Birla Insurance Fund Pager Individual.CDR

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Escorts Limited •• S~F2

c ESCORTS February 19, 2021 BSE Limited National Stock Exchange of Delhi Stock Exchange Limited Phiroze Jeejeebhoy India Limited DSE House, 3/1, Asaf Ali Road, Towers, Dalal Street, Exchange Plaza, Sandra New Delhi -110002 Mumbai - 400001 Kurla Complex, Bandra East, Mumbai - 400051 BSE-500495 NSE - ESCORTS DSE -00012 ••'*' Subject: Intimation pursuant to Regulation 31A of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 Dear Sir/ Madam, In compliance of Regulation 31A of Securities and Exchange Board of India (Listing Obligations And Disclosure Requirements) Regulations, 2015, we wish to inform you that the Company has received the enclosed request letter cum undertaking dated February 19, 2021 from the following shareholders currently belonging to Promoter/ Promoter Group of the Company for their reclassification from category of 'Promoter/ Promoter Group' to 'Public': Name No. of Shares as on date Mr. Girish Behari Mathur- Promoter Group 179 Ms. Rachna Mathur - Promoter group I Person acting 75 in concert The Company would take necessary actions to give effect to the above request. ,, You are requested to take the same on record Thanking You, Yours faithfully, For Escorts Limited •• s~f2. Company Secretary & Compliance Officer Encl: As above ESCORTS LIMITED CorporatE1 Secretarial & Low Registered Office : 15/5, Mothura Rood, Foridobod - 121 003, Horyana, Indio Phone : +91-129-2250222, ' E·moil : [email protected], Website : www.escortsgroup.com Corporate Identification Number - L74899HR1944PLC039088 Date: February 19, 2021 To The Board of Directors Escorts limited 15/5, Mathura Road, Faridabad -121003, Haryana Dear Sir/ Madam, Sub: Removal of my name along with the Person acting in Concert from Promoter and Promoter Group shareholding of the Escorts Limited ("Company") Ref: Regulation 31A of the SEBI (Listing Obligations and Disclosure Requirements) regulations, 2015 With reference to the above, I would like to inform that I, Girish Behari Mathur, along with my spouse Mrs. -

Annual Report (2018-2019)

73rd Annual Report 2018-19 Inside the Report Core divisions Key highlights FY 2018-19* Corporate Overview Revenue 2 Escorts at a Glance (H in crores) 4 Milestone Moments 6 Product Suite 6,196.4 8 Operational Highlights Escorts Agri Machinery 10 Key Performance Indicators (EAM) 23.5% Y-o-Y growth 12 From the Chairman’s Desk Offers a comprehensive range of advanced farm 16 Message from the Executive Director machinery products and crop 18 External Environment solution services, enriching EBITDA 22 Management Speak agricultural productivity in (H in crores) 24 Customer Centricity India and globally. 26 Excellence 76.6% 733.3 28 Innovation of Revenue 30 Agility 31.6% Y-o-Y growth 32 Board of Directors 34 Leadership Team 36 Social and Environment Sustainability Profit after tax (H in crores) Statutory Reports 38 Management Discussion and Analysis Escorts Construction 484.9 48 Directors’ Report Equipment (ECE) addresses India’s diverse 40.7% 63 Report on Corporate Governance Y-o-Y growth infrastructure requirements 98 Business Responsibility Report with a wide basket of material handling, road building, Financial Statements earth moving and other Earnings 108 Standalone Financial Statements equipment services. per share (H) 186 Consolidated Financial Statements 17.0% of Revenue About Escorts 40.58 40.7% Escorts Limited (Escorts) is one Y-o-Y growth of India’s leading engineering conglomerates. We manufacture best-in-class equipment for agriculture, *Standalone Financials infrastructure and railways. Ever since inception, we have played an important role in helping shape the country’s socio-economic progress. Railway Equipment Division (RED) Across three core businesses in plays a key role in the which we operate, we are pursuing evolution of the Indian innovation, fostering collaborations, Railway, with frugally driving modernisation and implementing engineered products, advanced manufacturing practices, cutting-edge technology to bring the best that the world has and state-of-the-art Research to offer to India; and take India’s best and Development (R&D). -

