Before the Public Service Commission

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Case 3:15-cv-02159-VC Document 183 Filed 01/19/18 Page 1 of 11 1 Derek W. Loeser, admitted pro hac vice Gretchen Freeman Cappio, admitted pro hac vice 2 KELLER ROHRBACK L.L.P. 3 1201 Third Avenue, Suite 3200 Seattle, WA 98101-3052 4 (206) 623-1900; Fax: (206) 623-3384 [email protected] 5 [email protected] 6 Jeffrey Lewis (Bar No. 66587) 7 KELLER ROHRBACK L.L.P. 300 Lakeside Drive, Suite 1000 8 Oakland, CA 94612 (510) 463-3900; Fax: (510) 463-3901 9 [email protected] 10 Attorneys for Plaintiffs 11 UNITED STATES DISTRICT COURT 12 NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO DIVISION 13 SHAHRIAR JABBARI and KAYLEE 14 HEFFELFINGER, on behalf of themselves and all others similarly situated, No. 15-cv-02159-VC 15 Plaintiffs, DECLARATION OF SHANNON R. 16 WHEATMAN, PH.D. ON THE 17 v. IMPLEMENTATION AND ADEQUACY OF THE CLASS NOTICE 18 WELLS FARGO & COMPANY and WELLS PROGRAM FARGO BANK, N.A., 19 Defendants. 20 21 I, Shannon R. Wheatman, declare as follows: 22 1. I am president of Kinsella Media, LLC (“KM”), a nationally recognized 23 advertising and legal notification firm in Washington, D.C. specializing in the design and 24 implementation of notification programs to reach unidentified putative class members, primarily 25 in consumer and antitrust class actions, and claimants in bankruptcy and mass tort litigation. My 26 27 business address is 2101 L Street, NW Suite 800, Washington, D.C. 20037. My telephone 28 number is (202) 686-4111. DECLARATION OF SHANNON R. WHEATMAN, PH.D. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 13F Form 13F COVER PAGE Report for the Calendar Year or Quarter Ended: 30-September-09 Check here if Amendment [_]; Amendment Number: ------------------- This Amendment {Check only one.): [_]; is a restatement. [_]; adds new holdings entries. Institutional Investment Manager Filing this Report: Name: Capital One Financial Corporation Address: 1680 Capital One Drive McLean, VA 22102 Form 13F File Number: 028-12320 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person signing this report on behalf of Reporting Manager: Name: Matthew J. Murphy Title: Head of Brokerage, Trust, COAM Phone: 631-577-5801 Signature, Place, and Date of Signing: /s/ Matthew J. Murphy Melville, New York November 10, 2009 - -------------------------- ------------------------- ------------------------- (Signature) (City, State) (Date) Report Type (Check only one): [_] 13F HOLDINGS REPORT. (Check here if all holdings qf this reporting manager are reported in this report.) [_] 13F NOTICE. (Check here if no holdings reported are in this report, and all holdings are reported by other reporting manager (s).} [X] 13F COMBINATION REPORT. (Check here if a portion of the holdings -

84 Lumber Co-Manager Adelphoi Village, Inc. Jr. Accountant ALCOA Travel and Expense Processor Allegheny Energy Fuels Technician

