Compulsory Licensing in Pharmaceuticals India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI Trading As ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP

Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI trading as ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP. COTTON GREEN RLY. STN. MUMBAI-400033. MANUFACTURE & MERCHANT INDIAN NATIONAL Used Since :31/01/2001 MUMBAI MEDICINAL PREPARATIONS. 537 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SEPTIGARD 1741718 08/10/2008 INDERJIT SINGH trading as ;INDERJIT SINGH B-104 , SWASTHYA SINGH , NEW DELHI -92 MERCHANTS & MANUFACTUERERS Address for service in India/Agents address: MAHTTA & CO. 43 - B/3, MAHTTA HOUSE,UDHAM SINGH NAGAR, LUDHIANA - 141 001, (PUNJAB). Proposed to be Used DELHI MEDICINAL & PHARMACEUTICAL PREPARATIONS. 538 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 FAIR & BEAUTY 1803779 08/04/2009 GALPHA LABORATORIES LIMITED 221, Kanakia Zillion, E Wing Bandra Kurla Complex Annex LBS Marg & CST Road Junction Kurla West MUMBAI 400070 MANUFACTURERS AND MERCHANTS INDIAN NATIONAL Used Since :15/11/2007 MUMBAI PHARMACEUTICAL AND MEDICINAL PREPARATIONS AND SUBSTANCES 539 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 O-BAMA 1815900 08/05/2009 KREMOINT PHARMA PVT. LTD. 151/5, SHRI KRISHNA DARSHAN, GARODIA NAGAR, GHATKOPAR (E), BOMBAY-400 077. MANUFACTURERS AND MERCHANTS. A CORPORATE ENTITY INCORPORATED IN INDIA UNDER THE COMPANIES ACT 1956. Address for service in India/Attorney address: KRISLAW CONSULTANTS BUILDING NO.4, C/104, SHANKESHWAR PALMS, BEHIND MODEL SCHOOL, KUMBHARKHANPADA, SUBHASH ROAD, DOMBIVILI(W) 421202 Used Since :02/05/2009 MUMBAI PHARMACETICAL AND MEDICINAL PREPARATIONS. 540 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 AYUSHAKTI D-VYRO 1815928 08/05/2009 SMITA NARAM BUNGALOW NO.31, NEXT TO M. -

Daiichi Sankyo Move Could Spark Copycats

June 12, 2008 Daiichi Sankyo move could spark copycats Lisa Urquhart Daiichi Sankyo’s surprise move yesterday on Ranbaxy sparked not only a flurry of news about the $4.1bn deal, but has also got many in the market wondering who else might be on the shopping list of other big pharma companies looking to snap up an Indian generics firm. Those excited by the acquisition are pointing to the attractions of these companies, which include the increasing moves by governments to use generics to reduce healthcare costs, and in the case of Indian generic companies, their access to the fast growing, developing markets that big pharma has already expressed an interest in. With Ranbaxy now out of the picture, according to the EvaluatePharma’s Peer Group Analyzer Glenmark would be one of the most attractive in terms of future growth. The company may not be in the top three of the biggest Indian generics, but it is forecast to report an impressive 38% compound annual growth in unbranded generic sales in the five years to 2012. WW Unbranded Generic Sales WW annual sales ($m) CAGR (07-12) Market Rank 2007 2012 2007 2012 Glenmark Pharmaceuticals 244 1,211 38% 30 16 Wockhardt 357 764 16% 25 20 Lupin 303 647 16% 27 26 Aurobindo Pharma 165 334 15% 31 31 Matrix Laboratories 131 265 15% 34 35 Cipla 872 1,656 14% 14 11 Ranbaxy Laboratories 1,496 2,827 14% 9 6 Torrent Pharmaceuticals 300 543 13% 28 29 Piramal Healthcare 418 756 13% 20 21 Zydus Cadila 395 697 12% 22 24 Sun Pharmaceutical Industries 775 1,332 11% 15 15 Dr. -

Hy Sun Missed the Pharma Rally: the Answer Is Hidden in a Bet Many Failed — Speciality Drugs - the Economic Times

