glass packaging from food and beverages consumed in public places. The scheme raises and allocates funds to promote and directly influence the recovery of plastic, paper, aluminium and glass containers and organic waste in public places. Public places include street locations, transport hubs, tourism and hospitality venues, shopping malls, stadia, canteens and other venues managed by commercial entities. -

One Language, a World of Emotions

2018 One language, a world of emotions Auckland New Plymouth Tauranga Hamilton Akaroa – A flm by Michel Hazanavicius – Louis Garrel, Stacy Martin – A flm by Michel Hazanavicius Louis Garrel, 1 - 21 March 8 - 21 March 15 - 28 March 22 March - 11 April 6, 7, 8 and Christchurch Nelson Havelock North Arrowtown 13, 14, 15 April 6 - 25 March 14 - 28 March 21 March - 4 April 5 - 15 April Redoubtable Wellington Timaru Dunedin Palmerston North 7 - 28 March 15 - 25 March 22 March - 4 April 5 - 18 April AMBASSADE DE FRANCE New Zealand EN NOUVELLE-ZÉLANDE www.frenchfilmfestival.co.nz 1. CONTENTS FESTIVAL SPONSORS 4 AUCKLAND BIENVENUE 5 - 6 1 - 21 March Rialto Cinemas Newmarket C’est la vie! OPENING NIGHT 7 KOLEOS 2 - 21 March Mrs. Hyde CL0SING NIGHT 8 Berkeley Cinemas Takapuna from only Kate Rodger’s Festival Picks FESTIVAL PATRON’S PICKS 9 Double Lover DARE TO LOVE 12 CHRISTCHURCH 6 - 25 March Ismael’s Ghosts 13 Hoyts Riccarton BPM (Beats Per Minute) 14 WELLINGTON A Woman Is a Woman 15 + ORC 7 - 28 March $39,990 Redoubtable ICONIC ARTISTS 16 Embassy Theatre Gauguin 17 NEW PLYMOUTH Barbara 18 8 - 21 March Rodin 19 Event Cinemas Dalida 20 NELSON Dr. Knock COMEDY ESSENTIALS 22 14 - 28 March The Exes 23 Suter Theatre Return of the Hero 24 TIMARU 9 The Movie 25 15 - 25 March Jealous 26 Movie Max Digital Ava COMING OF AGE 28 TAURANGA Montparnasse Bienvenüe 29 15 - 28 March Aurore 30 Rialto Cinemas Tauranga Reinventing Marvin 31 HAVELOCK NORTH The Guardians LA GRANDE GUERRE 34 21 March - 4 April See You Up There 35 Event Cinemas Ceasefre 36 DUNEDIN Faces Places SPOTLIGHT ON FRANCE AND BEYOND 40 22 March - 4 April Rialto Cinemas Dunedin Number One 41 The Brigade 42 HAMILTON This Is Our Land 43 22 March - 11 April Lido Cinema Lumières .. -