Employer Position 84 Lumber Co-Manager Adelphoi Village, Inc. Jr. Accountant ALCOA Travel and Expense Processor Allegheny Energy Fuels Technician Accounting Allegheny Ludlum Staff Accountant I Allegheny Valley Bank of Pittsburgh Staff Accountant Asset Genie, Inc. Accounting Department Bechtel Plant Machinery Inc. Procurement Specialist I BDO USA Tax Accountant, Auditor, Litigation Support Bononi and Bononi Accountant Boy Scouts-Westmoreland Fayette Council Accounting Specialist/Bookkeeper City of Greensburg Fiscal Assistant A/R Coca-Cola Budget Analyst DeLallo’s Italian Store Manager Department of Veteran Affairs-Dayton VA Accountant Trainee Medical Center Dept. of the Navy - Naval Audit Service Auditor Diamond Drugs, Inc. Staff Accountant Enterprise Rent A Car Accounting Coordinator FedEx Services Auditor First Commonwealth Financial Corporation Management Trainee - 16 month management development program Fox and James Inc. Controller (Office MGR, HR MGR, Accountant, Auditor) General American Corp. Accounts Payable Assistant Giant Eagle Staff Accountant Highmark Accountant One Inspector General's Office, Department of Junior Auditor Defense Irwin Bank and Trust Company Management Trainee James L. Wintergreen CPA Office Manager/Accountant - payroll, taxes John Wall, Inc Accountant Jordan Tax Service Accounting Clerk Kennametal Inc. Business Analyst Kennametal, Inc. Internal Auditor Limited Brands Internal Auditor Maher Duessel, CPAs Staff Accountant Malin, Bergquist & Company, LLP Staff Accountant Marathon Ashland Petroleum LLC Audit Staff -

Firstenergy's History of Bad Business Decisions

FirstEnergy’s history of bad business decisions Risky beginning In 1997, Ohio Edison changed its name to FirstEnergy when it acquired Centerior Energy, becoming the 11th largest electric utility in the country, serving 2.2 million customers in northern Ohio and western Pennsylvania. Centerior had invested in three expensive nuclear power plants, just about the time that the Three Mile Island accident in 1979 drove up the cost for these plants. Centerior cancelled one of the nuclear plants in 1994, slashed its dividend, and took a $1 billion write-off. Despite such troubles, and the threat of additional problems at reactors, Ohio Edison bailed out Centerior with the 1997 merger. With this risky investment, FirstEnergy was born. Safety violations FirstEnergy has made repeated mistakes with its poor safety record, as evidenced by its frequent citations from the Nuclear Regulatory Commission (NRC) for safety violations. In 2002, FirstEnergy narrowly averted disaster at the Davis-Besse reactor. The NRC had set a 2001 deadline for a crucial safety inspection, but FirstEnergy pushed it back to 2002, when the plant was scheduled to close for refueling. The NRC found a coolant leak from the reactor core had caused a gaping hole in the reactor cover, eating away six inches of the 6½-inch thick steel plate. The NRC also found a host of defective welds. FirstEnergy had to shut the plant down for two years for repairs. Poor oversight High costs for nuclear maintenance and safety led FirstEnergy to cut costs in other areas, like its tree trimming budget. In 2003, FirstEnergy inadvertently turned out the lights on the eastern U.S. -

You Can Double Your Gift to Extra Mile Education Foundation. Many Companies Will Match Their Employee's Contribution. Below I

You can double your gift to Extra Mile Education Foundation. Many companies will match their employee’s contribution. Below is a partial list of corporations and business who provide matching gifts. Please contact your Human Resource representative to help support children and their families seeking a values-based quality education. CBS GE Fund 3M CIGNA Foundation Gannett CNA Insurance Company Gap Foundation ADC Telecommunications, Inc. CNG General Electric AES Beaver Valley CR Bard General Mills AK Steel Corporation Cadence General Motors AMD Matching Gifts Program Design Systems, Inc. Gillette Company AMGEN Foundation (The) Capital Group Companies Charitable GlaxoSmithKline Foundation AT&T Casey Matching Gift Program Goldman, Sachs & Company Alcatel-Lucent Certain Teed Goodrich Corporation Alcoa Channel Craft Google Allegheny Energy Co., Inc. Chevron Texaco Corporation Allegheny Power Chicago Title & Trust Company H.J. Heinz Company Allegheny Technologies, Inc. Chubb & Son, Inc. Hamilton Sundstrand Alliant Techsystems Citigroup Harcourt, Inc. Altria Group, Inc. Citizens Bank Harsco Corporation Altria Program Cleveland H. Dodge Foundation, Inc. Hartford Steam Boiler Computer Associates International, Inc. American Express Financial Advisors Hewlett Packard Company Corning Incorporated American International Group Highmark Cyprus Amax Ameritech Hillman Company (The) Ameriprise Financial Home Depot, Inc. Del Monte Foods Company Aramark Honeywell Houghton Mifflin Deluxe Corporation Arco Chemical Company Dictaphone Corporation ARCO IBM Corporation Dominion Foundation Armco, Inc. International Minerals & Chemical Co. Astorino EQT Corporation Automatic Data Processing J.P. Morgan Chase ERICSSON AXA Financial/Equitable John Hancock Mutual Life Insurance. Co. East Suburban Medical Supply Johnson & Johnson Eaton Corporation B.F. Goodrich Johnson Controls Eli Lilly Company BNY Mellon Juniper Networks (The) Emerson Electric BP America Erie Insurance Group Baxter Allegiance Kaplan, Inc. -

