Testing Plays Critical Role in Australia's Largest Contact Center

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Natwest Markets Plc

Information Memorandum 5 March 2020 NatWest Markets Plc (incorporated in Scotland with limited liability under the Companies Act 1948 to 1980, registered number SC090312) A$5,000,000,000 Debt Issuance Programme Arranger & Dealer National Australia Bank Limited Dealers Australia and New Zealand Banking Group Limited Commonwealth Bank of Australia Mizuho Securities Asia Limited NatWest Markets Plc The Toronto-Dominion Bank Westpac Banking Corporation Contents Important notices 1 1. Programme summary 4 2. Information about NatWest Markets Plc 9 3. UK Bank Resolution Regime 10 4. Selling restrictions 11 5. Summary of certain taxation matters 15 6. Other important matters 17 7. Conditions of the Notes 19 8. Form of Pricing Supplement 39 9. Glossary 44 Directory 47 42015475_33 Important notices This Information Memorandum The distribution and use of this Information Memorandum, including any Issue Materials, and the This Information Memorandum relates to a debt offer or sale of Notes may be restricted by law in certain issuance programme (“ Programme ”) established by jurisdictions and intending purchasers and other NatWest Markets Plc (the “Issuer ”), under which it may investors should inform themselves about them and issue Notes from time to time. It has been prepared by, observe any such restrictions. and is issued with the authority of, the Issuer. In particular: The Issuer is neither a bank nor an authorised deposit- taking institution which is authorised under the this Information Memorandum is not a prospectus Australian Banking Act and nor is it supervised by the or other disclosure document for the purposes of the Australian Prudential Regulation Authority. The Notes Corporations Act. -

Pp43-45 6.3-Oliver

THE FINANCIAL SERVICES FORUM Retail Banking BANK TO THE FUTURE The high street banks have alienated many of their customers in their search for efficiency, depersonalising the whole experience with offshore call centres and centralised lending decisions. Malcolm Oliver looks at how two relative newcomers to the UK retail banking scene are reviving the old concept of real bank managers and personal service. The future of retail banking is a self-evidently important The key to success is often not the development of theme, and indeed one that The Financial Services Forum the ideas themselves but having the confidence (and addresses each year in the slightly broader context of its perhaps the commercial and professional courage) to Future of Retail Financial Services conferences. stand out and not dismiss them, like most of the herd, But between the positive idea and the delivered reality as passé or inappropriate to the needs of twenty-first- can fall a huge shadow. If speakers really have cracked century customers. As Allan Leighton said recently, in the problem in a way that will deliver lasting customer his new book on leadership, “the biggest challenge to satisfaction and regulatory approval and sustainable senior management is being able to listen effectively to profitability, why on earth would they want to give their those below who know what will and will not work”. secrets away to commercial rivals? Just reflect on how many financial services companies The Forum largely avoids this problem by its in the last decade or so have put in place new strategies membership formula, which means that most presenters to relocate call centres overseas, or to close local will already have built informal relationships with most of branches, or to withdraw free ATMs, or to restrict opening the audience, and will therefore feel that they are talking hours – only to have to perform an embarrassing volte- amongst friends rather than competitors. -

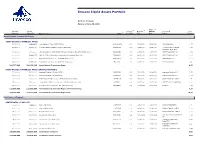

Invesco Liquid Assets Portfolio

Invesco Liquid Assets Portfolio Portfolio Holdings Data as of June 30, 2021 4 2 3 Final Principal Market 1 Coupon/ Maturity Maturity Associated % of Amount Value ($) Name of Issue CUSIP Yield (%) Date Date Issuer Portfolio Asset Backed Commercial Paper ASSET-BACKED COMMERCIAL PAPER 25,000,000 24,998,958 Ionic Capital III Trust (CEP-UBS AG) 46220WUG9 0.13 07/16/2021 07/16/2021 UBS GROUP AG 1.27 37,777,000 37,774,140 Lexington Parker Capital Company (Multi-CEP) 52953AUV5 0.15 07/29/2021 07/29/2021 Lexington Parker Capital 1.93 Company (Multi-CEP) 10,500,000 10,500,000 LMA Americas LLC (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QXR6 0.05 10/25/2021 10/25/2021 CREDIT AGRICOLE SA 0.54 40,000,000 39,992,272 LMA SA (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QW30 0.24 09/03/2021 09/03/2021 CREDIT AGRICOLE SA 2.04 20,000,000 20,000,000 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JW26 0.14 09/02/2021 09/02/2021 BNP PARIBAS SA 1.02 55,000,000 54,964,250 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JY81 0.14 11/08/2021 11/08/2021 BNP PARIBAS SA 2.80 188,277,000 188,229,620 Asset-Backed Commercial Paper 9.60 ASSET-BACKED COMMERCIAL PAPER (INTEREST BEARING) 50,000,000 50,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VG1 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 2.55 25,000,000 25,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VL0 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 1.27 10,000,000 10,000,000 Bedford Row Funding Corp. -

