Private Inurement As Follows: Distribution of Earnings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Homeless Non-Governmental Organisations and the Role of Research Mike Allen

10th Anniversary Issue 145 Homeless Non-Governmental Organisations and the Role of Research Mike Allen Focus Ireland, Dublin, Ireland >> Abstract_This paper explores the reciprocal and often complex relationships between homelessness research and NGOs, with a particular focus on the role and motives of homeless NGOs in commissioning and undertaking research and the impact this research has on NGO practice. The paper also explores the influence on NGOs of research emanating from the broader research community, using Focus Ireland, an Irish Homeless NGO, as a case study. The ethical challenges of NGO homelessness research reflect those of the wider research community whether academic or state sponsored, with additional unease regarding the potential exploitation of NGO clients. Citing such concerns, some NGOs refuse to engage in research, arguing that their primary role is to address clients’ personal problems; however, such a stance may unwittingly buttress individual interpretations of homelessness with a conse- quent downplaying of structural issues. The paper suggests that impact of research findings on the practice of service delivery is rarely direct and sometimes hard to detect. The paper concludes with identifying possible conduits for the communication and transfer of research findings. >> Keywords_NGO research on homelessness, ethical concerns, communica- tion of research findings ISSN 2030-2762 / ISSN 2030-3106 online 146 European Journal of Homelessness _ Volume 10, No. 3 _ 2016 Introduction The European Journal of Homelessness aims to provide “a critical analysis of policy and practice on homelessness in Europe for policy makers, practitioners, researchers and academics.” While a number of articles over the years have explored the relationship between research and policy-making at Government and regional levels, rather less attention has been given to the relationship between research and the organisations where most actual practice takes place – non- governmental organisations (NGOs) providing services to people who are homeless. -

Annual Report 2019/20

annual report 2019/20 Shelter Annual Report 2019/20 ANNUAL REPORT 2019/20 Registration Information Shelter, the National Campaign for Homeless People Limited Charity number: England: 263710 Scotland: SCO02327 Country of Incorporation: United Kingdom Company Registration Number: 1038133 Registered VAT no: 626 5556 24 Registered Office: 88 Old Street, London, EC1V 9HU Shelter Annual Report 2019/20 Contents 1. Introduction 2. Our year in numbers 3. Strategic programmes 4. Our work in England 5. Our work in Scotland 6. Supporting our work 7. Thanks 8. Our governance 9. Our finances 10. Financial statements Shelter Annual Report 2019/20 Strategic report What we do Shelter exists to defend the right to a safe home. Every year, we help millions of people struggling with bad housing or homelessness through our advice, support, and legal services. And we campaign to make sure that one day, the right to a home exists for everyone. Key objectives Shelter was set up in 1966 to: a. relieve hardship and distress among homeless people and those in need, including those living in adverse housing conditions b. make funds available to other bodies (whether corporate or not), whose charitable aims are to relieve hardship and distress c. relieve poverty and distress d. educate the public about the nature, causes, and effects of homelessness, human suffering, poverty, and distress; and to carry out research on these issues to make useful results available to all Introduction from the Chair The year 2019/20 saw Shelter taking the first major steps towards the delivery of our three year strategy and ten year ambitions. -

Annual Report 2018/19 What We Do Annual Report 2018/19 Annual Report 2018/19 What We Do