New Mexico State Record, 09-20-1918 State Publishing Company

University of New Mexico UNM Digital Repository New Mexico State Record, 1916-1921 New Mexico Historical Newspapers 9-20-1918 New Mexico State Record, 09-20-1918 State Publishing Company Follow this and additional works at: https://digitalrepository.unm.edu/nm_state_record_news Recommended Citation State Publishing Company. "New Mexico State Record, 09-20-1918." (1918). https://digitalrepository.unm.edu/ nm_state_record_news/115 This Newspaper is brought to you for free and open access by the New Mexico Historical Newspapers at UNM Digital Repository. It has been accepted for inclusion in New Mexico State Record, 1916-1921 by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. MEW MEXICO STATE 10) TC .CORD SUBSCRIPTION $1.50 SANTA FE, NEW MEXICO FRIDAY SEPTEMBER 20, 1918 NUMBER 207 COUNCIL OF DEFENSE NOT GUILTY SAYS REPUBLICANS TO SUBSCRIBE $12,000 ! Pankey Has. Caught Him, All Right ' HOLD CONVENTION FOR WAR STAMPS IN . REPORTS ON YEAR'S JURY IN TRIAL OF R. - TUESDAY OCT. 1ST FIFTEEN MINUTES WAR EXPENDITURES MRS. MAUD CASE ASSEMBLY OF DELEGATES. SANTA FE CITIZENS AT THE FARMERS LOANS, AGRICUL- SENSATIONAL TRIAL FOR TO NOMINATE TEN STATE PICTURE SHOW BALLY TURAL OPERATIONS, MILI- ALLEGED MURDER OF OFFICERS AND TWO NA- MAKE A RECORD FOR A TARY- AND EXECUTIVE HUSBAND WAS COMPLET- TIONAL CALLED BY THE CITY OF THIS SIZE IN BUDGET MAKES NEARLY ED FRIDAY NIGHT; JURY CHAIRMAN STAMP BUYING $200,000 OUT HOUR AND QUARTER L R At twelve o'clock The state convention At a held in the Paris Brice. disbursing agent for nearly 1'riday republican meeting submit-- the in the trial of Mrs. -

Common Stock Valuation

Chapter Common Stock Valuation McGraw-Hill/Irwin Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved. Common Stock Valuation • Our goal in this chapter is to examine the methods commonly used by financial analysts to assess the economic value of common stocks. • These methods are grouped into three categories: – Dividend discount models – Residual Income models – Price ratio models 6-2 Security Analysis: Be Careful Out There • Fundamental analysis is a term for studying a company’s accounting statements and other financial and economic information to estimate the economic value of a company’s stock. • The basic idea is to identify “undervalued” stocks to buy and “overvalued” stocks to sell. • In practice however, such stocks may in fact be correctly priced for reasons not immediately apparent to the analyst. 6-3 The Dividend Discount Model • The Dividend Discount Model (DDM) is a method to estimate the value of a share of stock by discounting all expected future dividend payments. The basic DDM equation is: D(1) D(2) D(3) D(T) V(0) = + 2 + 3 + L T ()1+ k ()1+ k ()1+ k ()1+ k • In the DDM equation: – V(0) = the present value of all future dividends – D(t) = the dividend to be paid t years from now – k = the appropriate risk-adjusted discount rate 6-4 Example: The Dividend Discount Model • Suppose that a stock will pay three annual dividends of $200 per year, and the appropriate risk-adjusted discount rate, k, is 8%. • In this case, what is the value of the stock today? D(1) D(2) D(3) V(0) = + + ()1+ k ()1+ k 2 ()1+ k 3 $200 $200 $200 V(0) = + + = $515.42 ()1+ 0.08 ()1+ 0.08 2 ()1+ 0.08 3 6-5 The Dividend Discount Model: the Constant Growth Rate Model • Assume that the dividends will grow at a constant growth rate g. -

