Torrent Pharmaceuticals Companyname

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daiichi Sankyo Move Could Spark Copycats

June 12, 2008 Daiichi Sankyo move could spark copycats Lisa Urquhart Daiichi Sankyo’s surprise move yesterday on Ranbaxy sparked not only a flurry of news about the $4.1bn deal, but has also got many in the market wondering who else might be on the shopping list of other big pharma companies looking to snap up an Indian generics firm. Those excited by the acquisition are pointing to the attractions of these companies, which include the increasing moves by governments to use generics to reduce healthcare costs, and in the case of Indian generic companies, their access to the fast growing, developing markets that big pharma has already expressed an interest in. With Ranbaxy now out of the picture, according to the EvaluatePharma’s Peer Group Analyzer Glenmark would be one of the most attractive in terms of future growth. The company may not be in the top three of the biggest Indian generics, but it is forecast to report an impressive 38% compound annual growth in unbranded generic sales in the five years to 2012. WW Unbranded Generic Sales WW annual sales ($m) CAGR (07-12) Market Rank 2007 2012 2007 2012 Glenmark Pharmaceuticals 244 1,211 38% 30 16 Wockhardt 357 764 16% 25 20 Lupin 303 647 16% 27 26 Aurobindo Pharma 165 334 15% 31 31 Matrix Laboratories 131 265 15% 34 35 Cipla 872 1,656 14% 14 11 Ranbaxy Laboratories 1,496 2,827 14% 9 6 Torrent Pharmaceuticals 300 543 13% 28 29 Piramal Healthcare 418 756 13% 20 21 Zydus Cadila 395 697 12% 22 24 Sun Pharmaceutical Industries 775 1,332 11% 15 15 Dr. -

ANNUAL REPORT 2018-19 2 Notice

CONTENTS Corporate Information ............................................................................................................ 02 Notice .................................................................................................................................... 03 Directors’ Report .................................................................................................................... 14 Annexures to Directors’ Report .............................................................................................. 25 Management Discussion and Analysis .................................................................................. 53 Business Responsibility Report ............................................................................................. 69 Report on Corporate Governance ......................................................................................... 80 Standalone Financial Statements .......................................................................................... 99 Consolidated Financial Statements ....................................................................................... 154 Financial Highlights - 5 years ................................................................................................. 212 CORPORATE INFORMATION BOARD OF DIRECTORS STATUTORY AUDITORS 1. Shri Sudhir Mehta B S R & Co. LLP Chairman Emeritus Chartered Accountants 2. Shri Samir Mehta Executive Chairman REGISTERED OFFICE 3. Shri Shailesh Haribhakti Torrent House, 4. Shri Haigreve -

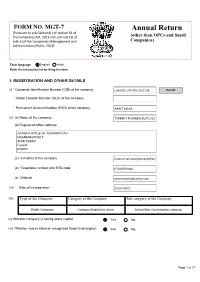

Annual Return

FORM NO. MGT-7 Annual Return [Pursuant to sub-Section(1) of section 92 of the Companies Act, 2013 and sub-rule (1) of (other than OPCs and Small rule 11of the Companies (Management and Companies) Administration) Rules, 2014] Form language English Hindi Refer the instruction kit for filing the form. I. REGISTRATION AND OTHER DETAILS (i) * Corporate Identification Number (CIN) of the company Pre-fill Global Location Number (GLN) of the company * Permanent Account Number (PAN) of the company (ii) (a) Name of the company (b) Registered office address (c) *e-mail ID of the company (d) *Telephone number with STD code (e) Website (iii) Date of Incorporation (iv) Type of the Company Category of the Company Sub-category of the Company (v) Whether company is having share capital Yes No (vi) *Whether shares listed on recognized Stock Exchange(s) Yes No Page 1 of 17 (a) Details of stock exchanges where shares are listed S. No. Stock Exchange Name Code 1 2 (b) CIN of the Registrar and Transfer Agent Pre-fill Name of the Registrar and Transfer Agent Registered office address of the Registrar and Transfer Agents (vii) *Financial year From date 01/04/2020 (DD/MM/YYYY) To date 31/03/2021 (DD/MM/YYYY) (viii) *Whether Annual general meeting (AGM) held Yes No (a) If yes, date of AGM 27/07/2021 (b) Due date of AGM 30/09/2021 (c) Whether any extension for AGM granted Yes No II. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY *Number of business activities 1 S.No Main Description of Main Activity group Business Description of Business Activity % of turnover Activity Activity of the group code Code company C C6 III. -