Revision in Market Lot of Derivative Contracts on Individual Stocks

Department : FUTURES & OPTIONS Download Ref No: NSE/FAOP/45895 Date : September 30, 2020 Circular Ref. No: 87/2020 All Members, Revision in Market Lot of Derivative Contracts on Individual Stocks In pursuance of SEBI guidelines for periodic revision of lot sizes for derivatives contracts specified in the SEBI circular CIR/MRD/DP/14/2015 dated July 13, 2015, the market lots of derivatives contracts shall be revised as follows: Sr. Underlying whose Derivative Count of Annexure No Effective date contract size shall be Underlying Number October 30, 2020 (for Nov 1 Revised Downwards 15 1 2020 & later expiries) 2 Revised Upwards 12 October 30, 2020 (for Jan 2 2021 & later expiries) 3 Unchanged 108 - 3 Revised Downwards but new October 30, 2020 (for Jan 4 lot size is not a multiple of old 1 4 2021 & later expiries) lot size To avoid operational complexities, in case of Annexure 2 and 4 above, following will be applicable: 1. Only the far month contract i.e. January 2021 expiry contracts will be revised for market lots. Contracts with maturity of November 2020 and December 2020 would continue to have the existing market lots. All subsequent contracts (i.e. January 2021 expiry and beyond) will have revised market lots. 2. The day spread order book will not be available for the combination contract of Dec 2020 – Jan 2021 expiry. For the purpose of the computation, the average of the closing price of the underlying has been taken for one month period of September 1st – September 30th 2020. This circular shall come into effect from October 30, 2020. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

OMAXE LIMITED (Incorporated on March 8, 1989 As Omaxe Builders Private Limited Under the Companies Act, 1956

C M Y K RED HERRING PROSPECTUS Please read Section 60B of the Companies Act, 1956 Dated July 7, 2007 100% Book Built Issue OMAXE LIMITED (Incorporated on March 8, 1989 as Omaxe Builders Private Limited under the Companies Act, 1956. We changed our name to Omaxe Construction Private Limited, which was approved by the Registrar of Companies, National Capital Territory of Delhi and Haryana through their approval letter dated March 4, 1997. We converted to a public company with the name of Omaxe Construction Limited by passing a special resolution in terms of section 31/21 read with section 44 of the Companies Act, 1956, which was approved by the Registrar of Companies, National Capital Territory of Delhi and Haryana through their approval letter dated August 10, 1999. We changed our name to Omaxe Limited with effect from June 6, 2006.) Registered Office: 7, Local Shopping Centre, Kalkaji, New Delhi 110 019, India. Tel: +91 11 41893100/41896680-85; Fax: +91 11 41896653/41896655/41896799 Contact Person: Mr. Venkat Rao; Email: [email protected]; Website: www.omaxe.com PUBLIC ISSUE OF UP TO 17,796,520 EQUITY SHARES OF Rs. 10 EACH (“EQUITY SHARES”) FOR CASH AT A PRICE OF RS. [z] PER EQUITY SHARE AGGREGATING RS. [z] MILLION BY OMAXE LIMITED (“OMAXE”, “THE COMPANY” OR “THE ISSUER”). ADDITIONALLY, THERE IS A GREEN SHOE OPTION OF UPTO 1,750,000 EQUITY SHARES TO BE OFFERRED FOR CASH AT A PRICE OF RS. [z] PER EQUITY SHARE, AGGREGATING RS. [z] MILLION. THE ISSUE SHALL CONSTITUTE 11.20% OF THE FULLY DILUTED POST-ISSUE CAPITAL OF OUR COMPANY, ASSUMING THE GREEN SHOE OPTION IS EXERCISED AND SHALL CONSTITUTE 10.30% OF THE FULLY DILUTED POST-ISSUE CAPITAL OF OUR COMPANY, ASSUMING THE GREEN SHOE OPTION IS NOT EXERCISED. -

