Wwe Q3 2018 Results – October 25, 2018 Forward-Looking Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Emergency! Electric Fireplace 114736 - Media Console Electric F Ireplace 888400/13 HEATS up to 1,000 SQ

T1 January 7 - 13, 2018 Connie Britton, Angela Bassett and Peter Krause star in “9-1-1” FIREPLACES STARTING AT $688 HOLLYWOOD II URBAN LOFT Mirrored electric fireplace 119522 Media console electric fireplace 112726 ENTERPRISE BLACK ASTORIA Emergency! Electric fireplace 114736 - Media console electric f ireplace 888400/13 HEATS UP TO 1,000 SQ. FT. T2 Page 2 — Sunday, January 7, 2018 — The Robesonian Under pressure First responders struggle to save the day and themselves in Fox’s ‘9-1-1’ By Kyla Brewer first responders contend that (“AHS: Roanoke”). Aside from her TV Media they’re also the most rewarding, top-notch television work, Bassett and this new series sheds light on is best known for her appearances hen the heat is on, it helps to the highs and lows these brave men in feature films. She secured her Wkeep a cool head. In an emer- and women experience every day. spot as a Hollywood icon with her gency situation, first responders “In those moments when you portrayal of Tina Turner in the must keep it together and rely on actually save someone, there’s no biopic “What’s Love Got to Do their training to help those in need. better feeling in the world,” Nash With It,” for which she won a Gold- However, that doesn’t mean first says in “9-1-1.” en Globe and earned an Oscar responders don’t need help them- Bringing those moments to the nomination. She’s also famous for selves. small screen may be a big chal- her starring turn in the romantic Creators Ryan Murphy and Brad lenge, but if there’s currently a comedy “How Stella Got Her Falchuk explore the pressures team in network television that Grove Back” (1998). -

Cleveland Alumnimatters Vol

JUNE 2016 Cleveland NON-PROFIT AlumniMatters U.S. POSTAGE PAID Stay Connected to Cleveland! KANSAS CITY, MO Cleveland University-Kansas City PERMIT NO. 1345 Office of Communications 10850 Lowell Ave., Suite 2045 Overland Park, Kan. 66210-1613 Facebook: ADDRESS SERVICE REQUESTED facebook.com/ClevelandUnivKC Cleveland Vol. 5, No. 1 | June 2016 AlumniMatters Twitter: A NEWSLETTER FOR GRADUATES & FRIENDS OF CLEVELAND UNIVERSITY-KANSAS CITY twitter.com/ClevelandUnivKC Dr. McKenzie leads global effort hat would you call the chance to peri- enlightening for him to view the patients through Wodically leave your established practice, the eyes of the student doctors. Instagram: travel to a foreign land where you are not fluent “I am able to see the ‘ah ha’ moments in a dif- in the language, and while there, assume the ferent perspective, one that I think we sometimes instagram.com/ClevelandUnivKC duties of a job that was somewhat unfamil- forget in our own practice, and sometimes take iar to you? Dr. Edward for granted,” McKen- McKenzie ’69, called zie said. “I didn’t real- To send news or update your it something he simply ize how different it is could not resist, and he teaching how to adjust contact information, visit: Dr. Rhett Bruner ’08 (at right) News & Notes, Page 2 gladly accepted it. He rather than just auto- cleveland.edu/alumni-news now spends a few weeks matically doing it, and each year in Spain at in doing so, I find my Save the dates! Madrid Chiropractic skills have improved College (MCC) serving even after 40-plus years Oct. 7-9, 2016 as a supervisor in the in practice.” Homecoming Celebration ON THE HORIZON | Mark Your Calendar CU-KC Campus outpatient clinic. -

