International Opportunities - TF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SEI Global Investments Fund Plc Unaudited Condensed Financial Statements for the Half Year Ended 31 December 2020

SEI GLOBAL INVESTMENTS FUND PLC Unaudited Condensed Financial Statements for the half year ended 31 December 2020 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 CONTENTS PAGE Directory 3 General Information 4 Investment Adviser’s Report The SEI Global Select Equity Fund 6 Portfolio of Investments The SEI Global Select Equity Fund 9 Condensed Income Statement 26 Condensed Statement of Financial Position 27 Condensed Statement of Changes in Net Assets Attributable to Redeemable Participating Shareholders 29 Notes to the Condensed Financial Statements 31 Appendix I – Remuneration Disclosures 40 Appendix II – Statement of Changes in Composition of Portfolio 41 Appendix III – Securities Financing Transactions Regulation 42 2 SEI Global Investments Fund plc Unaudited Condensed Financial Statements for the half year ended 31 December 2020 DIRECTORY Board of Directors at 31 December 2020 Michael Jackson (Chairman) (Irish) Kevin Barr (American) Robert A. Nesher (American) Desmond Murray* (Irish) Jeffrey Klauder (American) *Director, independent of the Investment Adviser Manager SEI Investments Global, Limited 2nd Floor Styne House Upper Hatch Street Dublin 2 Ireland Investment Adviser SEI Investments Management Corporation 1 Freedom Valley Drive Oaks, Pennsylvania 19456 U.S.A. Depositary Brown Brothers Harriman Trustee Services (Ireland) Limited 30 Herbert Street Dublin 2 Ireland Administrator SEI Investments – Global Fund Services Limited 2nd Floor Styne House Upper Hatch Street -

20Annual Report 2020 Equiniti Group

EQUINITI GROUP PLC 20ANNUAL REPORT 2020 PURPOSEFULLY DRIVEN | DIGITALLY FOCUSED | FINANCIAL FUTURES FOR ALL Equiniti (EQ) is an international provider of technology and solutions for complex and regulated data and payments, serving blue-chip enterprises and public sector organisations. Our purpose is to care for every customer and simplify each and every transaction. Skilled people and technology-enabled services provide continuity, growth and connectivity for businesses across the world. Designed for those who need them the most, our accessible services are for everyone. Our vision is to help businesses and individuals succeed, creating positive experiences for the millions of people who rely on us for a sustainable future. Our mission is for our people and platforms to connect businesses with markets, engage customers with their investments and allow organisations to grow and transform. 2 Contents Section 01 Strategic Report Headlines 6 COVID-19: Impact And Response 8 About Us 10 Our Business Model 12 Our Technology Platforms 14 Our Markets 16 Our Strategy 18 Our Key Performance Indicators 20 Chairman’s Statement 22 Chief Executive’s Statement 24 Operational Review 26 Financial Review 34 Alternative Performance Measures 40 Environmental, Social and Governance 42 Principal Risks and Uncertainties 51 Viability Statement 56 Section 02 Governance Report Corporate Governance Report 62 Board of Directors 64 Executive Committee 66 Board 68 Audit Committee Report 78 Risk Committee Report 88 Nomination Committee Report 95 Directors' Remuneration -

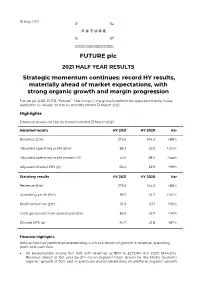

Rns Over the Long Term and Critical to Enabling This Is Continued Investment in Our Technology and People, a Capital Allocation Priority

19 May 2021 FUTURE plc 2021 HALF YEAR RESULTS Strategic momentum continues: record HY results, materially ahead of market expectations, with strong organic growth and margin progression Future plc (LSE: FUTR, “Future”, “the Group”), the global platform for specialist media, today publishes its results for the six months ended 31 March 2021. Highlights Financial results for the six months ended 31 March 2021 Adjusted results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Adjusted operating profit (£m)1 89.2 39.9 +124% Adjusted operating profit margin (%) 33% 28% +5ppt Adjusted diluted EPS (p) 65.4 32.9 +99% Statutory results HY 2021 HY 2020 Var Revenue (£m) 272.6 144.3 +89% Operating profit (£m) 59.7 24.7 +142% Profit before tax (£m) 56.9 27.1 +110% Cash generated from operations (£m) 85.9 35.7 +141% Diluted EPS (p) 40.7 21.8 +87% Financial highlights Robust first-half performance extending our track record of growth in revenue, operating profit and cash flow: An exceptionally strong first half, with revenue up 89% to £272.6m (HY 2020: £144.3m). Revenue ahead of last year by 21% on an organic2 basis, driven by the Media division’s organic2 growth of 30% and in particular digital advertising on-platform organic2 growth of 30% and eCommerce affiliates’ organic2 growth of 56%. US achieved revenue growth of 31% on an organic2 basis and UK revenues grew by 5% organically (UK has a higher mix of events and magazines revenues which were impacted more materially by the pandemic). -