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

Project Report on Comparative Analysis of 4-Stroke Bikes

Project Report On Comparative Analysis Of 4-Stroke Bikes Submitted towards the Partial fulfillment of Master of Business Administration (Affiliated to U.P. Technical University, Lucknow) Under the guidance of: Submitted by: Supervisor Name Your Name Roll: - CONTENTS A) Title page B) Acknowledgement C) Certificate 1) INTRODUCTION 2) INDUSTRY OVERVIEW 3) COMPANY PROFILE 4) MARKETING STRATEGIES 4) LITERATURE REVIEW 5) RESEARCH METHODOLOGY 6) DATA ANALYSIS AND INTERPRETATION 7) FINDINGS 8) SUGGESTIONS 9) CONCLUSION 10) REFERENCES AND ANNEXURES ACKNOWLEDGEMENT We express our sincere gratitude to our project guide Mr. Gaurav Kumar Verma for giving us the opportunity to work on this project. We are thankful to our Project Guide for their guidance and encouragement without which the satisfactory completion of our project would not have been possible. They have been a constant source of inspiration to us, showing all the patience and abundant encouragement throughout the project duration. Also, we are thankful to the librarians and staff of our institute, for their continued support and invaluable encouragement. Above all, we are thankful to the “Almighty” and to our parents for their blessings, humble support and showing their belief in us. TRIBHUVAN NARAYAN INTRODUCTION INTRODUCTION HISTORY OF BIKES Through the years… Bob Stark has been involved with Indian motorcycles throughout his entire life. Bob's father became an Indian dealer in 1918, after returning from military service during World War I. Bob still has a photo of his mother riding in a sidecar in 1923. Since Bob was born in 1934, his parents were involved with Indian cycles long before that. At the age of 10 Bob started staying around his fathers shop, and developed quite an interest in the Indian cycles. -

Aditya Birla Management Corporation Ltd. Airtel Amicorp Andhra Bank

Aditya Birla Management Corporation Ltd. Airtel Amicorp Andhra Bank Apollo Munich Health Insurance Co. Ltd. Arvind Ltd. Ashok Leyland Ltd Asian Paints Aviva Life Insurance AXA Business Services Axis Bank B C Management Services Pvt. Ltd. Bank of America BANK OF BARODA Bank of India Bank of Ireland Bank Of Maharashtra Bharat petroleum Corporation Ltd BHEL Binani Industries Broadridge Financial Solutions India Cairn Energy India Pty Ltd Canara HSBC OBC Life Insurance Capgemini Consulting India Pvt Ltd Carrefour WC & C India Pvt Ltd CEAT Coal India Limited Colgate Palmolive India Corporation Bank Cosmos Bank DCM Shriram Consolidated Ltd Department of Income Tax Diageo DMA Yellow Works Ltd Dr Reddys Lab DTDC Courier & Cargo Ltd Ericsson Telecom Escorts Limited Essar Enenrgy Fidelity Business Services India FLUXONIX CORPORATION PVT LTD Ford Motor Company FRanklin Templeton International Services India Franklin Templeton Intl Srvs (I) Pvt Ltd GAIL GalxoSmithKline Pharmaceuticals Ltd. GENERAL ELECTRIC APPLIANCES & LIGHTING GENERAL MILLS COMPANY Godrej Consumer Products Ltd. Government of Kerala Grupo HDI HCL HDFC LTD Hero MotoCorp Ltd. Hewlett Packard India Sales Pvt Ltd Hindustan Petroleum Corporation Ltd Hindusthan National Glass & Industiries Ltd ICICI Lombard general Insurance ICICI Prudential Life Insurance IDBI Bank Limited Idea Cellular Limited India First Life Insurance Indian Oil Corporation Ltd Indian Overseas Bank IndusInd Bank Ltd INTERGLOBE ENTERPRISES LTD IREO ITC Limited JBM Group Jewelex India Pvt. Ltd. JM financial JSW Steel Jubilant Life Sciences Ltd. Karur Vyasa Kotak Mahindra Bank Ltd KPMG India Liberty Videocon General Insurance Lupin Ltd Mahindra & Mahindra Mahindra Finance Mahindra Group Mahindra Logistics Ltd C/o Mahindra&Mahindra Marico Ltd Maruti Suzuki India Limited Max Life Insurance Co. -

