Evergrande Real Estate Group (3333.HK) Scalability Potential Not

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

* This Document Is Important and Requires Your

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this document, you should consult your licensed securities dealer, bank manager, Sch I front page solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Henderson China Holdings Limited, you should at once hand this document and the accompanying forms of proxy to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this document, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. * (Stock Code: 0246) PROPOSED PRIVATISATION BY BY WAY OF A SCHEME OF ARRANGEMENT (UNDER SECTION 99 OF THE COMPANIES ACT 1981 OF BERMUDA) INVOLVING THE CANCELLATION OF ALL THE ISSUED SHARES OF HK$1.00 EACH IN HENDERSON CHINA HOLDINGS LIMITED HELD BY THE SCHEME SHAREHOLDERS (AS DEFINED HEREIN) Financial Adviser to Henderson Land Development Company Limited Sch I Para 1 Independent financial adviser to the Independent Board Committee (as defined herein) of Henderson China Holdings Limited A letter from the board of directors of Henderson China Holdings Limited is set out on pages 8 to 17 of this document. An explanatory statement regarding the Proposal (as defined herein) is set out on pages 46 to 63 of this document. -

ANNUAL REPORT ADDITIONAL INFORMATION All Figures in This Document Are Expressed in Canadian Dollars, Unless Otherwise Indicated

2009 ANNUAL REPORT ADDITIONAL INFORMATION All figures in this document are expressed in Canadian dollars, unless otherwise indicated. This publication, as well as the 2009 Annual Report, are available at www.lacaisse.com. Information: 514 842-3261 [email protected] Ce document, de même que le Rapport annuel 2009, sont disponibles en français sur www.lacaisse.com. Legal Deposit – Bibliothèque et Archives nationales du Québec, 2010 50% Annual Report 2009 – Additional Information I. Tables of returns 1. Auditors’ Report ................................................................................................. 1 2. General Notes .................................................................................................... 2 3. Short Term Investments ....................................................................................... 4 4. Real Return Bonds ............................................................................................... 6 5. Long Term Bonds ................................................................................................. 8 6. Bonds .............................................................................................................. 10 7. Bonds - Fixed Income .......................................................................................... 12 8. Canadian Equity ................................................................................................ 14 9. Publicly Traded Canadian Equity Markets ............................................................. -

For Personal Use Only Use Personal For

13 November 2014 Norton Rose Fulbright Australia ABN 32 720 868 049 Level 15, RACV Tower 485 Bourke Street MELBOURNE VIC 3000 AUSTRALIA Tel +61 3 8686 6000 Company Announcements Fax +61 3 8686 6505 Australian Securities Exchange GPO Box 4592, Melbourne VIC 3001 Level 2 120 King Street DX 445 Melbourne MELBOURNE VIC 3000 nortonrosefulbright.com Direct line +61 3 8686 6710 Email [email protected] Our reference: 2813782 Dear Sir/Madam Takeover bid by Transcendent Resources Limited for Roc Oil Company Limited (ROC) – interests of substantial holder We act for Transcendent Resources Limited ( Fosun ) and its associated companies and controllers, which includes Fosun International Limited ( Fosun Parties ) in relation to Fosun’s off-market takeover bid for all of the ordinary shares in Roc Oil Company Limited ( ROC ). On behalf of the Fosun Parties and in accordance with section 671B of the Corporations Act 2001 (Cth), we enclose a notice of change of interests of substantial holder in respect of ROC ( Form 604 ). This notice will be provided to ROC today. Yours faithfully James Stewart Partner Norton Rose Fulbright Australia Encl. For personal use only APAC-#24924633-v1 Norton Rose Fulbright Australia is a law firm as defined in the Legal Profession Acts of the Australian states and territory in which it practises. Norton Rose Fulbright Australia, Norton Rose Fulbright LLP, Norton Rose Fulbright Canada LLP, Norton Rose Fulbright South Africa (incorporated as Deneys Reitz Inc) and Fulbright & Jaworski LLP, each of which is a separate legal entity, are members of Norton Rose Fulbright Verein, a Swiss Verein. -

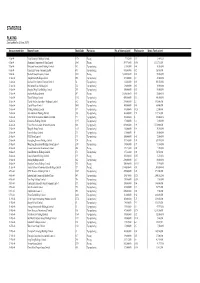

PLACING (Last Updated on 22 June 2007)

