Universita' Degli Studi Di Padova

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UCI Approved List

LIST OF APPROVED MODELS OF FRAMES AND FORKS Version on 11.08.2016 The Approval Procedure of bicycle frames and came into force on 1 January 2011 in accordance with Article 1.3.001bis of the UCI Regulations. From this date, all new models of frames and forks used by licence holders in road (RD), time trial (TT), track (TR) and cyclo-cross (CX) events must be approved on the basis of the Approval Protocol for Frames and Forks available from the UCI website. Approval by the UCI certifies that the new equipment meets the shape requirements set out in the UCI regulations. However, this approval does not certify in any case the safety of the equipment which must meet the applicable official quality and safety standards, in accordance with Article 1.3.002 of the UCI regulations. The models which are subject to the approval procedure are: all new models of frames and forks used by licence holders in road, track or cyclo-cross events, all models of frames and forks under development on 1 January 2011 which had not yet reached the production stage (the date of the order form of the moulds is evidence), any changes made to the geometry of existing models after 1 January 2011. Models on the market, at the production stage or already manufactured on 1 January 2011 are not required to be approved during the transition stage. However, the non-approved models have to comply in any case with the UCI technical regulations (Articles 1.3.001 to 1.3.025) and are subjects to the commissaires decision during events. -

The Elkhart Collection Lot Price Sold 1037 Hobie Catamaran $1,560.00 Sold 1149 2017 John Deere 35G Hydraulic Excavator (CHASSIS NO

Auction Results The Elkhart Collection Lot Price Sold 1037 Hobie Catamaran $1,560.00 Sold 1149 2017 John Deere 35G Hydraulic Excavator (CHASSIS NO. 1FF035GXTHK281699) $44,800.00 Sold 1150 2016 John Deere 5100 E Tractor (CHASSIS NO. 1LV5100ETGG400694) $63,840.00 Sold 1151 Forest River 6.5×12-Ft. Utility Trailer (IDENTIFICATION NO. 5NHUAS21X71032522) $2,100.00 Sold 1152 2017 Bravo 16-Ft. Enclosed Trailer (IDENTIFICATION NO. 542BE1825HB017211) $22,200.00 Sold 1153 2011 No Ramp 22-Ft. Ramp-Less Open Trailer (IDENTIFICATION NO. 1P9BF2320B1646111) $8,400.00 Sold 1154 2015 Bravo 32-Ft. Tag-Along Trailer (IDENTIFICATION NO. 542BE322XFB009266) $24,000.00 Sold 1155 2018 PJ Trailers 40-Ft. Flatbed Trailer (IDENTIFICATION NO. 4P5LY3429J3027352) $19,800.00 Sold 1156 2016 Ford F-350 Super Duty Lariat 4×4 Crew-Cab Pickup (CHASSIS NO. 1FT8W3DT2GEC49517) $64,960.00 Sold 1157 2007 Freightliner Business Class M2 Crew-Cab (CHASSIS NO. 1FVACVDJ87HY37252) $81,200.00 Sold 1158 2005 Classic Stack Trailer (IDENTIFICATION NO. 10WRT42395W040450) $51,000.00 Sold 1159 2017 United 20-Ft. Enclosed Trailer (IDENTIFICATION NO. 56JTE2028HA156609) $7,200.00 Sold 1160 1997 S&S Welding 53 Transport Trailer (IDENTIFICATION NO. 1S9E55320VG384465) $33,600.00 Sold 1161 1952 Ford 8N Tractor (CHASSIS NO. 8N454234) $29,120.00 Sold 1162 1936 Port Carling Sea Bird (HULL NO. 3962) $63,000.00 Sold 1163 1961 Hillman Minx Convertible Project (CHASSIS NO. B1021446 H LCX) $3,360.00 Sold 1164 1959 Giulietta Super Sport (FRAME NO. GTD3M 1017) $9,600.00 Sold 1165 1959 Atala 'Freccia d’Oro' (FRAME NO. S 14488) $9,000.00 Sold 1166 1945 Willys MB (CHASSIS NO. -

