1997 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Natwest Markets Plc

Information Memorandum 5 March 2020 NatWest Markets Plc (incorporated in Scotland with limited liability under the Companies Act 1948 to 1980, registered number SC090312) A$5,000,000,000 Debt Issuance Programme Arranger & Dealer National Australia Bank Limited Dealers Australia and New Zealand Banking Group Limited Commonwealth Bank of Australia Mizuho Securities Asia Limited NatWest Markets Plc The Toronto-Dominion Bank Westpac Banking Corporation Contents Important notices 1 1. Programme summary 4 2. Information about NatWest Markets Plc 9 3. UK Bank Resolution Regime 10 4. Selling restrictions 11 5. Summary of certain taxation matters 15 6. Other important matters 17 7. Conditions of the Notes 19 8. Form of Pricing Supplement 39 9. Glossary 44 Directory 47 42015475_33 Important notices This Information Memorandum The distribution and use of this Information Memorandum, including any Issue Materials, and the This Information Memorandum relates to a debt offer or sale of Notes may be restricted by law in certain issuance programme (“ Programme ”) established by jurisdictions and intending purchasers and other NatWest Markets Plc (the “Issuer ”), under which it may investors should inform themselves about them and issue Notes from time to time. It has been prepared by, observe any such restrictions. and is issued with the authority of, the Issuer. In particular: The Issuer is neither a bank nor an authorised deposit- taking institution which is authorised under the this Information Memorandum is not a prospectus Australian Banking Act and nor is it supervised by the or other disclosure document for the purposes of the Australian Prudential Regulation Authority. The Notes Corporations Act. -

Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254)

Table1.—Attribute data for the map "Mineral Facilities of Asia and the Pacific," 2007 (Open-File Report 2010-1254). [The United States Geological Survey (USGS) surveys international mineral industries to generate statistics on the global production, distribution, and resources of industrial minerals. This directory highlights the economically significant mineral facilities of Asia and the Pacific. Distribution of these facilities is shown on the accompanying map. Each record represents one commodity and one facility type for a single location. Facility types include mines, oil and gas fields, and processing plants such as refineries, smelters, and mills. Facility identification numbers (“Position”) are ordered alphabetically by country, followed by commodity, and then by capacity (descending). The “Year” field establishes the year for which the data were reported in Minerals Yearbook, Volume III – Area Reports: Mineral Industries of Asia and the Pacific. In the “DMS Latitiude” and “DMS Longitude” fields, coordinates are provided in degree-minute-second (DMS) format; “DD Latitude” and “DD Longitude” provide coordinates in decimal degrees (DD). Data were converted from DMS to DD. Coordinates reflect the most precise data available. Where necessary, coordinates are estimated using the nearest city or other administrative district.“Status” indicates the most recent operating status of the facility. Closed facilities are excluded from this report. In the “Notes” field, combined annual capacity represents the total of more facilities, plus additional -

Pp43-45 6.3-Oliver

THE FINANCIAL SERVICES FORUM Retail Banking BANK TO THE FUTURE The high street banks have alienated many of their customers in their search for efficiency, depersonalising the whole experience with offshore call centres and centralised lending decisions. Malcolm Oliver looks at how two relative newcomers to the UK retail banking scene are reviving the old concept of real bank managers and personal service. The future of retail banking is a self-evidently important The key to success is often not the development of theme, and indeed one that The Financial Services Forum the ideas themselves but having the confidence (and addresses each year in the slightly broader context of its perhaps the commercial and professional courage) to Future of Retail Financial Services conferences. stand out and not dismiss them, like most of the herd, But between the positive idea and the delivered reality as passé or inappropriate to the needs of twenty-first- can fall a huge shadow. If speakers really have cracked century customers. As Allan Leighton said recently, in the problem in a way that will deliver lasting customer his new book on leadership, “the biggest challenge to satisfaction and regulatory approval and sustainable senior management is being able to listen effectively to profitability, why on earth would they want to give their those below who know what will and will not work”. secrets away to commercial rivals? Just reflect on how many financial services companies The Forum largely avoids this problem by its in the last decade or so have put in place new strategies membership formula, which means that most presenters to relocate call centres overseas, or to close local will already have built informal relationships with most of branches, or to withdraw free ATMs, or to restrict opening the audience, and will therefore feel that they are talking hours – only to have to perform an embarrassing volte- amongst friends rather than competitors. -

