Growing the Aviation Industry in the North and North West Queensland Region

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Australian Diurnal Raptors and Airports

Australian diurnal raptors and airports Photo: John Barkla, BirdLife Australia William Steele Australasian Raptor Association BirdLife Australia Australian Aviation Wildlife Hazard Group Forum Brisbane, 25 July 2013 So what is a raptor? Small to very large birds of prey. Diurnal, predatory or scavenging birds. Sharp, hooked bills and large powerful feet with talons. Order Falconiformes: 27 species on Australian list. Family Falconidae – falcons/ kestrels Family Accipitridae – eagles, hawks, kites, osprey Falcons and kestrels Brown Falcon Black Falcon Grey Falcon Nankeen Kestrel Australian Hobby Peregrine Falcon Falcons and Kestrels – conservation status Common Name EPBC Qld WA SA FFG Vic NSW Tas NT Nankeen Kestrel Brown Falcon Australian Hobby Grey Falcon NT RA Listed CR VUL VUL Black Falcon EN Peregrine Falcon RA Hawks and eagles ‐ Osprey Osprey Hawks and eagles – Endemic hawks Red Goshawk female Hawks and eagles – Sparrowhawks/ goshawks Brown Goshawk Photo: Rik Brown Hawks and eagles – Elanus kites Black‐shouldered Kite Letter‐winged Kite ~ 300 g Hover hunters Rodent specialists LWK can be crepuscular Hawks and eagles ‐ eagles Photo: Herald Sun. Hawks and eagles ‐ eagles Large ‐ • Wedge‐tailed Eagle (~ 4 kg) • Little Eagle (< 1 kg) • White‐bellied Sea‐Eagle (< 4 kg) • Gurney’s Eagle Scavengers of carrion, in addition to hunters Fortunately, mostly solitary although some multiple strikes on aircraft Hawks and eagles –large kites Black Kite Whistling Kite Brahminy Kite Frequently scavenge Large at ~ 600 to 800 g BK and WK flock and so high risk to aircraft Photo: Jill Holdsworth Identification Beruldsen, G (1995) Raptor Identification. Privately published by author, Kenmore Hills, Queensland, pp. 18‐19, 26‐27, 36‐37. -

Aerospace Action Plan Progress Report

QUEENSLAND AEROSPACE 10-Year Roadmap and Action Plan PROGRESS REPORT By 2028, the Queensland aerospace industry will be recognised as a leading centre in Australasia and South East Asia for aerospace innovation in training; niche manufacturing; maintenance, repair and overhaul (MRO); and unmanned aerial systems (UAS) applications for military and civil markets. Launch Completion 2018 2028 International border closures due to COVID-19 had a dramatic impact on the aerospace industry in Queensland, particularly the aviation sector. Despite this temporary industry downturn, the Queensland Government has continued to stimulate the aerospace industry through investment in infrastructure, technology and international promotion. I look forward to continuing to champion Queensland aerospace businesses, taking the industry to new heights. The Honourable Steven Miles MP DEPUTY PREMIER and MINISTER FOR STATE DEVELOPMENT Case study – Queensland Flight Test Range in Cloncurry The Queensland Government has invested $14.5 million to establish the foundation phase of a common-user flight test range with beyond visual line of sight capabilities at Cloncurry Airport. The Queensland Flight Test Range (QFTR) provides a critical missing element in the UAS ecosystem for industry and researchers to test and develop complex technologies. Operated by global defence technology company QinetiQ, the QFTR supports the Queensland Government’s goal of establishing the state as a UAS centre of excellence and a UAS leader in the Asia-Pacific region. Inaugural testing at QFTR was completed by Boeing Australia in late 2020. Director of Boeing Phantom Works International Emily Hughes said the company was proud to be the first user of the site and would take the opportunity to continue flight trials on key autonomous projects. -