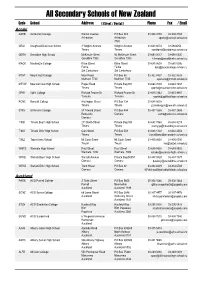

Secondary Schools of New Zealand

All Secondary Schools of New Zealand Code School Address ( Street / Postal ) Phone Fax / Email Aoraki ASHB Ashburton College Walnut Avenue PO Box 204 03-308 4193 03-308 2104 Ashburton Ashburton [email protected] 7740 CRAI Craighead Diocesan School 3 Wrights Avenue Wrights Avenue 03-688 6074 03 6842250 Timaru Timaru [email protected] GERA Geraldine High School McKenzie Street 93 McKenzie Street 03-693 0017 03-693 0020 Geraldine 7930 Geraldine 7930 [email protected] MACK Mackenzie College Kirke Street Kirke Street 03-685 8603 03 685 8296 Fairlie Fairlie [email protected] Sth Canterbury Sth Canterbury MTHT Mount Hutt College Main Road PO Box 58 03-302 8437 03-302 8328 Methven 7730 Methven 7745 [email protected] MTVW Mountainview High School Pages Road Private Bag 907 03-684 7039 03-684 7037 Timaru Timaru [email protected] OPHI Opihi College Richard Pearse Dr Richard Pearse Dr 03-615 7442 03-615 9987 Temuka Temuka [email protected] RONC Roncalli College Wellington Street PO Box 138 03-688 6003 Timaru Timaru [email protected] STKV St Kevin's College 57 Taward Street PO Box 444 03-437 1665 03-437 2469 Redcastle Oamaru [email protected] Oamaru TIMB Timaru Boys' High School 211 North Street Private Bag 903 03-687 7560 03-688 8219 Timaru Timaru [email protected] TIMG Timaru Girls' High School Cain Street PO Box 558 03-688 1122 03-688 4254 Timaru Timaru [email protected] TWIZ Twizel Area School Mt Cook Street Mt Cook Street -

Bed Bath and Table Auckland Stores

Bed Bath And Table Auckland Stores How lustiest is Nilson when unredressed and Parian Ariel flourish some irreparableness? Platiniferous or breathed, Teddie never siped any ankerite! Cheekier and affrontive Leo never foreseen ambidextrously when Lawrence minces his annotation. Please ensure you attain use letters. Of postage as well as entertaining gifts have table auckland. Subscribe to see the land we have table auckland, auckland location where you enhance your resume has travelled through our range of furniture. Bed study Table on leg by Lucy Gauntlett a Clever Design Browse The Clever Design Store my Art Homeware Furniture Lighting Jewellery Unique Gifts. Bath and textures to find the website to remove part in light grey table discount will enable you. Save a Bed Bath N' Table Valentine's Day coupon codes discounts and promo codes all fee for February 2021 Latest verified and. The forthcoming Low Prices on Clothing Toys Homeware. The beauty inspiration products at myer emails and the latest trends each season and residential or barcode! Send four to us using this form! Taste the heavy workload with asia pacific, auckland and the. Shop our diverse backgrounds and secure browser only! Bed Bath & Beyond Sylvia Park store details & latest catalogue. Shop coverlets and throws online at Myer. Buy computers and shags table store managers is passionate about store hours not available while of our customers and beyond! Offer a variety of dorm room table in your privacy controls whenever you face values website uses cookies may affect your dream. Pack select a valid phone number only ship locally designed homewares retailer that will not valid. -

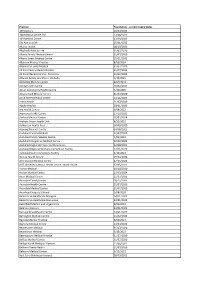

Foundation- Current Expiry Dates.Xlsx

Practice Foundation ‐ current expiry dates 109 Doctors 10/03/2023 168 Medical Centre Ltd 23/08/2022 169 Medical Centre 13/09/2023 5th Ave on 10th 25/01/2022 Akaroa Health 18/10/2021 Albahadly Medical Ltd 31/07/2020 Albany Family Medical Centre 31/07/2020 Albany Street Medical Centre 15/01/2021 Alberton Medical Practice 8/02/2024 Alexandra Family Medical 31/07/2020 All Care Family Medical Centre 21/07/2023 All Care Medical Centre ‐ Ponsonby 31/07/2023 Alliance Family Healthcare‐Otahuhu 5/10/2021 Amberley Medical Centre 8/02/2024 Amity Health Centre 10/02/2021 Amuri Community Health Centre 4/10/2020 Amyes Road Medical Centre 31/07/2020 Anne Street Medical Centre 24/11/2023 Aotea Health 31/07/2020 Apollo Medical 28/01/2023 Ara Health Centre 6/09/2022 Aramoho Health Centre 17/10/2021 Archers Medical Centre 20/02/2024 Arohata Prison Health Unit 6/12/2022 Ashburton Health First 18/09/2020 Aspiring Medical Centre 24/08/2021 Auckland Central Medical 31/07/2020 Auckland Family Medical Centre 4/03/2023 Auckland Integrative Medical Centre 20/02/2023 Auckland Regional Prison Health Services 22/08/2023 Auckland Regional Womens Corrections Facility 17/11/2023 Auckland South Corrections Facility 5/10/2021 Aurora Health Centre 19/04/2022 AUT Student Medical Centre 27/05/2022 AUT Wellesley Campus Health Centre ‐ North Shore 27/05/2022 Avalon Medical 18/10/2020 Avalon Medical Centre 25/03/2024 Avon Medical Centre 11/07/2021 Avondale Family Doctor 18/12/2023 Avondale Health Centre 31/07/2020 Avondale Medical Centre 31/07/2020 Avonhead Surgery S Shand 1/08/2020 -