annual report 2018/19 What we do Annual report 2018/19 Annual report 2018/19 What we do Strategic report – What we do Shelter exists to defend the right to a safe home for individuals, in communities, and across society. Every year, we help defend the rights of millions struggling with bad housing or homelessness through our advice, support and legal services. And we campaign to make sure that, one day, a safe home will be a reality for everyone. 2 3 Contents Annual report 2018/19 Annual report 2018/19 Contents 03 - What we do 44 - Our work in Scotland - Services Contents 07 - Introduction - Campaigns and policy - Volunteering 08 - Our new strategy - The housing crisis is now a 50 - Our corporate partners – national emergency - How we will achieve change 52 - Thanks - Rights for renters - Building more social housing 54 - Our governance - Supporting people who are struggling - How we are organised - Empowering communities and - Our commitment to good building a movement governance - Risk management and internal control 20 - Our year in numbers - Key objectives and statement of public benefit 22 - Achieving change - Legal and administrative in society information - Greater security for those 68 - Our finances who rent - A new vision for social housing - Income 2018/19 - Expenditure 2018/19 30 - Achieving change - Financial review - Reserves with individuals - Investments - Advice services - Statement of trustees' - Supporting people with responsibility complex needs - Working together with 76 - Independent auditor’s service users - Shelter’s legal services report - Our work with women and families - Financial statements - Notes to the financial statements 38 - Supporting our work - Shelter shops - Volunteering - Sleep Walk 4 5 Introduction Annual report 2018/19 Annual report 2018/19 Introduction The year 2018/19 was one of transition for Nationally, 2018/19 was a big year for Shelter. -

Community Fundraising Toolkit

Community Fundraising Toolkit UMOM NEW DAY CENTERS 3333 East Van Buren Street Phoenix, AZ 85008 UMOM.org Thank you for generously offering to host a fundraiser to support the families, women and youth experiencing homelessness in our community! One of the ways we’re able to serve UMOM clients is with the proceeds raised though events and activities from community supporters like you. We’re grateful to the many organizations who donate their time and talent to fundraise on our behalf – from individuals, families, neighborhood associations and faith groups to the business community – both small businesses and large corporations. We rely on your help as supporters and partners in our mission to break the cycle of homelessness and couldn’t do it without you. Amanda Montelongo-Fisher Event Coordinator [email protected] 602.362.5837 End Homelessness ABOUT UMOM Our mission is to prevent and end homelessness with innovative strategies and housing solutions that meet the unique needs of Community Volunteers, Donors, Partners each family and individual. Who we serve UMOM restores hope and rebuilds lives by providing shelter, services and housing for families, single women, youth and veterans experiencing homelessness. How we do it UMOM runs a very lean and large organization with a professional staff of 305 and a volunteer workforce of over 2,000 annually. We have 16 programs, 5 emergency shelters and 300 units of affordable housing to address all the challenges our clients are facing. Community support and fundraising is vital to our ongoing success at meeting the needs of people experiencing homelessness in our community. -

SPEA Capstone Group Charity Navigator 3.0 Indiana University, Spring 2012 SPEA V600 CAPSTONE GROUP

SPEA Capstone Group Charity Navigator 3.0 indiana University, Spring 2012 SPEA V600 CAPSTONE GROUP SPRING 2012 Executive Group Laurie Burns Lindsi Lara Molly McPherson May Nguyen Jason Simons Sarah Townsend Logic, Results, and Measures Jennifer Bellville Adrianne DiTommaso Ran Duan Frances Duberstein Rachel James Bekir Keles Lindsi Lara Independent Evaluations and Standards & Certification Mechanisms Laurie Burns Amy Countryman Kristen Dmytryk Emrullah Durmus Sarah Greenberg May Nguyen Constituent Voice Seongje Cho Jungkyun Kim Bethany Lister Molly McPherson Huy Nguyen Elizabeth Walker Whitney Williamson Information Intermediary Research Kristen Dmytryk Rachel James Kathryn Meier Huy Nguyen Sarah Townsend Donor Survey Adrianne DiTommaso Sarah Greenberg Jason Simons Elizabeth Walker Americorps Jennifer Bellville Laurie Burns Bethany Lister Kathryn Meier Faculty Leslie Lenkowsky Joseph Palus ii Table of Contents Executive Summary 1 Chapter One: Problem Statement 5 Chapter Two: Methodology 9 Chapter Three: Intermediaries 19 Chapter Four: Element One 39 Chapter Five: Element Two 75 Chapter Six: Element Three 95 Chapter Seven: Element Four 127 Chapter Eight: Assessment of the Charity 161 Navigator Research Tool Chapter Nine: Utility Survey 178 Chapter Ten: AmeriCorps Case Study 192 Chapter Eleven: Conclusions 206 Works Cited Appendices iii Executive Summary Charity Navigator, a highly regarded information intermediary, is testing its next iteration of its ratings tool. The new ratings system, called CN 3.0, assesses charities on four elements -