Map Marking Information for Kingaroy, Queensland [All

Map marking information for Kingaroy,Queensland [All] Courtesy of David Jansen Latitude range: -30 19.8 to -23 13.5 Longitude range: 146 15.7 to 153 33.7 File created Tuesday,15June 2021 at 00:58 GMT UNOFFICIAL, USE ATYOUR OWN RISK Do not use for navigation, for flight verification only. Always consult the relevant publications for current and correct information. This service is provided free of charge with no warrantees, expressed or implied. User assumes all risk of use. WayPoint Latitude Longitude ID Distance Bearing Description 95 Cornells Rd Strip 30 19.8 S 152 27.5 E CORNERIP 421 172 Access from Bald Hills Rd 158 Hernani Strip 30 19.4 S 152 25.1 E HERNARIP 420 172 East side, Armidale Rd, South of Hernani NSW 51 Brigalows Station Strip 30 13.0 S 150 22.1 E BRIGARIP 429 199 Access from Trevallyn Rd NSW 151 Guyra Strip 30 11.9 S 151 40.4 E GUYRARIP 402 182 Paddock North of town 79 Clerkness 30 9.9 S151 6.0 ECLERKESS 405 190 Georges Creek Rd, Bundarra NSW 2359 329 Upper Horton ALA 30 6.3 S150 24.2 E UPPERALA 416 199 Upper Horton NSW 2347, Access via Horton Rd 31 Ben Lomond Strip 30 0.7 S151 40.8 E BENLORIP 382 182 414 Inn Rd, Ben Lomond NSW 2365 280 Silent Grove Strip 29 58.1 S 151 38.1 E SILENRIP 377 183 698 Maybole Rd, Ben Lomond NSW 2365 Bed and Breakfast 165 Inverell Airport 29 53.2 S 151 8.7 E YIVL 374 190 Inverell Airport, Aerodrome Access Road, Gilgai NSW 2360 35 Bingara ALA 29 48.9 S 150 32.0 E BINGAALA 381 199 Bingara Airstrip Rd West from B95 55 Brodies Plains AF 29 46.4 S 151 9.9 E YINO 361 190 Inverell North Airport, Inverell NSW 2360. -

Download Itinerary

14 Day Cape York, Reef & Outback Cairns Bamaga,QLD Daintree National Park Cape Tribulation,QLD Cooktown Great Barrier Reef,QLD Port Douglas Mount Isa Longreach,QLD Winton,QLD Let Us Inspire You FROM $6,999 PER PERSON, TWIN SHARE Book Now TOUR ITINERARY The information provided in this document is subject to change and may be affected by unforeseen events outside the control of Inspiring Vacations. Where changes to your itinerary or bookings occur, appropriate advice or instructions will be sent to your email address. Call 1300 88 66 88 Email [email protected] www.inspiringvacations.com Page 1 TOUR ITINERARY DAY 1 Destination Cairns Meals included Hotel 4 Park Regis City Quays, or similar Welcome to Cairns! On arrival, make your way to your hotel. The rest of your day is free to explore Cairns at your own pace. Check in & arrival information A taxi or Uber from Cairns airport to your accommodation costs approximately $15 per car. Hotel check in is at 2pm. Should you arrive earlier than this, hotel staff will do all possible to check you in as soon as possible. If your room is not available before check-in time, you are welcome to leave your luggage in storage and explore the surrounding area. DAY 2 Cairns Bamaga Tip of Australia Bamaga Destination Cairns Meals included Breakfast, Lunch Hotel 4 Park Regis City Quays, or similar Gear up for a spectacular day as you travel by air and 4WD to the northernmost point of Australia. At the appropriate time, make your way to Cairns airport to meet your pilot and guide for the day. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Cairns Airport Drives Revenue with Ideas Car Park Product and Price Optimization Services

Press Contact: Haberman for IDeaS Megan Mell, PR Representative [email protected] +1 612 436 5549 FOR IMMEDIATE RELEASE Cairns Airport Drives Revenue with IDeaS Car Park Product and Price Optimization Services North Queensland airport partners with global revenue management leader to maximize non-aeronautical revenue CAIRNS, AUSTRALIA – NOVEMBER 23, 2015 – IDeaS Revenue Solutions, the leading provider of revenue management software solutions and advisory services, today announced that Cairns Airport is accessing their Car Park Product and Price Optimization Services (PPOS) to identify new opportunities to optimize its car parking business. Cairns Airport is part of NQA (the North Queensland Airports group), a consortium that also owns Mackay Airport. As the seventh busiest airport in Australia, Cairns sees almost five million passengers annually pass through its two terminals providing daily service to an expanding range of domestic and international destinations. More than 1,600 car spaces are available for short and long-term parking for passengers and visitors. “We’re experiencing significant growth in passenger numbers and this is set to continue with our increase in direct flights to Asia,” said Fiona Ward, General Manager Commercial for NQA. “Demand for parking is strong, and we are excited to work with IDeaS and ensure we’re doing everything we can to offer our customers a range of parking products at the right price, and find new opportunities to optimize use of our car parks.” IDeaS Car Park Product and Price Optimization Services (PPOS) are part of the comprehensive revenue management solution IDeaS offers worldwide for airport car parks. Suitable for any airport with reserved parking, IDeaS Car Park PPOS starts with historical parking data from across the business and analyses it with advanced tools from SAS®, the leader in business analytics and the largest independent vendor in the business intelligence market. -

