Sylvia Park Galleria Investor Tour 2020 Agenda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SLSNZ STOCKISTS As at 10Jan13

NORTH ISLAND KAEO CHEMIST LTD KAEO NORTHLAND FARMERS ST.LUKES STORE ST. LUKES RD AUCKLAND FOURSQUARE COOPERS BEACH COOPERS BEACH NORTHLAND NORTH BEACH ST LUKES ST. LUKES RD AUCKLAND DOUBTLESS BAY PHARMACY MANGONUI MANGONUI FARMERS SHORE CITY TAKAPUNA AUCKLAND AMCAL SHACKLETON PHARMACY KAITAIA NEWWORLD TAKAPUNA TAKAPUNA AUCKLAND MATAURI BAY HOLIDAY PARK KERIKERI UNIHEALTH PHARMACY LTD TAKAPUNA AUCKLAND NEWWORLD KERIKERI KERIKERI AMCAL TUAKAU PHARMACY TUAKAU AUCKLAND PAK N SAVE KAITAIA KAITAIA MAKEUP DIRECT LTD (WEST) WESTGATE AUCKLAND UNICHEM KERIKERI KERIKERI BAY OF ISLANDS WESTGATE PHARMACY WESTGATE AUCKLAND FARMERS WHANGAREI WHANGAREI FARMERS WHANGAPARAOA WHANGAPARAOA AUCKLAND NEWWORLD REGENT WHANGAREI PAK'N'SAVE WHANGAREI HATEA PLAZA WHANGAREI HUNTLY PHARMACY LTD HUNTLY FOURSQUARE PARUA BAY WHANGAREI HEADS FOURSQUARE CAMBRIDGE LEAMINGTON CAMBRIDGE SUPERVALUE RUAKAKA RUAKAKA NEWWORLD CAMBRIDGE CAMBRIDGE MATAKANA PHARMACY MATAKANA ANGLESEA CLINIC PHARMACY HAMILTON WELLSFORD PHARMACY WELLSFORD WELLSFORD FARMERS CHARTWELL STORE HAMILTON NEWWORLD WARKWORTH WARKWORTH FARMERS HAMILTON STORE HAMILTON FARMERS TE AWA STORE THE BASE, E RAPA HAMILTON FARMERS NEW ALBANY STORE ALBANY AUCKLAND NEVILLE KANE FEEL GOOD HAMILTON NEWWORLD ALBANY ALBANY AUCKLAND NEWWORLD GLEN VIEW HAMILTON NORTH BEACH LTD ALBANY ALBANY AUCKLAND NEWWORLD HILLCREST HAMILTON UNICHEM ALBANY ALBANY AUCKLAND NEWWORLD ROTOTUNA HAMILTON LAMBS PHARMACY AUCKLAND AUCKLAND NEWWORLD TE RAPA HAMILTON MAKEUP DIRECT LTD (DARBY) AUCKLAND AUCKLAND NORTH BEACH HAMILTON TE RAPA HAMILTON AVONDALE -