Settlement Banks for FX and MM Transactions, Options and Derivatives

Settlement Banks for FX and MM Transactions, Options and Derivatives Cou ntry: Currency: Correspondent Bank: SWIFT: Australia AUD National Australia Bank Ltd., Me lbourne NATAAU33033 Acc. 1803012548500 Bulgaria BGN Unicredit Bulbank AD, Sofia UNCRBGSF IBAN BG42UNCR96601030696607 Canada CAD Royal Bank of Canada, Toronto ROYCCAT2 Acc. 095912454619 SYDBANK A/S China CNY Standard Chartered Bank Ltd., Hong Kong SCBLHKHH Acc. 44709448980 Czech R epublic CZK Unicredit Bank Czech Republic AS , Prague BACXCZPP IBAN: CZ242700000000008166802 8 Acc. 81668028 Denmark DKK Danmarks Nationa lbank, Copenhagen DKNBDKKK Acc. 1115 -4 IBAN DK0910050000011154 Euroland EUR Commerzbank A G, Frankfurt COBADEFF Acc. 4008724346 IBAN DE 83500400000872434600 Hong Kong HKD Stan dard Chartered, Hong Kong SCBLHKHH Acc. 44708122739 Hungary HUF OTP Bank PLC , Budapest OTPVHUHB IBAN: HU66117820078102030800000000 Iceland ISK NBI HF NBIIISRE IBAN: IS230100270912726805925439 India INR Standard Chartered Bank , New Delhi SCBLINBB Acc. 222 -0-523804 -8 Indonesia IDR Standard Chartered Bank, Jakarta SCBLIDJX Japan JPY Bank of Tokyo -Mitsubishi UFJ Ltd , Tokyo BOTKJPJT Acc. 653 -0440973 Kenya KES Kenya Commercial Bank, Nairobi KCBLKENX Mexico MXN BBVA Bancomer S.A., Mexico BCMRMXMMCOR Acc. 0095001475 Morocco MAD Banque Marocaine du Commerce Extérieur, Cass ablanca BMCEMAMC New Ze aland NZD ANZ National Bank Ltd , Wellin gton ANZBNZ22058 Acc. 266650 -00001 NZD NO.1 Nor way NOK DNB Nor Bank ASA , Oslo DNBANOKK IBAN: NO32 70010213124 Acc. 7001.02.13124 Valid from: 24.02.2021 Sydbank A/S, CVR No DK 12626509, Aabenraa www.sydbank.com Page: 1/2 Settlement Banks for FX and MM Transactions, Options and Derivatives Cou ntry: Currency: Correspondent Bank: SWIFT: Poland PLN Bank Millennium SA, Warsaw BIGBPLPW IBAN PL 02116022020000000039897935 Romania RO N UniCredit Tiriac Bank SA, Bucharest BACXROBU IBAN RO65B ACX0000000001413310 Saudi Arabia SAR Saudi British Bank, Riyadh SABBSARI Acc. -

National Australia Bank Selects Payplus Cls from Fundtech; Fundtech Furthers Its Dominance in the Cls Market