GUIDEBOOK for BOARDS of DIRECTORS of NORTH CAROLINA NONPROFIT CORPORATIONS (2Nd Edition)

GUIDEBOOK FOR BOARDS OF DIRECTORS OF NORTH CAROLINA NONPROFIT CORPORATIONS (2nd edition) A cooperative project of: Business Law Section of the North Carolina Bar Association and N.C. Center for Nonprofits ACKNOWLEDGMENTS This guidebook reflects a collaborative effort. The idea of a reference book outlining the roles and responsibilities of board members of North Carolina nonprofit corporations arose from conversations between the Executive Council of the Business Law Section of the N.C. Bar Association and the N.C. Center for Nonprofits. With guidance and encouragement from Steve Poe and Tom Watkins (successive chairs of the Executive Council) and Trisha Lester (vice president of the Center), the project evolved and took form over a couple of years. Primary thanks to the principal drafters, a team of attorney volunteers of the Business Law Section: • Jean Brooks - Brooks, Pierce, McLendon, Humphrey & Leonard, LLP (Greensboro) • Benji Jones - Smith Anderson Blount Dorsett Mitchell & Jernigan, LLP (Raleigh) • Tom Lyon - Maupin Taylor & Ellis PA (Raleigh) • Alan Palmiter - Wake Forest University, School of Law (Winston-Salem) Special thanks to reviewers: • Ranlet Bell - Womble Carlyle Sandridge & Rice PLLC (Winston-Salem) • David Kyger - Smith Moore LLP (Greensboro) • Sally Migliore, N.C. Center for Nonprofits (Raleigh) • Alan Briggs, Save Our State (Raleigh) • Robert Epting, Epting & Hackney (Chapel Hill) The initial printing of the guidebook was funded by the Business Law Section. Additional copies and updates can be downloaded without charge from the websites of the Business Law Section and the N.C. Center for Nonprofits. http://business.ncbar.org/Legal+Resources/Publications/3571.aspx http://www.ncnonprofits.org February 2003 Trisha Lester, N.C. -

Rescue in Damascus Second Chance for Eevee

Oregon HumaneMAGAZINE Society fall | 2016 PICK SSTTAFFF RESCUE IN DAMASCUS 245 Animals Seized PURRFECT PICTURES TOOPP CATCAT Photo Contest Winners SECOND CHANCE FOR EEVEE Little Dog with Huge Heart OVERCOMING FELINE FEAR TOTOPTOP OTOOTHERTHER Babu’s Breakthrough TOP DOG FALL 2016 | VOL. 45 | NO. 3 OHS PHOTO BY CARLY RUSSELL CARLY BY PHOTO 1067 NE COLUMBIA BLVD. OREGON HUMANE SOCIETY HUMANE OREGON PORTLAND OR 97211 • oregonhumane.org Contents The Oregon Humane Society, is a 501(c)(3) charitable organization. OHS receives no tax page 10 money or portions of donations made to national humane organizations. Oregon Humane Society Magazine is published quarterly. Comments and OHS News Cats rescued in Lake Oswego; Nearly 250 birds seized in inquiries should be addressed to the editor. 4 Moving? Send your change of address Damascus; OHS creates emergency animal shelter. to: Oregon Humane Society Mailing List, 1067 NE Columbia Blvd., Portland, OR 97211, or email it to [email protected]. Telethon Time! Mark your calendar for Oct. 6, when the pets take EDITOR David Lytle • 503.416.2985 6 to the airwaves. [email protected] MANAGING EDITORR Cara O’Neil EDITORIAL ASSISTANTS Carol Christensen, Babu’s Journey A cat named Babu needs special help to adjust Jamie Klein, Peggy Quentin, Sara Yusavitz 7 to shelter life and find a new home. GRAPHIC DESIGN Defteling Design COVER PHOTO Winners of the 2016 OHS Photo Contest. Staff Pick, Marika Bierma; Top Cat, Sally Claycomb; Top “Other” Pet, Rescue Training A first-hand look at how volunteers from the Genna Andron; Top Dog, Wendy Smith. 9 OHS technical rescue team practice their life-saving skills. -

