The Future of Learning

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2013--Annual-Report-Accounts.Pdf

Helping people make measurable progress in their lives through learning ANNUAL REPORT AND ACCOUNTS 2013 OUR TRANSFORMATION To find out more about how we are transforming our business go to page 09 EFFICACY To find out more about our focus on efficacy go to page 14 OUR PERFORMANCE For an in-depth analysis of our performance in 2013 go to page 19 Pearson is the world’s leading learning company, with 40,000 employees in more than 80 countries working to help people of all ages to make measurable progress in their lives through learning. We provide learning materials, technologies, assessments and services to teachers and students in order to help people everywhere aim higher and fulfil their true potential. We put the learner at the centre of everything we do. READ OUR REPORT ONLINE Learn more www.pearson.com/ar2013.html/ar2013.html To stay up to date wwithith PPearsonearson throughout the year,r, visit ouourr blog at blog.pearson.comn.com and follow us on Twitteritter – @pearsonplc 01 Heading one OVERVIEW Overview 02 Financial highlights A summary of who we are and what 04 Chairman’s introduction 1 we do, including performance highlights, 06 Our business models our business strategy and key areas of 09 Chief executive’s strategic overview investment and focus. 14 Pearson’s commitment to efficacy OUR PERFORMANCE OUR Our performance 19 Our performance An in-depth analysis of how we 20 Outlook 2014 2 performed in 2013, the outlook 23 Education: North America, International, Professional for 2014 and the principal risks and 32 Financial Times Group uncertainties affecting our businesses. -

Literacy Promises

Literacy Promises The Thirty-Third Yearbook A Doubled Peer Reviewed Publication of the Association of Literacy Educators and Researchers Co-Editors Timothy Morrison Linda Martin Brigham Young University Ball State University Merry Boggs Susan Szabo Texas A&M University-Commerce Texas A&M University-Commerce Leslie Haas Editorial Assistant Texas A&M University-Commerce Copyright 2011 Association of Literacy Educators and Researchers Photocopy/reprint Permission Statement: Permission is hereby granted to professors and teaches to reprint or photocopy any article in the Yearbook for use in their classes, provided each copy of the article made shows the author and yearbook information sited in APA style. Such copies may not be sold, and further distribution is expressly prohibited. Except as authorized above, prior written permission must be obtained from the Association of Literacy Educators and Researchers to reproduce or trans- mit this work or portions thereof in any other form or by another electronic or mechanical means, including any information storage or retrieval system, unless expressly permitted by federal copyright laws. Address inquiries to the Association of Literacy Educators and Researchers (ALER), Dr. David Paige, School of Education, Bellarmine University, 2001 Newburg Road, Louisville, KY 40205 ISBN: 1-883604-17-6 Printed at Texas A&M University-Commerce Cover Design: Crystal Britton, Texas ii ALER OFFIC er S A ND Ele CT E D Boar D Member S Executive Officers 2009-2010 President: Laurie Elish-Piper, Northern Illinois University President-Elect: Mary F. Roe, Arizona State University Vice-President: John Smith, University of Texas at Arlington Past President: Mona Matthews, Georgia State University Executive Secretary: Kathleen (Kit) Mohr, University of North Texas Treasurer: David D. -