In the United States District Court for the District of New Jersey

Case 1:19-md-02875-RBK-JS Document 121 Filed 06/17/19 Page 1 of 130 PageID: 1141 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY IN RE: VALSARTAN PRODUCTS LIABILITY LITIGATION No. 1:19-md-2875-RBK Hon. Robert Kugler Hon. Joel Schneider Jury Trial Demanded Consolidated Amended Class Action Complaint CONSOLIDATED AMENDED ECONOMIC LOSS CLASS ACTION COMPLAINT 1. COME NOW, the Consumer and Third Party Payor (“TPP”) Plaintiffs (collectively the “Class Plaintiffs”), who file this Consolidated Amended Economic Loss Class Action Complaint (“Master Class Complaint”)1 against the below-enumerated Defendants. I. INTRODUCTION 2. This case arises from adulterated, misbranded, and unapproved valsartan- containing drugs (“VCDs”) that were designed, manufactured, marketed, distributed, packaged, and sold by Defendants (identified and defined infra at Part II.C-H) in the United States, and which have been and remain the subject of one of the largest ongoing contaminated drug recalls ever in the United States. These VCDs are non-merchantable, and are not of the quality represented by Defendants named herein. 3. Valsartan and its combination therapy with hydrochlorothiazide are the generic versions of the registered listed drugs (“RLDs”) Diovan® (“DIOVAN”) and Diovan HCT® (“DIOVAN HCT”), respectively. Amlodipine-valsartan and its combination therapy with hydrochlorothiazide are the generic versions of the RLDs of Exforge® (“EXFORGE”) and 1 This is one of three master complaints being filed in this multi-district litigation. The filing of three master complaints is to streamline the pleadings and issues for the parties’ mutual convenience only. Consumer Class Plaintiffs do not waive any claims that are not raised herein, or that are asserted in another master complaint. -

Company Reliance Industries Limited Tata Consultancy Services

Top 1000 Private Sector Companies (Rank-wise List) Company Reliance Industries Limited Tata Consultancy Services (TCS) Infosys Technologies Ltd Wipro Limited Bharti Tele-Ventures Limited ITC Limited Hindustan Lever Limited ICICI Bank Limited Housing Development Finance Corp. Ltd. TATA Steel Limited Ranbaxy Laboratories Limited HDFC Bank Ltd Tata Motors Limited Larsen & Toubro Limited (L&T) Satyam Computer Services Ltd. Maruti Udyog Limited Bajaj Auto Ltd. HCL Technologies Ltd. Hero Honda Motors Limited Hindalco Industries Ltd Reliance Energy Limited Grasim Industries Limited Jet Airways (India) Ltd. Sun Pharmaceuticals Industries Ltd Cipla Ltd. Gujarat Ambuja Cements Ltd. Videsh Sanchar Nigam Limited The Tata Power Company Limited Sterlite Industries (India) Ltd. Associated Cement Companies Ltd. Nestlé India Ltd. Hindustan Zinc Limited GlaxoSmithKline Pharmaceuticals Limited Siemens India Ltd. Motor Industries Company Limited Mahindra & Mahindra Limited UTI Bank Ltd. Zee Telefilms Limited Bharat Forge Limited ABB Limited i-Flex Solutions Ltd. Dr. Reddy's Laboratories Ltd. Nicholas Piramal India Limited Kotak Mahindra Bank Limited Reliance Capital Ltd. Ultra Tech Cement Ltd. Patni Computer Systems Ltd. Wockhardt Limited Indian Petrochemicals Corporation Limited Biocon India Limited Essar Oil Limited. Asian Paints Ltd. Dabur India Limited Jaiprakash Associates Limited JSW Steel Limited Tata Chemicals Limited Tata Tea Limited Tata Teleservices (Maharashtra) Limited The Indian Hotels Co. Ltd. Glenmark Pharmaceuticals Limited NIRMA Limited Jindal Steel & Power Ltd HCL Infosystems Ltd. Cadila Healthcare Limited Colgate-Palmolive (India) Limited The Great Eastern Shipping Company Limited Aventis Pharma India Ltd Ashok Leyland Limited Pantaloon Retail (India) Limited Indian Rayon And Industries Limited Financial Technologies (India) Ltd United Phosphorus Limited Matrix Laboratories Limited Sesa Goa Limited Lupin Ltd Cummins India Limited Crompton Greaves Limited. -

