Chinaamc Fund Family

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

U ACCESS Variable Capital Investment Company Luxembourg

Semi-annual report, including Unaudited Financial Statements as at 30th June 2019 U ACCESS Variable Capital Investment Company Luxembourg R.C.S. Luxembourg B 189 490 No subscription can be received on the basis of these financial statements. Subscriptions are only valid if made on the basis of the current prospectus and the Key Investor Information Documents (KIIDs) supplemented by the subscription form, the latest annual report including audited financial statements and the most recent semi-annual report including unaudited financial statements, if published thereafter. U ACCESS Contents Organisation ..................................................................................................................................................... 4 Combined statement of net assets ................................................................................................................... 8 Combined statement of operations and other changes in net assets ............................................................... 9 U ACCESS - BEST SELECTION CHINA A .................................................................................................... 10 U ACCESS - DYNAMIC CHINA (launched as at 9th April 2019)..................................................................... 19 U ACCESS - GLOBAL CREDIT 2020............................................................................................................. 27 U ACCESS - GLOBAL CREDIT 2021............................................................................................................ -

Evergrande Real Estate Group (3333.HK) Scalability Potential Not

October 9, 2009 Evergrande Real Estate Group Limited March 1, 2010 ACTION Buy Evergrande Real Estate Group (3333.HK) Return Potential: 29% Scalability potential not priced in; initiate with a Buy rating Source of opportunity Investment Profile We believe that Evergrande’s current valuation does not price in the scalability Low High potential of the company on the back of its: (1) strong balance sheet with optimal Growth Growth Returns * Returns * debt structure post its recent IPO and overseas note issuance; (2) attractive land Multiple Multiple bank portfolio located in 17 key municipalities and provincial capitals throughout Volatility Volatility China, with an average land cost of only 9% of 2009 ASP; (3) a standardized Percentile 20th 40th 60th 80th 100th Evergrande Real Estate Group (3333.HK) operation and product line that helps reduce execution risks during times of rapid Asia Pacific Property Peer Group Average scale expansion; and (4) a seasoned management team that is highly motivated * Returns = Return on Capital For a complete description of the investment profile measures please refer to to achieve its growth targets. We initiate coverage on Evergrande with a Buy the disclosure section of this document. rating and a 12-month NAV-based TP of HK$4.15. Catalyst Key data Current Price (HK$) 3.21 (1) We expect stronger-than-peers property sales performance to be achieved by 12 month price target (HK$) 4.15 Market cap (HK$ mn / US$ mn) 48,150.0 / 6,202.2 Evergrande through: (a) providing affordable, quality-competitive, mid-end Foreign ownership (%) -- properties to capitalize on the fast growing housing upgrade needs of less developed provincial capitals in China, and (b) setting asset turnover rather than 12/08 12/09E 12/10E 12/11E EPS (Rmb) 0.21 0.07 0.52 0.59 margin expansion as the business objective in a policy tightening environment, EPS growth (%) (53.9) (65.8) 630.7 13.9 which we think is practical. -

Financial Street Holding Co (000402.SZ) in Line With

August 19, 2010 EARNINGS REVIEW Financial Street Holding Co (000402.SZ) Neutral Research Report In line with expectations: lacking catalysts in 2H10; stay Neutral What surprised us Investment Profile Financial Street reported 1H10 results with net profit down 33% yoy to Low High Rmb508 mn, in line and achieving 47% of our full year forecasts. Excluding Growth Growth one-off gains (revaluations, assets disposals, etc), core profit came in at Returns * Returns * Multiple Multiple Rmb277 mn, up 71% yoy. Highlights: (1) 1H10 gross margin increased Volatility Volatility 7ppt yoy mainly due to the booked high margin project, Tianjin Jinmen. Percentile 20th 40th 60th 80th 100th We expect full year margins to trend down as the contribution from lower- Financial Street Holding Co (000402.SZ) margin projects increases. (2) 1H10 contract sales lagged peers with Asia Pacific Property Peer Group Average * Returns = Return on Capital For a complete description of the Rmb2.7 bn achieved or 39% of our full year target of Rmb7.1 bn vs. peers’ investment profile measures please refer to c. 54%, due to limited new launches. We expect 2H10 contract sales to the disclosure section of this document. slightly improve driven by more launches but see little chance of a Key data Current surprise on the upside. (3) Investment properties operations were on Price (Rmb) 7.44 12 month price target (Rmb) 6.85 track in 1H10 with 43% of ‘10E full year revenue estimates of Rmb799 mn Market cap (Rmb mn / US$ mn) 22,521.5 / 3,315.8 achieved and we expect them to contribute c. -