Exploring the Secrets of Success

people technolog siness Issue 35 In this issue Exploring the secrets of success 2 Business Insight GS-insight discusses some of the latest trends and Graham Charlton, CFO, Softcat opportunities in the international technology industry, the importance of company culture in business 5 Consulting Insight success and much more … Martin Smith, Executive Director, Sheffield Haworth Welcome to the 35th edition of GS-insight, fit and thereby de-risk the hiring process. Consulting Solutions the magazine of international technology Understandably, investors and Boards are sector Executive Search specialists Gillamor very keen to have a robust assessment of Stephens, part of Sheffield Haworth, the global the strengths and risks associated with 6 International Insight talent consulting and leadership advisory management teams and of their capability to Kelly Kinnard, VP Talent, firm. As a recruitment team, we are fortunate grow, change and adapt to achieve business Battery Ventures to work with companies at all stages of organ- objectives. isational and business development; from This issue of GS-insight explores a wide 8 Investment Insight university “spin-outs” requiring CEOs to help range of themes with leaders across our commercialise “bleeding edge” technology, Mark Boggett, CEO, industry sector. We discuss the importance Seraphim Space Capital through to privately owned and VC/PE of company culture and business growth with funded small-mid size businesses seeking Graham Charlton of Softcat and Russell Sloan the leaders to drive organic and acquisitive of Kainos, two of the most successful and 10 Non-Executive growth/internationalisation strategies to the fastest growing publicly listed technology Insight larger corporate entities hiring executives to businesses. -

Annual Report of Proxy Voting Record Date Of

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD FTSE 250 UCITS ETF --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: 3i Infrastructure plc TICKER: 3IN CUSIP: ADPV41555 MEETING DATE: 7/5/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #1: ACCEPT FINANCIAL STATEMENTS AND ISSUER YES FOR FOR STATUTORY REPORTS PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: APPROVE FINAL DIVIDEND ISSUER YES FOR FOR PROPOSAL #4: RE-ELECT RICHARD LAING AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #5: RE-ELECT IAN LOBLEY AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #6: RE-ELECT PAUL MASTERTON AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #7: RE-ELECT DOUG BANNISTER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #8: RE-ELECT WENDY DORMAN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #9: ELECT ROBERT JENNINGS AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #10: RATIFY DELOITTE LLP AS AUDITORS ISSUER YES FOR FOR PROPOSAL #11: AUTHORISE BOARD TO FIX REMUNERATION OF ISSUER YES FOR FOR AUDITORS PROPOSAL #12: APPROVE SCRIP DIVIDEND SCHEME ISSUER YES FOR FOR PROPOSAL #13: AUTHORISE CAPITALISATION OF THE ISSUER YES FOR FOR APPROPRIATE AMOUNTS OF NEW ORDINARY SHARES TO BE ALLOTTED UNDER THE SCRIP DIVIDEND SCHEME PROPOSAL #14: AUTHORISE ISSUE OF EQUITY WITHOUT PRE- ISSUER YES FOR FOR EMPTIVE RIGHTS PROPOSAL #15: AUTHORISE MARKET PURCHASE OF ORDINARY ISSUER YES FOR FOR -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Preliminary Results FY 2020

