A.D PERFOR BANK L in Par P D.M. COL RMANCE LTD KUM B Rtial

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Irrigation Facilities at Feasible Locations and Modernising, Improving and Rehabilitating the Existing Irrigation Infrastructure Assumes Great Importance

PUBLIC WORKS DEPARTMENT WATER RESOURCES DEPARTMENT PERFORMANCE BUDGET 2015-2016 © Government of Tamil Nadu 2016 PUBLIC WORKS DEPARTMENT WATER RESOURCES DEPARTMENT 1.0. General Management of water resources is vital to the holistic development of the State due to the growing drinking water needs and industrialisation, in addition to the needs of fisheries, environmental flows and community uses. Taking into account the limited availability of water and increasing demand for various uses, the need for creating new irrigation facilities at feasible locations and modernising, improving and rehabilitating the existing irrigation infrastructure assumes great importance. The Government is continuously striving to improve the service delivery of the irrigation system and to increase the productivity, through improving the water use efficiency, participation of farmers in operation and maintenance, canal automation, benchmarking studies and performance evaluation studies and building the capacity of Water Resources Department officials and farmers. In addition, the Government is taking up various schemes, viz., Rivers Inter-linking schemes, Artificial Recharge Schemes, Flood Management Programme, Coastal protection works, Restoration of Traditional water bodies, Augmenting drinking water supply, etc., to harness, develop and effectively utilise the seasonal flood flows occurring over a short period of time during monsoon. 1 2.0. Outlay and Expenditure for the year 2015-2016 The performance as against budgetary provisions for the year of 2015–2016, -

S. Vadivel Dr.P.H.Anand, M.Sc.,M.Phil.,Ph.D

SPATIAL DIMENSIONS OF FILARIASIS IN KUMBAKONAM CONTROL UNIT, TAMIL NADU, INDIA: A GIS APPROACH Thesis submitted to the Bharathidasan University for the award of degree of Doctor of Philosophy in Geography Submitted by S. Vadivel Assistant Professor and Part – time Research Scholar, Research Supervisor Dr.P.H.Anand, M.Sc.,M.Phil.,Ph.D. Associate Professor and Head Post Graduate and Research Department of Geography, Government Arts College (Autonomous), Kumbakonam – 612 001, Tamil Nadu, India May - 2012 DECLARATION I do hereby declare that the thesis entitled “SPATIAL DIMENSIONS OF FILARIASIS IN KUMBAKONAM CONTROL UNIT, TAMIL NADU, INDIA: A GIS APPROACH”, which I am submitting for the award of Degree of Doctor of Philosophy in Geography, to the Bharathidasan University, is the original work carried out by me, in the Post Graduate and Research Department of Geography, Government Arts College (Autonomous), Kumbakonam 612 001, Tamil Nadu, India, under the guidance and supervision of Dr. P.H. Anand, Associate Professor and Head, PG and Research Department of Geography, Government Arts College (Autonomous), Kumbakonam. I further declare that this work has not been submitted earlier in this or any other University and does not form the basis for the award of any other degree or diploma. Kumbakonam S. Vadivel 4th May 2012 Part-time Research Scholar PG and Research Department of Geography (DST-FIST Recognized) Government Arts College (Autonomous), (Accredited by NAAC // AICTE and Affiliated to Bharathidasan University)) Kumbakonam, 612 001, Tamil Nadu Dr.P.H.Anand,M.Sc.,M.Phil.,Ph.D. 04-05-2012 Associate Professor and Head, CERTIFICATE This is to certify that the thesis entitled “SPATIAL DIMENSIONS OF FILARIASIS IN KUMBAKONAM CONTROL UNIT, TAMIL NADU, INDIA: A GIS APPROACH”, submitted by Mr. -