List of Exempted Establishment

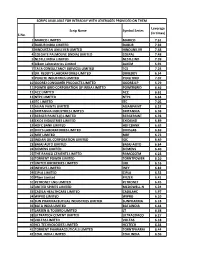

LIST OF P.F. EXEMPTED ESTABLISHMENTS S.No Est. Id Est. Name 1 MHBAN0000024000 EMPIRE INDUSTRIES 2 MPJBP0001251000 UNIVERSAL CABLES LTD. 3 SRBRH0014401000 GUJARAT NARMADA VALLEY FERTILIZERS & CHEMICALS LIMITED 4 DLCPM0002805000 ALL INDIA MANAGEMENT ASSOCIATION 5 PYPNY0000964000 BHARAT ELECTRONICS LIMITED 6 SRSRT000523800B GUJARAT STATE FERTILISERS - CHEMICAL LTD 7 RJRAJ0005060000 BIRLA INSTITUTE OF TECHNOLOGY AND SCIENCE PILANI DISTT JHUNJHUNU 8 RJRAJ0001475000 RAJASTHAN STATE IND. DEV. - INVEST. CORPORATION 9 DLCPM0004398000 NESTLE INDIA LTD. 10 PYPNY0003435000 I P R I T I 11 PYKRP002341900X VOLVO INDIA PVT LTD 12 WBCAL002689100E WELLAND GOULDSMITH SCHOOL 13 PYKRP000986600X COATS INDIA LTD 14 WBPRB0028002000 STEEL AUTHORITY OF INDIA 15 DSNHP003369100E NIIT TECHNOLOGIES LTD 16 PUPUN0005674000 ATLAS COPCO [I] LTD 17 THTHA0001616000 CENTURY RAYON 18 WBCAL0026974000 WEST BENGAL POWER DEVELOPMENT CORPORATION LIMITED 19 GNGGN0009476000 DELPHI AUTOMOTIVE SYSTEM LIMITED 20 PUPUN0007319000 JAYA HIND INDUSTRIES LTD. 21 DSSHD0004360000 MOTHER DAIRY 22 PUPUN0002885000 J N MARSHALL PVT LTD 23 VDBRD0003574000 THE PANCHMAHAL DIST. CO-OP. MILK PRODUCERS 24 MHBAN000633300X HAWKINS COOKERS LIMITED 25 KRKCH0003188000 SUD-CHEMIE INDIA PVT. LIMITED 26 MRMRT0000227000 TRIVENI ENGG. - INDUSTRIES LTD. 27 VDBRD0005238000 GUJARAT STATE FERTILIZERS CO. LTD., 28 GJRAJ000523800A GSFC LTD. 29 DSNHP0007658000 NIIT LTD. 30 DSNHP0019614000 AMERICAN EXPRESS INDIA PVT LTD 31 MHBAN0020972000 HOUSING DEVELOPMENT FINANCE CORP LTD 32 GJAHD001692300E THE UMRETH URBAN CO-OPERATIVE BANK LTD. 33 MPBPL000344800A HINDUSTAN ELECTRO GRAPHITE LTD. 34 MHBAN000710800X THE MUNICIPAL CO-OP.BANK LTD. 35 BGBNG002411700X MERCEDES BENZ RESEARCH AND DEVELOPMENT INDIA PVT LTD 36 RJRAJ0001004000 GANDHI SEWA SADAN BAYANA BHARATPUR 37 UPLKO0000180000 BAJAJ HINDUSTAN LTD. 38 TNMAS0007835000 BHARAT HEAVY ELECTRICALS 39 NESHG0000941000 NORTH EASTERN ELECTRICAL POWER CORPORATION LTD 40 DSNHP0000932000 NATIONAL SMALL IND CORPN. -

