Appendix I Chronology of Events

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Russian Oil and Gas Challenges

Order Code RL33212 Russian Oil and Gas Challenges Updated June 20, 2007 Robert Pirog Specialist in Energy Economics and Policy Resources, Science, and Industry Division Russian Oil and Gas Challenges Summary Russia is a major player in world energy markets. It has more proven natural gas reserves than any other country, is among the top ten in proven oil reserves, is the largest exporter of natural gas, the second largest oil exporter, and the third largest energy consumer. Energy exports have been a major driver of Russia’s economic growth over the last five years, as Russian oil production has risen strongly and world oil prices have been very high. This type of growth has made the Russian economy dependent on oil and natural gas exports and vulnerable to fluctuations in oil prices. The Russian government has moved to take control of the country’s energy supplies. It broke up the previously large energy company Yukos and acquired its main oil production subsidiary. The Duma voted to give Gazprom, the state- controlled natural gas monopoly the exclusive right to export natural gas; Russia moved to limit participation by foreign companies in oil and gas production and Gazprom gained majority control of the Sakhalin energy projects. Russia has agreed with Germany to supply Germany and, eventually, the UK by building a natural gas pipeline under the Baltic Sea, bypassing Ukraine and Poland. In late 2006 and early 2007, Russia cut off and/or threatened to cut off gas or oil supplies going to and/or through Ukraine, Moldova, Georgia, and Belarus in the context of price and/or transit negotiations — actions that damaged its reputation as a reliable energy supplier. -

Copyrighted Material

Index Abraham, Spencer, 82 Anadarko Petroleum Corp., 74, 185 Accidents, industrial, 18 Anderson, Jason, 158 Acheson, Dean, 53 Anderson, Paul, 153 Alaska, 24, 46, 56 –57, 81, 89 Anglo-Persian (Iranian) Oil Co., 45, 49, BP’s maintenance problems, 135 50 –54 fi nes paid by BP for spills, 133, 143 Angola, 12, 38, 41, 70 oil spills, 114, 119–135 Apache Corp., 186 Al-Husseini, Sadad I., 124 Atlantic Richfi eld Co. (ARCO), 30 –31, Allen, Mark, 37–38 56, 57, 114, 125, 126 Allen, Thad, 176 Atlantis, 66, 72, 193 All the Shah’s Men (Kinzer), 51 Azerbaijan, 31, 37, 41, 47 Al-Megrahi, Abdel Basset, 38 Al-Naimi, Ali, 35 –36 Baker, James, 105, 112, 142 Alternative energyCOPYRIGHTED technology, 33 Balzer, MATERIAL Dick, 40 Alyeska Pipeline Service Co., Barbier, Carl, 185 120, 121 Barton, Joe, 151, 182 American Petroleum Institute (API), 82, Bauer, Robert, 182 87, 91 Bea, Bob, 125 –128, 131, 160, 173 Amoco, 28 –30, 36 –37, 106, 125, 126 Bertone, Stephen, 6 –9, 16 217 bbindex.inddindex.indd 221717 112/1/102/1/10 77:05:39:05:39 AAMM INDEX Big Kahuna, 78 establishes victims’ fund after Gulf spill, Blackbeard well, 129, 160 181, 182–183 Bledsoe, Paul, 34 events leading up to Gulf explosion, Blowout preventer (BOP), 92, 146, 155 –173 148, 156 –157, 161, 167, 168, exploration and production unit, 175, 192 10, 145 Bly, Mark, 165 –166, 169 fi nally caps Gulf well, 152 Bondy, Rupert, 145 fi nancial liability from Gulf oil spill, 152 Bowlin, Mike, 30 fi nes paid for safety violations, 133, 143 BP: industrial accidents in U.S., 18 begins developing Alaska, 56 –57 investigation -

Enquest Announces the Appointment of Neil Mcculloch As Head of Its North Sea Business

