PPP:PPP: Aa Roadmaproadmap Forfor Successsuccess

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Promoting Private Sector Investment in Infrastructure

ADB DEVELOPING BEST PRACTICES FOR PROMOTING PRIVATE SECTOR INVESTMENT IN INFRASTRUCTURE ROADS Asian Development Bank The views, conclusions, and recommendations presented here are those of the study consultants, and should not be considered to represent the official views of the Asian Development Bank or its member governments. © Asian Development Bank 2000 ISBN No. 971-561-280-6 Stock No. 010300 Published by the Asian Development Bank P.O. Box 789, 0980 Manila, Philippines For more information on ADB, visit http:\\www.adb.org FOREWORD This report is one of a series of five commissioned by the Asian Development Bank (ADB) to identify and recommend best practices to be followed and specific steps to be taken, by ADB’s developing member countries in order to encourage both private sector investment and competition in infrastructure development. The study was financed through a $600,000 regional technical assistance grant - RETA 5753: Developing Best Practices for Promoting Private Sector Investment in Infrastructure. This report focuses on the road sector; the other reports cover the power, water supply, airport and air traffic control, and port sectors. Transport is central to achieving prosperity and the quality of life, to which all countries aspire. Transport policy has pervasive impacts: on economic performance; on the shape and structure of human settlements through its impact upon physical development and economic structures; on the distribution of income; and on the environment. This report develops best practices for promoting private sector investment in the road sector. It defines the objectives of private sector participation, reviews experiences of private sector participation in Asia and elsewhere, examines the degree of success that has been achieved to date, and identifies the key issues that provide the basis for determining best practices. -

Appendix 9 Concession Experience in the Road

Louis Berger S.A. APPENDIX 9 CONCESSION EXPERIENCE IN THE ROAD TRANSPORTATION SECTOR IN CENTRAL EUROPE 1. BACKGROUND Introduction During recent years, the goal in several countries in Central Europe has been to aim to bring an increasing participation of the private sector into the development of transport infrastructure. This has occurred in differing ways, with differing results through the whole spectrum from fully privatised, and public/private partnerships to wholly publicly financed projects. This paper summarises some of the key projects which have been realised, or are under realisation, principally in the countries of Hungary, Poland and Croatia in the Road Transport Sector. The focus therefore is on selected concessions for toll motorways in these countries. Hungary Under the previous government, there was a strong policy towards promoting the development of motorways in the Republic of Hungary on a privately financed basis. With enactment of the Concessions Act, the Ministry of Transport actively promoted the development of several Concessions. Poland In the Republic of Poland, the promotion of new motorways was stimulated by the enactment of the Motorway Act in 1994. However it has taken several years to reach realisation of the first toll motorway. The Act was modified in 1999 in order to favour the developments of public-private partnerships, under the management of the Motorway Agency. Eventually, an operating Concession was agreed as part of the A4 motorway between Krakow and Katowice and the first real concession for construction and realisation of a new motorway was closed in October 2000, for a section of the A2 motorway between Poznan and Konin, on the Berlin-Warsaw axis. -

Strategy for Hungary

DOCUMENT OF THE EUROPEAN BANK FOR RECONSTRUCTION AND DEVELOPMENT STRATEGY FOR HUNGARY As approved by the Board of Directors at its meeting on 22 January 2008 TABLE OF CONTENTS TABLE OF CONTENTS........................................................................................................... 1 ABBREVIATIONS .................................................................................................................... 2 EXECUTIVE SUMMARY........................................................................................................ 3 1. THE BANK’S PORTFOLIO................................................................................................. 5 1.1. OVERVIEW OF ACTIVITIES TO DATE ..............................................................................5 1.2. IMPLEMENTATION OF THE PREVIOUS COUNTRY STRATEGY ...........................................6 1.4. SELECTED LESSONS LEARNT ........................................................................................9 1.5. FINANCIAL PERFORMANCE OF THE EXISTING PORTFOLIO ..............................................9 1.6. MOBILISATION OF CO-FINANCING.................................................................................9 2. OPERATIONAL ENVIRONMENT................................................................................... 10 2.1. THE GENERAL REFORM ENVIRONMENT......................................................................10 2.1.1. Political environment.................................................................................................10 -

Transport Papers June 2009

49513 THE WORLD BANK GROUP WASHINGTON, D.C. TP-24 TRANSPORT PAPERS JUNE 2009 Public Disclosure Authorized Public Disclosure Authorized PRIVATE PARTICIPATION IN THE TRANSPORT SECTOR Lessons from Recent Experience in Europe and Central Asia V. Cuttaree, M. Humphreys, S. Muzira, and J-P Strand Public Disclosure Authorized Public Disclosure Authorized TRANSPORT SECTOR BOARD PRIVATE PARTICIPATION IN THE TRANSPORT SECTOR Lessons from Recent Experience in Europe and Central Asia V. Cuttaree, M. Humphreys, S. Muzira, and J-P Strand THE WORLD BANK WASHINGTON, D.C. 2009 The International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington, DC 20433 Telephone 202-473-1000 Internet: www.worldbank.org This volume is a product of the staff of The World Bank. The findings, interpretations, and conclusions expressed in this volume do not necessarily reflect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this publication is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development / The World Bank encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly. -