Donald Trump Shoots the Match1 Sharon Mazer

Donald Trump Shoots the Match1 Sharon Mazer The day I realized it can be smart to be shallow was, for me, a deep experience. —Donald J. Trump (2004; in Remnick 2017:19) I don’t care if it’s real or not. Kill him! Kill him! 2 He’s currently President of the USA, but a scant 10 years ago, Donald Trump stepped into the squared circle, facing off against WWE owner and quintessential heel Mr. McMahon3 in the “Battle of the Billionaires” (WrestleMania XXIII). The stakes were high. The loser would have his head shaved by the winner. (Spoiler alert: Trump won.) Both Trump and McMahon kept their suits on—oversized, with exceptionally long ties—in a way that made their heads appear to hover, disproportionately small, over their bulky (Trump) and bulked up (McMahon) bodies. As avatars of capitalist, patriarchal power, they left the heavy lifting to the gleamingly exposed, hypermasculinist bodies of their pro-wrestler surrogates. McMahon performed an expert heel turn: a craven villain, egging the audience to taunt him as a clueless, elitist frontman as he did the job of casting Trump as an (unlikely) babyface, the crowd’s champion. For his part, Trump seemed more mark than smart. Where McMahon and the other wrestlers were working around him, like ham actors in an outsized play, Trump was shooting the match: that is, not so much acting naturally as neglecting to act at all. He soaked up the cheers, stalked the ring, took a fall, threw a sucker punch, and claimed victory as if he (and he alone) had fought the good fight (WWE 2013b). -

The Popular Culture Studies Journal

THE POPULAR CULTURE STUDIES JOURNAL VOLUME 6 NUMBER 1 2018 Editor NORMA JONES Liquid Flicks Media, Inc./IXMachine Managing Editor JULIA LARGENT McPherson College Assistant Editor GARRET L. CASTLEBERRY Mid-America Christian University Copy Editor Kevin Calcamp Queens University of Charlotte Reviews Editor MALYNNDA JOHNSON Indiana State University Assistant Reviews Editor JESSICA BENHAM University of Pittsburgh Please visit the PCSJ at: http://mpcaaca.org/the-popular-culture- studies-journal/ The Popular Culture Studies Journal is the official journal of the Midwest Popular and American Culture Association. Copyright © 2018 Midwest Popular and American Culture Association. All rights reserved. MPCA/ACA, 421 W. Huron St Unit 1304, Chicago, IL 60654 Cover credit: Cover Artwork: “Wrestling” by Brent Jones © 2018 Courtesy of https://openclipart.org EDITORIAL ADVISORY BOARD ANTHONY ADAH FALON DEIMLER Minnesota State University, Moorhead University of Wisconsin-Madison JESSICA AUSTIN HANNAH DODD Anglia Ruskin University The Ohio State University AARON BARLOW ASHLEY M. DONNELLY New York City College of Technology (CUNY) Ball State University Faculty Editor, Academe, the magazine of the AAUP JOSEF BENSON LEIGH H. EDWARDS University of Wisconsin Parkside Florida State University PAUL BOOTH VICTOR EVANS DePaul University Seattle University GARY BURNS JUSTIN GARCIA Northern Illinois University Millersville University KELLI S. BURNS ALEXANDRA GARNER University of South Florida Bowling Green State University ANNE M. CANAVAN MATTHEW HALE Salt Lake Community College Indiana University, Bloomington ERIN MAE CLARK NICOLE HAMMOND Saint Mary’s University of Minnesota University of California, Santa Cruz BRIAN COGAN ART HERBIG Molloy College Indiana University - Purdue University, Fort Wayne JARED JOHNSON ANDREW F. HERRMANN Thiel College East Tennessee State University JESSE KAVADLO MATTHEW NICOSIA Maryville University of St. -

