Facing China's Coal Future

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

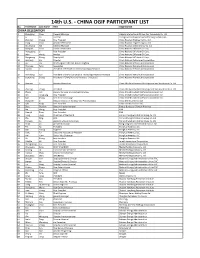

14TH OGIF Participant List.Xlsx

14th U.S. ‐ CHINA OGIF PARTICIPANT LIST No. First Name Last Name Title Organization CHINA DELEGATION 1 Zhangxing Chen General Manager Calgary International Oil and Gas Technology Co. Ltd 2 Li He Director Cheng Du Development and Reforming Commission 3 Zhaohui Cheng Vice President China Huadian Engineering Co. Ltd 4 Yong Zhao Assistant President China Huadian Engineering Co. Ltd 5 Chunwang Xie General Manager China Huadian Green Energy Co. Ltd 6 Xiaojuan Chen Liason Coordinator China National Offshore Oil Corp. 7 Rongguang Li Vice President China National Offshore Oil Corp. 8 Wen Wang Analyst China National Offshore Oil Corp. 9 Rongwang Zhang Deputy GM China National Offshore Oil Corp. 10 Weijiang Liu Director China National Petroleum Cooperation 11 Bo Cai Chief Engineer of CNPC RIPED‐Langfang China National Petroleum Corporation 12 Chenyue Feng researcher China National Petroleum Corporation 13 Shaolin Li President of PetroChina International (America) Inc. China National Petroleum Corporation 14 Xiansheng Sun President of CNPC Economics & Technology Research Institute China National Petroleum Corporation 15 Guozheng Zhang President of CNPC Research Institute(Houston) China National Petroleum Corporation 16 Xiaquan Li Assistant President China Shenhua Overseas Development and Investment Co. Ltd 17 Zhiming Zhang President China Shenhua Overseas Development and Investment Co. Ltd 18 Zhang Jian deputy manager of unconventional gas China United Coalbed Methane Corporation Ltd 19 Wu Jianguang Vice President China United Coalbed Methane Corporation Ltd 20 Jian Zhang Vice General Manager China United Coalbed Methane Corporation Ltd 21 Dongmei Li Deputy Director of Strategy and Planning Dept. China Zhenhua Oil Co. Ltd 22 Qifa Kang Vice President China Zhenhua Oil Co. -

Underreported Coal in Statistics a Survey-Based Solid Fuel

Applied Energy 235 (2019) 1169–1182 Contents lists available at ScienceDirect Applied Energy journal homepage: www.elsevier.com/locate/apenergy Underreported coal in statistics: A survey-based solid fuel consumption and T emission inventory for the rural residential sector in China ⁎ Liqun Penga,b,1, Qiang Zhanga, , Zhiliang Yaoc, Denise L. Mauzeralld,e, Sicong Kangb,f, Zhenyu Dug, Yixuan Zhenga, Tao Xuea, Kebin Heb a Ministry of Education Key Laboratory for Earth System Modeling, Department of Earth System Science, Tsinghua University, Beijing 100084, China b State Key Joint Laboratory of Environment Simulation and Pollution Control, School of Environment, Tsinghua University, Beijing 100084, China c School of Food and Chemical Engineering, Beijing Technology and Business University, Beijing 100048, China d Woodrow Wilson School of Public and International Affairs, Princeton University, Princeton, NJ 08544, USA e Department of Civil and Environmental Engineering, Princeton University, Princeton, NJ 08544, USA f Beijing Make Environment Co. Ltd., Beijing 100083, China g National Research Center for Environmental Analysis and Measurements, Beijing 100026, China HIGHLIGHTS • Solid fuel consumption rises with the increase in Heating Degree Days. • A transition from biofuel to coal occurs with per capita income growth. • Estimated coal consumption is 62% higher than that reported in official statistics. • An improved emission inventory of the residential sector is built in China. • Our work provides a new approach of obtaining data for other developing countries. ARTICLE INFO ABSTRACT Keywords: Solid fuel consumption and associated emissions from residential use are highly uncertain due to a lack of Rural residential reliable statistics. In this study, we estimate solid fuel consumption and emissions from the rural residential Survey sector in China by using data collected from a new nationwide field survey. -

