1 | Page Average True Range Is Often Used As an Indication of a Security's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Predicting SARS-Cov-2 Infection Trend Using Technical Analysis Indicators

medRxiv preprint doi: https://doi.org/10.1101/2020.05.13.20100784; this version posted May 20, 2020. The copyright holder for this preprint (which was not certified by peer review) is the author/funder, who has granted medRxiv a license to display the preprint in perpetuity. All rights reserved. No reuse allowed without permission. Predicting SARS-CoV-2 infection trend using technical analysis indicators Marino Paroli and Maria Isabella Sirinian Department of Clinical, Anesthesiologic and Cardiovascular Sciences, Sapienza University of Rome, Italy ABSTRACT COVID-19 pandemic is a global emergency caused by SARS-CoV-2 infection. Without efficacious drugs or vaccines, mass quarantine has been the main strategy adopted by governments to contain the virus spread. This has led to a significant reduction in the number of infected people and deaths and to a diminished pressure over the health care system. However, an economic depression is following due to the forced absence of worker from their job and to the closure of many productive activities. For these reasons, governments are lessening progressively the mass quarantine measures to avoid an economic catastrophe. Nevertheless, the reopening of firms and commercial activities might lead to a resurgence of infection. In the worst-case scenario, this might impose the return to strict lockdown measures. Epidemiological models are therefore necessary to forecast possible new infection outbreaks and to inform government to promptly adopt new containment measures. In this context, we tested here if technical analysis methods commonly used in the financial market might provide early signal of change in the direction of SARS-Cov-2 infection trend in Italy, a country which has been strongly hit by the pandemic. -

Relative Strength Index for Developing Effective Trading Strategies in Constructing Optimal Portfolio

International Journal of Applied Engineering Research ISSN 0973-4562 Volume 12, Number 19 (2017) pp. 8926-8936 © Research India Publications. http://www.ripublication.com Relative Strength Index for Developing Effective Trading Strategies in Constructing Optimal Portfolio Dr. Bhargavi. R Associate Professor, School of Computer Science and Software Engineering, VIT University, Chennai, Vandaloor Kelambakkam Road, Chennai, Tamilnadu, India. Orcid Id: 0000-0001-8319-6851 Dr. Srinivas Gumparthi Professor, SSN School of Management, Old Mahabalipuram Road, Kalavakkam, Chennai, Tamilnadu, India. Orcid Id: 0000-0003-0428-2765 Anith.R Student, SSN School of Management, Old Mahabalipuram Road, Kalavakkam, Chennai, Tamilnadu, India. Abstract Keywords: RSI, Trading, Strategies innovation policy, innovative capacity, innovation strategy, competitive Today’s investors’ dilemma is choosing the right stock for advantage, road transport enterprise, benchmarking. investment at right time. There are many technical analysis tools which help choose investors pick the right stock, of which RSI is one of the tools in understand whether stocks are INTRODUCTION overpriced or under priced. Despite its popularity and powerfulness, RSI has been very rarely used by Indian Relative Strength Index investors. One of the important reasons for it is lack of Investment in stock market is common scenario for making knowledge regarding how to use it. So, it is essential to show, capital gains. One of the major concerns of today’s investors how RSI can be used effectively to select shares and hence is regarding choosing the right securities for investment, construct portfolio. Also, it is essential to check the because selection of inappropriate securities may lead to effectiveness and validity of RSI in the context of Indian stock losses being suffered by the investor. -

Relative Strength Index (RSI) Application in Identifying Trading Movements of Selected IT Sector Companies in India 1P

IJMBS VOL . 7, Iss UE 1, JAN - MARCH 2017 ISSN : 2230-9519 (Online) | ISSN : 2231-2463 (Print) Relative Strength Index (RSI) Application in Identifying Trading Movements of Selected IT Sector Companies in India 1P. Selvam, 2L. Rakesh 1Business Studies, Sree Sastha Institute of Engineering & Technology, Chennai, India 2Senior Business Analyst, The Royal Bank of Scotland, Chennai, India Abstract The other variation of computing RSI: The stock market has been an integral part of the economy of any RSI = 100 X (1/(D/D+U) RSI – 100 ((100/U) /( 1+U/D)) country. The stock market plays a pivotal role in the growth of the Where, industry and commerce of the country that would subsequently D = an average of downward price change affect the economy of the country to a great extent. In the recent U = an average of upward price change past, share market investment has become one of the predominant As mentioned early, RSI usually makes fluctuation between 0 investment avenues for investors. Hence, investors wishing to make to 100. RSI peaks are an indication of overbought levels and an investment in share market are required to be conversant with suggest price tops, while RSI troughs are an indication of oversold share market trading practices, price fluctuations and appropriate levels and share price bottoms. Two horizontal lines are normally time for buying and selling securities. This article is proposed to drawn at 30 (indicating an oversold area) and 70 (indicating an apply the momentum oscillator by the name “Relative Strength overbought area). These two RSI lines can be adjusted depending Index – (RSI)” for figuring out an overbought and oversold on the market environment. -

