NAB 2008 AFR V05.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dexia Group Consolidated Results 20201

Regulated information – Brussels, Paris, 4 March 2021 – 07.30 Dexia Group Consolidated Results 20201 Operational continuity fully assured and resilience of funding against the background of the crisis linked to the Covid-19 pandemic Priority given to the protection of teams Rapid deployment of an operational crisis unit and the exceptional commitment of staff members Resilience of funding assured without recourse to central bank facilities Reaffirmation of the going concern principle Continuing reduction and proactive management of the balance sheet Balance sheet total of EUR 114.4 billion as at 31 December 2020, down 5% over the year Implementation of the asset disposal programme under volatile market conditions: 70% of the target set for the end of 2022 already reached by the end of 2020 Advances in the simplification of the Dexia network in the United States and in Italy Net income of EUR -618 million as at 31 December 2020 against EUR -898 million as at 31 December 2019 Recurring income (EUR -475 million) integrating a contained impact of the cost of risk (EUR -169 million): good intrinsic quality of the credit portfolio less exposed to sectors sensitive to the crisis Accounting volatility items (EUR -31 million): impact of the crisis on the financial markets at the end of March attenuated in the second half of the year Non-recurring elements (EUR -112 million) principally associated with the balance sheet reduction and the Group’s transformation Robust Total Capital Ratio at 28.5% as at 31 December 2020 Pierre Crevits, CEO of Dexia, stated, “2020 has been marked by a health crisis with unprecedented social and economic repercussions. -

Natwest Markets Plc

Information Memorandum 5 March 2020 NatWest Markets Plc (incorporated in Scotland with limited liability under the Companies Act 1948 to 1980, registered number SC090312) A$5,000,000,000 Debt Issuance Programme Arranger & Dealer National Australia Bank Limited Dealers Australia and New Zealand Banking Group Limited Commonwealth Bank of Australia Mizuho Securities Asia Limited NatWest Markets Plc The Toronto-Dominion Bank Westpac Banking Corporation Contents Important notices 1 1. Programme summary 4 2. Information about NatWest Markets Plc 9 3. UK Bank Resolution Regime 10 4. Selling restrictions 11 5. Summary of certain taxation matters 15 6. Other important matters 17 7. Conditions of the Notes 19 8. Form of Pricing Supplement 39 9. Glossary 44 Directory 47 42015475_33 Important notices This Information Memorandum The distribution and use of this Information Memorandum, including any Issue Materials, and the This Information Memorandum relates to a debt offer or sale of Notes may be restricted by law in certain issuance programme (“ Programme ”) established by jurisdictions and intending purchasers and other NatWest Markets Plc (the “Issuer ”), under which it may investors should inform themselves about them and issue Notes from time to time. It has been prepared by, observe any such restrictions. and is issued with the authority of, the Issuer. In particular: The Issuer is neither a bank nor an authorised deposit- taking institution which is authorised under the this Information Memorandum is not a prospectus Australian Banking Act and nor is it supervised by the or other disclosure document for the purposes of the Australian Prudential Regulation Authority. The Notes Corporations Act. -

Dexia Credit Local LEHMAN BROTHERS

OFFICIAL STATEMENT DATED MAY 31, 2006 NEW ISSUE RATINGS: FITCH: AAA/F1+ MOODY’S: Aaa/VMIG1 S&P: AAA/A-1+ BOOK-ENTRY ONLY In the opinion of Bond Counsel, assuming continuous compliance with certain covenants described herein, and subject to the conditions stated herein under “Tax Exemptions,” under existing law, (a) the interest on the Notes is excludable from gross income for Federal income tax purposes, and (b) the interest on the Notes is not an enumerated preference or adjustment for purposes of the Federal alternative minimum tax imposed on individuals and corporations; however, such interest will be taken into account in determining adjusted current earnings for the purpose of computing the alternative minimum tax imposed on corporations, and may be subject to the branch profits tax imposed on foreign corporations engaged in a trade or business in the United States. As described herein under “Tax Exemptions,” other Federal income tax consequences may arise from ownership of the Notes. It is also the opinion of Bond Counsel that, under existing law of the State of Maryland, the interest on the Notes and profit realized from the sale or exchange of the Notes is exempt from income taxation by the State of Maryland or by any of its political subdivisions; however, the law of the State of Maryland does not expressly refer to, and no opinion is expressed concerning, estate or inheritance taxes or any other taxes not levied directly on the Notes or the interest thereon. $50,000,000 MONTGOMERY COUNTY, MARYLAND CONSOLIDATED PUBLIC IMPROVEMENT BOND ANTICIPATION NOTES, 2006 SERIES A Dated: Date of Issuance Due: June 1, 2026 Price: 100% CUSIP No. -