The Sarasvati Mahal

Occ AS I ONAL PUBLicATION 28 India’s Best-Kept Secret: The Sarasvati Mahal by Pradeep Chakravarthy IND I A INTERNAT I ONAL CENTRE 40, MAX MUELLER MARG , NEW DELH I -110 003 TEL .: 24619431 FAX : 24627751 1 Occ AS I ONAL PUBLicATION 28 India’s Best-Kept Secret: The Sarasvati Mahal The views expressed in this publication are solely those of the author and not of the India International Centre. The Occasional Publication series is published for the India International Centre by Cmde.(Retd.) R. Datta. Designed and produced by FACET Design. Tel:91-11-24616720, 24624336. India’s Best-Kept Secret: The Sarasvati Mahal* IIC has a very special place in my heart because when I was a student in JNU in 1996-98, almost every Friday or Saturday I used to come here and listen to lectures or concerts. Those two years made me understand our heritage not just from an artistic point of view but also from a cross-disciplinary point of view, bringing my academic learning in JNU and my understanding of culture here together. Although I must confess that I had never thought when I sat here as a member of the audience that I would actually one day come up here and speak. I gave a very provocative title to this lecture about the Thanjavur Maharaja Serfoji’s Sarasvati Mahal Library partly for raising your curiosity but as I list some of its treasures, you will understand how perfectly apt it is that I should call it India’s best-kept secret. In my hands is a classic example of the proverb that asks us not to judge a book by the covers. -

Economic and Cultural History of Tamilnadu from Sangam Age to 1800 C.E

I - M.A. HISTORY Code No. 18KP1HO3 SOCIO – ECONOMIC AND CULTURAL HISTORY OF TAMILNADU FROM SANGAM AGE TO 1800 C.E. UNIT – I Sources The Literay Sources Sangam Period The consisted, of Tolkappiyam a Tamil grammar work, eight Anthologies (Ettutogai), the ten poems (Padinen kell kanakku ) the twin epics, Silappadikaram and Manimekalai and other poems. The sangam works dealt with the aharm and puram life of the people. To collect various information regarding politics, society, religion and economy of the sangam period, these works are useful. The sangam works were secular in character. Kallabhra period The religious works such as Tamil Navalar Charital,Periyapuranam and Yapperumkalam were religious oriented, they served little purpose. Pallava Period Devaram, written by Apper, simdarar and Sambandar gave references tot eh socio economic and the religious activities of the Pallava age. The religious oriented Nalayira Tivya Prabandam also provided materials to know the relation of the Pallavas with the contemporary rulers of South India. The Nandikkalambakam of Nandivarman III and Bharatavenba of Perumdevanar give a clear account of the political activities of Nandivarman III. The early pandya period Limited Tamil sources are available for the study of the early Pandyas. The Pandikkovai, the Periyapuranam, the Divya Suri Carita and the Guruparamparai throw light on the study of the Pandyas. The Chola Period The chola empire under Vijayalaya and his successors witnessed one of the progressive periods of literary and religious revival in south India The works of South Indian Vishnavism arranged by Nambi Andar Nambi provide amble information about the domination of Hindu religion in south India. -

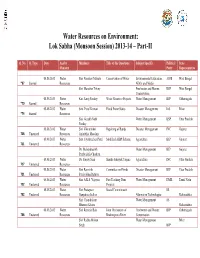

Water Resources on Environment: Lok Sabha (Monsoon Session) 2013-14 – Part-II

Water Resources on Environment: Lok Sabha (Monsoon Session) 2013-14 – Part-II Q. No. Q. Type Date Ans by Members Title of the Questions Subject Specific Political State Ministry Party Representative 08.08.2013 Water Shri Narahari Mahato Conservation of Water Environmental Education, AIFB West Bengal *67 Starred Resources NGOs and Media Shri Manohar Tirkey Freshwater and Marine RSP West Bengal Conservation 08.08.2013 Water Km. Saroj Pandey Water Resource Projects Water Management BJP Chhattisgarh *70 Starred Resources 08.08.2013 Water Smt. Putul Kumari Flood Prone States Disaster Management Ind. Bihar *74 Starred Resources Shri Gorakh Nath Water Management BSP Uttar Pradesh Pandey 08.08.2013 Water Shri Vikrambhai Repairing of Bunds Disaster Management INC Gujarat 708 Unstarred Resources Arjanbhai Maadam 08.08.2013 Water Smt. Jayshreeben Patel Modified AIBP Scheme Agriculture BJP Gujarat 711 Unstarred Resources Dr. Mahendrasinh Water Management BJP Gujarat Pruthvisinh Chauhan 08.08.2013 Water Dr. Sanjay Sinh Sharda Sahayak Yojana Agriculture INC Uttar Pradesh 717 Unstarred Resources 08.08.2013 Water Shri Ramsinh Committee on Floods Disaster Management BJP Uttar Pradesh 721 Unstarred Resources Patalyabhai Rathwa 08.08.2013 Water Shri A.K.S. Vijayan Fast Tracking Dam Water Management DMK Tamil Nadu 722 Unstarred Resources Projects 08.08.2013 Water Shri Prataprao Social Commitment SS 752 Unstarred Resources Ganpatrao Jadhav Alternative Technologies Maharashtra Shri Chandrakant Water Management SS Bhaurao Khaire Maharashtra 08.08.2013 Water -

