Macquarie Asset Management and Has a 23-Year Track Record in Infrastructure Investment and Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NSW Infrastructure Capability Assessment: Energy Baseline Report

NSW Infrastructure Capability Assessment Energy Baseline Report April 2012 This document is intended solely for the use and information of Infrastructure NSW Report Outline • Key Highlights • Introduction • Energy Industry Overview and Current Situation • Electricity • Gas 22 Key Highlights – Electricity • The majority of electricity generation and all transmission and distribution infrastructure assets in NSW are government owned • The NSW government recently privatised the retail electricity sector and announced plans to sell electricity generation assets • 82% (or 16,600MW) of electricity in NSW is generated by 4 key state owned corporations . Electricity is transmitted over a 12,000km transmission system and distributed over ~250,000km distribution system. The book value of this infrastructure is $34bn and the annual capital expenditure is around $4.5bn • Electricity infrastructure is planned through a number of national and operator network plans including the Electricity Statement of Opportunities, the National Transmission Network Development Plan, TransGrid's Annual Transmission Network Development Plan, the distributors Annual Network Development Plans and Performance Reports, and the 5-year Regulatory Proposals and Determinations by the Australian Energy Regulator • These reports provide evidence that, while a number of the state owned electricity distribution assets are beyond or approaching their standard design lives, electricity infrastructure appears to be in good condition and is capable of meeting demand • The performance of electricity generation, transmission and distribution infrastructure is monitored via a number of indicators. The NSW Government sets reliability and security standards through its Network licences. Key electricity operating licence performance indicators such as the average duration and frequency of interruptions have been improving over time • Electricity demand has been flat for the past 5 years partly due to slower economic growth, efficiency and in response to large price increases. -

Tariff Structure Statement (27 November 2015)

Tariff Structure Statement (27 November 2015) Supporting Documentation: Customer and Stakeholder Report TARIFF STRUCTURE STATEMENT CUSTOMER AND STAKEHOLDER REPORT NOVEMBER 2015 Further information contact: Kate McCue Manager Corporate Affairs, Endeavour Energy Ph: 02 9853 6141 Email: [email protected] Contents EXECUTIVE SUMMARY 3 OVERVIEW OF OUR TSS STAKEHOLDER ENGAGEMENT 6 TABLE 1 - PHASES ONE AND TWO: TSS STAKEHOLDER CONSULTATION AND ENGAGEMENT 2013-2015 6 TABLE 2 - WHAT STAKEHOLDERS SAID AND HOW WE RESPONDED 9 PHASES ONE AND TWO – HOW WE ENGAGED 17 TABLE 3 - PHASES ONE AND TWO - MODES OF TSS STAKEHOLDER ENGAGEMENT 2013 - 2015 17 TABLE 4 - PHASE TWO: INITIAL STAKEHOLDER ENGAGEMENT CONDUCTED BY ACIL ALLEN CONSULTING AROUND PREFERENCES ON ENGAGING THE NSW NETWORK BUSINESSES ON TSS ISSUES 20 TABLE 5 - PHASE TWO: INTERVIEWS (ONE-ON-ONE) OF UP TO ONE HOUR WITH TSS STAKEHOLDERS POST RELEASE OF THE NNSW TSS ISSUES PAPER 21 TABLE 6 - PHASE TWO: ENA AND NETWORKS NSW STAKEHOLDER WORKSHOP ON VULNERABLE CUSTOMER ISSUES AND FUTURE TARIFF STRUCTURES 21 TABLE 7 – PHASE TWO: NETWORKS NSW ELECTRICITY RETAILERS STAKEHOLDER ROUNDTABLE ON FUTURE TARIFF STRUCTURES 22 TABLE 8 - PHASE TWO: NETWORKS NSW FOOD AND FIBRE STAKEHOLDER ROUNDTABLE ON FUTURE TARIFF STRUCTURES 23 TABLE 9 - PHASE TWO: NETWORKS NSW ENVIRONMENT AND CONSUMER ADVOCATES ROUNDTABLE ON FUTURE TARIFF STRUCTURES 24 TABLE 10 - PHASE TWO: NETWORKS NSW ENVIRONMENT AND CONSUMER ADVOCATES SECOND ROUNDUNDTABLE ON FUTURE TARIFF OPTIONS 24 TABLE 11 - PHASE TWO: NETWORKS NSW ENVIRONMENTAL AND CONSUMER ADVOCATES THIRD ROUNDTABLE ON FUTURE TARIFF STRUCTURES 25 PHASE TWO: POST TSS ISSUES PAPER RELEASE INTERVIEWS WITH TIER ONE STAKEHOLDERS 26 1 TABLE 12 - ONE-ON-ONE STAKEHOLDER INTERVIEW QUESTIONS 27 1. -

