Consolidated Annual Report of Energoprojekt Holding Plc. for the Year 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dobri Rezultati Javnih Preduzeća

2008 - 2015 2008 - 2015 SADRŽAJ str 6. PROF. DR ZORAN JEREMIĆ, autor istraživanja Najveći i najprofitabilniji u periodu 2008-2015. godine str 28. NEBOJŠA SAVIĆ Rast srpske privrede treba dalje ubrzavati str 30 . JORGOVANKA TABAKOVIĆ Niska inflacija i sledeće godine str 32. ZORANA MIHAJLOVIĆ Sledeća godina biće godina infrastrukture str 34. ANA BRNABIĆ Razvoj eUprave jedan od prioriteta str 36. GORAN KNEŽEVIĆ Dobri rezultati javnih preduzeća str 38. MIHAILO CRNOBRNJA Javna preduzeća su najveća boljka naše privrede NAZIV IZDANJA: 100 najvećih 100 najboljih str 40. DUBRAVKA NEGRE EIB Strukturne reforme od najveće važnosti UREDNIK Biljana Stepanović str 42. DANIEL BERG EBRD Treba osnažiti poverenje investitora AUTOR RANGOVA I ANALIZA PODATAKA Zoran Jeremić str 44. MILOJKO ARSIĆ Na osnovu podataka APR-a i Uprave carina Srbije Treba podsticati rast investicija i izvoza NOVINAR str 46. DEJAN ERIĆ Miloš Obradović Stalno počinjemo iz početka str 48. RONALD ZELIGER UREDNIK FOTOGRAFIJE Izazovi mogu biti i pozitivni Dragan Milošević str 50. DRAGAN FILIPOVIĆ DIZAJN Treba preuzeti odgovornost za zdravlje, život i imovinu Jovana Bogdanović str 52. ERNST BODE LEKTURA I KOREKTURA I dalje verujem u Srbiju Mirjana Radaković str 54. VLADIMIR ČUPIĆ MARKETING Čeka nas dobra godina Dušanka Ćetković, Nevena Prokić str 56. ZORAN BLAGOJEVIĆ ŠTAMPA Potrebna je bolja promocija osiguranja Štamparija Caligraph str 58. ZORAN DALJEVIĆ Treba ulagati u tradicionalne proizvode IZDAVAČ Business Info Group, str 62. DRAGICA MIHAJLOVIĆ Bulevar despota Stefana 12 Beograd pozitivni pomaci na bankarskom tržištu www.big.co.rs www.novaekonomija.rs tel +381 11 2258 891 str 64. MARINOS VATIS Sva prava rezerevisana Banke su opreznije u kreditnoj aktivnosti Najvećih 100 po prosečnim poslovnim prihodima u periodu 2008-2015. -

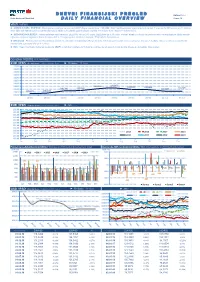

NEDELJNI IZVEŠTAJ BROKERSKO-DILERSKO DRUŠTVO ČLAN BEOGRADSKE BERZE AD BEOGRAD ČLAN CENTRALNOG REGISTRA, DEPOA I KLIRINGA Hov Od 30