ENQUEST ANNOUNCES THE APPOINTMENT OF NEIL MCCULLOCH AS HEAD OF ITS NORTH SEA BUSINESS EnQuest PLC is pleased to announce the appointment of Neil McCulloch as President, North Sea, with effect from 1 April 2014. Neil has held a number of senior positions in the oil and gas sector, and joins EnQuest from international oil and gas company OMV AG, where he held the global role of Senior Vice President Production & Engineering. Prior to this, Neil spent 11 years with BG Group in a range of senior UK and international roles, most recently as Vice President & Asset General Manager, UK Upstream, with accountability for the delivery of BG’s UK North Sea business. Neil will succeed David Heslop, who retires from his role as Managing Director UKCS on 1 April 2014. Thereafter David will continue to support EnQuest in an advisory capacity or on special projects. Amjad Bseisu, Chief Executive of EnQuest said: “I am delighted to welcome Neil as head of our North Sea business. With his wealth of technical and management experience in the oil and gas industry and in the UK North Sea in particular, I am confident that Neil will be an excellent member of EnQuest’s senior management team and will make a valuable contribution to the growth and development of EnQuest over the coming years. “The Board and I would also like to express our sincere gratitude to David for his contribution to EnQuest in our formative years; his leadership, knowledge and experience have been key to many of EnQuest’s successes and achievements, and have helped us to build a world class organisation in Aberdeen. -

Offshore Wind Operations & Maintenance a £9 Billion Per

OFFSHORE WIND OPERATIONS & MAINTENANCE A £9 BILLION PER YEAR OPPORTUNITY BY 2O3O FOR THE UK TO SEIZE OPERATIONS & MAINTENANCE SUMMARY New data compiled by the Offshore Renewable Energy (ORE) Catapult reveals the UK offshore wind operations & maintenance (O&M) market will grow faster in relative terms than any other offshore wind sub sector market over the next decade. By 2O3O, it will be the UK’s second largest sub sector market after turbine supply: a projected £1.3 billion per year opportunity. The Rest of the World (excluding UK) offshore wind O&M market opportunity is even greater. We project it will be valued at £7.6 billion per year by 2030. To discuss commercial dynamics in offshore wind O&M, we conducted an interview with energy industry leader Sir Ian Wood, which is summarised below. His comments highlight that offshore wind O&M is an area that plays to the UK’s existing strengths in offshore oil and gas services and associated technologies. O&M already has the highest level of UK content of any part of the offshore wind supply chain. In short, there is a sizable opportunity for the UK to create internationally significant service businesses in offshore wind O&M, learning from experience from the North Sea oil and gas industry. We already have the vital elements to capture this opportunity but investment in infrastructure to create the environment for collaborative development and demonstration of the enabling technologies and services is required. DEFINING OFFSHORE WIND O&M A clear definition of offshore wind O&M comes from a report published by GL Garrad Hassan: Offshore wind O&M is the activity that follows commissioning to ensure the safe and economic running of the project. -

Prospective Decommissioning Activity and Infrastructure Availability in the UKCS

NORTH SEA STUDY OCCASIONAL PAPER No. 122 Prospective Decommissioning Activity and Infrastructure Availability in the UKCS Professor Alexander G. Kemp and Linda Stephen October, 2011 DEPARTMENT OF ECONOMICS ISSN 0143-022X NORTH SEA ECONOMICS Research in North Sea Economics has been conducted in the Economics Department since 1973. The present and likely future effects of oil and gas developments on the Scottish economy formed the subject of a long term study undertaken for the Scottish Office. The final report of this study, The Economic Impact of North Sea Oil on Scotland, was published by HMSO in 1978. In more recent years further work has been done on the impact of oil on local economies and on the barriers to entry and characteristics of the supply companies in the offshore oil industry. The second and longer lasting theme of research has been an analysis of licensing and fiscal regimes applied to petroleum exploitation. Work in this field was initially financed by a major firm of accountants, by British Petroleum, and subsequently by the Shell Grants Committee. Much of this work has involved analysis of fiscal systems in other oil producing countries including Australia, Canada, the United States, Indonesia, Egypt, Nigeria and Malaysia. Because of the continuing interest in the UK fiscal system many papers have been produced on the effects of this regime. From 1985 to 1987 the Economic and Social Science Research Council financed research on the relationship between oil companies and Governments in the UK, Norway, Denmark and The Netherlands. A main part of this work involved the construction of Monte Carlo simulation models which have been employed to measure the extents to which fiscal systems share in exploration and development risks. -