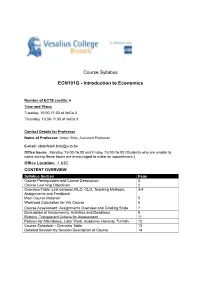

Course Syllabus ECN101G

Course Syllabus ECN101G - Introduction to Economics Number of ECTS credits: 6 Time and Place: Tuesday, 10:00-11:30 at VeCo 3 Thursday, 10:00-11:30 at VeCo 3 Contact Details for Professor Name of Professor: Abdel. Bitat, Assistant Professor E-mail: [email protected] Office hours: Monday, 15:00-16:00 and Friday, 15:00-16:00 (Students who are unable to come during these hours are encouraged to make an appointment.) Office Location: -1.63C CONTENT OVERVIEW Syllabus Section Page Course Prerequisites and Course Description 2 Course Learning Objectives 2 Overview Table: Link between MLO, CLO, Teaching Methods, 3-4 Assignments and Feedback Main Course Material 5 Workload Calculation for this Course 6 Course Assessment: Assignments Overview and Grading Scale 7 Description of Assignments, Activities and Deadlines 8 Rubrics: Transparent Criteria for Assessment 11 Policies for Attendance, Later Work, Academic Honesty, Turnitin 12 Course Schedule – Overview Table 13 Detailed Session-by-Session Description of Course 14 Course Prerequisites (if any) There are no pre-requisites for the course. However, since economics is mathematically intensive, it is worth reviewing secondary school mathematics for a good mastering of the course. A great source which starts with the basics and is available at the VUB library is Simon, C., & Blume, L. (1994). Mathematics for economists. New York: Norton. Course Description The course illustrates the way in which economists view the world. You will learn about basic tools of micro- and macroeconomic analysis and, by applying them, you will understand the behavior of households, firms and government. Problems include: trade and specialization; the operation of markets; industrial structure and economic welfare; the determination of aggregate output and price level; fiscal and monetary policy and foreign exchange rates. -

Longman Dictionary of Contemporary English 6 Ebook, Epub

LONGMAN DICTIONARY OF CONTEMPORARY ENGLISH 6 PDF, EPUB, EBOOK Pearson | 2224 pages | 05 Jul 2015 | Pearson Education Limited | 9781447954200 | English | Harlow, United Kingdom Longman Dictionary of Contemporary English 6 PDF Book Read full description. About this Item: Pearson Education Limited. Add to cart. Proven customer service excellence. View original item. What's new in version 7. Published by Longman Publishing Group Seller Inventory MX-G. Support for iOS7 to iOS9. Shipping prices may be approximate. Download Now. The Study Centre offers practice to help students expand their vocabulary and use words correctly together. Continue shopping. The brand new online resources offer the entire content of the dictionary plus additional innovative functionality to facilitate customisable teaching and learning, and a wealth of practice so that users focus on the words that they want to learn. Show prices without shipping. Brand new: Lowest price The lowest-priced brand-new, unused, unopened, undamaged item in its original packaging where packaging is applicable. It appears that Javascript is disabled in your browser. About Speedyhen. PLUS additional collocations, synonyms, and word origins. Product details Format: Paperback Language of text: English Isbn , Publisher: Pearson Education Limited Edition: 6 Series: Longman Dictionary of Contemporary English Imprint: Pearson Longman Publication date: Pages: Product dimensions: mm w x mm h x 50mm d Overview The sixth edition of this best-selling dictionary ensures students produce more accurate English both in writing and speaking with , words, phrases and meanings. The new Longman Collocations Dictionary and Thesaurus is now available online, giving you fast and easy access to the complete print dictionary. -

Alternative Textbooks Publishers

ALTERNATIVE TEXT PUBLISHERS TUTORING SERVICES 2071 CEDAR HALL ALTERNATIVE TEXT PUBLISHERS Below is a list of all the publishers we work with to provide alternative text files. Aaronco Pet Products, Inc. Iowa State: Extension and Outreach Abrams Publishing Jones & Bartlett Learning ACR Publications KendallHunt Publishing Alpine Publisher Kogan Page American Health Information Management Associations Labyrinth Learning American Hotels and Lodging Legal Books Distributing American Technical Publishers Lippincott Williams and Wilkins American Welding Society Longleaf Services AOTA Press Lynne Rienner Publishers Apress Macmillan Higher Education Associated Press Manning Publications ATI Nursing Education McGraw-Hill Education American Water Works Association Mike Holt Enterprises Baker Publishing Group Morton Publishing Company Barron's Mosby Bedford/St. Martin's Murach Books Bison Books NAEYC Blackwell Books NASW Press National Board for Certification in Bloomsbury Publishing Dental Laboratory Technology (NBC) National Restaurant Association/ Blue Book, The ServSafe Blue Door Publishing Office of Water Programs BookLand Press Openstax Broadview Press O'Reilly Media Building Performance Institute, Inc. Oxford University Press BVT Publishing Paradigm Publishing Cadquest Pearson Custom Editions ALTERNATIVE TEXT PUBLISHERS Cambridge University Press Pearson Education CE Publishing Peguin Books Cengage Learning Pennwell Books Charles C. Thomas, Publisher Picador Charles Thomas Publisher Pioneer Drama Cheng & Tsui PlanningShop Chicago Distribution -