A. Contracts Or Arrangements with Any Related Party Under Section 188 Or in Which Any Director Is Concerned Or Interested Under Sub-Section (2) of Section 184

FORM MBP-4 Register of contracts with related party and Bodies etc. in which directors are interested for the quarter ended June 30, 2020 [Pursuant to section 189 (1) and rule 16 (1)] A. Contracts or arrangements with any related party under section 188 or in which any director is concerned or interested under sub-section (2) of section 184 Sr. Date of Name of the Name of the Relation with Principal Whether the Date of Details of voting on such resolution Date of the Reference of Amount of Date of Signature Remarks, if No. Contract/ party with interested director director/ terms and transaction is approval at next meeting specific items contract or shareholders any Arrangement which company/ conditions at arm’s the meeting at which (a) to (g) arrangement ’ approval if contract is Nature of length basis of the Board register was under sub- (Rs. in crore) any entered into concern or placed for section (1) of interest signature section 188 No. of Directors Director Director Directors voting in s voting s present in favour against remainin the meeting g neutral 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 TORRENT PHARMACEUTICALS LIMITED B74 Between Torrent Sudhir Mehta Subsidiary Sale of Yes NA NA NA NA NA 06.08.2020 Rendering NA Exempted Apr, 20 to Pharmace- Samir Mehta of Holding Electricity of service under Jun 20 uticals Jinal Mehta Company 4.52 proviso 4 Limited to section 188(1) 120 Sr. No. Date of Name of the Name of the Relation with Principal terms Whether the Date of Details of voting on such resolution Date of the Reference of Amount of Date of Signature Remarks, if Contract/ party with interested director/ and conditions transaction is approval at next meeting specific items contract or shareholders any Arrangement which director company/ at arm’s the meeting at which (a) to (g) arrangement ’ approval if contract is Nature of length basis of the Board register was under sub- (Rs. -

(15) Sr No Student Name Program Graduated

5.2.2 Average percentage of placement of outgoing students during the last five years (15) Package in Download Sr No Student Name Program graduated from Name of Employer Lac. Proof Water and Sanitation management 1 Patel Devanshi Dharmendrabhai M. Sc. (Microbiology) 204000 Click Here Organisation 2 Vadera Jatin Arvindbhai M. Pharm (Regulatory Affairs) Urja Consumer health care (Velocity) 300000 Click Here 3 Divyanshu Joshi B.B.A., LL.B. (Hons.) Self Employed 470000 Click Here 4 Priyanshi Nagarkoti B.A., LL.B. (Hons.) Self Employed 470000 Click Here 5 Harsh Rathi B.B.A., LL.B. (Hons.) Self Employed 470000 Click Here 6 Jitendra Sharda B. Com., LL.B. (Hons.) Self Employed 470000 Click Here 7 Harshit Chordia B.A., LL.B. (Hons.) Self Employed 470000 Click Here 8 Aditi Singh B.A., LL.B. (Hons.) Chir Amrit 470000 Click Here 9 Shubham Kejriwal B. Com., LL.B. (Hons.) Self Employed 470000 Click Here 10 Shah Vyom Himanshu B. Com., LL.B. (Hons.) Adv. Gautam Joshi 470000 Click Here 11 Shreyans Ranka B. Com., LL.B. (Hons.) Self Employed 470000 Click Here 12 Sarthak Sonwalkar B.A., LL.B. (Hons.) PRS LAMP Fellowship 470000 Click Here 13 Pranav Malhotra B. Com., LL.B. (Hons.) Self Employed 470000 Click Here 14 Prabhansh Sharma B.A., LL.B. (Hons.) Self Employed 470000 Click Here 15 Tanna Raj Sanjay B. Com., LL.B. (Hons.) H L Patel Advocates 470000 Click Here 16 Saransh Sharma B.A., LL.B. (Hons.) Uttar Pradesh Judiciary 470000 Click Here 17 Kunjal Arora B. Com., LL.B. -