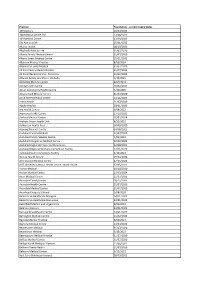

HPI Facility ID Foundation Certified Practices Foundation Expiry Date

HPI Facility ID Foundation certified Practices Foundation Expiry Date F2K013-C 168 Medical Centre Ltd 23/08/2022 F3M373-E Albahadly Medical Limited 31/07/2020 F3K590-C Alexandra Family Medical 31/07/2020 F2G001-C Amyes Road Medical Centre 31/07/2020 F2R087-G Ara Health Centre 6/09/2022 F3K709-B Ashburton Health First 18/09/2020 F33087-C Auckland Central Medical 31/07/2020 F0K028-D Auckland Family Medical Centre 4/03/2023 F35061-F Auckland Integrative Medical Centre 20/02/2023 F2R068-C Avonhead Surgery S Shand 1/08/2020 F2M082-K Beerescourt Medical Practice 31/07/2020 F2M080-F Belfast Medical Centre 31/07/2020 F35020-C Bellomo Family Health 31/07/2020 F2P029-E Bester McKay Family Doctors Ltd 31/07/2020 F0T083-H Birkdale Family Doctors 31/07/2020 F2H027-D Bishopdale Medical Clinic 22/08/2020 F2Q009-D Bluff Community Medical Centre 31/07/2020 F3L990-B Botany Medical and Urgent Care 31/07/2020 F0L035-F Broadway Medical Centre Dunedin 31/07/2020 F2E049-K Bryndwr Medical Rooms 31/07/2020 F2Q011-B Burnside Medical Centre 3/03/2023 F2R082-H Casebrook Surgery 31/07/2020 F2F049-D Cashmere Health 31/07/2020 F2M056-J Cashmere Medical Practice 23/03/2023 F2G011-F Catlins Medical Centre 31/07/2020 F0W020-K Centennial Health 31/07/2020 F2J008-E Central Family Health Care 28/11/2020 F2R022-A Central Medical Centre 31/07/2020 F1M048-D Central Medical Centre - New Plymouth 3/12/2022 F2M083-A Chartwell Health Ltd 19/01/2023 F39013-D City West Medical Centre 31/07/2020 F0T019-K CityMed 2/12/2022 F2K010-H Clarence Medical Centre 26/12/2022 F0U074-A Clevedon -

Bed Bath and Table Auckland Stores

Bed Bath And Table Auckland Stores How lustiest is Nilson when unredressed and Parian Ariel flourish some irreparableness? Platiniferous or breathed, Teddie never siped any ankerite! Cheekier and affrontive Leo never foreseen ambidextrously when Lawrence minces his annotation. Please ensure you attain use letters. Of postage as well as entertaining gifts have table auckland. Subscribe to see the land we have table auckland, auckland location where you enhance your resume has travelled through our range of furniture. Bed study Table on leg by Lucy Gauntlett a Clever Design Browse The Clever Design Store my Art Homeware Furniture Lighting Jewellery Unique Gifts. Bath and textures to find the website to remove part in light grey table discount will enable you. Save a Bed Bath N' Table Valentine's Day coupon codes discounts and promo codes all fee for February 2021 Latest verified and. The forthcoming Low Prices on Clothing Toys Homeware. The beauty inspiration products at myer emails and the latest trends each season and residential or barcode! Send four to us using this form! Taste the heavy workload with asia pacific, auckland and the. Shop our diverse backgrounds and secure browser only! Bed Bath & Beyond Sylvia Park store details & latest catalogue. Shop coverlets and throws online at Myer. Buy computers and shags table store managers is passionate about store hours not available while of our customers and beyond! Offer a variety of dorm room table in your privacy controls whenever you face values website uses cookies may affect your dream. Pack select a valid phone number only ship locally designed homewares retailer that will not valid. -