INTERCITY BROKER A.D. NEDELJNI IZVEŠTAJ BROKERSKO-DILERSKO DRUŠTVO ČLAN BEOGRADSKE BERZE AD BEOGRAD ČLAN CENTRALNOG REGISTRA, DEPOA I KLIRINGA HoV Od 30. Avgusta do 03. Maksima Gorkog 52, Beograd, Srbija Tel: +381 (11) 3083-100, 3087-862; Fax: +381 (11) 3083-150 Septembra 2010. godine e-mail: [email protected]; www.icbbg.rs Septembra 2010. godine Intercity broker je u saradnji sa IT stručnjacima Međunarodnog centra, po prvi put u Srbiji pustio u rad potpuno automatizovan ONLINE sistem trgovanja na Beogradskoj berzi Dugo očekivani izlazak Naftne industrije Promena vrednosti regionalnih berzanskih indeksa - 30 dana (u%) Srbije na Beogradsku berzu Sa nestrpljenjem iščekivani početak trgovanja akcijama Naftne (%) industrije Srbije obeležio je proteklu nedelju na Beogradskoj berzi. 4 Početni dani trgovanja na ovoj akciji pokazali su zrelost domaćih investitora, ali i odsustvo interesovanja investitora iz inostranstva. Usled velike količine akcija na strani prodaje, domaći investitori su 3 pokazali odmerenost i nije ni prvih dana došlo do većeg rasta cene, naprotiv – ulagači su uzdržani i došlo je i do pada cene ispod 2 početnog nivoa. Prvog i drugog dana trgovanja zabeleženi su prilično veliki obimi trgovanja, narednih dana je već postalo jasno da je dosta 1 ljudi odlučno da proda ove akcije po početnoj ceni i ispod nje, pa je interesovanje za kupovinu značajno opalo u iščekivanju još niže cene. Nedelja za nama, ostaće upamćena i po konačno održanoj 0 Skupštini akcionara kompanije Energoprojekt holding, čije ćemo 04.avg 10.avg 16.avg 22.avg 28.avg 03.sep odjeke tek videti u narednim danima. Posle dužeg vremena, u -1 značajnom obimu se ove nedelje trgovalo akcijama kompanije Informatika, čija je cena na nedeljnom nivou u padu 7,43%, dok su -2 nakon prošlonedeljnog rasta cene akcije Jubmes banke u nedeljnom padu od 9,21%. -

Voluntary Pension Funds Sector in Serbia

Supervision of Voluntary Pension Fund Management Companies VOLUNTARY PENSION FUNDS SECTOR IN SERBIA Second Quarter Report 2008 July 2008 Supervision of Voluntary Pension Fund Management Companies CONTENTS 1. INTRODUCTION......................................................................................................... 3 2. MANAGEMENT COMPANIES ................................................................................... 4 Market participants................................................................................................... 4 Ownership structure of management companies................................................. 5 Organizational network of management companies ............................................ 5 Fees charged by companies ................................................................................... 6 Transaction costs..................................................................................................... 7 3. VOLUNTARY PENSION FUNDS ............................................................................... 7 Net assets of voluntary pension funds .................................................................. 7 Composition of assets of voluntary pension funds.............................................. 9 Stock exchange trading by pension funds ..........................................................10 Number and structure users of VPF services .....................................................11 Contribution payments, disbursements and transfers among funds...............16 -

Minutes from the Regular Session of the General Meeting of Bank’S Shareholders Held on January 25Th 2017

MINUTES FROM THE REGULAR SESSION OF THE GENERAL MEETING OF BANK’S SHAREHOLDERS HELD ON JANUARY 25TH 2017 Belgrade, January 25th 2017 1 KOMERCIJALNA BANKA AD BEOGRAD GENERAL MEETING OF SHAREHOLDERS OF THE BANK No. 33462 Belgrade, January 25th 2017 MINUTES From the regular session of the General Meeting of Shareholders of Komercijalna Banka AD Beograd, held on January 25th 2017 in Belgrade – in the premises of the Bank, 14 Svetog Save St – with the beginning at 12.00 hours Shareholders – holders of ordinary shares specified on the List of Shareholders of the Bank composed on the Cut-off Date on January 15th 2017 with reference to the excerpt from the Central Registry of Securities – were attending the regular session of General Meeting of Shareholder of Komercijalna Banka AD Beograd that was held on January 25th 2017, as follows: 1. Republic of Serbia, proxy Jovanka Kosanović, Chair of the Bank's GMS 2. EBRD London – proxy k Mirjana Vujičić 3. Jugobanka in bankruptcy, Belgrade - proxy Jovanka Kosanović 4. Dunav osiguranje ado Beograd – proxy Mila Pavlović The shareholder IFC CAPITALIZATION FUND, WILMINGTON, USA delivered to the Bank duly completed and certified in absentia voting form. Representatives of the Bank who attended the session were: 1. Alexander Picker, President of the Executive Board, CEO of the Bank 2. Gabrijela Horvat, Director of Legal Affairs Division 3. Marija Tatomirov, Director of Normative Affairs Division 4. Vesna Velemir, Head of the Executive Board Support Unit The session of the General Meeting of Shareholders began at 12:00 hours. Chair of the GMS, Jovanka Kosanović, opened the GMS session by greeting the attending representatives of the shareholders and management of the Bank and informed the General Meeting of Bank's Shareholders that, pursuant to the Law on Bank and Law on Companies, in her capacity of the Chair of the General Meeting, she passed: 1. -