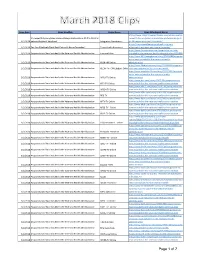

News with Link Attachments.Xlsx

News Date News Headline Outlet Name News Attachment Name https://www.integrativepractitioner.com/whats‐new/va‐ VA respectfully recognizes acupuncture professionals as GS 9 to GS 12 in respectfully‐recognizes‐acupuncture‐professionals‐gs‐9‐ 3/1/2018 new employment handbook Integrative Practitioner gs‐12‐new‐employment‐handbook/ https://areyouawellbeing.texashealth.org/can‐ 3/1/2018 Can You Effectively Treat Back Pain with Home Remedies? Texas Health Resources effectively‐treat‐back‐pain‐home‐remedies/ http://www.financialbuzz.com/acupuncturists‐now‐ 3/2/2018 Acupuncturists Now Included in the Veterans Health Administration Financial Buzz included‐in‐the‐veterans‐health‐administration‐1021509 http://www.937theeagle.com/story/37631380/acupunct urists‐now‐included‐in‐the‐veterans‐health‐ 3/2/2018 Acupuncturists Now Included in the Veterans Health Administration KLBB‐FM Online administration http://www.lubbockcw.com/story/37631380/acupunctu 3/2/2018 Acupuncturists Now Included in the Veterans Health Administration KLCW‐TV ‐ CW Lubbock Onlinerists‐now‐included‐in‐the‐veterans‐health‐ http://www.watchfox29.com/story/37631380/acupunct urists‐now‐included‐in‐the‐veterans‐health‐ 3/2/2018 Acupuncturists Now Included in the Veterans Health Administration WFLX‐TV Online administration http://www.kitv.com/story/37631380/acupuncturists‐ 3/2/2018 Acupuncturists Now Included in the Veterans Health Administration KITV‐TV Online now‐included‐in‐the‐veterans‐health‐administration http://www.nbc‐2.com/story/37631380/acupuncturists‐ 3/2/2018 Acupuncturists -

2008 OAH Annual Meeting • New York 1

Welcome ear colleagues in history, welcome to the one-hundred-fi rst annual meeting of the Organiza- tion of American Historians in New York. Last year we met in our founding site of Minneap- Dolis-St. Paul, before that in the national capital of Washington, DC. On the present occasion wew meet in the world’s media capital, but in a very special way: this is a bridge-and-tunnel aff air, not limitedli to just the island of Manhattan. Bridges and tunnels connect the island to the larger metropolitan region. For a long time, the peoplep in Manhattan looked down on people from New Jersey and the “outer boroughs”— Brooklyn, theth Bronx, Queens, and Staten Island—who came to the island via those bridges and tunnels. Bridge- and-tunnela people were supposed to lack the sophistication and style of Manhattan people. Bridge- and-tunnela people also did the work: hard work, essential work, beautifully creative work. You will sees this work in sessions and tours extending beyond midtown Manhattan. Be sure not to miss, for example,e “From Mambo to Hip-Hop: Th e South Bronx Latin Music Tour” and the bus tour to my own Photo by Steve Miller Steve by Photo cityc of Newark, New Jersey. Not that this meeting is bridge-and-tunnel only. Th anks to the excellent, hard working program committee, chaired by Debo- rah Gray White, and the local arrangements committee, chaired by Mark Naison and Irma Watkins-Owens, you can chose from an abundance of off erings in and on historic Manhattan: in Harlem, the Cooper Union, Chinatown, the Center for Jewish History, the Brooklyn Historical Society, the New-York Historical Society, the American Folk Art Museum, and many other sites of great interest. -