Il Comparto Motociclistico Nel Secondo Dopoguerra

Dipartimento di Economia & Management Cattedra di Storia dell’economia e dell’impresa Il comparto motociclistico nel secondo dopoguerra un confronto tra Italia e Giappone RELATORE Prof.ssa Vittoria Ferrandino CANDIDATO Carlo Alberto Richetti Matr. 199161 1 Indice I Introduzione ……………………………………………….3 Capitolo 1. La situazione industriale di Italia e Giappone nel secondo dopoguerra ………………………………………………………………4 1.1 Le condizioni generali alla fine del conflitto ……………………………...4 1.2 L’industria italiana nel dopoguerra. La riconversione industriale ……………5 1.3 La nascita e l’evoluzione del modello industriale giapponese ……………….9 1.4 La nascita del comparto motociclistico giapponese ………………………..11 Capitolo 2. Il miracolo economico e la ripresa degli anni Cinquanta ….15 2.1 Una nuova potenza industriale europea: l’Italia del boom economico ………..15 2.2 La motorizzazione di massa in Italia. L’innocenti, la Piaggio e “l’andare in giro con le ali sotto i piedi” ………………………………………………………17 2.3 Dalla ripresa al miracolo economico giapponese …………………………...21 2.4 Il caso Honda …………………………………………………………..24 Capitolo 3. La crisi degli anni Settanta ………………………………….26 3.1 Il distretto di Hamamatsu: una delle chiavi del vantaggio competitivo dei “Big Four” ……………………………………………………………..26 3.2 La competizione sportiva e l’epoca delle corse motociclistiche. Uno strumento di affermazione nel mercato internazionale ………………………………...28 3.3 Il mercato americano: la porta d’accesso al commercio internazionale ………..32 3.4 Il movimento giovanile italiano e le due ruote ……………………………...34 -

Fascicolo Ii – Iii / Maggio – Dicembre

RIVISTA DI ARTI, FILOLOGIA E STORIA NAPOLI NOBILISSIMA VOLUME LXXII DELL’INTERA COLLEZIONE SETTIMA SERIE - VOLUME I FASCICOLO II - III - MAGGIO - DICEMBRE 2015 RIVISTA DI ARTI, FILOLOGIA E STORIA NAPOLI NOBILISSIMA direttore segreteria di redazione La testata di «Napoli nobilissima» è di proprietà Pierluigi Leone de Castris Luigi Coiro della Fondazione Pagliara, articolazione Stefano De Mieri istituzionale dell'Università degli Studi Suor Orsola Benincasa di Napoli. Gli articoli pubblicati direzione Federica De Rosa su questa rivista sono stati sottoposti a valutazione Piero Craveri Gianluca Forgione rigorosamente anonima da parte di studiosi Lucio d’Alessandro Vittoria Papa Malatesta specialisti della materia indicati dalla Redazione. Ortensio Zecchino Gordon Poole Augusto Russo Un numero euro € 19,00 - doppio € 38,00 (Estero: singolo € 23,00 - doppio € 46,00) redazione Abbonamento annuale € 75,00 Giancarlo Alfano referenze fotografiche (Estero: € 103,00) Rosanna Cioffi Bari, Soprintendenza B.S.A.E. della Nicola De Blasi Puglia, pp. 30, 36 redazione Barletta, Museo Civico, pp. 106, 107 Renata De Lorenzo Università degli Studi Suor Orsola Benincasa Nicola Cleopazzo, pp. 46, 48, 49, 50, Fondazione Pagliara, via Suor Orsola 10 Arturo Fittipaldi 51 52 80131 Napoli Carlo Gasparri Fondo edifici di culto, pp. 19, 22 alto, [email protected] Gianluca Genovese 24, 108 Riccardo Naldi Luigi Maglio, p. 65 destra amministrazione Francesco Liuzzi, pp. pp. 80, 82, 83, 84, Giulio Pane prismi editrice politecnica napoli srl 85, 86, 87, 88, 89 via Argine 1150, 80147 Napoli Valerio Petrarca Gattatico (RE), Istituto Alcide Cervi, Mariantonietta Picone Biblioteca Archivio Emilio Sereni, pp. Federico Rausa 120, 121, 122, 123, 124, 125 Nunzio Ruggiero Lucera, Museo Diocesano, p. -