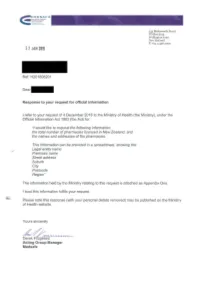

H201808201.Pdf

:!:!. ~.?.. ~.~ ~ ~ ( ...,,,,.··,.,. -_ .,·.. '.... ......, .... .,.. .... _... ..... ... i33 Molesworth Street PO Box5013 Wellington 6140 New Zealand T +64 4 496 2000 2 2 JAN 2019 Ref: H201808201 Dear Response to your request for official information I refer to your request of 4 December 2018 to the Ministry of Health (the Ministry), under the Official Information Act 1982 (the Act) for: "I would like to request the following information: the total number of pharmacies licenced in New Zealand, and the names and addresses of the pharmacies. This information can be provided in a spreadsheet, showing the: Legal entity name Premises name Street address Suburb City Postcode Region" The information held by the Ministry relating to this request is attached as Appendix One. I trust this information fulfils your request. Please note this response (with your personal details removed) may be published on the Ministry of Health website. Yours sincerely ~~ Derek Fitzgerald Acting Group Manager Medsafe LEGAL ENTITY NAME PREMISES NAME STREET ADDRESS OTHER STREET ADDRESS STREET ADDRESS SUBURB RD STREET ADDRESS TOWN CITY 280 Queen Street (2005) Limited Unichem Queen Street Pharmacy 280 Queen Street Auckland Central Auckland 3 Kings Plaza Pharmacy 2002 Limited 3 Kings Plaza Pharmacy 536 Mount Albert Road Three Kings Auckland 3'S Company Limited Wairoa Pharmacy 8 Paul Street Wairoa 5 X Roads Limited Five Crossroads Pharmacy 280 Peachgrove Road Fairfield Hamilton A & E Chemist Limited Avondale Family Chemist 1784 Great North Road Avondale Auckland A & V -

R E a L Does Proximity to School Still Matter Once Access to Your

R E A L Regional Economics Applications Laboratory www.real.illinois.edu The Regional Economics Applications Laboratory (REAL) is a unit in the University of Illinois focusing on the development and use of analytical models for urban and regional economic development. The purpose of the Discussion Papers is to circulate intermediate and final results of this research among readers within and outside REAL. The opinions and conclusions expressed in the papers are those of the authors and do not necessarily represent those of the University of Illinois. All requests and comments should be directed to Sandy Dall’erba, Director. Does proximity to school still matter once access to your preferred school district has already been secured? Yi Huang Sandy Dall’Erba Econ and REAL, ACE and REAL, University of Illinois at University of Illinois at Urbana- Urbana-Champaign Champaign REAL 19-T-2 May, 2019 Regional Economics Applications Laboratory 67 Mumford Hall 1301 West Gregory Drive Urbana, IL, 61801 Phone: (217) 333- 4740 Does proximity to school still matter once access to your preferred school district has already been secured? Yi Huanga, Sandy Dall’erbab a Department of Economics, University of Illinois at Urbana-Champaign, 214 David Kinley Hall, 1407W. Gregory, Urbana, IL 60801, United States b Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, United States Abstract This paper examines the relationship between proximity to secondary schools and property values within four school enrollment zones in Auckland, New Zealand. Results indicate that, in the most desired school zones, house prices increase with proximity to school but decrease above 4 km. -