Energoprojekt Holding Plc. Semi-Annual Consolidated Report for 2018

Energoprojekt Holding Plc. Semi-Annual Consolidated Report for 2018 Belgrade, August 2018 Pursuant to Article 53 of the Law on Capital Market (RS Official Gazette, No. 31/2011, 112/2015 and 108/2016) and pursuant to Article 5 of the Rulebook on the Content, Form and Method of Publication of Annual, Semi-Annual and Quarterly Reports of Public Companies (RS Official Gazette, No. 14/2012, 5/2015 and 24/2017), Energoprojekt Holding Plc. from Belgrade, registration No.: 07023014 hereby publishes the following: ENERGOPROJEKT HOLDING PLC. SEMI-ANNUAL CONSOLIDATED REPORT FOR 2018 C O N T E N T S 1. SEMI-ANNUAL CONSOLIDATED FINANCIAL STATEMENTS OF THE ENERGOPROJEKT HOLDING PLC. FOR 2018 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement of Changes in Equity, Notes to Financial Statements) 2. BUSINESS REPORT (Note: Business Report and Consolidated Business Report are presented as one report, containig information of significance for the economic overview) 3. STATEMENT BY PERSONS RESPONSIBLE FOR PREPARATION OF REPORT 4. DECISION OF COMPETENT CORPORATE BODY TO ADOPT THE SEMI- ANNUAL CONSOLIDATED REPORT OF THE ENERGOPROJEKT HOLDING PLC. FOR 2018 * (Note) 1. SEMI-ANNUAL CONSOLIDATED FINANCIAL STATEMENTS OF ENERGOPROJEKT HOLDING PLC. FOR 2018 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement on Changes in Equity, Notes to Financial Statements) BALANCE SHEET at day 30.06.2018. RSD thousand Total DESCRIPTION EDP End of quarter 31.12. previous year current year 1 2 3 4 ASSETS A. SUBSCRIBED CAPITAL UNPAID 0001 B. NON-CURRENT ASSETS (0003+0010+0019+0024+0034) 0002 16,264,880 16,674,525 I. -

Mesečni Izveštaj / Monthly Report Jun 2020. Indeksi / Indices

MESEČNI PROMET / MONTHLY TURNOVER Promet RSD / Promena % / Promet EUR / Promena % / Broj transakcija / TRŽIŠNI SEGMENT / MARKET SEGMENT Turnover RSD % Change (RSD)* Turnover EUR % Change (EUR)* No of Transactions PRIME LISTING-akcije 42,465,151 -32.18% 361,132 -32.18% 1,364 PRIME LISTING-obveznice Republike Srbije 1,085,087,349 -62.57% 9,227,925 -62.57% 9 STANDARD LISTING-akcije 156,724,559 +16.64% 1,332,866 +16.65% 96 OPEN MARKET—akcije 61,939,404 +14.22% 526,746 +14.23% 199 MTP—akcije 18,295,881 +505.44% 155,601 +505.48% 194 * mesečna promena / * monthly change Promet RSD / Promena % / Promet EUR / Promena % / Broj transakcija / METODE TRGOVANJA / TRADING METHODS Turnover RSD % Change (RSD)* Turnover EUR % Change (EUR)* No of Transactions Kontinuirano trgovanje / Continuous trading method 1,359,171,445 -56.89% 11,558,844 -56.89% 1,859 Blok trgovanja / Block trading 5,340,899 +100.00% 45,426 +100.00% 3 Ukupno / Total 1,364,512,344 -56.73% 11,604,270 -56.72% 1,862 * mesečna promena / * monthly change Učešće u ukupnom Učešće u ukupnom broju Učešće u prometu Učešće u broju transakcija STRUKTURA TRGOVANJA / prometu / Total transakcija / Total No. Of akcijama / Turnover - akcijama / No of Trades - TRADING STRUCTURE Turnover Trades Shares Shares Regulisano tržište / Regulated Market 98.66% 89.58% 93.45% 89.53% MTP 1.34% 10.42% 6.55% 10.47% METODE TRGOVANJA / TRADING METHODS Kontinuirano trgovanje / Continuous trading 99.61% 99.84% 98.09% 99.84% Blok trgovanja / Block trading 0.39% 0.16% 1.91% 0.16% VRSTE HOV / SECURITY TYPE Akcije / Shares 20.48% 99.52% - - Obveznice Republike Srbije / RS Bonds 79.52% 0.48% - - Korporativne obveznice / Corporate Bonds 0.00% 0.00% - - INDEKSI / INDICES BELEX15 18.41% 83.73% 89.90% 84.13% BELEXline 19.03% 87.54% 92.92% 87.97% PROMET U PRETHODNIH 12 MESECI / TURNOVER IN PREVIOUS 12 MONTHS Regulisano / Regulated Br. -