Heading Down Dead Ends

Heading down dead ends Transport sector fi nancing in Central and Eastern Europe September 2004 This study was compiled by Judit Madarassy (Clean Air Action Group, Hungary) and edited by András Lukács (Clean Air Action Group, Hungary), Peep Mardiste (Estonian Green Movement-FoE) and Pavel Pribyl (Hnuti DUHA/Friends of the Earth Czech Republic). National case studies were contributed by: Mari Jussi (Estonian Green Movement-FoE) Desislava Stoyanova (Za Zemiata, Bulgaria) Pavel Pribyl (Hnuti DUHA/Friends of the Earth Czech Republic) Jan Beskid (Poland) Yevgen Groza (National Ecological Centre of Ukraine) Peter Mihok (CEPA, Slovak Republic) Any enquiries about this publication should be sent to [email protected] Text editing: Greig Aitken Design & layout: Leos Knotek, Hnuti DUHA/Friends of the Earth Czech Republic Cartoons: © Andrew B. Singer © 2004 CEE Bankwatch Network Printed on recycled paper CEE Bankwatch Network 2004 5 Contents The need to hold on to CEE‘s pro-environmental comparative advantage . 7 Executive summary . 9 PART I. TRANSPORT TRENDS IN EUROPE . 11 1. Transport developments in the EU15 . 11 2. Environment vs. TEN-T in the EU . 13 2.1. EU engagement towards sustainable development and a sustainable transport policy . 13 2.2. EU projections of transport growth in the period 2000-2020 . 14 3. “Positive deviations” in the CEE transport sector still allow sustainable development . 17 PART II. TRANSPORT SECTOR TRENDS AND FINANCING IN CEE . 19 1. Trends in the transport sector . 19 1.1. Modal split changes . 19 1.2. Changes in the railway sector . 19 1.3. Changes in the road sector . 20 1.4. -

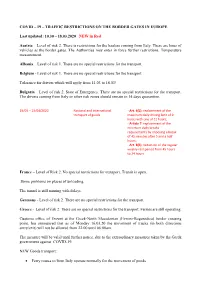

COVID – 19 – TRAFFIC RESTRICTIONS on the BORDER GATES in EUROPE Last Updated: 10.30 – 18.03.2020 NEW in Red Austria –

COVID – 19 – TRAFFIC RESTRICTIONS ON THE BORDER GATES IN EUROPE Last updated: 10.30 – 18.03.2020 NEW in Red Austria – Level of risk 2. There is restrictions for the haulers coming from Italy. There are lines of vehicles as the border gates. The Authorities may enter in force further restrictions. Temperature measurement. Albania – Level of risk 1. There are no special restrictions for the transport. Belgium - Level of risk 1. There are no special restrictions for the transport. Tolerance for drivers which will apply from 14.03 to 18.03! Bulgaria – Level of risk 2. State of Emergency. There are no special restrictions for the transport. The drivers coming from Italy or other risk zones should remain in 14 days quarantine. 19/03 – 13/04/2020 National and international - Art. 6(1): replacement of the transport of goods maximum daily driving limit of 9 hours with one of 11 hours; - Article 7: replacement of the minimum daily breaks requirements by imposing a break of 45 minutes after 5 and a half hours; - Art. 8(6): reduction of the regular weekly rest period from 45 hours to 24 hours. France – Level of Risk 2. No special restrictions for transport. Transit is open. Some problems on places of unloading. The tunnel is still running with delays. Germany - Level of risk 2. There are no special restrictions for the transport. Greece - Level of risk 2. There are no special restrictions for the transport. Ferries are still operating. Customs office of Evzoni at the Greek-North Macedonian (Evzoni-Bogorodica) border crossing point, has announced that as of Monday 16.03.20 the movement of trucks (in both directions entry/exit) will not be allowed from 22:00 until 06:00am. -

