INTERIM REPORT 2017 SUSTAINABLE GROWTH GROWTH 中期報告 INTERIM REPORT 2017 中期報告 2017 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2013 Contents

ANNUAL REPORT 2013 CONTENTS Corporate Profile 2 Corporate Information 3 Our Products 4 Business Overview 6 Financial Highlights 10 Chairman’s Statement 12 Management Discussion and Analysis 14 Directors and Senior Management 24 Directors’ Report 34 Corporate Governance Report 43 Independent Auditor’s Report 53 Consolidated Balance Sheet 55 Balance Sheet of the Company 57 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Statement of Changes in Equity 60 Consolidated Statement of Cash Flows 61 Notes to the Consolidated Financial Statements 62 Four Years’ Financial Summary 124 2 NEXTEER AUTOMOTIVE GROUP LIMITED CORPORATE PROFILE Nexteer Automotive Group Limited (the Company) together with its subsidiaries (together with the Company collectively referred to as we, us, Nexteer or the Group) is a global leader in advanced steering and driveline systems. Nexteer’s in-house development and integration of hardware, software and electronics gives us a competitive advantage as a full service steering supplier. Nexteer draws upon a 100-year heritage of product development, manufacturing and vehicle integration expertise. We have a strong foundation and a reputation for providing dependable steering and driveline solutions and enduring customer relationships. Nexteer provides real-world, vehicle-level thinking that is always ahead of the curve. • Customer Focused: Respected and trusted for delivering on promises • Innovative: Market leader in steering and driveline innovation • Agile: Respond quickly with high-quality, cost-effective solutions • Expert: Know and understand customer requirements • Experienced: Provide demonstrated high performance, custom engineered systems for every application • Global: Committed to exceeding customer and vehicle needs every time, everywhere With more than fifty (50) customers in every major region of the world, Nexteer has twenty (20) manufacturing plants, five (5) regional engineering centers, nine (9) customer service centers strategically located in North and South America, Europe and Asia. -

2013 Prospectus

Nexteer Automotive Group Limited 耐世特汽車系統集團有限公司 (Incorporated under the laws of the Cayman Islands with limited liability) (Stock Code : 01316) Joint Global Coordinators, Joint Bookrunners and Joint Sponsors Financial Advisor >cfYXc F]]\i`e^ IMPORTANT: If you are in any doubt about any of the contents of this Prospectus, you should seek independent professional advice. Nexteer Automotive Group Limited 耐世特汽車系統集團有限公司 (Incorporated under the laws of the Cayman Islands with limited liability) GLOBAL OFFERING Number of Offer Shares in the Global Offering : 720,000,000 Shares (subject to the Over-allotment Option) Number of Hong Kong Offer Shares : 72,000,000 Shares (subject to adjustment) Number of International Offer Shares : 648,000,000 Shares (subject to adjustment and the Over-allotment Option) Maximum Offer Price : HK$3.57 per Hong Kong Offer Share, plus brokerage of 1%, SFC transaction levy of 0.003%, and Hong Kong Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong dollars and subject to refund) Nominal value : HK$0.10 per Share Stock code : 01316 Joint Global Coordinators, Joint Bookrunners and Joint Sponsors Financial Advisor Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. A copy of this Prospectus, having attached thereto the documents specified in “Appendix VI — Documents Delivered to the Registrar of Companies and Available for Inspection,” has been registered by the Registrar of Companies in Hong Kong as required by Section 342C of the Companies Ordinance (Chapter 32 of the Laws of Hong Kong). -