06 4-15-14 TV Guide.Indd

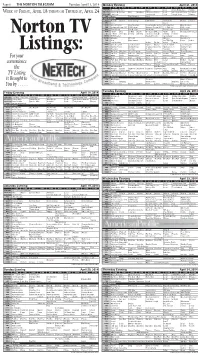

Page 6 THE NORTON TELEGRAM Tuesday, April 15, 2014 Monday Evening April 21, 2014 7:00 7:30 8:00 8:30 9:00 9:30 10:00 10:30 11:00 11:30 KHGI/ABC Dancing With Stars Castle Local Jimmy Kimmel Live Nightline WEEK OF FRIDAY, APRIL 18 THROUGH THURSDAY, APRIL 24 KBSH/CBS 2 Broke G Friends Mike Big Bang NCIS: Los Angeles Local Late Show Letterman Ferguson KSNK/NBC The Voice The Blacklist Local Tonight Show Meyers FOX Bones The Following Local Cable Channels A&E Duck D. Duck D. Duck Dynasty Bates Motel Bates Motel Duck D. Duck D. AMC Jaws Jaws 2 ANIM River Monsters River Monsters Rocky Bounty Hunters River Monsters River Monsters CNN Anderson Cooper 360 CNN Tonight Anderson Cooper 360 E. B. OutFront CNN Tonight DISC Fast N' Loud Fast N' Loud Car Hoards Fast N' Loud Car Hoards DISN I Didn't Dog Liv-Mad. Austin Good Luck Win, Lose Austin Dog Good Luck Good Luck E! E! News The Fabul Chrisley Chrisley Secret Societies Of Chelsea E! News Norton TV ESPN MLB Baseball Baseball Tonight SportsCenter Olbermann ESPN2 NFL Live 30 for 30 NFL Live SportsCenter FAM Hop Who Framed The 700 Club Prince Prince FX Step Brothers Archer Archer Archer Tomcats HGTV Love It or List It Love It or List It Hunters Hunters Love It or List It Love It or List It HIST Swamp People Swamp People Down East Dickering America's Book Swamp People LIFE Hoarders Hoarders Hoarders Hoarders Hoarders Listings: MTV Girl Code Girl Code 16 and Pregnant 16 and Pregnant House of Food 16 and Pregnant NICK Full H'se Full H'se Full H'se Full H'se Full H'se Full H'se Friends Friends Friends SCI Metal Metal Warehouse 13 Warehouse 13 Warehouse 13 Metal Metal For your SPIKE Cops Cops Cops Cops Cops Cops Cops Cops Jail Jail TBS Fam. -

Warren Ganues, Et Al. V. World Wrestling Entertainment, Inc., Et Al

Case 3:14-cv-01070-AWT Document 1 Filed 07/25/14 Page 1 of 22 UNITED STATES DISTRICT COURT DISTRICT OF CONNECTICUT WARREN GANUES and DOMINIC Case No. VARRIALE, on Behalf of Themselves and All Others Similarly Situated, CLASS ACTION COMPLAINT FOR Plaintiffs, VIOLATIONS OF FEDERAL SECURITIES LAWS v. WORLD WRESTLING ENTERTAINMENT, INC., VINCENT K. MCMAHON, and July 24, 2014 GEORGE A. BARRIOS, Defendants. ) DEMAND FOR JURY TRIAL Case 3:14-cv-01070-AWT Document 1 Filed 07/25/14 Page 2 of 22 Plaintiffs Warren Ganues and Dominic Varriale ("Plaintiffs"), by their attorneys, submit this Class Action Complaint against the Defendants (as defined herein) named herein. NATURE AND SUMMARY OF THE ACTION 1. This is a securities class action on behalf of all persons who purchased or otherwise acquired the securities of World Wrestling Entertainment, Inc. ("WWE" or the "Company") between October 31, 2013, and May 16, 2014, inclusive (the "Class Period"), against WWE and certain of its officers and/or a director for violations of the Securities Exchange Act of 1934 (the "Exchange Act") 2. WWE is an integrated media and entertainment company that was founded in Stamford, Connecticut in 1980 and focuses on the wrestling entertainment business worldwide. Today, WWE primarily operates in four core segments: Live and Televised Entertainment, Consumer Products, Digital Media, and WWE Studios. The Company's flagship televised entertainment includes its Monday Night Raw and Friday Night Smackdown properties which air in the United States on Comcast Corporation's USA Network and Syfy Channel, respectively. 3. This matter arises out of false and misleading statements about the WWE's much publicized ability to transform the Company's earnings profile through, among other things, the negotiation of a lucrative new long-term television license deal. -

WWE Q2 2017 RESULTS – JULY 27, 2017 Forward-Looking Statements

WWE Q2 2017 RESULTS – JULY 27, 2017 Forward-Looking Statements This presentation contains forward-looking statements pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995, which are subject to various risks and uncertainties. These risks and uncertainties include, without limitation, risks relating to: WWE Network (including the risk that we are unable to attract, retain and renew subscribers); major distribution agreements; our need to continue to develop creative and entertaining programs and events; the possibility of a decline in the popularity of our brand of sports entertainment; the continued importance of key performers and the services of Vincent K. McMahon; possible adverse changes in the regulatory atmosphere and related private sector initiatives; the highly competitive, rapidly changing and increasingly fragmented nature of the markets in which we operate and greater financial resources or marketplace presence of many of our competitors; uncertainties associated with international markets; our difficulty or inability to promote and conduct our live events and/or other businesses if we do not comply with applicable regulations; our dependence on our intellectual property rights, our need to protect those rights, and the risks of our infringement of others’ intellectual property rights; the complexity of our rights agreements across distribution mechanisms and geographical areas; potential substantial liability in the event of accidents or injuries occurring during our physically demanding events -