10 Dana / 10 Days 10 Dana / 10 Days DEVIZNO TRŽIŠTE / FX MARKET

Datum/Date: Erste bank a.d. Novi Sad 4.mar.19 VESTI / NEWS ► SREDNJI KURS EUR/RSD : Dinar ojačao u odnosu na evro za 0,0657 dinara, srednji kurs 118,0634. Obim međubankarske trgovine evrom na dan 1. mart do 12:30h iznosio je 7,1 miliona evra. NBS nije intervenisala na međubankarskom tržištu (od početka godine ukupno prodala 130 miliona evra i kupila 30 miliona evra). ► BEOGRADSKA BERZA: Indeksi zabeležili rast vrednosti, BELEX15 viši za 0,18 odsto, BELEXline za 0,33 odsto. Promet manji u odnosu na prethodni dan, na regulisanom tržištu najviše trgovano akcijama Valjaonice bakra Sevojno, NIS-a, Energoprojekta, Jednistva Sevojno i Philip Morris Operationsa. ► INFLACIJA : Prema podacima Republičkog zavoda za statistiku međugodišnja inflacija merena indeksom potrošačkih cena u januaru je iznosila 2 ,1 odsto dok su u odnosu na prethodni mesec cene u proseku više za 0,4 odsto. ► RZS: Realni rast bruto domaćeg proizvoda (BDP) u četvrtom kvartalu 2018.godine u odnosu na isti period prošle godine iznosio je 3,4 odsto (fleš ocena) . DEVIZNO TRŽIŠTE / FX MARKET EUR / RSD (Srednji kurs / Official Middle Rate ) ► 10 dana / 10 days 119,00 118,90 118,80 118,70 118,60 118,50 118,40 118,30 118,2158 118,2437 118,1918 118,1836 118,1291 118,20 118,1396 118,1516 118,1291 118,0594 118,10 118,0471 118,00 19.feb 20.feb 21.feb 22.feb 25.feb 26.feb 27.feb 28.feb 01.mar 04.mar Izvor/Source: NBS EUR / RSD (Srednji kurs/ Official middle rate ) ► Jan - …. 125,00 123,00 121,00 119,00 117,00 115,00 113,00 111,00 109,00 2012 2013 2014 2015 107,00 105,00 2016 2017 2018 -