1 in the United States District Court for the District Of

Case 1:19-cv-09348-RBK-JS Document 1 Filed 04/05/19 Page 1 of 48 PageID: 1 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY CAMDEN VICINAGE PAULETTE SILBERMAN, Individually and on behalf of all others similarly situated, Civil Action No.:______________ Plaintiff, Jury Trial Demanded v. Complaint-Class Action ZHEJIANG HUAHAI PHARMACEUTICAL CO., LTD.; HUAHAI US INC.; PRINSTON PHARMACEUTICAL INC. d/b/a SOLCO HEALTHCARE LLC; SOLCO HEALTHCARE U.S., LLC; TEVA PHARMACEUTICAL INDUSTRIES LTD.; ACTAVIS LLC; TEVA PHARMACEUTICALS USA, INC.; CARDINAL HEALTH, INC.; THE HARVARD DRUG GROUP, L.L.C.; MAJOR PHARMACEUTICALS, INC.; ARROW PHARM (MALTA) LTD.; ACTAVIS PHARMA, INC.; TORRENT PRIVATE LIMITED; TORRENT PHARMACEUTICALS, LTD.; TORRENT PHARMA, INC.; AUROBINDO PHARMA, LIMITED; AUROBINDO PHARMA USA, INC.; AUROLIFE PHARMA LLC; AND JOHN DOES 1-100, Defendants. 1. Plaintiff Paulette Silberman (“Plaintiff”), individually and on behalf of all others similarly situated, brings this action against Zhejiang Huahai Pharmaceuticals Co., Ltd. (“ZHP”), Huahai US Inc. (“Huahai US”), Prinston Pharmaceutical Inc. d/b/a Solco Healthcare LLC (“Prinston"), Solco Healthcare U.S., LLC (“Solco”), Teva Pharmaceutical Industries Ltd. (“Teva”), Actavis LLC (“Actavis”), Teva Pharmaceuticals USA, Inc. (“Teva USA”), Cardinal Health, Inc. (“Cardinal”), The Harvard Drug Group, L.L.C. (“Harvard”), Major Pharmaceuticals, Inc. (“Major”), Arrow Pharm (Malta) Ltd. (“Arrow”), Actavis Pharma, Inc. (“Actavis Pharma”), 1 Case 1:19-cv-09348-RBK-JS Document 1 Filed 04/05/19 Page 2 of 48 PageID: 2 Torrent Private Limited (“Torrent Private”), Torrent Pharmaceuticals, Ltd. (“Torrent Pharmaceuticals”), Torrent Pharma, Inc. (“Torrent Pharma”) (ZHP, Huahai US, Prinston, Solco, Teva, Actavis, Teva USA, Cardinal, Harvard, Major, Arrow, Actavis Pharma, Torrent Private, Torrent Pharmaceuticals, and Torrent Pharma, collectively, “ZHP Defendants”), Aurobindo Pharma, Limited (“Aurobindo”), Aurobindo Pharma USA, Inc. -

Factsheet March 2021

FACTSHEET MARCH 2021 Remember this TASK, Always wear a MASK Stay Safe. Stay Healthy *The Bank of Baroda logo belongs to Bank of Baroda and is used under license. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The Bank of Baroda logo belongs to Bank of Baroda CIO LETTER - March 2021 and is used under license Mr. Sanjay Chawla Chief Investment Officer Dear Investors, Warm Greetings! The BSE Sensex and Nifty 50 index ended with minor gains of 0.8% and 1.1% in the month of March. Globally, stock markets rallied sharply with DOW JONES up 5.6% and S&P500 up 3.8%. European markets too rallied by 5-6% for the month of March. In India, the breadth was positive with the BSE Mid-cap and BSE Small-cap indices gaining by 1% and 2.5% respectively. Amongst sector indices, IT, FMCG, Metals outperformed while Oil & Gas, Bank and Auto underperformed during last month. While the month started on a positive note as 3QFY21 GDP grew at 0.4% after two quarters of contraction and expansion of the vaccination drive, a rapid spurt in Covid-19 cases, imposition of lockdowns, night curfews and other restrictions, weak macroeconomic data, elevated crude prices and jump in bond yield weighed on market sentiments. In its policy meeting the US Federal Reserve kept interest rates unchanged; it also mentioned that it does not currently expect to hike interest rates through 2023 and will maintain the current quantum of bond purchases. The policy rates remained at 0%-0.25% band and median estimate for unemployment rates are pegged at 4.5% end 2021 and 3.9% end 2022. -