STATISTICS PLACING (Last updated on 22 June 2007) Announcement date Name of issuer Stock Code Particulars No. of shares placed Placing price Gross Funds raised (HK$) 5-Jan-04 Vitop Bioenergy Holdings Limited 1178 Placing 7,752,000 0.31 2,403,120 6-Jan-04 Aluminum Corporation of China Limited 2600 Placing 549,976,000 5.658 3,111,764,208 7-Jan-04 Perfectech International Holdings Limited 765 Top-up placing 21,000,000 0.68 14,280,000 8-Jan-04 China Eagle Group Company Limited 493 Top-up placing 473,000,000 0.12 56,760,000 9-Jan-04 Medtech Group Company Limited 1031 Placing 5,000,000,000 0.01 50,000,000 12-Jan-04 Tongda Group Holdings Limited 698 Top-up placing 227,500,000 0.2 45,500,000 13-Jan-04 Kowloon Development Company Limited 34 Top-up placing 83,000,000 6.85 568,550,000 13-Jan-04 Millennium Sense Holdings Ltd 724 Top-up placing 30,000,000 0.63 18,900,000 13-Jan-04 Shanghai Ming Yuan Holdings Limited 233 Top-up placing 100,000,000 0.55 55,000,000 13-Jan-04 Starbow Holdings Limited 397 Placing 2,000,000,000 0.01 20,000,000 13-Jan-04 Titan (Holdings) Limited 1192 Top-up placing 450,000,000 0.92 414,000,000 15-Jan-04 Chaoda Modern Agriculture (Holdings) Limited 682 Top-up placing 280,000,000 2.5 683,000,000 15-Jan-04 Capital Prosper Limited 1003 Top-up placing 140,000,000 0.05 68,000,000 15-Jan-04 Paliburg Holdings Limited 617 Top-up placing 180,000,000 0.128 22,500,000 15-Jan-04 Asia Aluminum Holdings Limited 930 Top-up placing 332,000,000 1.56 517,920,000 15-Jan-04 Silver Grant International Industries Limited 171 Top-up placing 165,000,000 -

Shanghai Forte Land Co., Ltd.*

14.63(2)(c) THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt about this circular or as to the action to be taken, you should consult your stockbroker, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Shanghai Forte Land Co., Ltd.*, you should at once hand this circular to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchange and Clearing Limited and The Stock Exchange of Hong Kong Limited take no 14.58(1) responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. App1B1 SHANGHAI FORTE LAND CO., LTD.* (a sino-foreign joint stock company incorporated in the People’s Republic of China with limited liability) 13.51A (Stock Code: 02337) MAJOR TRANSACTION ACQUISITION OF THE ENTIRE ISSUED QUOTAS IN THE CAPITAL OF GARDEN PLAZA CAPITAL SRL A letter from the Board is set out on pages 5 to 10 of this circular. * For identification purpose only 25 June 2010 CONTENTS pages Definitions ............................................................... 1 Letter from the Board ..................................................... 5 Appendix I — Financial Information of the Group .......................... I-1 Appendix II — Financial information of the Target Group .................... II-1 Appendix III — Unaudited pro forma financial information of the Enlarged Group ...................................III-1 Appendix IV — Valuation Report .........................................IV-1 Appendix V — General Information ..................................... -

U ACCESS Variable Capital Investment Company Luxembourg

Semi-annual report, including Unaudited Financial Statements as at 30th June 2019 U ACCESS Variable Capital Investment Company Luxembourg R.C.S. Luxembourg B 189 490 No subscription can be received on the basis of these financial statements. Subscriptions are only valid if made on the basis of the current prospectus and the Key Investor Information Documents (KIIDs) supplemented by the subscription form, the latest annual report including audited financial statements and the most recent semi-annual report including unaudited financial statements, if published thereafter. U ACCESS Contents Organisation ..................................................................................................................................................... 4 Combined statement of net assets ................................................................................................................... 8 Combined statement of operations and other changes in net assets ............................................................... 9 U ACCESS - BEST SELECTION CHINA A .................................................................................................... 10 U ACCESS - DYNAMIC CHINA (launched as at 9th April 2019)..................................................................... 19 U ACCESS - GLOBAL CREDIT 2020............................................................................................................. 27 U ACCESS - GLOBAL CREDIT 2021............................................................................................................ -

