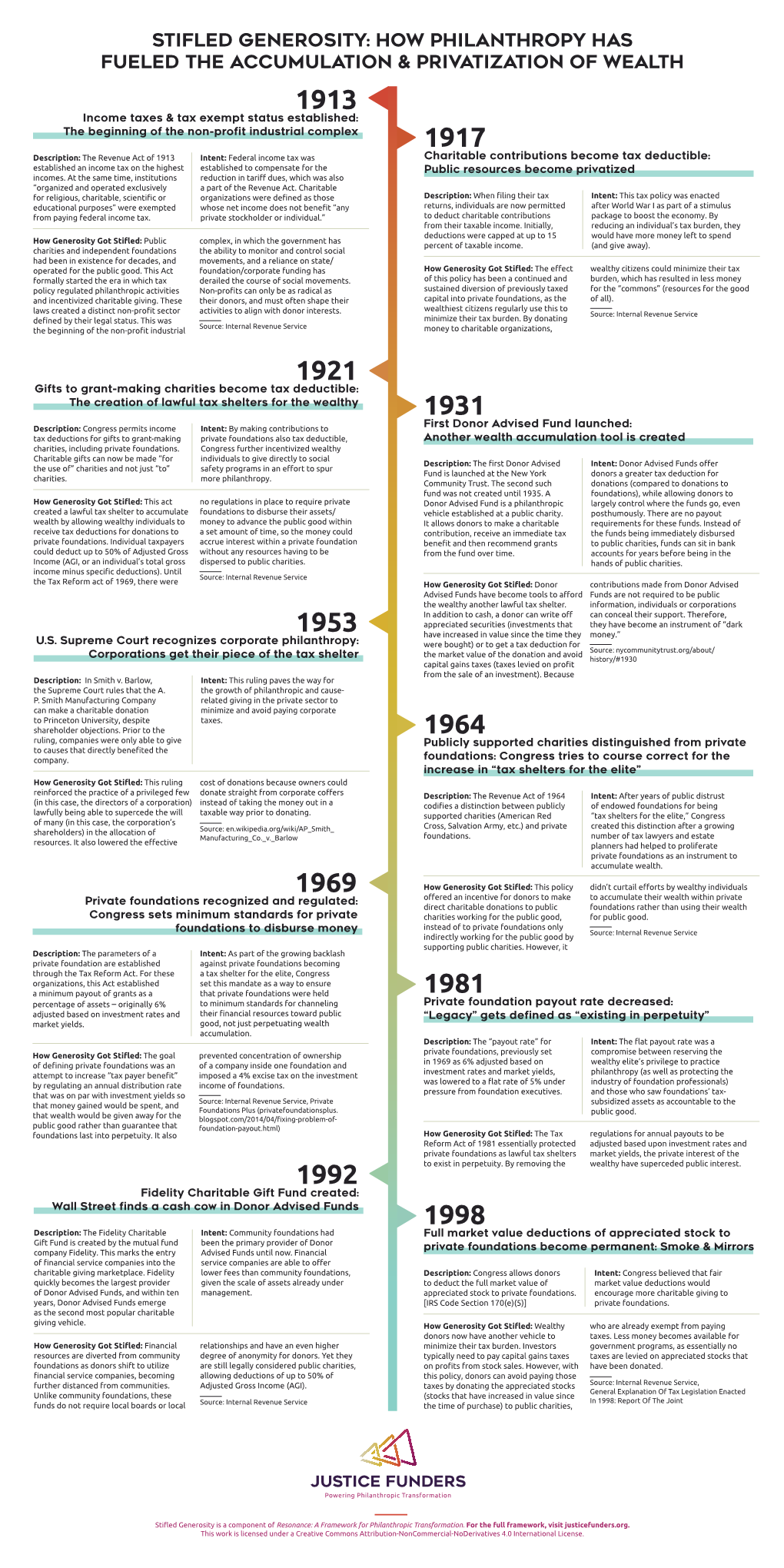

Stifled Generosity: How Philanthropy Has Fueled

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Best of Intentions Using Behavioral Design to Unlock Charitable Giving