Energy in China: Coping with Increasing Demand

FOI-R--1435--SE November 2004 FOI ISSN 1650-1942 SWEDISH DEFENCE RESEARCH AGENCY User report Kristina Sandklef Energy in China: Coping with increasing demand Defence Analysis SE-172 90 Stockholm FOI-R--1435--SE November 2004 ISSN 1650-1942 User report Kristina Sandklef Energy in China: Coping with increasing demand Defence Analysis SE-172 90 Stockholm SWEDISH DEFENCE RESEARCH AGENCY FOI-R--1435--SE Defence Analysis November 2004 SE-172 90 Stockholm ISSN 1650-1942 User report Kristina Sandklef Energy in China: Coping with increasing demand Issuing organization Report number, ISRN Report type FOI – Swedish Defence Research Agency FOI-R--1435--SE User report Defence Analysis Research area code SE-172 90 Stockholm 1. Security, safety and vulnerability Month year Project no. November 2004 A 1104 Sub area code 11 Policy Support to the Government (Defence) Sub area code 2 Author/s (editor/s) Project manager Kristina Sandklef Ingolf Kiesow Approved by Maria Hedvall Sponsoring agency Department of Defense Scientifically and technically responsible Report title Energy in China: Coping with increasing demand Abstract (not more than 200 words) Sustaining the increasing energy consumption is crucial to future economic growth in China. This report focuses on the current and future situation of energy production and consumption in China and how China is coping with its increasing domestic energy demand. Today, coal is the most important energy resource, followed by oil and hydropower. Most energy resources are located in the inland, whereas the main demand for energy is in the coastal areas, which makes transportation and transmission of energy vital. The industrial sector is the main driver of the energy consumption in China, but the transport sector and the residential sector will increase their share of consumption by 2020. -

The Mineral Industry of China in 2016

2016 Minerals Yearbook CHINA [ADVANCE RELEASE] U.S. Department of the Interior December 2018 U.S. Geological Survey The Mineral Industry of China By Sean Xun In China, unprecedented economic growth since the late of the country’s total nonagricultural employment. In 2016, 20th century had resulted in large increases in the country’s the total investment in fixed assets (excluding that by rural production of and demand for mineral commodities. These households; see reference at the end of the paragraph for a changes were dominating factors in the development of the detailed definition) was $8.78 trillion, of which $2.72 trillion global mineral industry during the past two decades. In more was invested in the manufacturing sector and $149 billion was recent years, owing to the country’s economic slowdown invested in the mining sector (National Bureau of Statistics of and to stricter environmental regulations in place by the China, 2017b, sec. 3–1, 3–3, 3–6, 4–5, 10–6). Government since late 2012, the mineral industry in China had In 2016, the foreign direct investment (FDI) actually used faced some challenges, such as underutilization of production in China was $126 billion, which was the same as in 2015. capacity, slow demand growth, and low profitability. To In 2016, about 0.08% of the FDI was directed to the mining address these challenges, the Government had implemented sector compared with 0.2% in 2015, and 27% was directed to policies of capacity control (to restrict the addition of new the manufacturing sector compared with 31% in 2015. -

En Gasbedrijven We Kijken Naar Investeringen in Olie- En Gasbedrijven Die Opgenomen Zijn in De Carbon Underground Ranking

