Igr WIA Entertainment White Paper

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Science, Mathematics & Computing Division

SCIENCE, MATHEMATICS & COMPUTING DIVISION senior projects spring 2021 Ultrasonic Pollution: A New Kind of Noise Pollution Cillian Ahearn Advisor: Bruce Robertson All organisms use verbal communication to gain information about their surroundings, in order to hunt, feed their chicks, and call or warn one another. This communication is increasingly masked by anthropogenic noise pollution, but that might not be the only type of noise pollution to exist. Recently, there has been a rise into the research of organisms that use ultrasound, but virtually none into anthropogenic ultrasound and whether or not it has the possibility to mask ultrasonic vocalizations. As such, my study hopes to fill in this gap of knowledge by doing an exploratory study in a city, Hartford, CT, where I identified sources of man-made ultrasound, as well as their frequency ranges. These ranges were then compared against ultrasonic vocalizations of mice, Richardson’s ground squirrels, and tomato plants. My study found that the more narrow a biological frequency range is, the more at risk it is to be fully masked. This implicates ultrasound as a potential new source of noise pollution that should be mitigated as part of conservation efforts to preserve the environment. Road to a Resilient Financial Sector: Impacts of the Dodd-Frank Act on Systemic Risk Muhammad Ali Advisors: Steven Simon & Guatam Sethi The U.S. financial sector has been plagued by crises in the last few decades. The Dodd-Frank Act was the most substantial set of reforms in recent history aimed at making the financial sector more resilient and stable than before. -

Fator Wins Hearts and Laughs with His Signature Las Vegas Show Arriving on DVD, Digital HD and Video on Demand February 18 from Lionsgate Home Entertainment

”His celebrity impressions will blow you away!” - Oprah Winfrey A One-Of-A-Kind Experience Fator Wins Hearts And Laughs With His Signature Las Vegas Show Arriving On DVD, Digital HD and Video on Demand February 18 From Lionsgate Home Entertainment LAS VEGAS – January 13, 2014 – Laugh harder than you have all year when Terry Fator: Live In Concert arrives on DVD (plus Digital UltraViolet) exclusively at Walmart and Redbox on Feb. 18, 2014 from Lionsgate Home Entertainment. The film will be available on Digital HD and Video on Demand everywhere the same day. The follow-up to Fator's multi-platinum DVD debut, Terry Fator: Live From Las Vegas, Terry Fator: Live In Concert captures the “America’s Got Talent” winner bringing a full cast of characters to life. Called “one of the best entertainers in the world,” by Simon Cowell, the multi-talented singer, comedian and impressionist’s performance spans genres and generations. Terry Fator: Live In Concert sees Fator tackling Broadway, Bieber and The Four Seasons - and that's with just one of his puppets. Familiar characters Emma Taylor, the little girl with the big voice, and Winston, the impersonating turtle, are joined by new faces Monty Carlo, the lounge singer, and Berry Fabulous, the hip-hop diva, in the totally rewritten and revamped Vegas show featuring comedic banter and amazing vocal impressions of musical superstars such as Garth Brooks, Dean Martin, Aretha Franklin, Lady Gaga and more. According to Fator, “This DVD is my heart and soul. I wrote the show and am so excited for everyone to see the best of what I do. -