A Historic North Sea Oil Discovery

AA historichistoric NorthNorth SeaSea oiloil discoverydiscovery 1616 AugustAugust 20112011 Sigrid Borthen Toven, VP Exploration North Sea South 1- Aldous Major South A new giant discovery “right in our back yard” High impact discovery in our core area • Utsira High, Greater Sleipner area • ~140 km west of Stavanger • 35 km south of Grane • Water depth: 112 meters Stavanger • Reservoir depth: ~ 1900 meters • Drilling rig: Transocean Leader 16/2-8 Aldous Major South PL265 license operated by Statoil • Statoil 40% • Petoro 30% • Det norske oljeselskap 20% ILLUSTRATIVE • Lundin 10% 2-2 - Aldous and Avaldsnes combined potential Probably largest NCS discovery since mid-80s Aldous • Oil/water contact confirms communication Major North • Combined discovery in PL 265 and PL 501 between 500 million and 1.2 billion barrels of PL 501 Avaldsnes recoverable o.e. (est.) discovery well • 200 to 400 million barrels proven by well 16/2-8 PL 265 with strong indications from well data of another Avaldsnes 200 to 400 million barrels in the same structure appraisal 5km • 100 to 400 barrels previously estimated in PL 501B Avaldsnes Aldous Major South • Aldous Major North well 16/2-9 (PL265) will clarify discovery well further upside potential and eventual Avaldsnes communication with Aldous/Avaldsnes appraisal PL 502 • Further appraisal drilling in licence PL 265 next year to clarify the full volume potential Aldous (PL 265) Avaldsnes (PL 501) • Statoil 40% (operator) • Lundin 40% (operator) • Petoro 30% • Statoil 40% • Det norske 20% • Mærsk 20% • Lundin 10% -

BP Annual Report and Form 20-F 2018 Scoping Our Scope Covered 136 Components

Financial 114 Consolidated financial statements of the BP group Independent auditor’s reports 114 Group statement of statements Group income statement 129 changes in equity 131 Group statement of Group balance sheet 132 comprehensive income 130 Group cash flow statement 133 134 Notes on financial statements 1. Significant accounting 22. Trade and other payables 172 policies 134 23. Provisions 172 2. Significant event – Gulf of 24. Pensions and other post- Mexico oil spill 151 retirement benefits 172 3. Business combinations and 25. Cash and cash equivalents 179 other significant transactions 153 26. Finance debt 179 4. Disposals and impairment 154 27. Capital disclosures and 5. Segmental analysis 156 analysis of changes in 6. Revenue from contracts net debt 180 with customers 159 28. Operating leases 180 7. Income statement analysis 159 29. Financial instruments and 8. Exploration expenditure 160 financial risk factors 181 9. Taxation 160 30. Derivative financial 10. Dividends 163 instruments 185 11. Earnings per share 163 31. Called-up share capital 192 12. Property, plant and 32. Capital and reserves 194 equipment 165 33. Contingent liabilities 197 13. Capital commitments 165 34. Remuneration of senior 14. Goodwill 166 management and non- 15. Intangible assets 167 executive directors 198 16. Investments in joint ventures 168 35. Employee costs and 17. Investments in associates 168 numbers 199 18. Other investments 170 36. Auditor’s remuneration 199 Financial statements 19. Inventories 170 37. Subsidiaries, joint 20. Trade and other arrangements -

Petroleum Politics: China and Its National Oil Companies

MASTER IN ADVANCED EUROPEAN AND INTERNATIONAL STUDIES ANGLOPHONE BRANCH - Academic year 2012/2013 Master Thesis Petroleum Politics: China and Its National Oil Companies By Ellennor Grace M. FRANCISCO 26 June 2013 Supervised by: Dr. Laurent BAECHLER Deputy Director MAEIS To Whom I owe my willing and my running CONTENTS List of Tables and Figures v List of Abbreviations vi Chapter 1. Introduction 1 1.1 Literature Review 2 1.2 Methodologies 4 1.3 Objectives and Scope 4 Chapter 2. Historical Evolution of Chinese National Oil Companies 6 2.1 The Central Government and “Self-Reliance” (1950- 1977) 6 2.2 Breakdown and Corporatization: First Reform (1978- 1991) 7 2.3 Decentralization: Second Reform (1992- 2003) 11 2.4 Government Institutions and NOCs: A Move to Recentralization? (2003- 2010) 13 2.5 Corporate Governance, Ownership and Marketization 15 2.5.1 International Market 16 2.5.2 Domestic Market 17 Chapter 3. Chinese Politics and NOC Governance 19 3.1 CCP’s Controlling Mechanisms 19 3.1.1 State Assets Supervision and Administration Commission (SASAC) 19 3.1.2 Central Organization Department 21 3.2 Transference Between Government and Corporate Positions 23 3.3 Traditional Connections and the Guanxi 26 3.4 Convergence of NOC Politics 29 Chapter 4. The “Big Four”: Overview of the Chinese Banking Sector 30 Preferential Treatment 33 Chapter 5. Oil Security and The Going Out Policy 36 5.1 The Policy Driver: Equity Oil 36 5.2 The Going Out Policy (zou chu qu) 37 5.2.1 The Development of OFDI and NOCs 37 5.2.2 Trends of Outward Foreign Investments 39 5.3 State Financing: The Chinese Policy Banks 42 5.4 Loans for Oil 44 Chapter 6. -