Shanghai Forte Land Co., Ltd.*

14.63(2)(b) THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION 14A.58(3)(b) If you are in any doubt about this circular or as to the action to be taken, you should consult your stockbroker, 14.63(2)(b) bankmanager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Shanghai Forte Land Co., Ltd.*, you should at once hand this circular 14A.58(3)(b) to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchange and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for 14.58(1) the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any 14A.59(1) liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. App1B1 SHANGHAI FORTE LAND CO., LTD.* (a sino-foreign joint stock company incorporated in the People’s Republic of China with limited liability) 13.51A (Stock Code: 02337) MAJOR AND CONNECTED TRANSACTION TRANSFER OF A 30% EQUITY INTEREST IN JV COMPANY AND CONNECTED TRANSACTION DOMESTIC SHARE ISSUE Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders of the Company SOMERLEY LIMITED A letter from the Board is set out on pages 1 to 10 of this circular. A letter from the Independent Board Committee which contains recommendations to the Independent Shareholders in respect of the Equity Transfer Agreement and the Capital Injection Agreement is set out on page 11 of this circular. -

Fosun International Limited Shanghai Forte Land Co., Ltd.*

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no 14.58(1) Note 5 to responsibility for the contents of this announcement, make no representation as to its accuracy or completeness 13.52 and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. FOSUN INTERNATIONAL LIMITED (Incorporated in Hong Kong with limited liability SHANGHAI FORTE LAND CO., LTD.* (a sino-foreign joint stock limited company incorporated in the under the Companies Ordinance) People’s Republic of China with limited liability) (Stock Code: 00656) (Stock Code: 02337) 13.51A JOINT ANNOUNCEMENT TRANSFER OF A 30% EQUITY INTEREST IN JV COMPANY MAJOR AND CONNECTED TRANSACTIONS Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders of Forte SOMERLEY LIMITED EQUITY INTEREST IN JV COMPANY Forte Investment, a subsidiary of Forte, and Zhejiang Fosun, a subsidiary of Fosun, entered into the Equity Transfer Agreement on 28 June 2010, whereby Zhejiang Fosun has agreed to acquire the Investment (comprising of a capital contribution in the amount of RMB300,000,000 (equivalent to approximately HK$343,697,729) and the Shareholder Loan in the amount of RMB1,300,000,000 (equivalent to approximately HK$1,489,356,827)) and take up all the rights and obligations of Forte Investment under the Joint Investment Agreement (including the Outstanding Financial Commitment) for a consideration of RMB1,600,000,000 (equivalent to approximately HK$1,833,054,556). As all of the applicable percentage ratios (as defined under Rule 14.04(9) of the Hong Kong Listing Rules) in relation to the Transfer are below 5%, the Transfer does not constitute a discloseable transaction of Fosun under Chapter 14 of the Hong Kong Listing Rules. -

International Cross-Listing Information for Chinese Firms

Appendix APPENDIX 1: INTERNATIONAL CROSS-LISTING INFORMATION FOR CHINESE FIRMS Table 1.1. Chinese firms listed on Hong Kong Stock Exchange Mainboard (Sources: Hong Kong Stock Exchange website, by December 31st, 2012) Company Listing Date Stock Code Industry Advanced Semiconductor April 7, 2006 3355 Semiconductors Manufacturing Corporation Ltd Agricultural Bank of China Ltd July 16, 2010 1288 Banks Air China Ltd December 15, 2004 753 Travel & Leisure Industrial Metals & Aluminum Corporation of China Ltd December 12, 2001 2600 Mining Industrial Metals & Angang Steel Co Ltd July 24, 1997 347 Mining Construction and Anhui Conch Cement Co Ltd October 21, 1997 914 Material Industrial Anhui Expressway Co Ltd November 13, 1996 995 Transportation Anhui Tianda Oil Pipe Co Ltd December 1, 2002 839 Industrial Supplier AviChina Industry & Technology October 30, 2003 2357 Industrial Engineering Co Ltd Bank of China Ltd June 1, 2006 3988 Banks Bank of Communications Co, Ltd June 23, 2005 3328 Banks Baoye Group Co Ltd June 30, 2003 2355 Industrial Construction BBMG Corporation July 29, 2009 2009 Industrial Metals Beijing Capital International Airport February 1, 2000 694 Travel and Leisure Co Ltd Real Estate Investment Beijing Capital Land Ltd June 19, 2003 2868 & Service Beijing Jingkelong Co Ltd February 26, 2008 814 Personal Goods Beijing Jingneng Clean Energy Co December 22, 2011 579 Electricity Ltd Beijing Media Corporation Ltd December 22, 2004 1000 Media Real Estate Investment Beijing North Star Co Ltd May 14, 1997 588 & Service Beiren Printing Machinery Holdings August 6, 1993 187 Industrial Engineering Ltd BYD Co Ltd July 31, 2002 1211 Industrial Products Software and Computer Capinfo Co Ltd December 21, 2001 1075 Services continued on following page 242 Appendix Table 1.1. -

