Reducing China's Coal Power Emissions with CCUS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investment Report of China Electric Power Industry, 2000-2008

Investment Report of China Electric Power Industry, 2000-2008 Abstract Bytheendof2007,China'stotalinstalledcapacityhasamountedto713millionkilowatt.China'spowerdemandis expectedtocontinuetokeepthemomentumofasteadygrowthin2008,up13%yearonyear.Withtheshutdown ofsmallthermalpowergeneratingunitsandtheslowdownininvestmentinpowergeneration,thehighgrowthrate ofChina'snewlyincreasedinstalledcapacityin2008willdecelerate,andtherateisexpectedtoreach11.8%year onyear. Fromthelongrun,China'spowerindustry,boostedbyacceleratedprocessofindustrializationandurbanizationat home,willhaveanaverageannualgrowthrateof6.6%to7.0%in thenexttenyears,indicatingpowerindustrywill requireagreatdealofinvestment. Regardingtheinvestmentdirection,Chinahasthemomentumofacceleratingthepaceofinvestmentin hydropower,windpowerandnuclearpower,butitsinvestmentincoal-firedpowergenerationstillranksthefirstin termsofinvestmentamount.SuchastructureofChinapowerindustrywillremainbasicallyunchangedforalong time.Atpresent,China'shydropoweroutputamountsto13.88percentofthenationaltotal,nuclearpoweroutput accountsfor1.94percentandwindpoweroutputamountsto0.26percent,whilecoal-firedpoweroutputtakesup atleast78%ofthenationaltotal.China'scoal-firedpowergenerationwillstillbeinastageofstabledevelopment atleastbefore2020,whenChina'sinstalledcapacityofcoal-firedpowergeneratingunitswillremainatmorethan 70percent. Wemakeacomparisonofinvestmentbetweentheabove-mentionedseveraltypesofpowergeneration,andtheir asset-liabilityratiosarebasicallythesameintermsoffinancialindicators.Butintermsofcostrateandratioof -

Roadmap for the Demonstration of Carbon Capture and Storage (CCS) in China

Final Report/June 2011 ADB TA‐7286 (PRC) People’s Republic of China Carbon Dioxide Capture and Storage Demonstration – Strategic Analysis and Capacity Strengthening Roadmap for the Demonstration of Carbon Capture and Storage (CCS) in China Final Report June 2011 Final Report /June 2011 ADB TA‐7286 (PRC) People’s Republic of China Carbon Dioxide Capture and Storage Demonstration – Strategic Analysis and Capacity Strengthening Roadmap for the Demonstration of Carbon Capture and Storage (CCS) in China Final Report June 2011 Report submitted by Project Team Prof. J. YAN – Team Leader & CCS Experts Prof. H. JIN – National Co‐leader Prof. Li Z., Dr. J. Hetland, Dr. Teng F., Prof. Jiang K.J., Ms. C. J. Vincent, Dr. A. Minchener, Prof. Zeng RS, Prof. Shen PP, Dr. X. D. Pei, Dr. Wang C., Prof. Hu J, Dr. Zhang JT The views expressed are those of the Consultants and do not necessarily reflect those of the Ministry or the Asian Development Bank (ADB). i Final Report /June 2011 TABLE OF CONTENTS Tables .............................................................................................................................. iv Figures ............................................................................................................................. v Key findings: .................................................................................................................... ix Main Recommendations: ................................................................................................. xi 1. Background and Objectives ....................................................................................... -

About CR Power

Electric power generation is our business. "We do everything at our best efforts" is the cornerstone of our business philosophy. Our company mission is to become one of the leading independent power producers ("IPP"s) in the world and the best IPP in China. We are committed to accomplishing this mission. About CR Power China Resources Power Holdings Company Limited (the “Company” or “CR Power”) is a fast-growing independent power producer which invests, develops, operates and manages power plants and coal mine projects in the more affluent regions and regions with abundant coal resources in China. As at 31 December 2009, CR Power has 41 power plants in commercial operation. The total attributable operational generation capacity of the power plants held by the Company is 17,753 MW, with 37% located in Eastern China, 22% located in Southern China, 20% located in Central China, 12% located in Northern China, and 9% located in Northeastern China. Corporate Structure China Resources (Holdings) Company Limited 64.59% China Resources Power Holdings Company Limited Coal-fired Coal-fired Coal-fired Clean Energy (≥600MW) (300MW) (≤200MW) • Changshu • Huaxin • Yixing • Danan Wind • Fuyang • Liyujiang A • Xingning • Shantou Wind • Liyujiang B • Cangzhou • Tangshan • Penglai Wind • Shouyangshan • Dengfeng • Jiaozuo • Chaonan Wind • Changzhou • Gucheng • Luoyang • Dahao Wind • Shazhou • Hubei • Jinzhou • Huilaixian’an Wind • Zhenjiang • Lianyuan • Shenhai Thermal • Honghe Hydro • Yangzhou No. 2 • Caofeidian • Banqiao • Beijing Thermal • Shaojiao C • -