The Politics of Oil, Gas Contract Negotiations in Sub-Saharan Africa

The politics of oil, gas contract negotiations in Sub-Saharan Africa This article is part of DIIS Report 2014:25 “Policies and finance for economic development and trade” Read more at www.diis.dk THE POLITICS OF OIL, GAS CONTRACT NEGOTIATIONS IN SUB-SAHARAN AFRICA By: Rasmus Hundsbæk Pedersen, DIIS, 2014 SUMMARY Much attention has been paid to the management of revenues from petroleum resources in Sub-Saharan Africa. An entire body of literature on the resource curse has developed which points to corruption during the negotiation of contracts, as well as the mismanagement of revenues on the continent. The analyses provide the basis for policy advice for countries as well as donors; transparency and anti- corruption initiatives aimed at lifting the curse flourish. Though this paper is sympathetic to these initiatives, it argues that the analysis may underestimate the inherently political nature of the negotiation of contracts. Based on a review of the existing literature on contract negotiations in Africa, combined with a case study of Tanzania, the paper argues that the resource curse need not hit all countries on the African continent. By focusing on changes in the relative bargaining strength of actors involved in negotiating processes, it points to the choices and trade-offs that invariably affect the terms and conditions of exploration and production activities. Whereas international oil companies are often depicted as being in the driving seat, the last decade’s high oil prices may have shifted power in governments’ favor. Though their influence has declined, donors may still want to influence oil and gas politics under these circumstances. -

Logoboek 2021-01-26

Offshore Supply and Support Vessels – World Wide JANUARI 2021 A Westcoasting Product Compiled by Ko Rusman, Herbert Westerwal and Dries Stommen [email protected] 1 Fleet List explanatarory notes ABS Marine Services Pvt. Ltd., Chennai, India The fleet listings are shown under the operating groups. The vessel listings indicate: Column 1 – Name of vessel. Column 2 – Year of build. Column 3 – Gross tonnage. Column 4 – Deadweight tonnage. Column 5 – Break horsepower. Column 6 – Bollard pull. Column 7 – Vessel type. ABS Amelia 2010 2177 3250 5452 PSV FiFi 1 Column 8 – FiFi Class. ABS Anokhi 2005 1995 1700 6002 65 AHTS FiFi 1 Explanation column 7 Vessel types: Abu Qurrah Oil Well Maintenance Establishment, Abu Dhabi, UAE PSV –Platform Supply Vessel. AHTS –Anchor Handling Tug Supply. AHT –Anchor Handling Tug. DS –Diving Support Vessel. StBy –Safety Standby Vessel. MAIN –Maintenance Vessel. U-W –Utility Workboat. SEIS –Seismic Survey Vessel. RES –Research Vessel. OILW –Oilwell Stimulation Vessel. OilPol –Oil Pollution Vessel Al Nader 1970 275 687 1700 20 OILW MAIN –Maintenance Vessel. Al-Manarah 1971 275 687 1700 OILW W2W –Walk To Work Vessel. Al-Manarah 2 1998 769 1000 1250 OILW FRU –Floating Regasification Unit. ACSM Agencia Maritima S.L.U., Vigo, Spain Nautilus 2001 2401 3248 5302 PSV ACE Offshore Ltd., Hong Kong, China A & E Petrol Nigeria, Ltd., Warri, Nigeria Guangdong Yuexin 3270 2021 1930 1370 6400 75 AHTS Guangdong Yuexin 3271 2021 1930 1370 6400 75 AHTS O'Misan 1 1968 575 550 1700 PSV Acta Marine Group, Den Helder, Netherlands AAM -