2020 Interim Report

Contents Corporate Profile 2 Corporate Information 3 Business Overview 4 Financial Highlights 16 Management Discussion and Analysis 17 Corporate Governance/Other Information 28 Report on Review of Interim Financial Information 33 Condensed Consolidated Interim Balance Sheet 34 Condensed Consolidated Interim Income Statement 36 Condensed Consolidated Interim Statement of Comprehensive Income 37 Condensed Consolidated Interim Statement of Changes in Equity 38 Condensed Consolidated Interim Statement of Cash Flows 39 Notes to the Condensed Consolidated Interim Financial Information 40 02 NEXTEER AUTOMOTIVE GROUP LIMITED INTERIM REPORT 2020 Corporate Profile CORPORATE PROFILE Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, as well as advanced driver assistance systems (ADAS) and automated driving (AD) enabling technologies. In-house development and full integration of hardware, software and electronics provides Nexteer a competitive advantage as a full-service supplier to automotive original equipment manufacturers (OEM) around the world. As a leader in intuitive motion control, our continued focus and drive is to leverage our design, development and manufacturing strengths in advanced steering and driveline systems that provide differentiated and value-added solutions to our customers. We develop solutions that enable a new era of safety and performance for all levels of ADAS/AD, as well as supporting all modes of vehicle propulsion be it traditional internal combustion, hybrid or pure electric systems. Overall, we are making driving safer, more fuel-efficient and fun for today’s world and an increasingly electrified and automated future. -

2016 Annual Report

ANNUAL REPORT 2016 年 報 2016 年報 ANNUAL REPORT 2016 Contents Corporate Profile 02 Corporate Information 04 Our Products 06 Business Overview 10 Financial Highlights 20 Chairman’s Statement 22 Management Discussion and Analysis 24 Directors and Senior Management 33 Directors’ Report 41 Corporate Governance Report 58 Independent Auditor’s Report 69 Consolidated Balance Sheet 76 Consolidated Income Statement 78 Consolidated Statement of Comprehensive Income 79 Consolidated Statement of Changes in Equity 80 Consolidated Statement of Cash Flows 81 Notes to the Consolidated Financial Statements 82 Five Years’ Financial Summary 146 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2016 02 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, advanced driver assistance systems (ADAS) and autonomous vehicle technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full service supplier. Our vision is to remain a leader in intuitive motion control – leveraging our strengths in advanced steering and driveline systems. We maintain product focus on electric power steering (EPS), a socially responsible technology that offers automakers increased fuel economy and reduced emissions. Nexteer Automotive has put more than 40 million EPS units on the road, since 1999, saving more than 4 billion gallons of fuel. Our ability to integrate our systems seamlessly into automotive original equipment manufacturer (OEM) vehicles is a testament of our 110-year heritage of vehicle integration expertise and product craftsmanship. -

2019 Annual Results Announcement

2019 Annual Results Announcement 30 March 2020 Copyright 2020, Nexteer Automotive Corporation. All rights reserved. 1 Safe Harbor Statement These materials have been prepared by Nexteer Automotive Group Limited (“Nexteer” or the “Company”) and are being furnished to you solely for informational purposes. The information contained in these materials has not been independently verified. NO REPRESENTATION OR WARRANTY EXPRESS OR IMPLIED IS MADE AS TO, AND NO RELIANCE SHOULD BE PLACED ON, THE FAIRNESS, ACCURACY, COMPLETENESS OR CORRECTNESS OF THE INFORMATION OR OPINIONS CONTAINED HEREIN. It is not the intention to provide, and you may not rely on these materials as providing, a complete or comprehensive analysis of the Company’s financial or trading position or prospects. Neither Nexteer nor any of its affiliates, advisors or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss that may arise from any use of this presentation or its contents or otherwise arising in connection with this presentation. Certain statements contained in these materials constitute forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, which may cause the actual results, performance or achievements of the Company to be materially different from those expressed by, or implied by the forward-looking statements in these materials. The Company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. Many factors may cause the actual development to be materially different from the expectations expressed here. Such factors include, for example and without limitation, changes in general economic and business conditions, fluctuations in currency exchange rates or interest rates, the introduction of competing products, the lack of acceptance for new products or services and changes in business strategy. -

Workers' Compensation Payer List (PDF)