Green Energy Powering Life with China Resources Power Holdings Company Limited Holdings Company Power China Resources Sustainable Development Report 2020

Green Energy Green Powering Life with with Life Powering China Resources Power Holdings Company Limited Holdings Company Power China Resources Sustainable Development Report 2020 China Resources Power Holdings Company Limited SUSTAINABLE DEVELOPMENT REPORT 2020 润电力���限�司 This is the 11th annual Sustainable Development Report published by China Resources Power About Holdings Company Limited (“CR Power”) for the year from January 1 to December 31, 2020. the Report Basis of Preparation Scope This Report is prepared with reference to the This Report relates to China Resources Power following important standards: Holdings Company Limited and its affiliates • Environmental, Social and Governance (see Organizational Structure at page 13), Reporting Guide as set forth in Appendix referred to herein as “We,” “the Company,” 27 of the Rules Governing the Listing of or “CR Power.” Securities on the Stock Exchange of Hong Kong Limited issued by the Stock Exchange We have engaged an independent of Hong Kong Limited (“HKEx” ) third party to provide assurance of 16 • Sustainability Reporting Guidelines of the performance indicators in this Report. Global Reporting Initiative (GRI Standards) See pages 4-5 for the Assurance Report. • Guidelines on Corporate Social Responsibility Reporting for Chinese Enterprises (CASS-CSR4.0) – Basic Framework of the Chinese Academy of Social Sciences • Guidelines on Corporate Social Responsibility Reporting for Chinese Enterprises - Power Production Industry (CASS-CSR3.0) • Guidelines to the State-Owned Enterprises Directly -

China's Expanding Overseas Coal Power Industry

Department of War Studies strategy paper 11 paper strategy China’s Expanding Overseas Coal Power Industry: New Strategic Opportunities, Commercial Risks, Climate Challenges and Geopolitical Implications Dr Frank Umbach & Dr Ka-ho Yu 2 China’s Expanding Overseas Coal Power Industry EUCERS Advisory Board Marco Arcelli Executive Vice President, Upstream Gas, Frederick Kempe President and CEO, Atlantic Council, Enel, Rome Washington, D.C., USA Professor Dr Hüseyin Bagci Department Chair of International Ilya Kochevrin Executive Director of Gazprom Export Ltd. Relations, Middle East Technical University Inonu Bulvari, Thierry de Montbrial Founder and President of the Institute Ankara Français des Relations Internationales (IFRI), Paris Andrew Bartlett Managing Director, Bartlett Energy Advisers Chris Mottershead Vice Principal, King’s College London Volker Beckers Chairman, Spenceram Limited Dr Pierre Noël Sultan Hassanal Bolkiah Senior Fellow for Professor Dr Marc Oliver Bettzüge Chair of Energy Economics, Economic and Energy Security, IISS Asia Department of Economics and Director of the Institute of Dr Ligia Noronha Director Resources, Regulation and Global Energy Economics (EWI), University of Cologne Security, TERI, New Delhi Professor Dr Iulian Chifu Advisor to the Romanian President Janusz Reiter Center for International Relations, Warsaw for Strategic Affairs, Security and Foreign Policy and President of the Center for Conflict Prevention and Early Professor Dr Karl Rose Senior Fellow Scenarios, World Warning, Bucharest Energy Council, Vienna/Londo Dr John Chipman Director International Institute for Professor Dr Burkhard Schwenker Chairman of the Strategic Studies (IISS), London Supervisory Board, Roland Berger Strategy Consultants GmbH, Hamburg Professor Dr Dieter Helm University of Oxford Professor Dr Karl Kaiser Director of the Program on Transatlantic Relations of the Weatherhead Center for International Affairs, Harvard Kennedy School, Cambridge, USA Media Partners Impressum Design © 2016 EUCERS. -