12/3/2020 Sun Pharma: Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs - The Economic Times Home ETPrime Markets News Industry RISE Politics Wealth MF Tech Jobs Opinion NRI Panache ET NOW More Aayush English Edition | E-Paper Tech Consumer Markets Corporate Governance Telecom + OTT Auto + Aviation Pharma Fintech + BFSI Economy Infra Environment Energy Business News › Prime › Pharma › Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs Getty Images MARKETS hy Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs Dilip Shanghvi, founder and managing director, Sun Pharmaceuticals Synopsis Sun Pharma is the only Indian company to have made some inroads into speciality drugs. What worries investors is high investments and uncertainties over ramp up in revenue. The stock can still see upside because of its current valuations, strong India business, and any positive surprises in US generic business. But it is crucial that its speciality bet pays off. BACK TO TOP https://economictimes.indiatimes.com/prime/pharma-and-healthcare/why-sun-missed-the-pharma-rally-the-answer-is-hidden-in-a-bet-many-failed-spe… 1/11 12/3/2020 Sun Pharma: Why Sun missed the pharma rally: the answer is hidden in a bet many failed — speciality drugs - The Economic Times Home ETPrime Markets NeCwasllI nitd uas trbyleRssISiEngP oilniti cdsisWgeuailthse fMoFr tTheceh InJodbisanOpinion NRI Panache ET NOW More pharmaceutical industry. The stocks of pharma companies have been on a tear since the beginning of the Covid-19 crisis. -

Pharmaceuticals Stellar Quarter; Healthy Outlook Sector Update

Pharmaceuticals Stellar quarter; Healthy Outlook Sector Update Q2FY2021 was yet another stellar quarter for pharmaceutical companies under Q2FY2021 Results Review Sharekhan’s pharma universe. The quarter witnessed a sustained improvement in Sector: Pharmaceuticals the US business while the domestic business showed signs of improvement. The overall plant utilization levels during Q2FY2021 were at normal levels (as against Sector View: Positive relatively low utilization levels in previous quarter), thus yielding costs benefits. For the quarter, the pharma companies delivered revenue growth of 8.8% y-o-y, while sequentially as well it clocked a growth of 8.3%. Topline performance was better than estimates and was driven by sturdy performance of the US business, while the India operations also grew a decent pace. Growth in the base business, stabilizing price erosion and new launches led to the growth in US business, while in India business, companies with a relatively higher share of chronic business grew strongly and outperformed the industry. Select players such as Aurobindo, Cadila and Cipla reported strong 12.5%, 18% and 10% y-o-y growth respectively in the US business. Divis labs also reported a strong 21% y-o-y growth in the topline backed by a strong performance in the API segment, while Laurus labs posted a 60% revenue Our active coverage universe growth on the back of an impressive growth in the formulations segment. Operating CMP PT profit for the universe increased sharply by 21% y-o-y. Operating margin also Companies Reco. (Rs) (Rs) expanded by 251 bps y-o-y, better the expected 150 bps y-o-y expansion. -

ANNUAL REPORT 2018-19 2 Notice

CONTENTS Corporate Information ............................................................................................................ 02 Notice .................................................................................................................................... 03 Directors’ Report .................................................................................................................... 14 Annexures to Directors’ Report .............................................................................................. 25 Management Discussion and Analysis .................................................................................. 53 Business Responsibility Report ............................................................................................. 69 Report on Corporate Governance ......................................................................................... 80 Standalone Financial Statements .......................................................................................... 99 Consolidated Financial Statements ....................................................................................... 154 Financial Highlights - 5 years ................................................................................................. 212 CORPORATE INFORMATION BOARD OF DIRECTORS STATUTORY AUDITORS 1. Shri Sudhir Mehta B S R & Co. LLP Chairman Emeritus Chartered Accountants 2. Shri Samir Mehta Executive Chairman REGISTERED OFFICE 3. Shri Shailesh Haribhakti Torrent House, 4. Shri Haigreve -