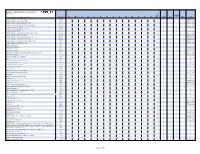

WORKERS' COMPENSATION / AUTO PAYER LIST 09/10/2021 All WORK * Provider must be contracted with Carisk Payer ID TX MN CA IL LA NJ NY OR WI NC NM OK TN VA States 837P 837I COMP AUTO 835 *Carisk Imaging to Allstate Insurance - Auto Only E1069 x x x x Rejects Only *Carisk Imaging to Geico (Auto Only) GEICO x x x x Rejects Only *Carisk Imaging to Nationwide (Auto Only) A0002 x x x x Rejects Only *Carisk Imaging to New York City Law Department NYCL001 x x x x Rejects Only *Carisk Imaging to NJ-PLIGA E3926 x x x x Rejects Only *Carisk Imaging to North Dakota WSI NDWSI x x x x *Carisk Imaging to NYSIF NYSIF1510 x x x x Rejects Only *Carisk Imaging to Progressive Insurance (Auto Only) E1139 x x x x Rejects Only *Carisk Imaging to Pure (Auto Only) PURE01 x x x x Rejects Only *Carisk Imaging to Safeco Insurance (Auto Only) E0602 x x x x Rejects Only *Carisk Imaging to SafeTPA, LLC (NY Only) SAFE01 x x x x Rejects Only *Carisk Imaging to Selective Insurance (Auto Only) E1077 x x x x Rejects Only *Carisk Imaging to USAA (Auto Only) A0001 x x x x Rejects Only 1st Auto & Casualty J1585 x x x x x 21st Century Insurance 41556 x x x x Rejects Only 22125 Roscoe Corp. 41556 x x x x Rejects Only AAA Minnesota/Iowa 11983 x x x x x AAA Northern California, Nevada & Utah Insurance Exchange 41556 x x x x Rejects Only ABC Const. -

Table of Contents

Vol. 30, No. 6 July/August 2017 Table of Contents Essential to Autonomous Vehicle Development, 2 Simulation Isn’t Close to Being Ready More Supplier Disruption Coming 6 Zoox Self-Driving Startup to Design, Build, Operate Its 8 Own Urban Taxi Service The Company Profile: Nexteer 11 Movimento Details OTA Update Types 20 The Hansen Report on Automotive Electronics, July/August 2016 www.hansenreport.com© 2017 Paul Hansen Associates, 150 Pinehurst Road, Portsmouth, NH 03801 USA Telephone: 603-431-5859; fax: 603-431-5791; email: [email protected] All rights reserved. Materials may not be reproduced in any form without written permission. ISSN 1046-1105 2 Essential to Autonomous Vehicle Development, Simulation Isn’t Close to Being Ready Despite more than one million road fatalities globally each year, human drivers perform exceedingly well, especially in the United States, where there were just 1.13 fatalities per hundred million miles traveled in 2015. While it has become a widely held belief that autonomous vehicles will soon be safer than vehicles driven by humans, proving that point will not be at all easy. Indeed, an automated vehicle under test would have to drive several hundred million miles on real roads to verify that it is at least as safe as a human-driven vehicle. But that is not a real- world option. One possible remedy is to use simulators to “drive” virtual vehicles millions of miles in virtual worlds, such that a sufficient number of exceptional, accident- causing edge cases can be found and addressed in a fraction of the time real world testing would take. -