Annual Report

* (A joint stock limited company incorporated in the People's Republic of China with limited liability) Stock Code: 1798 2018 ANNUAL REPORT * For identification purpose only Contents Chairman’s Statement 2 President’s Statement 3 Company Profile 4 Key Operating and Financial Data 6 Financial Highlights 8 Management Discussion and Analysis 10 Major Events in 2018 31 Report of Directors 32 Corporate Governance Report 67 Report of the Supervisory Committee 91 Environmental, Social and Governance Report 94 Investor Relations 116 Profile of Directors, Supervisors 117 and Senior Management Human Resources 126 Independent Auditor’s Report 128 Consolidated Statement of Profit or Loss 135 Consolidated Statement of 136 Comprehensive Income Consolidated Statement of Financial Position 137 Consolidated Statement of Changes in Equity 139 Consolidated Statement of Cash Flows 141 Notes to Financial Statements 144 Glossary of Terms 270 Corporate Information 274 Chairman’s Statement In 2018, adhering to the goal of improving development quality and efficiency, the Company proactively adapted to the new situation of power system reform and structural reform at supply side, coped with challenges, and seized opportunities. In light of the complex business environment, the Company successfully accomplished the annual business development tasks and goals. In the past year, the Company maintained stable safety production and its reliability indicator still lead the industry. Technical retrofit of equipment and integrated improvement of efficiency achieved remarkable success, which significantly enhanced the economic operation of units. The annual electricity generation of the Company amounted to 17,975 million kWh, representing an increase of 17.49% as compared to the corresponding period of last year; the revenue amounted to RMB8,319 million, representing an increase of 17.11% as compared to the corresponding period of last year. -

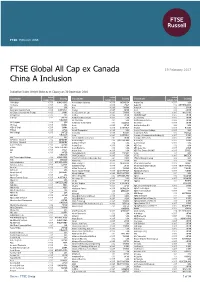

FTSE Global All Cap Ex Canada China a Inclusion

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 19 February 2017 China A Inclusion Indicative Index Weight Data as at Closing on 30 December 2016 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 1st Source <0.005 USA Acea <0.005 ITALY Aegon NV 0.02 NETHERLANDS 2U <0.005 USA Acer <0.005 TAIWAN Aena S.A. 0.02 SPAIN 360 Capital Industrial Fund <0.005 AUSTRALIA Acerinox <0.005 SPAIN Aeon 0.02 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Aces Electronic Co. Ltd. <0.005 TAIWAN Aeon (M) <0.005 MALAYSIA 3-D Systems <0.005 USA Achilles <0.005 JAPAN AEON DELIGHT <0.005 JAPAN 3i Group 0.02 UNITED Achillion Pharmaceuticals <0.005 USA Aeon Fantasy <0.005 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Financial Service <0.005 JAPAN 3M Company 0.26 USA Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN 3S Korea <0.005 KOREA Acom <0.005 JAPAN AerCap Holdings N.V. 0.02 USA 3SBio (P Chip) <0.005 CHINA Aconex <0.005 AUSTRALIA Aeroflot <0.005 RUSSIA 77 Bank <0.005 JAPAN Acorda Therapeutics <0.005 USA Aerojet Rocketdyne Holdings <0.005 USA 888 Holdings <0.005 UNITED Acron JSC <0.005 RUSSIA Aeroports de Paris 0.01 FRANCE KINGDOM Acrux <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 8x8 <0.005 USA ACS Actividades Cons y Serv 0.01 SPAIN Aerospace Hi-Tech (A) <0.005 CHINA A P Moller - Maersk A 0.02 DENMARK Actelion Hldg N 0.05 SWITZERLAND Aerosun (A) <0.005 CHINA A P Moller - Maersk B 0.02 DENMARK Activision Blizzard 0.06 USA AeroVironment <0.005 USA A.G.V. -