Annual Report 2018 ANNUAL REPORT 2018

Gensler Annual Report 2018 ANNUAL REPORT 2018 ONE COMMUNITY 1 Gensler Annual Report 2018 Every day, by using innovation and creativity, people at Gensler solve important challenges through our work. This is what Gensler is built for—we thrive on the challenges that our clients bring us on projects of all types and scales, from the everyday to the complex. In fact, over the past year we worked with our clients on an amazing 10,000 projects in 2,500 cities. Each project was unique and vital to the future. To make the greatest positive impact on the world around us, Gensler is organized as a single cohesive community that’s connected across the globe, working with shared values and shared purpose. This year, we reshaped our network as One Community that’s able to bring Gensler’s unique strengths to the marketplace and drive transformation for our clients anywhere in the world. This annual report highlights four key areas that go to the core of who we are. We take pride in the fact that we are an industry leader in diversity, with the understanding that assembling a team of people from diverse backgrounds and with different perspectives fuels our ability to practice in over 90 countries, designing every- thing from office furniture to major sports stadiums. We’re also making significant investments in platforms that drive innovation, developing our own software applications, invest- ing in data-driven design, hiring talented leaders from related fields, and growing in ways that will allow exciting new partnerships with our clients. With offices in 48 locations, we have committed to a greater focus on community impact, enriching the human experi- ence through active engagement with community, charitable, civic, and not-for-profit organizations in our cities. -

What Is a Land Rich Company?

No provision for capital gains tax (CGT) will be derived from the trading of A-shares, bar those derived from the trading of PRC resident enterprises defined as “Land Rich Companies”. Further, Z-Ben Advisors believe that this LRC provision extends to HK-domiciled RQFII funds only. The European outlook suggests that no withholding provision will be made as stated by Source/CSOP in their CSOP Source FTSE China A50 UCITS ETF prospectus, we expect Deutsche Bank/Harvest to follow suit with their db x-trackers Harvest CSI300 Index UCITS ETF . Below is Z-Ben Advisors’ LRC breakdown of what we understand constitutes a Land Rich Company and what proportion these contribute to the CSI 300 and FTSE China A50 indices. Land Rich Companies CSI 300 Weight: 12.15% 50 45 45 Real Estate Sector Port and Railway Sector 40 Beijing Tianhong Baoye Real Estate Co Ltd Daqin Railway Co Ltd 35 China Merchants Property Development Co Ltd Ningbo Port Co Ltd China Vanke Co Ltd 30 Shanghai International Airport Co Ltd Financial Street Holding Co Ltd 25 Shanghai International Port (Group) Co Ltd 20 Gemdale Corporation Poly Real Estate Group Co Ltd Oil and Gas Sector 15 A Risesun Real Estate Development Co Ltd China Petroleum and Chemical Corp (Sinopec) 10 7 Shanghai Lujiazui Finance and Trade Zone Development Co Ltd PetroChina Co Ltd 5 Shanghai Oriental Pearl (Group) Co Ltd Mining Sector 0 Shanghai Wai Gaoqiao Free Trade Zone Development Co Ltd CSI 300 FTSE China A 50 Aluminum Corporation of China Limited Shanghai Yuyuan Tourist Mart Co Ltd Anhui Hengyuan Coal Industry and Electricity Power Co Ltd Shanghai Zhangjiang Hi-tech Park Development Co Ltd Chenzhou Mining Group Co Ltd Shenzhen Overseas Chinese Town Co Ltd China Coal Energy Co Ltd Suning Universal Co Ltd China Molybdenum Co., Ltd. -