Best of Intentions Using Behavioral Design to Unlock Charitable Giving Authors: Omar Parbhoo, Katy Davis, Robert Reynolds, Piyush Tantia, Pranav Trewn, Sarah Welch July 2018 Contents Introduction ......................................................................................... 3 Generosity ........................................................................................... 8 Activating Donor-Advised Funds ............................................................................................................10 Promoting generosity through a holistic picture of giving Fostering Charitable Giving at Work ...................................................................................................... 14 Making employee giving opportunities more salient Intentionality ......................................................................................17 Helping Employees Fulfill Their Charitable Intentions .....................................................................18 Incorporating goal-setting into workplace giving platforms Informed Giving ..................................................................................21 Unlocking Philanthropy Through Curation ..........................................................................................23 How simplifying choice may increase giving The Importance of Testing .................................................................... 26 Conclusion ......................................................................................... 28 ideas42 -

Million Dollar List – Scaling Philanthropy Methodology and Summary Statistics

Million Dollar List – Scaling Philanthropy Methodology and Summary Statistics Una Osili Indiana University School of Philanthropy [email protected] School of Philanthropy Research Project Team: Jason Ward Sindhu Raghavan Reema Bhakta Michael Copple Elizabeth Farris Shannon Neumeyer Cynthia Hyatte Abstract This paper provides an explanation of the methodology behind the Million Dollar List, a unique dataset providing gift-level data on million dollar-plus charitable donations. It further provides summary statistics based on data between 2000 and 2010. Initial research into the MDL has produced a number of noteworthy findings. Million dollar giving by individuals tends to be greater on a gift-to-gift basis than that of foundations and corporations. We also find that gifts to higher education institutions dominate the number of gifts received, but these gifts tend to be relatively small as a fraction of total dollars given on the MDL. There are significant differences in per capita giving and receiving by state, due in large part to the geographic dispersion of large foundations and nonprofits. There are numerous opportunities for future studies using the MDL data, including detailed investigations into donor networks, gift dispersion based on source of donor wealth, and a study of institutional characteristics that attract million dollar plus gifts. 1 Indiana University School of Philanthropy Every culture depends on philanthropy and nonprofit organizations to provide essential elements of a civil society. Effective philanthropy and nonprofit management are instrumental in creating and maintaining public confidence in the philanthropic traditions – voluntary association, voluntary giving, and voluntary action. The Indiana University School of Philanthropy (formerly the Center on Philanthropy) increases the understanding of philanthropy and improves its practice through programs in research, teaching, public service, and public affairs. -

Private Inurement As Follows: Distribution of Earnings

C. OVERVIEW OF INUREMENT/PRIVATE BENEFIT ISSUES IN IRC 501(c)(3) 1. Preface An apocryphal domestic relations case has a judge inquiring of the elderly plaintiff about why, after some fifty years of marriage, she was now seeking a divorce. "Well, your honor," she replied, "enough is enough!" In the charitable area, some private benefit may be unavoidable. The trick is to know when enough is enough. 2. Introduction IRC 501(c)(3) provides exemption from federal income tax for organizations that are "organized and operated exclusively" for religious, educational, or charitable purposes. The exemption is further conditioned on the organization being one "no part of the net income of which inures to the benefit of any private shareholder or individual." This article examines the proscription against inurement and the requirement that an organization must be organized and operated exclusively for exempt purposes by serving public rather than private interests. 3. The Prohibition Against Inurement of Net Earnings A. What Is Inurement? The statutory prohibition against inurement of net earnings first appeared in 1894. The provision has been carried forward without significant Congressional comment or debate through successive revenue acts and codifications. See "The Concept of Charity" in the Exempt Organizations Annual Technical Review Institutes for 1980 beginning at page 7. While the provision speaks of "net earnings," it is not interpreted in a strict accounting sense to mean the remainder after expenses are subtracted from gross earnings. Any unjust enrichment, whether out of gross or net earnings, may constitute inurement. See People of God Community v. Commissioner, 75 T.C. -

Stewardship and Generosity from a Variety Aged to Use the Term Most Appropriate for Their Setting

STEWA R D S HIP A ND GENE R O S ITY SPECIAL REPO R T A PUBLICATION FROM THE CENTER FOR CONGREG A TIONS STEWA R D S HIP AND GENE R O S ITY is intended to provide information and resources to congregations to help their leaders focus more intentionally on stewardship. The Center for Congregations hopes that you will find this information useful in your work. hat resources can congregations use to teach their ing suggest that “generosity is a companion to the word Wmembers about giving? This question prompted stewardship.” Ruben Swint in Growing Generosity While the Center for Congregations to engage in a resource dis- Practicing Stewardship suggests that the terms are embraced covery process to find, evaluate and recommend resources differently by different generations. He proposes that the that congregations could use to focus more intentionally builders generation is more comfortable with the word on stewardship, not just at budget time, but year-round. stewardship, while younger generations respond more to the concept of generosity.1 Within the scope of this From late 2009 through early 2010, Christine B. Roush, research and report, the terms “stewardship” and “gener- researcher and author of this report, investigated available osity” were seen as interchangeable. The reader is encour- resources on stewardship and generosity from a variety aged to use the term most appropriate for their setting. of perspectives. The process of reviewing and evaluat- ing applicable resources led to the compilation of this list. There has been a shift in the field of stewardship educa- These excellent resources offer practical ways of talking tion over the past decade. -