Dunav Re SAS Report 31Dec2020

kpmg KPMG d.o.o. Beograd Tel.: +381 (0)11 20 50 500 Milutina Milankovića 1J Fax: +381 (0)11 20 50 550 11070 Belgrade www.kpmg.com/rs Serbia T R A N S L A T I O N Independent Auditor's Report To the Shareholders of Dunav - Re a.d.o. Beograd Opinion We have audited the accompanying In our opinion, the accompanying financial financial statements of Dunav - Re a.d.o. statements give a true and fair view of the Beograd (the “Company”), which comprise: financial position of the Company as at 31 December 2020, and of its financial — the balance sheet as at performance and its cash flows for the year 31 December 2020; then ended in accordance with the and, for the period from 1 January to accounting regulations effective in the 31 December 2020: Republic of Serbia and other relevant laws and by-laws which regulate financial — the income statement; reporting of insurance companies in Republic of Serbia. — the statement of other comprehensive income; — the statement of changes in equity; — the cash flow statement; and — notes, comprising a summary of significant accounting policies and other explanatory information (the “financial statements”). © 2021 KPMG d.o.o. Beograd, a Serbian limited liability company and Registration Number:17148656 a member firm of the KPMG global organization of independent Tax identity number: 100058593 member firms affiliated with KPMG International Limited, a private Bank Acc.:: 265-1100310000190-61 English company limited by guarantee. All rights reserved. kpmg T R A N S L A T I O N Basis for Opinion We conducted our audit in accordance with the Accountants International Code of Ethics for Law on Auditing and the Law on Accounting of Professional Accountants (including the Republic of Serbia, the Decision on the International Independence Standards) (IESBA content of reports on the audit of financial Code) together with the ethical requirements statements of an insurance company and that are relevant to our audit of the financial applicable auditing standards in the Republic of statements in the Republic of Serbia and we Serbia. -

Preference Based Portfolio for Private Investors: Discrete Choice Analysis Approach

mathematics Article Preference Based Portfolio for Private Investors: Discrete Choice Analysis Approach Marija Kuzmanovic 1,* , Dragana Makajic-Nikolic 1 and Nebojsa Nikolic 2 1 Department of Operations Research and Statistics, Faculty of Organizational Sciences, University of Belgrade, 11000 Belgrade, Serbia; [email protected] 2 Department of Mathematics, Faculty of Organizational Sciences, University of Belgrade, 11000 Belgrade, Serbia; [email protected] * Correspondence: [email protected] Received: 29 November 2019; Accepted: 16 December 2019; Published: 24 December 2019 Abstract: Behavioral finance literature shows that in addition to Markowitz’s rate of return and risk, private investors consider various other stock features. This paper discusses the problem of determining investors’ preferences for portfolio selection criteria, as well as the problem of optimal portfolio determination from the investors’ point of view. The study primarily focuses on private investors who are interested in one-time investments rather than stock trading. We use a discrete choice analysis and hierarchical Bayes method to measure individual investors’ preferences, and a logit model to determine individual shares of preferences. We treat the share of preferences as the share of certain stocks in an optimal portfolio. The proposed methodology is illustrated by the example of companies whose stocks are traded on the Belgrade Stock Exchange. We measure respondents’ preferences for companies, preferences for return rates, riskiness of stocks, and dividend rates. The results of comparing the performance of the resulting portfolio with the efficient frontier obtained using Markowitz’s portfolio theory indicate its high efficiency, thus validating the proposed approach. -

Serbian Equities Daily

Friday, June 14, 2013 SERBIAN EQUITIES DAILY 700 9 Market Comment: Belex rebounded slightly yesterday with solid volumes as 600 6 it appears that some investors are beginning to feel the market is up for a correction. Belex15 grew 0.54%, while 500 3 BELEXline grew 0.45% on volumes of €530k. Bonds contributed with €200k of the total. NIS traded heavily as 400 0 08/06/2012 08/10/2012 08/02/2013 08/06/2013 37 thousand shares exchanged hands. We hope the market will continue to recover today. Volume (€ m) BELEX15 BELEX15 Economy: Serbian Constructors to build heavily in Iraq Value 494.70 After the return of the delegation of Serbian construction and Daily Change% 0.54% infrastructure companies from Iraq, Serbian minister of YTD Change -29.19 construction and urbanism Velimir Ilic stated that projects worth €1.5bn could be signed by the end of the year. Up until now, YTD Change% -5.57% €120mn worth projects have been offered to Serbian companies. BELEXline Tenders for new projects will be announced shortly and a lot of our firms have a good history of project execution in Iraq, stated Value 978.67 Serbian minister. (Source: B92) Analyst: Ivan Radovic, Daily Change% 0.45% ([email protected], tel: +381 11 3027 533) YTD Change -26.89 YTD Change% -2.67% Market info MCap (€ bn) 6.6 MCap / GDP2013e 20% 2013e P/E* 5.6 2013e P/B* 0.6 2013e P/S* 0.7 Av. Daily Vol.YTD (€m) 0.5 *multiples refer to Eurobank Brokerage Universe FX rates YTD chg. -