Queensland Outback to Reef 2022 BROCHURE.Pub

EXPLORE LONGREACH, WINTON, MOUNT ISA, CLONCURRY, KARUMBA, COBBOLD GORGE, UNDARA, CAIRNS AND MORE 15 - 28 May 2022 14 Days for $5,990 PRICE IS PER PERSON TWIN SHARE. SINGLE SUPPLEMENT EXTRA $1,360 CONTACT KTG TOURS TO BOOK YOUR SEAT [email protected] | 02 9007 2443 | www.ktgtours.com.au EXPLORE LONGREACH, WINTON, MOUNT ISA, CLONCURRY, KARUMBA, COBBOLD GORGE, UNDARA, CAIRNS AND MORE ON KTG TOURS 14 DAY QUEENSLAND OUTBACK TO REEF TOUR Please note that for full enjoyment of this tour, a reasonable level of fitness is required. Day 1 Sunday 15 May 2022 Meals: D Your tour starts at Sydney Airport where you meet your KTG Tours Hostess who will accompany you on your 14 day adventure. Our Qantas flight departs Sydney at around 11am, with a short stopover in Brisbane before arriving in Longreach mid afternoon.* On arrival at Longreach Airport, we are met by our Driver who will transfer us to our accommodation where we spend the next 2 nights. Get to know your fellow travellers over a tasty meal tonight in town. Hotel: Outback Pioneers, LONGREACH Day 2 Monday 16 May 2022 Meals: B, L, D This morning we visit the impressive Australian Stockman’s Hall of Fame. Explore the Galleries with your virtual guide “Hugh”, take your seat in the undercover stadium for the Live Show - A Stockman’s Life and see the Story of the Australian Stockman in a fully immersive cinema experience. Next, we visit the Qantas Founders Museum where we have lunch followed by some time to explore the Museum at your own pace. -

Avis Australia Commercial Vehicle Fleet and Location Guide

AVIS AUstralia COMMErcial VEHICLES FLEET SHEET UTILITIES & 4WDS 4X2 SINGLE CAB UTE | A | MPAR 4X2 DUAL CAB UTE | L | MQMD 4X4 WAGON | E | FWND • Auto/Manual • Auto/Manual • Auto/Manual • ABS • ABS • ABS SPECIAL NOTES • Dual Airbags • Dual Airbags • Dual Airbags • Radio/CD • Radio/CD • Radio/CD The vehicles featured here should • Power Steering • Power Steering • Power Steering be used as a guide only. Dimensions, carrying capacities and accessories Tray: Tray: are nominal and vary from location 2.3m (L), 1.8m (W) 1.5m (L), 1.5m (W), 1.1m (wheelarch), tub/styleside to location. All vehicles and optional 4X4 SINGLE CAB UTE | B | MPBD 4X4 DUAL CAB UTE | D | MQND 4X4 DUAL CAB UTE CANOPY | Z | IQBN extras are subject to availability. • Auto/Manual • Auto/Manual • Auto/Manual For full details including prices, vehicle • ABS • ABS • ABS availability and options, please visit • Dual Airbags • Dual Airbags • Dual Airbags • Radio/CD • Radio/CD • Radio/CD www.avis.com.au, call 1800 141 000 • Power Steering • Power Steering • Power Steering or contact your nearest Avis location. Tray: Tray: Tray: 1.5m (L), 1.5m (W), 2.3m (L), 1.8m (W) 1.8m (L), 1.8m (W) 0.9m (H) lockable canopy VANS & BUSES DELIVERY VAN | C | IKAD 12 SEATER BUS | W | GVAD LARGE BUS | K | PVAD • Air Con • Air Con • Air Con • Cargo Barrier • Tow Bar • Tow Bar • Car Licence • Car Licence • LR Licence Specs: 5m3 2.9m (L), 1.5m (W), Specs: 12 People Specs: 1.1m (wheelarch) including Driver 20-25 People HITop VAN | H | SKAD 4.2M MovING VAN | F | FKAD 6.4M MovING VAN | S | PKAD 7.3M VAN | V | PQMR • Air Con • Air Con • Air Con • Air Con • Power Steering • Ramp/Lift • Ramp/Lift • Ramp/Lift • Car Licence • Car Licence • MR Licence • MR Licence Specs: 3.7m (L), 1.75m (W), Specs: Specs: Specs: 19m3, 4.2m (L), 34m3, 6.4m (L), 42m3, 7.3m (L), 1.9m (H), between 2.1m (W), 2.1m (H), 2.3m (W), 2.3m (H), 2.4m (W), 2.4m (H), wheel arch 1.35m (L) up to 3 pallets up to 10 pallets up to 12 pallets *Minimum specs. -