Annual Report 1999 an International Financial Services Group

An international financial services group Annual Report 1999 National Australia Bank Limited ACN004044937 The National’s International Franchise Our Vision Contents To be the world’s leading financial services company. 1999 @ a Glance 2 Our Mission Financial Highlights 4 We tailor financial services to help Corporate Highlights 6 individuals, families, businesses and The Board of Directors 8 communities to achieve their goals. Group Leadership Team 10 Our Values Year in Review by the Chairman Service to our customers and the Managing Director 11 Quality in everything we do Business and Personal Professionalism and ethics in all our Financial Services 16 actions Products and Services 18 Competitiveness and a will to win Growth and development of our Global Wholesale Financial Services 20 people National Services Information Continuous productivity improvement Technology Enterprises 22 Growing profit for our stakeholders Community Relations 24 Key Business Units 26 Financial Information and Analysis Description of Business 30 Financial Review 36 Financial Calendar United Kingdom Asia Australia United States Report of the Directors 75 15 December 1999 Final dividend payable Financial Report Financial Statements 80 16 December 1999 Annual General Meeting Notes to the 27 January 2000 1999–2000 Q1 Results Financial Statements 84 Directors’ Declaration 165 4 May 2000 1999–2000 Q2 Results Auditors’ Report 165 July 2000 Interim 1999–2000 dividend paid Form 20-F Cross Reference Index 166 27 July 2000 1999–2000 Q3 Results Shareholder Information -

0710 Dexia Offshore Wind

Offshore wind Options for non-recourse financing All photos from Gunnar Britse – windpowerphotos.com Offshore wind Options for non-recourse financing 1. Some Info on Dexia 2. Offshore wind: prospects and risks 3. Finding solutions: the Q7 and C-Power deals 4. Notable structural features of Q7 and C-Power Offshore wind Options for non-recourse financing 1. Some Info on Dexia 2. Offshore wind: prospects and risks 3. Finding solutions: the Q7 and C-Power deals 4. Notable structural features of Q7 and C-Power Offshore wind Dexia Group Options for non-recourse financing A top credit standing in the banking sector Ratings: Dexia Group AA / Aa2 • Dexia is in the top third of the Euronext 100 index and Dexia Municipal Agency AAA / Aaa / AAA is listed on three European F.S.A. AAA / Aaa / AAA stock exchanges (Paris, Balance Sheet Dexia Group EUR 567 billion Brussels, Luxembourg). F.S.A. Insured Portfolio USD 365 billion Net Income EUR 2.75 billion • Dexia is the world leader Tier 1 Ratio 9.8% in Public Finance with a R.O.E. 23.1% total market share of 17% in Europe and of 25% in the Stock market capitalization EUR 24.8 billion United States. (all as of 31 December 2006) 4 Offshore wind Dexia – Renewable Energy Options for non-recourse financing Recent References EDF EN Portugal Noble BBWP C-Power La Madagascona Wind farm portfolio NY wind portfolio Wind farm portfolio Offshore wind farm PV solar Portugal USA Worldwide Belgium Spain EUR 257 M USD 266 M EUR 1,031 M EUR 106 M EUR 183 M Mandated Mandated Mandated Mandated Mandated Lead Arranger Lead -

Orora Investor Briefing November 2013 Contents

Orora Investor Briefing November 2013 Contents • The demerger of Orora Limited • About Orora Limited • Strategic Direction of Orora • Orora Leadership • Board & Management Teams • Summary Orora Ltd 2 The demerger of Orora Limited The steps to the demerger 3 Demerger to be completed this calendar year Event Date Announced intention to demerge 1 August 2013 Scheme Booklet lodged with ASX 1 November 2013 Scheme and General Meeting (SGM) 9 December 2013 Demerger effective date (last date Amcor shares will trade cum-entitlement) 17 December 2013 Orora shares commence trading (deferred settlement basis) 18 December 2013 Scheme record date 24 December 2013 Demerger implemented 31 December 2013 Orora shares commence trading (normal settlement basis) 3 January 2014 Process is “on track” Orora Ltd 4 About Orora Limited The newest global packaging brand 5 Orora is set up for success • Strong, well-positioned core business • Focused portfolio & good industry structures • Stable, defensive earnings streams • Experienced Board & Executive Team with track record of performance • Cost reduction opportunities a key factor in expected near term earnings growth • Strong financial profile/metrics • Strong balance sheet • Well-capitalised businesses • Near-term earnings growth in company’s direct control • Strong cash flows • Proposed dividend payout 60 – 70% - dividends to be franked to the extent practicable • Disciplined approach to future growth • Capital management optionality Orora Ltd 6 The Orora Limited Group – A focused company Orora Australasia 26 -