Achtergrond bedrijvenlijst klimaatlabel Olie- en gasbedrijven We kijken naar investeringen in olie- en gasbedrijven die opgenomen zijn in de Carbon Underground ranking. Dit zijn beursgenoteerde bedrijven met de grootste koolstofinhoud in hun bewezen voorraden – die dus het sterkst bijdragen aan klimaatverandering bij ontginning van de voorraden waarop ze rekenen. Zie http://fossilfreeindexes.com Anadarko Petroleum Antero Resources Apache ARC Resources BASF Bashneft BHP Billiton Birchcliff Energy BP Cabot Oil & Gas California Resources Canadian Natural Resources Cenovus Energy Centrica Chesapeake Energy Chevron China Petroleum & Chemical Corp Cimarex Energy CNOOC Concho Resources ConocoPhillips CONSOL Energy Continental Resources Crescent Point Energy Denbury Resources Det Norske Devon Energy DNO International Ecopetrol Encana Energen ENI EOG Resources EP Energy EQT ExxonMobil Freeport-McMoRan Galp Energia Gazprom GDF SUEZ Great Eastern Gulfport Energy Hess Husky Energy Imperial Oil Inpex JX Holdings KazMunaiGas EP Linn Energy Lukoil Lundin Petroleum Maersk Marathon Oil MEG Energy Memorial Resource Mitsui MOL Murphy Oil National Fuel Gas Newfield Exploration Noble Energy Novatek Oando Energy Occidental Oil India Oil Search OMV ONGC - Oil & Natural Gas Corp Ltd (India) Painted Pony Petroleum PDC Energy Petrobras PetroChina Peyto E&D Pioneer Natural Resources Polish Oil & Gas = Polskie Gornictwo Gazownictwo PTT QEP Resources Range Resources Repsol Rosneft Royal Dutch Shell SandRidge Energy Santos Sasol Seven Generations Energy SK Innovation -

Clean Tech Handbook for Asia Pacific May 2010

Clean Tech Handbook for Asia Pacific May 2010 Asia Pacific Clean Tech Handbook 26-Apr-10 Table of Contents FOREWORD .................................................................................................................................................. 16 1 INTRODUCTION.................................................................................................................................... 19 1.1 WHAT IS CLEAN TECHNOLOGY? ........................................................................................................................ 19 1.2 WHY CLEAN TECHNOLOGY IN ASIA PACIFIC? .......................................................................................................19 1.3 FACTORS DRIVING THE CLEAN TECH MARKET IN ASIA PACIFIC .................................................................................20 1.4 KEY CHALLENGES FOR THE CLEAN TECH MARKET IN ASIA PACIFIC ............................................................................20 1.5 WHO WOULD BE INTERESTED IN THIS REPORT? ....................................................................................................21 1.6 STRUCTURE OF THE HANDBOOK ........................................................................................................................ 21 PART A – COUNTRY REVIEW.......................................................................................................................... 22 2 COUNTRY OVERVIEW.......................................................................................................................... -

Roadmap for the Demonstration of Carbon Capture and Storage (CCS) in China

Final Report/June 2011 ADB TA‐7286 (PRC) People’s Republic of China Carbon Dioxide Capture and Storage Demonstration – Strategic Analysis and Capacity Strengthening Roadmap for the Demonstration of Carbon Capture and Storage (CCS) in China Final Report June 2011 Final Report /June 2011 ADB TA‐7286 (PRC) People’s Republic of China Carbon Dioxide Capture and Storage Demonstration – Strategic Analysis and Capacity Strengthening Roadmap for the Demonstration of Carbon Capture and Storage (CCS) in China Final Report June 2011 Report submitted by Project Team Prof. J. YAN – Team Leader & CCS Experts Prof. H. JIN – National Co‐leader Prof. Li Z., Dr. J. Hetland, Dr. Teng F., Prof. Jiang K.J., Ms. C. J. Vincent, Dr. A. Minchener, Prof. Zeng RS, Prof. Shen PP, Dr. X. D. Pei, Dr. Wang C., Prof. Hu J, Dr. Zhang JT The views expressed are those of the Consultants and do not necessarily reflect those of the Ministry or the Asian Development Bank (ADB). i Final Report /June 2011 TABLE OF CONTENTS Tables .............................................................................................................................. iv Figures ............................................................................................................................. v Key findings: .................................................................................................................... ix Main Recommendations: ................................................................................................. xi 1. Background and Objectives ....................................................................................... -