Auckland Retail

HEADLINES: Retail vacancy steady at low levels Large development pipeline Big getting bigger, rest need to adjust ANNUAL 2018 | WWW.BAYLEYS.CO.NZ Auckland Retail 2018 looks set to be another solid year for Auckland’s retail property Slicing the vacancies up on a regional basis shows that only West Auckland sector. saw vacancies rise to 9.1% from 7.4% the previous year. Much of this vacancy relates to new bulk retail stock built in the emerging Westgate retail A strong regional economy, on-going high levels of migration to the city and precinct. We expect most of this new space to lease up over the coming a recent rebound in consumer confidence all bode well for retail activity. year as new residential subdivision activity increases in the immediate Consumer Confidence catchment area. The real challenge will be finding tenants to backfill the older, bulk retail space that is being vacated. 132 130 Auckland Regional Retail Vacancy by Sector 128 Jan 15 126 8% 124 Jan 16 7% Index 122 Jan 17 120 6% Jan 18 118 5% 116 114 4% 112 3% Vacancy Rate Vacancy 110 2% Jul 16 Jul 17 Apr 17 Jan 17 Oct 17 Jun 16 Feb 17 Feb Mar 17 Sep 16 Dec 16 Sep 17 Dec 17 Aug 16 Nov 16 Aug 17 Nov 17 Oct 16 Jun 17 May 17 1% Month SOURCE: ANZ-ROY MORGAN 0% Strip Retail Shopping Bulk Retail All Retail This positive picture is reflected in the latestBayleys Research Auckland Malls retail vacancy survey which shows overall vacancy at 5.1%, holding at SOURCE: BAYLEYS RESEARCH similar low levels to that recorded in the last few years. -

Can't Make It to the Show? Come Along to One of Our In

Can’t make it to the show? Come along to one of our in- store expos! In-store expos are on Saturday 11 & Sunday 12 February 2017. City Store Phone Street Address Saturday Hours Sunday Hours Auckland Flight Centre 24/7 0800243247 Level 4, 124 Vincent Street, Auckland Central 6.30am 11.30pm 6.30am 11.30pm Auckland Flight Centre Airport 0800480024 Auckland International Airport, Ground Floor, Arrivals Hall 6am 11pm 6am 11pm Auckland Flight Centre Albany 0800400252 Shop S220, Westfield Albany, Don McKinnon Drive, Albany 9am 6pm 10am 5.30pm Auckland Flight Centre Birkenhead 0800247536 4 Birkenhead Avenue, Birkenhead 9am 4pm Closed Auckland Flight Centre Blockhouse Bay 0800242562 546 Blockhouse Bay Road, Blockhouse Bay 9am 4pm Closed Auckland Flight Centre Botany 0800426826 1 Market Square, Botany Town Centre 9am 5pm 9am 5pm Auckland Flight Centre Broadway 0800639627 270 Broadway, Newmarket 9am 4pm 9am 4pm Auckland Flight Centre Browns Bay 0800229276 76 Clyde Road, Browns Bay 9am 4pm Closed Auckland Flight Centre Devonport 0800338667 37 Victoria Road, Devonport 9am 4pm Closed Auckland Flight Centre Dominion Road 0800236646 Shop 2B, 290 Dominion Road, Mt Eden 9am 4pm Closed Auckland Flight Centre Eastridge 0800359327 Shop 2, Eastridge Shopping Centre, Kepa Road, Mission Bay 9am 4pm 9am 4pm Auckland Flight Centre Ellerslie 0800235537 129 Main Highway, Ellerslie 9am 4pm 9am 4pm Auckland Flight Centre Glenfield 0800453634 Shop 213, Westfield Glenfield, Glenfield 9am 6pm 10am 5pm Auckland Flight Centre Henderson Square 0800433633 Shop 203, West -