FTSE Publications

2 FTSE Russell Publications FTSE MPF Asia Pacific ex Japan 19 August 2021 Australia & New Zealand Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 360 Security (A) (SC SH) <0.005 CHINA Anta Sports Products (P Chip) 0.36 CHINA Bank of Jiangsu (A) (SC SH) 0.01 CHINA 3M India 0.01 INDIA Apollo Hospitals Enterprise 0.07 INDIA Bank Of Nanjing (A) (SC SH) 0.02 CHINA 3SBio (P Chip) 0.02 CHINA ASE Technology Holding 0.19 TAIWAN Bank of Ningbo (A) (SC SZ) 0.03 CHINA AAC Technologies Holdings 0.07 HONG Ashok Leyland 0.03 INDIA Bank of Qingdao (A) (SC SZ) <0.005 CHINA KONG Asia Cement 0.06 TAIWAN Bank of Shanghai (A) (SC SH) 0.02 CHINA ABB India 0.02 INDIA Asian Paints 0.25 INDIA Bank of Suzhou (A) (SC SZ) <0.005 CHINA Aboitiz Power 0.01 PHILIPPINES ASM Pacific Technology 0.06 HONG Bank of The Philippine Islands 0.04 PHILIPPINES ACC 0.03 INDIA KONG Bank of ZhengZhou (A) (SC SZ) <0.005 CHINA Accton Technology 0.09 TAIWAN ASMedia Technology 0.03 TAIWAN Bank Rakyat Indonesia 0.2 INDONESIA Acer 0.04 TAIWAN Asset World 0.01 THAILAND Banpu 0.03 THAILAND ADAMA (A) (SC SZ) <0.005 CHINA Astra Agro Lestari <0.005 INDONESIA Baoshan Iron & Steel (A) (SC SH) 0.02 CHINA Adani Enterprises 0.07 INDIA Astra International 0.09 INDONESIA Barito Pacific 0.02 INDONESIA Adani Gas 0.05 INDIA Astral 0.03 INDIA Bata India 0.02 INDIA Adani Green Energy 0.08 INDIA Astro Malaysia Holdings 0.01 MALAYSIA Bayer Cropscience 0.01 INDIA Adani Ports and Special -

FTSE Global All Cap Ex Canada China a Inclusion

FTSE Russell Publications FTSE Global All Cap ex Canada 20 May 2018 China A Inclusion Indicative Index Weight Data as at Closing on 30 March 2018 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 Drillisch 0.01 GERMANY Ace Hardware Indonesia <0.005 INDONESIA Aegon NV 0.02 NETHERLANDS 1st Source <0.005 USA Acea <0.005 ITALY Aena SME SA 0.03 SPAIN 21Vianet Group (ADS) (N Shares) <0.005 CHINA Acer <0.005 TAIWAN Aeon 0.02 JAPAN 2U 0.01 USA Acerinox <0.005 SPAIN AEON DELIGHT <0.005 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Achilles <0.005 JAPAN Aeon Fantasy <0.005 JAPAN 3-D Systems <0.005 USA ACI Worldwide 0.01 USA AEON Financial Service 0.01 JAPAN 3i Group 0.02 UNITED Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN KINGDOM Acom <0.005 JAPAN AerCap Holdings N.V. 0.01 USA 3M Company 0.25 USA Acorda Therapeutics <0.005 USA Aerie Pharmaceuticals Inc <0.005 USA 3SBio (P Chip) <0.005 CHINA ACS Actividades Cons y Serv 0.02 SPAIN Aeroflot <0.005 RUSSIA 51job ADR (N Shares) <0.005 CHINA Activision Blizzard 0.1 USA Aerojet Rocketdyne Holdings <0.005 USA 58.com ADS (N Shares) 0.01 CHINA Actuant Corp <0.005 USA Aeroports de Paris 0.01 FRANCE 77 Bank <0.005 JAPAN Acuity Brands Inc 0.01 USA Aerospace Communications Holdings (A) <0.005 CHINA 888 Holdings <0.005 UNITED Acxiom Corp <0.005 USA Aerospace Hi-Tech (A) <0.005 CHINA KINGDOM Adana Cimento(A) <0.005 TURKEY Aerosun (A) <0.005 CHINA 8x8 <0.005 USA Adani Enterprises <0.005 INDIA AeroVironment <0.005 USA A P Moller - Maersk A 0.01 DENMARK Adani Ports and Special Economic Zone 0.01 INDIA AES Corp. -