2016 State Utility Commissioners Clean Energy Policy and Technology Leadership Mission to China

2016 STATE UTILITY COMMISSIONERS CLEAN ENERGY POLICY AND TECHNOLOGY LEADERSHIP MISSION TO CHINA SPONSORED BY OFFICE OF CLEAN COAL & CARBON MANAGEMENT US-CHINA CLEAN ENERGY RESEARCH CENTER US DEPARTMENT OF ENERGY BEIJING, HAIYANG, SHANGHAI, AND ORDOS TRIP REPORT ROBERT W. GEE, PRESIDENT SHERI S. GIVENS, SENIOR VICE PRESIDENT .... Gee Strategies 11111 Group,LLc WASHINGTON | AUSTIN WITH SPECIAL APPRECIATION TO: COMMISSIONER TRAVIS KAVULLA, MONTANA COMMISSIONER DAVID ZIEGNER, INDIANA COMMISSIONER LIBBY JACOBS, IOWA COMMISSIONER SANDY JONES, NEW MEXICO COMMISSIONER SHERINA MAYE EDWARDS, ILLINIOIS JOE GIOVE, US DEPARTMENT OF ENERGY a1J1 6e e Strategies Group,LLc 11111 December 1, 2016 Dr. Robert C. Marlay US Director US-China Clean Energy Research Center Office of International Affairs US Department of Energy Mr. David Mohler Deputy Assistant Secretary for Clean Coal and Carbon Management Office of Fossil Energy US Department of Energy Dear Dr. Marlay and Mr. Mohler: We are forwarding you the 2016 Trip Report for the State Utility Commissioners Clean Energy Policy and Technology Leadership Mission to China As the attached report outlines, each goal we set out to accomplish at the outset of the mission was achieved, and we believe that the lessons learned by the participating state utility commissioners will yield dividends to the US Government and Department of Energy. We extend my deep gratitude for your support for this mission. Sincerely, Robert W. Gee President Gee Strategies Group LLC Sheri S. Givens Sheri S. Givens Senior Vice President Gee Strategies Group LLC Attachment TABLE OF CONTENTS Background 1 Delegation Meetings 2 Beijing 3 Haiyang 33 Shanghai 38 Ordos 44 Major Mission Accomplishments 56 Recommendations 58 Appendices A. -

1441959514164.Pdf

Cover Story "Clean Coal” and "Green Environment” are the themes for China Shenhua Energy Company Limited’s annual report this year. Today, coal has an important role in satisfying the world's growing appetite for energy. As a leader in the industry, we develop valuable coal energy and generate returns in a responsible and environmental friendly manner, and through which, we have established a leading example in the industry. Since the environment is important to us all, how coal is used is an important matter. Our goal is to contribute to a better future on basis of a safe and efficient production environment. Contents 4 Company Profile 7 Results Highlights 8 Group Structure Important notice The board of directors, supervisory committee and the directors, supervisors and senior management of China Shenhua Energy Company Limited (the “Company”) warrant that this report does not contain any misrepresentation, misleading statements or material omissions, and jointly and severally accept full responsibility for the authenticity, accuracy and completeness of the information contained in this report. All directors of the Company have attended meetings of the board of directors. KPMG Huazhen and KPMG have issued standard unqualified audit reports to the Company in accordance with China’s Auditing Standards and Hong Kong Standards on Auditing, respectively. Mr. Chen Biting, Chairman of the Company, Ms. Zhang Kehui, Chief Financial Officer and the person in charge of accounting affairs of the Company, and Mr. Hao Jianxin, General Manager of Accounting and the person in charge of the accounting department of the Company, warrant the authenticity and completeness of the financial statements in this annual report. -