Generous Orthodoxy - Doing Theology in the Spirit

Generous Orthodoxy - Doing Theology in the Spirit When St Mellitus began back in 2007, a Memorandum of Intent was drawn up outlining the agreement for the new College. It included the following paragraph: “The Bishops and Dean of St Mellitus will ensure that the College provides training that represents a generous Christian orthodoxy and that trains ordinands in such a way that all mainstream traditions of the Church have proper recognition and provision within the training.” That statement reflected a series of conversations that happened at the early stages of the project, and the desire from everyone involved that this new college would try in some measure to break the mould of past theological training. Most of us who had trained at residential colleges in the past had trained in party colleges which did have the benefit of strengthening the identity of the different rich traditions of the church in England but also the disadvantage of often reinforcing unhelpful stereotypes and suspicion of other groups and traditions within the church. I remember discussing how we would describe this new form of association. It was Simon Downham, the vicar of St Paul’s Hammersmith who came up with the idea of calling it a “Generous Orthodoxy”, and so the term was introduced that has become so pivotal to the identity of the College ever since. Of course, Simon was not the first to use the phrase. It was perhaps best known as the title of a book published in 2004 by Brian McLaren, a book which was fairly controversial at the time. -

Homeless Non-Governmental Organisations and the Role of Research Mike Allen

10th Anniversary Issue 145 Homeless Non-Governmental Organisations and the Role of Research Mike Allen Focus Ireland, Dublin, Ireland >> Abstract_This paper explores the reciprocal and often complex relationships between homelessness research and NGOs, with a particular focus on the role and motives of homeless NGOs in commissioning and undertaking research and the impact this research has on NGO practice. The paper also explores the influence on NGOs of research emanating from the broader research community, using Focus Ireland, an Irish Homeless NGO, as a case study. The ethical challenges of NGO homelessness research reflect those of the wider research community whether academic or state sponsored, with additional unease regarding the potential exploitation of NGO clients. Citing such concerns, some NGOs refuse to engage in research, arguing that their primary role is to address clients’ personal problems; however, such a stance may unwittingly buttress individual interpretations of homelessness with a conse- quent downplaying of structural issues. The paper suggests that impact of research findings on the practice of service delivery is rarely direct and sometimes hard to detect. The paper concludes with identifying possible conduits for the communication and transfer of research findings. >> Keywords_NGO research on homelessness, ethical concerns, communica- tion of research findings ISSN 2030-2762 / ISSN 2030-3106 online 146 European Journal of Homelessness _ Volume 10, No. 3 _ 2016 Introduction The European Journal of Homelessness aims to provide “a critical analysis of policy and practice on homelessness in Europe for policy makers, practitioners, researchers and academics.” While a number of articles over the years have explored the relationship between research and policy-making at Government and regional levels, rather less attention has been given to the relationship between research and the organisations where most actual practice takes place – non- governmental organisations (NGOs) providing services to people who are homeless. -

Inspiring Philanthropy Across Generations

Private Wealth Advisory Inspiring Philanthropy Across Generations 2 | Thinking Strategically About Charitable Giving For philanthropic families, charitable giving is more than just a way to strengthen their communities and support causes that are dear to their hearts. Philanthropy is a central part of the family’s mission, values, and legacy. While children and grandchildren often have a natural interest in the family’s charitable endeavors, making sure that the family’s philanthropic legacy is maintained and strengthened across multiple generations requires a thoughtful approach. We examine best practices for teaching younger generations about philanthropy and engaging them in the family’s charitable activities. Inspiring Philanthropy Across Generations | 3 How to Instill a Spirit of Philanthropy in Children and Grandchildren As with most behaviors, the best way for parents and Encourage hands-on participation grandparents to teach younger generations about the It’s important to teach children that philanthropy is about value of charitable giving is by modeling. While acting as a much more than just investing money in worthwhile causes. philanthropic role model is a great start, there are several Teach them that gifts of time, energy, and expertise can be specific strategies that parents and grandparents can use to every bit as powerful as monetary gifts. Giving money can engage children in a way that inspires them to carry on the be an abstract idea that is difficult for children, especially family’s philanthropic mission throughout their lives. younger ones, to grasp. They might not fully understand Start talking about philanthropy early … what the money is going toward, and they may not view and don’t stop giving away money as a tangible sacrifice. -