Don't Make Me Think, Revisited

Don’t Make Me Think, Revisited A Common Sense Approach to Web Usability Steve Krug Don’t Make Me Think, Revisited A Common Sense Approach to Web Usability Copyright © 2014 Steve Krug New Riders www.newriders.com To report errors, please send a note to [email protected] New Riders is an imprint of Peachpit, a division of Pearson Education. Editor: Elisabeth Bayle Project Editor: Nancy Davis Production Editor: Lisa Brazieal Copy Editor: Barbara Flanagan Interior Design and Composition: Romney Lange Illustrations by Mark Matcho and Mimi Heft Farnham fonts provided by The Font Bureau, Inc. (www.fontbureau.com) Notice of Rights All rights reserved. No part of this book may be reproduced or transmitted in any form by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher. For information on getting permission for reprints and excerpts, contact [email protected]. Notice of Liability The information in this book is distributed on an “As Is” basis, without warranty. While every precaution has been taken in the preparation of the book, neither the author nor Peachpit shall have any liability to any person or entity with respect to any loss or damage caused or alleged to be caused directly or indirectly by the instructions contained in this book or by the computer software and hardware products described in it. Trademarks It’s not rocket surgery™ is a trademark of Steve Krug. Many of the designations used by manufacturers and sellers to distinguish their products are claimed as trademarks. Where those designations appear in this book, and Peachpit was aware of a trademark claim, the designations appear as requested by the owner of the trademark. -

Our Publishing Instructors

Our Publishing Instructors Our instructors are respected industry experts. They all work in publishing and bring up-to- date, applied knowledge to every course. Elizabeth d’Anjou is a freelance editor with over 25 years of experience serving a diverse clientele, including educational publishers, corporations, government, and non-profit agencies. She is a sought-after speaker and trainer, offering workshops on a number of editing-related topics across the country through Editors Canada and in corporate settings. She has twice served on the Editors Canada national executive, most recently as Director of Standards, and has co-chaired local branches in Toronto and Kingston. Current and past clients include Nelson Education, the RCMP, the Osgoode Hall Law Journal, and the Centre for Addiction and Mental Health (CAMH). Course(s): CDPB 102, CDPB 312 Saffron Beckwith is President at Ampersand Inc. As part of Canada’s longest-serving commissioned sales force, she has experience selling everything from Harry Potter to first-time poets. She has been teaching since 2004 and loves teaching and selling. Course(s): CDPB 105 Gary Bennett is a publishing professional with over 25 years’ experience. Currently VP Digital Studio at Pearson Education in Toronto, he manages a diverse team of developers and producers who support Pearson Canada's domestic digital and print publishing programs for both K-12 and Higher Education. He has prior experience as a Publisher, Acquisitions Editor, Marketing Manager, Sales Representative, and Sales Manager. Previously, he has worked at John Wiley & Sons, McGraw-Hill Ryerson, and Nelson Canada. Course(s): CDPB 101 Camilla Blakeley is a partner in Blakeley Words+Pictures. -

A FIRST COURSE in PROBABILITY This Page Intentionally Left Blank a FIRST COURSE in PROBABILITY