Potential Industry Partners

The UM Mobility Transformation Center Peter Sweatman Huei Peng John Maddox Carrie Morton Director Associate Director Assistant Director Managing Director November 10, 2015 The MTC A public/private R&D partnership that will lead a revolution in mobility and develop the foundations for a commercially viable ecosystem of connected and automated vehicles Leadership Circle Members With Support From MTC AFFILIATES . Auto Club Enterprises, an AAA affiliate . MOBIS . AGC Automotive . Munich Re . Allstate Insurance Co. New Eagle Consulting . Arada Systems, Inc. Nexteer Automotive . Autoliv . OSIsoft, LLC . Brandmotion LLC . PTC, Inc. Calspan Corporation . Realtime Technologies, Inc. Changan Automobile . Renesas Electronics America Inc. Cohda Wireless . Savari Inc. Desjardins General Insurance Group, Inc. Subaru . DURA Automotive Systems . Sumitomo Electric Industries, Ltd. Faurecia . Suncorp Group . Freescale Semiconductor, Inc. TASS International, Inc. Harada Industry of America, Inc. TRW Automotive . Harman International Industries . Zip Car . HERE, a Nokia company . Hitachi, Ltd. IAV . IDIADA . LG Electronics . Mechanical Simulation Corporation . Miller, Canfield, Paddock and Stone, PLC The Three Living Laboratories of MTC Will Collect Data 1. Connected Ann Arbor (2014+) – 9,000 equipped vehicles (~1600 currently) – 60 intersections (19 currently) 2. Connected Southeast Michigan (2015+) – 20,000 equipped vehicles – 500 equipped nodes, including highways and intersections – 5000 devices including nomadic seed devices, extending to vulnerable road users including pedestrians 3. Automated Ann Arbor (2016+) – 2,000 connected and automated vehicles UMTRI Data Collected (2013- ) . From more than 2,800 vehicles and 19 RSE (road- side equipment) units . Data > 70 TB . Trips > 5.0 Million . Distance > 35 Million Miles . Time > 1.2 Million Hours . BSMs > 101.4 Billion records What Can We Learn From the Data . -

Annual Report 2019

Contents Corporate Profile 2 Corporate Information 4 Our Products 6 Business Overview 13 Financial Highlights 32 CEO’s Statement 33 Management Discussion and Analysis 36 Directors and Senior Management 48 Directors’ Report 56 Corporate Governance Report 74 Independent Auditor’s Report 86 Consolidated Balance Sheet 92 Consolidated Income Statement 94 Consolidated Statement of Comprehensive Income 95 Consolidated Statement of Changes in Equity 96 Consolidated Statement of Cash Flows 97 Notes to the Consolidated Financial Statements 98 Five Years’ Financial Summary 168 02 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2019 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, as well as advanced driver assistance systems (ADAS) and automated driving (AD) enabling technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full-service supplier. As a leader in intuitive motion control, our continued focus and drive is to leverage our design, development and manufacturing strengths in advanced steering and driveline systems that provide differentiated and value-added solutions to our customers. We develop solutions that enable a new era of safety and performance for traditional and varying levels of ADAS/AD. Overall, we are making driving safer, more fuel-efficient and fun for today’s world and an automated future. Our ability to seamlessly integrate our systems into automotive original equipment manufacturers’ (OEM) vehicles is a testament to our more than 110-year heritage of vehicle integration expertise and product craftsmanship. -

2018 Annual Report and Highlight a Few of the Year’S Increase Product Exposure with Current Customers

Contents Corporate Profile 2 Corporate Information 4 Our Products 7 Business Overview 14 Financial Highlights 27 CEO’s Statement 28 Management Discussion and Analysis 30 Directors and Senior Management 40 Directors’ Report 48 Corporate Governance Report 66 Independent Auditor’s Report 78 Consolidated Balance Sheet 84 Consolidated Income Statement 86 Consolidated Statement of Comprehensive Income 87 Consolidated Statement of Changes in Equity 88 Consolidated Statement of Cash Flows 89 Notes to the Consolidated Financial Statements 90 Five Years’ Financial Summary 156 02 NEXTEER AUTOMOTIVE GROUP LIMITED ANNUAL REPORT 2018 Corporate Profile Nexteer Automotive Group Limited (the Company) together with its subsidiaries are collectively referred to as we, us, our, Nexteer, Nexteer Automotive or the Group. Nexteer Automotive is a global leader in advanced steering and driveline systems, advanced driver assistance systems (ADAS) and autonomous driving (AD) enabling technologies. In-house development and full integration of hardware, software and electronics give Nexteer a competitive advantage as a full-service supplier. As a leader in intuitive motion control, our continued focus and drive is to leverage strengths in advanced steering and driveline systems that provide value-added solutions to our customers. We maintain product focus on electric power steering (EPS) systems – a socially responsible technology that offers automakers increased fuel economy and reduced emissions. As just one example, Nexteer Automotive has put more than 60 million EPS units on the road since 1999, saving enough fuel to fill the equivalent of 48 billion 16-oz. water bottles. Our ability to seamlessly integrate our systems into automotive original equipment manufacturers’ (OEM) vehicles is a testament to our more than 110-year heritage of vehicle integration expertise and product craftsmanship. -