China's Coal-Fired Electricity Generation, 1990-2025

LBNL-2334E ERNEST ORLANDO LAWRENCE BERKELEY NATIONAL LABORATORY China’s Coal: Demand, Constraints, and Externalities Nathaniel Aden, David Fridley, Nina Zheng Environmental Energy Technologies Division July 2009 This work was supported by the Dow Chemical Company through the U.S. Department of Energy under Contract No. DE-AC02-05CH11231. Disclaimer This document was prepared as an account of work sponsored by the United States Government. While this document is believed to contain correct information, neither the United States Government nor any agency thereof, nor The Regents of the University of California, nor any of their employees, makes any warranty, express or implied, or assumes any legal responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by its trade name, trademark, manufacturer, or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States Government or any agency thereof, or The Regents of the University of California. The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States Government or any agency thereof, or The Regents of the University of California. Ernest Orlando Lawrence Berkeley National Laboratory is an equal opportunity employer. China’s Coal Industry: Resources, Constraints, and Externalities -

Extracting Fossil Fuels from Your Portfoliosm

EXTRACTING FOSSIL FUELS FROM YOUR PORTFOLIOSM: An UPDATED Guide to Personal Divestment and Reinvestment ABOUT THE AUTHORS 350.org is a global network inspiring the world to rise to 100% of Green Century’s profits earned for managing the challenge of the climate crisis. Since its inception in the Green Century Funds belong to the founding group 2008, their online campaigns, grassroots organizing, and of environmental non-profit organizations, the Public mass public actions have been led from the bottom up Interest Research Groups (PIRGs), that started Green by people in 188 countries. Century in 1991. 350 means climate safety. To preserve our planet, Since 2005, Green Century’s Balanced Fund has been scientists tell us we must reduce the amount of CO2 in 100% fossil fuel free; it is an actively managed fund the atmosphere from its current levels of 400 parts per made up of the stocks and bonds of well-managed million to below 350 ppm. 350 is more than a number — companies. The Balanced Fund is almost 50% less it’s a symbol of where we need to head as a planet. carbon intensive than the S&P 500® Index as measured by the international data and analysis firm Trucost.1 The 350 works in a new way — everywhere at once using Green Century Equity Fund, which is also fossil fuel free, online tools to facilitate strategic offline action — under invests in the longest running sustainability index minus the belief that if a global grassroots movement holds the fossil fuel companies in that index. our leaders accountable to the realities of science and principles of justice, we can realize the solutions that For more information, click here or visit www. -

Understanding Our Changing World

2013: ISSUE 9 A publication of Caterpillar Global Mining Shenhua leads the way in new CHINESE COAL MINING REGION PRODUCTION & MAINTENANCE One team & one goal: PRODUCTIVITY UNDERSTANDING OUR CHANGING WORLD DISCUSSING KEY INDUSTRY TOPICS UKRAINIAN ENERGY MINE SETS PRODUCTION RECORD IN LONGWALL MINE NEWMONT RELIES ON REMOTE DOZING TECHNOLOGY TO KEEP OPERATORS SAFE One of the reasons we enjoy publishing Viewpoint magazine is that it gives us an opportunity to celebrate our mining customers who are working hard around the world — providing the commodities we need while looking for new ways to work efficiently, keep people safe, reduce their impact on the environment and be good citizens of the communities where they operate. • DTEK, the largest private energy company in Ukraine, which recently set a production record In this issue, we introduce “Mining for a Better for longwall mining at its mine in Stepnaya. World,” a new feature that allows us to recognize the Our best practices article discusses the interrelation sustainability programs and initiatives of companies between maintenance and production, featuring that demonstrate what it means to mine responsibly. two Caterpillar experts discussing the individual roles We hope you enjoy reading about what others are and how they depend on one another for success. doing in this arena and encourage you to share your sustainability stories with us in the future. Finally, we take a few pages to recognize the 50th anniversary of Cat off-highway trucks. I want to Sustainability was a hot topic at MINExpo 2012, personally thank the thousands of Caterpillar where industry leaders gathered to see the latest employees and dealers who have designed, equipment and technologies and to discuss the developed, manufactured and supported them topics affecting the mining industry.