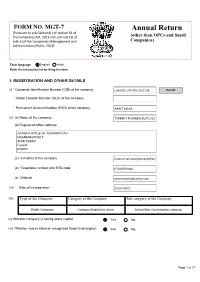

Annual Return

FORM NO. MGT-7 Annual Return [Pursuant to sub-Section(1) of section 92 of the Companies Act, 2013 and sub-rule (1) of (other than OPCs and Small rule 11of the Companies (Management and Companies) Administration) Rules, 2014] Form language English Hindi Refer the instruction kit for filing the form. I. REGISTRATION AND OTHER DETAILS (i) * Corporate Identification Number (CIN) of the company Pre-fill Global Location Number (GLN) of the company * Permanent Account Number (PAN) of the company (ii) (a) Name of the company (b) Registered office address (c) *e-mail ID of the company (d) *Telephone number with STD code (e) Website (iii) Date of Incorporation (iv) Type of the Company Category of the Company Sub-category of the Company (v) Whether company is having share capital Yes No (vi) *Whether shares listed on recognized Stock Exchange(s) Yes No Page 1 of 17 (a) Details of stock exchanges where shares are listed S. No. Stock Exchange Name Code 1 2 (b) CIN of the Registrar and Transfer Agent Pre-fill Name of the Registrar and Transfer Agent Registered office address of the Registrar and Transfer Agents (vii) *Financial year From date 01/04/2020 (DD/MM/YYYY) To date 31/03/2021 (DD/MM/YYYY) (viii) *Whether Annual general meeting (AGM) held Yes No (a) If yes, date of AGM 27/07/2021 (b) Due date of AGM 30/09/2021 (c) Whether any extension for AGM granted Yes No II. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY *Number of business activities 1 S.No Main Description of Main Activity group Business Description of Business Activity % of turnover Activity Activity of the group code Code company C C6 III. -

Pharmaceutical Cluster in Andhra Pradesh

Pharmaceutical Cluster in Andhra Pradesh Microeconomics of Competitiveness Final Project Harvard Business School Helene Herve | Lhakpa Bhuti | Saurabh Agarwal | Sonny Kushwaha | Akbar Causer May 2013 Table of Contents 1 Executive Summary ............................................................................................................................ 3 2 Introduction to India ........................................................................................................................... 4 2.1 History and Political Climate ....................................................................................................... 5 2.2 Competitive Positioning of India ................................................................................................. 6 2.2.1 Endowments .......................................................................................................................... 6 2.2.2 Economic Performance To-Date and Macroeconomic Policy .............................................. 7 2.2.3 Summary of Export Clusters ................................................................................................. 9 2.2.4 Social Infrastructure and Political Institutions .................................................................... 10 2.2.5 India Diamond .................................................................................................................... 11 3 Andhra Pradesh ................................................................................................................................ -

Case 1:06-Cv-01134-RCL Document 27 Filed 07/12/06 Page 1 of 10

Case 1:06-cv-01134-RCL Document 27 Filed 07/12/06 Page 1 of 10 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA ____________________________________ SANDOZ, INC. , ) ) Plaintiff, ) ) v. ) Civil Action No. 06-1134 (RCL) ) FOOD AND DRUG ) ADMINISTRATION, et. al.,) ) Defendants. ) ____________________________________) MEMORANDUM OPINION This matter comes before the Court on the plaintiff’s motion [4] for a preliminary injunction. Upon consideration of plaintiff’s motion, the opposition thereto, plaintiff’s reply, the arguments of counsel, the applicable law, and the record in this case, the Court finds that plaintiff’s motion for preliminary injunction should be DENIED. BACKGROUND Congress established the Hatch-Waxman Act of 1984 to lower the regulatory barriers facing generic drug companies and to encourage those companies to challenge the patents blocking generic entry to the market. See, e.g., Andrx Pharms., Inc. v. Biovail Corp., 276 F.3d 1368, 1371 (Fed. Cir. 2002). In order to encourage generic drug companies to undertake the substantial cost of identifying patents to challenge and bearing the accompanying risks of potential patent litigation, Congress created a critical incentive to reward the first generic manufacturer to file a certification pursuant to 21 U.S.C. § 355(j)(2)(A)(vii)(IV) (a “Paragraph 1 Case 1:06-cv-01134-RCL Document 27 Filed 07/12/06 Page 2 of 10 IV certification”)1 challenging a pharmaceutical patent—namely, a 180 day period of exclusivity during which no other generic version of the drug can be approved. See 21 U.S.C. § 355(j)(5)(B)(iv) (2002); 21 C.F.R. -