Valsartan Ndma Products Liability Litig

Case 1:19-cv-16971-RBK-JS Document 1 Filed 08/20/19 Page 1 of 66 PageID: 1 THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY CAMDEN VICINAGE : IN RE: VALSARTAN NDMA : PRODUCTS LIABILITY :Master Docket No. 19-2875 (RBK/JS) LITIGATION : : PATRICIA ANN WITTE, : COMPLAINT AND JURY DEMAND INDIVIDUALLY AND AS : REPRESENTATIVE OF THE ESTATE : OF LAURENCE JOSEPH WITTE JR, :Civil Action No.__________________ DECEASED, TREY WITTE, AND : KERRIE KATHLEEN STEGER : : Plaintiffs, : : v. : : ZHEJIANG HUAHAI : PHARMACEUTICAL CO., LTD, : HETERO LABS, LTD., PRINSTON : PHARMACEUTICAL, INC. dba SOLCO : HEALTHCARE US, LLC, SOLCO : HEALTHCARE US, LLC, CAMBER : PHARMACEUTICALS, INC., HETERO DRUGS, LTD., THE KROGER CO., LTD., EXPRESS SCRIPTS, INC., HUAHAI U.S., INC., HETERO USA, INC., ZHEJIANG HUAHAI, ZHEJIANG TIANYU PHARMACEUTICAL CO., HETERO PHARMACEUTICAL LABORATORIES, PRINSTON PHARMACEUTICAL, INC., MEDCO HEALTH, MYLAN, NOVARTIS PHARMACEUTICAL CORPORATION, NOVARTIS PHARMACEUTICAL CORPORATION SANDOZ DIVISION, TORRENT PHARMA, INC., TEVA PHARMACEUTICALS INDUSTRIES, LTD., TEVA PHARMACEUTICALS USA, LTD., TEVA PHARMACEUTICALS USA, INC., TEVA PHARMACEUTICALS D/B/A MAJOR PHARMACEUTICALS, TEVA i Case 1:19-cv-16971-RBK-JS Document 1 Filed 08/20/19 Page 2 of 66 PageID: 2 PHARMACEUTICALS D/B/A ACTAVIS LLC, TEVA PHARMACEUTICALS, AUROBINDO PHARMA USA, AUROBINDO PHARMA, AUROBINDO PHARMA LIMITED, MYLAN, INC., MYLAN NV, MYLAN PHARMACEUTICAL INC., MYLAN LABORATORIES, LIMITED, MYLAN PHARMACEUTICALS, MYLAN INDIA, SOLCO HEALTHCARE US LLC, BRYANT RANCH PREPACK INC., MAJOR PHARMACEUTICALS, ACTAVIS LLC, A-S MEDICAL SOLUTIONS LLC, NORTHWIND PHARMACEUTICALS, REMEDY REPACK INC., NUCARE PHARMACEUTICALS INC., TORRENT PHARMACEUTICALS, AVKARE INC., HONG KONG MEDICAL SUPPLIES, LTD., ACTAVIS HONG KONG, H.J. HARKINS COMPANY, INC., LAKE ERIE MEDICAL, D/B/A QUALITY CARE PRODUCTS LLC, PROFICIENT RX, GOLDEN STATE MEDICAL SUPPLY INC., WESTMINISTER PHARMACEUTICALS, SCIGEN PHARMACEUTICALS INC., SANDOZ INC., MACLEODS PHARMACEUTICALS LIMITED, QUALITY FOOD CENTERS, INC. -