Lawler WWE 104 Akira Tozawa Raw 105 Alicia

BASE BASE CARDS 101 Tyler Bate WWE 102 Brie Bella WWE 103 Jerry "The King" Lawler WWE 104 Akira Tozawa Raw 105 Alicia Fox Raw 106 Apollo Crews Raw 107 Ariya Daivari Raw 108 Harley Race WWE Legend 109 Big Show Raw 110 Bo Dallas Raw 111 Braun Strowman Raw 112 Bray Wyatt Raw 113 Cesaro Raw 114 Charly Caruso Raw 115 Curt Hawkins Raw 116 Curtis Axel Raw 117 Dana Brooke Raw 118 Darren Young Raw 119 Dean Ambrose Raw 120 Emma Raw 121 Jeff Hardy Raw 122 Goldust Raw 123 Heath Slater Raw 124 JoJo Raw 125 Kalisto Raw 126 Kurt Angle Raw 127 Mark Henry Raw 128 Matt Hardy Raw 129 Mickie James Raw 130 Neville Raw 131 R-Truth Raw 132 Rhyno Raw 133 Roman Reigns Raw 134 Sasha Banks Raw 135 Seth Rollins Raw 136 Sheamus Raw 137 Summer Rae Raw 138 Aiden English SmackDown LIVE 139 Baron Corbin SmackDown LIVE 140 Becky Lynch SmackDown LIVE 141 Charlotte Flair SmackDown LIVE 142 Daniel Bryan SmackDown LIVE 143 Dolph Ziggler SmackDown LIVE 144 Epico SmackDown LIVE 145 Erick Rowan SmackDown LIVE 146 Fandango SmackDown LIVE 147 James Ellsworth SmackDown LIVE 148 Jey Uso SmackDown LIVE 149 Jimmy Uso SmackDown LIVE 150 Jinder Mahal SmackDown LIVE 151 Kevin Owens SmackDown LIVE 152 Konnor SmackDown LIVE 153 Lana SmackDown LIVE 154 Naomi SmackDown LIVE 155 Natalya SmackDown LIVE 156 Nikki Bella SmackDown LIVE 157 Primo SmackDown LIVE 158 Rusev SmackDown LIVE 159 Sami Zayn SmackDown LIVE 160 Shinsuke Nakamura SmackDown LIVE 161 Sin Cara SmackDown LIVE 162 Tyler Breeze SmackDown LIVE 163 Viktor SmackDown LIVE 164 Akam NXT 165 Aleister Black NXT 166 Andrade "Cien" Almas -