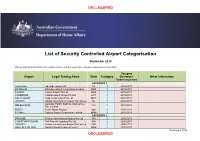

Airport Categorisation List

UNCLASSIFIED List of Security Controlled Airport Categorisation September 2018 *Please note that this table will continue to be updated upon new category approvals and gazettal Category Airport Legal Trading Name State Category Operations Other Information Commencement CATEGORY 1 ADELAIDE Adelaide Airport Ltd SA 1 22/12/2011 BRISBANE Brisbane Airport Corporation Limited QLD 1 22/12/2011 CAIRNS Cairns Airport Pty Ltd QLD 1 22/12/2011 CANBERRA Capital Airport Group Pty Ltd ACT 1 22/12/2011 GOLD COAST Gold Coast Airport Pty Ltd QLD 1 22/12/2011 DARWIN Darwin International Airport Pty Limited NT 1 22/12/2011 Australia Pacific Airports (Melbourne) MELBOURNE VIC 1 22/12/2011 Pty. Limited PERTH Perth Airport Pty Ltd WA 1 22/12/2011 SYDNEY Sydney Airport Corporation Limited NSW 1 22/12/2011 CATEGORY 2 BROOME Broome International Airport Pty Ltd WA 2 22/12/2011 CHRISTMAS ISLAND Toll Remote Logistics Pty Ltd WA 2 22/12/2011 HOBART Hobart International Airport Pty Limited TAS 2 29/02/2012 NORFOLK ISLAND Norfolk Island Regional Council NSW 2 22/12/2011 September 2018 UNCLASSIFIED UNCLASSIFIED PORT HEDLAND PHIA Operating Company Pty Ltd WA 2 22/12/2011 SUNSHINE COAST Sunshine Coast Airport Pty Ltd QLD 2 29/06/2012 TOWNSVILLE AIRPORT Townsville Airport Pty Ltd QLD 2 19/12/2014 CATEGORY 3 ALBURY Albury City Council NSW 3 22/12/2011 ALICE SPRINGS Alice Springs Airport Pty Limited NT 3 11/01/2012 AVALON Avalon Airport Australia Pty Ltd VIC 3 22/12/2011 Voyages Indigenous Tourism Australia NT 3 22/12/2011 AYERS ROCK Pty Ltd BALLINA Ballina Shire Council NSW 3 22/12/2011 BRISBANE WEST Brisbane West Wellcamp Airport Pty QLD 3 17/11/2014 WELLCAMP Ltd BUNDABERG Bundaberg Regional Council QLD 3 18/01/2012 CLONCURRY Cloncurry Shire Council QLD 3 29/02/2012 COCOS ISLAND Toll Remote Logistics Pty Ltd WA 3 22/12/2011 COFFS HARBOUR Coffs Harbour City Council NSW 3 22/12/2011 DEVONPORT Tasmanian Ports Corporation Pty. -