Influences of Venture Philanthropy on Nonprofits' Funding

The Foundation Review Volume 7 Issue 4 Open Access 12-2015 Influences of enturV e Philanthropy on Nonprofits’ unding:F The Current State of Practices, Challenges, and Lessons Tamaki Onishi University of North Carolina at Greensboro Follow this and additional works at: https://scholarworks.gvsu.edu/tfr Part of the Nonprofit Administration and Management Commons, and the Public Affairs, Public Policy and Public Administration Commons Recommended Citation Onishi, T. (2015). Influences of enturV e Philanthropy on Nonprofits’ unding:F The Current State of Practices, Challenges, and Lessons. The Foundation Review, 7(4). https://doi.org/10.9707/ 1944-5660.1267 Copyright © 2016 Dorothy A. Johnson Center for Philanthropy at Grand Valley State University. The Foundation Review is reproduced electronically by ScholarWorks@GVSU. https://scholarworks.gvsu.edu/tfr doi: 10.9707/1944-5660.1267 RESULTS Influences of Venture Philanthropy on Nonprofits’ Funding: The Current State of Practices, Challenges, and Lessons Tamaki Onishi, Ph.D., University of North Carolina at Greensboro Keywords: Venture philanthropy, grantmaking, funding instruments, funder-recipient relationship, nonprofit funders, survey, institutional theory and Grossman (1997) widely advocated the idea Key Points of venture philanthropy (although the authors did · This article looks at the current state of venture not use this term) by stressing potential benefits philanthropy practices in the nonprofit sector, for grantmaking foundations from borrowing a based on data from a survey of 124 -

High Net Worth Philanthropy

THE 2016 U.S. TRUST STUDY OF High Net Worth Philanthropy CHARITABLE PRACTICES AND PREFERENCES OF WEALTHY HOUSEHOLDS OCTOBER 2016 A collaboration between U.S. Trust and the Indiana University Lilly Family School of Philanthropy This study is a continuation of the 2006, 2008, 2010, 2012 Bank of America Study of High Net Worth Philanthropy and 2014 U.S. Trust® Study of High Net Worth Philanthropy research series. Institutional Investments & Philanthropic Solutions (II&PS) is part of U.S. Trust, Bank of America Corporation (U.S. Trust). U.S. Trust operates through Bank of America, N.A. and other subsidiaries of Bank of America Corporation (BofA Corp.). Bank of America, N.A., Member FDIC. Trust and fiduciary services and other banking products are provided by wholly owned banking affiliates of BofA Corp., including Bank of America, N.A. Brokerage services may be performed by wholly owned brokerage affiliates of BofA Corp., including Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S). Certain U.S. Trust associates are registered representatives with MLPF&S and may assist you with investment products and services provided through MLPF&S and other nonbank investment affiliates. MLPF&S is a registered broker-dealer, Member SIPC and a wholly owned subsidiary of BofA Corp. Investment products: ARE NOT FDIC INSURED ARE NOT BANK GUARANTEED MAY LOSE VALUE Bank of America, N.A. and MLPF&S make available investment products sponsored, managed, distributed or provided by companies that are affiliates of BofA Corp. ©2016 Bank of America Corporation. All rights reserved. | ARMCGDN7 | 10/2016 2 THE 2016 U.S. -

Annual Report 2019/20

annual report 2019/20 Shelter Annual Report 2019/20 ANNUAL REPORT 2019/20 Registration Information Shelter, the National Campaign for Homeless People Limited Charity number: England: 263710 Scotland: SCO02327 Country of Incorporation: United Kingdom Company Registration Number: 1038133 Registered VAT no: 626 5556 24 Registered Office: 88 Old Street, London, EC1V 9HU Shelter Annual Report 2019/20 Contents 1. Introduction 2. Our year in numbers 3. Strategic programmes 4. Our work in England 5. Our work in Scotland 6. Supporting our work 7. Thanks 8. Our governance 9. Our finances 10. Financial statements Shelter Annual Report 2019/20 Strategic report What we do Shelter exists to defend the right to a safe home. Every year, we help millions of people struggling with bad housing or homelessness through our advice, support, and legal services. And we campaign to make sure that one day, the right to a home exists for everyone. Key objectives Shelter was set up in 1966 to: a. relieve hardship and distress among homeless people and those in need, including those living in adverse housing conditions b. make funds available to other bodies (whether corporate or not), whose charitable aims are to relieve hardship and distress c. relieve poverty and distress d. educate the public about the nature, causes, and effects of homelessness, human suffering, poverty, and distress; and to carry out research on these issues to make useful results available to all Introduction from the Chair The year 2019/20 saw Shelter taking the first major steps towards the delivery of our three year strategy and ten year ambitions. -