BP Plc Vs Royal Dutch Shell Which One to Buy Right Now

DECEMBER 2019 ATLANTIC ADVISORY BP plc Vs Royal Dutch Shell Which one to buy right now 01872 229 000 www.atlanticmarkets.co.uk01872 229 000 www.atlanticadvisory.co.uk www.atlanticmarkets.co.uk BP Plc Ticker BP. Objective Capital growth and income Dividend Yield 6.71% A Brief History BP is a British multinational oil and gas company headquartered in London. It is one of the world’s oil and gas supermajors. · 1908. The founding of the Anglo-Persian Oil Company, established as a subsidiary of Burmah Oil Company to take advantage of oil discoveries in Iran. · 1935. It became the Anglo-Iranian Oil Company · 1954. Adopted the name British Petroleum. · 1959. The company expanded beyond the Middle East to Alaska and it was one of the first companies to strike oil in the North Sea. · 1978. British Petroleum acquired majority control of Standard Oil of Ohio. Formerly majority state- owned. · 1979–1987. The British government privatised the company in stages between. · 1998. British Petroleum merged with Amoco, becoming BP Amoco plc, · 2000-2001. Acquired ARCO and Burmah Castrol, becoming BP plc. · 2003–2013. BP was a partner in the TNK-BP joint venture in Russia. Positioning Bp is a “vertically integrated” company, meaning it’s involved in the whole supply chain – from discovering oil, producing it, refining it, shipping it, trading it and selling it at the petrol pump. BP has operations in nearly 80 countries worldwide, produced around 3.7 million barrels per day (590,000 m3/d) of oil equivalent, and had total proven reserves of 19.945 billion barrels (3.1710×109 m3) of oil equivalent. -

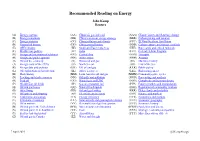

Recommended Reading on Energy

Recommended Reading on Energy John Kemp Reuters (A) Energy systems (AA) China oil, gas and coal (AAA) Climate issues and planetary change (B) Energy transitions (BB) China’s overseas energy strategy (BBB) Carbon pricing and taxation (C) Energy statistics (CC) China pollution and climate (CCC) El Nino/Southern Oscillation (D) General oil history (DD) China general history (DDD) Carbon capture and storage, synfuels (E) OPEC history (EE) South and East China Seas (EEE) Rare earths and critical minerals (F) Middle East politics (FF) India (FFF) Federal Helium Program (G) Energy and international relations (GG) Central Asia (GGG) Transport (H) Energy and public opinion (HH) Arctic issues (HHH) Aviation (I) Oil and the economy (II) Russia oil and gas (III) Maritime history (J) Energy crisis of the 1970s (JJ) North Sea oil (JJJ) Law of the Sea (K) Energy data and analysis (KK) UK oil and gas (KKK) Public policy (L) Oil exploration and production (LL) Africa resources (LLL) Risk management (M) Shale history (MM) Latin America oil and gas (MMM) Commodity price cycles (N) Fracking and shale resources (NN) Oil spills and pollution (NNN) Forecasting and analysis (O) Peak oil (OO) Natural gas and LNG (OOO) Complexity and systems theory (P) Middle East oil fields (PP) Gas as a transport fuel (PPP) Futures markets and manipulation (Q) Oil and gas leases (QQ) Natural Gas Liquids (QQQ) Regulation of commodity markets (R) Oil refining (RR) Oil and gas lending (RRR) Hedge funds and volatility (S) Oil tankers and shipping (SS) Electricity and security (SSS) Finance and markets (T) Tank farms and storage (TT) Energy efficiency (TTT) Economics and markets (U) Petroleum economics (UU) Solar activity and geomagnetic storms (UUU) Economic geography (V) Oil in wartime (VV) Renewables and grid integration (VVV) Economic history (W) Oil and gas in the United States (WW) Nuclear power and weapons (WWW) Epidemics and disease (X) Oil and gas in U.S.