RED BANK REGISTER 7 Cents

7 Cents RED BANK REGISTER HI COW VOLUME LXXIH. NO. 51. RED BANK, N. J., THURSDAY, JUNE 21, 1951 SECTION ONE—PAGES 1 TO 16. EMrrtain* Cnmmillre Hire Architects Of Reermitimg A«*Vs Community Daily Vacation Bible it • Home RrraU'aftt Hoffman Gets Suspended Term Council Opposes Tfe* eaaaatr Araty ana) Asr Fates Miss Martha C. Han^on, director To Map Plan for WfHtMtog arnica has a—a—red School Opening Monday Morning of Public Health nur.^inu, recently For Possession of Narcotics Curtailment of entertained tho advisory commit- that ate* who hat* HwMvaa thsSr The Community Daily Vacation under leadership of Vrjs. A. Johnson tee of the Red Bank Public Health FREEHOLD — Morris Hoffman, i lo J p , Or,;ge r\ Clay- Bible school to be conducted June and Mrs. Warren Karrington is 19. of :13 Washington st , Red Bank. I ton B'ink police dfi- School Addition •rssa«awHaaiasatslrsjle Nursing association fit a bmk- Rail Service 25 to July 5 at the Red Bank Meth- prepared to receive children be- faFt meeting at her home un Hill- w a :• £ivcn a <=uspended ."entenrp to part lo fnc roundup. •r ash* Bate •ronaHy taken akfc- odist church by the Minitterium of tween 4 and S. Annandale reforrmtory Kriil.iv a-! Umutmn Mm O.K. top terrace. Thi? was the Hnal •fudge Seen linporiaiirr Decision on Drummemt la««ralna pfcyefcait saey Red Bank and vicinity will be part Rev. Frederick Pyki? who recent- meeting boforr the summer it- Jilfl^e J. KduTlrr! Knight scntrncd ; — I —1- a* * of the 50th anniversary of the Daily ly retired as missionary to China cess. -

A Genealogy of Top Level Cycling Teams 1984-2016

This is a work in progress. Any feedback or corrections A GENEALOGY OF TOP LEVEL CYCLING TEAMS 1984-2016 Contact me on twitter @dimspace or email [email protected] This graphic attempts to trace the lineage of top level cycling teams that have competed in a Grand Tour since 1985. Teams are grouped by country, and then linked Based on movement of sponsors or team management. Will also include non-gt teams where they are “related” to GT participants. Note: Due to the large amount of conflicting information their will be errors. If you can contribute in any way, please contact me. Notes: 1986 saw a Polish National, and Soviet National team in the Vuelta Espana, and 1985 a Soviet Team in the Vuelta Graphics by DIM @dimspace Web, Updates and Sources: Velorooms.com/index.php?page=cyclinggenealogy REV 2.1.7 1984 added. Fagor (Spain) Mercier (France) Samoanotta Campagnolo (Italy) 1963 1964 1965 1966 1967 1968 1969 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Le Groupement Formed in January 1995, the team folded before the Tour de France, Their spot being given to AKI. Mosoca Agrigel-La Creuse-Fenioux Agrigel only existed for one season riding the 1996 Tour de France Eurocar ITAS Gilles Mas and several of the riders including Jacky Durant went to Casino Chazal Raider Mosoca Ag2r-La Mondiale Eurocar Chazal-Vetta-MBK Petit Casino Casino-AG2R Ag2r Vincent Lavenu created the Chazal team. -

Fameia Capodistriana

ALDO CHERINI Fameia Capodistriana Aldo Cherini ANDAR PER BOTTEGHE OVVERO SE L’USAR INUTILMENTE TERMINI ESOTICI NON CI RIMORDESSE SHOPPING CAPODISTRIANO Fameia Capodistriana 1 La vita economica minuta – che si articolava in numerose attività di carattere commerciale, industriale, artigianale, agricolo, marittimo e misto – era notevole e veniva alimentata in misura rilevante dal movimento dei contadini dell’Istria nord-occidentale nonché dal turismo popolare proveniente dalla vicina Trieste, che procuravano un giro di affari non disprezzabile. Un esame delle attività economiche minute è interessante anche dal punto di vista del costume locale. Molti negozianti e taluni artigiani godevano di una posizione invidiata ed erano proprietari di casa in città e di campagna nel circondario. Davano alimento a notevoli correnti economiche le attività professionali (ingegneri, geometri, capitani marittimi, agronomi), gli uffici pubblici (tribunale civile e penale con sessioni di corte d’assise, pretura, uffici delle imposte, dogana e catasto), le molte scuole con numeroso e qualificato corpo insegnante, il presidio militare (nei primi anni con comando di divisione, poi di reggimento), la tenenza dei Carabinieri e delle Guardie di Finanza, il consorzio dell’acquedotto e della bonifica dei fondi ex saliferi, la casa di pena, il seminario diocesano, il decanato e i canonici della concattedrale. Una nota di colore e un vivace trambusto, che durava per parecchi giorni, erano dati dalle fiere annuali del Cristo in Ponte e di San Matteo in Brolo nonché dalla festa della Semedella, che tradizionalmente richiamavano gran numero di contadini e di forestieri. Gli stallaggi e le rimesse, col loro movimento di carriaggi e di animali – quelli che portavano la legna da ardere, si fermavano generalmente sul grande spiazzo fuori Porta della Muda – erano dislocate in Riva Castel Leone. -