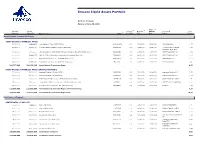

Invesco Liquid Assets Portfolio

Invesco Liquid Assets Portfolio Portfolio Holdings Data as of June 30, 2021 4 2 3 Final Principal Market 1 Coupon/ Maturity Maturity Associated % of Amount Value ($) Name of Issue CUSIP Yield (%) Date Date Issuer Portfolio Asset Backed Commercial Paper ASSET-BACKED COMMERCIAL PAPER 25,000,000 24,998,958 Ionic Capital III Trust (CEP-UBS AG) 46220WUG9 0.13 07/16/2021 07/16/2021 UBS GROUP AG 1.27 37,777,000 37,774,140 Lexington Parker Capital Company (Multi-CEP) 52953AUV5 0.15 07/29/2021 07/29/2021 Lexington Parker Capital 1.93 Company (Multi-CEP) 10,500,000 10,500,000 LMA Americas LLC (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QXR6 0.05 10/25/2021 10/25/2021 CREDIT AGRICOLE SA 0.54 40,000,000 39,992,272 LMA SA (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QW30 0.24 09/03/2021 09/03/2021 CREDIT AGRICOLE SA 2.04 20,000,000 20,000,000 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JW26 0.14 09/02/2021 09/02/2021 BNP PARIBAS SA 1.02 55,000,000 54,964,250 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JY81 0.14 11/08/2021 11/08/2021 BNP PARIBAS SA 2.80 188,277,000 188,229,620 Asset-Backed Commercial Paper 9.60 ASSET-BACKED COMMERCIAL PAPER (INTEREST BEARING) 50,000,000 50,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VG1 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 2.55 25,000,000 25,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VL0 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 1.27 10,000,000 10,000,000 Bedford Row Funding Corp. -

ETO Listing Dates As at 11 March 2009

LISTING DATES OF CLASSES 03 February 1976 BHP Limited (Calls only) CSR Limited (Calls only) Western Mining Corporation (Calls only) 16 February 1976 Woodside Petroleum Limited (Delisted 29/5/85) (Calls only) 22 November 1976 Bougainville Copper Limited (Delisted 30/8/90) (Calls only) 23 January 1978 Bank N.S.W. (Westpac Banking Corp) (Calls only) Woolworths Limited (Delisted 23/03/79) (Calls only) 21 December 1978 C.R.A. Limited (Calls only) 26 September 1980 MIM Holdings Limited (Calls only) (Terminated on 24/06/03) 24 April 1981 Energy Resources of Aust Ltd (Delisted 27/11/86) (Calls only) 26 June 1981 Santos Limited (Calls only) 29 January 1982 Australia and New Zealand Banking Group Limited (Calls only) 09 September 1982 BHP Limited (Puts only) 20 September 1982 Woodside Petroleum Limited (Delisted 29/5/85) (Puts only) 13 October 1982 Bougainville Copper Limited (Delisted 30/8/90) (Puts only) 22 October 1982 C.S.R. Limited (Puts only) 29 October 1982 MIM Holdings Limited (Puts only) Australia & New Zealand Banking Group Limited (Puts only) 05 November 1982 C.R.A. Limited (Puts only) 12 November 1982 Western Mining Corporation (Puts only) T:\REPORTSL\ETOLISTINGDATES Page 1. Westpac Banking Corporation (Puts only) 26 November 1982 Santos Limited (Puts only) Energy Resources of Aust Limited (Delisted 27/11/86) (Puts only) 17 December 1984 Elders IXL Limited (Changed name - Foster's Brewing Group Limited 6/12/90) 27 September 1985 Queensland Coal Trust (Changed name to QCT Resources Limited 21/6/89) 01 November 1985 National Australia -