Market Masala… the Flavors That Influenced the Market This Week

Go India Advisors Weekly Newsletter Market Masala… The flavors that influenced the market this week Week 24/CY20: 6th – 12th June 2020 1 Headlines this week Go India Advisors Another Day, another Deal; Powell GDP statement; Court – interest(ed) or not Weekly Newsletter Supreme Court clarified on the case of interest charged during moratorium. The issue now is limited to interest on interest deferred during moratorium. This is significant less Jio announced 7th and 8th sale of it's equity, this time 1.16% for threatening than question of interest waiver all together. Rs5683cr to Abu Dhabi Investment Authority (ADIA) and Banking sector took a sigh of relief and so did Indian additional 0.93% to Silver Lake Partners for Rs4546cr. Totalling upto 21.06% stake for Rs97885cr. More deals in offing are market. TPG(US$1.5bn), Saudi Arabia's Public Investment Fund (PIF) (US$1.5bn). And some rumours about either Google or Microsoft coming in. US Fed in it MPC on Thursday was dovish as expected. However more than expected downbeat assessment of the economy proved little bit too much for the stock markets to handle. This triggered the worst falls in stock market since 16th March. 13-06-2020 2 Global Markets – risk off Go India Advisors US Fed downbeat assessment of the economy, too hot for market to handle Weekly Newsletter Returns % Data for year 2020; except as specified 13-06-2020 3 Indian market – rally takes a breather Go India Advisors Volatility is the name of the game Weekly Newsletter Indian Markets for Week Ending 12th June 2020 For more information: Click on the image. -

List of Shareholders Whose Final Dividend Remained Unclaimed/Unpaid

TORRENT PHARMACEUTICALS LIMITED DETAILS OF UNPAID DIVIDEND AS ON 23.08.2019 FOR FINAL DIVIDEND 2018-2019 Sno Folio/DP ID Client ID Name of the Shareholder Name of Joint Holder - 1 Name of Joint Holder - 2 Shares Amount ADDRESS 1 TRE0010943 J K RATHOD 400 1600.00 R F O ATPOST KASA D THANE 2 TRE0012833 BALVINDER SINGH 400 1600.00 H NO 1365/3 MIG FLAT PHASE-XI MOHALI 3 TRE0018711 BIMAL K BHATIA LAVINA BHATIA 400 1600.00 P O BOX 51176 DUBAI U A E 4 TRE0027621 LAL CHAND MOTWANI JAWAHAR MOTWANI 800 3200.00 LAXMI BHAVAN BUJI BHAVAN CHOWKRAIGARH M P0 5 TRE0027996 MOTILAL 400 1600.00 203, BRIJ ANUKAMPA2ND FLOOR, ASHOK MARGC-SCHEMEJAIPUR (RAJ) 6 TRE0029226 BAIKUNTHI DEVI 400 1600.00 GOPAL GANJ SARAI LABARIYAALIGARH 7 TRE0031633 RACHANA P NANWANI 400 1600.00 SINDHU NAGARCHATRI TALAO ROAD AMRAVATI M S 8 TRE0034026 KRISHANCHAND JINDAL SURJEET GUPTA 800 3200.00 66 MEDICAL CAMPUS FARIDKOT 9 IN30133017901952 CENTURY CONSULTANTS LTD. 400 1600.00 21, ASHOK MARGLUCKNOW-100000 10 TRE0013230 SITA DEVI BIDWAT 800 3200.00 23/4741 ANSARI ROAD DARYA GANJNEW DELHI-110002 11 TRE0014018 SIRAJ PRACHA 400 1600.00 3073, PRACHA TOWER,NEHAR WALI HAVELI,DARYAGANJ,NEW DELHI-110002 12 TRE0016932 ASHOK KUMAR AGGARWAL 800 3200.00 3288 PEEPAL MAMHA DEV HAUZ QAZIDELHI-110006 13 TRE0016933 PHOOL WATI 400 1600.00 3288 PEEPAL MAMHA DEV HAUZ QAZIDELHI-110006 14 TRE0026233 SHANKAR LAL JHANWAR 800 3200.00 ASSAM ELECTRONICS SHOP NO 66II FLOOR 1572 BHAGIRATH PALACE DELHI-110006 15 TRE0013194 VIKRAM SINGH SANTOSH KUMARI 800 3200.00 52-A KAMLA NAGAR DELHI-110007 16 TRE0017067 URVARSHI