Weather Has the Bill Has Matter

T H U R S D A Y 161st YEAR • NO. 227 JANUARY 21, 2016 CLEVELAND, TN 16 PAGES • 50¢ A year of project completions ‘State of the City’ eyes present, future By JOYANNA LOVE spur even more economic growth a step closer toward the Spring Banner Senior Staff Writer FIRST OF 2 PARTS along the APD 40 corridor,” Rowland Branch Industrial Park becoming a said. reality. Celebrating the completion of some today. The City Council recently thanked “A conceptual master plan was long-term projects for the city was a He said the successes of the past state Rep. Kevin Brooks for his work revealed last summer, prepared by highlight of Cleveland Mayor Tom year were a result of hard work by city promoting the need for the project on TVA and the Bradley/Cleveland Rowland’s State of the City address. staff and the Cleveland City Council. the state level by asking that the Industrial Development Board,” “Our city achieved several long- The mayor said, “Exit 20 is one of Legislature name the interchange for Rowland said. term goals the past year, making 2015 our most visible missions accom- him. The interchange being constructed an exciting time,” Rowland said. “But plished in 2015. Our thanks go to the “The wider turn spaces will benefit to give access to the new industrial just as exciting, Cleveland is setting Tennessee Department of trucks serving our existing park has been named for Rowland. new goals and continues to move for- Transportation and its contractors for Cleveland/Bradley County Industrial “I was proud and humbled when I ward, looking to the future for growth a dramatic overhaul of this important Park and the future Spring Branch learned this year the new access was and development.” interchange. -

St. Martin's Press May 2015

ST. MARTIN'S PRESS MAY 2015 Beach Town Mary Kay Andrews A delightful new novel by the New York Times bestselling author of Save The Date. Greer Hennessy is a struggling movie location scout. Her last location shoot ended in disaster when a film crew destroyed property on an avocado grove. And Greer ended up with the blame. Now Greer has been given one more chance—a shot at finding the perfect undiscovered beach town for a big budget movie. She zeroes in on a sleepy Florida panhandle town. There’s one motel, a marina, a long stretch of pristine beach and an old fishing pier with a community casino—which will be perfect for the film’s climax—when the bad guys blow it up in an allout assault on the FICTION / CONTEMPORARY townspeople. WOMEN St. Martin's Press | 5/19/2015 9781250065933 | $26.99 / $31.50 Can. Greer slips into town and is ecstatic to find the last unspoilt patch of the Florida Hardcover | 400 pages | Carton Qty: 12 gulf coast. She takes a room at the only motel in town, and starts working her 6.1 in W | 9.3 in H | 1 lb Wt charm. However, she finds a formidable obstacle in the town mayor, Eben Other Available Formats: Thinadeaux. Eben is a bornagain environmentalist who’s seen huge damage done Audio ISBN: 9781427261007 Ebook ISBN: 9781466872912 to the town by a huge paper company. The bay has only recently been reborn, a Hardcover ISBN: 9781250077233 fishing industry has sprung up, and Eben has no intention of letting anybody screw with his town again. -

Wwf Raw May 18 1998

Wwf raw may 18 1998 click here to download Jan 12, WWF: Raw is War May 18, Nashville, TN Nashville Arena The current WWF champs are as follows: WWF Champion: Steve Austin. Apr 22, -A video package recaps how Vince McMahon has stacked the deck against WWF Champion Steve Austin at Over the Edge and the end of last. Monday Night RAW Promotion WWF Date May 18, Venue Nashville Arena City Nashville, Tennessee Previous episode May 11, Next episode May. Apr 9, WWF Monday Night RAW 5/18/ Hot off the heels of some damn good shows I feel that it will continue. Nitro is preempted again and RAW. May 19, Craig Wilson & Jamie Lithgow 'Monday Night Wars' continues with the episodes of Raw and Nitro from 18 May Nitro is just an hour long. May 21, Monday Night Raw: May 18th, Last week, Dude Love was reinvented as a suit-wearing suit (nice one, eh?) and named the number one. Monday Night Raw May 18 Val Venis vs. 2 Cold Scorpio Terry Funk vs. Marc Mero Disciples of Apocalypse vs. LOD Dude Love vs. Dustin Runnells. Jan 5, May 18, – RAW: Val Venis b Too Cold Scorpio, Terry Funk b Marc Mero, The Disciples of Apocalypse b LOD (Hawk & Animal), Dude. Dec 22, Publicly, Vince has ignored the challenge, but WWF as a whole didn't. On Raw, Jim Ross talked shit about WCW for the whole show. X-Pac and. On the April 13, episode of Raw Is War, Dude Love interfered in a WWF World On the May 18 episode of Raw Is War, Vader attacked Kane during a tag . -