Annual Report 03

2 Corporate Profile 4 Corporate and Shareholder Information 6 Financial Highlights Contents 7 Project Overview 10 Chairman’s Statement 12 Management Discussion and Analysis 32 Profile of Directors, Supervisors and Senior Management 37 Corporate Governance Report 43 Report of the Directors 50 Report of the Supervisory Committee 51 Independent Auditors’ Report 53 Consolidated Income Statement 54 Balance Sheets 56 Consolidated Statement of Changes in Equity 58 Consolidated Cash Flow Statement 60 Notes to Financial Statements 145 Notice of Annual General Meeting Corporate Profile Tianjin ︱ Forte . Tianjin Centre 2008 Annual Report 03 Corporate Profile Shanghai Forte Land Co., Ltd. (“Forte” or the “Company”), together with its subsidiaries collectively known as the “Group”, has been listed on the Main Board of The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) (stock code: 02337) since 6 February 2004. The Company is headquartered in Shanghai, the PRC. Adhering to the “For Better Living” motto, the Company develops high value living, working and leisure space for China’s new urban middle class. Existing projects span international metropolises such as Shanghai and Beijing, regional centers such as Tianjin, Wuhan, Chongqing, Chengdu, Xi’an and Changchun, and Yangtze River Delta cities such as Hangzhou, Nanjing and Wuxi. Corporate and Shareholder Information Corporate Information Board of Directors Strategy Committee Company Website Mr. Guo Guangchang (chairman) www.forte.com.cn Executive Directors Mr. Fan Wei Mr. Guo Guangchang (chairman) Mr. Charles Nicholas Brooke Principal Place of Business in Mr. Fan Wei (president) Mr. Zhang Hongming Hong Kong Mr. Wang Zhe Level 28 Supervisory Committee Three Pacific Place Non-Executive Directors Mr. -

Investment in Shui on Land Limited Very Substantial Acquisition and Connected Transactions

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Shui On Construction and Materials Limited, you should at once hand this circular and the accompanying form of proxy to the purchaser or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or the transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this circular, makes no 14.40 representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. * (Incorporated in Bermuda with limited liability) INVESTMENT IN SHUI ON LAND LIMITED App. 1B VERY SUBSTANTIAL ACQUISITION AND CONNECTED TRANSACTIONS Independent Financial Adviser to the Independent Board Committee A letter from the Independent Board Committee is set out on page 30 of this circular. A letter from BNP Paribas Peregrine Capital Limited, the independent financial adviser to the Independent Board Committee is set out on pages 31 to 44 of this circular. A notice convening a special general meeting of Shui On Construction and Materials Limited to be held at Room 103, 1/F Shui On Centre, 6-8 Harbour Road, Wanchai, Hong Kong, 2:30 p.m. -

Financial Street Holding Co (000402.SZ) in Line With

August 19, 2010 EARNINGS REVIEW Financial Street Holding Co (000402.SZ) Neutral Research Report In line with expectations: lacking catalysts in 2H10; stay Neutral What surprised us Investment Profile Financial Street reported 1H10 results with net profit down 33% yoy to Low High Rmb508 mn, in line and achieving 47% of our full year forecasts. Excluding Growth Growth one-off gains (revaluations, assets disposals, etc), core profit came in at Returns * Returns * Multiple Multiple Rmb277 mn, up 71% yoy. Highlights: (1) 1H10 gross margin increased Volatility Volatility 7ppt yoy mainly due to the booked high margin project, Tianjin Jinmen. Percentile 20th 40th 60th 80th 100th We expect full year margins to trend down as the contribution from lower- Financial Street Holding Co (000402.SZ) margin projects increases. (2) 1H10 contract sales lagged peers with Asia Pacific Property Peer Group Average * Returns = Return on Capital For a complete description of the Rmb2.7 bn achieved or 39% of our full year target of Rmb7.1 bn vs. peers’ investment profile measures please refer to c. 54%, due to limited new launches. We expect 2H10 contract sales to the disclosure section of this document. slightly improve driven by more launches but see little chance of a Key data Current surprise on the upside. (3) Investment properties operations were on Price (Rmb) 7.44 12 month price target (Rmb) 6.85 track in 1H10 with 43% of ‘10E full year revenue estimates of Rmb799 mn Market cap (Rmb mn / US$ mn) 22,521.5 / 3,315.8 achieved and we expect them to contribute c.