Electric Bikes User Manual

Electric bikes User manual Welcome to the electric era! EN Thank you for having chosen a more sustainable mobility which makes air more breathable with lower consumption and great savings, as well as guaranteed autonomy; a way to do good to yourself and the planet. EN Congratulations for having decided to embrace a new lifestyle and innovative thinking: using cutting-edge technology such as electricity can only have positive effects. With the purchase of Askoll bicycles, you can finally enjoy a vehicle that concentrates the best of Askoll’s functionality, EN design and technology. Askoll a company that has forty years experience in the design and manufacture of electric motors. This manual has been prepared to allow you to fully appreciate its quality. It contains information, warnings and EN advice on the proper use and maintenance of your new vehicle. It is important to read it entirely before driving your vehicle for the first time. You will find out details and features that will reassure you of the choice made. EN This publication is to be considered an integral part of the vehicle. If the vehicle is sold, the manual must be delivered to the new owner. The constant evolution in the design, aimed to guarantee the safety and quality standards of Askoll vehicles, may result in the fact that some information contained in this Use and Maintenance Handbook can be different from the vehicle in your possession. We are therefore confident that you will understand that the data, figures and descriptions herein may not be grounds for any claims. -

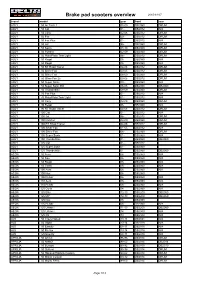

Brake Pad Scooters Overview

Brake pad scooters overview 2015-01-07 brand model year front rear ADLY 50 Air Tech 1 08-09 DB2060 DRUM ADLY 50 Cat 01- DB2012 N/A ADLY 50 Cosy 02-06 DB2012 DRUM ADLY 50 Fox 00- DB2012 DRUM ADLY 50 Fox Plus 01- DB2012 N/A ADLY 50 Jet 96- DB2060 DRUM ADLY 50 Noble 08-10 DB2060 DRUM ADLY 50 Panther 02-09 DB2060 DRUM ADLY 50 Pista/Pista Twin Light 96- DB2012 DRUM ADLY 50 Regal 06 DB2060 N/A ADLY 50 Regal 06 DB2060 N/A ADLY 50 RT Road Tracer 04-06 DB2012 DRUM ADLY 50 Silver Fox 00-05 DB2012 DRUM ADLY 50 Silver Fox 06-09 DB2060 DRUM ADLY 50 Silver Fox 25 00-05 DB2012 DRUM ADLY 50 Super Sonic 00 - DB2060 N/A ADLY 50 Super Sonic RS 06-08 DB2060 DB2060 ADLY 50 Thunderbike 08-09 DB2060 DRUM ADLY 70 Fox Plus 01- DB2012 N/A ADLY 70 Pista/Pista Twin Light 01- DB2012 N/A ADLY 80 Cosy 02-06 DB2060 DRUM ADLY 90 Regal 06 DB2060 N/A ADLY 90 RT Road Tracer 04-06 DB2012 DRUM ADLY 100 Cat 01- DB2012 N/A ADLY 100 Jet 96- DB2012 DRUM ADLY 100 Panther 02-09 DB2060 DRUM ADLY 100 RT Road Tracer 04-06 DB2012 DRUM ADLY 100 Silver Fox 01-05 DB2012 N/A ADLY 100 Silver Fox 06- DB2060 DRUM ADLY 100 Super Sonic 01- DB2060 N/A ADLY 100 Thunderbike 01- DB2060 DB2060 ADLY 125 Cat 01- DB2012 ADLY 125 Super Sonic 01- DB2060 ADLY 125 Thunderbike 01- DB2060 DB2060 AEON 50 Aero 06 DB2060 N/A AEON 50 Nox 06 DB2060 N/A AEON 50 Regal 06 DB2060 N/A AEON 50 Torch 06- DB2060 N/A AEON 100 Aero 06 DB2060 N/A AEON 100 Nox 06 DB2060 AEON 100 Pulsar 06 DB2060 N/A AEON 110 Aero 06- DB2060 N/A AEON 110 Pulsar 06- DB2060 N/A AEON 125 Co-In 14 DB2060 N/A AEON 125 Elite 12-13 DB2200 DB2050 -