Responding to Issues of Homelessness in Grand Rapids Through Design Thinking Katrina Kore Grand Valley State University

Grand Valley State University ScholarWorks@GVSU Undergraduate Research Liberal Studies 4-2016 Community Kindness Walls: Responding to Issues of Homelessness in Grand Rapids through Design Thinking Katrina Kore Grand Valley State University Hector Garcia Grand Valley State University, [email protected] Tim Beardslee Grand Valley State University Jeffrey Hess Grand Valley State University, [email protected] Cameron Saghaiepour Grand Valley State University, [email protected] See next page for additional authors Follow this and additional works at: http://scholarworks.gvsu.edu/lib_undergrad Part of the Liberal Studies Commons Recommended Citation Kore, Katrina; Garcia, Hector; Beardslee, Tim; Hess, Jeffrey; Saghaiepour, Cameron; and Steenwyk, Megan, "Community Kindness Walls: Responding to Issues of Homelessness in Grand Rapids through Design Thinking" (2016). Undergraduate Research. 18. http://scholarworks.gvsu.edu/lib_undergrad/18 This Article is brought to you for free and open access by the Liberal Studies at ScholarWorks@GVSU. It has been accepted for inclusion in Undergraduate Research by an authorized administrator of ScholarWorks@GVSU. For more information, please contact [email protected]. Authors Katrina Kore, Hector Garcia, Tim Beardslee, Jeffrey Hess, Cameron Saghaiepour, and Megan Steenwyk This article is available at ScholarWorks@GVSU: http://scholarworks.gvsu.edu/lib_undergrad/18 1 Table of Contents Design Brief……………………………………………………… Page 3 Stakeholder Map…………………………………………………. Page 12 Insights Map……………………………………………………… Page 14 Stakeholder Interviews & Dialogue Summaries…………...…….. Page 15 Research Bibliography……………………………………………. Page 48 Collaborator Debriefs……………………………………………… Page 86 Summaries of Top Five Innovations………………………………. Page 93 Written Descriptions of Two Design Prototypes…………………… Page 98 Final Prototype……………………………………….…………….. Page 100 Process Presentation……………….………………….……………. Page 102 Team Video……….………………….………………….…………. Page 113 Team Narrative………….………………….…………………....…. Page 114 References……….………………….…………....……………....…. -

Estate Planning Year End 2015

Insight on Estate Planning Year End 2015 Defined-value gifts: A formula for estate planning success? Paying for LTC insurance using a tax-free exchange The family vacation home Relax — but don’t relax the rules Estate Planning Pitfall You’re selling your interest in a charitable remainder trust Defined-value gifts: A formula for estate planning success? ffluent families who wish to make large lifetime gifts should consider using Adefined-value clauses or other formula clauses to minimize or eliminate gift taxes. These clauses are especially effective when transferring assets that are difficult to value, such as closely held business interests or real estate. By defining the gift according to the amount of value you wish to transfer — rather than a per- centage interest or specified number of ownership units — you can protect yourself and your family in the event the IRS or state tax authorities challenge your valuation. Revaluation risk When you transfer difficult-to-value assets to your children or other family members, there’s a risk that the IRS, in connection with an audit of In 2017, the IRS audits Stuart’s gift tax return your gift tax return, will revalue those assets, and determines that the actual value of the triggering additional gift taxes. interest is $7 million and assesses gift taxes of $628,000 [($7 million - $5.43 million) × 40%] plus interest and penalties. A properly designed formula Hedging your bets clause can help you hedge your A properly designed formula clause can help you bets, reducing the risk that a hedge your bets, reducing the risk that a revalu- revaluation will result in an ation will result in an unwelcome gift tax bill. -

