Harnessing Market Volatility

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

My Favorite Trading Strategy Indicators

Trade Ideas My Favorite Trading Strategy Indicators by Dave Mabe | Dir. of Software Development My Favorite Trading Stratey Indicators | 2020 1 About Dave Mabe Director of Software Development Dave Mabe has been an active trader for over 15 years. Prior to joining Trade Ideas in 2011, Dave started StockTickr, an online trading journal. Dave created Holly, Trade Ideas Artificial Intelligence implementation, drawing from machine learning and data analysis techniques that he’s used in trading strategies for many years. Dave also was the architect behind Brokerage Plus and the Trade Ideas stock charts. @davemabe www.davemabe.com www.trade-ideas.com My Favorite Trading Stratey Indicators | 2020 2 Chapter 1 Clean Charts Too many trading indicators on a chart is a sign of mediocrity. Your charts should be nice and clean showing you exactly what you need to see to make your pre- planned decisions and no more. Many traders take this to heart and have simple charts that aren’t littered with indicators, but too many draw the wrong conclusion at this point: that all indicators are worthless. A trader’s clean chart is not recognition that all indicators are garbage – it should represent that the trader has gone through the thorough and painstaking work of determining which indicators are most important to their trading and why. It should represent countless ideas of what indicators make their trading tick and lots of decisions about the trade offs of including or excluding certain ones. A simple chart should represent the quantifiable tests that have gone into determining which indicators contribute to profit. -

Research Article AVERAGE TRUE RANGE: HIGH VOLATILITY AS A

Available Online at http://www.recentscientific.com International Journal of CODEN: IJRSFP (USA) Recent Scientific International Journal of Recent Scientific Research Research Vol. 11, Issue, 01(B), pp. 36805-36812, January, 2020 ISSN: 0976-3031 DOI: 10.24327/IJRSR Research Article AVERAGE TRUE RANGE: HIGH VOLATILITY AS A SUCCESS FACTOR FOR TRADING Dr.Ulrich R. Deinwallner PhD Management and Finance, Walden University, USA DOI: http://dx.doi.org/10.24327/ijrsr.2020.1101.4999 ARTICLE INFO ABSTRACT Article History: High volatility can be an indication to achieve excess returns with an investment strategy, according to the Efficient Market Hypothesis (EMH), since the underlying markets might exhibit less Received 6th October, 2019 th efficiency. In connection to this it was relevant to understand, if trading with low or high Average Received in revised form 15 True Range (ATR) values can improve the return results of a Moving Average (MA) trading November, 2019 strategy. The purpose of this quantitative research was to compare different MA strategies in Accepted 12th December, 2019 th different U.S. stock markets and to find an optimal ATR setting, to determine if excess returns can Published online 28 January, 2020 be achieved. The research question (RQ) was: what ATR setting can improve the return results of a MA trading strategy for U.S stock market indices? The following computations occurred: (a) simple Key Words: moving average; (b) ATR; and (c) t-Tests. I find in this study that a ATR(5) with high values Average True Range, Volatility Trading, (threshold = 25.92) is the most profitable setting to improve a Simple MA (SMA) trading strategy Moving Average, Efficient Market for the S&P500 index with (i.e., rSMA (20)_High_ATR (5)_S&P500 = 21.84 % per month), hypothesis, Portfolio Management. -

How Day Trade for a Living by Andrew Aziz

Glossary How Day Trade for A Living by Andrew Aziz A Alpha stock: a Stock in Play, a stock that is moving independently of both the overall market and its sector, the market is not able to control it, these are the stocks day traders look for. Ask: the price sellers are demanding in order to sell their stock, it’s always higher than the bid price. Average daily volume: the average number of shares traded each day in a particular stock, I don’t trade stocks with an average daily volume of less than 500,000 shares, as a day trader you need sufficient liquidity to be able to get in and out of the stock without difficulty. Average relative volume: how much of the stock is trading compared to its normal volume, I don’t trade in stocks with an average relative volume of less than 1.5, which means the stock is trading at least 1.5 times its normal daily volume. Average True Range/ATR: how large of a range in price a particular stock has on average each day, I look for an ATR of at least 50 cents, which means the price of the stock will move at least 50 cents most days. Averaging down: adding more shares to your losing position in order to lower the average cost of your position, with the hope of selling it at break-even in the next rally in your favor, as a day trader, don’t do it, do not average down, ever, a full explanation is provided in this book, to be a successful day trader you must avoid the urge to average down. -