Preliminary results FY 2020 25 November 2020 1 2 Agenda ● Overview ● FY 2020 financial review ● Progress against our strategy in FY 2020 ● Recommended offer for GoCo Group plc ● Summary & outlook 3 Exceptional results, Values led 01 ahead of expectations... 02 execution... ● Strong core values facilitated ● Group revenue up 53% to agile response to the rapidly £339.6m, underpinned by changing landscape acquisitions and media organic ● Operating leverage driving revenue growth of 23% adjusted operating margin ● Continued growth in adjusted expansion to 28% operating profit, up 79% to ● Continue to be highly cash £93.4m Continued generative, with adjusted free ● Adjusted free cash flow growth cash flow of 103% of adjusted of 79% strength of operating profit ● Exceptional performance performance despite COVID-19 underpinned ...delivered by ongoing ...enables strong by delivery 03 focus on strategy 04 acquisitions performance ● TI Media integration ● Continued shift in revenue, completed, savings of £20m with Media division now 65% 1 identified, with focus now on of revenues (Sept 2020) building revenue ● Geographical diversification monetisation, with launch of 6 continues with US now 43% of new sites revenue (Sept 2020)1 2 ● Barcroft and SmartBrief both ● Online audience growth of in BAU mode, delivering in 56%, with organic audience line with plans up 48%, driving sales ● Recommended offer for performance in Media GoCo Group plc announced today (25 November) 4 1 Sept month 2020 shown to reflect TI Media acquisition 2 Google Analytics online users. -

Underthebonnet

JOHCM UK DYNAMIC FUND UNDER THE BONNET 2019 ANNUAL REVIEW Alex Savvides, Senior Fund Manager Tom Matthews, Analyst INVESTMENT BACKGROUND Global equity markets continued to move higher in December as economic indicators showed a pick-up in global growth, there was further progress in US-China trade discussions and the UK’s Conservative party won an overall majority in the general election. The JP Morgan Global Composite PMI ticked up from the previous month’s 44-month low following a steepening in China’s composite PMI growth rate and a strengthening in US business activity. US equities had a remarkable year, capped by President Trump announcing he would sign a phase one trade deal with China in January and move to negotiations on phase two. The S&P 500, Dow Jones Industrial Average and NASDAQ 100 total return indices all reached new all-time highs in December, with gains of 32%, 25% and 40% respectively for the year. We wrote the following in August’s ‘Under the Bonnet’: “When we come to reflect on 2019, July will likely be seen as a decisive… a month in which geopolitical brinkmanship came to a head, leading government and central bank policies to be reappraised which ultimately may lead to a new market narrative.” The progress in the US-China trade deal marked a clear de-escalation in this brinkmanship globally, but starker still were the final quarter’s developments in the UK: a new withdrawal agreement negotiated with the EU and - in December alone - the Conservative Party winning an historic majority in the general election and the withdrawal agreement subsequently being passed by parliament more than 13 months after Theresa May’s cabinet first backed her deal. -

Electrocomponents Plc Annual Report and Accounts 2009

International Management Centre plc Electrocomponents 8050 Oxford Business Park North The leading high service distributor to engineers worldwide Oxford OX4 2HW United Kingdom t: (44) (0) 1865 204000 f: (44) (0) 1865 207400 w: www.electrocomponents.com Annual Report and Accounts 2009 ELECTROCOMPONENTS PLC ANNUAL REPORT AND ACCOUNTS 2009 Cert no. SGS-COC-1732 Published by Black Sun Plc +44 (0)20 7736 0011 Electrocomponents plc Printed at St Ives Westerham Press Ltd Contents MORE INFORMATION IFC Highlights of theYear 38 Group Cash Flow Statement 1 Chairman’s Statement 39 Group Significant Accounting Policies 3 Chief Executive’s Review 43 Notes to the Group Accounts 6 Strategic overview 71 Company Balance Sheet 12 Business Review 72 Company Significant 21 Board of Directors Accounting Policies 22 Directors’ Report 74 Notes to the Company Accounts 24 Corporate Governance Report 81 FiveYear Record 28 Remuneration Report 82 Additional Information for 34 Statement of Directors’ Responsibilities Electrocomponents plc Shareholders GET MORE ONLINE 35 Independent Auditors’ Report 83 Registered Office, Advisers 36 Group Income Statement and Financial Calendar 37 Group Balance Sheet 84 Principal Locations WWW.ELECTROCOMPONENTS.COM HIGHLIGHTS OF THE YEAR ACCESS THE LATEST – 10% GROWTH IN E-COMMERCE SALES Revenue 1 SHAREHOLDER – LEADERSHIP TEAMS IN EUROPE AND INFORMATION ELECTRONICS STRENGTHENED £974.6m • Updates via email • Latest share price – ELECTRONICS OFFER EXPANDED • Corporate governance – SUCCESSFUL LAUNCH OF ELECTRONICS Headline profit before tax -