M1/M15 Motorway, Hungary

TOOLKI T FOR PUBLIC-PRIVA T E PAR T NERSHI P S IN ROADS & H IGHWAYS M1/M15 Motorway, Hungary (with comments on other Hungarian Motorways) WHY READ THIS CASE STUDY? The M1/M15 motorway is presented because; A The project was completed and the two sections opened in 1996 and 1998 so there is experience of completed project implementation and operation over a substantial period. B The project shows a number of relevant aspects for toll road planners. C The project was constructed to a high standard, but failed financially due to optimistic traffic forecasts and was nationalized partly due to unpopularity of tolls and especially the high tolls. D The implications of renationalization were not fully understood by the government. E The M5 motorway is also commented on because; F Notwithstanding the problems on M1/M15, similar problems were experienced on M5, which opened in 1998. G Problems arose from optimistic traffic and resulting financial issues. H A number of measures however were taken which resulted in this case in refinancing rather than nationalization. I As a result of these difficulties, the toll road program was quite substantially affected. Although in the early 1990s, Hungary had been very advanced in its PPP program, by 2007 it still had only 3 toll roads under private sector operation. Project overview The M1-M15 project consisted of the Design, Building, Financing, Operation and Transfer (concession of 35 years) of 43 km of Motorways between Gyor (North West of Hungary) to the Austrian Border (M1) and 14 km of motorway linking the M1 to Bratislava (M15). -

Adblue® – QUALITY GUARANTEED

AdBlue® – QUALITY GUARANTEED JOINING FORCES TO PROTECT THE ENVIRONMENT! AdBlue® – TO PROTECT OUR ENVIRONMENT Vehicle pollutant emission standards are becoming ever more stringent. Most vehicle and engine manufacturers achieve compliance with regulatory requirements by using SCR systems with the AdBlue® additive. The SCR system reduces nitrogen oxide in exhaust gases. SCR System Operation AdBlue tank Exhaust gas containing Nitrogen, water and ammonium carbon dioxide SCR catalytic SCR katalizátor AdBlue converter control unit AdBlue carburation and mixing Hot exhaust gas from engine Diesel engine Multiple Quality Guarantees The quality requirements of the AdBlue® additive are exceptionally strict. AdBlue® that is not appropriately pure or has been diluted may quickly result in SCR system malfunction. This is why you should only buy AdBlue® products from a reliable source. AdBlue® distributed by MOL-LUB Ltd. is guaranteed by the German Automotive Industry Association (VDA). This ensures that the product meets strictly controlled manufacturing, handling, transportation and warehousing requirements – compliance with which is regularly audited. AdBlue® is fully ISO 22241 and DIN 70070 standard compliant – therefore its quality is constantly high. ® Registered trademark of the German Automotive Industry Association (VDA). HELPFUL TIPS FOR USING AdBlue® CORRECTLY Do not use your vehicle without AdBlue®! AdBlue® is a highly corrosive substance, so only use tools and equipment guaranteed to suit the purpose when storing and filling it. Ensure that storage temperature is between -10°C and +30°C year round; AdBlue® will freeze below and start to decompose intensively above, these limits. Take care to prevent contaminants, water, fuel, dust, etc. from entering AdBlue®, because this may result in malfunction of the SCR system’s elements. -

As of March 11, 2020, the Government Declared an Emergency. Restrictions and Measures Affecting the Freight and Passenger Transp

As of March 11, 2020, the government declared an emergency. Restrictions and measures affecting the freight and passenger transport (valid until the withdrawal of the emergency!) 1. Buses transporting passengers from the territory of the Italian Republic, China, Korea, Iran, and Israel (from 14th of March), and in passenger traffic (by car) non-Hungarian citizens cannot enter Hungary. Hungarian nationals coming from these countries are subject to 14 days' domestic quarantine upon entry (including Hungarian truck drivers), foreign nationals are not allowed to enter from these countries. However, foreign drivers traveling in freight traffic may enter. In their case, the exact procedure is not known yet, and the Hungarian Operational Staff has not yet answered the question of whether they are subject to health checks or are subject to health restrictions such as those traveling by passenger cars or the Hungarian truck drivers. In our experience, they may have a health check at the border (checking their fever). Therefore, no restriction on the transport of goods (interesting: the foreign carriers are allowed in transit, even if they are coming from or thru Italy. 2. The usual truck bans on Saturday from 22:00 to Sunday 22:00 has been suspended for the duration of the emergency. 3. Border controls at the Slovenian-Austrian border have also been reintroduced. Border crossing points in operation and recommended transit routes (AT, SLO) http://www.police.hu/hu/hirek-es-informaciok/legfrissebb-hireink/hatarrendeszet/mukodo- hataratkelohelyek-es-tranzitutvonalak Border Information(No info in the english version of the page I suggest google translate, it works fine): http://www.police.hu/hu/hirek-es- informaciok/hatarinfo?field_hat_rszakasz_value=osztrák+határszakasz Closed border crossings: • Hungarian - Romanian border Turnu, Sacuieni, Salonta and Valea lui Mihai crossings • on the Hungarian - Serbian border: Hadikfalva, Bajmok, Ásotthalom, Horgos highway, Tiszasziget, Kübekháza. -