EWG 19 13A Anx 2 Confirmed Attendees

No. Name Company Name Title Email Phone Address Gender Role Senior Management & 626 Cochrans Mill Road P.O.Box 10940 1 Scott Smouse US DOE;APEC EGCFE [email protected] Male Speaker Technical Advisor OV 202 5866278 Pittsburgh,PA 15236-0940 Andrew 2 (IEA) Clean Coal Centre General Manager Andrew.Minchener@iea- Park House 14 Northfields London SW18 IDD UK Male Speaker Minchener coal.org 44 20 88776280 5th Floor, Heddon House, 149-151 Regent Street, 3 Benjamin Sporton World Coal Association(London) Acting Chief Executive Male Speaker [email protected] 44 2078510052 London, W1B 4JD, UK 3F Daiwa Nishi-shimbashi Building 3-2-1 Nishi- 4 Keiji Makino Japan coal energy center Professor Male Speaker [email protected] 8 13 64026101 Shimbashi, Minato-ku, Tokyo 105-0003 Japan 1300 West W. T. Harris Blvd, Charlotte, NC 5 Jeffrey N. Phillips EPRI Sr. Program Mgr Male Speaker [email protected] 1 704 9414188 28262, USA 26th Floor FFC No.5 North 3rd Ring Road, 6 Murray Mortson Airbone President m.mortson@airbornecleanen Male Speaker ergy.com 86 13466688305 Chaoyang District, Beijing 26th Floor FFC No.5 North 4rd Ring Road, 7 Michael Zhao Airbone CEO Male Participant [email protected] 86 13910538135 Chaoyang District, Beijing Forest Power & Energy Holdings, 2nd Floor No 7 Building YuquanHuigu No 3 8 Croll Xue Vice-president Male Participant Inc. [email protected] 86 13321156701 Minzhuang Road Haidian District Beijing Forest Power & Energy Holdings, 2nd Floor No 7 Building YuquanHuigu No 3 9 Mingtao Zhu Senior manager Male Participant Inc. [email protected] 86 13901383638 Minzhuang Road Haidian District Beijing 10 Daming Yang CARE-Gen, LLC.(GP Strategies) President Male Speaker [email protected] 86 18515099980 Shijingshan District, Beijing Rm K-M, 7/F, Tower A, The East Gate Plaza, #9 11 Xiaoliang Yang World Resources Institute Research Analyst Male Participant [email protected] 86 18510568512 Dongzhong Street, Beijing, China, 100027 Manager (Energy & Hongkong Electric Centre, 44 Kennedy Road, 12 Mr. -

SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® Etfs Stock Code: 3073 Website

SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 1st October 2020 to 31st March 2021 SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 Contents Page Condensed Statement of Financial Position (Unaudited) 2 Condensed Statement of Comprehensive Income (Unaudited) 3 Condensed Statement of Changes in Equity (Unaudited) 4 Condensed Statement of Cash Flows (Unaudited) 5 Notes to the Unaudited Condensed Financial Statements 6 Investment Portfolio (Unaudited) 10 Statement of Movements in Portfolio Holdings (Unaudited) 41 Derivative Financial Instruments (Unaudited) 42 Performance Record (Unaudited) 42 Administration and Management 43 1 SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® ETFs Interim Report 2021 CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED) As at 31st March 2021 31.03.2021 30.09.2020 Notes HK$ HK$ Assets Current assets Investments 1,385,908,557 969,438,426 Derivative financial instruments 54,331 47,229 Amounts due from brokers – 1,529,953 Dividends receivable 994,452 1,771,941 Other receivables 6(i) 122,017 347,255 Margin deposits 104,721 1,032,223 Cash at bank 6(f) 3,100,556 2,423,717 Total Assets 1,390,284,634 976,590,744 Liabilities Current liabilities Derivative financial instruments – 14 Amounts due to brokers – 1,500,560 Audit fee payable 154,612 309,225 Trustee fee payable 6(e) 382,474 270,773 Management fee payable 6(d) 684,377 481,283 Tax provision 156,265 214,282 Total Liabilities 1,377,728 2,776,137 Equity Net assets attributable to unitholders 4 1,388,906,906 973,814,607 The notes on pages 6 to 9 form part of these financial statements. -

Tianjin Integrated Gasification Combined Cycle

N IGCC I NJ IA T TIANJIN INTEGRATED G NEN A GASIFICATION COMBINED HU CYCLE POWER PLANT PROJECT New Power Generation Technology Syngas purification system for Near-Zero Emissions ɂ Power generation in the People’s Republic of China heavily relies on coal. In 2008, coal-based power plants produced 81% of the country’s electricity. ɂ Coal dependency results in severe environmental degradation. A third of the country suffers from acid rain due to emissions from large-scale coal production. ɂ Coal also aggravates poor air quality in most eastern and central cities, inducing public health hazards. The World Health Organization reports that air pollution contributes to 40% of deaths caused by ischemic heart disease.a ɂ With assistance from the Asian Development Bank, the government initiated the Tianjin Integrated Gasification Combined Cycle Power Plant, which generates lower-cost electricity while reducing emissions from sulfur dioxide, nitrogen oxide, mercury, and particulate matter by 95%. Such type of power plant can also provide a low-cost platform for carbon capture and storage, potentially reducing carbon emissions up to 90%. a World Health Organization. 2014. Seven million premature deaths annually linked to air pollution. 25 March. http://www.who.int/ mediacentre/news/releases/2014/air-pollution/en/ 26 CONTEXT ProJECT SNapshot oal-based energy production increased in the People’s LOAN APPROVAL DAte: Republic of China (PRC), from 0.98 billion tons in 2000 to February 2010 C2.74 billion tons in 2008. Projections suggest continuing increases as the PRC works to keep pace with an accelerating LOAN AMount: demand for energy. -

