Adaptive Average True Range (ATR), 132 Moving Average, 89, 118-120

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

My Favorite Trading Strategy Indicators

Trade Ideas My Favorite Trading Strategy Indicators by Dave Mabe | Dir. of Software Development My Favorite Trading Stratey Indicators | 2020 1 About Dave Mabe Director of Software Development Dave Mabe has been an active trader for over 15 years. Prior to joining Trade Ideas in 2011, Dave started StockTickr, an online trading journal. Dave created Holly, Trade Ideas Artificial Intelligence implementation, drawing from machine learning and data analysis techniques that he’s used in trading strategies for many years. Dave also was the architect behind Brokerage Plus and the Trade Ideas stock charts. @davemabe www.davemabe.com www.trade-ideas.com My Favorite Trading Stratey Indicators | 2020 2 Chapter 1 Clean Charts Too many trading indicators on a chart is a sign of mediocrity. Your charts should be nice and clean showing you exactly what you need to see to make your pre- planned decisions and no more. Many traders take this to heart and have simple charts that aren’t littered with indicators, but too many draw the wrong conclusion at this point: that all indicators are worthless. A trader’s clean chart is not recognition that all indicators are garbage – it should represent that the trader has gone through the thorough and painstaking work of determining which indicators are most important to their trading and why. It should represent countless ideas of what indicators make their trading tick and lots of decisions about the trade offs of including or excluding certain ones. A simple chart should represent the quantifiable tests that have gone into determining which indicators contribute to profit. -

Research Article AVERAGE TRUE RANGE: HIGH VOLATILITY AS A

Available Online at http://www.recentscientific.com International Journal of CODEN: IJRSFP (USA) Recent Scientific International Journal of Recent Scientific Research Research Vol. 11, Issue, 01(B), pp. 36805-36812, January, 2020 ISSN: 0976-3031 DOI: 10.24327/IJRSR Research Article AVERAGE TRUE RANGE: HIGH VOLATILITY AS A SUCCESS FACTOR FOR TRADING Dr.Ulrich R. Deinwallner PhD Management and Finance, Walden University, USA DOI: http://dx.doi.org/10.24327/ijrsr.2020.1101.4999 ARTICLE INFO ABSTRACT Article History: High volatility can be an indication to achieve excess returns with an investment strategy, according to the Efficient Market Hypothesis (EMH), since the underlying markets might exhibit less Received 6th October, 2019 th efficiency. In connection to this it was relevant to understand, if trading with low or high Average Received in revised form 15 True Range (ATR) values can improve the return results of a Moving Average (MA) trading November, 2019 strategy. The purpose of this quantitative research was to compare different MA strategies in Accepted 12th December, 2019 th different U.S. stock markets and to find an optimal ATR setting, to determine if excess returns can Published online 28 January, 2020 be achieved. The research question (RQ) was: what ATR setting can improve the return results of a MA trading strategy for U.S stock market indices? The following computations occurred: (a) simple Key Words: moving average; (b) ATR; and (c) t-Tests. I find in this study that a ATR(5) with high values Average True Range, Volatility Trading, (threshold = 25.92) is the most profitable setting to improve a Simple MA (SMA) trading strategy Moving Average, Efficient Market for the S&P500 index with (i.e., rSMA (20)_High_ATR (5)_S&P500 = 21.84 % per month), hypothesis, Portfolio Management. -

How Day Trade for a Living by Andrew Aziz

Glossary How Day Trade for A Living by Andrew Aziz A Alpha stock: a Stock in Play, a stock that is moving independently of both the overall market and its sector, the market is not able to control it, these are the stocks day traders look for. Ask: the price sellers are demanding in order to sell their stock, it’s always higher than the bid price. Average daily volume: the average number of shares traded each day in a particular stock, I don’t trade stocks with an average daily volume of less than 500,000 shares, as a day trader you need sufficient liquidity to be able to get in and out of the stock without difficulty. Average relative volume: how much of the stock is trading compared to its normal volume, I don’t trade in stocks with an average relative volume of less than 1.5, which means the stock is trading at least 1.5 times its normal daily volume. Average True Range/ATR: how large of a range in price a particular stock has on average each day, I look for an ATR of at least 50 cents, which means the price of the stock will move at least 50 cents most days. Averaging down: adding more shares to your losing position in order to lower the average cost of your position, with the hope of selling it at break-even in the next rally in your favor, as a day trader, don’t do it, do not average down, ever, a full explanation is provided in this book, to be a successful day trader you must avoid the urge to average down. -