Update 5/24/12

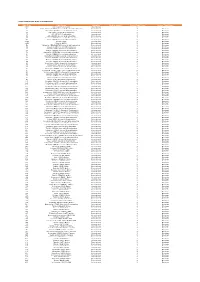

1 Update 5/24/12 © 2012 DECE, LLC – DECE CONFIDENTIAL 2 3. In-Market Status: Adoption As of May 7 • Rights: 3.03M • Averaging 81K new accounts per week since launch • Users: 2.46M • Past 4 weeks averaging 185K new accounts/week (past 7 days: 114K) • Accts: 2.42M • Users per acct = 1.015; Rights per acct = 1.28 (slowly inching up) 3500000 3000000 Rights Users 2500000 Accou nts 2000000 1500000 Ratio of incremental rights / incremental 1000000 accounts • Since launch – 500000 1.28 • Past month – 1.36 0 • Past week – 1.52 40849 40891 40942 40954 40962 40970 40980 40989 40997 41005 41015 41023 41031 40828 40869 40913 40949 40959 40967 40975 40983 40994 41002 41010 41018 41026 41034 © 2012 DECE, LLC – DECE CONFIDENTIAL 3 3. In-Market Status: Capabilities illustration Where can I use an UltraViolet title I own, vs. an iTunes one? (U.S.) iTunes/iCloud UltraViolet via the iTunes app PCs and Macs via multiple companies’ websites and apps only <4M installed base >50M installed base* Apple TV PS3 Philips Sony Xbox 360 RCA Sylvania Living Room Devices (game consoles, Blu- LG Samsung Toshiba ray Players, Internet TVs, other) Magnavox Sanyo Vizio Panasonic Sharp Only Apple products Apple products**… …AND tens of millions of other devices** iPhone iPhone Android phones from: Tablets from: * Via Vudu apps, as well as Flixster now shipping on some devices (Samsung, Sony) and available to Google TV devices via Android Market ** UltraViolet on mobile devices via Retailers’iPad apps (e.g. Flixster) and/oriPad mobile-optimized HTML5HTC sites (e.g. Vudu.com -

Voucher Details

VUDU $10 Promo + Daily Burn Premium 3-Month Service VUDU $10 Promo VUDU, a leading digital video on demand service, is the easiest way to discover, watch and collect the latest movies and TV shows. VUDU provides instant access to over 100,000 titles to rent or own in up to stunning 1080p resolution and 7.1 digital surround sound. VUDU makes it easy to watch movies and TV shows anytime, anywhere because it works on Smart TVs, DVD/Blu-ray players, Windows and Mac computers, iOS and Android mobile devices, set-top boxes like Roku, and game consoles like PlayStation and Xbox. • Rent, watch, and buy from a library of over 100,000 movies and TV shows • Available on over 50 million devices including smart TVs, cell phones, and gaming systems • Stream anytime, anywhere with an internet enabled device • Many movies available before Blu-ray/DVD release • Many TV shows available as soon as the day after they air on television • The only digital service compliant with UltraViolet AND Disney Movies Anywhere standards • No subscriptions. No late fees. Daily Burn Premium 3-Month Service Important Note: Offer only valid until 6/30/2021. After your 3 month trial, you will be enrolled in a membership for $19.95 per month. Please note that your credit card will be automatically billed if you do not cancel your trial or subscription before the trial period has expired. To cancel, visit your account at DailyBurn.com, view Manage Subscription and click on View Your Options to confirm your cancellation. Daily Burn Premium Online offers over 1000 streaming workouts taught by expert trainers. -

Download Movies Anywhere Movies from Browser Movies Anywhere APK

download movies anywhere movies from browser Movies Anywhere APK. Access your movie collection in one place, so you can watch the movies you’ve purchased when and where you want. With Movies Anywhere, every night is movie night. NO SUBSCRIPTION FEE, EVER Create an account with Movies Anywhere. Only pay for the movies you want to watch. CONNECT AND SYNC IN SECONDS Sync your digital accounts to bring your movies together from Google Play and other participating retailers in to your Movies Anywhere collection in seconds! DISCOVER NEW MOVIES Whether it’s date night or a late night, we’ve got you covered. With over 7,500 movies, including the newest releases, there’s a movie for every occasion. YOUR MOVIES, ALWAYS WITH YOU Stream your movies AND download for later. No matter where you go, your Movies Anywhere collection will go with you. WATCH ANYWHERE Smartphone, laptop, connected TV, tablet — wherever you want to watch, we’re there. Download movies anywhere movies from browser. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. What can I do to prevent this in the future? If you are on a personal connection, like at home, you can run an anti-virus scan on your device to make sure it is not infected with malware. If you are at an office or shared network, you can ask the network administrator to run a scan across the network looking for misconfigured or infected devices. Another way to prevent getting this page in the future is to use Privacy Pass. -