Year in Review

Queensland Section YEAR IN REVIEW 14/15 Our Mission 3 Our Vision, Our Values 4 Chairman’s Report 5 CEO’s Report 6 2014/15 Highlights 7 2014/15 Overview 10 Health Services 10 Clinical Governance Highlights 10 Integrated Operations 11 Finance 14 People and Corporate Services 14 Marketing and Fundraising 15 Bequests and Trusts In Perpetuity 16 Our Patients > Shannon Smithwick 18 Map > Locations we travelled to 19 The Furthest Corner. The Finest Care. 20 Map > Our primary health care locations 22 Our People 23 Our Patients > Tayla Law 24 Our Bases 25 Our Partners and Supporters 26 About the Royal Flying Doctor Service The Royal Flying Doctor Service of Australia (RFDS) takes the finest care to the furthest corners of our land. Established in 1928 by the Reverend John Flynn, the RFDS has grown to become the largest and most comprehensive aeromedical organisation of its kind in the world, delivering 24-hour emergency aeromedical and primary health care services to all those who live, work and travel throughout Australia. Today, the RFDS conducts more than 290,000 patient consults across Australia every year – that’s one person every two minutes. In Queensland, the RFDS currently operates from nine bases at Brisbane, Bundaberg, Cairns, Charleville, Longreach, Mount Isa, Rockhampton, Roma and Townsville. These bases form a strategic network of aeromedical services as well as delivering a broad range of health care programs including general practice, Aboriginal and Torres Strait Islander health, child and family health, social and emotional wellbeing, mental health, women’s health, oral health and health promotion activities. -

2019-20 Budget Estimates Volume of Additional Information

2019-20 Budget Estimates Volume of Additional Information Reports No. 30 and 31, 56th Parliament Economics and Governance Committee August 2019 Table of Contents Correspondence regarding leave to participate in the hearing Questions on notice and responses Speaker of the Legislative Assembly Questions on notice and responses Premier and Minister for the Trade Questions on notice and responses Deputy Premier, Treasurer and Minister for Aboriginal and Torres Strait Islander Partnerships Questions on notice and responses Minister for Local Government, Minister for Racing and Minister for Multicultural Affairs Answers to questions taken on notice at the hearing 23 July 2019 Responses to requests for additional information taken at the hearing 23 July 2019 Documents tabled at the hearing 23 July 2019 Correspondence regarding leave to participate in the hearing Correspondence 1. 25 June 2019 – Letter from Deb Frecklingon MP, Leader of the Opposition and Shadow Minister for Trade 2. 4 July 2019 – Letter from Sandy Bolton MP, Member for Noosa 3. 16 July 2019 – Letter from Jon Krause MP, Member for Scenic Rim 4. 16 July 2019 – Email from Michael Berkman MP, Member for Maiwar 25 June 2019 Economics and Governance Committee Attention: Mr Linus Power MP, Chair By email: [email protected] Dear Mr Power Reference is made to the consideration of 2019/2020 portfolio budget estimates. Pursuant to section 181(e) of the Standing Rules and Orders of the Legislative Assembly, I seek leave for the following Members to attend the public estimates hearings of the Committee, scheduled for Tuesday 23 July 2019: • Deb Frecklington MP, Member for Nanango • Tim Mander MP, Member for Everton • Jarrod Bleijie MP, Member for Kawana • Dr Christian Rowan MP, Member for Moggill • Ann Leahy MP, Member for Warrego • John-Paul Langbroek MP, Member for Surfers Paradise Should you have any queries, please contact Peter Coulson of my office. -

North Queensland Airports (NQA)

Invest & Manage Airports 2011 London December 9th, 2011 North Queensland Airports (NQA) In January 2009, a consortium led by institutional investors advised by J.P.Morgan Asset Management bought Cairns & Mackay airports from the Queensland government NQA owns and manages Cairns and Mackay airports under 99-year leases – Cairns is Australia's 7th largest airports with c. 4.0m pax in FY11 and the gateway to World Heritage Great Barrier Reef and Tropical Rainforests of Northern Queensland – Mackay airport, with c. 1m pax in FY11, is the main airport serving the Bowen Basin, which contains one of the largest deposits of coal in the world 2 NQA - Overview Cairns Airport Cairns Airport 758 ha site located c.8 km from the CBD Separate domestic & international terminals Two runways: main runway (3,197m) & cross runway (925m) Curfew free Mackay Airport Mackay Airport 274 ha site located c.5 km from the CBD Single terminal Two runways: main runway (1,981m), cross runway (1,344m) Curfew free 3 NQA – Passenger Profile Cairns Mackay 6% 6% 12% 25% 44% 11% 64% NQA 25% 6% 16% 17% 61% Leisure Business VFR Other 4 NQA – Strong Traffic performance since Acquisition FY 2011/2010 Passenger growth 9.9% 9.5% 7.7% 6.9% 4.3% 4.1% 3.6% NQA Perth Airport APAC MAp QAL Sydney Airport NT Airports 5 Continued route expansion and carrier diversification 81 new services and new routes introduced since acquisition equating to over 1.4m new seats Both Cairns and Mackay have experienced strong volumes growth as a result of: – Strategically marketing the airport