Thanjavur Temple History in Tamil Pdf Download

Thanjavur temple history in tamil pdf download Continue Thanjai Peria Kovil History in Tamil PdfDownload Thanjai Peria Kovil History in Tamil Pdf Location in Tamil Nada, India Show Map of Tamil Nadu Basic Information Location: Festivals District State Of India Architectural Description creator Completed 1010 AD Inscriptions of Tamil and Grantha scripts Brihadishvara Temple, also referred to as Rajesvara Peruvudaiyr or Brihadeeswarar Temple, dedicated located in, India.King Raja Raja Cholan built Tanjay Grand Temple (also called Thanjavur Peria Koil, Peria Covil, Koyil, and Tanjore Grand Temple) more than a thousand years ago; it took 4 years of construction and was dedicated in 1010 AD தைச ரகவர ேகா எ, தைச ெபய ேகா ('Big.Thanjai periya periya periya kovil history Brihadeeswarar Temple. TanjoreView Temple Brihadiswarar, Marata Palace, zakova field, Rajarajan Manimandapam (Bell Tower) and Tamil University, Siwangangai ParkCoordinates: 10'47'00N79'8'10E/ 10.7833 3'N 79.13611'ECoordinates: 10'47'00N79'8'10E / 10.78333 N 79.13 611'ECountryIndiaStateMil NaduRegionChola NaduDistrictThanjavur-1uvery Delta Government Municipal Corporationur CityArea - Total 38.33 km2 (14.80 sq m) Area rank11 Rise88 m (289 ft) Population (2011) - Total 290 724 - Density7 600/km2 (20,000/sq. mi) Demonym (s)TanjoriansLanguages - OfficialTamilTime zoneUTC-5:30 (IST)PIN613 xxxTelephone code04362Vehicle registrationTN-49Thanjavur, formerly Tanjore, is an Indian city in Tamilnad. Thanjavur is an important centre of South Indian religion, art and architecture. Most of the temples of the Great Living Chola, which are UN World Heritage Sites, are located in And around Thanjavur. The most important of them, the temple of Brihadesvar, is located in the center of the city. -

Arasalar River)

Revised Action plan for restoration of polluted river stretches (ARASALAR RIVER) Arasalar River Puducherry Pollution Control Committee Department of Science, Technology & Environment Government of Puducherry REVISED ACTION PLAN FOR RESTORATION OF ARASALAR RIVER U.T. OF PUDUCHERRY ( KARAIKAL REGION) Preamble: In pursuance of the Hon’ble National Green Tribunal (Principal Bench), New Delhi, orders dt. 20.09.2018 and 19.12.2018 in original application No. 673/2018 in the matter of News item published in “The Hindu” Titled more river stretches are now critically polluted - Central Pollution Control Board. Action plans were framed with the objective of restoration of Arasalar river , Karaikal to meet the bathing standards of pH, Dissolved Oxygen (DO), Biological Oxygen Demand (BOD), Faecal coliforms and Faecal Streptococci within 2 years period. River Rejuvenation committee has been constituted vide OM No. 4739/PPCC/RRC/SCI- I/2018 dt. 13.11.2018 to prepare and execute the action plan. A meeting was held on 28.01.2019 under the Chairmanship of Hon’ble Chief Minister on preparation of revised Action plan to restore polluted river stretches. Fig.1 Revised Action plan presented before the Hon’ble Chief Minister of Puducherry In compliance with the Hon’ble NGT order dated 06.12.2019, State Level Monitoring Committee (SLMC) has been constituted under the Chairmanship of Secretary (Envt) vide order no. 6836/PPCC/NGT/SEE/2020 dt. 08.01.2020. First State Level Monitoring Meeting was held on 29.01.2020. 2 Arasalar: Arasalar River is having a total run of 24 Km, enters Karaikal, a little east of kalanganni. -

The Journal of the Music Academy Devoted to the Advancement of the Science and Art of Music