200 MOMENTI FOTOGRAFICI DEL “TOUR” 1949. Didascalie Di Emilio De Martino

n. 1 200 MOMENTI FOTOGRAFICI DEL “TOUR” 1949. Didascalie di Emilio De Martino. Selezione fotografica di Ghea. Milano, La Gazzetta Dello Sport, 1949. Album in-16 p. (mm. 170x235), brossura edit. illustrata a colori, frontespi- zio, con 200 bellissime fotografie in seppia che immortalano i momenti più importanti del “Tour de France” 1949 (trentaseiesima edizione della “Grande Boucle”) che si svolse in 21 tappe, tra il 30 giugno e il 24 luglio 1949, su un percorso di complessivi 4808 km. Fu vinto per la prima volta dal passista-cro- noman e scalatore italiano Fausto Coppi. Ben conservato. € 120 n. 2 50° GIRO CICLISTICO D’ITALIA. Collezione completa degli annulli postali relativi alle tappe. A cura della F.D.C. “Roma”. 1967. Album oblungo (mm. 110x190) in similpelle contenente una raccolta comple- ta di 23 buste a colori, con francobolli e relativi annulli postali, dalla prima all’ultima tappa del Giro d’Italia del 1967 (20 Maggio - 11 Giugno): Treviglio Milano. Le tappe sono in effetti 22 + una 22bis, semitappa conclusiva da Ma- donna del Ghisallo a Milano. Inoltre nella ns. raccolta la busta della 15a tappa è doppia (una ha 3 francobolli invece di 1 da lire 40). In ottimo stato. € 220 n. 3 A UMBERTO DEI - NELL’ANNO IX DI SUA PRESIDENZA, I VETE- RANI CICLISTI ITALIANI CON AFFETTO. 25 Ottobre 1931 - Anno IX E.F. Milano, Unione Veterani Ciclisti Italiani, 1931. In-8 gr., brossura edit. figu- rata, legata con cordoncino, pp. 71, con ill. fotografiche in b.n. nel t. Il volume contiene un profilo di Umberto Dei (dapprima corridore ciclista, poi produttore di perfette biciclette da corsa) e una serie di lettere con le quali personaggi del ciclismo ricordano episodi vissuti con lui. -