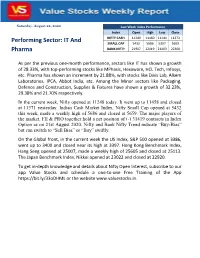

Nifty Poised to Open Gap up on Strong Payroll Data

Saturday, August 22, 2020 Last Week Index Performance Index Open High Low Close NIFTY CASH 11249 11460 11144 11372 Performing Sector: IT And SMALL CAP 5432 5686 5357 5659 Pharma BANK NIFTY 21907 22419 21403 22300 As per the previous one-month performance, sectors like IT has shown a growth of 28.33%, with top-performing stocks like MPhasis, Hexaware, HCL Tech, Infosys, etc. Pharma has shown an increment by 21.88%, with stocks like Divis Lab, Alkem Laboratories, IPCA, Abbot India, etc. Among the Minor sectors like Packaging, Defence and Construction, Supplies & Fixtures have shown a growth of 32.23%, 29.38% and 21.70% respectively. In the current week, Nifty opened at 11248 today. It went up to 11458 and closed at 11371 yesterday. Indian Cash Market Index, Nifty Small Cap opened at 5432 this week, made a weekly high of 5686 and closed at 5659. The major players of the market, FII & PRO together hold a net position of (-) 31419 contracts in Index Option as on 21st August 2020. Nifty and Bank Nifty Trend indicate “Buy-Bias” but can switch to “Sell Bias” or “Buy” swiftly. On the Global front, in the current week the US Index, S&P 500 opened at 3386, went up to 3400 and closed near its high at 3397. Hong Kong Benchmark Index, Hang Seng opened at 25007, made a weekly high of 25605 and closed at 25113. The Japan Benchmark Index, Nikkei opened at 23022 and closed at 22920. To get in-depth knowledge and details about Nifty Open Interest, subscribe to our app Value Stocks and schedule a one-to-one Free Training of the App https://bit.ly/33oDHML or the website www.valuestocks.in. -

Saturday, 23Rd August 2014 Index Levels : Market Trend (Nifty)

` Saturday, 23rd August 2014 Index Levels : Market Trend (Nifty): Trend Reversal Point INDEX SUPPORTS RESISTANCES Period Current Trend (TRP)Nifty close basis NIFTY# 7930/8000/8090 Short Term Trend UP DOWN BELOW 7750 (7913.20) 7850/7760 SENSEX# 26250/26000 26550/26700/27200 Medium Term UP DOWN BELOW 7650 (26419.55) ITE-35* -------- -------- Long Term Trend UP DOWN BELOW 6500 (10239.68) ND #as on 22 August 2014 Imtiaz Merchant’s Best Picks: Indices: CURRENT Domestic COMPANY NAME SIZE SECTOR Close Points % Chg PRICE Indices Large Cipla Health Care 499 BSE Sensex 26419.55 59.44 0.23 % Cap Large Industrials and UPL 338 Nifty 7913.20 22.10 0.28 % Cap Capital Goods ITE Shariah 10239.68 42.83 0.42 % 35* S&P CNX 500 1919.15 4.92 0.12 % Note: (Buying should be done from a medium to long term perspective) Shariah Advance/ Advance Decline AD Un- Market Brief Decline Ratio Changed BSE 1462 1572 0.93:1 114 On the back of positive global cues and some NSE 693 782 0.89:1 60 reform announcements by the Union Shariah Government, the markets on Friday ended the Universe*** 291 269 1.08:1 15 day and the week on positive note; Auto, Info. Technology and Health Care sectors were the flavor of the week. The undertone appears to Global Indices Close Points % Chg be bullish. All the trends are up. More reform Dow Jones* 16979.13 60.36 0.36% announcements from the Govt. and good NASDAQ* 4526.48 5.62 0.12% corporate results will further fuel the rally and FTSE* 6755.48 22.18 0.33% the Nifty is likely to see the 8000 level soon. -