ISSN. 0970 -3101 THE JOURNAL OF THE MUSIC ACADEMY DEVOTED TO THE ADVANCEMENT OF THE SCIENCE AND ART OF MUSIC Vol. LXVI 1995 »T5CtCT w qrafor w fagffa w * II "/ dwell not in Vaikuntha, nor in the hearts o f Yogins nor in the Sun; (but) where my bhaktas sing, there be I, NaradaV' Edited by T.S. PARTHASARATHY The Music Academy, Madras 306, T.T.K. Road, Madras - 600 014. Annual Subscript sign $ 3-00 THE JOURNAL OF THE MUSIC ACADEMY DEVOTED TO THE ADVANCEMENT OF THE SCIENCE AND ART OF MUSIC Vol. LXVI 1995 t TOTfiT 1 V f t I *nr nurfer w ftgrfir h r * n "I dwell not in Vaikuntha, nor in the hearts o f Yogins nor in the Sun; (but) where my bhaktas sing, there be I, Narada!" Edited by T.S. PARTHASARATHY The Music Academy, Madras 306, T.T.K. Road, Madras - 600 014. Annual Subscription - Inland oreign $ 3-00 r OURSELVES This Journal is published as an Annual. All correspondence relating to the Journal should be sent to The Editor Journal of the Music Academy, 306, T.T.K. Road, Madras - 600 014. Articles on music and dance are accepted for publication on the understanding that they are contributed solely to the Journal of the Music Academy. Manuscripts should be legibly written or, preferably, typewritten (double -spaced and on one side of the paper only) and should be signed by the writer (giving his or her address in full). The Editor of the Journal is not responsible for the views expressed by contributors in their articles. -

Interpretation of Soil Resources Using Remote Sensing and GIS in Thanjavur District, Tamil Nadu, India

Available online a t www.pelagiaresearchlibrary.com Pelagia Research Library Advances in Applied Science Research, 2011, 2 (3): 525-535 ISSN: 0976-8610 CODEN (USA): AASRFC Interpretation of soil resources using remote sensing and GIS in Thanjavur district, Tamil Nadu, India J. Punithavathi*, S. Tamilenthi and R. Baskaran Department of Industries and Earth Sciences, Tamil University, Thanjavur, TN, India ______________________________________________________________________________ ABSTRACT Mapping of physiographic units and the sediments/soils of an area can give useful information for land use planning. Remote sensing technique plays an important role in the mapping of soil, physiographic units and other land resources. In this present study, Thanjavur district, Tamil Nadu has been choosen to prepare physiographic units and soil maps by using IRS-P6 satellite imagery, (Scale 1:50,000). This study reveals that the mapping of different soil/sediment types and physiographic units can be effectively and the land suitability can be inferred. Key words: Physiographic units, Soil productivity, Crops grown, Remote sensing and GIS. ______________________________________________________________________________ INTRODUCTION In view of soil resources mapping, the study area of Thanjavur district Tamil nadu has been interpreted. The Remote sensing Technique is a major tool interpreting the land resources and that can be used for a Thanjavur area like this kind of soil mapping. The major physiographic features such as alluvial and sandy plains, undulating pediplan, upland and natural vegetation, coastal plain areas or low lying lands of the study area have been interpreted. There are many previous investigation such as Ahuja R.L[1], Kumar, Ashok and Sanjay Kumar Srivastava [3], Fabos J.G.[4], Fitz and Patrick.E.A [5], Lillesand, Keieper[6], Saha and S.K.Singh [7] and many other soil resources related of the previous investigation. -

Chapter – Iii Agro Climatic Zone Profile

CHAPTER – III AGRO CLIMATIC ZONE PROFILE This chapter portrays the Tamil Nadu economy and its environment. The features of the various Agro-climatic zones are presented in a detailed way to highlight the endowment of natural resources. This setting would help the project to corroborate with the findings and justify the same. Based on soil characteristics, rainfall distribution, irrigation pattern, cropping pattern and other ecological and social characteristics, the State Tamil Nadu has been classified into seven agro-climatic zones. The following are the seven agro-climatic zones of the State of Tamil Nadu. 1. Cauvery Delta zone 2. North Eastern zone 3. Western zone 4. North Western zone 5. High Altitude zone 6. Southern zone and 7. High Rainfall zone 1. Cauvery Delta Zone This zone includes Thanjavur district, Musiri, Tiruchirapalli, Lalgudi, Thuraiyur and Kulithalai taluks of Tiruchirapalli district, Aranthangi taluk of Pudukottai district and Chidambaram and Kattumannarkoil taluks of Cuddalore and Villupuram district. Total area of the zone is 24,943 sq.km. in which 60.2 per cent of the area i.e., 15,00,680 hectares are under cultivation. And 50.1 per cent of total area of cultivation i.e., 7,51,302 19 hectares is the irrigated area. This zone receives an annual normal rainfall of 956.3 mm. It covers the rivers ofCauvery, Vennaru, Kudamuruti, Paminiar, Arasalar and Kollidam. The major dams utilized by this zone are Mettur and Bhavanisagar. Canal irrigation, well irrigation and lake irrigation are under practice. The major crops are paddy, sugarcane, cotton, groundnut, sunflower, banana and ginger. Thanjavur district, which is known as “Rice Bowl” of Tamilnadu, comes under this zone. -