Pp43-45 6.3-Oliver

THE FINANCIAL SERVICES FORUM Retail Banking BANK TO THE FUTURE The high street banks have alienated many of their customers in their search for efficiency, depersonalising the whole experience with offshore call centres and centralised lending decisions. Malcolm Oliver looks at how two relative newcomers to the UK retail banking scene are reviving the old concept of real bank managers and personal service. The future of retail banking is a self-evidently important The key to success is often not the development of theme, and indeed one that The Financial Services Forum the ideas themselves but having the confidence (and addresses each year in the slightly broader context of its perhaps the commercial and professional courage) to Future of Retail Financial Services conferences. stand out and not dismiss them, like most of the herd, But between the positive idea and the delivered reality as passé or inappropriate to the needs of twenty-first- can fall a huge shadow. If speakers really have cracked century customers. As Allan Leighton said recently, in the problem in a way that will deliver lasting customer his new book on leadership, “the biggest challenge to satisfaction and regulatory approval and sustainable senior management is being able to listen effectively to profitability, why on earth would they want to give their those below who know what will and will not work”. secrets away to commercial rivals? Just reflect on how many financial services companies The Forum largely avoids this problem by its in the last decade or so have put in place new strategies membership formula, which means that most presenters to relocate call centres overseas, or to close local will already have built informal relationships with most of branches, or to withdraw free ATMs, or to restrict opening the audience, and will therefore feel that they are talking hours – only to have to perform an embarrassing volte- amongst friends rather than competitors. -

Ostrum Euro Bonds Opportunities 12 Months

Ostrum Euro Bonds Opportunities 12 Months Quarterly portfolio commentary 31-Mar-2021 Strategy performance Over the first quarter the Euro Bond Opportunities 12 Months strategy outperformed capitalized Eonia by +6bps, a return of - 0.06% (net of fees, I/C shareclass), versus -0.12% for capitalized Eonia. Over the period, interest rate spreads on Italian, Portuguese and Spanish debts widened. The 2-year Spread Italy went from a level of 27 to 30. Spanish and Portuguese spread levels moved from 6 to 19 bps and from -4 to 12 bps in the quarter. Only the spread of the Greece 2023 tighten by 3 bps.In the euro zone, German rates rose sharply upwards in a context of reflation and resumption of economic growth. The German 10-year rate retreated 50% from its level to end the quarter at -0.28%. The steepening of the German 2-10 curve is steepened from 11bps to 40 bps, partly driven by the steepening in the US.We reduced our exposure in the quarter by short near 90 cts of duration on futures (bobl, bund and buxl).We also slightly increased our position in Italians debt on maturity 2022 and 2023 in january and Spanish debts 2022 in march.We are maintaining our positioning on breakeven inflation rates. Although new health restriction measures have been taken, expectations of economic recovery and the theme of reflation will continue to push this widening upwards. Market environment The recovery of the world economy continued in the first quarter and was accompanied by an accelerated acceleration of international trade, driven mainly by Asia and China. -