A FIRST COURSE IN PROBABILITY This page intentionally left blank A FIRST COURSE IN PROBABILITY Eighth Edition Sheldon Ross University of Southern California Upper Saddle River, New Jersey 07458 Library of Congress Cataloging-in-Publication Data Ross, Sheldon M. A first course in probability / Sheldon Ross. — 8th ed. p. cm. Includes bibliographical references and index. ISBN-13: 978-0-13-603313-4 ISBN-10: 0-13-603313-X 1. Probabilities—Textbooks. I. Title. QA273.R83 2010 519.2—dc22 2008033720 Editor in Chief, Mathematics and Statistics: Deirdre Lynch Senior Project Editor: Rachel S. Reeve Assistant Editor: Christina Lepre Editorial Assistant: Dana Jones Project Manager: Robert S. Merenoff Associate Managing Editor: Bayani Mendoza de Leon Senior Managing Editor: Linda Mihatov Behrens Senior Operations Supervisor: Diane Peirano Marketing Assistant: Kathleen DeChavez Creative Director: Jayne Conte Art Director/Designer: Bruce Kenselaar AV Project Manager: Thomas Benfatti Compositor: Integra Software Services Pvt. Ltd, Pondicherry, India Cover Image Credit: Getty Images, Inc. © 2010, 2006, 2002, 1998, 1994, 1988, 1984, 1976 by Pearson Education, Inc., Pearson Prentice Hall Pearson Education, Inc. Upper Saddle River, NJ 07458 All rights reserved. No part of this book may be reproduced, in any form or by any means, without permission in writing from the publisher. Pearson Prentice Hall™ is a trademark of Pearson Education, Inc. Printed in the United States of America 10987654321 ISBN-13: 978-0-13-603313-4 ISBN-10: 0-13-603313-X Pearson Education, Ltd., London Pearson Education Australia PTY. Limited, Sydney Pearson Education Singapore, Pte. Ltd Pearson Education North Asia Ltd, Hong Kong Pearson Education Canada, Ltd., Toronto Pearson Educacion´ de Mexico, S.A. -

Thesis Submitted for the Degree of Doctor of Education University of Bath Department of Education January 2017

University of Bath DOCTOR OF EDUCATION (EDD) The role of a transnational education service business in higher education Irving, Rosalind Award date: 2017 Awarding institution: University of Bath Link to publication Alternative formats If you require this document in an alternative format, please contact: [email protected] General rights Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying the publication in the public portal ? Take down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. Download date: 25. Sep. 2021 The Role of a Transnational Education Service Business in Higher Education Rosalind Irving A Thesis Submitted for the Degree of Doctor of Education University of Bath Department of Education January 2017 COPYRIGHT Attention is drawn to the fact that copyright of this thesis rests with the author. A copy of this thesis has been supplied on condition that anyone who consults it is understood to recognise that its copyright rests with the author and that they must not copy it or use material from it except as permitted by law or with the consent of the author. -

In 2013, Pearson Increased Sales by 2% in Headline Terms to £5.2Bn

Section 2 Our performance 19 Our performance: 2013 financial overview KEY FINANCIAL GOALS OVERVIEW Adjusted earnings per share Pence 13 70.1p70.1p 12 8282.6p.6p 11 86.086.0pp 10 7777.5p.5p 09 65.4p 08 57.7p Average annual growth (headline) 4% Robin Freestone, Chief financial officer of Pearson OperatingOperating cash flowflow £m£m PERFORMANCE OUR 13 £588m£588m 12 £788m£788m In 2013, Pearson increased 11 £983m 10 £1,057m£1,057m sales by 2% in headline 09 £913m£913m terms to £5.2bn generating 08 £796m ReturnReturn on invested capitalcapital % adjusted operating profit 13 5.4%5.4% 12 99.1%.1% BUSINESS RESPONSIBLE of £736m after net 11 9.0% restructuring charges. 10 10.3% 09 8.9% 08 9.2% Average capital/actual cash tax Penguin Random House was reported post-tax Acquisitions contributed £119m to sales and £50m to following completion of the transaction on 1 July 2013 operating profits. This includes integration costs and and resulted in a £23m reduction in the contribution investments related to our newly-acquired companies, to operating income with an equal benefit to our tax which we expense. Disposals and our exit from GOVERNANCE charge. We expensed £135m of net restructuring Pearson in Practice reduced revenues by £49m but charges during the year. Adjusted operating profit boosted operating income by £23m. Associate including the negative impact of Penguin Random accounting arising from the Penguin Random House House associate accounting but excluding the transaction reduced operating income by £23m. restructuring charges was £871m. Stripping out the impact of portfolio changes, the The headline growth rates were helped by both Penguin Random House transaction, net restructuring currency movements and acquisitions. -