Timeframeset

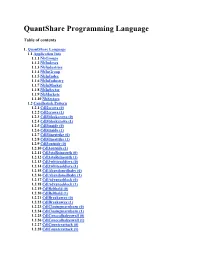

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

Harnessing Market Volatility

HOW TO FIND OPPORTUNITY IN FAST -MOVING MARKETS HARNESSING MARKET VOLATILITY One of the benefits of trading forex is the opportunity to find profit potential in both rising and falling markets. Since the market can go up or down at a moment’s notice, volatility can work to your advantage—if you know how to use it. We’ll show you some technical and fundamental analysis that can help you harness market volatility, as well as some risk management techniques that can help you capture potential profit and limit losses. An example of market volatility The following table illustrates the percentage change of different instruments since October 2007 and July 2008. Oil prices plummeted more than 50 percent in that time frame while the EUR/USD, GBP/JPY and USD/JPY fell approximately 20 percent. The daily trading ranges increased significantly as few hundred point swings in the Dow became the norm. The same was true for currencies where the average daily range expanded significantly. The average true range for many currency pairs doubled in that period. PAIR OCTOBER 1, CHANGE JULY 1, CHANGE OCTO- 2007 2008 BER 23, 2008 EUR/USD 1.4282 -10% 1.5827 -19% 1.2820 GBP/USD 2.0495 -21% 2.0000 -19% 1.6105 USD/JPY 106.39 -9% 123.29 -21% 97.32 DJIA 14116 -39% 11408 -25% 8545 SP500 1549 -42% 1285 -30% 897 FTSE 6467 -37% 5626 -28% 4046 DAX 7922 -44% 6395 -30% 4456 NIKKEI 16773 -50% 13515 -37% 8461 ASX 6568 -39% 5232 -24% 3974 OIL 82.0 -18% 143.3 -53% 68 GOLD 747.4 -6% 948.3 -26% 705 VIX 18.44 272% 25.14 173% 68.61 20% change >50% change DETERMINING TRADING STRATEGIES To increase the probability of successful trades, traders must understand whether the market is in trend or range. -

Xxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxx 1 • • • • Sample • • • • 7 Charting Tools for Spread Betting A practical guide to making money from spread betting with technical analysis by Malcolm Pryor HARRIMAN HOUSE LTD 3A Penns Road Petersfield Hampshire GU32 2EW GREAT BRITAIN Tel: +44 (0)1730 233870 Fax: +44 (0)1730 233880 Email: [email protected] Website: www.harriman-house.com First published in Great Britain in 2009 by Harriman House. Copyright © Harriman House Ltd The right of Malcolm Pryor to be identified as the author has been asserted in accordance with the Copyright, Design and Patents Act 1988. 978-1-905641-84-0 British Library Cataloguing in Publication Data A CIP catalogue record for this book can be obtained from the British Library. All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. This book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover other than that in which it is published without the prior written consent of the Publisher. Printed in the UK by CPI William Clowes, Beccles NR34 7TL No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the employer of the Author. Designated trademarks and brands are the property of their respective owners. -