Blackbody Radiation and the Ultraviolet Catastrophe Introduction

Activity – Blackbody Radiation and the Ultraviolet Catastrophe Introduction: A blackbody is a term used to describe the light given by an object that only gives off emitted light, in other words it doesn’t reflect light. Of course, in order for such an object to emit light it must get hot. In this activity, you are going to observe the nature of light given off by hot objects and determine if there is an empirical relationship between an object’s temperature and the light emitted. These are some helpful video links which provide an excellent foundation of knowledge of Blackbody Radiation. Crash Course (First Half of Video) https://www.youtube.com/watch?v=7kb1VT0J3DE&list=PL8dPuuaLjXtN0ge7yDk_UA0ldZJdhwkoV&index=44&t=438 s Professor Dave’s Summary on Blackbody Radiation and the Ultraviolet Catastrophe https://www.youtube.com/watch?v=7BXvc9W97iU PHET’s Manipulative Graph of Spectral Power Density vs. Wavelength https://phet.colorado.edu/en/simulation/blackbody-spectrum Draw a graph depicting classical blackbody radiation, (Y-axis is Spectral Power Density, X-axis is Wavelength). Complete the graph correlating the spectral power density to wavelength for the sun, as demonstrated on the Phet activity. Describe the correlation between wavelength of light emitted with the average kinetic energy of particles within a substance. Temperature in Kelvin for Red Light: Temperature in Kelvin for Yellow Light: Temperature in Kelvin for Violet Light: Questions: Dianna Cowern with PBS has an enthusiastic video explaining the origin of quantum topics. https://www.youtube.com/watch?v=FXfrncRey-4 What does the ultraviolet catastrophe refer to, and why does the curve collapse on the left-hand side of the graph? (At what approximate wavelength does the curve drop)? What is Max Planck’s explanation for the ultraviolet catastrophe, and how does it lead to the Planck equation? (Provide Planck equation and Planck’s constant). -

International Space Station Benefits for Humanity, 3Rd Edition

International Space Station Benefits for Humanity 3RD Edition This book was developed collaboratively by the members of the International Space Station (ISS) Program Science Forum (PSF), which includes the National Aeronautics and Space Administration (NASA), Canadian Space Agency (CSA), European Space Agency (ESA), Japan Aerospace Exploration Agency (JAXA), State Space Corporation ROSCOSMOS (ROSCOSMOS), and the Italian Space Agency (ASI). NP-2018-06-013-JSC i Acknowledgments A Product of the International Space Station Program Science Forum National Aeronautics and Space Administration: Executive Editors: Julie Robinson, Kirt Costello, Pete Hasbrook, Julie Robinson David Brady, Tara Ruttley, Bryan Dansberry, Kirt Costello William Stefanov, Shoyeb ‘Sunny’ Panjwani, Managing Editor: Alex Macdonald, Michael Read, Ousmane Diallo, David Brady Tracy Thumm, Jenny Howard, Melissa Gaskill, Judy Tate-Brown Section Editors: Tara Ruttley Canadian Space Agency: Bryan Dansberry Luchino Cohen, Isabelle Marcil, Sara Millington-Veloza, William Stefanov David Haight, Louise Beauchamp Tracy Parr-Thumm European Space Agency: Michael Read Andreas Schoen, Jennifer Ngo-Anh, Jon Weems, Cover Designer: Eric Istasse, Jason Hatton, Stefaan De Mey Erik Lopez Japan Aerospace Exploration Agency: Technical Editor: Masaki Shirakawa, Kazuo Umezawa, Sakiko Kamesaki, Susan Breeden Sayaka Umemura, Yoko Kitami Graphic Designer: State Space Corporation ROSCOSMOS: Cynthia Bush Georgy Karabadzhak, Vasily Savinkov, Elena Lavrenko, Igor Sorokin, Natalya Zhukova, Natalia Biryukova, -