Fundtech Contact: Media Contact: George Ravich Justine Schneider Fundtech Ltd. Ruder Finn, Inc. (201) 946-1100 (212) 583-2750 [email protected] [email protected] FOR IMMEDIATE RELEASE NATIONAL AUSTRALIA BANK SELECTS PAYPLUS CLS FROM FUNDTECH; FUNDTECH FURTHERS ITS DOMINANCE IN THE CLS MARKET JERSEY CITY, N.J.--(BUSINESS WIRE)--Oct. 5, 2000--Fundtech Ltd. (NASDAQ:FNDT), a leading provider of e-payments and Internet banking solutions, today announced that its PAYplus CLS(TM) software has been selected by the National Australia Bank Limited (ASX: NAB) to facilitate settlement of foreign exchange (FX) trades in the Continuous Linked Settlement (CLS) environment. The National Australia Bank is a major Australian financial institution with subsidiary operations in the United Kingdom, Ireland, New Zealand and the United States. It ranks among the top 50 banks in the world, with assets of over AUD 322 billion. "Fundtech's PAYplus CLS provides an integrated solution which is consistent with the National's straight through processing philosophy," said Mr. Bruce Rose, General Manager, Global Wholesale Support Services, National Australia Bank. "Fundtech's PAYplus CLS will support the management of the Group's foreign exchange operations in the new CLS system." Major global financial services companies such as Bank of America, Bank of New York, Deutsche Bank, Dresdner Bank, and Commerzbank have also Fundtech Corporation 30 Montgomery Street, Suite 501, Jersey City, NJ 07302, USA ■ Tel: +1-201-946-1100 ■ Fax: +1-210-946-1313 www.fundtech.com selected Fundtech's CLS solution. Fundtech is currently contracting with several other large global banks for its PAYplus CLS solution. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Absa Bank (South Africa)

The Companies Listed under the Consortium for Next Gen ATMs ABA (American Bankers Association) Absa Bank (South Africa) Access Cash General Partnership (EZEE ATM) ACG ACI Worldwide ATEFI AIB (Allied Irish Banks) Akbank (Turkey) Altron Bytes Managed Solutions Aman (Palestine) ANZ Argotechno ATB Financial ATEFI ATM24 ATM CLUB Atima ATMIA ATM Security Association Auriga Australian Technology Management Pty Ltd Axis Communications AB 1 Bank of America Bank of Hawaii Bank of Montreal Bank of South Pacific Bank Permata BANTAS A.S Banktech (Australia) Barclays Bank BBVA Belfius Bank & Verzekeringen Bitstop Blanda Marketing & Public Relations BMO Financial Group BOSACH Technologies & Consulting Pvt. Ltd. BVK Capital One Cashflows Cashway Technology Co., Ltd. Capital One Bank Capitec Bank Cardtronics Cash and Card World Ltd Cash Connect® – ATM Solutions by WSFS Bank Cash Infrastructure Projects and Services GmbH Cashware Cecabank CIBC (Canadian Imperial Bank of Commerce) Citibank Citizens Bank CMS Analytics Coast Capital Savings Credit Union 2 Columbus Data Comerica Bank Commonwealth Bank of Australia Convergint Technologies CO-OP Financial Services CR2 Culiance Cummins Allison Cyttek Group Desjardins Dgiworks Technology (Turkey) Diebold-Nixdorf dormakaba USA Inc DPL Eastern Carolina ATM Eastman Credit Union EFTA Elan Financial Services Electronic Payment & Services (Pty) Ltd Embry Consulting, LLC Emirates NBD Euronet Worldwide EuroTechzam S.A. EVERTEC, Inc – US EVERI EVO Payments Faradis Alborz Corp First American Payment Systems First Data First National Bank of South Africa FISERV 3 FIS Global (Fidelity National Information Services) Fujitsu Ten España G4S GCB Bank (Ghana) General Dynamics Mission Systems Genmega GMR GMV Gorham Savings Bank GPT Great Southern Bank GRG Banking Gunnebo Gunnebo India Private Ltd Heritage Bank Hitachi Europe Hitachi-Omron Terminal Solutions, Corp. -