The Journal of the Music Academy Devoted to the Advancement of the Science and Art of Music

THE JOURNAL OF THE MUSIC ACADEMY DEVOTED TO THE ADVANCEMENT OF THE SCIENCE AND ART OF MUSIC Vol. LXIV 1993 arsr nrafcr a s farstfa s r 3 ii “I dwell not in Vaikuntha, nor in the hearts of Yogins nor in the Sun; (but) where my bhaktas sing, there be I, Narada!” Edited by T.S. PARTHASARATHY The Music Academy, Madras 306, T.T.K. Road, Madras - 600 014 Annual Subscription -- Inland Rs.40: Foreign $ 3-00 OURSELVES This Journal is published as an Annual. All correspondence relating to the Journal should be addressed and all books etc., intended for it should be sent to The Editor Journal of the Music Academy, 306, T.T.K. Road, Madras - 600 014. Articles on music and dance are accepted for publication on the understanding that they are contributed solely to the Journal of the Music Academy. Manuscripts should be legibly written or, preferably, typewrittern (dounle-spaced and on one side of the paper only) and should be signed by the writer (giving his or her address in full.) The Editor of the Journal is not responsible for the views expressed by contributors in their articles. CONTENTS S.No. Page 1. 66th Madras Music Conference - Official Report 1 2. Advisory Committee Meetings 20 3. The Sadas 47 4. Tyagaraja and the Bhakti Community - William Jackson 70 Princess Rukinini Bai - B.Pushpa 79 6. Indian classical Music - T.S.Parthasarathy 83 Tagore’s Dance concept - Gayatri Chatterjce 97 From Sarn^adeva to Govinda 101 Literary and Prosodical Beauties - T.S. Parthasarathy 107 10. -

Depositional Environmental Studies of Sediments Near Arasalar River Mouth, Karaikal Region Pondicherry Union Territory, East Coast of India S

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395 -0056 Volume: 02 Issue: 02 | May-2015 www.irjet.net p-ISSN: 2395-0072 Depositional Environmental studies of sediments near Arasalar river mouth, Karaikal region Pondicherry Union Territory, East coast of India S. Venkatesan1 , S.R. Singarasubramanian2 1 Ph.D Research Scholar, Department of Earth Sciences, Annamalai University Tamil Nadu, India 2 Associate Professor, Department of Earth Sciences, Annamalai University Tamil Nadu, India ---------------------------------------------------------------------***--------------------------------------------------------------------- Abstract - Grain size and depositional pattern of 2. STUDY AREA sediment from Arasalar river mouth (ARM North and Arasalar River in Karaikal union territory is located at the latitude 10̊54’52’N Longitude 79̊51’09’’E. The Cauvery ARM South) in Karaikal region of Pondicherry Union River; located in the delta between the Cauvery and forms territory and Southern part of Tamil Nadu have been many tributaries. Arasalar River forms a tributary of carried to using the textural parameters. The samples Cauvery at Papanasam, near Kumbakonam. Geologically were processed and sieved following standard the study area comprises of Coastal alluvial soil. The procedures. Textural parameter like mean, standard Karaikal area is completely covered by a thick mantle of deviation, skewness and kurtosis are calculated using alluvium and no exposures are met. The major part of the standard methods to understand the transportation study area is covered by black clay soils (matured) as per the classification of soil survey and land use shown an and the depositional environment of the sediments. isolated patch of brown clay loam soil in the area Statistical parameters revealed that sediments are bordering the north-western boundary of the Karaikal dominant in fine sand category, moderately well sorted, region.