Annual Report 2018/19 What We Do Annual Report 2018/19 Annual Report 2018/19 What We Do

annual report 2018/19 What we do Annual report 2018/19 Annual report 2018/19 What we do Strategic report – What we do Shelter exists to defend the right to a safe home for individuals, in communities, and across society. Every year, we help defend the rights of millions struggling with bad housing or homelessness through our advice, support and legal services. And we campaign to make sure that, one day, a safe home will be a reality for everyone. 2 3 Contents Annual report 2018/19 Annual report 2018/19 Contents 03 - What we do 44 - Our work in Scotland - Services Contents 07 - Introduction - Campaigns and policy - Volunteering 08 - Our new strategy - The housing crisis is now a 50 - Our corporate partners – national emergency - How we will achieve change 52 - Thanks - Rights for renters - Building more social housing 54 - Our governance - Supporting people who are struggling - How we are organised - Empowering communities and - Our commitment to good building a movement governance - Risk management and internal control 20 - Our year in numbers - Key objectives and statement of public benefit 22 - Achieving change - Legal and administrative in society information - Greater security for those 68 - Our finances who rent - A new vision for social housing - Income 2018/19 - Expenditure 2018/19 30 - Achieving change - Financial review - Reserves with individuals - Investments - Advice services - Statement of trustees' - Supporting people with responsibility complex needs - Working together with 76 - Independent auditor’s service users - Shelter’s legal services report - Our work with women and families - Financial statements - Notes to the financial statements 38 - Supporting our work - Shelter shops - Volunteering - Sleep Walk 4 5 Introduction Annual report 2018/19 Annual report 2018/19 Introduction The year 2018/19 was one of transition for Nationally, 2018/19 was a big year for Shelter. -

Generosity: the flourishing Virtue in the Consecrated Life

Generosity: The flourishing virtue in the consecrated life Author: Bao Nguyen Persistent link: http://hdl.handle.net/2345/bc-ir:105010 This work is posted on eScholarship@BC, Boston College University Libraries. Boston College Electronic Thesis or Dissertation, 2012 Copyright is held by the author, with all rights reserved, unless otherwise noted. GENEROSITY: THE FLOURISHING VIRTUE IN THE CONSECRATED LIFE Thesis Submitted in Fulfillment Of the Requirements for the S.T.L. Degree From the Boston College School of Theology and Ministry. By Bao Nguyen, S.J. Thesis Director: Daniel Harrington, SJ Second Reader: Thomas Kane, CSP April 30, 2012 AMDG Nguyen 2 ACKNOWLEDGMENT This work has been possible because of the kind dedication of my mentors, Professor Daniel Harrington, S.J. and Thomas Kane, C.S.P., scholars at School of Theology and Ministry at Boston College. In memoriam of my mother, Mrs. Vinh Nguyen, who had taught me generosity through her life. AMDG Nguyen 3 CONTENTS Introduction ……………………………………………………………………………………..4 Chapter 1 Scriptural Foundation for Generosity …………………………………………….10 I. Generosity in Johannine Tradition…………………………………………………….....11 II. Biblical Interpretation of Generosity: Pauline methodology of generosity and collection in 2 Corinthians 8-9…………………………………………………...…………………28 Chapter 2: Philosophical and Theological Understanding of Generosity …………………..38 I. The Virtue of Generosity………………………………………………………………...41 II. Transforming Impossible Generosity to be Possible…………………………………….57 Chapter 3: Generosity of the Consecrated Life ………………………………………………67 I. The Religious in Vietnam………………………………………………………………..68 II. Generosity: Necessary virtue in the evangelical counsels……………………………….75 III. Generosity: Bridging over divisions in the contemporary world………………………..90 Conclusion……………………………………………………………………………………….97 AMDG Nguyen 4 INTRODUCTION Virtue ethics have been enriched by interpretations of Holy Scriptures and Catholicism, and Christians for centuries have attempted to practice virtues as Jesus’ teaching in their lives.