Big Business in Twentieth-Century Australia

CENTRE FOR ECONOMIC HISTORY THE AUSTRALIAN NATIONAL UNIVERSITY SOURCE PAPER SERIES BIG BUSINESS IN TWENTIETH-CENTURY AUSTRALIA DAVID MERRETT UNIVERSITY OF MELBOURNE SIMON VILLE UNIVERSITY OF WOLLONGONG SOURCE PAPER NO. 21 APRIL 2016 THE AUSTRALIAN NATIONAL UNIVERSITY ACTON ACT 0200 AUSTRALIA T 61 2 6125 3590 F 61 2 6125 5124 E [email protected] https://www.rse.anu.edu.au/research/centres-projects/centre-for-economic-history/ Big Business in Twentieth-Century Australia David Merrett and Simon Ville Business history has for the most part been dominated by the study of large firms. Household names, often with preserved archives, have had their company stories written by academics, journalists, and former senior employees. Broader national studies have analysed the role that big business has played in a country’s economic development. While sometimes this work has alleged oppressive anti-competitive behaviour, much has been written from a more positive perspective. Business historians, influenced by the pioneering work of Alfred Chandler, have implicated the ‘visible hand’ of large scale enterprise in national economic development particularly through their competitive strategies and modernised governance structures, which have facilitated innovation, the integration of national markets, and the growth of professional bureaucracies. While our understanding of the role of big business has been enriched by an aggregation of case studies, some writers have sought to study its impact through economy-wide lenses. This has typically involved constructing sets of the largest 100 or 200 companies at periodic benchmark years through the twentieth century, and then analysing their characteristics – such as their size, industrial location, growth strategies, and market share - and how they changed over time. -

To Be Renamed Ausmex Mining Group Limited

Eumeralla Resources Limited ACN 148 860 299 to be renamed Ausmex Mining Group Limited PROSPECTUS For the offer of up to 75 million shares at an issue price of $0.08 each to raise up to $6,000,000 (before costs) (public offer). The public offer is subject to a minimum subscription requirement of $4,000,000. The public offer is not underwritten. This prospectus is a re-compliance prospectus for the purposes of satisfying chapters 1 and 2 of the listing rules and to satisfy ASX requirements for reinstatement of the company’s securities to trading following a change in the nature and scale of the company’s activities. The offers made under this prospectus and the issue of securities pursuant to this prospectus are subject to and conditional on satisfaction of the offer conditions. If the offer conditions are not satisfied, no securities will be issued pursuant to this prospectus and the company will repay all money received from applicants without interest. Lead manager Solicitors to the Offers CPS Capital Group Pty Ltd Blackwall Legal LLP Level 45, 108 St Georges Terrace Level 6, 105 St Georges Terrace Perth WA 6000 Perth WA 6000 This document is important and should be read in its entirety. If after reading this prospectus you have any questions about the securities being offered under this prospectus or any other matter, then you should consult your stockbroker, accountant or other For personal use only professional advisor. The shares offered by this prospectus should be considered as highly speculative. CONTENTS 1. CORPORATE DIRECTORY ............................................................................................. 3 2. -