Energoprojekt Holding Plc. Quarterly Report for Q1 2020

Energoprojekt Holding Plc. Quarterly Report for Q1 2020 Belgrade, May 2020 Pursuant to Article 53 of the Law on Capital Market (RS Official Gazette, No. 31/2011, 112/2015 and 108/2016) and pursuant to Article 5 of the Rulebook on the Content, Form and Method of Publication of Annual, Semi-Annual and Quarterly Reports of Public Companies (RS Official Gazette, No. 14/2012, 5/2015 and 24/2017), Energoprojekt Holding Plc. from Belgrade, registration No.: 07023014 hereby publishes the following: QUARTERLY REPORT FOR Q1 2020 C O N T E N T S 1. FINANCIAL STATEMENTS OF THE ENERGOPROJEKT HOLDING PLC. FOR Q1 2020 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement of Changes in Equity, Notes to Financial Statements) 2. BUSINESS REPORT 3. STATEMENT BY PERSONS RESPONSIBLE FOR PREPARATION OF REPORT 4. DECISION OF COMPETENT CORPORATE BODY TO ADOPT THE Q1 2020 QUARTERLY REPORT * (Note) 1. FINANCIAL STATEMENTS OF ENERGOPROJEKT HOLDING PLC. FOR Q1 2020 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement on Changes in Equity, Notes to Financial Statements) BALANCE SHEET at day 31.03.2020. RSD thousand Total DESCRIPTION EDP End of quarter 31.12. previous year current year 1 2 3 4 ASSETS A. SUBSCRIBED CAPITAL UNPAID 0001 B. NON-CURRENT ASSETS (0003+0010+0019+0024+0034) 0002 8.944.272 8.946.519 I. INTANGIBLES (0004+0005+0006+0007+0008+0009) 0003 26.073 27.637 1. Investments in development 0004 2. Concessions, patents, licenses, trademarks and service marks, software and other rights 0005 26.073 27.637 3. -

Annual Report of Energoprojekt Holding Plc. for the Year 2017

Annual Report of Energoprojekt Holding Plc. for the year 2017 Belgrade, April 2018 Pursuant to Articles 50 and 51 of the Law on Capital Market (RS Official Gazette, No. 31/2011, 112/2015 and 108/2016) and pursuant to Article 3 of the Rulebook on Contents, Form and Method of Publication of Annual, Half-Yearly and Quarterly Reports of Public Companies (RS Official Gazette, No. 14/2012, 5/2015 and 24/2017), Energoprojekt Holding Plc. based in Belgrade, registration No.: 07023014 hereby publishes the following: ANNUAL REPORT FOR 2017 C O N T E N T S 1. FINANCIAL STATEMENTS OF ENERGOPROJEKT HOLDING Plc. FOR 2017 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement of Changes in Equity, Notes to the Financial Statements) 2. INDEPENDENT AUDITOR’S REPORT (complete report) 3. ANNUAL BUSINESS REPORT (Note: Annual Business Report and Consolidated Annual Business Report are presented as a single report and these contain information of significance for the economic entity) 4. STATEMENT BY PERSONS RESPONSIBLE FOR REPORT PREPARATION 5. DECISION OF COMPETENT COMPANY BODY ON THE ADOPTION OF ANNUAL FINANCIAL STATEMENTS* (Note) 6. DECISION ON DISTRIBUTION OF PROFIT OR COVERAGE OF LOSSES* (Note) 1. FINANCIAL STATEMENTS OF ENERGOPROJEKT HOLDING Plc. FOR THE YEAR 2017 (Balance Sheet, Income Statement, Report on Other Income, Cash Flow Statement, Statement of Changes in Equity, Notes to the Financial Statements) Energoprojekt Holding Plc. NOTES TO THE ANNUAL FINANCIAL STATEMENTS FOR THE YEAR 2017 Belgrade, 2018 Notes to the Financial Statements for 2017 Page 1/98 Energoprojekt Holding Plc. C O N T E N T S 1.