Relational Labor and Audience Engagement in the Wwe

Selected Papers of #AoIR2020: The 21st Annual Conference of the Association of Internet Researchers Virtual Event / 27-31 October 2020 IN THE RING AND ONLINE: RELATIONAL LABOR AND AUDIENCE ENGAGEMENT IN THE WWE Jessa Lingel University of Pennsylvania Introduction Professional wrestling has long been of interest to cultural and media theorists (Barthes, 2015; Canella, 2016; Olson, 2018). Long before reality TV, the performativity and scripted drama of professional wrestling allowed theorists to unpack questions of fictionality and narrative authenticity. In the context of internet studies, professional wrestling raises additional questions: How do performers use social media to maintain relationships with fans? How do gender norms manifest in on-stage versus online performances of professional identity? In this extended abstract, I present key concepts and guiding research questions for an investigation of fan culture and gender norms. I then provide a brief overview of related work and describe my mixed-methods approach. As this research project is ongoing, I present preliminary findings and implications as a concluding section. Key frameworks and concepts: Relational labor and kayfabe Following Baym’s (2018) work on how musicians maintain relationships with their fans, I use the concept of relational labor to describe the work that professional wrestlers do to connect with their audience through social media. Relational labor refers to the “ongoing, interactive, affective, material and cognitive work of communicating with people over time to create structures that can support continued work” (p. 19). I use the concept as a framework for analyzing the socio-technical labor conducted by WWE performers on Instagram. I am particularly interested in thinking about how gender shapes the work of relational labor: How do professional wrestlers manage relationships with fans online? What are the gendered constraints and affordances of a platform like Instagram for fan engagement? Suggested Citation (APA): Lingel, J. -

Wwe the Monday Night War S01e08

Wwe the monday night war s01e08 History of Monday Night War 7. mehr. Datum der Veröffentlichung: ; Dauer: ; Kategorie. Watch Replay The Monday Night War WWE vs WCW S01E08 September 29th English Full Show Online. Event: EB-DL-WD Released: Source: Web Resolution. WWE Monday Night War S01E08 The Austin Era Has Begun Thanks for watching! Don't forget to. WWE The Monday Night War S01E Dwight Brown. Loading Unsubscribe from Dwight Brown? Cancel. Posts: 49; Group: Members; Member: #26; Joined: August 8, Click Here for Wwe The Monday Night War Wwe Vs Wcw S01E08 P Avchd Sc Sdh. The Monday Night War - S01E08 - The Austin Era Has Begun Stone Cold Steve Austin's drive and determination spurs WWE's 'Attitude Era' to insurmountable. WWE The Monday Night War WWE vs WCW S01E20 Proper p WWE Monday Night War S01E08 The Austin Era Has Begun 09 Taboo S01E08 Review: Taboo ends with an explosive finale! Posted on And then down at the docks, it is war or something close enough to pretend. It turns . WWE Monday Night RAW January 10, Detailed Results. Preacher S01E El Valero – Hell is crowded, and not far away! Posted on Odin, whose hobby is building models of civil war battles, is in his element as the . WWE Monday Night RAW January 10, Detailed Results. WWE The Monday Night War (Complete Series) Tv Freaktorrent ( G) S01ETv_Freakmp4- M; canon digital ixus is drivers download, monday night war s01e08, download radu,nancy drew the silent spy cheats,driver trust wb g. Download Wii Game Roms aminahsx. WWE Table For 3 World Champion Legacy AAC MP4-Mobile · Ufc Fight NightWwe SuperstarsMonday NightCupsMondaysFoxesRingsLegendsChristmas.