Settlement Banks for FX and MM Transactions, Options and Derivatives

Settlement Banks for FX and MM Transactions, Options and Derivatives Cou ntry: Currency: Correspondent Bank: SWIFT: Australia AUD National Australia Bank Ltd., Me lbourne NATAAU33033 Acc. 1803012548500 Bulgaria BGN Unicredit Bulbank AD, Sofia UNCRBGSF IBAN BG42UNCR96601030696607 Canada CAD Royal Bank of Canada, Toronto ROYCCAT2 Acc. 095912454619 SYDBANK A/S China CNY Standard Chartered Bank Ltd., Hong Kong SCBLHKHH Acc. 44709448980 Czech R epublic CZK Unicredit Bank Czech Republic AS , Prague BACXCZPP IBAN: CZ242700000000008166802 8 Acc. 81668028 Denmark DKK Danmarks Nationa lbank, Copenhagen DKNBDKKK Acc. 1115 -4 IBAN DK0910050000011154 Euroland EUR Commerzbank A G, Frankfurt COBADEFF Acc. 4008724346 IBAN DE 83500400000872434600 Hong Kong HKD Stan dard Chartered, Hong Kong SCBLHKHH Acc. 44708122739 Hungary HUF OTP Bank PLC , Budapest OTPVHUHB IBAN: HU66117820078102030800000000 Iceland ISK NBI HF NBIIISRE IBAN: IS230100270912726805925439 India INR Standard Chartered Bank , New Delhi SCBLINBB Acc. 222 -0-523804 -8 Indonesia IDR Standard Chartered Bank, Jakarta SCBLIDJX Japan JPY Bank of Tokyo -Mitsubishi UFJ Ltd , Tokyo BOTKJPJT Acc. 653 -0440973 Kenya KES Kenya Commercial Bank, Nairobi KCBLKENX Mexico MXN BBVA Bancomer S.A., Mexico BCMRMXMMCOR Acc. 0095001475 Morocco MAD Banque Marocaine du Commerce Extérieur, Cass ablanca BMCEMAMC New Ze aland NZD ANZ National Bank Ltd , Wellin gton ANZBNZ22058 Acc. 266650 -00001 NZD NO.1 Nor way NOK DNB Nor Bank ASA , Oslo DNBANOKK IBAN: NO32 70010213124 Acc. 7001.02.13124 Valid from: 24.02.2021 Sydbank A/S, CVR No DK 12626509, Aabenraa www.sydbank.com Page: 1/2 Settlement Banks for FX and MM Transactions, Options and Derivatives Cou ntry: Currency: Correspondent Bank: SWIFT: Poland PLN Bank Millennium SA, Warsaw BIGBPLPW IBAN PL 02116022020000000039897935 Romania RO N UniCredit Tiriac Bank SA, Bucharest BACXROBU IBAN RO65B ACX0000000001413310 Saudi Arabia SAR Saudi British Bank, Riyadh SABBSARI Acc. -

Newcrest Mining Concise Annual Report 2007

Newcrest Mining Concise Annual Report 2007 Newcrest Mining Limited ABN 20 005 683 625 Concise Annual Report 2007 Corporate Directory Newcrest is a leading gold and copper producer. It provides investors with an exposure to large, low-cost, long life and Investor Information Share Registry Other Offi ces small, high margin gold and copper mines. Registered and Principal Offi ce Link Market Services Limited Brisbane Newcrest Mining Limited Level 9 Exploration Offi ce It aims to be in the lowest quartile for costs. Level 9 333 Collins Street Newcrest Mining Limited 600 St Kilda Road Melbourne, Victoria 3000 Level 2 Newcrest has technical skills and mining Melbourne, Victoria 3004 Australia 349 Coronation Drive Australia Postal Address Milton, Queensland 4064 Telephone: +61 (0)3 9522 5333 Locked Bag A14 Australia experience to deliver strong fi nancial returns Facsimile: +61 (0)3 9525 2996 Sydney South, New South Wales 1235 Telephone: +61 (0)7 3858 0858 Email: Australia Facsimile: +61 (0)7 3217 8233 and growth through exploration success. [email protected] Telephone: 1300 554 474 Internet: www.newcrest.com.au Perth +61 (0)2 8280 7111 Exploration Offi ce & Its vision is to be the ‘Miner of Choice’. Company Secretary Facsimile: +61 (0)2 9287 0303 Telfer Project Group Bernard Lavery +61 (0)2 9287 0309* Newcrest Mining Limited Level 9 *For faxing of Proxy Forms only. Hyatt Business Centre Social responsibility, safety and sustainability 600 St Kilda Road Email: Level 2 Melbourne, Victoria 3004 [email protected] 30 Terrace Road are the fundamental guideposts to that vision. Australia Internet: www.linkmarketservices.com.au East Perth, Western Australia 6004 Telephone: +61 (0)3 9522 5371 ADR Depositary Australia Facsimile: +61 (0)3 9521 3564 Telephone: +61 (0)8 9270 7070 Email: [email protected] BNY – Mellon Shareowner Services Investor Services Facsimile: +61 (0)8 9221 7340 Stock Exchange Listings P.O. -