Natwest-Markets-Nv-Cash-Ssi.Pdf

NatWest Markets N.V., AMSTERDAM Standard Settlement Instruction (cash) for Foreign Exchange, Money Market, Currency Options, FRAs, Interest Rate & Commodity Swaps, Interest Rate & Commodity Options, Fixed Income, Collateral, Credit Derivatives and Exchange Traded Futures & Options & Equity Derivatives Transactions. All accounts are in the name of NatWest Markets N.V., Amsterdam OMGEO Alert Acronym is RBSFMFX. Model Name is NWMNV. Effective From 15/04/2019 Correspondent Swift Beneficiary ISO CCY Country Correspondent Details Account Number Address Swift Code United Arab 1012003958924016 AED NBADAEAA National Bank of Abu Dhabi RBOSNL2RTCM Emirates IBAN - AE540351012003958924016 AUD Australia NATAAU3303M National Australia Bank Ltd Melbourne 1803114456500 RBOSNL2RTCM BBD BARBADOS BNBABBBB Republic Bank (Barbados) Ltd 028042192003 RBOSNL2RTCM 1030028017 BGN BULGARIA RZBBBGSF Raiffesen Bank AD Sofia RBOSNL2RTCM IBAN - BG55RZBB91551030028017 0099637057 BHD BAHRAIN NBOBBHBM National Bank of Bahrain RBOSNL2RTCM IBAN - BH94NBOB00000099637057 BMD Bermuda BNTBBMHM Bank of NT Butterfield & Son Hamilton 0601664670019 RBOSNL2RTCM CAD CANADA ROYCCAT2 Royal Bank of Canada Toronto 095911005743 RBOSNL2RTCM 02300000061046050000B CHF Switzerland UBSWCHZH80A UBS AG, Zurich RBOSNL2RTCM IBAN - CH140023023006104605B Care should be taken as this relates to CNH/CNY trading and settling offshore in CNY Hong Kong SCBLHKHH 44700867654 RBOSNL2RTCM Hong Kong with Standard Chartered Bank (Hong Kong) Ltd 266310663 CZK CZECH REPUBLIC CEKOCZPP Ceskoslovenska Obchodni Banka -

CIBC, Itaú, NAB and Natwest Group Launch Carbon Offset Platform to Drive Transparency in Voluntary Carbon Market

CIBC, Itaú, NAB and NatWest Group launch carbon offset platform to drive transparency in Voluntary Carbon Market O Pilot brings efficiency, liquidity and global standards to the carbon offset ecosystem LONDON, United Kingdom, TORONTO, Canada, SYDNEY, Australia, SAO PAULO, Brazil, July 7 [TBD], 2021 /CNW/ - As part of an international joint effort, CIBC (TSX:CM) (NYSE:CM), Itaú Unibanco (NYSE:ITUB), National Australia Bank (ASX:NAB) and NatWest Group (LSE:NWG) today announced Project Carbon, a Voluntary Carbon Marketplace pilot. Corporations worldwide are using carbon offsets as a tool to implement their climate action strategies. Project Carbon aims to support a thriving global marketplace for quality carbon offsets with clear and consistent pricing and standards and will provide a valuable pathway for our clients in their efforts to achieve a net zero goal. Our project will facilitate: • Increased delivery of high-quality carbon offset projects • A liquid carbon credit marketplace with price certainty and transparency • The creation of a strong ecosystem to support the offset market • The development of tools to help clients manage climate risk In alignment with the leading Taskforce on Scaling Voluntary Carbon Markets (TSVCM), established by Mark Carney, UN Special Envoy for Climate Action and Finance, the project helps remove current barriers to voluntary carbon offset purchasing. Corporativo | Interno Project Carbon will initially be launched as a pilot in August to demonstrate the operational, legal and technical capability of the platform. The team is keen to invite like-minded institutions to join the cohort to help deliver a shared service platform that the group believes will be fundamental to the scaling of the Voluntary Carbon Market. -

Natwest Markets Plc Cash Ssis

NatWest Markets, London Standard Settlement Instruction (cash) for Foreign Exchange, Money Market, Currency Options, FRAs, Interest Rate & Commodity Swaps, Interest Rate & Commodity Options, Fixed Income, Credit Derivatives and Exchange Traded Futures & Options & Equity Derivatives Transactions. For Equity Derivative business only, settled via DTCC CFM - please note these settlement instructions pertain to DTCC Participant ID 00007701. All accounts are in the name of NatWest Markets Plc Effective from : 22/05/2019 Correspondent Beneficiary Swift ISO CCY Country Swift Correspondent Details Account Number Code Address United Arab AED NBADAEAA First Abu Dhabi Bank AE120354022003002430029 RBOSGB2RTCM Emirates AUD Australia NATAAU3303M National Australia Bank Ltd Melbourne 1803071544500 RBOSGB2RTCM BBD Barbados BNBABBBB Barbados National Bank Bridgetown 028042192002 RBOSGB2RTCM BGN Bulgaria RZBBBGSF Raiffeisenbank AD Sofia BG93RZBB91551030526107 RBOSGB2RTCM BHD Bahrain NBOBBHBM National Bank Of Bahrain Manama BH48 NBOB 0000 0099628864 RBOSGB2RTCM BMD Bermuda BNTBBMHM Bank of NT Butterfield & Son Hamilton 060 1644010020 RBOSGB2RTCM BWP Botswana BARCBWGX Barclays Bank of Botswana, Gaborone 1002227 RBOSGB2RTCM CAD Canada ROYCCAT2 Royal Bank of Canada Toronto 09591 100 314 4 RBOSGB2RTCM For MT103 ONLY use IBAN CH260023023004042505H CHF Switzerland UBSWCHZH80A UBS AG, Zurich RBOSGB2RTCM For MT202 use account number: 02300000040425050000H Care should be taken as this relates to CNH/CNY trading CNY Hong Kong SCBLHKHH and settling offshore in Hong -