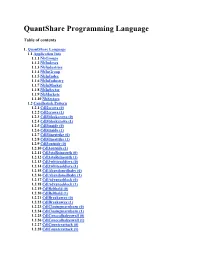

Timeframeset

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

Xxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxx 1 • • • • Sample • • • • 7 Charting Tools for Spread Betting A practical guide to making money from spread betting with technical analysis by Malcolm Pryor HARRIMAN HOUSE LTD 3A Penns Road Petersfield Hampshire GU32 2EW GREAT BRITAIN Tel: +44 (0)1730 233870 Fax: +44 (0)1730 233880 Email: [email protected] Website: www.harriman-house.com First published in Great Britain in 2009 by Harriman House. Copyright © Harriman House Ltd The right of Malcolm Pryor to be identified as the author has been asserted in accordance with the Copyright, Design and Patents Act 1988. 978-1-905641-84-0 British Library Cataloguing in Publication Data A CIP catalogue record for this book can be obtained from the British Library. All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. This book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover other than that in which it is published without the prior written consent of the Publisher. Printed in the UK by CPI William Clowes, Beccles NR34 7TL No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the employer of the Author. Designated trademarks and brands are the property of their respective owners. -

Position Sizing Methods for a Trend Following CTA

Position sizing methods for a trend following CTA HENRIK SANDBERG RASMUS ÖHMAN Master of Science Thesis Stockholm, Sweden 2014 Positionsskalningsmetoder för en trendföljande CTA HENRIK SANDBERG RASMUS ÖHMAN Examensarbete Stockholm, Sverige 2014 Positionsskalningsmetoder för en trendföljande CTA av Henrik Sandberg Rasmus Öhman Examensarbete INDEK 2014:47 KTH Industriell teknik och management Industriell ekonomi och organisation SE-100 44 STOCKHOLM Position sizing methods for a trend following CTA Henrik Sandberg Rasmus Öhman Master of Science Thesis INDEK 2014:47 KTH Industrial Engineering and Management Industrial Management SE-100 44 STOCKHOLM Examensarbete INDEK 2014:47 Positionsskalningsmetoder för en trendföljande CTA Henrik Sandberg Rasmus Öhman Godkänt Examinator Handledare 2014-06-04 Hans Lööf Tomas Sörensson Uppdragsgivare Kontaktperson Coeli Spektrum N/A Sammanfattning Denna studie undersöker huruvida en trendföljande managed futures-fond kan förbättra sina resultat genom att ändra positionsskalningsmetod. Handel med en enkel trendföljande strategi simulerades på 47 futureskontrakt åren 1990-2012, för olika metoder att för bestämma positionsstorlek. Elva positionsskalningmetoder undersöktes, exemplevis Target Volatility, Omega Optimization och metoder baserade i korrelationsrankning. Både tidigare beskrivna metoder och nya tillvägagångssätt testades, och jämfördes med den grundläggande strategin med avseende på risk och avkastning. Denna studies resultat visar att framförallt Target Volatility, och i viss uträckning Max Drawdown -

Some Techniques Used Is Technical Analysis

Some Techniques Used in Technical Analysis Moving Averages Simple Moving Averages (SMA) A simple moving average is formed by computing the average (mean) price of a security over a specified number of periods. While it is possible to create moving averages from the Open, the High, and the Low data points, most moving averages are created using the closing price. For example: a 5-day simple moving average is calculated by adding the closing prices for the last 5 days and dividing the total by 5. The calculation is repeated for each price on the chart. The averages are then joined to form a smooth curving line - the moving average line. Continuing our example, if the next closing price in the average is 15, then this new period would be added and the oldest day, which is 10, would be dropped. The new 5-day simple moving average would be calculated as follows: Over the last 2 days, the SMA moved from 12 to 13. As new days are added, the old days will be subtracted and the moving average will continue to move over time. Note that all moving averages are lagging indicators and will always be "behind" the price. The price of EK is trending down, but the simple moving average, which is based on the previous 10 days of data, remains above the price. If the price were rising, the SMA would most likely be below. Because moving averages are lagging indicators, they fit in the category of trend following indicators. When prices are trending, moving averages work well. -

Noncandlestick Confirmation Indicators and Terms

C HAPTER DEFINITION: momentum oscillator Noncandlestick Confi rmation A momentum oscillator is a type of price- based indicator. Momentum measures Indicators and Terms the rate of change in price; an oscillator shows how value changes in relation to a set value or values over time. accumulation/distribution (AD) a momentum oscil- the price levels and movements. A series of A/D days lator based on price trends, developed by Marc Chaikin, a expressed in a moving average and divided by volume trader who recognized the importance of whether current for the averaged period (usually 21 days) is called the DEFINITION: price movement of a stock is controlled by buyers (accu- Chaikin Money Flow (CMF), a strong technical sign The A/D indicator mulation phase) or by sellers (distribution phase). that often provides reversal signals in advance of the The A/D indicator is a momentum The A/D indicator is based on a single day’s prices turnaround and that may be confi rmed by candlestick oscillator. Its value goes beyond the initial calculation, however. The moving and it identifi es whether buyers or sellers determined signals. average of A/D serves as the basis for the more revealing signal, the Chaikin Money Flow (CMF). 246 c08.indd 246 13/12/11 9:02 AM Bloomberg Visual Guide to Candlestick Charting ■ 247 American Express (AXP) accumulation/distribution (A/D) STEP-BY-STEP DO IT YOURSELF Follow these steps to calculate A/D: 1. Subtract the session’s low from the close. A/D is calculated by fi nding the sum of differences be- 2. -