SCORE! and Pearson to Co-Develop Customized Learning Technology for Online Tutoring

SCORE! and Pearson to Co-Develop Customized Learning Technology for Online Tutoring March 6, 2000 SAN FRANCISCO--Pearson to Invest in SCORE! and Promote eSCORE.com Online Through its Education Network Alliance Supports Kaplan's Commitment to Internet Education SCORE! Learning, Inc., a subsidiary of Kaplan, Inc. and a leading provider of education services for families, and Pearson plc, the world's largest educational publisher, today announced their intention to form a strategic alliance that will expand both companies' reach in the pre-K through 12 market. SCORE! and Pearson will co-develop technology to provide customized learning experiences for children. Pearson will give eSCORE.com premium placement on the pre-K through 12 section of its education network, a portal scheduled to launch later this year on the Web and on America Online. The network will be the preferred supplier of educational content and tools on AOL, enabling eSCORE.com to reach millions of subscribers. In addition, Pearson will invest at least $20 million in SCORE! for an ownership interest in the company, and Kaplan plans to invest an undisclosed sum in Pearson's education network. The proposed investments and business partnership are subject to negotiation and execution of definitive agreements. eSCORE.com, SCORE!'s online learning site, will use the jointly developed technology as the foundation for launching online tutoring services, where children will work synchronously with a live, online academic Coach on their math, reading, spelling and other skills. The customized learning software will also be used in SCORE!'s after-school educational centers, where students in grades K-10 build academic skills, self-confidence and a love of learning. -

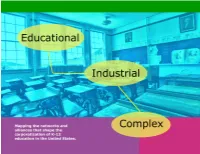

Educational Industrial Complex (EIC)?

What is the Educational Industrial Complex (EIC)? The term Educational Industrial Complex (EIC) was first used by Anthony Picci- ano in 1994. According to A. Picciano and Joel Spring (2013), the EIC revolves Charter Schools: the Safe and Stable around three major components-ideology, profit, and technology. The EIC is made up of multiple networks and alliances of agencies, organizations, foun- Investment Choice dations, media companies, educational technology providers, for profit educa- tional providers, venture philanthropies, and think tanks. These networks and In 2012 on CNBC David Brain, the head of a large real-estate alliances interact with each other to push for market-based initiatives. investment company called Entertainment Properties Trust, talks about how profitable charter school investment is: The three biggest players in “education reform” in K-12 schools mostly directed “Well I think it’s a very stable business, very recession-resistant. to low-income students and families are the Bill and Melinda Gates Founda- It’s a very high-demand product” tion (Microsoft), the Eli and Edythe Board Foundation (finance, real estate, When he was asked about the most profitable sector in the real and insurance) and the Walton Family Foundation (Walmart). estate market he said: “Well, probably the charter school business. We said it’s our high- Education reform means promoting market based initiatives that undermine est growth and most appealing sector right now of the portfolio. public education. These market-based initiatives promote competition, privati- It’s the most high in demand, it’s the most recession-resistant. zation, high-stakes testing and anti-teachers unions.