Stage3lessonbook Online 17J

1 Acknowledgements This unit of work was developed by Ausgrid, Endeavour Energy and Essential Energy in collaboration with the NSW Department of Education. It has been developed to align with part of the NSW Science and Technology Syllabus and outcomes in other key learning areas. The following advisers have made a contribution to the development of these materials. Vicki Morante, Swansea Public School NSW Department of Education, Learning and Teaching Division The sections ‘How to use a Scitech journal’ and ‘How to organise a cooperative learning group’ are sourced from the Australian Academy of Science Primary Connections series, and are reproduced with permission. Electricity & Safety Unit Lesson Book for Stage 3 2 Contents Unit Overview 6 Unit Outcomes 8 1 What do we know about electricity? 14 Attachment: KWL Chart 16 Attachment: Word Wall Cards (enlarge for display on wall) 18 Attachment: How to Use a SciTech Journal 20 2 Electricity Safety 21 Attachment: Electricity Safety Quiz 23 3 What is Energy? 26 Attachment: Word Cards 28 STEM Design Challenge: Transferred Energy 29 Attachment: Planning Page 30 Attachment: Explanation Page 32 Attachment: Student Reflection Checklist 33 4 Transforming Energy 34 Attachment: How to organise a cooperative learning group 36 Attachment: Example of a Science Report 42 Attachment: Quiz – Types of Energy 43 Attachment: Cloze Passage – Types of Energy 45 STEM Design Challenge: Transformed Energy 46 Attachment: Planning Page 47 Attachment: Explanation Page 49 Attachment: Student Reflection Checklist 50 -

Fully Charged: Renewables and Storage Powering Australia

FULLY CHARGED: RENEWABLES AND STORAGE POWERING AUSTRALIA CLIMATECOUNCIL.ORG.AU Thank you for supporting the Climate Council. The Climate Council is an independent, crowd-funded organisation providing quality information on climate change to the Australian public. We would like to thank the Australian Communities Foundation for their support in producing this report. Published by the Climate Council of Australia Limited ISBN: 978-1-925573-43-5 (print) 978-1-925573-42-8 (web) © Climate Council of Australia Ltd 2018 Andrew Stock This work is copyright the Climate Council of Australia Ltd. All material Climate Councillor contained in this work is copyright the Climate Council of Australia Ltd except where a third party source is indicated. Climate Council of Australia Ltd copyright material is licensed under the Creative Commons Attribution 3.0 Australia License. To view a copy of this license visit http://creativecommons.org.au. You are free to copy, communicate and adapt the Climate Council of Australia Greg Bourne Ltd copyright material so long as you attribute the Climate Council of Australia Ltd and the authors in the following manner: Climate Councillor Fully Charged: Renewables and Storage Powering Australia. Authors: Andrew Stock, Greg Bourne, Louis Brailsford and Petra Stock. We would like to thank Dr Matt Stocks (ANU), Andrew Blakers (ANU) and Tim Buckley (IEEFA) for their thorough reviews. Louis Brailsford — Researcher Cover image credits: “Gemasolar solar thermal power plant, Spain” by Flickr user Beyond Coal and Gas Image Library licensed under CC BY-NC 2.0 and “Hornsdale 20161212_30cs” by Flickr user David Clarke licensed under CC BY-NC-ND 2.0. -