2019 TPM Excellence Awards Winners List 0127現在.Xlsx

2019 TPM Excellence Awards Winners (Outside Japan) Award for World Class TPM Achievement Name Area Tetra Pak (Hohhot) Co.,Ltd. People's Republic of China TETRA PAK PAKISTAN LAHORE FACTORY Islamic Republic of Pakistan Advanced Special Award for TPM Achievement Name Area Bajaj Auto Ltd. Chakan Plant, Pune India Mahindra & Mahindra Ltd. Farm Division - India Mumbai, Nagpur & India Rudrapur Plants Special Award for TPM Achievement Name Area ARCOR S.A.I.C - CARTOCOR S.A CARDBOARD ARROYITO PLANT Argentine Republic JD Components Co., Ltd Taiwan LINDT & SPRÜNGLI SPA INDUNO OLONA Italian Republic Raychem RPG Pvt. Ltd. GMD-CA, Energy Division, Vasai Plant India Tetra Pak Tubex Portugal, Lda. Portuguese Republic THE SIAM REFRACTORY INDUSTRY CO., LTD. Kingdom of Thailand Tractors and Farm Equipment Limited Engineering Plastics and Tool Room India Division ‒ Maraimalai Nagar Tractors and Farm Equipment Limited Engineering Plastics and Tool Room India Division-DBR, Bangalore TVS Motor Company Limited Plant 1, Hosur India TVS Motor Company Limited Plant 2, Hosur India TVS Motor Company Limited Plant 4, Mysore India VESTEL Home Appliances Industry and Trade inc. Republic of Turkey Award for Excellence in Consistent TPM Commitment Name Area AURANGABAD ELECTRICALS LIMITED ( A CIE AUTOMOTIVE GROUP India COMPANY) AURANGABAD ELECTRICALS LIMITED PLANT -N1 CPF(Thailand) Public Company Limited Tharnkasem Feedmill (TKF) Kingdom of Thailand CPF(Thailand) Public Company Limited Rajburi Feedmill Kingdom of Thailand EIMCO ELECON (INDIA) LIMITED Vallabh Vidyanagar India Escorts Limited Escorts Agri Machinery India ETI GIDA SANAYİ VE TİCARET A.Ş. Grain Plant Republic of Turkey Godrej & Boyce Mfg. Co. Ltd. Appliance Division, Mohali India Indian Oil Corporation Limited Mathura Refinery India JINDAL STEEL & POWER LTD TRB Iron Ore Mines, Tensa India JTEKT INDIA LIMITED Sriperumbudur - Chennai India Mahindra & Mahindra Ltd. -

M.Com Fcma, Aca

TATA MOTORS LIMITED Annexure to Directors' Report Information as per Section 197(12) of the Companies Act 2013 and the Companies (Particulars of Employees) Rules, 1975 and forming a part of the Directors Report for the year ended Mar 31, 2016 6=7+8+9+10- 13 = 14-15-16- 4 1 3 5 11-12 17-18 19 20 1/21/1900 22 23 24 26 27 Sr Name Age Designation / Nature of duties Gross Net Qualifications Exp Date of Last Employment Location Emp_Stat Remark Deputation_ No Yrs Renumeration Renumeration Yrs Joining Designation - Period stat Steel Authority Of India Ltd - Bokaro Steel 1 A K Mukhopadhyay 55 Vice President - Business Planning 10,837,170.64 7,330,152.04 M.COM FCMA, ACA, ACS 33 6/7/2001 Plant,Finance / Price Panel- 18 yrs MUCO Live Full Year 2 A S Minz* 60 AGM (Parts Procurement, Jsr) 1,813,778.84 1,368,038.09 BTech(Mechanical) 38 7/1/1977 - JSPR Separated Part of Year 3 A. K. Saxena 59 Vice President (Purchasing) 12,415,603.80 7,743,469.80 ICWA Final 40 7/2/1976 - PNCV Live Full Year 4 Abhay Chintamani Chouthai 53 General Manager (Veh Integration-LCV) 6,219,265.16 4,195,369.32 BE, ME(Mechanical) 34 6/27/2006 L & T Ltd,Manuf/Prodn/Operations- 0 yrs PNCV Live Full Year 5 Abhay Madhusudan Deshpande 52 Head-Advanced Modular Platform (X4) 6,625,599.76 4,398,397.72 BE(Mechanical), MBA 29 8/17/2005 Fiat India Ltd,Design- 18 yrs PNCV Live Full Year Fiat India Automobiles Ltd,Finance / Price 6 Abhay Padmakar Bawale 54 CFO & Managing Director 6,660,504.88 6,394,692.87 BCom(Accounts), CS FINAL 31 8/27/2013 Panel- 5 yrs MUCO Live Full Year DEPUTED 7 Abhijit Aravind Gajendragadkar 53 Sr. -