Index Weight Data As at Closing on 27 October 2020

2 FTSE Russell Publications 28 October 2020 FTSE Emerging Indicative Index Weight Data as at Closing on 27 October 2020 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 360 Security (A) (SC SH) <0.005 CHINA AMMB Holdings 0.02 MALAYSIA Bajaj Holdings & Investment 0.01 INDIA 3M India 0.01 INDIA Anadolu Efes 0.01 TURKEY Balkrishna Industries 0.02 INDIA 3SBio (P Chip) 0.02 CHINA Angang Steel (A) (SC SZ) <0.005 CHINA Banca Transilvania S.A. 0.04 ROMANIA 51job ADS (N Shares) 0.03 CHINA Angang Steel (H) 0.01 CHINA Banco Bradesco S/A Ord 0.07 BRAZIL ABB India 0.01 INDIA Angel Yeast (A) (SC SH) 0.01 CHINA Banco Bradesco S/A Pref. 0.28 BRAZIL Abdullah Al Othaim Markets 0.03 SAUDI ARABIA Anglo American Platinum 0.08 SOUTH AFRICA Banco de Chile 0.06 CHILE Aboitiz Power 0.02 PHILIPPINES Anglogold Ashanti 0.17 SOUTH AFRICA Banco de Credito 0.03 CHILE Absa Group Limited 0.07 SOUTH AFRICA Anhui Anke Biotechnology (Group) (A) (SC <0.005 CHINA Banco Do Brasil ON 0.08 BRAZIL Abu Dhabi Commercial Bank 0.07 UAE SZ) Banco do Estado do Rio Grande do Sul PN 0.01 BRAZIL Abu Dhabi Islamic Bank 0.03 UAE Anhui Conch Cement (A) (SC SH) 0.04 CHINA B ACC 0.02 INDIA Anhui Conch Cement (H) 0.13 CHINA Banco Inter 0.01 BRAZIL Accton Technology 0.06 TAIWAN Anhui Expressway (A) (SC SH) <0.005 CHINA Banco Inter S.A. -

Interim Financial Statements Global X Etf Series

INTERIM FINANCIAL STATEMENTS GLOBAL X ETF SERIES GLOBAL X MSCI CHINA ETF GLOBAL X HANG SENG HIGH DIVIDEND YIELD ETF GLOBAL X CSI 300 ETF GLOBAL X CHINA BIOTECH ETF GLOBAL X CHINA CLOUD COMPUTING ETF FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2020 (SUB-FUNDS OF GLOBAL X ETF SERIES) GLOBAL X ETF SERIES Unaudited Condensed Interim Financial Statements CONTENTS Page Interim financial statements Statement of net assets (Unaudited) 1 - 2 Statement of profit or loss and other comprehensive income (Unaudited) 3 Statement of changes in net assets attributable to unitholders (Unaudited) 4 Statement of cash flows (Unaudited) 5 - 9 Notes to the financial statements (Unaudited) 10 - 39 Investment portfolio (Unaudited) 40 - 62 Statement of movements in investment portfolio (Unaudited) 63 - 93 Performance record (Unaudited) 94 - 95 Management and administration 96 IMPORTANT: Any opinion expressed herein reflects the Manager’s view only and is subject to change. For more information about the Global X ETF Series, please refer to the prospectus of Global X ETF Series which is available at our website: www.globalxetfshk.com. Investors should not rely on the information contained in this report for their investment decisions. GLOBAL X ETF SERIES STATEMENT OF NET ASSETS As at 30 September 2020 (unaudited) Global X MSCI Global X Hang Seng High China ETF Dividend Yield ETF Global X CSI 300 ETF Global X China Biotech ETF As at As at As at As at As at As at As at As at 30 September 31 March 30 September 31 March 30 September 31 March 30 September 31 March 2020 2020 -

Return of Private Foundation 990-PF

Return of Private Foundation OMB No. 1545-0052 Form 990-PF or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation Department of the Treasury 2011 Internal Revenue Service Note. The foundation may be able to use a copy of this return to satisfy state reporting requirements. For calendar year 2011 or tax year beginning , and ending Name of foundation A Employer identification number Number and street (or P.O. box number if mail is not delivered to street address) Room/suite B Telephone number City or town, state, and ZIP code C If exemption application is pending, check here~| G Check all that apply: Initial return Initial return of a former public charityD1. Foreign organizations, check here ~~| Final return Amended return Foreign organizations meeting the 85% test, Address change Name change2. check here and attach computation ~~~~| H Check type of organization: Section 501(c)(3) exempt private foundation E If private foundation status was terminated Section 4947(a)(1) nonexempt charitable trust Other taxable private foundationunder section 507(b)(1)(A), check here ~ | IJFair market value of all assets at end of year Accounting method: Cash Accrual F If the foundation is in a 60-month termination (from Part II, col. (c), line 16) Other (specify) under section 507(b)(1)(B), check here ~| | $ (Part I, column (d) must be on cash basis.) Part I Analysis of Revenue and Expenses (a) Revenue and (b) Net investment (c) Adjusted net (d) Disbursements (The total of amounts in columns (b), (c), and (d) may not for charitable purposes necessarily equal the amounts in column (a).) expenses per books income income (cash basis only) 1 Contributions, gifts, grants, etc., received ~~~ 2 Check | if the foundation is not required to attach Sch. -