Distribution Annual Planning Report

Distribution Annual Planning Report 2020 DAPR December 2020 Disclaimer Endeavour Energy is registered as a Distribution Network Service Provider. This Distribution Annual Planning Report (DAPR) has been prepared and published by Endeavour Energy under clause 5.13.2 of the National Electricity Rules. Its purpose is to notify Registered Participants and Interested Parties of the results of Endeavour Energy’s distribution network annual planning review and it should only be used for that purpose. This report is intended for general information only. Independent verification and assessment of the information in this report for its accuracy, completeness, reliability and suitability for purposes other than for general information should be undertaken prior to it being used for such purposes. Accordingly, Endeavour Energy makes no representations or warranty as to the accuracy, reliability, completeness or suitability for any particular purpose of the information in this document. Persons reading or utilising this document acknowledge that Endeavour Energy and their employees, agents and consultants shall have no liability (including liability to any person by reason of negligence or negligent misstatement) for any statements, opinions, information or matter (expressed or implied) arising out of, contained in or derived from, or for any omissions from, the information in this document, except insofar as liability under any New South Wales and Commonwealth statute cannot be excluded. Contact For all enquiries regarding this Distribution Annual Planning Report and for making written submissions contact: Endeavour Energy Head of Asset Planning & Performance GPO Box 811 Seven Hills NSW 1730 Email: [email protected] Distribution Annual Planning Report 2 Contents 1. -

Endeavour Energy’S G/Net Master Facility Model (And Extract from Google Maps Street View) There Is

Bruce Zhang Subject: FW: NSW Planning, Industry & Environment Request for SEARs SSD-10436 ESR Horsley Logistics Park Attachments: DP1214912 UIS0700 RPM17485 Johnston Cres Horsley Park.pdf; SW08773 Work near underground assets.pdf; EE Fact Sheet Building Conctruction.pdf; EE FPJ 6007 Technical Review Request Aug 2019.pdf; EE General Restrictions OH Power Lines Dec 2019.pdf; EE Guide for Padmount Substations.pdf; EE MDI0044 Easements and Property Tenure.pdf; EE Safety on the job.pdf; EE Safety Plumbing.pdf; ENA EMF What We Know.pdf; SW Work near overhead power lines.pdf From: Cornelis Duba <[email protected]> Sent: Wednesday, 25 March 2020 11:31 AM To: Bruce Zhang <[email protected]> Subject: NSW Planning, Industry & Environment Request for SEARs SSD‐10436 ESR Horsley Logistics Park Hello Bruce I refer to your below email of 12 March 2020 regarding the Secretary’s Environmental Assessment Requirements (SEARs) for State Significant Development SSD‐10436 for ESR Horsley Logistics Park being the staged development of the Horsley Logistics Park for a warehousing and distribution hub including a Concept Proposal and Stage 1 Development located at 6 Johnston Crescent, Horsley Park (Lot 103 DP 1214912) in the Fairfield City Local Government Area. Submissions need to be made to the Department by 27 March 2020. As shown in the below site plans from Endeavour Energy’s G/Net master facility model (and extract from Google Maps Street View) there is: An easement over the site benefitting Endeavour Energy (indicated by red hatching) for 132,000 volt / 132 kilovolt (kV) high voltage overhead power lines, overhead earth cables and overhead pilot cables (carrying protection signals or communications between substations) to the eastern side boundary within the E2 – Environmental Conservation corridor. -