Position Sizing Methods for a Trend Following CTA

Position sizing methods for a trend following CTA HENRIK SANDBERG RASMUS ÖHMAN Master of Science Thesis Stockholm, Sweden 2014 Positionsskalningsmetoder för en trendföljande CTA HENRIK SANDBERG RASMUS ÖHMAN Examensarbete Stockholm, Sverige 2014 Positionsskalningsmetoder för en trendföljande CTA av Henrik Sandberg Rasmus Öhman Examensarbete INDEK 2014:47 KTH Industriell teknik och management Industriell ekonomi och organisation SE-100 44 STOCKHOLM Position sizing methods for a trend following CTA Henrik Sandberg Rasmus Öhman Master of Science Thesis INDEK 2014:47 KTH Industrial Engineering and Management Industrial Management SE-100 44 STOCKHOLM Examensarbete INDEK 2014:47 Positionsskalningsmetoder för en trendföljande CTA Henrik Sandberg Rasmus Öhman Godkänt Examinator Handledare 2014-06-04 Hans Lööf Tomas Sörensson Uppdragsgivare Kontaktperson Coeli Spektrum N/A Sammanfattning Denna studie undersöker huruvida en trendföljande managed futures-fond kan förbättra sina resultat genom att ändra positionsskalningsmetod. Handel med en enkel trendföljande strategi simulerades på 47 futureskontrakt åren 1990-2012, för olika metoder att för bestämma positionsstorlek. Elva positionsskalningmetoder undersöktes, exemplevis Target Volatility, Omega Optimization och metoder baserade i korrelationsrankning. Både tidigare beskrivna metoder och nya tillvägagångssätt testades, och jämfördes med den grundläggande strategin med avseende på risk och avkastning. Denna studies resultat visar att framförallt Target Volatility, och i viss uträckning Max Drawdown -

Noncandlestick Confirmation Indicators and Terms

C HAPTER DEFINITION: momentum oscillator Noncandlestick Confi rmation A momentum oscillator is a type of price- based indicator. Momentum measures Indicators and Terms the rate of change in price; an oscillator shows how value changes in relation to a set value or values over time. accumulation/distribution (AD) a momentum oscil- the price levels and movements. A series of A/D days lator based on price trends, developed by Marc Chaikin, a expressed in a moving average and divided by volume trader who recognized the importance of whether current for the averaged period (usually 21 days) is called the DEFINITION: price movement of a stock is controlled by buyers (accu- Chaikin Money Flow (CMF), a strong technical sign The A/D indicator mulation phase) or by sellers (distribution phase). that often provides reversal signals in advance of the The A/D indicator is a momentum The A/D indicator is based on a single day’s prices turnaround and that may be confi rmed by candlestick oscillator. Its value goes beyond the initial calculation, however. The moving and it identifi es whether buyers or sellers determined signals. average of A/D serves as the basis for the more revealing signal, the Chaikin Money Flow (CMF). 246 c08.indd 246 13/12/11 9:02 AM Bloomberg Visual Guide to Candlestick Charting ■ 247 American Express (AXP) accumulation/distribution (A/D) STEP-BY-STEP DO IT YOURSELF Follow these steps to calculate A/D: 1. Subtract the session’s low from the close. A/D is calculated by fi nding the sum of differences be- 2. -

5-Step-Trading Fx ® Workbook

1 L E X¶S FAV O URI T E T E C H NI C A L T R A DIN G ST R AT E G I ES F O R F X - W O R K B O O K This workbook is intended to accompany the /H[¶VF avourite Technical Trading Strategies for F X - Applicable to Commodities and Equity Indexes as well online module. WORKBOOK QU ESTION: Why do you think technical indicators make trading less emotional and more objective? 2 Table of contents Types of traders ....................................................................................................................................................... 5 Technical indicators: Introduction ........................................................................................................................... 7 Technical indicators: Leading Indicators ................................................................................................................ 9 a) Support & Resistance, Fibonacci retracement levels and Floor Pivot points ............................................. 9 b) Relative Strength Index (RSI) .................................................................................................................. 13 c) Stochastic Oscillator ................................................................................................................................. 14 Technical indicators: Lagging Indicators .............................................................................................................. 16 a) Moving Averages ..................................................................................................................................... -