My Favorite Trading Strategy Indicators

Trade Ideas My Favorite Trading Strategy Indicators by Dave Mabe | Dir. of Software Development My Favorite Trading Stratey Indicators | 2020 1 About Dave Mabe Director of Software Development Dave Mabe has been an active trader for over 15 years. Prior to joining Trade Ideas in 2011, Dave started StockTickr, an online trading journal. Dave created Holly, Trade Ideas Artificial Intelligence implementation, drawing from machine learning and data analysis techniques that he’s used in trading strategies for many years. Dave also was the architect behind Brokerage Plus and the Trade Ideas stock charts. @davemabe www.davemabe.com www.trade-ideas.com My Favorite Trading Stratey Indicators | 2020 2 Chapter 1 Clean Charts Too many trading indicators on a chart is a sign of mediocrity. Your charts should be nice and clean showing you exactly what you need to see to make your pre- planned decisions and no more. Many traders take this to heart and have simple charts that aren’t littered with indicators, but too many draw the wrong conclusion at this point: that all indicators are worthless. A trader’s clean chart is not recognition that all indicators are garbage – it should represent that the trader has gone through the thorough and painstaking work of determining which indicators are most important to their trading and why. It should represent countless ideas of what indicators make their trading tick and lots of decisions about the trade offs of including or excluding certain ones. A simple chart should represent the quantifiable tests that have gone into determining which indicators contribute to profit. -

Research Article AVERAGE TRUE RANGE: HIGH VOLATILITY AS A

Available Online at http://www.recentscientific.com International Journal of CODEN: IJRSFP (USA) Recent Scientific International Journal of Recent Scientific Research Research Vol. 11, Issue, 01(B), pp. 36805-36812, January, 2020 ISSN: 0976-3031 DOI: 10.24327/IJRSR Research Article AVERAGE TRUE RANGE: HIGH VOLATILITY AS A SUCCESS FACTOR FOR TRADING Dr.Ulrich R. Deinwallner PhD Management and Finance, Walden University, USA DOI: http://dx.doi.org/10.24327/ijrsr.2020.1101.4999 ARTICLE INFO ABSTRACT Article History: High volatility can be an indication to achieve excess returns with an investment strategy, according to the Efficient Market Hypothesis (EMH), since the underlying markets might exhibit less Received 6th October, 2019 th efficiency. In connection to this it was relevant to understand, if trading with low or high Average Received in revised form 15 True Range (ATR) values can improve the return results of a Moving Average (MA) trading November, 2019 strategy. The purpose of this quantitative research was to compare different MA strategies in Accepted 12th December, 2019 th different U.S. stock markets and to find an optimal ATR setting, to determine if excess returns can Published online 28 January, 2020 be achieved. The research question (RQ) was: what ATR setting can improve the return results of a MA trading strategy for U.S stock market indices? The following computations occurred: (a) simple Key Words: moving average; (b) ATR; and (c) t-Tests. I find in this study that a ATR(5) with high values Average True Range, Volatility Trading, (threshold = 25.92) is the most profitable setting to improve a Simple MA (SMA) trading strategy Moving Average, Efficient Market for the S&P500 index with (i.e., rSMA (20)_High_ATR (5)_S&P500 = 21.84 % per month), hypothesis, Portfolio Management. -