Managing Our Energy Transition

Managing our energy transition Keynote speaker: The Hon. Matt Kean MP, NSW Minister for Energy and Environment Friday, 7 June 2019, 12.00pm to 2.00pm Shangri-La Hotel, Sydney MAJOR SPONSORS www.ceda.com.au agenda 11.30am Registrations 12.00pm Welcome Lee Kelly State Director NSW/ACT, CEDA 12.05pm Introduction Andrew Mansour Partner, Sector Leader, Power & Utilities, Allens 12.10pm Keynote address The Hon. Matt Kean MP NSW Minister for Energy and Environment 12.22pm Lunch 12.55pm Introduction Andrew Mansour Partner, Sector Leader, Power & Utilities, Allens 1.00pm Paul Italiano Chief Executive Officer TransGrid 1.20pm Rosemary Sinclair AM Chief Executive Officer Energy Consumers Australia 1.40pm Q&A session 1.55pm Vote of thanks Bernard Norton Head of Power Grids, ABB Australia 2.00pm Close . sponsor Major Sponsor ABB Australia ABB is a pioneering technology leader in electrification products, robotics and motion, industrial automation and power grids, serving customers in utilities, industry and transport & infrastructure globally. ABB operates in more than 100 countries with about 136,000 employees. With more than four decades at the forefront of digital technologies, we are a leader in digitally connected and enabled industrial equipment and systems, with an installed base of more than 70,000 control systems connecting 70 million devices. We start with the best people, engineering expertise and over a century of knowledge and know-how of electrification and process control in mines. Our team then provides integrated products, services and solutions to help mining and mineral processing customers optimize their power and productivity resulting in increased availability and lower lifetime investment costs. -

New South Wales Auditor-General's Report Financial Audit Volume Four

New South Wales Auditor-General’s Report | Financial | Focusing Audit on Four | Volume Electricity 2012 New South Wales Auditor-General’s Report Financial Audit Volume Four 2012 Focusing on Electricity Professional people with purpose Making the people of New South Wales proud of the work we do. Level 15, 1 Margaret Street Sydney NSW 2000 Australia t +61 2 9275 7100 f +61 2 9275 7200 e [email protected] office hours 8.30 am–5.00 pm audit.nsw.gov.au The role of the Auditor-General GPO Box 12 The roles and responsibilities of the Auditor- Sydney NSW 2001 General, and hence the Audit Office, are set out in the Public Finance and Audit Act 1983. Our major responsibility is to conduct financial or ‘attest’ audits of State public The Legislative Assembly The Legislative Council sector agencies’ financial statements. Parliament House Parliament House Sydney NSW 2000 Sydney NSW 2000 We also audit the Total State Sector Accounts, a consolidation of all agencies’ accounts. Pursuant to the Public Finance and Audit Act 1983, Financial audits are designed to add credibility I present Volume Four of my 2012 report. to financial statements, enhancing their value to end-users. Also, the existence of such audits provides a constant stimulus to agencies to ensure sound financial management. Peter Achterstraat Auditor-General Following a financial audit the Office issues 7 November 2012 a variety of reports to agencies and reports periodically to parliament. In combination these reports give opinions on the truth and fairness of financial statements, and comment on agency compliance with certain laws, regulations and Government directives. -

Draft Western Sydney Aerotropolis Constraints and Land Capability Assessment Draft Utilities Audit Western Sydney Planning Partnership October 2020

Draft Western Sydney Aerotropolis Constraints and Land Capability Assessment Draft Utilities Audit Western Sydney Planning Partnership October 2020 Contents 1 Executive Summary ............................................................................................................................ 1 2 Utilities Audit Overview ...................................................................................................................... 3 2.1 Background .............................................................................................................................. 3 2.2 Purpose .................................................................................................................................... 3 2.3 Approach .................................................................................................................................. 4 2.4 Consultation .............................................................................................................................. 4 2.5 Western Sydney Airport Utilities ............................................................................................... 5 3 Utilities Baseline Service Assessment .............................................................................................. 7 3.1 Potable Water and Recycled Water ......................................................................................... 7 3.1.1 Sydney Water ........................................................................................................... -