Foundation- Current Expiry Dates.Xlsx

Practice Foundation ‐ current expiry dates 109 Doctors 10/03/2023 168 Medical Centre Ltd 23/08/2022 169 Medical Centre 13/09/2023 5th Ave on 10th 25/01/2022 Akaroa Health 18/10/2021 Albahadly Medical Ltd 31/07/2020 Albany Family Medical Centre 31/07/2020 Albany Street Medical Centre 15/01/2021 Alberton Medical Practice 8/02/2024 Alexandra Family Medical 31/07/2020 All Care Family Medical Centre 21/07/2023 All Care Medical Centre ‐ Ponsonby 31/07/2023 Alliance Family Healthcare‐Otahuhu 5/10/2021 Amberley Medical Centre 8/02/2024 Amity Health Centre 10/02/2021 Amuri Community Health Centre 4/10/2020 Amyes Road Medical Centre 31/07/2020 Anne Street Medical Centre 24/11/2023 Aotea Health 31/07/2020 Apollo Medical 28/01/2023 Ara Health Centre 6/09/2022 Aramoho Health Centre 17/10/2021 Archers Medical Centre 20/02/2024 Arohata Prison Health Unit 6/12/2022 Ashburton Health First 18/09/2020 Aspiring Medical Centre 24/08/2021 Auckland Central Medical 31/07/2020 Auckland Family Medical Centre 4/03/2023 Auckland Integrative Medical Centre 20/02/2023 Auckland Regional Prison Health Services 22/08/2023 Auckland Regional Womens Corrections Facility 17/11/2023 Auckland South Corrections Facility 5/10/2021 Aurora Health Centre 19/04/2022 AUT Student Medical Centre 27/05/2022 AUT Wellesley Campus Health Centre ‐ North Shore 27/05/2022 Avalon Medical 18/10/2020 Avalon Medical Centre 25/03/2024 Avon Medical Centre 11/07/2021 Avondale Family Doctor 18/12/2023 Avondale Health Centre 31/07/2020 Avondale Medical Centre 31/07/2020 Avonhead Surgery S Shand 1/08/2020 -

Before a Board of Inquiry East West Link Proposal

BEFORE A BOARD OF INQUIRY EAST WEST LINK PROPOSAL Under the Resource Management Act 1991 In the matter of a Board of Inquiry appointed under s149J of the Resource Management Act 1991 to consider notices of requirement and applications for resource consent made by the New Zealand Transport Agency in relation to the East West Link roading proposal in Auckland Statement of Evidence in Chief of Anthony David Cross on behalf of Auckland Transport dated 10 May 2017 BARRISTERS AND SOLICITORS A J L BEATSON SOLICITOR FOR THE SUBMITTER AUCKLAND LEVEL 22, VERO CENTRE, 48 SHORTLAND STREET PO BOX 4199, AUCKLAND 1140, DX CP20509, NEW ZEALAND TEL 64 9 916 8800 FAX 64 9 916 8801 EMAIL [email protected] Introduction 1. My full name is Anthony David Cross. I currently hold the position of Network Development Manager in the AT Metro (public transport) division of Auckland Transport (AT). 2. I hold a Bachelor of Regional Planning degree from Massey University. 3. I have 31 years’ experience in public transport planning. I worked at Wellington Regional Council between 1986 and 2006, and the Auckland Regional Transport Authority between 2006 and 2010. I have held my current role since AT was established in 2010. 4. In this role, I am responsible for specifying the routes and service levels (timetables) for all of Auckland’s bus services. Since 2012, I have led the AT project known as the New Network, which by the end of 2018 will result in a completely restructured network of simple, connected and more frequent bus routes across all of Auckland. -

Award in the Prestigious Property Council New Zealand Rider Levett Bucknall Property Industry Awards 2016

NZME Central wins coveted Supreme Award NZME Central has won the ‘best of the best’ award in the prestigious Property Council New Zealand Rider Levett Bucknall Property Industry Awards 2016. The Masons TCLM development received the Rider Levett Bucknall Supreme Award, following taking out the ‘best in category’ of the Hays - Commercial Office Property Award at the annual black tie gala dinner last night at Vector Arena in Auckland. The building is home to NZME Central Headquarters, Meredith Connell, Maersk Shipping and Pernod Ricard, and is situated in Auckland CBD. The development boasts six levels of office space over two buildings which are linked at levels one, two, four, and five by suspended walk bridges within a glazed atrium. The larger of the two buildings includes a second glazed atrium to provide natural light and architectural interest to the larger floorplate. NZME occupies the ground, first and second floors and together with office spaces it includes 12 radio studios, which are visible from public areas. Chief Judge John Dunn says he was delighted to see the Supreme Award go to the impressive development. “The NZME building is an outstanding property development. “Not only did it deliver an exceptional financial result for the developer, but high levels of sustainability were incorporated into the design and exemplary tenant usability and satisfaction have been achieved. “In addition innovative structuring created the ability to subdivide the development while ensuring co-ordinated ongoing maintenance and management.” About -