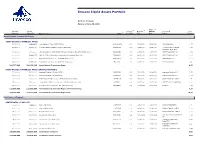

Invesco Liquid Assets Portfolio

Invesco Liquid Assets Portfolio Portfolio Holdings Data as of June 30, 2021 4 2 3 Final Principal Market 1 Coupon/ Maturity Maturity Associated % of Amount Value ($) Name of Issue CUSIP Yield (%) Date Date Issuer Portfolio Asset Backed Commercial Paper ASSET-BACKED COMMERCIAL PAPER 25,000,000 24,998,958 Ionic Capital III Trust (CEP-UBS AG) 46220WUG9 0.13 07/16/2021 07/16/2021 UBS GROUP AG 1.27 37,777,000 37,774,140 Lexington Parker Capital Company (Multi-CEP) 52953AUV5 0.15 07/29/2021 07/29/2021 Lexington Parker Capital 1.93 Company (Multi-CEP) 10,500,000 10,500,000 LMA Americas LLC (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QXR6 0.05 10/25/2021 10/25/2021 CREDIT AGRICOLE SA 0.54 40,000,000 39,992,272 LMA SA (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QW30 0.24 09/03/2021 09/03/2021 CREDIT AGRICOLE SA 2.04 20,000,000 20,000,000 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JW26 0.14 09/02/2021 09/02/2021 BNP PARIBAS SA 1.02 55,000,000 54,964,250 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JY81 0.14 11/08/2021 11/08/2021 BNP PARIBAS SA 2.80 188,277,000 188,229,620 Asset-Backed Commercial Paper 9.60 ASSET-BACKED COMMERCIAL PAPER (INTEREST BEARING) 50,000,000 50,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VG1 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 2.55 25,000,000 25,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VL0 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 1.27 10,000,000 10,000,000 Bedford Row Funding Corp. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

Belgian Bank Dexia Was Biggest Borrower from Federal Reserve Discount Window Telegraph

6/27/2017 Belgian bank Dexia was biggest borrower from Federal Reserve discount window Telegraph Belgian bank Dexia was biggest borrower from Federal Reserve discount window Dexia, one of Belgium's biggest banks, proved the biggest borrower from the Federal Reserve's discount window in the week of the financial crisis that saw record demand for the facility. The Fed had argued the release of the data could discourage banks from using the window in the future. Photo: AFP By Richard Blackden, US Business Editor 8:43PM BST 31 Mar 2011 At the height of the financial meltdown, on October 24, 2008, Dexia's New York branch was used to borrow $31.5bn (£19.6bn). The total borrowing from all banks during that week climbed to $111bn, according to lending data released by the central bank on Thursday. ADVERTISING Replay 3 Depfa, a unit of the German lender Hypo Real Estate Holding, also tapped the window for $24.6bn. http://www.telegraph.co.uk/finance/financialcrisis/8420060/BelgianbankDexiawasbiggestborrowerfromFederalReservediscountwindow.html 1/2 6/27/2017 Belgian bank Dexia was biggest borrower from Federal Reserve discount window Telegraph The Fed was forced to disclose the names of the banks and the amounts they borrowed after a legal challenge by Bloomberg. The central bank argued the release of the data could discourage banks from using the window in the future. "The information is backwardlooking," said Ulrike Pommee, a spokeswoman for Dexia. "We experienced a great deal of tension concerning the liquidity of the dollar at the time." Dexia has since reduced its outstanding balance at the Fed to zero, said Ms Pommee. -

Seeyond Europe Market Neutral

Seeyond Europe Market Neutral Quarterly portfolio commentary 31-Mar-2021 FUND PERFORMANCE Over the first quarter of 2021, Seeyond Europe Market Neutral returned +0.61% while the EONIA Capitalization Index returned -0.1%. MARKET ENVIRONMENT After a strong start to the year - and retaining the same momentum as the end of 2020, markets ended down in the latter part of January. In the US, social networks fueled an incredible price jump of some small-caps and heavily shorted stocks, which prompted several hedge funds to cut their positions and - on a larger scale - the whole market to sharply reduce its leverage. While this phenomenon initially targeted a few companies, its technical impact in the market was magnified by the highly convex and correlated nature of assets. In February, in a context of sharp interest rates’ rises both in the United States (+34bps for the 10 years) and in Europe (+ 49bps for the UK 10 years) and resilient markets, sector and factor rotations once again made the headlines - this time in favor of Banking (Eurozone banks up by almost 20%) and Energy stocks. Despite these transitions with extraordinary magnitude and speed, the "risk-on" mood still prevails, in anticipation of the positive fallout coming from the reopening of economies and – above all - from the various tax supports of President Biden's budget program. In addition, the momentum of the manufacturing activity remains solid, as do estimates of overall GDP growth for the year ahead - as the positive impacts of the vaccination programs progressively kick in. The first quarter of 2021 ended sharply higher for all equity markets, still supported by progress in the deployment of vaccination and reopening programs, as well as by a context of implementation of exceptional fiscal stimulus policies.