Bullish Pattern

International School of Financial Markets WWW.ISFM.CO.IN Best Stock Market School Gurgaon 0124-2200689, 9540008689 Reg. office: Plot no. 152 - P (LGF), Sec – 38, Medicity Road, NR Bakhtawar Chowk Phone : 0124-2200689, +91 9540008689, +91 9953147497, +91 9911878442 Web: www.isfm.co.in , Email : [email protected] Reg. office: Plot no. 152 - P (LGF), Sec – 38, Medicity Road, Near Medanta Hospital Contact No. - 0124-2200689, +919540008689, WWW.ISFM.CO.IN Accumulation The act of buying more shares of a security without causing the price to increase significantly. After a decline, a stock may start to base and trade sideways for an extended period. While this base builds, well-informed traders and investors may seek to establish or increase existing long positions. In that case, the stock is said to have come under accumulation. Accumulation Distribution Line A momentum indicator that relates price changes with volume. It relates the closing price to the range of prices (H - L). The closer the close is to the high, the more volume is added to the cumulative total. Advance Decline Line One of the most widely used indicators to measure the breadth of a stock market advance or decline. The AD line tracks the net difference between advancing and declining issues. It is usually compared to a market average WWW.ISFM.CO.INwhere divergence from that average would be an early indication of a possible trend reversal. AdvanceBest Decline Stock Ratio Market School The ratio of advancing issues over declining issues. Taking the moving average of the AD ratioGurgaon will smooth it so it can be used as an overbought and oversold indicator. -

5-Step-Trading Fx ® Workbook

1 L E X¶S FAV O URI T E T E C H NI C A L T R A DIN G ST R AT E G I ES F O R F X - W O R K B O O K This workbook is intended to accompany the /H[¶VF avourite Technical Trading Strategies for F X - Applicable to Commodities and Equity Indexes as well online module. WORKBOOK QU ESTION: Why do you think technical indicators make trading less emotional and more objective? 2 Table of contents Types of traders ....................................................................................................................................................... 5 Technical indicators: Introduction ........................................................................................................................... 7 Technical indicators: Leading Indicators ................................................................................................................ 9 a) Support & Resistance, Fibonacci retracement levels and Floor Pivot points ............................................. 9 b) Relative Strength Index (RSI) .................................................................................................................. 13 c) Stochastic Oscillator ................................................................................................................................. 14 Technical indicators: Lagging Indicators .............................................................................................................. 16 a) Moving Averages ..................................................................................................................................... -

Samurai for Ninjatrader® “Train Your Ninja with Samurai”

Quant Trade 233 South Wacker Drive, Suite 8625 Chicago, IL 60606 (872) 225-2110 ext. 2 [email protected] A Guide to Samurai for NinjaTrader® “Train your Ninja with Samurai” SAMURAI for NinjaTrader® Risk Disclosure Statement The risk of loss in trading commodity futures contracts can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. You may sustain a total loss of the initial margin funds and any additional funds that you deposit with your broker to establish or maintain a position in the commodity futures market. Past performance is not indicative of future results. We recommend that you learn more from the Commodity Futures Trading Commission (CFTC) or the National Futures Association. Trading Securities: In considering whether to trade in securities or enter into any such transaction, you should be aware that trading in securities can be extremely risky. You should be prepared to lose all of the funds used for trading in securities. You should not fund your security trading activities with retirement savings, emergency funds or funds set aside for purposes such as education or home ownership. Trading in securities can also lead to large and immediate financial losses. Trading in securities requires knowledge of the securities markets. Trading in securities requires in-depth knowledge of the securities markets and trading techniques and strategies. In attempting to profit through trading in securities, you must compete with professional, licensed traders employed by securities companies. You should have the appropriate experience before engaging in the trading of securities. -

Everything You Need to Know About Forex from How Forex Trading Works Contents Introduction

Everything You Need to Know about Forex from How Forex Trading Works Contents Introduction.............................................................................................................................4 The Basics of Forex...............................................................................................................5 The Size of the Forex Market.................................................................................................7 Where Forex Market Currencies Are Traded.........................................................................9 How Forex Market Currencies Are Traded..........................................................................10 The Advantages of Forex Trading........................................................................................12 Currency Pairs Explained....................................................................................................13 Forex Spreads Explained.....................................................................................................15 The Costs of Forex Trading.................................................................................................16 Types of Forex Orders.........................................................................................................18 Forex Margin Trading Explained..........................................................................................20 Forex Micro Accounts and Lots Explained...........................................................................22