Never Mind the Balance Sheet

Never mind the balance sheet The dangers posed by public-private partnerships in central and eastern Europe Research and writing Fidanka Bacheva-McGrath, CEE Bankwatch Network Eliska Cisarova, Transparency International – Czech Republic Akos Eger, National Society of Conservationists Hungary/CEE Bankwatch Network Pippa Gallop, CEE Bankwatch Network Zvezdan Kalmar, Center for Ecology and Sustainable Development, Serbia Vera Ponomareva, Save Yuntolovo Public Environmental Movement, Russia Acknowledgements Alda Ozola, Latvian Green Movement/CEE Bankwatch Network Andrzej Gula, CEE Bankwatch Network Anelia Stefanova, CEE Bankwatch Network Anna Roggenbuck, CEE Bankwatch Network David Hall, Public Services International Research Unit, UK Ivaylo Hlebarov, Za Zemiata/CEE Bankwatch Network Klara Sikorova, CEE Bankwatch Network David Price, Centre for International Public Health Policy, University of Edinburgh Roman Havlicek, Friends of the Earth - CEPA, Slovakia/CEE Bankwatch Network Editing Greig Aitken Design Andrea Hruskova, www.adisha.eu Printing Grafokon, s.r.o., www.grafokon.cz Cover photo Jan Prenosil, www.fixca.info/ Attribution-NonCommercial-NoDerivs, www. creativecommons.org CEE Bankwatch Network gratefully acknowledges financial support from the International Visegrad Fund and the European Commission (DG Environment). Sole responsibility for content lies with the authors of the report. Funders cannot be held responsible for any further use that may be made of the information contained therein. Contents FOREWORD 4 EXECUTIVE SUMMARY 6 INTRODUCTION -

Case Study: M43 Motorway Between Szeged and Makó, Hungary

Ex post evaluation of major projects supported by the European Regional Development Fund (ERDF) and Cohesion Fund between 2000 and 2013 M43 Motorway between Szeged and Makó Hungary . EUROPEAN COMMISSION Directorate-General for Regional and Urban Policy Directorate Directorate-General for Regional and Urban Policy Unit Evaluation and European Semester Contact: Jan Marek Ziółkowski E-mail: [email protected] European Commission B-1049 Brussels EUROPEAN COMMISSION Ex post evaluation of major projects supported by the European Regional Development Fund (ERDF) and Cohesion Fund between 2000 and 2013 M43 Motorway between Szeged and Makó Hungary Directorate-General for Regional and Urban Policy 2020 EN Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). Manuscript completed in 2018 The European Commission is not liable for any consequence stemming from the reuse of this publication. Luxembourg: Publications Office of the European Union, 2020 ISBN 978-92-76-17423-3 doi: 10.2776/26226 © European Union, 2020 Reuse is authorised provided the source is acknowledged. The reuse policy of European Commission documents is regulated by Decision 2011/833/EU (OJ L 330, 14.12.2011, p. 39). This report is part of a study carried out by a Team selected by the Evaluation Unit, DG Regional and Urban Policy, European Commission, through a call for tenders by open procedure No 2016CE16BAT077. The consortium selected comprises CSIL – Centre for Industrial Studies (lead partner, Italy), Ramboll Management Consulting A/S (Denmark), Significance BV (The Netherlands), TPLAN Consulting (Italy). -

Integration of European Inland Transport Markets EUROPEAN CONFERENCE of MINISTERS of TRANSPORT (ECMT)

INTEGRATION OF EUROPEAN INLAND TRANSPORT MARKETS EUROPEAN CONFERENCE OF MINISTERS TRANSPORT OECD, 2000. Software: 1987-1996, Acrobat is a trademark of ADOBE. All rights reserved. OECD grants you the right to use one copy of this Program for your personal use only. Unauthorised reproduction, lending, hiring, transmission or distribution of any data or software is prohibited. You must treat the Program and associated materials and any elements thereof like any other copyrighted material. All requests should be made to: Head of Publications Service, OECD Publications Service, 2, rue Andr´e-Pascal, 75775 Paris Cedex 16, France. EUROPEAN CONFERENCE OF MINISTERS OF TRANSPORT Integration of European Inland Transport Markets EUROPEAN CONFERENCE OF MINISTERS OF TRANSPORT (ECMT) The European Conference of Ministers of Transport (ECMT) is an inter-governmental organisation established by a Protocol signed in Brussels on 17 October 1953. It is a forum in which Ministers responsible for transport, and more specifically the inland transport sector, can co-operate on policy. Within this forum, Ministers can openly discuss current problems and agree upon joint approaches aimed at improving the utilisation and at ensuring the rational development of European transport systems of international importance. At present, the ECMT’s role primarily consists of: – helping to create an integrated transport system throughout the enlarged Europe that is economically and technically efficient, meets the highest possible safety and environmental standards and takes