Power of Risk Reward Ratio

First of all, let me take some time to introduce myself to you. I am Kee and I am a full time currency trader. I have a passion for trading and this drives me to create a forex blog that gathers a community of traders together. How I Trade Profitably Every Single Month without Fail First of all, let me take some time to introduce myself to you. I am KoonKee Hee (KL)(Aka KL) First of all, let me take some time to introduce myself to you. I am KoonL KunKoonKoo Hwee Hui Hee and(KH ILee) am anda a fatherI am a offull one time kid. currency I am tradingtrader. Icurrency have a passion full time for since trading 2009 and andthis drivesI have me a great to create passion a forex for blog trading. that gathers This drives a community me to create of traders my own forextogether. blog that gathers a community of traders together There are a lot of marketers in the market trying to pose as traders selling courses and services that do not work. This is mainly because the internet allows them to hide behind their computer to cheat people. Before I begin, let me do some introduction about myself so that you know who you are dealing with. I have been a full time trader since 2008 and earning consistent profits month after month since 2009 regardless of market conditions. However I didn’t miraculously start off as a great trader. Before I stumbled upon this forex trading opportunity, I used to work as an engineer in a multi-national company. -

Breakout Trading Explanatory Notes.Pdf

Breakout Trading Newsletter Explanatory Notes Revision 1902 Breakout Trading Newsletter Explanatory Notes General Advice ActVest Pty Ltd is a Corporate Authorised Representative (CAR No.306718) of Primary Securities Ltd AFSL No. 224107 ("PSL"). This document has been prepared for the general information of investors and does not take into account the investment objectives, financial situation and particular needs of any particular person. Persons intending to act on information in this document should seek professional advice to confirm that the investments or strategies mentioned are appropriate in the light of their particular investment needs, objectives and financial circumstances prior to taking any action. While reasonable care has been exercised and the statements contained herein are based on information believed to be accurate and reliable, neither ActVest, PSL, nor their employees or agents shall be obliged to update you if the information or its advice changes or be liable (unless otherwise required by law) for any loss or damage suffered or caused to any person or corporation resulting from or contributed to by any error or omission from such statements including any loss or damage caused by any fault or negligence on the part of ActVest or PSL, whether direct, indirect, consequential or otherwise, whether foreseeable or not. Direct investing in the stock market can result in financial loss. This document, and any associated files, is intended solely for its intended recipient. The contents are confidential and may be legally privileged. ©Copyright Alan Hull 2019 This document is copyright. This document, in part or whole, may not be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise without prior written permission. -

Forex Trading System Development

Forex Trading System Development An Interactive Qualifying Project Report Submitted to the Faculty of WORCESTER POLYTECHNIC INSTITUTE In partial fulfillment of the requirements for the Degree of Bachelor of Science By Ziyan Ding Mingkun Ma Omar Olortegui Trivani Shahi Date:01/16/2018 Report Submitted to: Professors Hossein Hakim and Michael Radzicki of Worcester Polytechnic Institute Table of Contents Abstract …………………………………………………………………………....……..….….5 Chapter 1: Introduction ……………………………………………………………..…….…....6 Chapter 2: Background Information ……………………………………………….…..…..….8 Financial Markets …………………………………………...……..………………....9 Capital Market ………………………………………………………………...…...…9 Stock Market ………………………………………………………………...…...… 10 Bond Market ………………………………………………………………...…........10 Money Market ………………………………………………………………...…......10 Derivative Market ………………………………………………………………...….11 Forex Market ………………………………………………………………...…....... 11 Forex Trading sessions ……………………………………………………..............12 Best Times During the Day to Trade Forex …………………………….…………..13 Common Forex Trading Terms………………………………………………………14 Base/Quote Currency ………………………………………………………………..14 Bid Price ………………………………………………………………...…................15 Ask Price ………………………………………………………………...…...............15 Pip………………………………………………………………...…......………….....15 Leverage ………………………………………………………………...…...….........15 Lot Size ………………………………………………………………...….................15 Short/Long ………………………………………………………………...…....….....16 Margin call ………………………………………………………………...…...…......16 Stop Loss ………………………………………………………………...…...…...….16