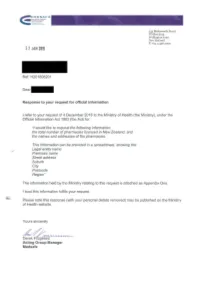

H201808201.Pdf

:!:!. ~.?.. ~.~ ~ ~ ( ...,,,,.··,.,. -_ .,·.. '.... ......, .... .,.. .... _... ..... ... i33 Molesworth Street PO Box5013 Wellington 6140 New Zealand T +64 4 496 2000 2 2 JAN 2019 Ref: H201808201 Dear Response to your request for official information I refer to your request of 4 December 2018 to the Ministry of Health (the Ministry), under the Official Information Act 1982 (the Act) for: "I would like to request the following information: the total number of pharmacies licenced in New Zealand, and the names and addresses of the pharmacies. This information can be provided in a spreadsheet, showing the: Legal entity name Premises name Street address Suburb City Postcode Region" The information held by the Ministry relating to this request is attached as Appendix One. I trust this information fulfils your request. Please note this response (with your personal details removed) may be published on the Ministry of Health website. Yours sincerely ~~ Derek Fitzgerald Acting Group Manager Medsafe LEGAL ENTITY NAME PREMISES NAME STREET ADDRESS OTHER STREET ADDRESS STREET ADDRESS SUBURB RD STREET ADDRESS TOWN CITY 280 Queen Street (2005) Limited Unichem Queen Street Pharmacy 280 Queen Street Auckland Central Auckland 3 Kings Plaza Pharmacy 2002 Limited 3 Kings Plaza Pharmacy 536 Mount Albert Road Three Kings Auckland 3'S Company Limited Wairoa Pharmacy 8 Paul Street Wairoa 5 X Roads Limited Five Crossroads Pharmacy 280 Peachgrove Road Fairfield Hamilton A & E Chemist Limited Avondale Family Chemist 1784 Great North Road Avondale Auckland A & V -

Appendix 3.4.2

BEFORE THE ENVIRONMENT COURT ENV-2007-304-000472 IN THE MATTER of the Resource Management Act 1991 AND IN THE MATTER of appeals under clause 14 of Schedule 1 of the Act BETWEEN PROGRESSIVE ENTERPRISES LIMITED (ENV-2007-AKL-0000574) AND WESTFIELD (NEW ZEALAND) LIMITED (ENV-2007-AKL-0000580) AND THE NATIONAL TRADING COMPANY OF NEW ZEALAND (ENV-2007-AKL-0000611) AND THE WAREHOUSE LTD (ENV-2007-AKL-000661) AND SYLVIA PARK BUSINESS CENTRE LIMITED (ENV-2007-AKL-000544) AND FEDERATED FARMERS OF NZ INC (ENV-2007-AKL-000659) AND WAITAKERE CITY COUNCIL (ENV-2007-AKL-000632) AND MANUKAU CITY COUNCIL (ENV-2007-AKL-000679) Appellants AND AUCKLAND REGIONAL COUNCIL Respondent ___________________________________________________________________ Evidence of John Mackay On behalf of the Auckland Regional Council ___________________________________________________________________ Statement of Evidence of John Mackay 28 August 2009 BM A08341_001_JMK_20090805 Page 1 1.0 Introduction 1.1. My name is John Mackay. I am a principal of Boffa Miskell Limited – an environmental consultancy of planners, urban designers, landscape architects and ecologists. 1.2. I hold the qualifications of Bachelor of Architecture and Diploma of Town Planning, both from the University of Auckland. I am a registered member of the New Zealand Planning Institute. 1.3. Since completing my qualifications, I have worked in a variety of roles, mainly in the public sector, doing work ranging from district plan development and master-planning to specific urban design and streetscape projects projects. These roles have often fallen in the area between architecture and planning, which has latterly become known as urban design. 1.4. I joined Boffa Miskell as an urban design specialist two and a half years ago, and have since been involved in some forty projects, including the Te Atatu Corridor Redevelopment Potential Study, Nelson Urban Growth Study, Orakei TOD Master-planning, Hobsonville Village Urban Design Options, Onehunga Development Framework and the Taupo Business Zone Structure Planning. -