Stock Code Company Long Name

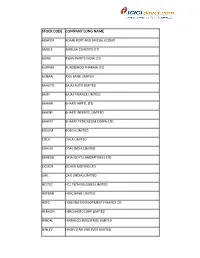

STOCK CODE COMPANY LONG NAME ADAPOR ADANI PORT AND SPECIAL ECONO AMBCE AMBUJA CEMENTS LTD ASIPAI ASIAN PAINTS INDIA LTD AURPHA AUROBINDO PHARMA LTD AXIBAN AXIS BANK LIMITED BAAUTO BAJAJ AUTO LIMITED BAJFI BAJAJ FINANCE LIMITED BHAAIR BHARTI AIRTEL LTD BHAINF BHARTI INFRATEL LIMITED BHAPET BHARAT PETROLEUM CORPN LTD BOSLIM BOSCH LIMITED CIPLA CIPLA LIMITED COALIN COAL INDIA LIMITED DRREDD DR REDDY'S LABORATORIES LTD EICMOT EICHER MOTORS LTD GAIL GAIL (INDIA) LIMITED HCLTEC HCL TECHNOLOGIES LIMITED HDFBAN HDFC BANK LIMITED HDFC HOUSING DEVELOPMENT FINANCE CO HERHON HERO MOTOCORP LIMITED HINDAL HINDALCO INDUSTRIES LIMITED HINLEV HINDUSTAN UNILEVER LIMITED HINPET HINDUSTAN PETROLEUM CORP ICIBAN ICICI BANK LIMITED INDBA INDUSIND BANK LIMITED INDOIL INDIAN OIL CORPORATION LIMITED INFTEC INFOSYS LTD ITC ITC LIMITED INDHO JAIN IRRIGATION SYSTEMS LTD KOTMAH KOTAK MAHINDRA BANK LTD LARTOU LARSEN AND TOUBRO LIMITED LUPIN LUPIN LIMITED MAHMAH MAHINDRA & MAHINDRA LIMITED MARUTI MARUTI SUZUKI INDIA LTD NTPC NTPC LIMITED ONGC OIL AND NATURAL GAS CORPORATIO POWGRI POWER GRID CORPORATION OF INDI RELIND RELIANCE INDUSTRIES STABAN STATE BANK OF INDIA SUNPHA SUN PHARMACEUTICAL INDUSTRIES TATMOT TATA MOTORS LIMITED TATSTE TATA STEEL LIMITED TCS TATA CONSULTANCY SERVICES LTD TECMAH TECH MAHINDRA LIMITED ULTCEM ULTRATECH CEMENT LIMITED UNIP UPL LIMITED VEDLIM VEDANTA LIMITED WIPRO WIPRO LTD YESBAN YES BANK LIMITED ZEEENT ZEE ENTERTAINMENT ENTERPRISES ACC ACC LIMITED ADAENT ADANI ENTERPRISES LIMITED ADAPOW ADANI POWER LIMITED AJAPHA AJANTA PHARMA LTD ALLBAN