National Australia Bank Selects Payplus Cls from Fundtech; Fundtech Furthers Its Dominance in the Cls Market

Fundtech Contact: Media Contact: George Ravich Justine Schneider Fundtech Ltd. Ruder Finn, Inc. (201) 946-1100 (212) 583-2750 [email protected] [email protected] FOR IMMEDIATE RELEASE NATIONAL AUSTRALIA BANK SELECTS PAYPLUS CLS FROM FUNDTECH; FUNDTECH FURTHERS ITS DOMINANCE IN THE CLS MARKET JERSEY CITY, N.J.--(BUSINESS WIRE)--Oct. 5, 2000--Fundtech Ltd. (NASDAQ:FNDT), a leading provider of e-payments and Internet banking solutions, today announced that its PAYplus CLS(TM) software has been selected by the National Australia Bank Limited (ASX: NAB) to facilitate settlement of foreign exchange (FX) trades in the Continuous Linked Settlement (CLS) environment. The National Australia Bank is a major Australian financial institution with subsidiary operations in the United Kingdom, Ireland, New Zealand and the United States. It ranks among the top 50 banks in the world, with assets of over AUD 322 billion. "Fundtech's PAYplus CLS provides an integrated solution which is consistent with the National's straight through processing philosophy," said Mr. Bruce Rose, General Manager, Global Wholesale Support Services, National Australia Bank. "Fundtech's PAYplus CLS will support the management of the Group's foreign exchange operations in the new CLS system." Major global financial services companies such as Bank of America, Bank of New York, Deutsche Bank, Dresdner Bank, and Commerzbank have also Fundtech Corporation 30 Montgomery Street, Suite 501, Jersey City, NJ 07302, USA ■ Tel: +1-201-946-1100 ■ Fax: +1-210-946-1313 www.fundtech.com selected Fundtech's CLS solution. Fundtech is currently contracting with several other large global banks for its PAYplus CLS solution. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

SUSTAINABILITY REPORT 2017 Front Cover Image: Amanda, Haile, United States This Page: Macraes Processing, New Zealand

SUSTAINABILITY REPORT 2017 Front cover image: Amanda, Haile, United States This page: Macraes processing, New Zealand ABOUT THIS REPORT SECTION 3 Our reporting framework 4 OUR COMMITMENT TO RESPONSIBLE MINING Reporting scope and limitations 4 Our contribution to a sustainable future 28 Our sustainability framework 28 Precautionary approach 30 Memberships and associations 30 CHAIRMAN AND CEO’S Materiality 31 YEAR IN REVIEW 5 Awards 32 Acting ethically and with integrity 34 Our approach 34 Code of conduct 34 SECTION 1 Anti-corruption compliance 34 Transparency 35 ABOUT US Human rights 35 Case study: Strengthening our social performance 29 Our operations 10 Our growth strategy 12 Organic growth 12 Strategic investments 13 SECTION 4 Other projects 13 Closed sites 14 ECONOMIC PERFORMANCE AND CONTRIBUTION Our history 15 Financial summary 38 Production and cost results summary 38 Fines and penalties 39 SECTION 2 Social investment 39 Summary of payments and financial contributions 40 THE OCEANAGOLD WAY Summary of procurement spend 40 Case study: OceanaGold’s economic contribution to Our values 18 New Zealand 41 Our vision 19 Our strategic objectives 19 Our people 19 Corporate governance 20 Our Board 20 Organisational Chart 24 2 SUSTAINABILITY REPORT 2017 SECTION 5 SECTION 7 OUR PEOPLE OUR STAKEHOLDERS Employment 44 Stakeholder engagement and consultation 66 Inclusion and diversity 44 Social investment 71 Freedom of association and collective bargaining 47 Local procurement 72 Training and development 47 Indigenous rights 75 Employee engagement