R E a L Does Proximity to School Still Matter Once Access to Your

R E A L Regional Economics Applications Laboratory www.real.illinois.edu The Regional Economics Applications Laboratory (REAL) is a unit in the University of Illinois focusing on the development and use of analytical models for urban and regional economic development. The purpose of the Discussion Papers is to circulate intermediate and final results of this research among readers within and outside REAL. The opinions and conclusions expressed in the papers are those of the authors and do not necessarily represent those of the University of Illinois. All requests and comments should be directed to Sandy Dall’erba, Director. Does proximity to school still matter once access to your preferred school district has already been secured? Yi Huang Sandy Dall’Erba Econ and REAL, ACE and REAL, University of Illinois at University of Illinois at Urbana- Urbana-Champaign Champaign REAL 19-T-2 May, 2019 Regional Economics Applications Laboratory 67 Mumford Hall 1301 West Gregory Drive Urbana, IL, 61801 Phone: (217) 333- 4740 Does proximity to school still matter once access to your preferred school district has already been secured? Yi Huanga, Sandy Dall’erbab a Department of Economics, University of Illinois at Urbana-Champaign, 214 David Kinley Hall, 1407W. Gregory, Urbana, IL 60801, United States b Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, United States Abstract This paper examines the relationship between proximity to secondary schools and property values within four school enrollment zones in Auckland, New Zealand. Results indicate that, in the most desired school zones, house prices increase with proximity to school but decrease above 4 km. -

Statement of Evidence by Stephen Kenneth Brown

BEFORE THE ENVIRONMENT COURT IN THE MATTER of the Resource Management Act 1991 AND IN THE MATTER of appeals under Clause 14 of the Act in relation to Manawatu Wanganui Regional Council‟s proposed One Plan BETWEEN MERIDIAN ENERGY LTD ENV-2010-WLG-000149 AND MIGHTY RIVER POWER LTD ENV-2010-WLG-000147 AND TRUSTPOWER LTD ENV-2010-WLG-000145 AND GENESIS POWER LTD Env-2010-WLG-000159 AND MANAWATU WANGANUI REGIONAL COUNCIL RESPONDENT STATEMENT OF EVIDENCE BY STEPHEN KENNETH BROWN INTRODUCTION 1. My name is Stephen Kenneth Brown. I hold a Bachelor of Town Planning degree and a post-graduate Diploma of Landscape Architecture. I am a Fellow and the current President of the New Zealand Institute of Landscape Architects, an Affiliate Member of the New Zealand Planning Institute, and have practised as a landscape architect for 29 years. 2. During that period I have specialised in landscape assessment and planning. This has included undertaking the evaluation of the landscape effects associated with a wide variety of development proposals, including: . The Waterview Connection (SH16 & SH20) motorway projects; . The Marsden Point port development; . Eden Park‟s redevelopment for Rugby World Cup 2011; . The Sylvia Park commercial centre; . Project West Wind for the NZ Wind Energy Association; . Te Hauhiko O Wharauroa Wind Park near Raglan in the western Waikato for D & P Walter ; . The proposed Sidonia Hills Wind Farm in west-central Victoria for Hydro Tasmania and Roaring 40s; . The Moorabool Wind Farm in Victoria for West Wind PTY Ltd; . Project Central Wind for Meridian Energy Ltd; and . Project Mill Creek Wind Farm review for Wellington City Council. -