Transfer of Technology for Successful Integration Into the Global Economy

UNCTAD/ITE/IPC/Misc.22 Transfer of Technology for Successful Integration into the Global Economy A Case Study of the Pharmaceutical Industry in India Biswajit Dhar and C. Niranjan Rao, with inputs by Veena Gupta United Nations New York and Geneva 2002 Transfer of Technology Note This paper is part of the series of case studies on Transfer of Technology for Successful Integration into the Global Economy carried out by the Investment Policy and Capacity Building Branch, DITE, under the UNCTAD/UNDP Global Programme on Globalization, Liberalization and Sustainable Human Development: Best Practices in Transfer of Technology. The work has been carried out under the direction of Assad Omer, assisted by Maria Susana Arano. Overall guidance was provided by Khalil Hamdani. The views expressed by the authors do not necessarily represent those of UNCTAD or UNDP. UNCTAD/ITE/IPC/MISC. 22 ii Transfer of Technology TABLE OF CONTENTS Preface ………………………………………………………………………. vii Introduction.........................................................................................………. ix Chapter I: Historical overview of the Indian pharmaceutical industry 1 1. The policy regime since the 1970s…………………………………… 2 2. The new drug policy of 1978 2 A. Expansion of capabilities and the role of foreign firms……… 2 B. Emphasis on technology and R&D…………………………… 3 C. Price control regime…………………………………………. 4 3. Modifications to the drug policy……………………………………... 5 4. The Indian patent system..……………………………………………. 6 Chapter II: Impact of the policy regime on the development of the pharmaceutical industry.…………………………………………. 9 1. The effects of active policy intervention……………………………… 9 2. Performance of the pharmaceutical industry during the 1990s.........…. 14 A. Production…………………………………………………….. 15 B. Exports………………………………………………………… 16 C. Imports………………………………………………………… 19 D. Research and development……………………………………. -

In the United States District Court for the District of New Jersey

Case 1:19-md-02875-RBK-JS Document 121 Filed 06/17/19 Page 1 of 130 PageID: 1141 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY IN RE: VALSARTAN PRODUCTS LIABILITY LITIGATION No. 1:19-md-2875-RBK Hon. Robert Kugler Hon. Joel Schneider Jury Trial Demanded Consolidated Amended Class Action Complaint CONSOLIDATED AMENDED ECONOMIC LOSS CLASS ACTION COMPLAINT 1. COME NOW, the Consumer and Third Party Payor (“TPP”) Plaintiffs (collectively the “Class Plaintiffs”), who file this Consolidated Amended Economic Loss Class Action Complaint (“Master Class Complaint”)1 against the below-enumerated Defendants. I. INTRODUCTION 2. This case arises from adulterated, misbranded, and unapproved valsartan- containing drugs (“VCDs”) that were designed, manufactured, marketed, distributed, packaged, and sold by Defendants (identified and defined infra at Part II.C-H) in the United States, and which have been and remain the subject of one of the largest ongoing contaminated drug recalls ever in the United States. These VCDs are non-merchantable, and are not of the quality represented by Defendants named herein. 3. Valsartan and its combination therapy with hydrochlorothiazide are the generic versions of the registered listed drugs (“RLDs”) Diovan® (“DIOVAN”) and Diovan HCT® (“DIOVAN HCT”), respectively. Amlodipine-valsartan and its combination therapy with hydrochlorothiazide are the generic versions of the RLDs of Exforge® (“EXFORGE”) and 1 This is one of three master complaints being filed in this multi-district litigation. The filing of three master complaints is to streamline the pleadings and issues for the parties’ mutual convenience only. Consumer Class Plaintiffs do not waive any claims that are not raised herein, or that are asserted in another master complaint.