Fragmentation of the Single Market for On-Line Video-On-Demand Services: Point of View of Content Providers

FRAGMENTATION OF THE SINGLE MARKET FOR ON-LINE VIDEO-ON-DEMAND SERVICES: POINT OF VIEW OF CONTENT PROVIDERS FINAL REPORT A study prepared for the European Commission DG Communications Networks, Content & Technology by Digital Agenda for Europe This study was carried out for the European Commission by iMinds (SMIT), Gaston Crommenlaan 8, 9050 GENT, Belgium Authors: Dr. Sophie De Vinck Dr. Heritiana Ranaivoson Dr. Ben Van Rompuy with the collaboration of Anca Birsan and Katharina Hölck Internal identification Contract number: 30-CE-0540861/00-45 SMART number: 2012/0027 DISCLAIMER By the European Commission, Directorate-General of Communications Networks, Content & Technology. The information and views set out in this publication are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. ISBN 978-92-79-38400-4 DOI 10.2759/49194 © European Union, 2014. All rights reserved. Certain parts are licensed under conditions to the EU. Reproduction is authorised provided the source is acknowledged. Table of Contents Executive Summary ................................................................................................................................. 1 1.1 Purpose, scope and method ................................................................................................... -

Ultraviolet™ Begins B2b Deployment in U.S. Market

ULTRAVIOLET™ BEGINS B2B DEPLOYMENT IN U.S. MARKET Licensing Program Launched for Groundbreaking Video Ecosystem UltraViolet will Permit Cloud Access through Open Digital Rights Locker System LOS ANGELES, (July 13, 2011) – The Digital Entertainment Content Ecosystem (DECE) LLC, an open, cross-industry consortium of more than 70 companies dedicated to facilitating the development and operation of UltraViolet™, today announced the launch of its licensing program for content, technology and service providers. DECE continues to anticipate that, beginning this fall, consumers in the United States will be able to purchase select movies and TV shows with UltraViolet rights. Designed to address growing discontent with today’s siloed market for digital video, UltraViolet will provide consumers with a new, compelling way to collect and enjoy movies and TV shows from a wide array of outlets. This ecosystem will combine the benefits of cloud access with the power of an open, industry standard – empowering consumers to use multiple content services and device brands interchangeably, at home and on-the-go. Becoming an UltraViolet licensee will enable companies to implement technical specs; market content, services and products with the UltraViolet name and logo; and make use of a centralized digital rights locker system for consumers’ management of their UltraViolet proofs-of-purchase. Licensing is available for companies to participate in UltraViolet through one or more of five defined roles: content provider, retailer, streaming service provider, app/device maker, and download infrastructure/services provider. Information on licensing can be found at www.uvvu.com. Mark Teitell, UltraViolet’s General Manager, commented: "Consumers are looking for a better value proposition to own and collect digital movies and TV shows -- a proposition that provides downloads, streaming and physical copy viewing options which are accessible on multiple platforms. -

Codes Used in D&M

CODES USED IN D&M - MCPS A DISTRIBUTIONS D&M Code D&M Name Category Further details Source Type Code Source Type Name Z98 UK/Ireland Commercial International 2 20 South African (SAMRO) General & Broadcasting (TV only) International 3 Overseas 21 Australian (APRA) General & Broadcasting International 3 Overseas 36 USA (BMI) General & Broadcasting International 3 Overseas 38 USA (SESAC) Broadcasting International 3 Overseas 39 USA (ASCAP) General & Broadcasting International 3 Overseas 47 Japanese (JASRAC) General & Broadcasting International 3 Overseas 48 Israeli (ACUM) General & Broadcasting International 3 Overseas 048M Norway (NCB) International 3 Overseas 049M Algeria (ONDA) International 3 Overseas 58 Bulgarian (MUSICAUTOR) General & Broadcasting International 3 Overseas 62 Russian (RAO) General & Broadcasting International 3 Overseas 74 Austrian (AKM) General & Broadcasting International 3 Overseas 75 Belgian (SABAM) General & Broadcasting International 3 Overseas 79 Hungarian (ARTISJUS) General & Broadcasting International 3 Overseas 80 Danish (KODA) General & Broadcasting International 3 Overseas 81 Netherlands (BUMA) General & Broadcasting International 3 Overseas 83 Finnish (TEOSTO) General & Broadcasting International 3 Overseas 84 French (SACEM) General & Broadcasting International 3 Overseas 85 German (GEMA) General & Broadcasting International 3 Overseas 86 Hong Kong (CASH) General & Broadcasting International 3 Overseas 87 Italian (SIAE) General & Broadcasting International 3 Overseas 88 Mexican (SACM) General & Broadcasting -