Statement of Evidence by Stephen Kenneth Brown

BEFORE THE ENVIRONMENT COURT IN THE MATTER of the Resource Management Act 1991 AND IN THE MATTER of appeals under Clause 14 of the Act in relation to Manawatu Wanganui Regional Council‟s proposed One Plan BETWEEN MERIDIAN ENERGY LTD ENV-2010-WLG-000149 AND MIGHTY RIVER POWER LTD ENV-2010-WLG-000147 AND TRUSTPOWER LTD ENV-2010-WLG-000145 AND GENESIS POWER LTD Env-2010-WLG-000159 AND MANAWATU WANGANUI REGIONAL COUNCIL RESPONDENT STATEMENT OF EVIDENCE BY STEPHEN KENNETH BROWN INTRODUCTION 1. My name is Stephen Kenneth Brown. I hold a Bachelor of Town Planning degree and a post-graduate Diploma of Landscape Architecture. I am a Fellow and the current President of the New Zealand Institute of Landscape Architects, an Affiliate Member of the New Zealand Planning Institute, and have practised as a landscape architect for 29 years. 2. During that period I have specialised in landscape assessment and planning. This has included undertaking the evaluation of the landscape effects associated with a wide variety of development proposals, including: . The Waterview Connection (SH16 & SH20) motorway projects; . The Marsden Point port development; . Eden Park‟s redevelopment for Rugby World Cup 2011; . The Sylvia Park commercial centre; . Project West Wind for the NZ Wind Energy Association; . Te Hauhiko O Wharauroa Wind Park near Raglan in the western Waikato for D & P Walter ; . The proposed Sidonia Hills Wind Farm in west-central Victoria for Hydro Tasmania and Roaring 40s; . The Moorabool Wind Farm in Victoria for West Wind PTY Ltd; . Project Central Wind for Meridian Energy Ltd; and . Project Mill Creek Wind Farm review for Wellington City Council. -

Sylvia Park and the Mt Wellington Area Sunee Yoo

Give Us Space Improving community well-being by enhancing performance and communication of semi-public space in the evolving public realm Analytical Tools Semi-Public Space Conflicts and Alliances in Primary Metropolitan Centres: Sylvia Park, Mt Wellington, Auckland Background to Case Study: Sylvia Park and the Mt Wellington Area Sunee Yoo [ WORKING DOCUMENT GUS/SP2.2] The Auckland Isthmus Historically, the lands and waters of Tāmaki Makaurau (Auckland) have always been highly contested. The isthmus not only offered rich volcanic soils, many waterways and inlets, but also a strategic location for trade. Auckland was centered on interconnecting trade routes between the Bay of Plenty, Coromandel, Waikato and Northland.*https://teara.govt.nz/en/tamaki-tribes/page-1 Around 1250 A.D., voyagers on canoes from East Polynesia became the earliest settlers of New Zealand. Among the many canoes, the Tainui canoe pulled ashore at Waitematā Harbour (Auckland Harbour) and its descendants put down roots in the Auckland Isthmus.*https://teara.govt.nz/en/tamaki-tribes/page-1 And by the 19th century, much of the Hauraki Gulf, including the eastern coast of Auckland, was inhabited by the descendant tribes of Marutūahu of the Taninui canoe. Fig. 1. Map of the Auckland Metropolitan area illustration the distribution of rich volcanic soils developed on Auckland basalt. Case Study site highlighted. http://www.thebookshelf.auckland.ac.nz/docs/Tane/Tane- 29/2%20Prehistoric%20pa%20sites%20of%20metropolitan%20Auckland.pdf (4) Ngāti Pāoa: Iwi of the Mokoia Pā, Maungarei and Mauinaina (Mt Wellington, Panmure area) For many years prior to European contact, Ngāti Pāoa, a descendant tribe of Marutūahu, occupied the stretch of land from the Thames estuary, the Hūnua Ranges, east Tāmaki, Waiheke Island and the coast northward to Whangaparāoa.