2019 Topps WWE Raw Checklist

BASE BASE CARDS 1 Akam Raw® 2 Alexa Bliss Raw® 3 Alicia Fox Raw® 4 Apollo Crews Raw® 5 Baron Corbin Raw® 6 Batista WWE 7 Bayley Raw® 8 Bo Dallas Raw® 9 Bobby Lashley Raw® 10 Bobby Roode Raw® 11 Booker T Raw® 12 Braun Strowman Raw® 13 Bray Wyatt Raw® 14 Brie Bella Raw® 15 Brock Lesnar Raw® 16 Chad Gable Raw® 17 Charly Caruso Raw® 18 Corey Graves Raw® 19 Curt Hawkins Raw® 20 Curtis Axel Raw® 21 Dana Brooke Raw® 22 Dash Wilder Raw® 23 David Otunga WWE 24 Dean Ambrose Raw® 25 Dolph Ziggler Raw® 26 Drake Maverick Raw® 27 Drew McIntyre Raw® 28 Elias Raw® 29 Ember Moon Raw® 30 Fandango Raw® 31 Finn Bálor Raw® 32 Gran Metalik Raw® 33 Heath Slater Raw® 34 Jason Jordan Raw® 35 Jinder Mahal Raw® 36 Jonathan Coachman WWE 37 John Cena WWE 38 JoJo Raw® 39 Kalisto Raw® 40 Kane WWE 41 Kayla Braxton Raw® 42 Kevin Owens Raw® 43 Konnor Raw® 44 Kurt Angle Raw® 45 Lince Dorado Raw® 46 Lio Rush Raw® Rookie 47 Liv Morgan Raw® 48 Michael Cole Raw® 49 Mickie James Raw® 50 Mike Rome Raw® 51 Mojo Rawley Raw® 52 Natalya Raw® 53 Nia Jax Raw® 54 Nikki Bella Raw® 55 No Way Jose Raw® 56 Paul Heyman Raw® 57 Renee Young Raw® 58 Rezar Raw® 59 Rhyno Raw® 60 Roman Reigns Raw® 61 Ronda Rousey Raw® 62 Ruby Riott Raw® 63 Sami Zayn Raw® 64 Samir Singh Raw® 65 Sarah Logan Raw® 66 Sasha Banks Raw® 67 Scott Dawson Raw® 68 Seth Rollins Raw® 69 Stephanie McMahon Raw® 70 Sunil Singh Raw® 71 Titus O'Neil Raw® 72 Tyler Breeze Raw® 73 Viktor Raw® 74 Zack Ryder Raw® 75 Akira Tozawa 205 Live® 76 Ariya Daivari 205 Live® 77 Buddy Murphy 205 Live® Rookie 78 Cedric Alexander 205 Live® 79 Drew -

IPTV Channel Lineup

G E T C O N N E C T E D & S T A Y C O N N E C T E D 4 0 6 - 2 9 3 - 4 3 3 5 M O N T A N A S K Y . N E T Internet, TV, Voice, IT, Cloud. Redefined. Proudly serving NW Montana since 1994 Basic $39.95 222 AMG TV 1214 Lifetime 605 ESPN Classic 7 PBS 219 Aspire 1752 Lifetime Movies 1615 ESPN Deportes 8 CBS 1500 AXs TV 1617 MAV TV 1603 ESPN News 9 NBC 1125 Animal Planet 1600 MLB Network 1604 ESPN U 11 PBS (2) 1401 AWETV 1129 MotorTrend TV 1608 Game+ 12 Create 1576 BBC America 1513 MSNBC 1501 Fuse 13 CW 1630 beIN Sports 1224 Nat Geo Wild 1407 GAC 14 GRIT 1632 beIN Sports Espanol 1225 National Geographic 1753 HD Net Movies 15 MTSKY Channel 1616 Big 10 Network 1514 NBC Sports 1520 NBC Olympic 16 iON 1301 Cartoon Network 1211 OWN 1699 NHL Network 17 MeTV 1508 CNBC 1516 Oxygen 1754 Reelz 18 CHARGE! 1006 CNN 1203 RFD TV 1127 Science 23 ABC 1123 Discovery 1606 SEC Network 1698 Strike Zone MLB 24 FOX 1206 Disney 1518 SYFY 1751 Turner Classic M 25 SWX Right Now 1304 Disney JR 1755 Sundance Film 519 Telemundo 1412 Beach TV ATL 1303 Disney XD 1008 TBS 1517 Universal Kids NBC 1418 Beach TV Key West 1510 E ! 1618 Tennis Channel TDB ROOT Sports 1414 Beach TV PCB 1601 ESPN 1142 The Weather Channel Premium Pack $99.95 1419 Beach TV New Orleans 1602 ESPN2 1124 TLC Basic + Core + Core+ 1417 Beach TV Destin 1404 Food Network 1011 TNT 1815 Encore 1416 Beach TV Myrtle B 1579 Fox Business 1410 Travel Channel 1816 Encore Action 1551 Catholic TV 1578 Fox News 1012 TruTV 1817 Encore Black 1131 CSPAN 1613 Fox Sports 1 1204 UPtv 1818 Encore Classic 1132 CSPAN 2 1614 Fox