Pinarello Dogma F10 White Paper 1.0

PINARELLO DOGMA F10 WHITE PAPER 1.0 PINARELLO DOGMA F10 © Cicli Pinarello Spa - All rights reserved - October 2016 PINARELLO DOGMA F10 WHITE PAPER 1.0 CONTENTS 1. INTRODUCTION 3 a. Pinarello 4 b. Team Sky 5 c. Dogma F8 6 d. Bolide TT 2. PRELIMINARY DESIGN 7 a. Purposes 8 b. Aesthetics 3. AERODYNAMIC DESIGN 12 a. Concave Downtube 16 b. “Fork Flap” 4. STRUCTURAL DESIGN 19 a. Tubing Design 21 b. Material’s Choice 5. PRODUCTION 24 a. RP Samples 25 b. Samples 6. TEST 26 a. Lab Test 27 b. Road Test 7. RESULT 28 a. Structural Performances 29 b. Riding Performance 30 c. Integration 31 d. Main Features 8. TECHNICAL SPECIFICATIONS 32 a. Specifications 33 b. Geometries 9. RACING 35 a. UCI Approved 36 b. Debut 2 © Cicli Pinarello Spa - All rights reserved - October 2016 PINARELLO DOGMA F10 WHITE PAPER 1.0 1. INTRODUCTION a. Pinarello Cicli Pinarello SpA is one of the most famous and winning bike manufacturer in the world. Founded in Treviso (Italy) in 1952 by Giovanni (Nani) Pinarello, it produces high end racing bikes. This name, Pinarello, recalls legendary victories of the greatest cyclists of all times: since 1975, the first victory in Giro d’Italia with Fausto Bertoglio, Pinarello has won all the most important races in the world, including Olympics, World Champion- ships and Tour de France. Just in the recent past, we celebrated for: Elia Viviani - gold medal in Omnium, Rio 2016 Olympics Chris Froome - winner of Tour de France 2013·2015·2016 Wout Poels - winner of Liege-Bastogne-Liege 2016 Vasil Kiryienka - Time Trial World Champion in Richmond 2015 Sir Bradley Wiggins - Hour Record holder in London 2015 and Time Trial World Champion in Ponferrada 2014 Sir Bradley Wiggins Wout Poels Vasil Kiryienka Chris Froom Elia Viviani 3 © Cicli Pinarello Spa - All rights reserved - October 2016 PINARELLO DOGMA F10 WHITE PAPER 1.0 1. -

AXONE Direct TEXA S.P.A

Tehničke karakteristike Dimenzija i težina: 241 x 146 x 47 mm, 852 g Procesor: Intel X-Scale PXA270 520 MHz , Windows CE 5.0 NEW SDRAM: 128 Mbyte low power mobile na 32 bit bus Displej: Touch-screen, LCD-TFT sa QVGA rezolucijom, 240x320 pixela, 5.7 ‘ , 65536 boja Baterija: Lithium polymer 3.7 VDC, 5000 mAh, standardna autonomnost 480 minuta Backup baterija: punjiva litium 3V, 11mAh Kamera: CMOS sa VGA rezolucijom (640x480) Bluetooth i Wi-Fi 802.11b/g modul: ugrađen, s unutrašnjom baterijom I/O konektor: za vanjsko napajanje, USB, USB host i jedan RS232 serijski port Vanjso napajanje (docking station): 100-240 VAC, 50/60 Hz, 5.25 VDC 3A Radna temperatura: 0/+45°C Protokol: Blink kodovi, CAN ISO 11898 i ISO 15765-4, K - L, ISO 9141-2, ISO 14230 (Keyword 2000), SAE J1850 PWM 41.6 Kbps i VPW 10.4 Kbps, ISO 11519-2, SAE J1708 – FMS sukladno, EOBD (svi): ISO 15031-5, ISO 15765-4 POKRIVENOST MARKI AUTOMOBILI ALFA ROMEO DAIHATSU JEEP MG ROVER ASTON MARTIN DR KATAY MINI SAAB AUDI FERRARI KIA MITSUBISHI SEAT AUTOBIANCHI FIAT LADA MORGAN SKODA BMW FORD LANCIA NISSAN SMART CHERY HONDA LAND ROVER OPEL SUBARU CHEVROLET HYUNDAI LEXUS PAGANI SUZUKI CHRYSLER IKCO LOTUS PEUGEOT TOYOTA CITROEN INNOCENTI MAYBACH PIAGGIO VOLKSWAGEN DACIA ISUZU MAZDA PORSCHE VOLVO DAEWOO JAGUAR MERCEDES-BENZ RENAULT KOMERCIJALNA VOZILA CITROEN IVECO MERCEDES-BENZ PEUGEOT SUZUKI FIAT PIAGGIO NISSAN RENAULT TOYOTA FORD LDV OPEL RENAULT TRUCKS VOLKSWAGEN HYUNDAI MOTOCIKLI ATV-QUAD JET SKI ADIVA GILERA MOTO MORINI ARCTIC CAT HONDA MARINE APRILIA HARLEY-DAVIDSON MV AGUSTA CAN-AM SEA-DOO BENELLI HONDA PEUGEOT GAS GAS SNOWMOBILE BIMOTA HONDA MONTESA PIAGGIO GG TECHNIK ARCTIC CAT BMW KAWASAKI SHERCO HONDA MALA VOZILA BUELL KTM SUZUKI KAWASAKI HONDA CAGIVA KYMCO TRIUMPH KVN MOTORS PIAGGIO V.