2010 ADDITIONAL INFORMATION Page 4 of 44 4

2010 ANNUAL REPORT ADDITIONAL INFORMATION Annual Report 2010 – Additional Information I. Tables of returns 1. Auditors’ Report ................................................................................................. 1 2. General Notes .................................................................................................... 4 3. Short Term Investments ....................................................................................... 6 4. Real Return Bonds .............................................................................................. 8 5. Long Term Bonds ............................................................................................... 10 6. Bonds .............................................................................................................. 12 7. Bonds - Fixed Income ......................................................................................... 14 8. Canadian Equity ................................................................................................ 16 9. Publicly Traded Canadian Equity Markets ............................................................. 18 10. EAFE Foreign Equity .......................................................................................... 20 11. U.S. Equity ....................................................................................................... 22 12. Emerging Markets Equity .................................................................................... 24 13. Publicly Traded Emerging Market Equity -

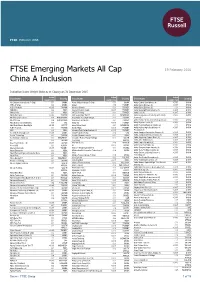

FTSE Emerging Markets All Cap China a Inclusion

FTSE PUBLICATIONS FTSE Emerging Markets All Cap 19 February 2016 China A Inclusion Indicative Index Weight Data as at Closing on 31 December 2015 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 361 Degrees International (P Chip) 0.01 CHINA Ajisen China Holdings (P Chip) 0.01 CHINA Anhui Golden Seed Winery (A) <0.005 CHINA 3SBio (P Chip) 0.03 CHINA Akbank 0.13 TURKEY Anhui Gujing Distillery (A) <0.005 CHINA A.G.V. Products <0.005 TAIWAN Akcansa Cimento 0.01 TURKEY Anhui Gujing Distillery (B) 0.01 CHINA ABB India 0.02 INDIA Akenerji Elektrik Uretim <0.005 TURKEY Anhui Guofeng Plastic Industry (A) <0.005 CHINA Abbott India 0.01 INDIA AKFEN Holding 0.01 TURKEY Anhui Heli (A) <0.005 CHINA Ability Enterprise <0.005 TAIWAN AKR Corporindo Tbk PT 0.02 INDONESIA Anhui Hengyuan Coal Industry & Electricity <0.005 CHINA Aboitiz Equity Ventures 0.08 PHILIPPINES Aksa Akrilik Ve Kimya Sanayii 0.01 TURKEY Power (A) Aboitiz Power 0.04 PHILIPPINES Aksa Enerji Uretim AS 0.01 TURKEY Anhui Honglu Steel Construction (group) (A) <0.005 CHINA Abu Dhabi Commercial Bank 0.09 UAE Aksigorta <0.005 TURKEY Anhui Huamao Textile (A) <0.005 CHINA Abu Dhabi Islamic Bank Egypt <0.005 EGYPT Alam Sutera Realty 0.01 INDONESIA Anhui Huaxing Chemical Industry (A) 0.01 CHINA AcBel Polytech 0.01 TAIWAN Alarko Hldgs <0.005 TURKEY Anhui Huilong Agricultural Means of <0.005 CHINA ACC 0.03 INDIA Albaraka Turk Katilim Bankasi AS <0.005 TURKEY Production (A) Accelink Technologies (A) <0.005 CHINA Aldar Properties PJSC 0.06 UAE Anhui Jianghuai Automotive Chassis (A) <0.005 CHINA Accton Technology 0.01 TAIWAN Alembic Pharmaceuticals 0.01 INDIA Anhui Jiangnan Chemical Industry (A) <0.005 CHINA Ace Hardware Indonesia 0.01 INDONESIA Alexander Forbes Equity Holdings 0.01 SOUTH Anhui Jingcheng Copper Share (A) <0.005 CHINA Acer 0.03 TAIWAN Proprietary AFRICA Anhui Jinhe Industrial (A) <0.005 CHINA Aces Electronic Co.