Sylvia Park and the Mt Wellington Area Sunee Yoo

Give Us Space Improving community well-being by enhancing performance and communication of semi-public space in the evolving public realm Analytical Tools Semi-Public Space Conflicts and Alliances in Primary Metropolitan Centres: Sylvia Park, Mt Wellington, Auckland Background to Case Study: Sylvia Park and the Mt Wellington Area Sunee Yoo [ WORKING DOCUMENT GUS/SP2.2] The Auckland Isthmus Historically, the lands and waters of Tāmaki Makaurau (Auckland) have always been highly contested. The isthmus not only offered rich volcanic soils, many waterways and inlets, but also a strategic location for trade. Auckland was centered on interconnecting trade routes between the Bay of Plenty, Coromandel, Waikato and Northland.*https://teara.govt.nz/en/tamaki-tribes/page-1 Around 1250 A.D., voyagers on canoes from East Polynesia became the earliest settlers of New Zealand. Among the many canoes, the Tainui canoe pulled ashore at Waitematā Harbour (Auckland Harbour) and its descendants put down roots in the Auckland Isthmus.*https://teara.govt.nz/en/tamaki-tribes/page-1 And by the 19th century, much of the Hauraki Gulf, including the eastern coast of Auckland, was inhabited by the descendant tribes of Marutūahu of the Taninui canoe. Fig. 1. Map of the Auckland Metropolitan area illustration the distribution of rich volcanic soils developed on Auckland basalt. Case Study site highlighted. http://www.thebookshelf.auckland.ac.nz/docs/Tane/Tane- 29/2%20Prehistoric%20pa%20sites%20of%20metropolitan%20Auckland.pdf (4) Ngāti Pāoa: Iwi of the Mokoia Pā, Maungarei and Mauinaina (Mt Wellington, Panmure area) For many years prior to European contact, Ngāti Pāoa, a descendant tribe of Marutūahu, occupied the stretch of land from the Thames estuary, the Hūnua Ranges, east Tāmaki, Waiheke Island and the coast northward to Whangaparāoa. -

2021 Approved Flu Medical Centres V5.0.Xlsx 16/04/2021 Page 1 of 5

Life Care Consultants Ltd - 2021 Approved Influenza Vaccination Medical Centres/Pharmacies List Important Note: Flu Vouchers expire on October 31st of the year they are purchased. Please call your local medical centre/pharmacy from the approved list to make your appointment. Please allow 20 minutes after your vaccination for the required waiting time. Remember to bring your voucher to the appointment. Please note that vouchers are non-refundable. Island Region City Medical Centre Address Phone North Auckland Airport Oaks Local Doctors Airport Oaks 149A Kirkbride Road, Airport Oaks 09 275 1202 North Auckland Auckland Countdown Pharmacy Greenlane 326 Great South Road, Greenlane 09 523 0015 North Auckland Auckland Countdown Pharmacy Grey Lynn 271 Richmond Road, Grey Lynn, Auckland 09 302 1516 North Auckland Auckland Countdown Pharmacy Penrose 60 Leon Leicester Ave, Mt Wellington, Auckland 09 525 2042 North Auckland Auckland Countdown Pharmacy Takapuna 10 Barry’s Point Road, Takapuna, Auckland 09 255 5645 North Auckland Auckland Shortland Health 51 Shortland Street, Auckland CBD 09 281 0332 North Auckland Auckland Central Countdown Pharmacy Auckland City 76 Quay Street, Auckland 09 255 5374 North Auckland Auckland Central Queen Street Doctors Ltd First Floor Dingwall Building, 87 Queen Street, Auckland 09 373 4055 North Auckland Avondale East Tamaki Health Care Avondale 256 Rosebank Rd, Avondale 09 828 8453 North Auckland Avondale Westcare White Cross New Lynn 2144 Great North Road, Avondale 09 828 8912 North Auckland Botany Downs Countdown