Privatisation in NSW: a Timeline and Key Sources

Number 2/June 2017 Privatisation in NSW: a timeline and key sources 1. Introduction .......................................................................................................... 2 2. Timeline ................................................................................................................. 5 Privatised government enterprises ......................................................................... 5 Privatisations in NSW, proceeds and numbers ..................................................... 10 3. NSW ..................................................................................................................... 10 Parliament ............................................................................................................ 10 Department of Premier and Cabinet ..................................................................... 11 Treasury ............................................................................................................... 12 Land and Property Information ............................................................................. 12 Transport for NSW ................................................................................................ 13 Infrastructure NSW ............................................................................................... 13 Audit Office of New South Wales .......................................................................... 13 4. Council of Australian Governments ................................................................ -

The Energy Conversation Fact Sheet 1 May 2013

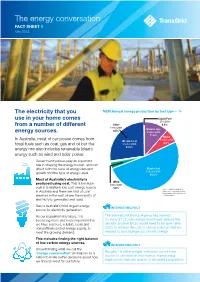

The energy conversation FACT SHEET 1 May 2013 The electricity that you NEM Annual energy production by fuel type – % use in your home comes Liquid Fuel 370 GWh from a number of different Other 0.2% 1036 GWh Natural Gas 0.5% energy sources. 23664 GWh 11.6% In Australia, most of our power comes from Hydro Brown Coal 13182 GWh fossil fuels such as coal, gas and oil but the 55084 GWh 6.5% energy mix also includes renewable (clean) 27.0% energy such as wind and solar power. Government policies play an important role in shaping the energy market, and can affect both the pace of energy demand Black Coal 104293 GWh growth and the type of energy used. 51.2% Most of Australia’s electricity is Wind produced using coal. This is because 6055 GWh coal is a relatively low cost energy source 3.0% Source: AEMO, ESOO 2012 in Australia and there are a lot of coal www.aemo.com.au/Electricity/ Planning/Electricity-Statement- reserves in the east where the majority of of-Opportunities electricity is generated and used. Gas is Australia’s third largest energy INTERESTinG FACT source for electricity generation. As our population increases, it is The International Energy Agency has warned: becoming more and more important that for every $1 of clean energy investment delayed this we have a secure, reliable, clean and decade, another $4.30 would need to be spent after competitively priced energy supply, to 2020, to achieve the cuts in carbon pollution that are meet the growing demand. -

Energy Policies of Iea Countries

ENERGY POLICIES OF IEA COUNTRIES Australia 2018 Review Secure Sustainable Together ENERGY POLICIES OF IEA COUNTRIES Australia 2018 Review INTERNATIONAL ENERGY AGENCY The IEA examines the full spectrum of energy issues including oil, gas and coal supply and demand, renewable energy technologies, electricity markets, energy efficiency, access to energy, demand side management and much more. Through its work, the IEA advocates policies that will enhance the reliability, affordability and sustainability of energy in its 29 member countries, 7 association countries and beyond. The four main areas of IEA focus are: n Energy Security: Promoting diversity, efficiency, flexibility and reliability for all fuels and energy sources; n Economic Development: Supporting free markets to foster economic growth and eliminate energy poverty; n Environmental Awareness: Analysing policy options to offset the impact of energy production and use on the environment, especially for tackling climate change and air pollution; and n Engagement Worldwide: Working closely with association and partner countries, especially major emerging economies, to find solutions to shared IEA member countries: energy and environmental Australia concerns. Austria Belgium Canada Czech Republic Denmark Estonia Finland France Germany Secure Greece Sustainable Hungary Together Ireland Italy Japan Korea Luxembourg Netherlands New Zealand Norway Poland Portugal Slovak Republic © OECD/IEA, 2018 Spain International Energy Agency Sweden Website: www.iea.org Switzerland Turkey United Kingdom Please note that this publication United States is subject to specific restrictions that limit its use and distribution. The European Commission The terms and conditions are also participates in available online at www.iea.org/t&c/ the work of the IEA. Foreword The International Energy Agency (IEA) has been conducting in-depth energy policy reviews of its member countries since 1976.