Automotive News 100 Leading Women in the North American Auto Industry 9-Nov-15 Final Attendee List

Automotive News 100 Leading Women in the North American Auto Industry 9-Nov-15 Final attendee list First Last Title Company Kathryn LaFerle Manager Membership AIAG David Lalain VP AIAG Jim Charnitz Alcoa Inc. Cherlyn Foster Manufacturing Manager, Finishing & Automotive Alcoa Inc. Mike Murphy Alcoa inc. Rob Woodall Alcoa Inc. Mark Manzo Ally Financial Diane Morais Ally Financial Kristen Rohrbaugh Ally Financial Erin Klepaski Sr. Director, Strategic Alliances Ally Financial, Inc. Michele Lieber Chief Public Policy Officer Ally Financial, Inc. Allyson Parker Sr. Director, Human Resources Ally Financial, Inc. Kathie Patterson Senior Vice President, Human Resources Ally Financial, Inc. Gina Proia Chief Communications Officer Ally Financial, Inc. Andrea Riley Chief Marketing Officer Ally Financial, Inc. Dan Soto Chief Compliance Officer Ally Financial, Inc. Bridget Sponsky Director Ally Financial, Inc. Doug Timmerman President Ally Insurance Gloria Rzucidlo Photographer AmericaJR.com Jerome Rzucidlo Reporter AmericaJR.com Patricia Price National Account Director AQUENT John Moyer President and COO Asahi Kasei Plastics North James Bourdganis Area Sales Manager Audi of America Tracy King Area General Manager Audi of America Jenni Young Customer Experience Manager Audi of America Scott Dershem Autoliv Steve Fredin Autoliv Dan Garceau Autoliv Dave Jackson Autoliv Frank Kiiskila Autoliv Kim Kovac Autoliv Jordi Lombarte Autoliv Tony Nellis Autoliv Erin Patrick Autoliv Lisa Frary VP Quality Autoliv North America Shiraz Ahmed Automotive News Leslie -

Timberwolf Technology Transformation Cyber Investments Will Help Make Northwood the Leader of the Pack PAGE 8

IDEA Timberwolf Technology Transformation Cyber Investments Will Help Make Northwood the Leader of the Pack PAGE 8 THE ALUMNI MAGAZINE OF NORTHWOOD UNIVERSITY SPRING 2019 IDEA ON THE COVER: Building on a proud past, Northwood is investing in a fruitful future with expanded technology programs. Northwood’s 60th anniversary is a cause for year-long celebration across campus and everywhere around the world that our alumni call home. In this issue of IDEA magazine, we take a MISSION STATEMENT look at our history and the brilliant thinking that To develop the future leaders of a global, free-enterprise society. spurred Arthur Turner and Gary Stauffer to give birth to Northwood back in 1959. PURPOSE STATEMENT To develop leaders, managers, Yet even as we honor the past, we continue to strive boldly into the future. and entrepreneurs with the Another story involves new programs in Cybersecurity and Data Analytics character and skills to drive that Northwood will launch in the fall. Thanks to generous support from personal, organizational, and the Herbert H. and Grace A. Dow Foundation, we will be upgrading our societal success. technology facilities, adding faculty, and infusing our entire curriculum CORE VALUES STATEMENT with expanded expertise in these exciting fields. The plans include We believe in: Northwood’s first doctoral degree. • The advantages of an entrepreneurial, free-enterprise This issue also shares the stories of a few of the outstanding Northwood society graduates who are doing amazing things in the world. One launched an • Individual freedom and online startup company in the Netherlands. One is a motivational speaker individual responsibility who recently released a new book.