1997 Annual Report

1997 Annual Report National Australia Bank Limited ACN004044937 Our Vision Financial calendar Annual General Meeting • Financial year ends on The Annual General Meeting of the To be the world’s leading financial ser- September 30 annually. members of National Australia Bank vices company. • Full year results announced Limited will be held at 10.00am November 6, 1997. (Melbourne time) on Thursday Our Mission • Shares to be quoted ex-dividend December 18, 1997 in the John Batman Theatre, Level 3, Melbourne Convention We tailor financial services to help on the Australian Stock Exchange on November 20, 1997. and Exhibition Centre, corner Spencer individuals, families, businesses and and Flinders Streets, Melbourne, communities to achieve their goals. • Record date (books closing date) for Victoria, Australia. final dividend is November 28, 1997 for shareholders on the Australian register. Shareholder gatherings Our Values • Final dividend payable on Gatherings of members of National • Service to our customers December 17, 1997 (49c per share). Australia Bank Limited will be held • Quality in everything we do • First quarter results for the 1997/98 at 9.45am (Sydney time) on Thursday • Professionalism and ethics in all financial year currently scheduled to be December 18, 1997 in the Grand our actions announced on January 22, 1998. Ballroom at The Wentworth A Rydges • Competitiveness and a will to win • First half results for the 1997/98 finan- Hotel, 61–101 Philip Street, Sydney; and • Growth and development of cial year currently scheduled to be at 8.45am (Brisbane time) on our people announced on May 7, 1998. Thursday December 18, 1997 in the • Shares currently scheduled to be quoted Grand Ballroom at the Brisbane Hilton, • Continuous productivity improve- 190 Elizabeth Street, Brisbane. -

Trade Finance Program Confirming Banks List As of 31 December 2015

Trade Finance Program Confirming Banks List As of 31 December 2015 AFGHANISTAN Bank Alfalah Limited (Afghanistan Branch) 410 Chahri-e-Sadarat Shar-e-Nou, Kabul, Afghanistan National Bank of Pakistan (Jalalabad Branch) Bank Street Near Haji Qadeer House Nahya Awal, Jalalabad, Afghanistan National Bank of Pakistan (Kabul Branch) House No. 2, Street No. 10 Wazir Akbar Khan, Kabul, Afghanistan ALGERIA HSBC Bank Middle East Limited, Algeria 10 Eme Etage El-Mohammadia 16212, Alger, Algeria ANGOLA Banco Millennium Angola SA Rua Rainha Ginga 83, Luanda, Angola ARGENTINA Banco Patagonia S.A. Av. De Mayo 701 24th floor C1084AAC, Buenos Aires, Argentina Banco Rio de la Plata S.A. Bartolome Mitre 480-8th Floor C1306AAH, Buenos Aires, Argentina AUSTRALIA Australia and New Zealand Banking Group Limited Level 20, 100 Queen Street, Melbourne, VIC 3000, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Adelaide Branch - Trade and Supply Chain) Level 20, 11 Waymouth Street, Adelaide, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Brisbane Branch - Trade and Supply Chain) Level 18, 111 Eagle Street, Brisbane QLD 4000, Australia Australia and New Zealand Banking Group Limited (Perth Branch) Level 6, 77 St Georges Terrace, Perth, Australia Australia and New Zealand Banking Group Limited (Perth Branch