Web & Mobile Device Captioning

Closed Captioning Products Article Web & Mobile Device Captioning Closed captioning products Challenges for IP/Web Video Captioning MacCaption and CaptionMaker For broadcast video, there is one specific area in the video signal where allow you to easily author, edit, captions are placed. Since there is only one broadcast specification for all of encode and repurpose video North America, every TV station has the equipment necessary to insert the captions for television, web and captions, and every TV sold in the region can receive them. mobile delivery. Utilizing exclusive e-Captioning™ technology, For web video, there are a number of different standards and types of video MacCaption (for Mac) and playback mechanisms (Flash, Silverlight, HTML5, QuickTime, HLS, HDS, MS CaptionMaker (for Windows) Smooth Streaming, MPEG DASH, UltraViolet, etc.). To support a broad variety simplify the process of complying of different playback devices, a provider may need to stream the video in with FCC regulatory requirements, multiple formats, because there is no one video format that is supported by enabling greater access to every device. broadcast content for television, online and mobile viewers. Until now most of the focus on web captioning has been video on demand (non-live video) which has pretty broad captioning support across the different formats, but live captioning has mostly been an afterthought. Telestream’s goal is to work with live streaming providers, encoder manufacturers, etc. to cooperate on the necessary pieces of the puzzle to enable -

A Modern Guide to Hearing Loss

A MODERN GUIDE www.mass.gov/mcdhh TO HEARING LOSS A MODERN NEW GUIDE EDITION 2019 TO HEARING For the Deaf and LOSS Hard of Hearing • FOR THE DEAF Massachusetts Commission for the AND Deaf and Hard of Hearing What’s Inside What’s New 600 Washington Street HARD • The Impact of Hearing Loss Understanding and Boston, MA 02111 • Where to Turn for Help Coping with Trauma OF • Emerging Technologies and Hearing Loss Phone Numbers: HEARING 617-740-1600 Voice 617-740-1700 TTY 617-740-1810 Fax EXCLUSIVE • Toll Free: 800-882-1155 Voice 2019 Toll Free: 800-530-7570 TTY Foreword includes personal stories from survivors VP 617-326-7546 of mass tragedies who suffered hearing loss Massachusetts Commission for the Deaf and Hard of Hearing A Modern Guide to Hearing Loss for the Deaf and Hard of Hearing Massachusetts Commission for the Deaf and Hard of Hearing Boston, MA All rights reserved by the Massachusetts Commission for the Deaf and Hard of Hearing. This book or any portion thereof may not be reproduced or used in any manner without the express written permission of the publisher. Funding by the Massachusetts Commission for the Deaf and Hard of Hearing (MCDHH) and the Massachusetts Office for Victim Assistance (MOVA) through the Antiterrorism Emergency Assis- tance Program, cooperative agreement number 2014-RF-GX-K002 from the Office for Victims of Crime, Office of the Justice Programs and the US Department of Justice. Copyright ©2019 Printed by FLAGSHIP PRESS, INC. 150 Flagship Drive • North Andover, MA Cover and book design by Denise Adkerson FOREWORD The Massachusetts Commission for the Deaf and Hard of Hearing is excited to have the opportunity to update its guide, originally known Tas the “Savvy Consumer’s Guide to Hearing Loss.” Our first guide was written nearly 20 years ago, and has been updated several times, the most recent in 2008, yet so much in our society has changed.