Quarterly Commentary—Artisan Non-U.S. Small

QUARTERLY Artisan Non-U.S. Small-Mid Growth Strategy FactCommentary Sheet As of 30 June 2020 Investment Process We seek long-term investments in high-quality businesses exposed to structural growth themes that can be acquired at sensible valuations in a contrarian fashion and are led by excellent management teams. Investing with Tailwinds We identify structural themes at the intersection of growth and change with the objective of investing in companies having meaningful exposure to these trends. Themes can be identified from both bottom-up and top-down perspectives. High-Quality Businesses We seek future leaders with attractive growth characteristics that we can own for the long term. Our fundamental analysis focuses on those companies exhibiting unique and defensible business models, high barriers to entry, proven management teams, favorable positions within their industry value chains and high or improving returns on capital. In short, we look to invest in small companies that have potential to become large. A Contrarian Approach to Valuation We seek to invest in high-quality businesses in a contrarian fashion. Mismatches between stock price and long-term business value are created by market dislocations, temporary slowdowns in individual businesses or misperceptions in the investment community. We also examine business transformation brought about by management change or restructuring. Manage Unique Risks of International Small- and Mid-Cap Equities International small- and mid-cap equities are exposed to unique investment risks that require managing. We define risk as permanent loss of capital, not share price volatility. We manage this risk by having a long-term ownership focus, understanding the direct and indirect security risks for each business, constructing the portfolio on a well-diversified basis and sizing positions according to individual risk characteristics. -

Enabling Success

ENABLING SUCCESS Computacenter plc Annual Report and Accounts 2020 2020 Highlights 1. Adjusted operating profit or loss, Revenue £m +7.7% Dividend per share Pence +402.0% adjusted net finance income or expense, adjusted profit or loss before tax, adjusted tax, adjusted profit or 5,441.3 50.7 loss, adjusted earnings per share and adjusted diluted earnings per share are, as appropriate, each stated 2020 5,441.3 2020 50.7 before: exceptional and other 2019 5,052.8 2019 10.1 adjusting items including gains or losses on business acquisitions and 2018 4,352.6 2018 30.3 disposals, amortisation of acquired intangibles, utilisation of deferred tax 2017 3,793.4 2017 26.1 assets (where initial recognition was 2016 3,245.4 2016 22.2 as an exceptional item or a fair value adjustment on acquisition), and the related tax effect of these exceptional Profit before tax £m +46.5% Adjusted1 profit before tax £m +37.0% and other adjusting items, as Management do not consider these items when reviewing the underlying performance of the Segment or the 206.6 200.5 Group as a whole. A reconciliation to adjusted measures is provided on page 2020 206.6 2020 200.5 61 of the Group Finance Director’s Review which details the impact of 2019 141.0 2019 146.3 exceptional and other adjusted items when compared to the non-Generally 2018 108.1 2018 118.2 Accepted Accounting Practice financial 2017 111.7 2017 106.2 measures in addition to those reported in accordance with IFRS. -

Your Guide Directors' Remuneration in FTSE 250 Companies

Your guide Directors’ remuneration in FTSE 250 companies The Deloitte Academy: Promoting excellence in the boardroom October 2018 Contents Overview from Mitul Shah 1 1. Introduction 4 2. Main findings 8 3. The current environment 12 4. Salary 32 5. Annual bonus plans 40 6. Long term incentive plans 52 7. Total compensation 66 8. Malus and clawback 70 9. Pensions 74 10. Exit and recruitment policy 78 11. Shareholding 82 12. Non-executive directors’ fees 88 Appendix 1 – Useful websites 96 Appendix 2 – Sample composition 97 Appendix 3 – Methodology 100 Your guide | Directors’ remuneration in FTSE 250 companies Overview from Mitul Shah It has been a year since the Government announced its intention to implement a package of corporate governance reforms designed to “maintain the UK’s reputation for being a ‘dependable and confident place in which to do business’1, and in recent months we have seen details of how these will be effected. The new UK Corporate Governance Code, to take effect for accounting periods beginning on or after 1 January 2019, includes some far reaching changes, and the year ahead will be a period of review and change for many companies. Remuneration committees must look at how best to adapt to an expanded remit around workforce remuneration, as well as a greater focus on how judgment is used to ensure that pay outcomes are justified and supported by performance. Against this backdrop, 2018 has been a mixed year in the FTSE 250 executive pay environment. In terms of pay outcomes, the picture is relatively stable. Overall pay levels have fallen for FTSE 250 chief executives and we have seen continued momentum in companies adopting executive alignment features such as holding periods, as well as strengthening shareholding guidelines for executives.