Achtergrond Bedrijvenlijst Klimaatlabel

Achtergrond bedrijvenlijst klimaatlabel Olie- en gasbedrijven We kijken naar investeringen in olie- en gasbedrijven die opgenomen zijn in de Carbon Underground ranking. Dit zijn beursgenoteerde bedrijven met de grootste koolstofinhoud in hun bewezen voorraden – die dus het sterkst bijdragen aan klimaatverandering bij ontginning van de voorraden waarop ze rekenen. Zie http://fossilfreeindexes.Com Anadarko Petroleum Antero Resources Apache ARC Resources BASF Bashneft BHP Billiton Birchcliff Energy BP Cabot Oil & Gas California Resources Canadian Natural Resources Cenovus Energy Centrica Chesapeake Energy Chevron China Petroleum & Chemical Corp Cimarex Energy CNOOC Concho Resources ConocoPhillips CONSOL Energy Continental Resources Crescent Point Energy Denbury Resources Det Norske Devon Energy DNO International Ecopetrol Encana Energen ENI EOG Resources EP Energy EQT ExxonMobil Freeport-McMoRan Galp Energia Gazprom GDF SUEZ Great Eastern Gulfport Energy Hess Husky Energy Imperial Oil Inpex JX Holdings KazMunaiGas EP Linn Energy Lukoil Lundin Petroleum Maersk Marathon Oil MEG Energy Memorial Resource Mitsui MOL Murphy Oil National Fuel Gas Newfield Exploration Noble Energy Novatek Oando Energy Occidental Oil India Oil Search OMV ONGC - Oil & Natural Gas Corp Ltd (India) Painted Pony Petroleum PDC Energy Petrobras PetroChina Peyto E&D Pioneer Natural Resources Polish Oil & Gas (Polskie Gornictwo, Gazownictwo) PTT QEP Resources Range Resources Repsol Rosneft Royal Dutch Shell SandRidge Energy Santos Sasol Seven Generations Energy SK Innovation -

Exclusion List Companies 08-08-2021

Exclusion list companies 08-08-2021 Name Country Reason for exclusion 22nd Century Group Inc United States Tobacco Aboitiz Power Corporation Philipines Coal Adani Power Limited India Coal Aerojet Rocketdyne Holdings, Inc. United States Weapons AES Gener S.A. Chili Coal Agritrade Resources Limited Bermuda Coal Airbus SE France Weapons Albioma France Coal Al-Eqbal Investment Co PLC Jordan Tobacco Altria Group Inc United States Tobacco Ameren Corporation United States Coal An Hui Wenergy Company Limited China Coal Anhui Great Wall Military Indu China Weapons Anhui Hengyuan Coal-Electricity Group Co., Ltd. China Coal Arch Resources, Inc. United States Coal Arko Corp United States Tobacco Athabasca Oil Corporation Canada Tar Sand Babcock International Group PL Britain Weapons Badeco Adria JSC Sarajevo Bosnia-Herze. Tobacco BAE Systems PLC Britain Weapons Banpu Power Public Company Limited Thailand Coal Banpu Public Company Limited Thailand Coal Beijing Haohua Energy Resource Co., Ltd. China Coal Beijing Jingneng Power Co., Ltd. China Coal Bentoel Internasional Investam Indonesia Tobacco Bharat Dynamics Ltd India Weapons Boeing Co/The United States Weapons British American Tobacco Bangl Bangladesh Tobacco British American Tobacco Kenya Kenya Tobacco British American Tobacco Malay Malaysia Tobacco British American Tobacco PLC Britain Tobacco British American Tobacco Ugand Uganda Tobacco British American Tobacco Zambi Zambia Tobacco British American Tobacco Zimba Zimbabwe Tobacco Bulgartabac Holding AD Bulgaria Tobacco BWX Technologies Inc United