Shelter Cleaning Team VOLUNTEER HANDBOOK P a G E | 2

Shelter Cleaning Team VOLUNTEER HANDBOOK P a g e | 2 Table of Contents Location and Hours of Operation ..........................................................................3 About SAFE Haven for Cats ..................................................................................4 Policies and Procedures ........................................................................................5 About our Shelter ..................................................................................................9 Shelter Cleaning Overview .................................................................................. 11 Cleaning Instructions ........................................................................................... 12 Cage Setup ......................................................................................................... 17 Volunteering Opportunities .................................................................................. 18 Play Time Etiquette ............................................................................................. 23 Volunteer FAQs ................................................................................................... 25 Adoption FAQs .................................................................................................... 26 SAFE Haven for Cats August 2019 www.safehavenforcats.org P a g e | 3 Location and Hours of Operation Shelter Hours SAFE Haven for Cats 8431Garvey Drive, Suite 137 Raleigh, NC 27616 919-872-7233 SAFE Haven business office is -

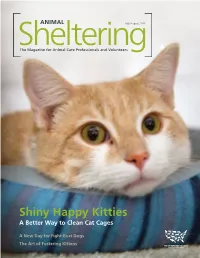

Shiny Happy Kitties a Better Way to Clean Cat Cages

July/August 2011 Shiny Happy Kitties A Better Way to Clean Cat Cages A New Day for Fight-Bust Dogs The Art of Fostering Kittens th 1927 84 2011 Shor-Line has been a leading industry craftsman for 84 years. We have done so by reinventing established product designs and engineering new innovative products. We are committed to continuous product improvement and our products showcase genuine quality, not like the other guys. Call today and rediscover quality, 888.551.4058. Visit www.shor-line.com/animalcare_as for product specific information. Use your smartphone to scan this QR Code or visit www.shor-line.com for more product information. ALSO: Jerry Lewis isn’t the only one who knows the fundraising power of telethons: At least a handful of shelters around the nation host their own annual broadcasts that reliably bring in hundreds of thousandshow it’s of donedollars. in Learn Show Mep. the 10. Money, 22 26 30 Here for a Reason Getting Real A New Day for The story of an Oklahoma puppy who The Austin Humane Society is one of Fight-Bust Dogs lived through euthanasia, had his story several shelters that have started a Law enforcement officials, the sheltering publicized on Facebook, and went on hand-feeding, enrichment, and training community, and the public used to view to get adoption applications from as far program for adoptable dogs. The results dogs seized from dogfighting rings as away as France captures the bittersweet are easy to see—a kennel that’s a too dangerous to place. The Michael Vick complexity of dramatic survival stories, pleasant environment for both people case and its ensuing media coverage of which often garner great public attention and pets. -

Other Community Resources

OTHER COMMUNITY RESOURCES Fundraising to Combat Description COVID-19 Center for Disaster The Center for Disaster Philanthropy (CDP) is the only full-time national resource dedicated to Philantrophy helping donors maximize their impact by making more intentional disaster-related giving decisions. Charity Navigator Founded in 2001, Charity Navigator has become the nation’s largest and most-utilized evaluator of charities. In our quest to help donors, our team of professional analysts has examined tens of thousands of non-profit financial documents. We’ve used this knowledge to develop an unbiased, objective, numbers-based rating system to assess over 9,000 of America’s best-known and some lesser known, but worthy, charities. Charity Watch CharityWatch—founded 25 years ago as the American Institute of Philanthropy (AIP)—is America’s most independent, assertive charity watchdog. CharityWatch does not merely repeat what a charity reports using simplistic or automated formulas. We dive deep to let you know how efficiently a charity will use your donation to fund the programs you want to support. CharityWatch exposes nonprofit abuses and advocates for your interests as a donor. Direct Relief Direct Relief is coordinating with public health authorities, nonprofit organizations and businesses in the U.S., China and globally to provide personal protective equipment and essential medical items to health workers responding to coronavirus (COVID-19). Gates Philanthrophic Gates Philanthropy PartGates Philanthropy Partners currently has two funds dedicated to Partners fighting the COVID-19 pandemic. The Combating COVID-19 Fund will help develop promising vaccines and diagnostics and protect the most vulnerable. The COVID-19 Therapeutics Accelerator Fund will expedite the process of getting new treatments to market quickly.