Technical-Analysis-Bloomberg.Pdf

TECHNICAL ANALYSIS Handbook 2003 Bloomberg L.P. All rights reserved. 1 There are two principles of analysis used to forecast price movements in the financial markets -- fundamental analysis and technical analysis. Fundamental analysis, depending on the market being analyzed, can deal with economic factors that focus mainly on supply and demand (commodities) or valuing a company based upon its financial strength (equities). Fundamental analysis helps to determine what to buy or sell. Technical analysis is solely the study of market, or price action through the use of graphs and charts. Technical analysis helps to determine when to buy and sell. Technical analysis has been used for thousands of years and can be applied to any market, an advantage over fundamental analysis. Most advocates of technical analysis, also called technicians, believe it is very likely for an investor to overlook some piece of fundamental information that could substantially affect the market. This fact, the technician believes, discourages the sole use of fundamental analysis. Technicians believe that the study of market action will tell all; that each and every fundamental aspect will be revealed through market action. Market action includes three principal sources of information available to the technician -- price, volume, and open interest. Technical analysis is based upon three main premises; 1) Market action discounts everything; 2) Prices move in trends; and 3) History repeats itself. This manual was designed to help introduce the technical indicators that are available on The Bloomberg Professional Service. Each technical indicator is presented using the suggested settings developed by the creator, but can be altered to reflect the users’ preference. -

How Day Trade for a Living by Andrew Aziz

Glossary How Day Trade for A Living by Andrew Aziz A Alpha stock: a Stock in Play, a stock that is moving independently of both the overall market and its sector, the market is not able to control it, these are the stocks day traders look for. Ask: the price sellers are demanding in order to sell their stock, it’s always higher than the bid price. Average daily volume: the average number of shares traded each day in a particular stock, I don’t trade stocks with an average daily volume of less than 500,000 shares, as a day trader you need sufficient liquidity to be able to get in and out of the stock without difficulty. Average relative volume: how much of the stock is trading compared to its normal volume, I don’t trade in stocks with an average relative volume of less than 1.5, which means the stock is trading at least 1.5 times its normal daily volume. Average True Range/ATR: how large of a range in price a particular stock has on average each day, I look for an ATR of at least 50 cents, which means the price of the stock will move at least 50 cents most days. Averaging down: adding more shares to your losing position in order to lower the average cost of your position, with the hope of selling it at break-even in the next rally in your favor, as a day trader, don’t do it, do not average down, ever, a full explanation is provided in this book, to be a successful day trader you must avoid the urge to average down. -

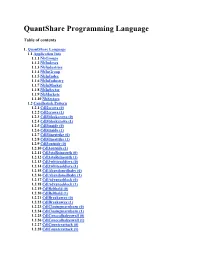

Timeframeset

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

Harnessing Market Volatility

HOW TO FIND OPPORTUNITY IN FAST -MOVING MARKETS HARNESSING MARKET VOLATILITY One of the benefits of trading forex is the opportunity to find profit potential in both rising and falling markets. Since the market can go up or down at a moment’s notice, volatility can work to your advantage—if you know how to use it. We’ll show you some technical and fundamental analysis that can help you harness market volatility, as well as some risk management techniques that can help you capture potential profit and limit losses. An example of market volatility The following table illustrates the percentage change of different instruments since October 2007 and July 2008. Oil prices plummeted more than 50 percent in that time frame while the EUR/USD, GBP/JPY and USD/JPY fell approximately 20 percent. The daily trading ranges increased significantly as few hundred point swings in the Dow became the norm. The same was true for currencies where the average daily range expanded significantly. The average true range for many currency pairs doubled in that period. PAIR OCTOBER 1, CHANGE JULY 1, CHANGE OCTO- 2007 2008 BER 23, 2008 EUR/USD 1.4282 -10% 1.5827 -19% 1.2820 GBP/USD 2.0495 -21% 2.0000 -19% 1.6105 USD/JPY 106.39 -9% 123.29 -21% 97.32 DJIA 14116 -39% 11408 -25% 8545 SP500 1549 -42% 1285 -30% 897 FTSE 6467 -37% 5626 -28% 4046 DAX 7922 -44% 6395 -30% 4456 NIKKEI 16773 -50% 13515 -37% 8461 ASX 6568 -39% 5232 -24% 3974 OIL 82.0 -18% 143.3 -53% 68 GOLD 747.4 -6% 948.3 -26% 705 VIX 18.44 272% 25.14 173% 68.61 20% change >50% change DETERMINING TRADING STRATEGIES To increase the probability of successful trades, traders must understand whether the market is in trend or range. -

Xxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxx 1 • • • • Sample • • • • 7 Charting Tools for Spread Betting A practical guide to making money from spread betting with technical analysis by Malcolm Pryor HARRIMAN HOUSE LTD 3A Penns Road Petersfield Hampshire GU32 2EW GREAT BRITAIN Tel: +44 (0)1730 233870 Fax: +44 (0)1730 233880 Email: [email protected] Website: www.harriman-house.com First published in Great Britain in 2009 by Harriman House. Copyright © Harriman House Ltd The right of Malcolm Pryor to be identified as the author has been asserted in accordance with the Copyright, Design and Patents Act 1988. 978-1-905641-84-0 British Library Cataloguing in Publication Data A CIP catalogue record for this book can be obtained from the British Library. All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. This book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover other than that in which it is published without the prior written consent of the Publisher. Printed in the UK by CPI William Clowes, Beccles NR34 7TL No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the employer of the Author. Designated trademarks and brands are the property of their respective owners. -

Package 'Quanttools'

Package ‘QuantTools’ October 14, 2016 Type Package Title Enhanced Quantitative Trading Modelling Version 0.5.0 Author Stanislav Kovalevsky Maintainer Stanislav Kovalevsky <[email protected]> Description Download and organize historical market data from multiple sources like Ya- hoo (<http://finance.yahoo.com>), Google (<https://www.google.com/finance>), Fi- nam (<http://www.finam.ru/profile/moex- akcii/sberbank/export/>) and IQFeed (<http://www.iqfeed.net/symbolguide/index.cfm?symbolguide=lookup>). Code your trad- ing algorithms in modern C++11 with powerful event driven tick processing API including trad- ing costs and exchange communication latency and transform detailed data seam- lessly into R. In just few lines of code you will be able to visualize every step of your trad- ing model from tick data to multi dimensional heat maps. URL https://quanttools.bitbucket.io/_site/index.html BugReports https://bitbucket.org/quanttools/quanttools/issues License GPL-3 Encoding UTF-8 LazyData false Depends data.table, R (>= 2.10) Imports methods, fasttime, RCurl, Rcpp (>= 0.12.6) LinkingTo Rcpp SystemRequirements C++11 RoxygenNote 5.0.1 NeedsCompilation yes Repository CRAN Date/Publication 2016-10-14 00:29:33 1 2 R topics documented: R topics documented: add_last_values . .3 add_legend . .4 back_test . .4 BBands . .5 bbands . .6 bw..............................................7 calc_decimal_resolution . .7 Candle . .8 Cost.............................................8 Crossover . .9 crossover . 10 distinct_colors . 11 dof.............................................. 11 Ema............................................. 12 ema ............................................. 12 empty_plot . 13 gen_futures_codes . 13 get_market_data . 14 hist_dt . 15 Indicator . 15 iqfeed . 16 iround . 20 lapply_named . 20 lines_ohlc . 21 lines_stacked_hist . 21 lmerge . 22 multi_heatmap . 23 na_locf . 24 Order . 24 plot_table . 25 plot_ts . 26 Processor . 27 returns . -

Position Sizing Methods for a Trend Following CTA

Position sizing methods for a trend following CTA HENRIK SANDBERG RASMUS ÖHMAN Master of Science Thesis Stockholm, Sweden 2014 Positionsskalningsmetoder för en trendföljande CTA HENRIK SANDBERG RASMUS ÖHMAN Examensarbete Stockholm, Sverige 2014 Positionsskalningsmetoder för en trendföljande CTA av Henrik Sandberg Rasmus Öhman Examensarbete INDEK 2014:47 KTH Industriell teknik och management Industriell ekonomi och organisation SE-100 44 STOCKHOLM Position sizing methods for a trend following CTA Henrik Sandberg Rasmus Öhman Master of Science Thesis INDEK 2014:47 KTH Industrial Engineering and Management Industrial Management SE-100 44 STOCKHOLM Examensarbete INDEK 2014:47 Positionsskalningsmetoder för en trendföljande CTA Henrik Sandberg Rasmus Öhman Godkänt Examinator Handledare 2014-06-04 Hans Lööf Tomas Sörensson Uppdragsgivare Kontaktperson Coeli Spektrum N/A Sammanfattning Denna studie undersöker huruvida en trendföljande managed futures-fond kan förbättra sina resultat genom att ändra positionsskalningsmetod. Handel med en enkel trendföljande strategi simulerades på 47 futureskontrakt åren 1990-2012, för olika metoder att för bestämma positionsstorlek. Elva positionsskalningmetoder undersöktes, exemplevis Target Volatility, Omega Optimization och metoder baserade i korrelationsrankning. Både tidigare beskrivna metoder och nya tillvägagångssätt testades, och jämfördes med den grundläggande strategin med avseende på risk och avkastning. Denna studies resultat visar att framförallt Target Volatility, och i viss uträckning Max Drawdown